Hedge Fund Trade Tip (PIN) – Position Idea Notification

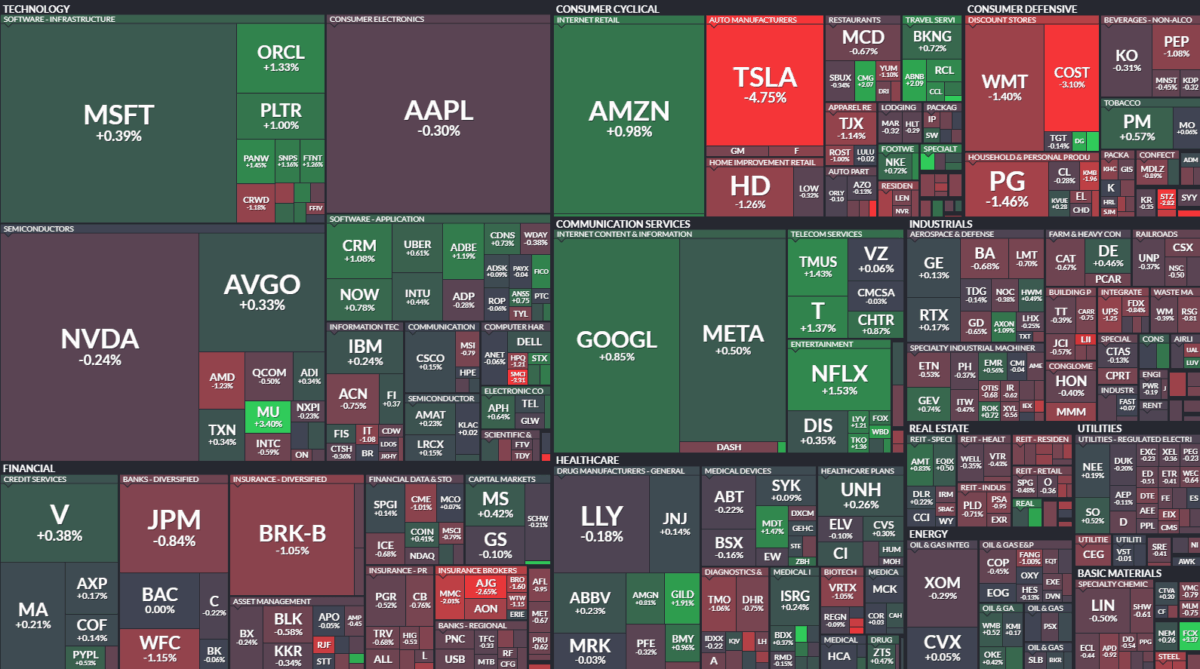

Where is money flowing today?

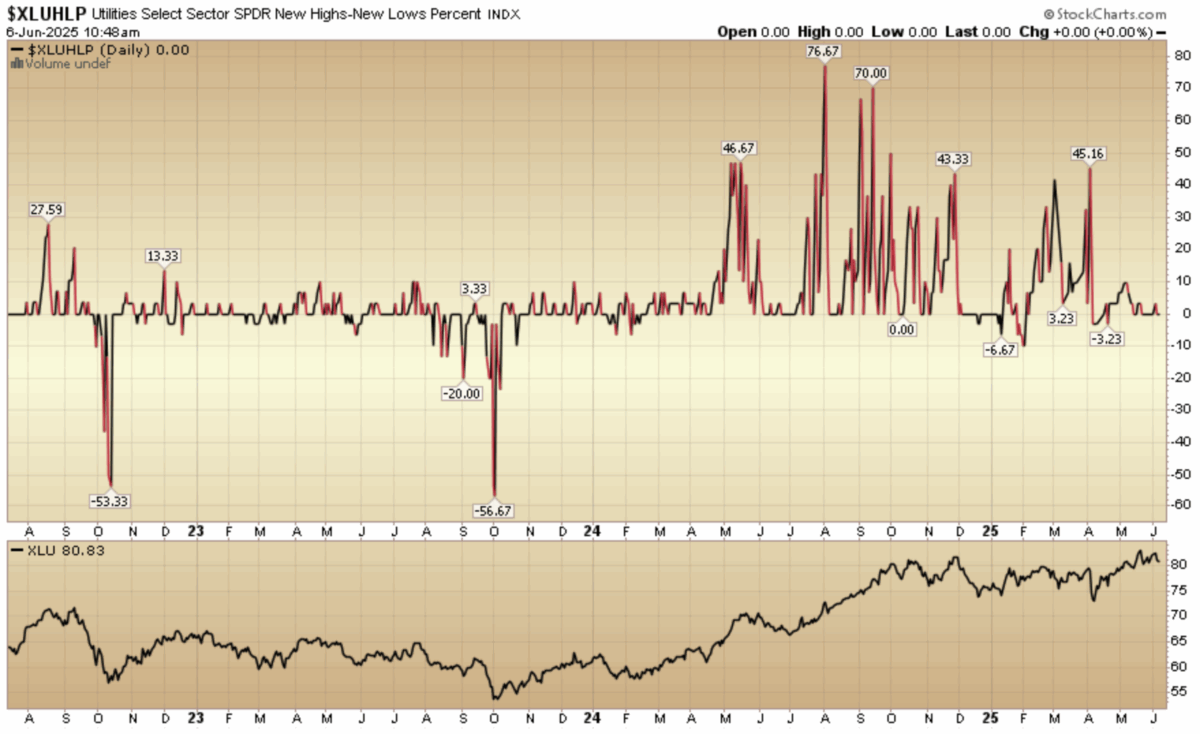

Indicator of the Day (video): Utilities New Highs New Lows %

Quote of the Day…

Be in the know. 23 key reads for Friday…

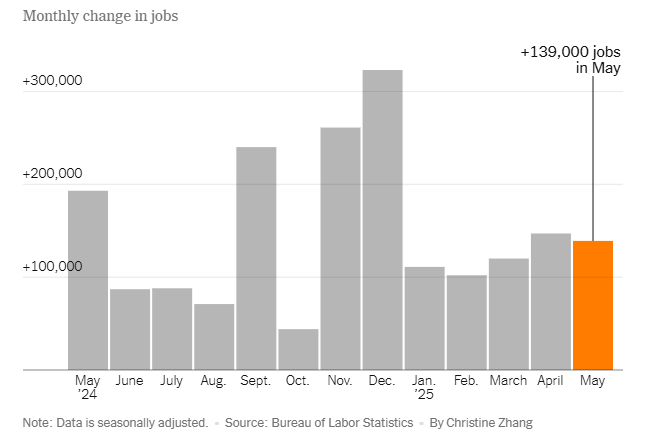

- U.S. payrolls increased 139,000 in May, more than expected; unemployment at 4.2% (cnbc)

- Is China Reversing Its ‘Uninvestable’ Image? (bloomberg)

- Alibaba unveils new open-source AI embedding models, a field it leads globally (scmp)

- Regulatory Support For AI & Tech Raises Growth Stocks, Trump & Xi Speak (chinalastnight)

- Trump Gets His Call With Xi. The Two Sides Agreed to Keep Talking. (barrons)

- Xi’s Message to Trump: Rein in the Hawks Trying to Derail the Truce (nytimes)

- US Power Grid “Getting Critically Tight” — Time To Consider Backup Power At Home (zerohedge)

- Surging electricity demand is just one reason natural gas looks so appealing to investors this summer and beyond (marketwatch)

- Boeing rebuilding trust as airline bosses see improved jet quality (reuters)

- Mortgage rates fall for the first time in 5 weeks, opening up a ‘window of opportunity’ for home buyers (marketwatch)

- Disney says its theme parks generate $67 billion in annual U.S. economic impact (cnbc)

- Wolfe Research initiates QXO stock with outperform rating and $44 target (investing)

- ‘Summer Euphoria’ – Goldman Flows Gurus Give “Greenlight” For Equity Bulls (zerohedge)

- Stop-In Season: The Real Pain Is Still to the Upside (zerohedge)

- US Treasury Calls on BOJ to Hike Rates to Correct Yen Weakness (bloomberg)

- BofA stays bearish on the U.S. dollar (streetinsider)

- Wall Street Is Too Pessimistic on the Dollar. That Could Be a Problem. (barrons)

- Stablecoins may be nasty, but for Americans they’re also cheap (ft)

- The case for a Fed rate cut (ft)

- Should Investors Bet on Intel’s Turnaround In 2025? (yahoo)

- Shop Slow, Spend More: The Retailers Hoping That Customers Linger (wsj)

- Norwegian and Other Cruise Stocks Stage a Recovery. Why There’s Smoother Sailing Ahead. (barrons)

- The economy is still growing despite the craziness every day: Hightower’s Stephanie Link (youtube)

Where is money flowing today?

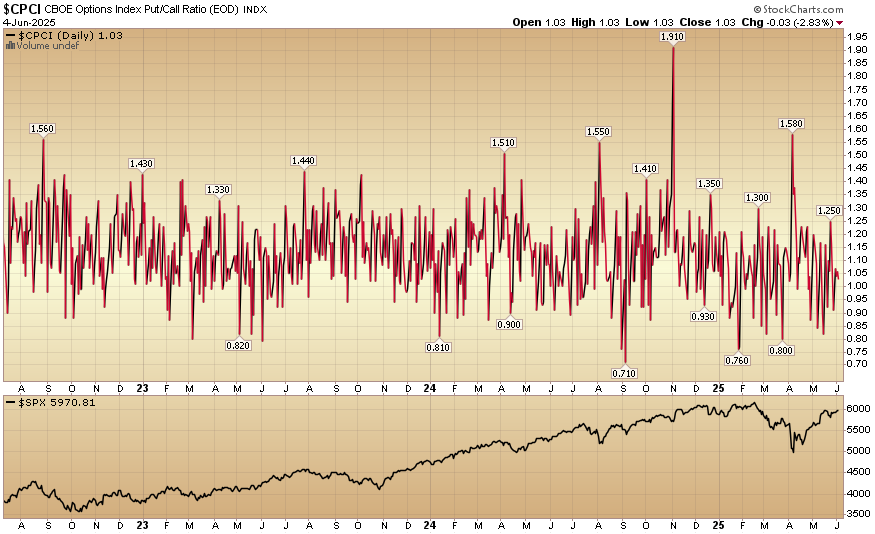

Indicator of the Day (video): CBOE Index Put/Call Ratio

Quote of the Day…

Be in the know. 20 key reads for Thursday…

- More Homes Are for Sale Since Before the Pandemic. What It Means for Buyers and Sellers. (barrons)

- Home Remodeling Bond Sales Surge as Americans Avoid Moving (bloomberg)

- ‘So Bad It’s Good’: Buying Window Opens for Battered Small Caps (bloomberg)

- Bond Yields & Dollar Plunge As ‘Bad’ Data Sparks Surge In Rate-Cut Hopes (zerohedge)

- Trump Loves Europe’s Rate Cuts. Why the Fed Should Take Cover. (barrons)

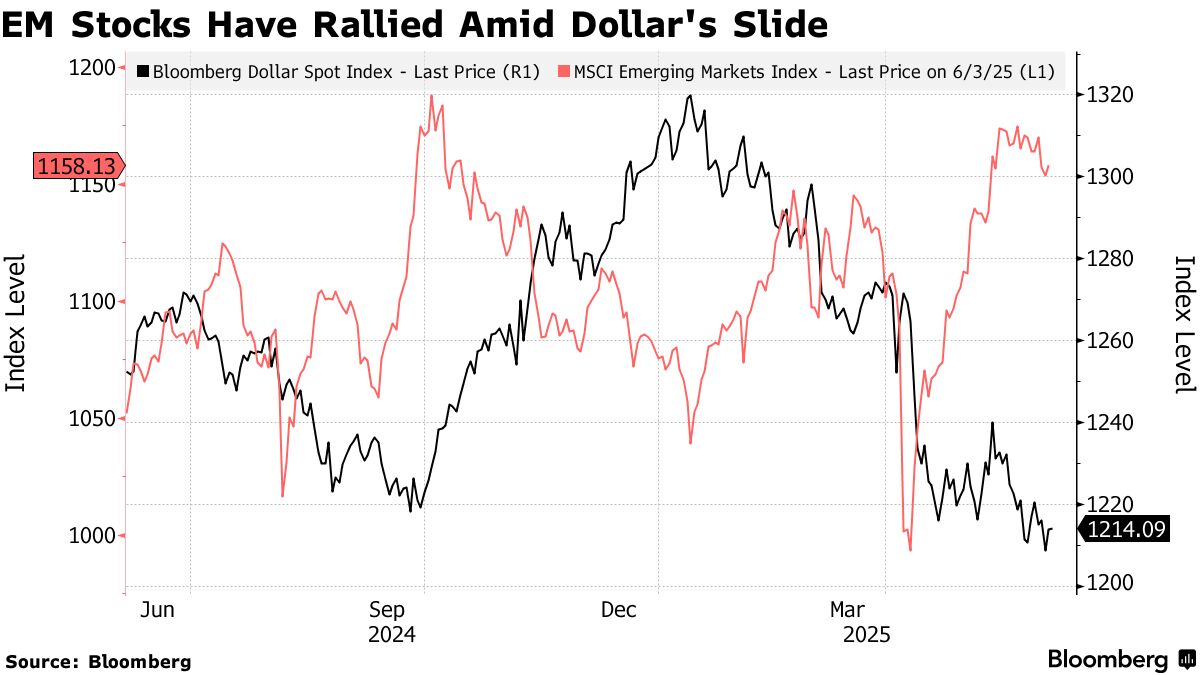

- BofA’s Hauner Expects More Emerging-Market Gains as Dollar Drops (bloomberg)

- Big investors shift away from US markets (ft)

- Confidence Game: Share Buybacks Are Soaring. CEO Optimism Isn’t. (barrons)

- As S&P 6,000 Looms, Speculators Are Ramping Up Their Bullish Bets (zerohedge)

- Hong Kong stocks rise for third day as China’s services PMI beats expectations (scmp)

- Shein and Temu see U.S. demand plunge on ‘de minimis’ trade loophole closure (cnbc)

- Apple and Alibaba’s AI rollout in China delayed by Donald Trump’s trade war (ft)

- US, Vietnam to hold new round of trade talks by end of next week, Hanoi says (reuters)

- Mizuho updates U.S. top picks: Adds CVS Health, PayPal and Oracle (streetinsider)

- Mastercard and PayPal collaborate to ease checkout (yahoo)

- Venmo Unleashes Next Phase of Commerce with the Venmo Debit Card and Venmo Checkout (yahoo)

- Jefferies raises Boeing stock price target to $250 on delivery growth (investing)

- Boeing Agrees to Pay $1.1 Billion to Avoid Prosecution for 737 MAX Crashes (wsj)

- Cooper Standard Wins 2024 Ford Supplier of the Year Award (yahoo)

- Meta Talks to Disney, A24 About Content for New VR Headset (wsj)