- Hedge Funds See Something in the Reflation Trade They Don’t Like (Bloomberg)

- Why Analysts Are Bullish on Banks’ Upcoming Earnings (Barron’s)

- BP Hits Debt Reduction Target a Year Early. Share Buybacks Are Coming. (Barron’s)

- Real and Imagined. The Energy Report 04/06/2021 (Phil Flynn)

- Bank M&A Is Picking Up Again. Seven Lenders to Watch. (Barron’s)

- The SPAC Bust Has Created Bargains for Investors. How to Play it. (Barron’s)

- Kim Kardashian is officially a billionaire (New York Post)

- Biden and Democrats Detail Plans to Raise Taxes on Multinational Firms (New York Times)

- This Just Might Be the Best U.S. Economy Ever (Barron’s)

- The Robinhood Generation Is Debating Old School Investors on Trading Stocks (Bloomberg)

- Fast food struggles to hire as demand soars, U.S. economy roars (Reuters)

- BofA keeps $10 target on GameStop despite ‘positive’ funding news (TheFly)

- Housing Market Euphoria Craziest In Years As Inventory Sinks To New Low (ZeroHedge)

- Opinion: U.S. stocks will continue to beat the alternatives (MarketWatch)

- U.S. job openings jump to 7.37 million and top pre-pandemic levels as economy surges (MarketWatch)

- Day of 4 Million Vaccines Signals Sharp Turnaround for U.S. (Bloomberg)

- Fundstrat’s Tom Lee explains why he expects a ‘face-ripper rally’ in April (CNBC)

- Schumer says Senate could pass an additional bill without GOP votes (CNBC)

- Top Wall Street Strategist Focuses on Secure Dividend Stocks: 5 Top Buys (24/7 Wall Street)

- The New Shortage: Ketchup Can’t Catch Up (Wall Street Journal)

Tom Hayes – Quoted in Reuters article – 4/5/2021

Thanks to Chibuike Oguh for including me in his article on Reuters tonight. You can find it here:

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Hedge Fund Tips (PCN) – Position Completion Notification

Where is money flowing today?

Tom Hayes – Quoted in Reuters article – 4/5/2021

Thanks to Medha Singh and Shivani Kumaresan for including me in their article on Reuters today. You can find it here:

Be in the know. 30 key reads for Monday…

- 9 Beaten-Down Stocks That Look Promising (Barron’s)

- Wall Street set to rise after strong jobs data; eyes on services sector survey (Reuters)

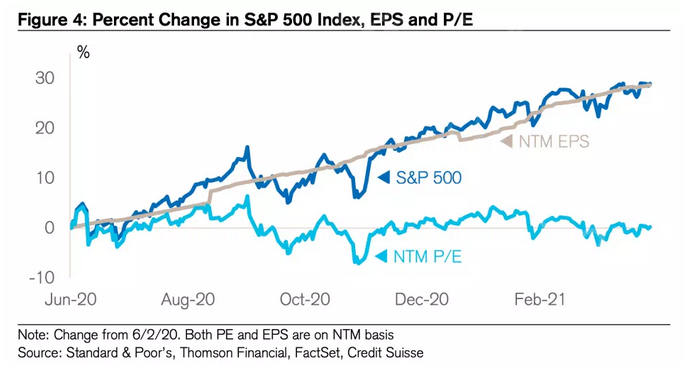

- This simple chart nails why stocks are up: Morning Brief (Yahoo! Finance)

- Goldman Sachs Says Buy Energy After Pullback: 3 Dividend-Paying Stocks to Buy Now (24/7WallSt)

- US companies are expected to see their strongest profit growth in nearly 20 years after downward revisions were ‘too aggressive’ (Business Insider)

- Betrayal. The Energy Report 04/05/2021 (Phil Flynn)

- Consumer Staples Have Been Left Out of the Stock Rally. It Might Be Time to Buy. (Barron’s)

- IPOs Post Their Best Record Since 1995. What Comes Next. (Barron’s)

- Uneven Gains in Job Market Give Investors a Goldilocks Moment. Can It Last? (Barron’s)

- J&J Will Manufacture Its Own Vaccine at Emergent Facility Where Doses Were Ruined (Barron’s)

- The Stock Market’s First Quarter Was Strong. What Comes Next. (Barron’s)

- Individual Investors Retreat from Markets After Show-Stopping Start to 2021 (Wall Street Journal)

- If You Sell a House These Days, the Buyer Might Be a Pension Fund (Wall Street Journal)

- The Post-Pandemic Office Is Already Here—in Australia (Wall Street Journal)

- How Big Is Amazon, Really? (New York Times)

- GameStop to Offer Up to $1 Billion in Shares; Stock Declines (Bloomberg)

- Tesla China Demand Fuels ‘Home Run’ Quarter for Deliveries (Bloomberg)

- Do-Nothing SPACs Sag, Offering Investors a $1.1 Billion Return (Bloomberg)

- Investors should buy real assets – from wine to art – as inflation reaches a ‘secular turning point,’ Bank of America says (Business Insider)

- Las Vegas shows reopen: Here’s what will be different for audiences and performers (USA Today)

- Here’s the $4.5 trillion ‘firepower’ that will drive stocks higher in April, says strategist Thomas Lee (MarketWatch)

- US Airports Busiest In More Than Year On Good Friday (ZeroHedge)

- Biden says his $2.3-trillion infrastructure plan will create 19 million jobs — most would not require a college degree (MarketWatch)

- ‘Godzilla vs. Kong’ has best box-office debut since pandemic started (MarketWatch)

- Norwegian Cruise stock surges after plan submitted to CDC to resume U.S. cruises in July (MarketWatch)

- Opinion: How to make money from stocks — while you sleep (MarketWatch)

- Palm Beach County Mansions Scooped Up in Hot Pandemic Market (Bloomberg)

- CVS to now offer COVID-19 antibody tests for $38 (MarketWatch)

- Britian to Launch Large-Scale Effort to Find Pill for Early Onset Mild-to-Moderate COVID-19: Will they Include Repurposed Generics in the Investigation? (TrialSiteNews)

- Alibaba May Be Seeing Tough Times But, Alongside Tencent, Remains ‘The Benchmark’ For Chinese Tech Stocks: Analyst (Benzinga)

Be in the know. 10 key reads for Easter Sunday…

- Waffle House Chairman Joe Rogers Jr. Debuts As A Billionaire As Restaurant Industry Digs Out From Wreckage (Forbes)

- Billionaire Bill Foley Is SPAC Market’s Overlooked Star (Wall Street Journal)

- How Troubled Trader Bill Hwang Quietly Amassed $10 Billion (Forbes)

- Pfizer CEO Albert Bourla Helped Save The World. Can He Save His Company’s Stock? (Forbes)

- Tilman Fertitta says he’s been surprised by strength of his restaurants and casinos in March by Kevin Stankiewicz (CNBC)

- ECRI Weekly Leading Index Update (advisorperspectives)

- The Maserati Levante GTS: Behind The Wheel of a Racy Italian SUV (Maxim)

- What Information Do You Need in Order to Change? (Farnam Street)

- The Transcript 03.29.20: Higher Confidence (theweeklytranscript)

- Individual Investors Retreat from Markets After Show-Stopping Start to 2021 (Wall Street Journal)

Be in the know. 15 key reads for Saturday…

- Consumer Staples Have Been Left Out of the Stock Rally. It Might Be Time to Buy. (Barron’s)

- Don’t Raise Taxes for Infrastructure Push. The U.S. Should Be Like a Business and Borrow. (Barron’s)

- After 10 Years of Underperformance, Commodities Are Set to Boom. Here’s How to Play the Rally. (Barron’s)

- This Torrid Market Still Has Plenty of Room to Run (Barron’s)

- Two REIT Stocks See Large Insider Buys (Barron’s)

- U.S. Added 916,000 Jobs in March as Hiring Accelerated (Wall Street Journal)

- This 1950s Spanish Resort—Beloved by Audrey Hepburn—Is Still Going Strong (Wall Street Journal)

- Vaccine Trickle Becomes Torrent as U.S. Eligibility Rules Widen (Bloomberg)

- Bill Gates says companies have gone from staying private too long to going public too soon and that he’s avoiding ‘low quality’ SPACs (Business Insider)

- 2 consecutive days of gains points to a stronger than usual April for the stock market, Fundstrat’s Tom Lee says (Business Insider)

- Hotels reaching highest occupancy levels since the pandemic, Wyndham CEO says (CNBC)

- 76 all-cash offers on one home. The housing madness shows no signs of slowing (CNN Business)

- How Close Is The UK To Herd Immunity? (ZeroHedge)

- 10 Undervalued Wide-Moat Stocks (Morningstar)

- A History of Boats, Canals & Finance (investoramnesia)