Hedge Fund Tips (PCN) – Position Completion Notification

Be in the know. 15 key reads for Wednesday…

- What’s in Biden’s $2.25 Trillion Infrastructure and Tax Proposal (Bloomberg)

- Pfizer’s Vaccine Is 100% Effective in Adolescents, Company Says (Barron’s)

- H&R Block Wants to Do More Than Your Taxes. Why Its Stock Is a Buy. (Barron’s)

- Tesla Could Be One of the Big Winners in Biden’s $2 Trillion Infrastructure Plan (Barron’s)

- OPEC cuts, vaccines to sustain oil’s recovery: Reuters poll (Reuters)

- Biden to unveil $2tn infrastructure plan and big corporate tax rise (Financial Times)

- Boeing Gets More 737 MAX Orders From Alaska Airlines Over December Commitment (Benzinga)

- Wall Street is pricing in $4 trillion of infrastructure spending. Here are the stocks that could benefit, according to Bank of America. (MarketWatch)

- These are the stocks for playing Biden’s infrastructure push, analysts say (MarketWatch)

- Biden kicks off effort to reshape U.S. economy with infrastructure package (Reuters)

- Energy Mixer. The Energy Report 03/31/2021 (Phil Flynn)

- U.S. Companies Add Most Jobs Since September, ADP Data Show (Bloomberg)

- Kimberly-Clark (KMB) Announces Price Increases for North American Consumer Products Business (Street Insider)

- U.S. Home Prices Rise at Fastest Pace in 15 Years (Wall Street Journal)

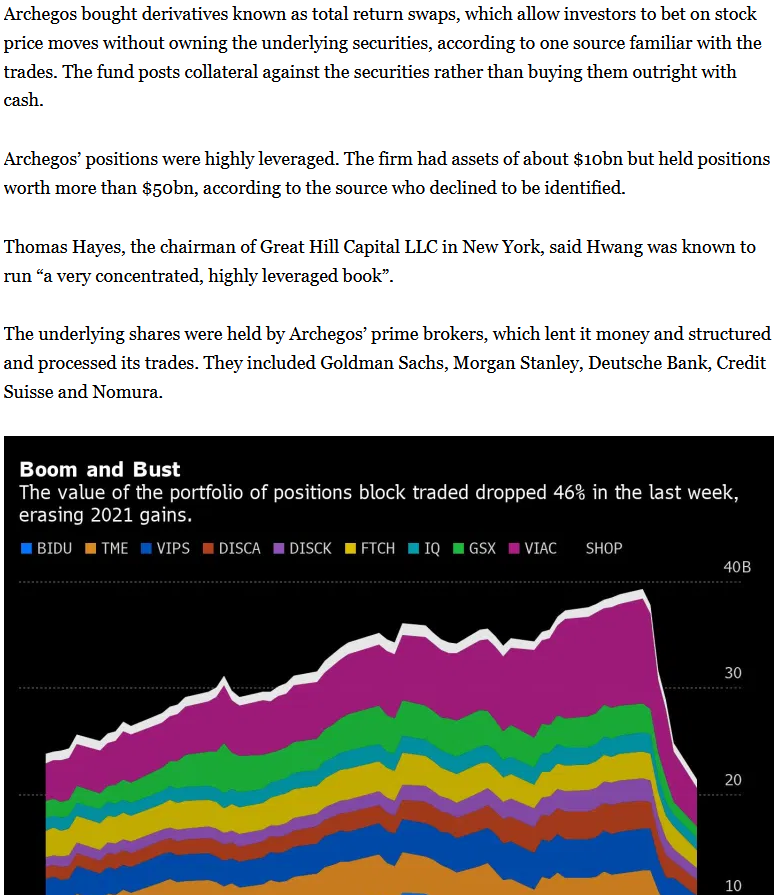

- What Is a Total Return Swap and How Did Archegos Capital Use It? (Wall Street Journal)

Tom Hayes – Quoted in Bloomberg article – 3/30/2021

Thanks to Venus Feng for including me in her article on Bloomberg. You can find it here:

Tom Hayes – The Claman Countdown – Fox Business Appearance – 3/30/2021

Where is money flowing today?

Be in the know. 20 key reads for Tuesday…

- Institutional investors have been net sellers of stocks since December but that’s actually a bullish signal for equities, according to Fundstrat (Business Insider)

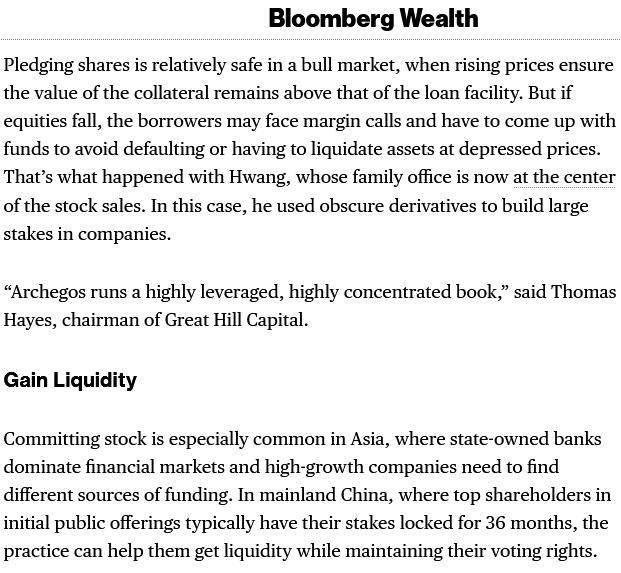

- Here are the complex bets at the heart of ‘unprecedented’ Archegos-linked $30 billion margin call (MarketWatch)

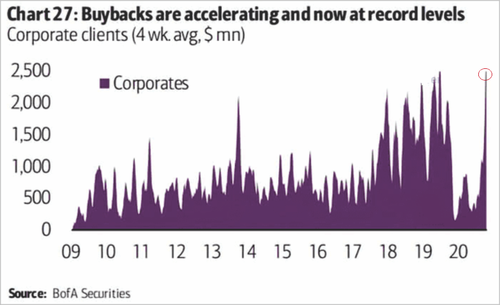

- This past week, share buybacks hit a new record. (zerohedge)

- Real Estate Investors Desperate to Spend $250 Billion Hoard (Bloomberg)

- Splunk Fell Behind in the Cloud Era. Now It’s Catching Up and the Stock Could Soar. (Barron’s)

- The Fed May Allow Bank Dividend Hikes. How to Play It. (Barron’s)

- Investors See Poor Large-Cap Stock Gains This Year. Here’s Where There’s Opportunity. (Barron’s)

- Boeing Stock Is Jumping, With 3 Pieces of Good News (Barron’s)

- Billions in Secret Derivatives at Center of Archegos Blowup (Bloomberg)

- Here’s why Wall Street and investors aren’t giddy enough, says top strategist (MarketWatch)

- China, Long a Source of Deflation, Starts Raising Prices for the World (Wall Street Journal)

- SPACs Are the Stock Market’s Hottest Trend. Here’s How They Work. (Wall Street Journal)

- Treasury Yields Rise With Biden Spending in Focus: Markets Wrap (Bloomberg)

- How the U.S. Is Vaccinating Its Way Out of the Pandemic (Bloomberg)

- Value Quants Take Wall Street by Storm With Best Run Since 2000 (Bloomberg)

- Big Oil’s Secret World of Trading (Bloomberg)

- Bank and cyclical stocks should be bought on the dip, Jim Cramer says (CNBC)

- Oil drops as Suez opens, focus turns to OPEC+ output cuts (Street Insider)

- Oil Choppy Ahead of OPEC Plus. The Energy Report 03/30/2021 (Phil Flynn)

- ‘Biggest Risk’ Facing Apple, Tesla, Other Nasdaq Stocks? US-China ‘Cold Tech War,’ Says Analyst (Benzinga)

Unusual Options Activity – Wells Fargo & Company (WFC)

Data Source: barchart

Today some institution/fund purchased 29,442 contracts of May $45 strike calls (or the right to buy 2,944,200 shares of Wells Fargo & Company (WFC) at $45). The open interest was 15,410 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”

Hedge Fund Tips (PCN) – Position Completion Notification

Tom Hayes – Quoted in Reuters article – 3/29/2021

Thanks to Herb Lash for including me in his article on Reuters this afternoon. You can find it here: