Data Source: Finviz

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 20 key reads for Thursday…

- Biopharma Stocks Aren’t Getting a Lot of Credit. Here Are 5 of the Most Undervalued. (Barron’s)

- For Stock Market Bulls, There’s Potential Downside to Economic Opening (Bloomberg)

- Pumped. The Energy Report 03/18/2021 (Phil Flynn)

- Nokia CEO Thinks Longer 5G Cycle Gives Him Time to Catch Up (Bloomberg)

- Marriott’s New Chief on the Pandemic and a Changed Industry (Barron’s)

- Bitcoin’s Not Really an Inflation Hedge, Bank of America Says (Barron’s)

- Google Searches for ‘Inflation’ Have Surged. Here’s Why that Matters. (Barron’s)

- What to Expect From U.S.-China Summit (Barron’s)

- Kanye West could now be worth more than $6 billion (New York Post)

- Fed Projects Patience Even as Economic Outlook Brightens (New York Times)

- North Korea Gives U.S. Cold Shoulder, Calls Nuclear Talks ‘Waste of Time’ (Wall Street Journal)

- Federal Reserve expects to keep its key rate near zero through 2023 (New York Post)

- Iran-Backed Fighters Launch More Attacks in Yemen as U.S. Looks to Cut Ties (Wall Street Journal)

- New Houses Are Costing More as Prices Jump for Wood, Bricks (Wall Street Journal)

- Everywhere You Look, the Global Supply Chain Is a Mess (Wall Street Journal)

- US weekly jobless claims climb to 770,000 as country edges closer toward reopening (Business Insider)

- Biden’s proposed tax hike could hit Americans earning $200,000 (Fox Business)

- Apollo, Caesars, and Wall Street’s ‘Billionaire Brawl’ for Control of a Gaming Empire (institutionalinvestor)

- Raymond James Bullish on Oil: 6 Top Stocks to Buy for Continued 2021 Gains (24/7 Wall Street)

- General Electric Commits To Cutting Debt By 35% Within 3 Years (Benzinga)

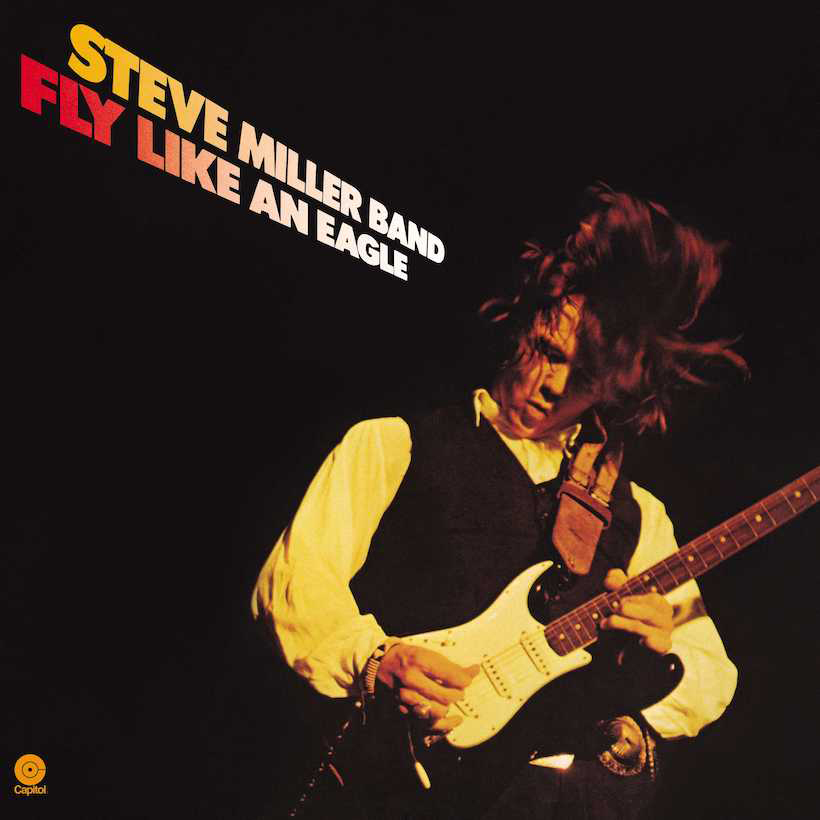

The “Fly Like an Eagle” Stock Market (and Sentiment Results)…

Following Chair Powell’s press conference yesterday, the song that appropriately captures market sentiment this week is the Steve Miller Band’s “Fly Like an Eagle.” It hit #2 on the Billboard Hot 100 chart in March 1977 (four months before I was born!): Continue reading “The “Fly Like an Eagle” Stock Market (and Sentiment Results)…”

Unusual Options Activity – American Electric Power Company, Inc. (AEP)

Data Source: barchart

Today some institution/fund purchased 3,001 contracts of Jan 2022 $90 strike calls (or the right to buy 300,100 shares of American Electric Power Company, Inc. (AEP) at $90). The open interest was just 642 prior to this purchase. Continue reading “Unusual Options Activity – American Electric Power Company, Inc. (AEP)”

Where is money flowing today?

Be in the know. 20 key reads for St. Patrick’s Day…

- Why UK value stocks may be the trade of the decade (Financial Times)

- This Is the ‘Biggest Risk of All’ for Investors, According to Howard Marks (institutionalinvestor)

- Nokia to Cut Up to 10,000 Jobs to Offset 5G Investment (Wall Street Journal)

- Value Stocks a Week Away From ‘Holy Grail’ Momentum Boost (Bloomberg)

- What to Expect From the Fed’s Key Meeting (Barron’s)

- Inflation Is a Bigger Risk to the Bull Market Than Covid-19, Fund Managers Say (Barron’s)

- Investors say regulatory relief for bank capital rules could ease pressure on bond market (MarketWatch)

- The ‘Reflation Trade’ Is Stumbling. Why It’s Not Over Yet. (Barron’s)

- Lennar Beat Earnings Estimates. What the Company Sees for the Year Ahead. (Barron’s)

- Solar Stocks Sink on Proposed California Rule Changes. Why Utilities in Other States May Wage Similar Battles. (Barron’s)

- Biden may propose $1 trillion in new taxes, says a former aide — and here’s how Congress will react (MarketWatch)

- Opinion: Here’s what most of the world gets wrong about St. Patrick’s Day (MarketWatch)

- Why the airline industry recovery has a lot of runway to go (Yahoo! Finance)

- Making sense of February’s retail flop: Morning Brief (Yahoo! Finance)

- Fed must walk a fine line as financial markets hang in the balance (CNBC)

- Extended Stay America Banks On Its No-Frills Approach (Wall Street Journal)

- Carbon Capture Is Key to Companies’ Net Zero Pledges (Wall Street Journal)

- Would Biden’s Tax Hike Really Spare the Middle Class? Nope (Bloomberg)

- Stumbling Hotel Industry Starts to Regain Footing After Its Worst Year (Wall Street Journal)

- Tidal Wave of ESG Funds Brings Profit to Wall Street (Wall Street Journal)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 3/16/2021

Unusual Options Activity – Pfizer Inc. (PFE)

Data Source: barchart

Today some institution/fund purchased 3,044 contracts of July $32 strike calls (or the right to buy 304,400 shares of Pfizer Inc. (PFE) at $32). The open interest was just 642 prior to this purchase. Continue reading “Unusual Options Activity – Pfizer Inc. (PFE)”