Data Source: Finviz

Be in the know. 30 key reads for Tuesday…

- Stocks Are Pricey. Here’s Where to Find Value Now. (Barron’s)

- Nokia Is Cutting Up to 10,000 Jobs to Boost 5G Investment (Barron’s)

- What to Focus on as Fed Rate Panel Meets (Barron’s)

- ‘Taper tantrum’ worries creeping in, but equity crash not imminent: BofA (Reuters)

- Opinion: Why the health-care sector — not gold — is the best inflation hedge (MarketWatch)

- ‘Big Short’ investor Michael Burry slams NFTs with a quote warning ‘crypto grifters’ are selling them as ‘magic beans’ (Business Insider)

- Fed aims for tricky balance between wounded economy, booming outlook as it unveils new forecasts (USA Today)

- COVID-19 is no longer the biggest tail risk: BofA fund manager survey (Yahoo! Finance)

- How the U.S. Got It (Mostly) Right in the Economy’s Rescue (New York Times)

- U.S. Retail Sales Declined in February as Weather Impeded Demand (Bloomberg)

- Sucking It Down. The Energy Report 03/16/2021 (Phil Flynn)

- Xi Jinping Warns Against Tech Excess in Sign Crackdown Will Widen (Bloomberg)

- Biden’s Planned Tax Hike to Hit People Earning Over $400,000 Hardest (Bloomberg)

- The World’s Three Biggest Coal Users Get Ready to Burn Even More (Bloomberg)

- Investing in bonds has ‘become stupid,’ Ray Dalio says. Here’s what he recommends instead (MarketWatch)

- Are Americans Ready To Travel? BofA Sees Biggest Airline Bookings Jump Since Pandemic Began (Benzinga)

- Goldman Sachs Sees a Faster than Expected Airline Recovery Suggests Buying ALK and/or UAL, Both PTs Raised (Street Insider)

- EU says Pfizer to deliver over 200 million vaccine doses in second quarter (Street Insider)

- Gilead (GILD), Merck (MRK) Announce Agreement to Jointly Develop and Commercialize Long-Acting, Investigational Treatment Combinations of Lenacapavir and Islatravir in HIV (Street Insider)

- Goldman Sachs Sees a Faster than Expected Airline Recovery Suggests Buying ALK and/or UAL, Both PTs Raised (Street Insider)

- Fed officials may talk technical rate move but delay acting for now (Street Insider)

- What Does The Olive Garden Reveal About Dining Sector Recovery? (Benzinga)

- AstraZeneca Trial Data May Not Be Impressive, Setting Up a Buying Opportunity (Barron’s)

- China’s Regulators Punished Tech Giants and Rattled Investors. What Could Come Next. (Barron’s)

- U.S. Banks Will Turn Last Year’s Fear Into This Year’s Profits (Wall Street Journal)

- Why Berkshire Hathaway Energy Is One of Warren Buffett’s 4 ‘Jewels’ (Barron’s)

- Berkshire Hathaway Proxy Shows Warren Buffett Is Old School When it Comes to Compensation, Board Makeup (Barron’s)

- Fed should ‘switch’ up its playbook and buy more Treasurys, fewer mortgage bonds, urge analysts (MarketWatch)

- Value stocks are making a comeback. Don’t get left behind, these analysts say (MarketWatch)

- Five things to watch from the Federal Reserve meeting (Financial Times)

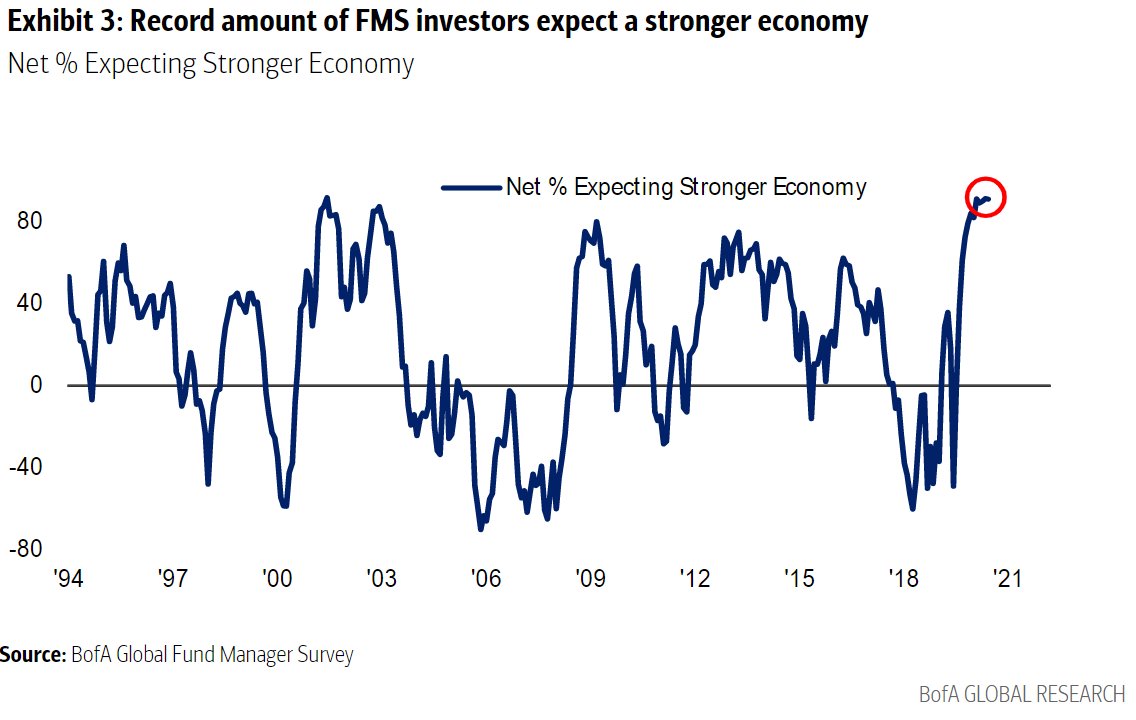

March Bank of America Global Fund Manager Survey Results (Summary)

~200 Managers overseeing ~$600B AUM responded to this month’s BofA survey. Continue reading “March Bank of America Global Fund Manager Survey Results (Summary)”

Where is money flowing today?

Be in the know. 20 key reads for Monday…

- U.S. Banks to Turn Last Year’s Cash Buildup Into Profits (Wall Street Journal)

- Biden Eyes First Major Tax Hike Since 1993 in Next Economic Plan (Bloomberg)

- With New Covid Relief On Its Way, the Focus Turns to Infrastructure (Barron’s)

- China Industrial Output, Retail Sales Surge In Pandemic Rebound (Barron’s)

- Here’s What Wall Street Will Focus on as the Fed Rate Panel Meets (Barron’s)

- Americans Are Flying Again. Here’s Who Benefits. (Barron’s)

- White House Weighs How to Pay for Long-Term Economic Program (Wall Street Journal)

- Why the Next Big-Tech Fights Are in State Capitals (Wall Street Journal)

- Why $4-a-Gallon Gas May Be Coming Your Way This Summer (New York Times)

- New York Manufacturing Expands Most Since 2018 as Prices Climb (Bloomberg)

- The Housing Boom That Never Ends Already Wiped Out All the Short-Sellers (Bloomberg)

- India to propose cryptocurrency ban, penalising miners, traders –source (Business Insider)

- The $166 billion of SPAC deals in the 1st quarter exceeds all of 2020 (Business Insider)

- Big questions loom ahead of Biden’s next spending push, like ‘what is infrastructure?’ (Reuters)

- Investor questions for the Fed: rebound, inflation and yields (Reuters)

- Why Costco may actually still win long after the pandemic ends (Yahoo! Finance)

- China Becomes First Major Economy to Start Withdrawing Pandemic Stimulus Efforts (Wall Street Journal)

- Taylor Swift Wins Album of the Year at the Grammys (Wall Street Journal)

- Not-So Supertankers Deserve a Look as Pandemic Fades (Wall Street Journal)

- Overlooked corner of stock market offers protection from bond-market volatility (Fox Business)

Be in the know. 15 key reads for Sunday…

- Factbox: Energy firms seize on carbon tech, environmental goals to build new businesses (Reuters)

- Well-Known Companies Highlight Stocks to Buy Under $10 With Huge Potential (24/7 Wall Street)

- Fed to Hike Rates in 2023 but Dots Won’t Show It, Economists Say (Bloomberg)

- Air Force Receives First F-15EX Capable Of Carrying Hypersonic Weapons (ZeroHedge)

- Goldman’s Clients Are Asking If There Are Any Cheap Stocks Left (ZeroHedge)

- March Quarterly Options Expiration Week Historically Bullish: DJIA, S&P 500 & NASDAQ Up 10 of Last 13 (Almanac Trader)

- Banksy’s Painting for Health Care Workers Will Be Sold to Benefit England’s National Health Service (architecturaldigest)

- This Ferrari Monza SP1 Is World’s Most Beautiful Car, According to Science (Maxim)

- jaguar is restoring 12 e-type sports cars for its 60th anniversary (designboom)

- Top Gear Season 30: How the World’s Most Famous Motoring Show Out-Drove a Pandemic (thedrive)

- Most Dictators Self Destruct. Why? (getpocket)

- The European Central Bank fumbles its way towards yield curve control (moneyweek)

- Avoiding Bad Decisions (Farnam Street)

- Spirit: From laughingstock to legit airline (USA Today)

- Short Sellers Boost Bets Against SPACs (Wall Street Journal)

Be in the know. 50 key reads for Saturday…

- Big Pharma Battled the Pandemic. The Stocks Are Cheap. (Barron’s)

- These Aerospace Stocks Will Take Flight Soon. Flying Taxis? Not So Fast. (Barron’s)

- The pandemic made these cereals cool again (CNN Business)

- The value proposition for markets (Financial Times)

- Boeing Gets a Brand New 737 MAX Buyer, and the Stock Is Jumping (Barron’s)

- U.S. Surpasses 100 Million Covid-19 Vaccines Administered (Wall Street Journal)

- The tech-heavy Nasdaq has underperformed the Dow for four straight weeks — a first since 2016 (CNBC)

- Curious Speculations: Collectibles & NFTs (investoramnesia)

- As Covid Wanes, the U.S. Economy Could Soar. What That Means for Investors (Barron’s)

- Charlie Munger uses these mental tricks (cmqinvesting)

- Value Investors Finally Have Reason to Celebrate—for Now (Wall Street Journal)

- Fox’s Tubi Made Millions With Reruns. Now It Wants Original Programming (Bloomberg)

- Why You Should Be Wary of Claims That the Stock Market Is in a Bubble (Time)

- ‘Stimmy’ Is Setting Stage for Next Wave of Retail Stock Frenzy (Bloomberg)

- The Renaissance of Pipelines (contrarianedge)

- Novavax Stock Jumps on Final Data From U.K. Vaccine Trial (Barron’s)

- David Tepper says he’s getting bullish on stocks for a very specific reason (CNBC)

- Drive-Throughs That Predict Your Order? Restaurants Are Thinking Fast (New York Times)

- What Came Before the $10 Billion Bet on Flying Taxis (Wall Street Journal)

- Charlie Munger: How Berkshire got started and became a success (YouTube)

- 3D-printed housing developments suddenly take off – here’s what they look like (CNBC)

- Higher Rates Won’t Kill the Stock Market. What to Do Now. (Barron’s)

- The Tactics People Are Using to Get Their Money Out of China (Bloomberg)

- How Non-Fungible Tokens Are Transforming the Art World (Barron’s)

- The Booming IPO Market Shows No Signs of Slowing. What Investors Need to Know. (Barron’s)

- Eli Lilly Offers More Positive Data on Its Alzheimer’s Drug (Barron’s)

- 14 Undervalued Small-Cap Stocks (Morningstar)

- Here’s What Wall Street Will Focus on Next Week as Fed Rate Panel Meets (Barron’s)

- Bear Warning Seen With Nasdaq 100 Velocity Stalling at 2000 Peak (Bloomberg)

- How Israel Became the World Vaccine Leader (Wall Street Journal)

- It’s Not Just GameStop. Why These Retro Stocks Are Suddenly Hot. (Barron’s)

- How to Play the Valuation Gap Between Growth and Value Stocks (Barron’s)

- Covid-19 Rewrote the Rules of Shopping. What Is Next? (Wall Street Journal)

- Short Seller Takes Aim at Another EV Maker. Its Stock Is Tumbling. (Barron’s)

- China’s Corporate Earnings Set for Biggest Jump in a Decade (Bloomberg)

- Bridgewater’s Prince warns on risky assets after bond decline (Financial Times)

- China Aims to Vaccinate 70-80% of Population By Mid-2022 (Bloomberg)

- Americans with more education are optimistic about the economy. The rest aren’t. (Business Insider)

- Why the spiking bond yields driving sharp losses in tech stocks are not a long-term threat to the market, according to one Wall Street chief strategist (Business Insider)

- Tech’s Volatility Roller Coaster Is Back at Pandemic-Crash Level (Bloomberg)

- Factories Are Gearing Up for a Post-Covid Boom (Bloomberg)

- Billionaire and Celebrity Endorsements Lure Retail Investors to the SPAC Craze (Bloomberg)

- Everything Hot Is ‘Unwinding’ in $21 Billion of Clean-Power ETFs (Bloomberg)

- 50 Companies to Watch in 2021 (Bloomberg)

- Vitalik Buterin, Creator of Ethereum, on Understanding Ethereum, ETH vs. BTC, ETH2, Scaling Plans and Timelines, NFTs, Future Considerations, Life Extension, and More (Featuring Naval Ravikant) (#504) (Tim Ferriss)

- Investors Panic During Natural Disasters. Who Wins When They Do? (institutionalinvestor)

- Investors see ‘gold rush on steroids’ for green battery metals (Financial Times)

- For Wall Street, Everybody’s a Post-Covid Winner (Wall Street Journal)

- 17 Reasons to Let the Economic Optimism Begin (New York Times)

- $100 Billion Has Rotated Back To Value Investing, And More Could Be Coming (ZeroHedge)

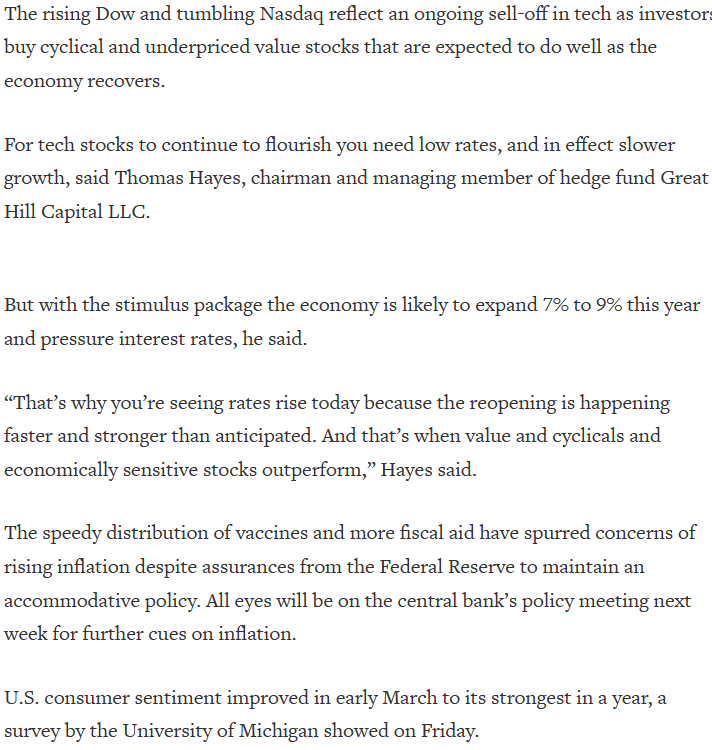

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 73

Hedge Fund Tips with Tom Hayes – Podcast – Episode 63

Tom Hayes – Quoted in Reuters article – 3/12/2021

Thanks to Herbert Lash for including me in his articles on Reuters today. You can find it here: