Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 20 key reads for Friday…

- Vertex Stock Fell After a Setback on a New Drug. It’s an Opportunity for Investors. (Barron’s)

- Oil Jumps On Shocking OPEC+ Move As Saudis Brush Off Shale; ‘Drill, Baby, Drill Is Gone Forever’ (Investor’s Business Daily)

- Companies Are Issuing Guidance Again. What Investors Should Know. (Barron’s)

- Gasoline prices may hit highest levels since 2014 as OPEC+ keeps oil output cuts: report (MarketWatch)

- Walmart-Held Flipkart Reportedly Weighs U.S. Listing Through SPAC Deal (Barron’s)

- Oil Prices Spike on OPEC Surprise. How to Play It. (Barron’s)

- What’s next for markets, after the Fed’s Powell signals he’s not riding to the rescue just yet (MarketWatch)

- Rising Rates Hit M&A as CoStar Pulls Offer for CoreLogic (Barron’s)

- Amgen Acquires a Cancer Drug. Expect More Deals. (Barron’s)

- 5 reasons why negative repo rates are different than the last overnight-funding crisis (MarketWatch)

- ‘Coming 2 America’ Review: Comedic Royalty (New York Times)

- Here’s What’s in the Senate’s $1.9 Trillion Stimulus Legislation (Bloomberg)

- Boeing’s 737 Max Return Gathers Pace With 100 Planes Back in Sky (Bloomberg)

- A Country Club for Race Cars Emerges Minutes From Miami Beach (Bloomberg)

- Here’s why inflation is kryptonite for bonds as Powell’s comments rock markets (CNBC)

- Tech stocks’ market leadership may be over and investors aren’t ‘bullish enough about the reopening’, says Fundstrat’s Tom Lee (Business Insider)

- General Electric (GE) Catalyst Ahead on 3/10, PT Raised to ‘Street High’ $17 at Morgan Stanley (Street Insider)

- Connecticut Rolls Back Covid-19 Business Restrictions (Wall Street Journal)

- Apple Faces U.K. Antitrust Probe Over App Store Rules (Wall Street Journal)

- Winter Storm Eased Natural-Gas Glut (Wall Street Journal)

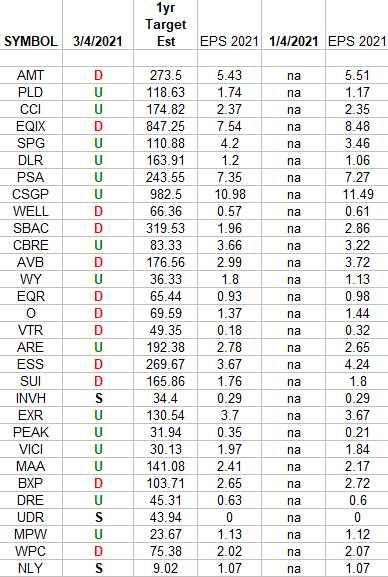

Real Estate Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Real Estate (REIT) Sector ETF (IYR) top 30 weighted stocks. Continue reading “Real Estate Earnings Estimates/Revisions”

Unusual Options Activity – Merck & Co., Inc. (MRK)

Data Source: barchart

Today some institution/fund purchased 2,097 contracts of Jan 2023 $85 strike calls (or the right to buy 209,700 shares of Merck & Co., Inc. (MRK) at $85). The open interest was just 278 prior to this purchase. Continue reading “Unusual Options Activity – Merck & Co., Inc. (MRK)”

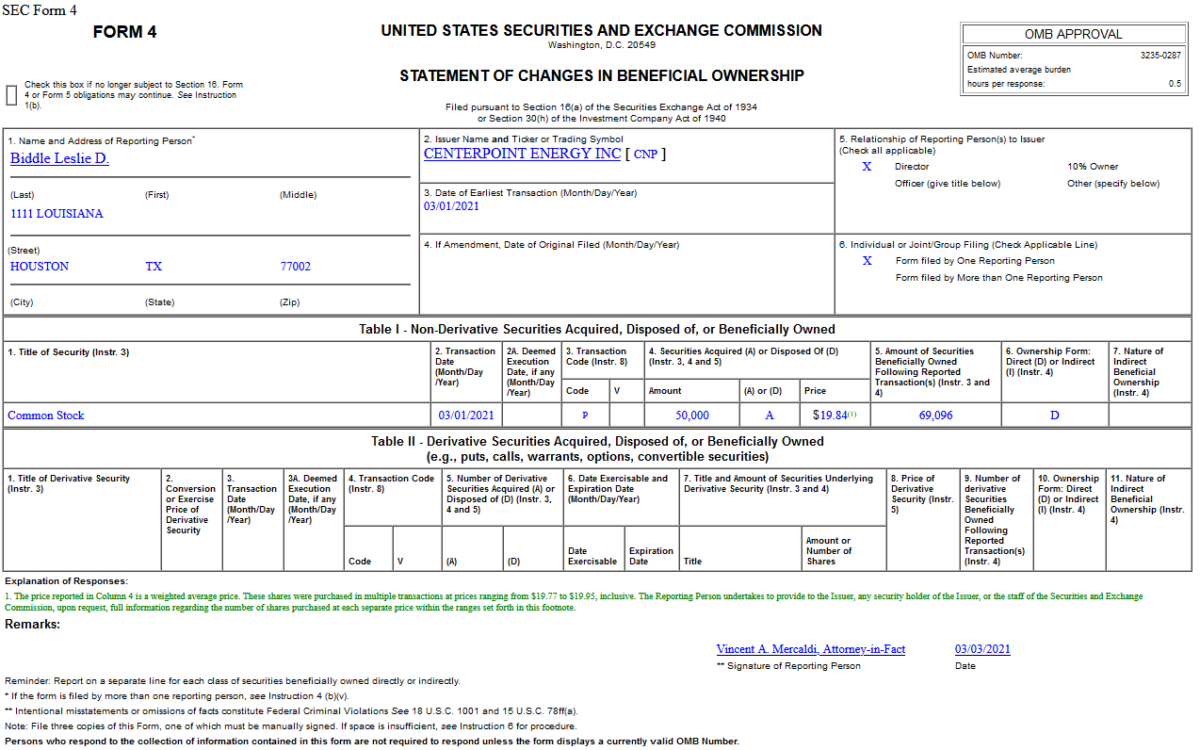

Insider Buying in CenterPoint Energy, Inc. (CNP)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Quote of the Day…

Be in the know. 20 key reads for Thursday…

- Rockets Hit Iraq Base Hosting U.S. Troops Amid Tension With Iran (Wall Street Journal)

- How the Oil Lobby Learned to Love Carbon Taxes (Bloomberg)

- The Inflation Regime Change Is Already Upon Us (Bloomberg)

- Boeing Stock Is Nearing a Key Level. More Gains Could Be Ahead. (Barron’s)

- Be Like Warren Buffett. Use This Options Strategy. (Barron’s)

- The Stock Market Stands to Win Big in a New Stimulus Program (Barron’s)

- Flashing Caution Lights Are Ahead in China. Here’s How Investors Should Proceed. (Barron’s)

- The Treasury Market Is Spooking Tech Stocks Again. Here’s Why. (Barron’s)

- Nuclear Power Finds a New Role in Renewable Energy. That Will Boost Uranium Prices. (Barron’s)

- Why the S&P 500’s bull-market run probably is only getting started (MarketWatch)

- Exxon, Once a Skeptic, Sees Profit in Capturing Carbon Emissions (Wall Street Journal)

- OPEC+ debates whether to raise or freeze oil output as price recovers (Reuters)

- Frequent Fliers Itch to Take Off a Year After Being Grounded (Wall Street Journal)

- Can Eddie Murphy’s ‘Coming 2 America’ Live Up to the Hype? (Wall Street Journal)

- How the Oil Market Bounced Back From a Year of Crisis (Wall Street Journal)

- Inside Pfizer’s Fast, Fraught, and Lucrative Vaccine Distribution (Bloomberg)

- Buffett’s NetJets to Buy 20 Supersonic Luxury Planes From Aerion (Bloomberg)

- Vaccine Shipments Present a Security Challenge Worthy of a James Bond Film (Bloomberg)

- Novartis agrees to help make CureVac COVID-19 vaccine (MarketWatch)

- Hedge funds cash in on the ‘great reflation trade’ (Financial Times)