Where is money flowing today?

Be in the know. 20 key reads for Friday…

- Treasury Secretary Janet Yellen makes push for major stimulus, sees bigger risk in not doing enough (CNBC)

- We’ll Have Herd Immunity by April (Wall Street Journal)

- Why 5 Buy-Rated Energy Stocks May Have Much Higher Upside Potential (24/7 Wall Street)

- FirstEnergy says activist investor Carl Icahn looking to buy stake (Yahoo! Finance)

- Millennium emerges as top hedge fund investor in Spacs (Financial Times)

- Single Dose of Pfizer Vaccine Is 85% Effective, Study Shows (Barron’s)

- Novavax Unveils Potentially Huge Deal to Supply Vaccines (Barron’s)

- The Big Oil Stocks That Goldman Says Have up to 50% Upside Ahead of a Global Recovery (Barron’s)

- Hedge funds on the lookout: ‘they don’t want to get burned’, says analyst as GameStop-style short interest falls (MarketWatch)

- Fluor Is Engineering a Turnaround. Its Stock Could Soar 80%. (Barron’s)

- ‘I am not a cat’: GameStop hearing provides drama and humor (USA Today)

- Pfizer says vaccine can be stored in normal freezer temperatures: Latest COVID-19 updates (USA Today)

- Can Allbirds Live Up to Its $1 Billion Valuation? (Bloomberg)

- Billionaire Peterffy Says N.Y. Rich in Florida Are There to Stay (Bloomberg)

- Billionaire investor Bill Gross made $10 million betting against GameStop — after he was down $15 million at one point (Business Insider)

- Walgreens to start receiving 480,000 COVID-19 vaccine doses a week (MarketWatch)

- How Redditors Find the Next GameStop Stock (Wall Street Journal)

- Clubhouse and Twitter Spaces: The New Way to Play, Network and Escape Video Calls (Wall Street Journal)

- Leon Cooperman Calls for Reinstating the Uptick Rule (Bloomberg)

- Shipping Container Shortage Gives Commodity Prices Extra Boost (Wall Street Journal)

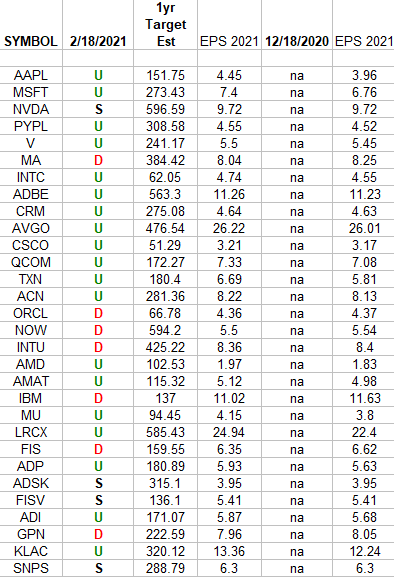

Technology Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Technology Sector ETF (XLK) top 30 weighted stocks. Continue reading “Technology Earnings Estimates/Revisions”

Unusual Options Activity – Pfizer Inc. (PFE)

Data Source: barchart

Today some institution/fund purchased 3,222 contracts of Sept $42 strike calls (or the right to buy 322,200 shares of Pfizer Inc. (PFE) at $42). The open interest was 1,604 prior to this purchase. Continue reading “Unusual Options Activity – Pfizer Inc. (PFE)”

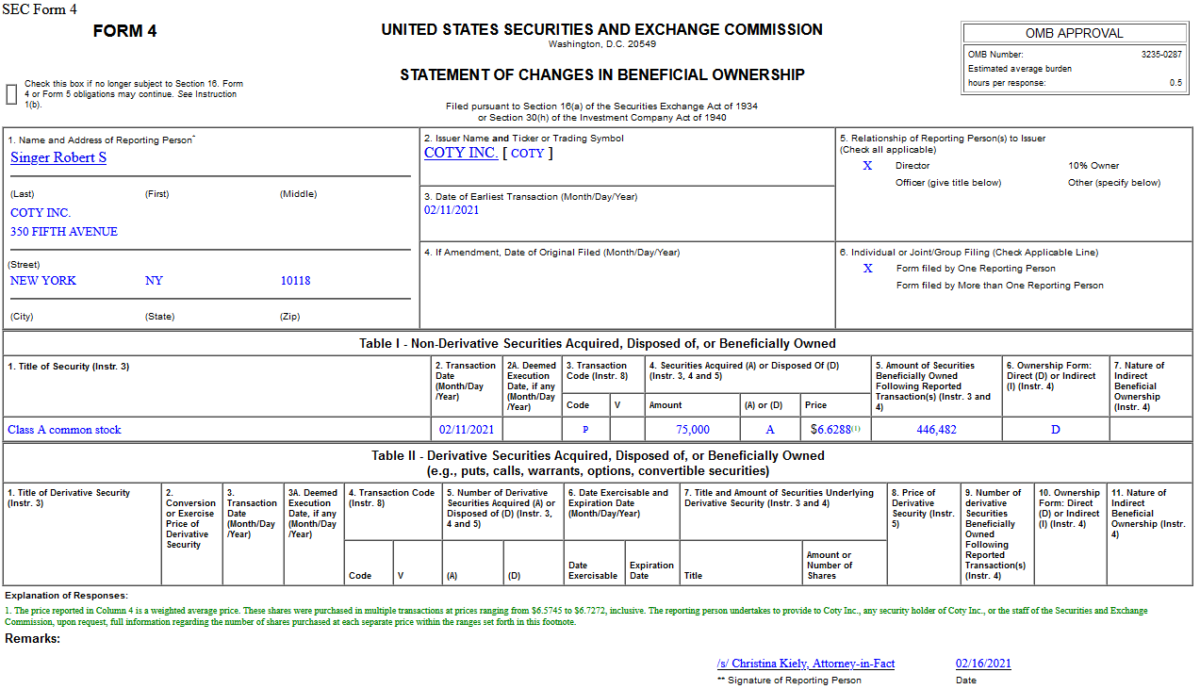

Insider Buying in Coty Inc. (COTY)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 20 key reads for Thursday…

- Wells Fargo stock extends surge after Wall Street’s lone bear said it’s no longer a sell (MarketWatch)

- Mercedes Owner Daimler Says Profit Surged 48% in 2020 on High Demand for Premium Vehicles, Will Spin-Off and List its Daimler Truck Division (StreetInsider)

- VIX Outlook ‘Less Controversial’ Going Forward After Dipping Below 20 for the First Time in 255 Days – UBS (StreetInsider)

- Hedge funds, Robinhood face grilling by Congress over GameStop Reddit rally (StreetInsider)

- U.S. weekly jobless claims unexpectedly rise (Reuters)

- Food Prices Continue to Rise. Expect Bigger Grocery Bills. (Barron’s)

- GE CEO Larry Culp Is Talking About 2021. Cash Flow Is the Key. (Barron’s)

- U.S. Retail Sales Rose Strongly on Stimulus in January (Wall Street Journal)

- Should AT&T Or Verizon Try To Acquire Nokia In 2021? (Yahoo! Finance)

- Dogecoin Has a Top Dog Worth $2.1 Billion (Wall Street Journal)

- Oil Prices Are Up, but Frackers Stay on the Sidelines—for Now (Wall Street Journal)

- Wells Fargo’s $8 Billion Question: How to Slash Costs Without Angering Regulators (Wall Street Journal)

- McLaren’s $258,000 Hybrid Boasts Blazing Speed (Bloomberg)

- U.S. Housing Starts Fell in January for First Time Since August (Bloomberg)

- Music Mogul Buys Beach Boys Songs, Calling Band ‘Underappreciated’ (Bloomberg)

- Bob Pisani explains how ‘payment for order flow’ works (CNBC)

- Walmart shares fall on earnings miss, retailer sees sales growth slowing (CNBC)

- How Lamborghini learned to love the SUV (CNBC)

- No Pandemic Sugar Rush for Nestlé (Wall Street Journal)

- Robinhood heads to the Hill: What to watch at the Congressional hearing (Financial Times)

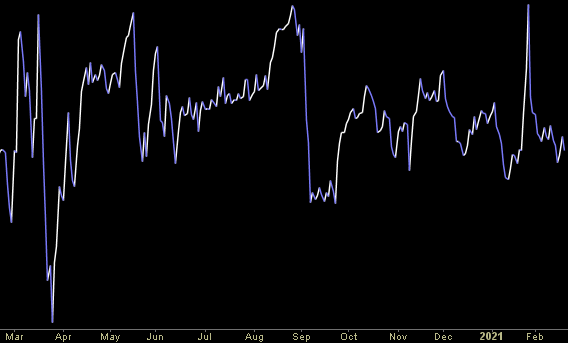

The “Roaring Kitty” Stock Market (and Sentiment Results)…

By now, everyone knows about Keith Gill (aka Roaring Kitty aka Deep F**king Value). He’s the guy who put out a relatively solid fundamental thesis on GameStop and got it more “right” than anyone could have anticipated. Continue reading “The “Roaring Kitty” Stock Market (and Sentiment Results)…”