Data Source: Finvz

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 22 key reads for Wednesday…

- GE Reports Surge in Year-End Cash Flow (Wall Street Journal)

- Larry Kudlow, former top economic adviser to Trump, to host Fox Business show (New York Post)

- Israelis Say They Will Attack Iran If Biden Returns US To Nuclear Deal (ZeroHedge)

- Fed on hold as officials weigh pandemic against vaccines, fiscal support (Reuters)

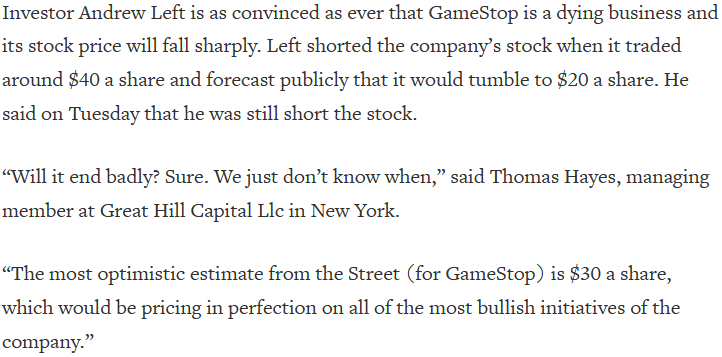

- GameStop Investor Michael Burry — Of ‘The Big Short’ Fame — Dubs Rally ‘Unnatural, Insane, And Dangerous’ (Benzinga)

- Chamath Palihapitiya, Silicon Valley SPAC King, Wants to Be Governor of California (Institutional Investor)

- Is This The Next Big Hedge Fund To Blow Up… And What Happens Next (ZeroHedge)

- Day-Trader Obsession With Hated Stocks Takes Over Options Market (Bloomberg)

- Regeneron says its COVID-19 antibody cocktail still works against new strains in lab test (MarketWatch)

- Dems unveil $15 minimum wage bill, say they may use reconciliation to pass legislation (Fox Business)

- ‘Weaponised’ options trading turbocharges GameStop’s dizzying rally (Financial Times)

- 4 Sin Stocks to Buy That May Survive a Coming Massive Market Sell-Off (24/7 Wall Street)

- How Retail Option Traders Are ‘Supercharging The Short Squeeze’ In GameStop And Other Potential Bubble Stocks (Benzinga)

- Raytheon CEO says the company will ‘load up’ on share buybacks in 2021 after strong 4th-quarter earnings (Business Insider)

- Las Vegas Sands appoints Robert Goldstein its permanent CEO (MarketWatch)

- Putin warns of ‘all against all’ fight if global tensions are not resolved (CNBC)

- Putin says U.S. social media giants are now competing with elected governments (CNBC)

- JPMorgan is launching a digital retail bank in the U.K., looking overseas for growth (CNBC)

- Putin Warns of Global Tensions Similar to 1930s in Davos Speech (Bloomberg)

- Here’s What to Expect When Apple Reports on Wednesday (Barron’s)

- Boeing’s 737 Max Can Fly Again in Europe. What It Means for Airbus Stock. (Barron’s)

- 3M Expects Sales Growth as Customers Return to Offices, Schools (Wall Street Journal)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 1/26/2021

Tom Hayes – Quoted in Reuters article – 1/26/2021

Thanks to Shreyashi Sanyal and Susan Mathew for including me in their article on Reuters today. You can find it here:

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Where is money flowing today?

Be in the know. 30 key reads for Tuesday…

- Wall Street Is Still Betting on Wells Fargo (Barron’s)

- Raytheon’s Solid Earnings Offer Hope for Aerospace Suppliers (Barron’s)

- GE Soars as Cash Outlook Shows Turnaround Regaining Traction (Bloomberg)

- The One Key Number in Johnson & Johnson’s Earnings (Barron’s)

- These 10 Stocks Offer Yields of 5% and Up (Barron’s)

- The 1920s Roared After a Pandemic, and the 2020s Will Try (Bloomberg)

- Why This Schlumberger Analyst Has ‘Growing Confidence In An International Inflection’ (Benzinga)

- IMF expects US and China to recover most strongly from virus economic hit (Financial Times)

- J&J Covid-19 vaccine data due ‘soon’ as drug maker boosts outlook (FoxBusiness)

- Goldman Sachs warns of a dangerous bubble in these 39 stocks (Yahoo! Finance)

- Regeneron (REGN) COVID-19 Antibody Cocktail Prevented 100% of Symptomatic Infections When Used as Passive Vaccine (streetinsider)

- GameStop Day Traders Won’t Sack Wall Street (Wall Street Journal)

- Amazon Union Drive Takes Hold in Unlikely Place (New York Times)

- How Options Trading Could Be Fueling a Stock Market Bubble (New York Times)

- Pfizer to Deliver U.S. Vaccine Doses Faster Than Expected: CEO (Bloomberg)

- GameStop Shorts Don’t Deserve All the Schadenfreude (Bloomberg)

- Home Prices in U.S. Cities Rise at Fastest Pace Since 2014 (Bloomberg)

- Booming Blank Check Companies Are the Talk of Reddit and TikTok (Bloomberg)

- Mania in stocks like GameStop suggest a market pullback is coming (CNBC)

- BlackRock calls for more disclosure on companies’ climate change plans (CNBC)

- Google says North Korean state hackers are targeting security researchers (CNBC)

- Tech companies could see blowout fourth quarters for ad revenue (CNBC)

- Short sellers are down $91 billion in January as GameStop leads squeeze in stocks they bet against (CNBC)

- Janet Yellen becomes the first female Treasury chief; may be a calming influence in a divided Washington (USA Today)

- Opinion: Insider selling is alarmingly high and small-cap stocks are in the crosshairs (MarketWatch)

- GameStop Stock Is Just the Latest Sign of a Speculative Frenzy (MarketWatch)

- Liberty Global’s $100 Billion Deal Making Spree Is Paying Off (Barron’s)

- The risk of a stock market correction is increasing as resistance levels come into play, BofA says (Business Insider)

- 5 Airlines Are Reporting Earnings This Week. Here’s What to Expect. (Barron’s)

- Yellen Passed the Economic Stability Baton to Powell. Now, He’s Handing It Back. (Wall Street Journal)

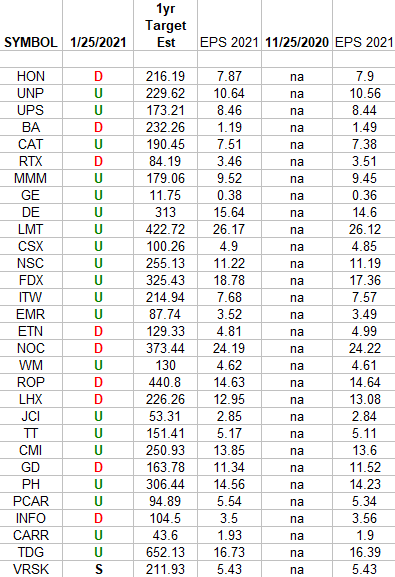

Industrials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2021 earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. The column under the date 1/25/2021 has a letter that represents the movement in 2021 earnings estimates since the most recent print (11/25/2020).

Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”