Article referenced in VideoCast above:

Hedge Fund Tips with Tom Hayes – Podcast – Episode 45

Unusual Options Activity – Raytheon Technologies Corporation (RTX)

Data Source: barchart

Today some institution/fund purchased 16,812 contracts of June $70 strike calls (or the right to buy 1,681,200 shares of Raytheon Technologies Corporation (RTX)) at $70). The open interest was just 1,854 prior to this purchase. Continue reading “Unusual Options Activity – Raytheon Technologies Corporation (RTX)”

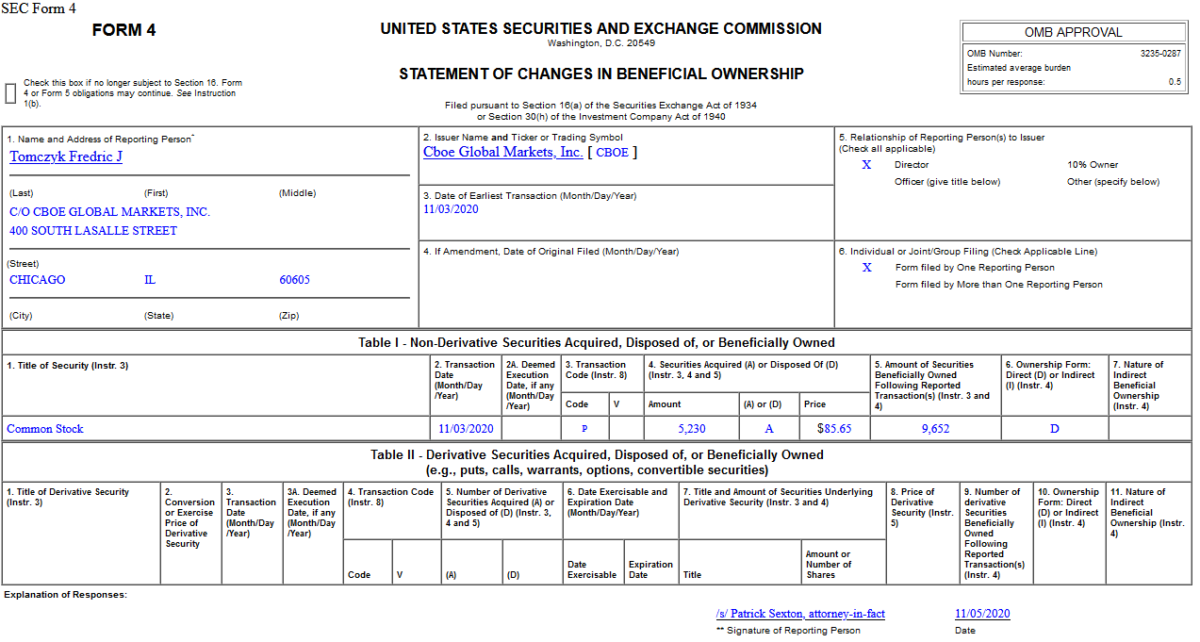

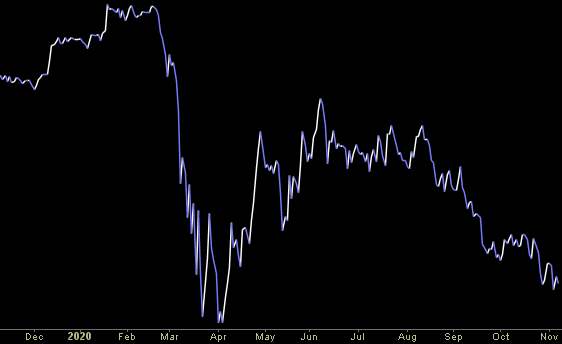

Insider Buying in Cboe Global Markets, Inc. (CBOE)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Friday…

- Citi and Barclays Push Back Against the Reflation Doom and Gloom (Bloomberg)

- Unemployment Falls to 6.9% as Hiring Climbs More Than Expected (Barron’s)

- Why Danone Stock Could Be Appetizing to Investors (Barron’s)

- 6 S&P 500 Dividend Payers With Safe Yields Above 2% (Barron’s)

- The Fed Could Do a Little More. But a Stimulus Package Would Be Better. (Barron’s)

- Investments to Add to Your Portfolio in a Contested Election (Barron’s)

- The Boeing 737 MAX Will Come Back Soon. Wall Street Is Getting Ready. (Barron’s)

- Alibaba cloud growth outpaces Amazon and Microsoft as Chinese tech giant pushes for profitability (CNBC)

- Why the stock market is loving the prospect of a divided government (Business Insider)

- Carl Icahn boosts Xerox stake to over 14% (Yahoo! Finance)

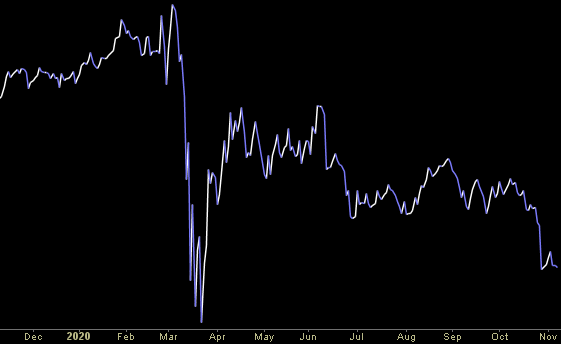

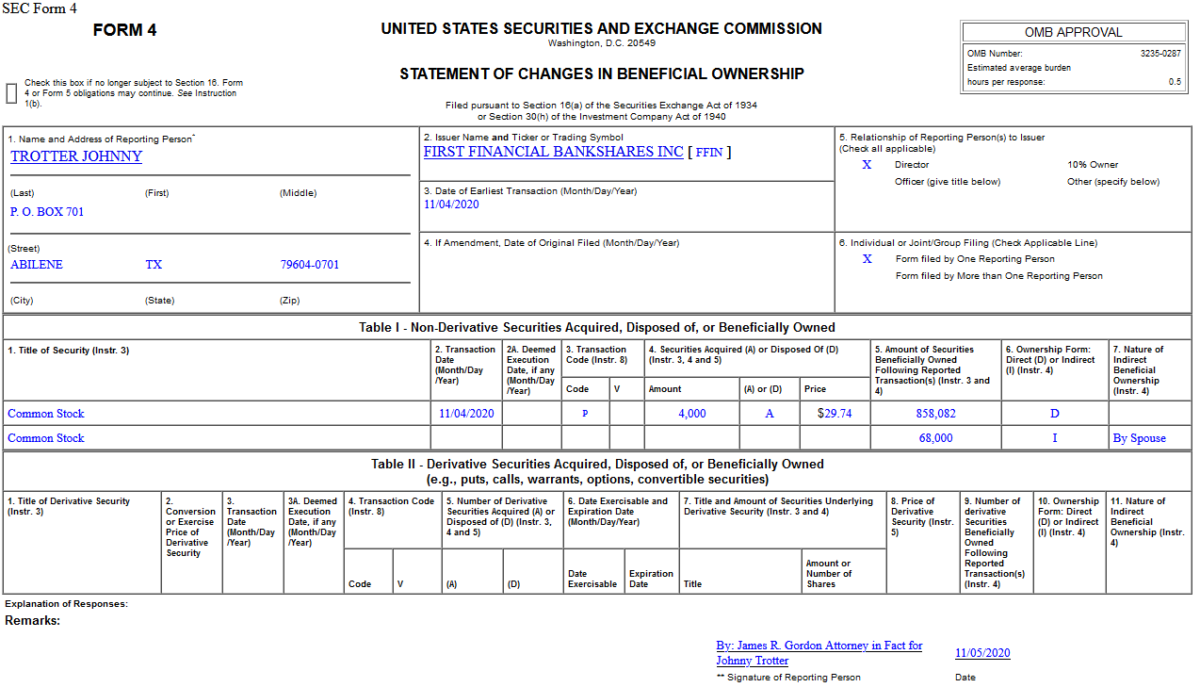

Insider Buying in First Financial Bankshares, Inc. (FFIN)

Unusual Options Activity – Social Capital Hedosophia Holdings Corp. III (IPOC)

Data Source: barchart

Today some institution/fund purchased 2,365 contracts of May $12.50 strike calls (or the right to buy 236,500 shares of Social Capital Hedosophia Holdings Corp. III (IPOC) at $12.50). The open interest was just 799 prior to this purchase. Continue reading “Unusual Options Activity – Social Capital Hedosophia Holdings Corp. III (IPOC)”