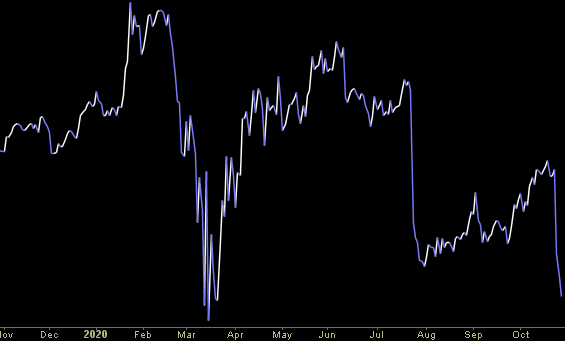

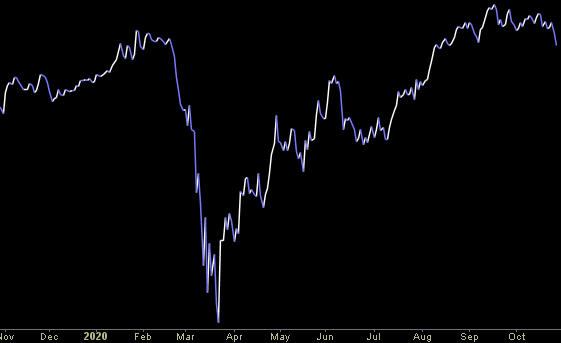

Data Source: Finviz

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Tom Hayes – Quoted in Reuters article – 10/27/2020

Thanks to Medha Singh and Shivani Kumaresan for including me in their article on Reuters today. You can find it here:

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 30 key reads for Tuesday…

- Opinion: Most investors now expect the U.S. stock market to crash like it did in October 1987 — why that’s good news (MarketWatch)

- The S&P 500 could jump 14% to 3,900 if Trump wins the election, JPMorgan says (Business Insider)

- Kazakhstan, Reversing Itself, Embraces ‘Borat’ as Very Nice (New York Times)

- Odeon’s Dick Bove Cites 3 Reasons for Bank Stock Rally, Which Should Continue (Street Insider)

- Chairman Plattner buys nearly $300 million in SAP stock (Street Insider)

- Covid condemns value investing to worst run in two centuries (Financial Times)

- SAP Casts a Cloud Over Software (Wall Street Journal)

- Cummins stock surges toward a record after profit and revenue beats, upbeat outlook (MarketWatch)

- Biogen (BIIB) Shares Looking ‘Interesting’ Into Big Week Ahead – Mizuho (Street Insider)

- Are the Polls Wrong Again? (LPL Financial)

- ‘Orderly’ Trump win most favorable outcome for equities, JPMorgan says (Reuters)

- Wells Fargo Considers Sale Of Corporate-Trust Unit, Student-Loan Portfolio: Report (Benzinga)

- All About Ant Group, the Next Big Tech I.P.O. (New York Times)

- 9 Promising Stocks From Emerging Markets (Barron’s)

- 10 High-Yielding Stocks That Should Please Investors Looking for Income (Barron’s)

- 3M’s Earnings Were a Positive Surprise. Investors Should Be Relieved. (Barron’s)

- BP Returns to Profit as Oil Demand and Prices Recover. (Barron’s)

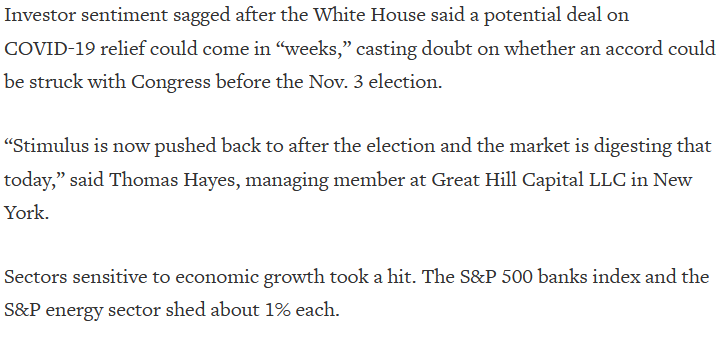

- Stimulus Hope On Hold Until After Election as Senate Leaves (Bloomberg)

- The Land Rover Defender Returns With a Nod to Silicon Valley (Bloomberg)

- The Market Is Betting Trump Will Lose the Election. Here’s the Playbook if It’s Wrong. (Barron’s)

- Why Amazon, Tesla, and other ‘Elite Eight’ mega-cap titans look to be in a bubble despite strong profit growth, according to one research firm (Business Insider)

- Stocks historically win in this election scenario (Fox Business)

- Early voting surge points to huge turnout in US election (Financial Times)

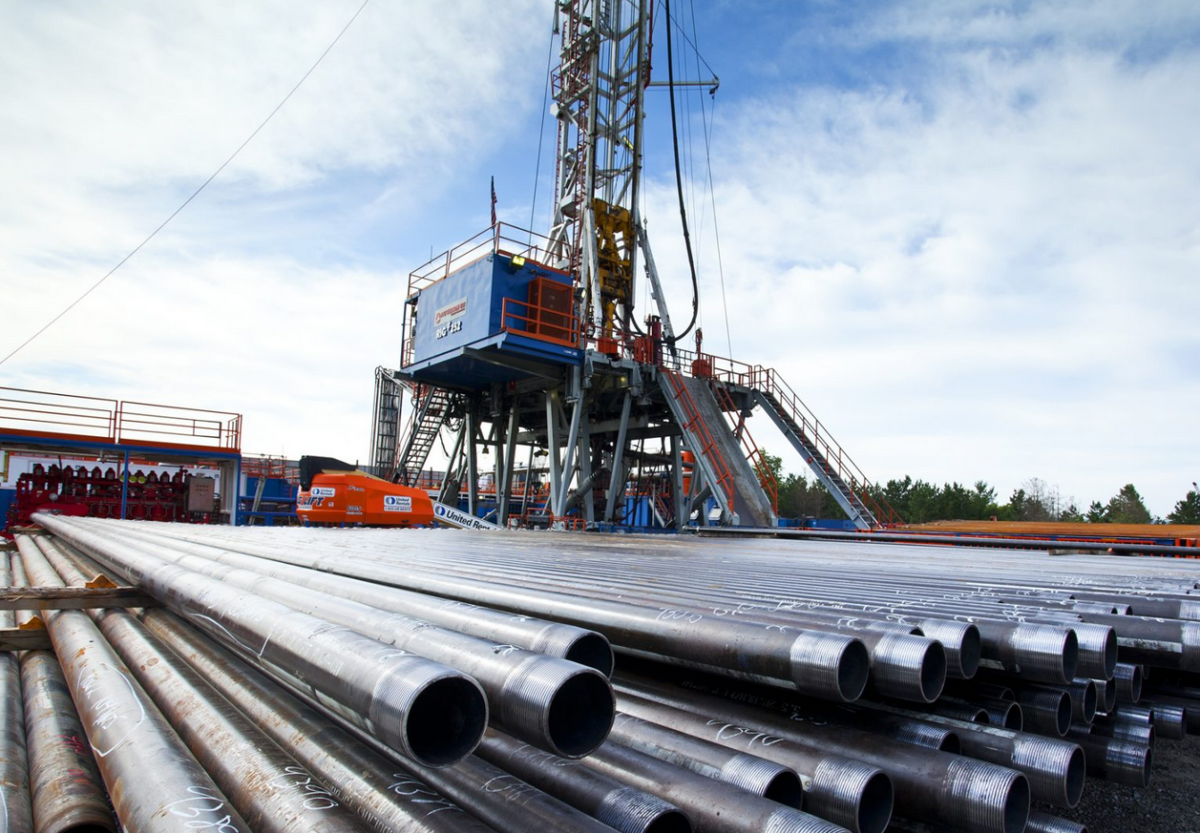

- The US shale industry’s top priority: win back Wall Street (Financial Times)

- Pfizer earnings report touts COVID vaccine progress in clinical trial (FoxBusiness)

- Pandemic Fatigue Is Real—And It’s Spreading (Wall Street Journal)

- Oxford, AstraZeneca Vaccine Shows Promising Immune Response in Older Adults (Wall Street Journal)

- American International Group to Divest Life-Insurance Business (Wall Street Journal)

- Corporate Defaults Slow, Lifting Debt Market (Wall Street Journal)

- 40 perfect Christmas gift ideas for men (USA Today)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 10/26/2020

Where is money flowing today?

Be in the know. 12 key reads for Monday…

- Why Small-Cap Stocks Are Poised to Outpace Large-Caps (Barron’s)

- The tech giants are at risk of a 2001-style valuation collapse, says colorful SocGen strategist (MarketWatch)

- The Government Is Coming for Google and Other Big Tech Companies. What to Do With the Stocks. (Barron’s)

- Groundwork for US lawsuit vs. Google goes back to 2012 (New York Post)

- Oh, No, Zeta! The Energy Report 10/26/2020 (Phil Flynn)

- UPDATE 2-Ant Group to raise up to $34.4 bln in world’s biggest public offering (Reuters)

- Pfizer test experimental vaccine on 12-year-olds (CNN)

- Academics Say Momentum Factor Is ‘Much Weaker’ Than You Think (Institutional Investor)

- AstraZeneca COVID-19 Vaccine Data Shows Promising Signs In Older Age Group: FT (Benzinga)

- ‘Don’t believe anything,’ says Nicole Kidman of twisty HBO thriller ‘The Undoing’ with Hugh Grant (USA Today)

- A Global Rebound Could Be Determined by How Freely Households Spend (Wall Street Journal)

- Cenovus and Husky to Merge in $2.89 Billion Deal (Wall Street Journal)

Be in the know. 12 key reads for Sunday…

- Card Companies, Surprised by Low Write-Offs, Seek New Customers (Bloomberg)

- Josh Younger on Rate Derivatives and Volatility (Podcast) (Bloomberg)

- The 2021 Ford Bronco and Bronco Sport Configurators Are Here, So Show Us Your Dream Rigs (The Drive)

- Elon Musk’s 2 Rules For Learning Anything Faster (entrepreneurshandbook)

- Vegas Strip’s live performances to resume (Fox Business)

- Larry David Reveals All-Time Favorite ‘Seinfeld’ Episode (Hollywood Reporter)

- Natural Gas Looks to Join the Energy Merger Wave. EQT Is Said to Be Pursuing CNX. (Barron’s)

- Ready for another Big Tech hearing/earnings doubleheader? (MarketWatch)

- Stock-market investors brace for busiest week of earnings in October’s final hurrah (MarketWatch)

- Starboard tries to find another winner in the fintech space (CNBC)

- Look Past Election Blues for Health Stocks (Wall Street Journal)

- AstraZeneca and Johnson & Johnson COVID-19 Vaccine Trials to Resume in the United States (TrialSiteNews)

Be in the know. 25 key reads for Saturday…

- Remdesivir Gets FDA Approval. What It Means for Gilead Stock and Vaccine Makers (Barron’s)

- How Coke Is Shaking Things Up — and Why Its Stock Is a Buy (Barron’s)

- Stocks will see a big surge in the 1st quarter of 2021 after stimulus passes, forecasts billionaire investor Paul Tudor Jones (Business Insider)

- “Tech Workers Are Never Going Back to the Office”: The Pandemic Housing-Market Explosion Could Upend Silicon Valley as We Know It (Vanity Fair)

- U.S. natural gas exports to Mexico have increased in the first nine months of 2020 (eia)

- Matthew McConaughey on His Success Playbooks, the Powerful Philosophy of Greenlights, and Choosing the Paths Less Traveled (#474) (Tim Ferriss)

- 3 Undervalued Travel Stocks We Like (Morningstar)

- Psychology, Behavior & Markets (Investor Amnesia)

- Rotation (theirrelevantinvestor)

- Reflections on 100 Baggers (woodlockhousefamilycapital)

- What Sharks Can Teach Us About Survivorship Bias (Farnam Street)

- Who Says Value’s Dead? (thefelderreport)

- Value: If Not Now, When? (pzena)

- Berkshire Announced $19 billion in Investments After Buffett Blasted for Not Buying (validea)

- Emerging Market Stocks Are Breaking Out. These Companies Can Rival U.S. Tech Giants (Barron’s)

- Epidemiologists Stray From the Covid Herd (Wall Street Journal)

- BofA Securities Stays Bullish on 4 Former Blue-Chip Stocks Trading Under $10 (24/7 Wall Street)

- Halloween Trading Strategy: S&P 500 Up 85% of the Time (Almanac Trader)

- The USA vs. Google (Financial Times)

- Smaller Hedge Funds Are Outpacing Their Larger Rivals (Forbes)

- Ray Dalio on the Decline of Real Interest Rates (Podcast) (Bloomberg)

- De Tomaso Is Moving to the US So It Can Build the New P72 Supercar Stateside (Robb Report)

- Rebecca Takes Place in the Ultimate English Estate (Architectural Digest)

- These Classic Alfa Romeo Concepts Could Sell for $20 Million (Maxim)

- First Drive: The New McLaren GT (Maxim)