- 8 Best Buffett Stocks to Buy for Dividends (US News)

- The Economic Legacy Of Shinzo Abe (NPR Planet Money)

- FAANGs Risk Ending Up Like the Nifty Fifty, Cooperman Worries (CIO)

- ‘Cobra Kai’ Never Dies With Teaser Video Announcing Season 3 Netflix Premiere Date (Maxim)

- Buy Terex Stock. Here’s Why It’s Barron’s Stock Pick This Week. (Barron’s)

- Watch Official Trailer for ‘Borat’ Sequel (Maxim)

- 2020 Chevrolet Corvette Daily-Driven Review: An Exotic You Can Race Comfortably to Costco (thedrive)

- Trump’s illness sparks new urgency for COVID-19 deal (The Hill)

- Ivermectin Could Turn COVID-19 Around. We Need To Find Out If It Works. (TrialSiteNews)

- Investors expect banks to kick off better Q3 earnings, but fear stimulus bridge for U.S. economy is crumbling (MarketWatch)

Be in the know. 20 key reads for Saturday…

- 7 reasons why investors should favour value stocks over growth, according to BofA (Business Insider)

- Wall Street claims the ‘Nasdaq Whale’ is back to pushing up tech stocks (New York Post)

- Being Smart is Not Enough (Farnam Street)

- Physicians Decided to Start Remdesivir Therapy for Trump (Bloomberg)

- JPMorgan’s quant guru details 2 ways Trump’s COVID-19 diagnosis can lift markets (Business Insider)

- The Nifty Fifty: Valuing Growth Stocks (Dividend Growth Investor)

- Elon Musk: Fusion Will Probably Be More Expensive Than Wind, Solar (Futurism)

- Dallas Fed’s Kaplan Lays Out Path for Additional Federal Reserve Aid, If Needed (Wall Street Journal)

- Will value survive its long winter? (Robeco)

- Warren Buffett’s charity dinner spurred the boss of an online-trading platform to embrace value investing (Business Insider)

- Think Like a Poker Player (Real Reutrns)

- Monopolies Are Distorting the Stock Market (Sparkline Capital)

- Warren Buffett was blasted as ‘washed up’ for not buying during the coronavirus crash. Berkshire Hathaway has announced $19 billion of investments this quarter (Business Insider)

- MiB: Dave Portnoy, founder of Barstool Sports (Bloomberg)

- What You Need To Know About Trump’s Experimental Coronavirus Antibody Treatment (Forbes)

- The Scientologist Billionaire Trying To Make A New Antibiotic (Forbes)

- The Richest Hedge Fund Managers On The 2020 Forbes 400 List (Forbes)

- Billionaire Backers: Explore The Big Money Behind Biden & Trump (Forbes)

- Letter from the Value Investing Mental Asylum or How I Embraced Stoics (Insider Monkey)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 50

Article referenced in VideoCast above:

The “Build Me Up Buttercup” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 40

Article referenced in podcast above:

The “Build Me Up Buttercup” Stock Market (and Sentiment Results)…

Unusual Options Activity – Citigroup Inc. (C)

Data Source: barchart

Today some institution/fund purchased 9,907 contracts of Jan 2022 $62.50 strike calls (or the right to buy 990,700 shares of Citigroup Inc. (C) at $62.50). The open interest was 2,908 prior to this purchase. Continue reading “Unusual Options Activity – Citigroup Inc. (C)”

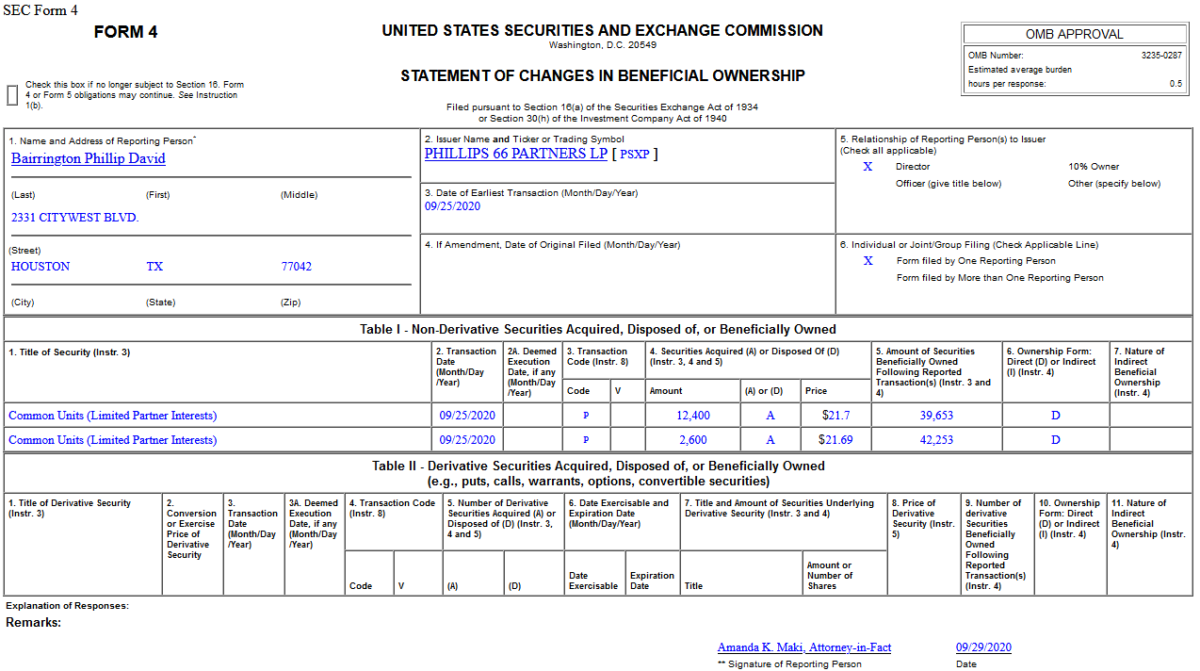

Insider Buying in Phillips 66 Partners LP (PSXP)

Where is money flowing today?

Be in the know. 10 key reads for Friday…

- The Stock Market Doesn’t Need Another Stimulus Bill. Really. (Barron’s)

- Dr. Scott Gottlieb: Remdesivir best coronavirus treatment should Trump need one (CNBC)

- Trian Fund Management takes 9.9% stakes in Invesco, Janus Henderson (CNBC)

- The McLaren GT is out of this world in style and performance (USA Today)

- White House doctor says Trump can carry out duties without disruption (MarketWatch)

- Why US evangelicals are flocking to Trump (Financial Times)

- Roblox Plans To Go Public Via IPO Or Direct Listing: Report (Benzinga)

- President of One of Largest Dominican Republic Private Health Systems: Ivermectin has Helped Treat 6,000 Patients (TrialSiteNews)

- Wall Street’s Biggest Banks Are Muscling Into Small Deals (Bloomberg)

- Even in a Rough Patch, Some Energy Stocks Offer Attractive Yield (Barron’s)

Unusual Options Activity – Wells Fargo & Company (WFC)

Data Source: barchart

Today some institution/fund purchased 25,973 contracts of Dec $30 strike calls (or the right to buy 2,597,300 shares of Wells Fargo & Company (WFC) at $30). The open interest was 11,074 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”