Where is money flowing today?

Be in the know. 20 key reads for Friday…

- Banks Could Soon Get Their Day in the Sun (Barron’s)

- Sandy Weill says Citi has ‘an unbelievable opportunity’ to grow (CNBC)

- Jefferies Global Survey Has 12 Incredible COVID-19-Related Surprises and Predictions (24/7 Wall Street)

- As Airlines Fight for Leisure Travel, Some Are Being More Nimble Than Others (Barron’s)

- And Now for a Contrarian View: By Some Measures, the Job Market Is Back to Normal (Barron’s)

- Corporate bond issuance off to a bang in September (MarketWatch)

- J.P. Morgan Wants Trading Staff Back in the Office (Barron’s)

- Another Analyst Has Weighed in on Rocket. Here’s How They Value the Stock. (Barron’s)

- Citigroup’s Jane Fraser to Succeed Michael Corbat as CEO (Wall Street Journal)

- AstraZeneca COVID-19 vaccine could be ready this year despite study halt (New York Post)

- Chevy’s Little Engine That Could (New York Times)

- Several Covid-19 Vaccines Could Join Winner’s Circle (Wall Street Journal)

- Goldman Sachs raises global equities to ‘overweight’ (Street Insider)

- Top CEOs put big city mayor on notice over rise in crime, quality of life issues (Fox Business)

- Companies urged to issue debt in calm before US election (Financial Times)

- 7 Undervalued Stocks to Buy Before They’re Blasting Off Again (Yahoo! Finance)

- Star Island Is Reliving Its Glory Days, Thanks to Buyers Like Ken Griffin and Jennifer Lopez (Wall Street Journal)

- The New ‘Blank Check’ Barons Are Coming for Wall Street (Bloomberg)

- History and Gentrification Clash in a Gilded Age Resort (Bloomberg)

- Morgan Stanley’s Rich Clients Shift to Hedge Funds for Defense (Bloomberg)

Tom Hayes – CGTN “The Heat” Appearance – 9/10/2020

Tom Hayes – The Claman Countdown – Fox Business Appearance – 9/10/2020

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 15 key reads for Thursday…

- Fed Needs Fiscal Support to Close Gap Between Markets, Real Economy (Wall Street Journal)

- Did Warren Buffett Do the Prudent Thing and Sell Some Apple (AAPL) as it Surpassed 50% of Berkshire’s Portfolio? (Street Insider)

- 5 Very Undervalued Large Cap Biotech Stocks That Could Explode in 2021 (24/7 Wall Street)

- Wall Street sees a bright side in ‘healthy’ tech selloff (Reuters)

- New York Islanders Fans Finally Have Something to Cheer About (Wall Street Journal)

- JPMorgan Says Big Options Bets Can Swing Stocks in Thin Markets (Bloomberg)

- The market and Congress are locked in a high-stakes game of chicken — and who blinks first will ultimately determine where stocks go next (Business Insider)

- More Americans Are Quitting Their Jobs. That’s a Good Sign (Bloomberg)

- Soybeans have been surging on Chinese demand, trade group CEO says buying could continue (CNBC)

- Maserati’s New Supercar: All the Photos and Specs (Bloomberg)

- Breaking Up With China Is Hard to Do. Here’s What Investors Need to Know. (Barron’s)

- AstraZeneca’s Vaccine-Trial Pause Won’t Slow Its Rivals (Barron’s)

- Goldman Sachs memo reveals plan to bring thousands of bankers back to the office (fn London)

- There are seven coronavirus vaccine candidates being tested in the U.S. — here’s where they stand (MarketWatch)

- New York City to Resume Indoor Dining at Restaurants (Wall Street Journal)

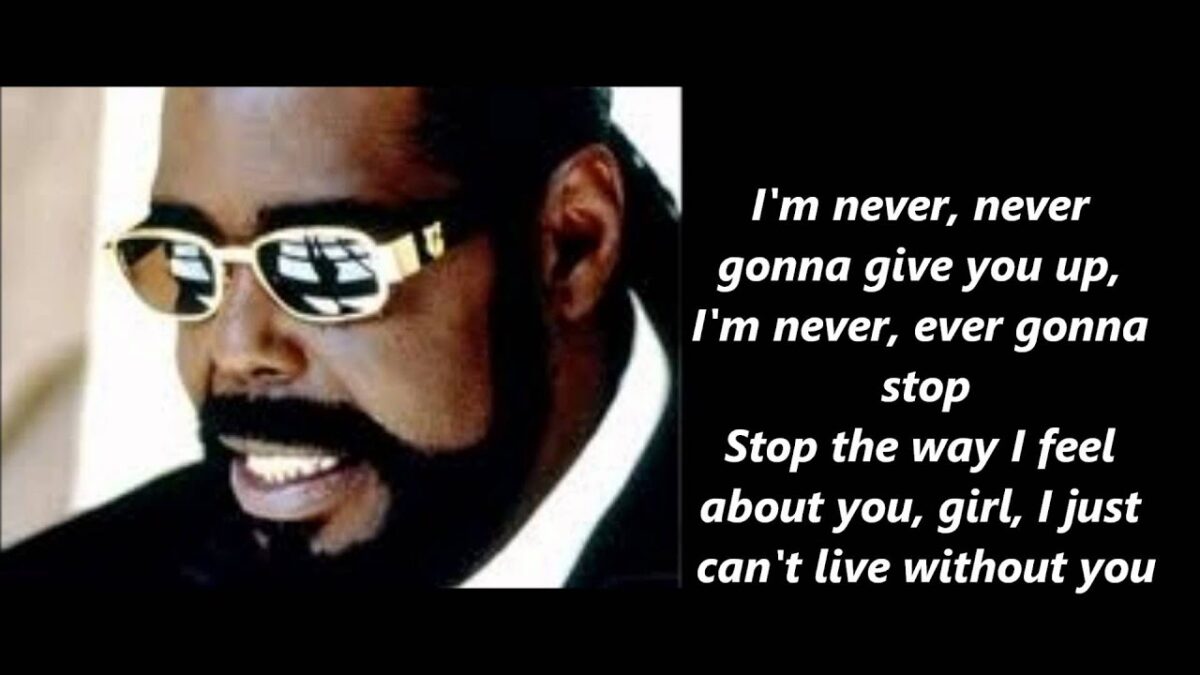

The Barry White, “Never Gonna Give You Up” Stock Market (and Sentiment Results)…

This shortened Holiday Week, the song we chose to embody Stock Market sentiment is Barry White’s, “Never Gonna Give you Up.” Continue reading “The Barry White, “Never Gonna Give You Up” Stock Market (and Sentiment Results)…”