- The hedge fund manager behind a long-shot coronavirus pill (Financial Times)

- Goldman Sachs says a national mask mandate could slash infections and save economy from a 5% hit (CNBC)

- A Few Thoughts on the Wells Fargo Dividend Cut/Cap (Hedge Fund Tips)

- Dow futures bounce around as investors await Powell, Mnuchin testimony on the coronavirus response (MarketWatch)

- How Dell Stock Can Take Off. A VMware Spinoff Is Just Part of the Answer. (Barron’s)

- Gilead Is Wise to Leave Remdesivir Money on the Table (Wall Street Journal)

- Who Says Emerging Economies Shouldn’t Print Money? (Wall Street Journal)

- Saudi Prince Calls OPEC Laggard Nigeria Amid Push for Oil Cuts (Bloomberg)

- Low and slow – how to barbecue beef ribs (Financial Times)

- Tesla On Track To Beat Q2 Deliveries Forecast, Analyst Says (Benzinga)

A Few Thoughts on the Wells Fargo Dividend Cut/Cap

We’ve spoken about the potential for dividend cuts on banks in recent Podcasts/VideoCasts – and that given how they were trading before the fact (like death) – it could likely be a “sell the rumor, buy the news” event. Continue reading “A Few Thoughts on the Wells Fargo Dividend Cut/Cap”

Unusual Options Activity – Bank of America Corporation (BAC)

Data Source: barchart

Today some institution/fund purchased 5,514 contracts of June 2021 $23 strike calls (or the right to buy 551,400 shares of Bank of America Corporation (BAC) at $23). The open interest was 4,298 prior to this purchase. Continue reading “Unusual Options Activity – Bank of America Corporation (BAC)”

Where is money flowing today?

Quoted in Reuters article Monday:

Thanks to Devik Jain and Pawel Goraj for including me in their article on Reuters today. You can find it here:

Be in the know. 20 key reads for Monday…

- CanSino’s coronavirus vaccine candidate approved for military use in China (CNBC)

- Fed Reveals Bond Purchases Including AT&T, UnitedHealth, Walmart (Bloomberg)

- Covid Takes a Back Seat. The Energy Report 06/29/2020 (Phil Flynn)

- Gilead Discloses Pricing Plans for Covid-19 Treatment Remdesivir (Barron’s)

- Boeing 737 MAX Test Flights Are Set to Begin (Barron’s)

- FedEx, Micron, June Jobs Data, Fed Minutes, and More to Watch This Week (Barron’s)

- Burger King sales rebound as states reopen after COVID-19 lockdown (Yahoo! Finance)

- We need to get capital into communities of color: Michael Milken (Fox Business)

- Hedge funds eye new corporate structure in Singapore (Financial Times)

- Coty to buy 20% stake in Kim Kardashian West’s beauty line (Financial Times)

- Hedge Funds Are Rushing to Get Out of Bearish U.S. Stock Bets (Bloomberg)

- Telehealth’s Long-Term Staying Power (Bloomberg)

- Ten Years After IPO, a Look Back at Tesla’s Extraordinary Decade (Bloomberg)

- Reopenings Power a 9-Week Climb in Canadian Consumer Confidence (Bloomberg)

- Southwest will soar 47% as domestic focus and strong balance sheet outshine rivals, Goldman says (Business Insider)

- Baltic index rises on firmer capesize, supramax demand (Reuters)

- Fed Looks Down Under for Rate Strategy (Wall Street Journal)

- Will Anyone Bid $60 Million Online for a Painting? (Wall Street Journal)

- Even the Bible Is Full of Flawed Characters (Wall Street Journal)

- Big-Tech Investors Need to Start Watching Brussels More Closely (Wall Street Journal)

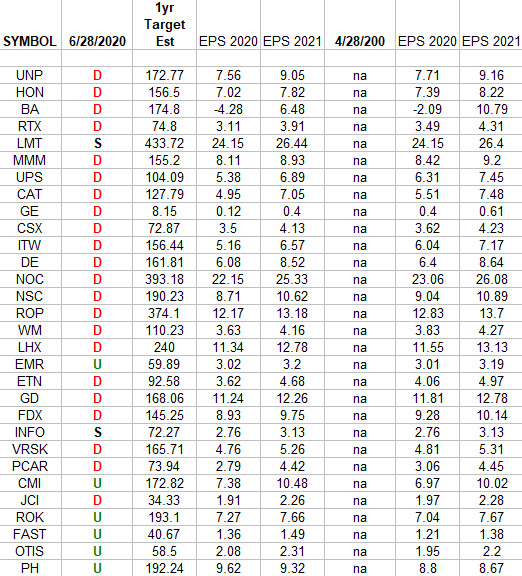

Industrials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the 2020 and 2021 earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. The column under the date 6/28/2020 has a letter that represents the movement in 2020 earnings estimates since the most recent print (4/28/2020). Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”

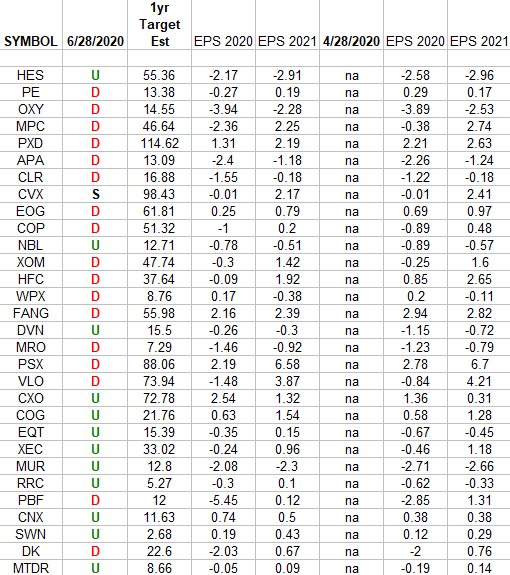

Exploration & Production Sector (XOP) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Exploration & Production Sector (XOP). I have columns for what the 2020 and 2021 estimates were: 4/28/2020 and today. Continue reading “Exploration & Production Sector (XOP) – Earnings Estimates/Revisions”

Tom Hayes – NJNN TV Appearance – 6/28/2020

NJNN TV Appearance – Thomas Hayes – Chairman of Great Hill Capital – June 28, 2020

Be in the know. 25 key reads for Sunday…

- Americans Hold Huge Pile of Cash That’s Key to Economic Recovery (Bloomberg)

- Boeing 737 MAX certification flight tests to begin Monday: sources (Fox Business)

- What The Black Death And Spanish Flu Tell Us (Podcast) (Bloomberg)

- The Word of the Day Is Cautious (Futures Mag)

- Well-Known Energy Companies Highlight Goldman Sachs Stocks to Buy Under $10 (24/7 Wall Street)

- Masks Could Help Stop Coronavirus. So Why Are They Still Controversial? (Wall Street Journal)

- Gilead is about to start trials of an inhaled version of Remdesivir (Gilead)

- Jim Cramer: Memo to Texas – No Mask, No Success, Period (TheStreet)

- Christmas in July: NASDAQ’s Mid-Year Rally (Almanac Trader)

- Pandemic Real Estate Boom? Medieval History Says Yes (Wall Street Journal)

- What Type Of Yacht Does Rande Gerber Escape To In The Summer? (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Bentley Rolls the Final Mulsanne Off the Production Line (Robb Report)

- John F. Kennedy’s Former Winter White House in Palm Beach Sells (Architectural Digest)

- This Reinforced 1971 Plymouth Road Runner Packs A V10 From A Viper (The Drive)

- The Donkervoort D8 GTO-JD70 Is an Absurdly Fast Dutch Roadster (Maxim)

- Old Drugs Could Reveal a New Way to Attack the Coronavirus (Wired)

- Will Ferrell’s Best Comedy in Years Is Here (The Atlantic)

- The people who get the best coaches aren’t the ones who need them most (Michael Lewis)

- The best rubs you can buy for grilled steak, chicken, pork and fish (CNET)

- Tesla Model Y – Jay Leno’s Garage (YouTube)

- ‘The Profit’ Host Marcus Lemonis on Bringing Small Businesses Back After Lockdown (Guest Column) (Variety)

- AstraZeneca makes another vaccine supply agreement (BioPharma)

- Credit managers race to hire distress experts (Pensions and Investments)

- Many Will Pay Later If the Government Doesn’t Borrow Freely Now (Barron’s)