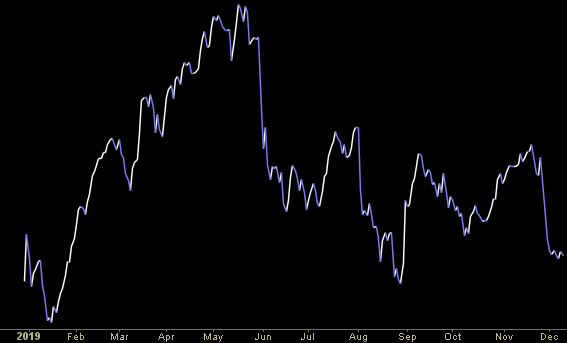

Unusual Options Activity – Cisco Systems, Inc. (CSCO)

![]()

Data Source: barchart

Today some institution/fund purchased 1,115 contracts of Jan 2020 $57.5 strike calls (or the right to buy 111,500 shares of Cisco Systems, Inc. (CSCO) at $57.5). The open interest was just 633 prior to this purchase. Continue reading “Unusual Options Activity – Cisco Systems, Inc. (CSCO)”

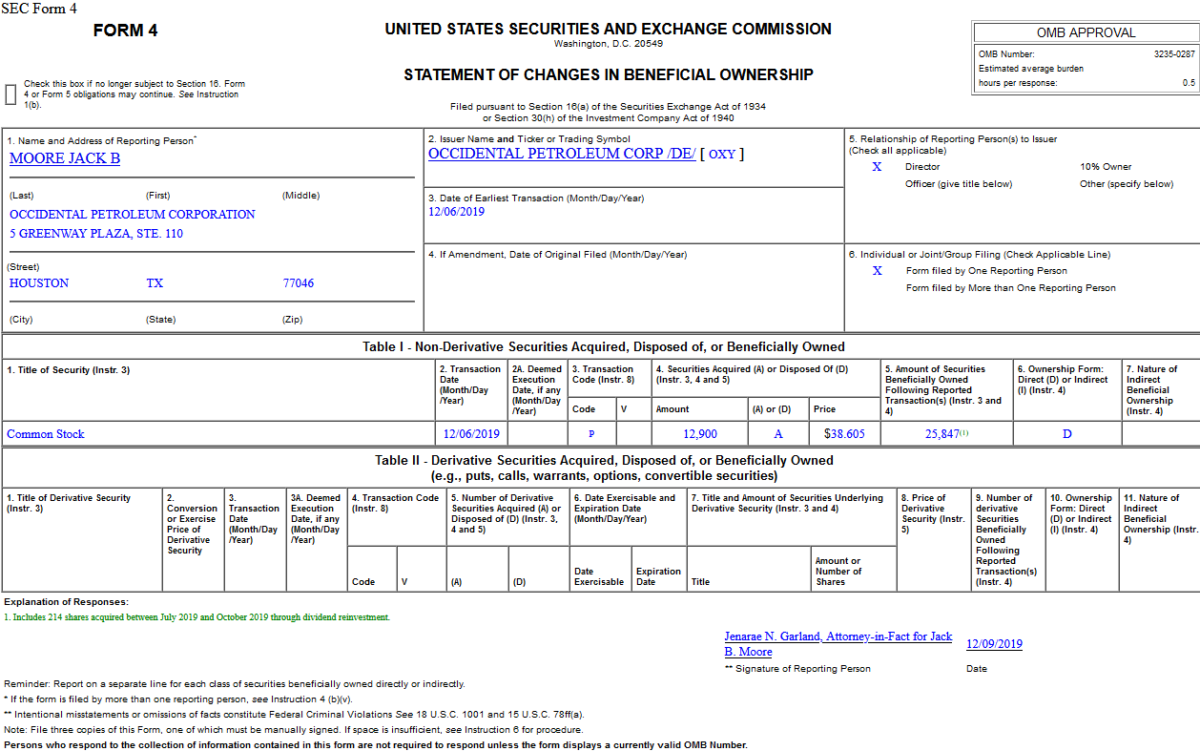

Insider Buying in Occidental Petroleum Corporation (OXY)

On December 6, 2019, Jack Moore – Director of Occidental Petroleum Corporation (OXY) – purchased 12,900 shares of OXY at $38.61. His out of pocket cost was $498,005. Continue reading “Insider Buying in Occidental Petroleum Corporation (OXY)”

Where is money flowing today?

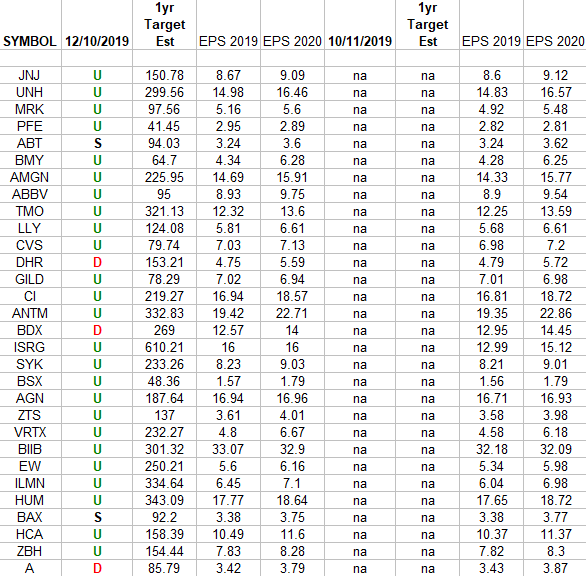

Healthcare (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Healthcare Sector ETF (XLV) top 30 weighted stocks. Continue reading “Healthcare (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Quote of the Day…

Be in the know. 12 key reads for Tuesday…

- 6 Strong Buy Oil and Gas Stocks Called to Surge in 2020 (24/7 Wall Street)

- Here’s What It’s Like To Drive a $210,000 McLaren (Barron’s)

- The Time to Buy Home Depot Stock Is Now, Analysts Say (Barron’s)

- JP Morgan is bullish on Vietnamese banks, says sector offers high growth and profitability (CNBC)

- The Federal Reserve’s Meeting Starts Today. Here’s What You Need to Know. (Barron’s)

- The Fed will stay in hibernation until at least summer: CNBC survey (CNBC)

- Big-name US investors take aim at beaten-up energy sector (Financial Times)

- Democrats and the Trump administration near a tentative North American trade deal (CNBC)

- There’s no better place to put your money than the U.S., says hedge-fund manager Kyle Bass (MarketWatch)

- Ross: US close to largest trade deal in history of the world, 170,000 jobs (Fox Business)

- US and Chinese trade negotiators planning for delay of December tariff Fox Business)

- Next Oil Rally May Be Made in Texas, Not Vienna (Wall Street Journal)

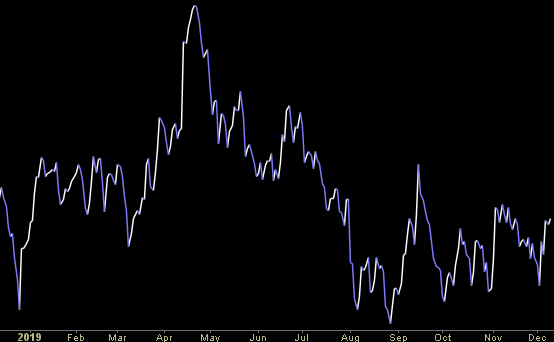

Unusual Options Activity in Chesapeake Energy Corporation (CHK)

Data Source: barchart

Today some institution/fund purchased 1,505 contracts of July $1 strike calls (or the right to buy 150,500 shares of Chesapeake Energy Corporation (CHK) at $1). The open interest was 1,065 prior to this purchase.

![]()

Continue reading “Unusual Options Activity in Chesapeake Energy Corporation (CHK)”