Today some institution/fund purchased 2,000 contracts of Jan $42.50 strike calls (or the right to buy 200,000 shares of Capri Holdings Limited (CPRI) at $42.50). The open interest was 1,236 prior to this purchase. Continue reading “Unusual Options Activity – Capri Holdings Limited (CPRI)”

Where is money flowing today?

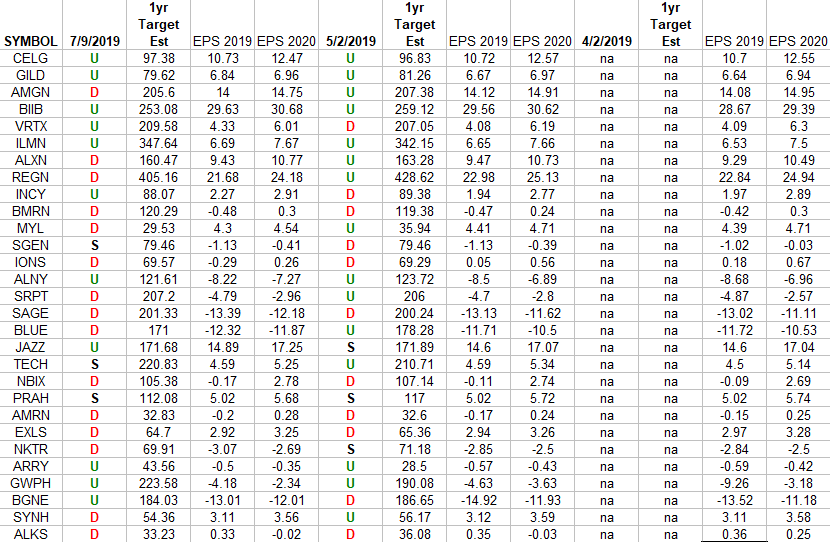

Biotech (top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Nasdaq Biotech ETF (IBB) top weighted stocks. The column under the date 7/9/2019 has a letter that represents the movement in 2019 earnings Continue reading “Biotech (top weights) Earnings Estimates/Revisions”

Be in the know. 8 key reads for Tuesday…

- Health care is one of the stock market’s healthiest sectors right now (MarketWatch)

- U.S., China to relaunch talks with little changed since deal fell apart (Reuters)

- Exclusive: Russian output falls to three-year low as oil rivals clash (Reuters)

- Hedge Funds Post Best First Half in Decade (Bloomberg)

- PepsiCo earnings top estimates on strong snack and beverage sales, backs 2019 forecast (CNBC)

- Boeing’s Grounded 737 Max — The Story So Far (Bloomberg)

- Richard Branson’s Virgin Galactic will take tourists to space. Now it’s set to go public (USA Today)

- Intellectual content tops menu at Sun Valley billionaires camp (New York Post)

Unusual Options Activity – The Boeing Company (BA)

Today some institution/fund purchased 4,199 contracts of Aug $370 strike calls (or the right to buy 419,900 shares of The Boeing Company (BA) at $370). The open interest was just 1,720 prior to this purchase. Continue reading “Unusual Options Activity – The Boeing Company (BA)”

Where is money flowing today?

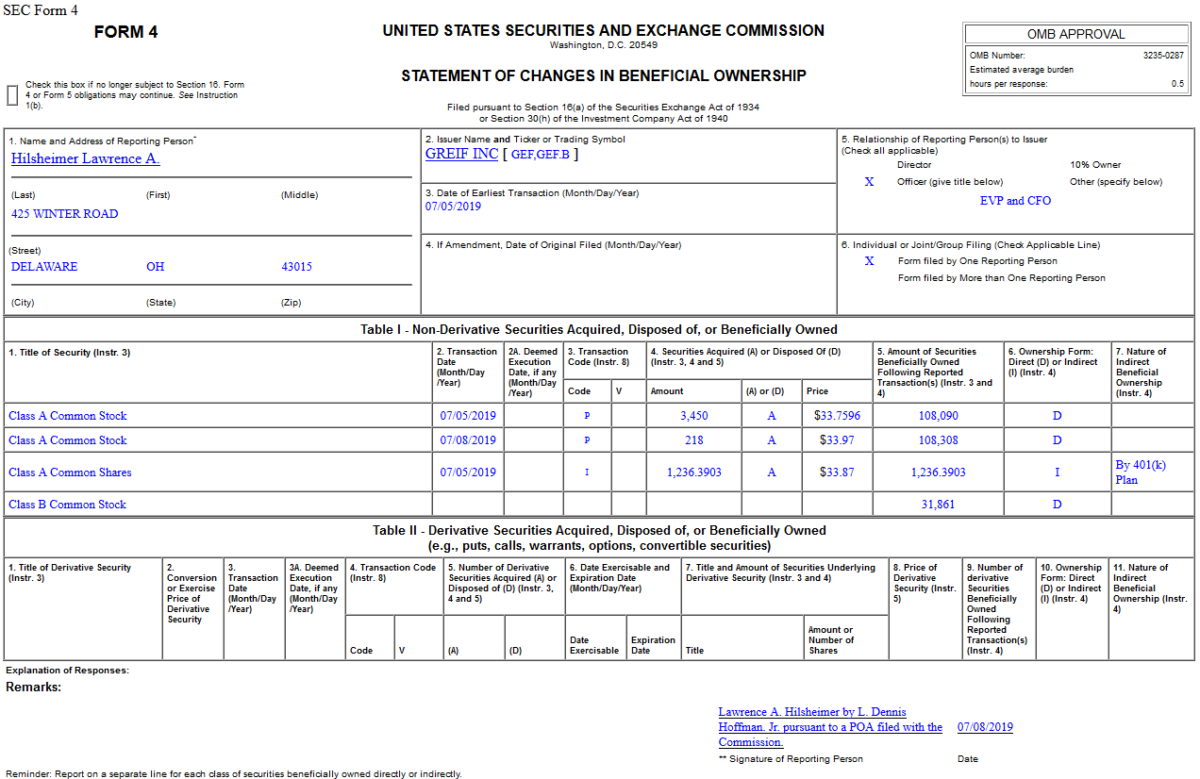

Insider Buying in Greif, Inc. (GEF)

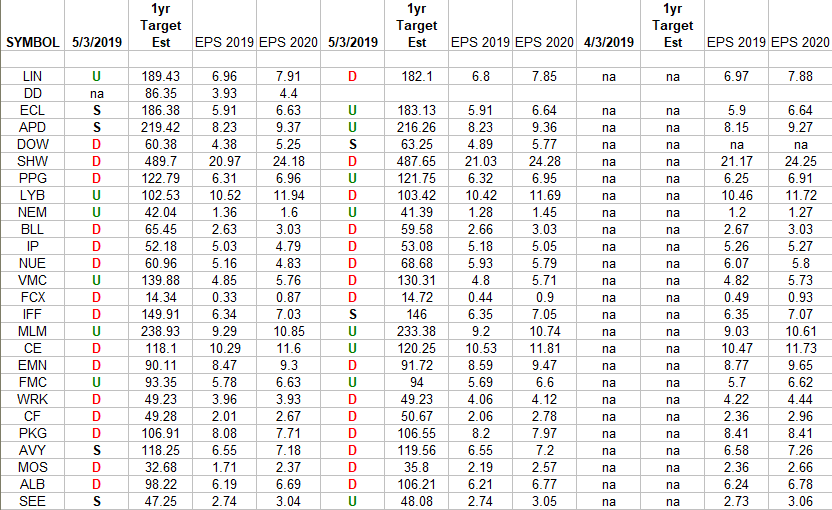

Basic Materials Sector (XLB) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2019 and 2020 estimates were: 4/3/2019, 5/3/2019 and today 7/8/2019. The column under Continue reading “Basic Materials Sector (XLB) – Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 7 key reads for Monday…

Cartoon: Rainer Hachfeld

- Hedge funds chart course through ‘IMO 2020’ storm (Reuters)

- The U.S. Is Overflowing With Natural Gas. Not Everyone Can Get It. (Wall Street Journal)

- Iran’s Oil Output Plunges to More Than Three-Decade Low (Bloomberg)

- BlackRock sees economic outlook worsening for the second half, but stocks doing well anyway (CNBC)

- It’s Never Going to Be Perfect, So Just Get It Done (New York Times)

- Instagram Turns Obscure U.S. Sights Into Social-Media Destinations (Wall Street Journal)

- Where to Invest When the Fed Cuts Rates (Wall Street Journal)