Continue reading “The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)…”

Tag: Financials

Where is money flowing today?

Data Source: Finviz

Be in the know. 25 key reads for Saturday…

- Newly Flush PNC Could Kick Off the Next Round of Bank M&A (Barron’s)

- Oil Market Dazzled With a Swift Delivery of Supply Cuts (Bloomberg)

- Slash tax rate in half for corporations returning to US, White House adviser suggests (New York Post)

- McConnell says next stimulus must have coronavirus liability protections (New York Post)

- Appaloosa buys Twitter, Netflix stakes, exits Caesars, cuts Facebook position (TheFly)

- TSA Preparing to Check Passenger Temperatures at Airports Amid Coronavirus Concerns (Wall Street Journal)

- Wells Fargo Has Lost $220 Billion in Market Value Under Fed Cap (Bloomberg)

- Inside the Science and Companies Racing to Develop a Covid-19 Vaccine (Barron’s)

- John Malone Has a Great Investing Record. Here’s How to Play Along. (Barron’s)

- How Investors Should Evaluate Energy Bonds — And the Funds That Own Them (Barron’s)

- This Economist Sees a ‘Regime Change’ Favoring Stockpickers (Barron’s)

- Assessing the stock market after one of the fastest declines and subsequent comebacks in history (CNBC)

- On Furlough From the Kingdom, Disney Workers Try to Keep the Magic Alive (Wall Street Journal)

- Michael Jordan Didn’t Manage People, He Lit Them on Fire (Wall Street Journal)

- Car Makers See Chinese Market Picking Up (Wall Street Journal)

- Bill Murray drinks, jokes with Guy Fieri on Nacho Showdown: ‘Truth is, he’s a redhead’ (USA Today)

- Google Antitrust Lawsuit Being Drafted by U.S Justice Department (Bloomberg)

- Next coronavirus aid package expected to become reality ‘in June at the earliest,’ as House passes its bill (MarketWatch)

- Is this the pullback you’ve been waiting for? (QuantifiableEdges)

- JPMorgan Bets on a Dash for the Suburbs (Institutional Investor)

- What Happens to Stocks After a Big Up Month? (A Wealth of Common Sense)

- Bill Miller doesn’t see market as ‘dramatically overvalued,’ says Amazon could double in 3 years (CNBC)

- Loeb’s Third Point Builds Stake in Disney, Exits Campbell Soup (Bloomberg)

- Saudi wealth fund snaps up $7.7bn of blue-chip stocks (Financial Times)

- How bank hedging jolted investors into talk of negative rates (Financial Times)

Unusual Options Activity – Wells Fargo & Company (WFC)

Data Source: barchart

Today some institution/fund purchased 5,056 contracts of Jan 2022 $17.50 strike calls (or the right to buy 505,600 shares of Wells Fargo & Company (WFC) at $17.50). The open interest was just 395 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”

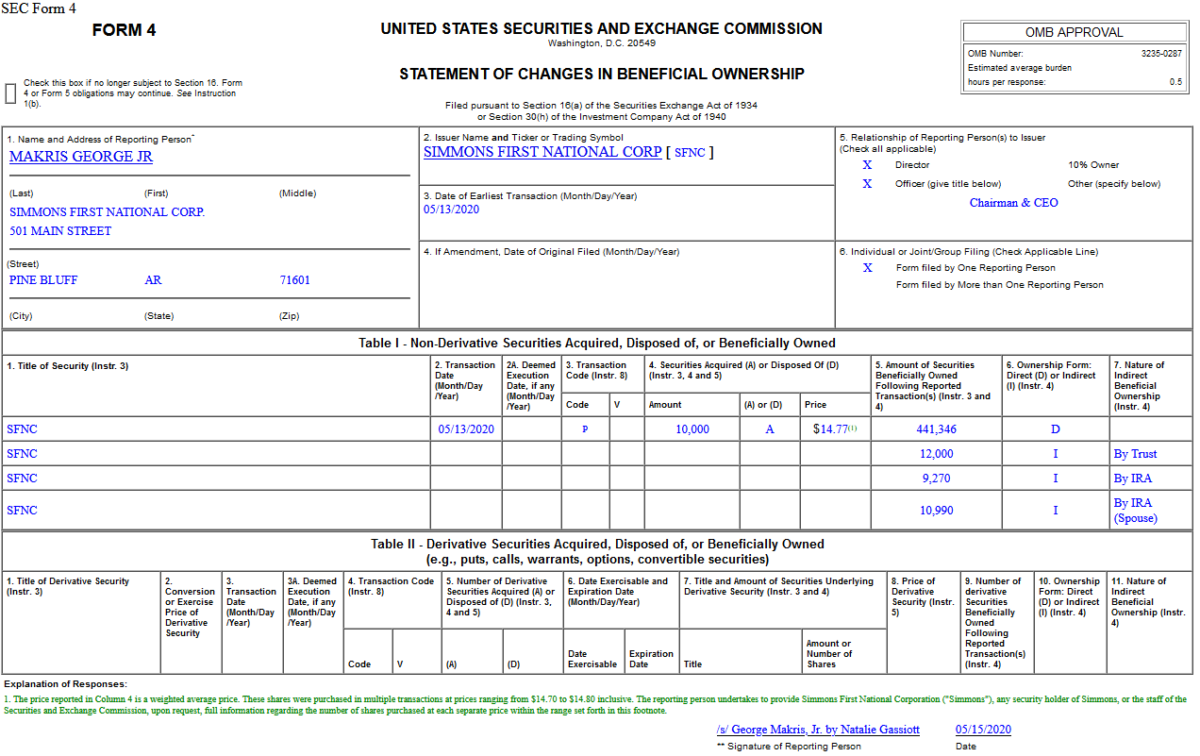

Insider Buying in Simmons First National Corporation (SFNC)

On May 13, 2020, George Makris – Chairman & CEO of Simmons First National Corporation (SFNC) – purchased 10,000 shares of SFNC at $14.77. His out of pocket cost was $147,700.

Unusual Options Activity – Wells Fargo & Company (WFC)

Data Source: barchart

Today some institution/fund purchased 1,422 contracts of Jan 2021 $17.50 strike calls (or the right to buy 142,200 shares of Wells Fargo & Company (WFC) at $17.50). The open interest was just 285 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”

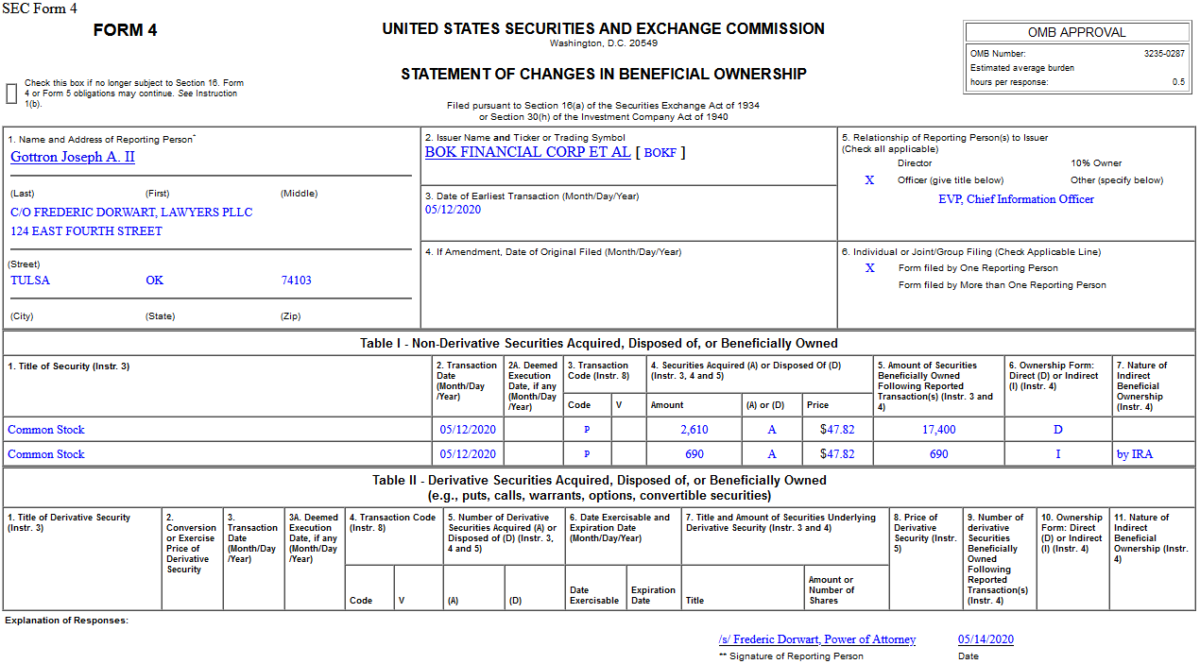

Insider Buying in BOK Financial Corporation (BOKF)

On May 12, 2020, Joseph Gottron – EVP & CIO of BOK Financial Corporation (BOKF) – purchased 2,610 shares of BOKF at $47.82. His out of pocket cost was $124,810.

Where is money flowing today?

Data Source: Finviz

Unusual Options Activity – JPMorgan Chase & Co. (JPM)

Data Source: barchart

Today some institution/fund purchased 2,053 contracts of Jan 2022 $95 strike calls (or the right to buy 205,300 shares of JPMorgan Chase & Co. (JPM) at $95). The open interest was 1,215 prior to this purchase. Continue reading “Unusual Options Activity – JPMorgan Chase & Co. (JPM)”

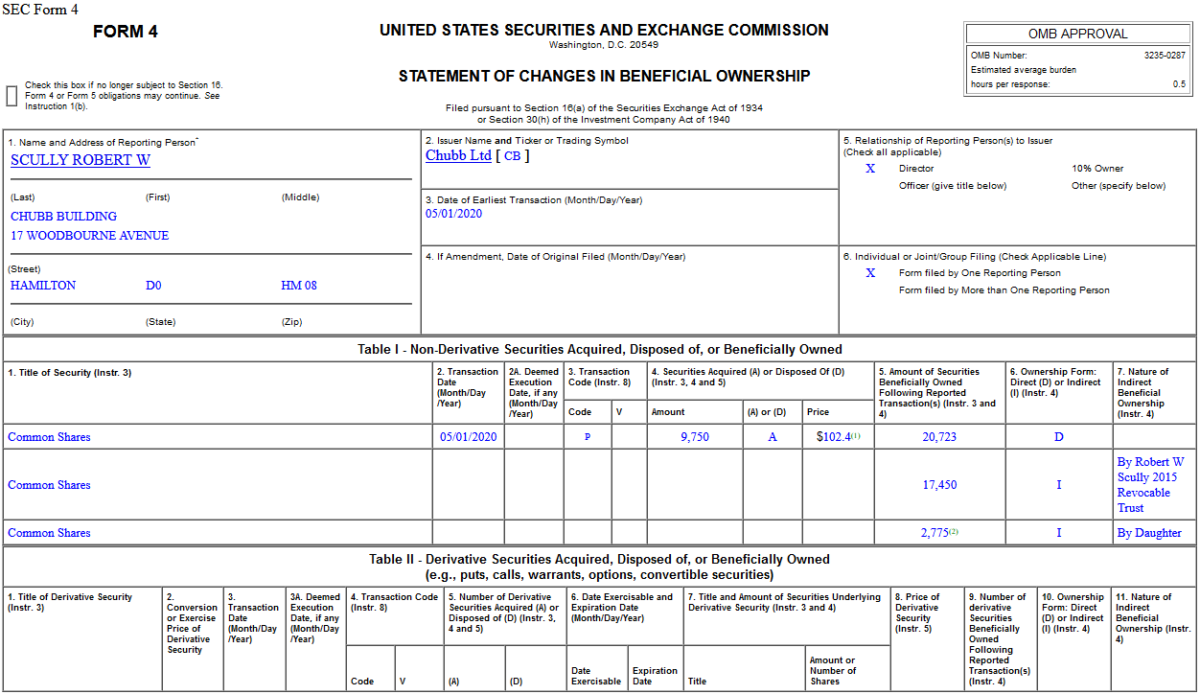

Insider Buying in Chubb Limited (CB)

On May 1, 2020, Robert Scully – Director of Chubb Limited (CB)) – purchased 9,750 shares of CB at $102.40. His out of pocket cost was $998,400.