Skip to content

Biotech Giant Surges On Plan To Test Coronavirus Drug In Humans (Investor’s Business Daily )

Flu and HIV Drugs Show Efficacy Against Coronavirus (The Scientist )

The Final Frontier of Streaming: ViacomCBS Launches Star Trek (Barron’s )

OPEC Scrambles to React to Falling Oil Demand From China (New York Times )

Oil rebounds on potential for further OPEC+ supply cuts (Street Insider )

How an Och-Less Och-Ziff Changed Its Attitude, Its Leadership – and Its Name (Institutional Investor )

Global junk bond issuance hits monthly record (Financial Times )

Here are the risks to watch in the CLO market, says industry group made famous by ‘The Big Short’ (MarketWatch )

YouTube brought in $15 billion in advertising revenue in 2019 — 9 times more than Google paid to acquire the site 14 years ago. (Business Insider )

A Hedge Fund With 29% Return Record Is Shorting Tesla Bonds (Bloomberg )

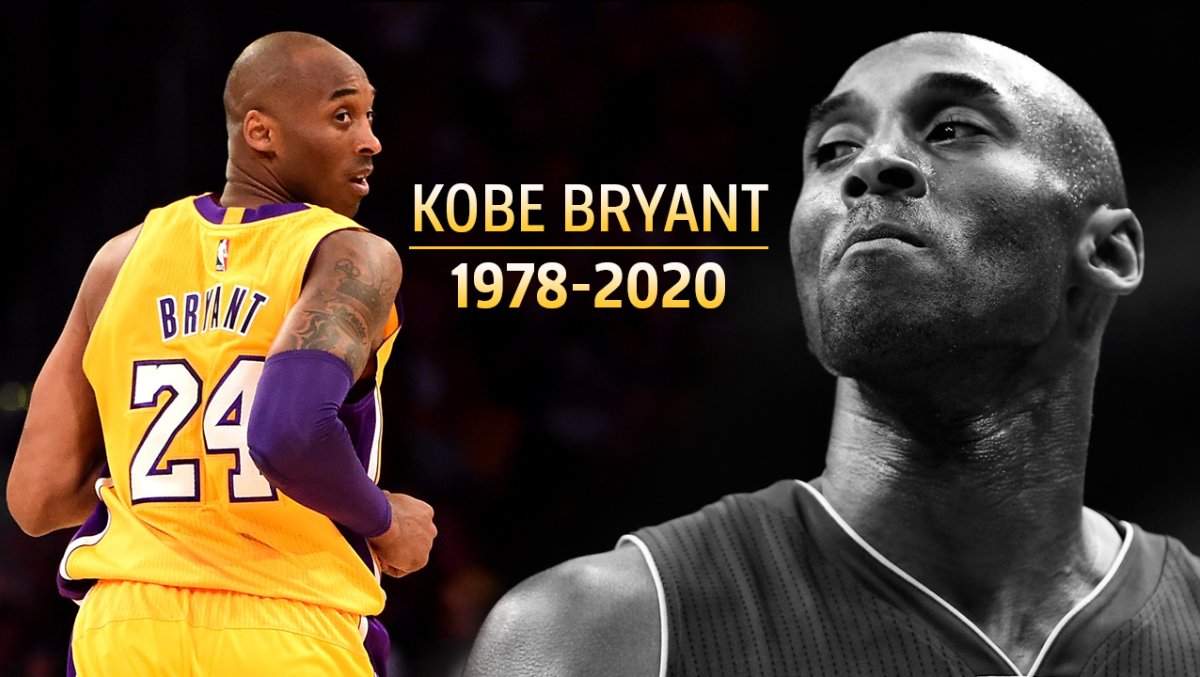

Kobe Bryant’s Last Great Interview (YouTube )

How Amazon Keeps Defying Gravity (New York Times )

February’s First Trading Day: DJIA & NASDAQ up 76.2% of the Time Last 21 Years (Almanac Trader )

ECRI Weekly Leading Index Update (Advisor Perspectives )

Inside big tech’s quest for human-level A.I. (Fortune )

Fed’s Clarida: U.S. economy in good place, coronavirus a ‘wildcard’ (Reuters )

Hedge Fund and Insider Trading News: Jamie Dinan, Ray Dalio, Israel Englander, Air Products & Chemicals, Inc. (APD), Cidara Therapeutics Inc (CDTX), and More (Insider Monkey )

The First Action-Packed ‘Fast and Furious 9’ Trailer Is Here (Men’s Journal )

This American-Made Supercar Could Make History With a Win at Le Mans (Maxim )

Hedge Fund Tips – Episode 15 – VideoCast. Stock Market Commentary. (ZeroHedge )

Using Fiscal Stimulus To Stave Off A Recession (Podcast) (Bloomberg )

The Big Question Hanging Over China’s Virus Attack: How Long Before Containment? (Barron’s )

Barron’s Picks And Pans: Intel, Johnson & Johnson, T-Mobile And More (Yahoo! Finance )

Why hedge funds are still searching for the next big thing (Financial Times )

4 Bargains to Be Found Among Stocks Hit by Coronavirus Fears (Barron’s )

4 Bargains to Be Found Among Stocks Hit by Coronavirus Fears (Barron’s )

James Bond’s favorite car maker Aston Martin gets rescue investor (New York Post )

UK formally leaves the European Union and begins Brexit transition period (CNBC )

What Third Point Is Worried About in 2020 (Institutional Investor )

S&P 500 wipes out gain for the year on coronavirus fears (Financial Times )

The Inner Game: Why Trying Too Hard Can Be Counterproductive (Farnam Street )

How Warren Buffett Made 50% Returns During His Partnership Days | Warren Buffett’s Investment Strategy Explained (Macro-Ops )

Eight Things I Never Knew About Jack Dorsey (Ramp Capital )

Ray Dalio Is Still Driving His $160 Billion Hedge-Fund Machine (WSJ )

Drugmakers Are Racing to Develop a Coronavirus Vaccine (Barron’s )

How the stock market has performed during past viral outbreaks, as epidemic locks down 16 Chinese cities (MarketWatch )

Sam Zell — Strategies for High-Stakes Investing, Dealmaking, and Grave Dancing (#407) (Tim Ferriss )

Sports Gambling Will Be Huge. Buy These Stocks. (Barron’s )

Stocks Catch a Cold After Fed Stops Expanding Its Balance Sheet (Barron’s )

Porsche’s first Super Bowl ad since 1997 features car chase with its all-electric Taycan (CNBC )

EIA expects U.S. net natural gas exports to almost double by 2021 (EIA )

Life is Short (safalniveshak )

Seth Klarman passionately defends value investing and said its time is coming again soon (CNBC )

You Can Buy Into These Sports Teams. But the Valuations Are Lofty. (Barron’s )

Opinion: Here’s what the Super Bowl ‘Predictor’ sees for stocks in 2020, depending on whether the 49ers or the Chiefs win (MarketWatch )

Tiger Cubs, the Next Generation: Meet Chase Coleman’s Proteges (Bloomberg )

3 Pieces to the 2020 Earnings Puzzle (and Sentiment Results) (Zero Hedge )

Adding a Chronograph Makes This Already-Great Watch Even Better (Bloomberg )

Exclusive: U.S. pushing India to buy $5-6 billion more farm goods to seal trade deal – sources (Reuters )

European stocks climb as economic data fuels growth hopes (Reuters )

3 Oil and Gas Equipment Stocks in Possible New Uptrend (Investopedia )

Legendary investor Bill Miller scored 120% returns though he did ‘nothing’ in the last months of 2019 (Business Insider )

Trump is studying ‘numerous’ middle-class tax cut plans ahead of election, White House says (Business Insider )

If You Missed Out on Tesla, Consider This Chinese Car Maker (Barron’s )

Vietnam’s Economy Is Booming. Just Don’t Expect to Find Its Stocks In Your Emerging Markets Fund. (Barron’s )

Help! I’m Trapped Inside TikTok and I Can’t Get Out (Wall Street Journal )

Activist Investors and the Art of the Deal (Wall Street Journal )

Founder of world’s largest hedge fund says ‘cash is trash’ as the Dow soars to records (Yahoo! Finance )

EXCLUSIVE: Trump promises ‘very big’ middle-class tax cut, trade deals, and health care in second term (Fox Business )

At Davos, Kudlow touts huge wage gains among blue-collar worker (Fox Business )

Monopoly Power and the Malfunctioning American Economy (Institutional Investor )

Trump expects EU trade deal before November election (Financial Times )

Americans Don’t Want to Drive Electric Cars (24/7 Wall St. )

Trump Says Dow Would Be 10,000 Points Higher Without Fed’s ‘Big Mistake’ (MarketWatch )

Bets on BOE Rate Cut Fall Below 50% as Factory Optimism Jumps (Bloomberg )

Nio’s stock has soared 60% during 9-day win streak through Tuesday (MarketWatch )

GOLDMAN SACHS: Stocks that pay huge dividends are historically cheap. Here are the 12 poised to make the biggest payouts to investors through 2021. (Business Insider )

How the SECURE Act Affects Investors (U.S. News and World Report )

A Big Contrarian Investor Bought Up Boeing Stock (Barron’s )

Federal Reserve’s embrace of higher inflation is ‘momentous’ for markets (Financial Times )

The Real-Life Diet of NHL Player Brent Burns, Who Hunts and Farms His Own Food (GQ )

Mark Wahlberg’s Secret to Becoming More Disciplined (Entrepreneur )

‘Blank-Check’ Companies Are Hot on Wall Street. Investors Can’t Ignore Them. (Barron’s )

The Method Behind the Melt-up: Why the Dow Won’t Stop at 30,000 (Barron’s )

The 47,500% Return: Meet The Billionaire Family Behind The Hottest Stock Of The Past 30 Years (Forbes )

The Hidden Dangers of the Great Index Fund Takeover (Bloomberg )

Bill Miller 4Q 2019 Market Letter (Miller Value )

The Secretive Company That Might End Privacy as We Know It (New York Times )

Hedge Fund and Insider Trading News: Stanley Druckenmiller, David Tepper, D.E. Shaw, Millennium Management, Aurora Cannabis Inc (ACB), Lennar Corporation (LEN), and More (Insider Monkey )

Trump Fans or Not, Business Owners Are Wary of Warren and Sanders (New York Times )

A theory on who’s doing all the buying that’s pushing stocks higher and higher (CNBC )

ECRI Weekly Leading Index Update (Advisor Perspectives )

Europe is rediscovering its penchant for statist intervention (The Economist )

Dan Fink Designs the Ultimate Automobile-Friendly Man Cave (Architectural Digest )

The World’s Most Beautiful Libraries: Wiblingen and Schussenried Abbeys (Daily Beast )

The Quiet Billionaires Behind America’s Predator Drone That Killed Iran’s Soleimani (Forbes )

China’s Birth Rate Falls to New Low, Threatening Economy (Wall Street Journal )

Martha Stewart mocks Gwyneth Paltrow’s ‘vagina-scented’ candle: ‘I wouldn’t buy it’ (Fox Business )

How To Create Havoc In The U.S. Options Market (Podcast) (Bloomberg )

Connecticut’s Bold Population Goal (U.S. News & World Report )

Kill Switch for CRISPR Could Make Gene Editing Safer (Scientific American )

Inside Jared Kushner’s Unusual White House Role (Time )

Tepper, Druckenmiller Say They’re ‘Riding’ Market Rally (Bloomberg )

OPEC secretary general says oil demand has ‘upside potential’ (CNBC )

Tesla and 25 Other Stock Picks from Barron’s Roundtable Panelists (Barron’s )

Here’s what Elon Musk said when Jack Dorsey asked him how to fix Twitter (CNN Business )

Netflix earnings, Trump speaks at Davos, IBM reports: 3 things to watch for on Tuesday (CNBC )

Ex-Millennium Trader Quadruples Hedge Fund Assets to $1 Billion (Bloomberg )

Emerging Markets Could Be Poised to Outperform U.S. Stocks for a Very Long Time (Barron’s )

Barron’s Beat the Stock Market Last Year. Here’s How We Did It. (Barron’s )

These Leaders and CEOs Will Be in Davos Next Week. What They Say May Move Markets. (Barron’s )

Pharma and Biotech Aren’t Worried About Democrats’ Attacks Against Drugmakers (Barron’s )

Oil’s Minnows Need to Start Earning Their Keep (Bloomberg )

Intel earnings: How Intel figures in data-center recovery is key (MarketWatch )

Can HBO Maintain its Dominance in the Streaming Wars? (Vanity Fair )

Bob Iger — CEO and Chairman of Disney (#406) (Tim Ferriss Show )

Value Investing Isn’t Dead Yet, Research Associates Argues (Institutional Investor )

China says trade deal good for all, media discourages ‘nitpicking’ (Reuters )

“Are you tired of winning yet?” Stock Market (and Sentiment Results)… (ZeroHedge )

U.S. Energy Industry Looks for Clarity in China Trade Deal (New York Times )

Morgan Stanley Downgrades Tesla (TSLA) to Underweight, Raises PT (Street Insider )

Why Raymond James Top MLPs to Buy Also May Be 2020 Best Income Ideas (24/7 Wall Street )

Morgan Stanley 4Q earnings smash Wall Street estimates as revenue jumps across the board (Business Insider )

Intuitive Surgical CEO Cracks The Da Vinci Code Of Success For You (Investor’s Business Daily )

2020 Could Be the Year for Small-Caps. Buy Only the Best. (Barron’s )

Things May Be Looking Up for Hedge Funds (Institutional Investor )

Nobody Makes Money Like Apollo’s Ruthless Founder Leon Black (Bloomberg )

Bridgewater’s Greg Jensen sees gold rallying as central banks ease (Financial Times )

Burger King offers Prince Harry a job (New York Post )

US natgas production to slip for first time since 2016 (Financial Times )

FOX Business EXCLUSIVE: Breakdown of China’s $200B buys from America under historic phase one trade deal (Fox Business )

This Is What Sets Top-Performing Hedge Fund Managers Apart (Institutional Investor )

It May Be Time to Shop for Shares of U.K. Property Firms (Barron’s )

Sen. Rob Portman: Trump’s Trade Deal Forces China to Start Playing by the Rules (Barron’s )

Are Amazon and FedEx Really Ready to Be Friends Again? (24/7 Wall Street )

The Fed (Mostly) Didn’t Cause the Latest Stock Market Melt-Up (Wall Street Journal )

Nio’s stock soars on heavy volume after report of funding secured (MarketWatch )