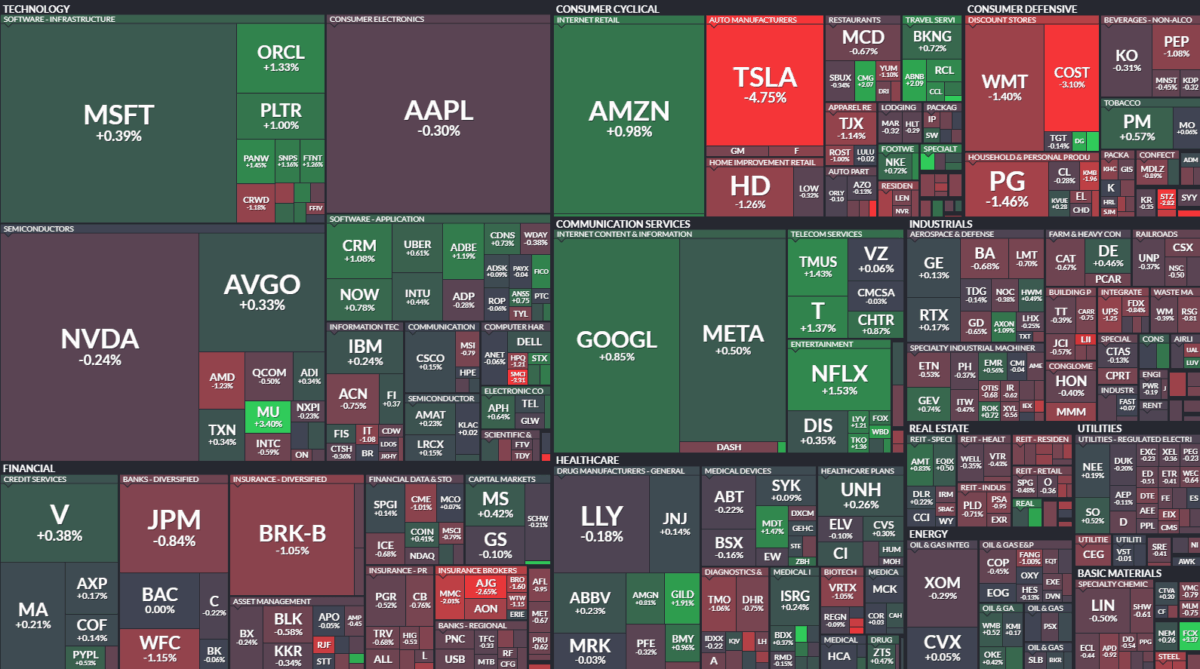

Data Source: Finviz

Tag: StockMarket

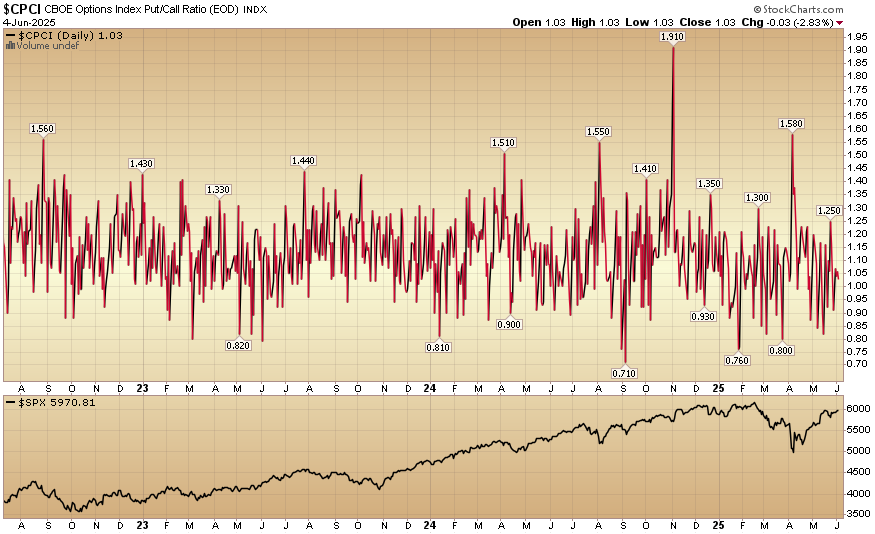

Indicator of the Day (video): CBOE Index Put/Call Ratio

Our Applied Stock Market Indicator of the Day (in 60 Seconds or Less) is:

CBOE Index Put/Call Ratio

Quote of the Day…

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 294

Article referenced in VideoCast above:

“What the Consumer Wants” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 294

Article referenced in Podcast above:

“What the Consumer Wants” Stock Market (and Sentiment Results)…

Be in the know. 20 key reads for Thursday…

- More Homes Are for Sale Since Before the Pandemic. What It Means for Buyers and Sellers. (barrons)

- Home Remodeling Bond Sales Surge as Americans Avoid Moving (bloomberg)

- ‘So Bad It’s Good’: Buying Window Opens for Battered Small Caps (bloomberg)

- Bond Yields & Dollar Plunge As ‘Bad’ Data Sparks Surge In Rate-Cut Hopes (zerohedge)

- Trump Loves Europe’s Rate Cuts. Why the Fed Should Take Cover. (barrons)

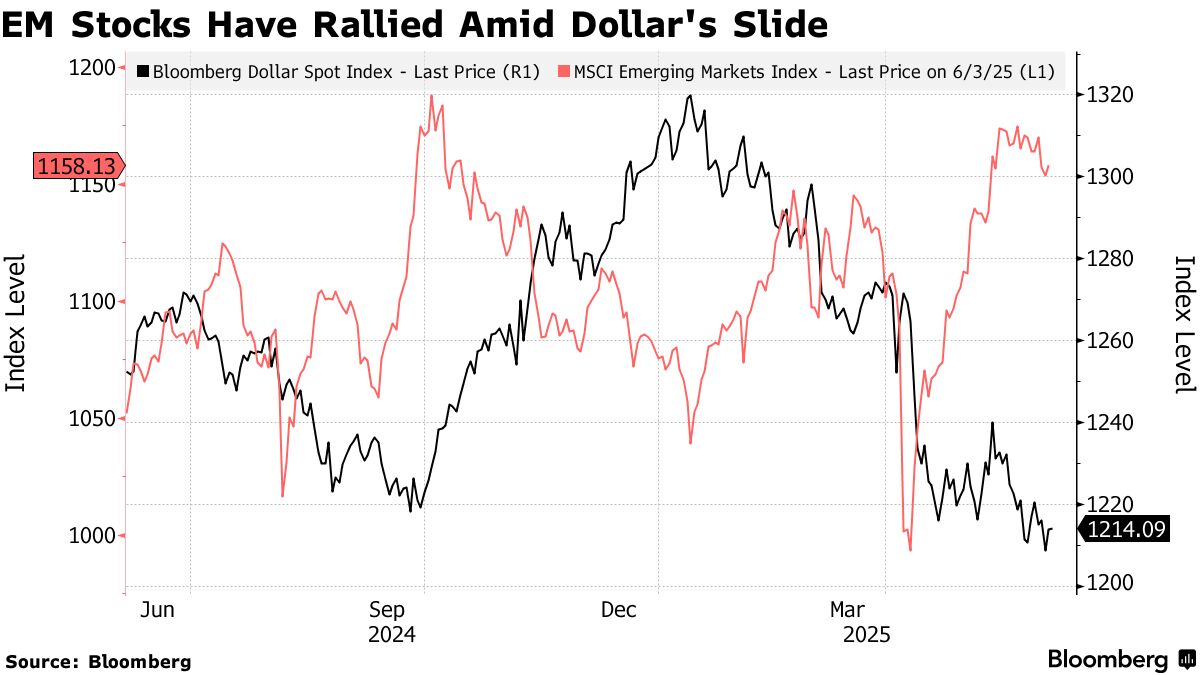

- BofA’s Hauner Expects More Emerging-Market Gains as Dollar Drops (bloomberg)

- Big investors shift away from US markets (ft)

- Confidence Game: Share Buybacks Are Soaring. CEO Optimism Isn’t. (barrons)

- As S&P 6,000 Looms, Speculators Are Ramping Up Their Bullish Bets (zerohedge)

- Hong Kong stocks rise for third day as China’s services PMI beats expectations (scmp)

- Shein and Temu see U.S. demand plunge on ‘de minimis’ trade loophole closure (cnbc)

- Apple and Alibaba’s AI rollout in China delayed by Donald Trump’s trade war (ft)

- US, Vietnam to hold new round of trade talks by end of next week, Hanoi says (reuters)

- Mizuho updates U.S. top picks: Adds CVS Health, PayPal and Oracle (streetinsider)

- Mastercard and PayPal collaborate to ease checkout (yahoo)

- Venmo Unleashes Next Phase of Commerce with the Venmo Debit Card and Venmo Checkout (yahoo)

- Jefferies raises Boeing stock price target to $250 on delivery growth (investing)

- Boeing Agrees to Pay $1.1 Billion to Avoid Prosecution for 737 MAX Crashes (wsj)

- Cooper Standard Wins 2024 Ford Supplier of the Year Award (yahoo)

- Meta Talks to Disney, A24 About Content for New VR Headset (wsj)

“What the Consumer Wants” Stock Market (and Sentiment Results)…

Key Market Outlook(s) and Pick(s)

On Monday, I joined Sean Callebs on CGTN America to discuss Elon Musk, DOGE, Starlink, Neuralink, SpaceX, Tesla, and more. Thanks for Sean and Nancy Said Ali for having me on:

Continue reading ““What the Consumer Wants” Stock Market (and Sentiment Results)…”

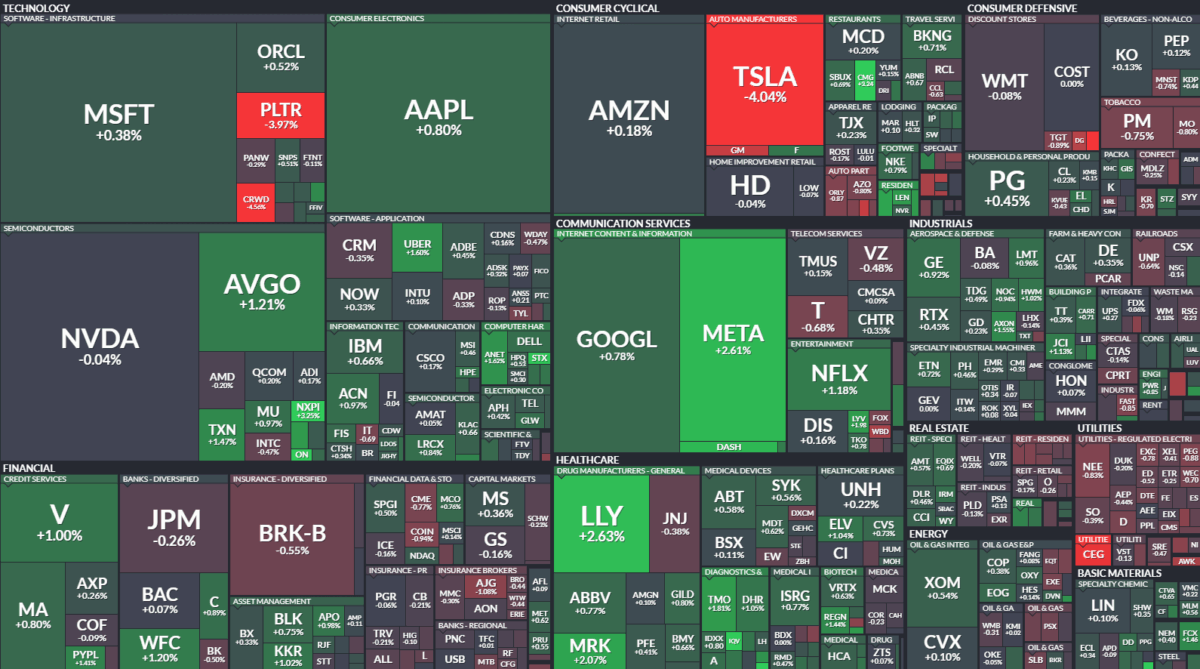

Where is money flowing today?

Data Source: Finviz

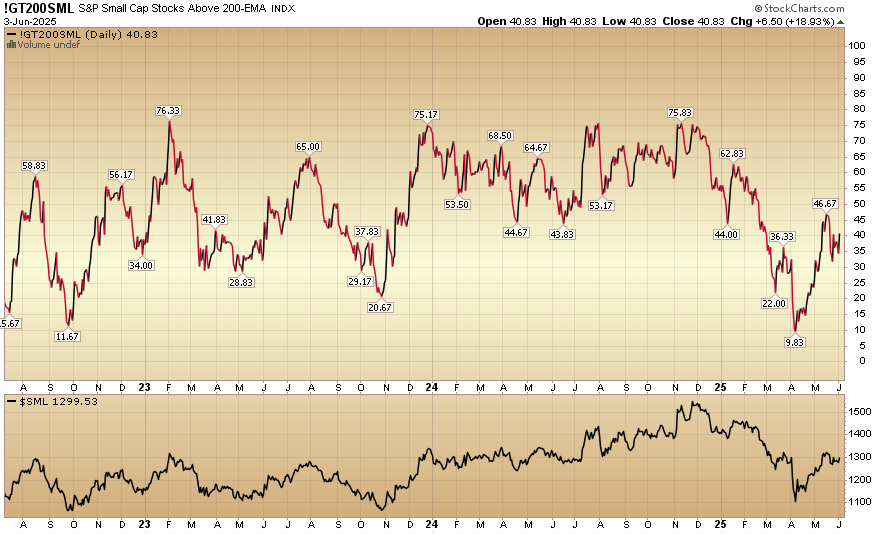

Indicator of the Day (video): S&P Small Cap Stocks Above 200 Day Moving Average

Our Applied Stock Market Indicator of the Day (in 60 Seconds or Less) is:

S&P Small Cap Stocks Above 200 Day Moving Average

Be in the know. 19 key reads for Wednesday…

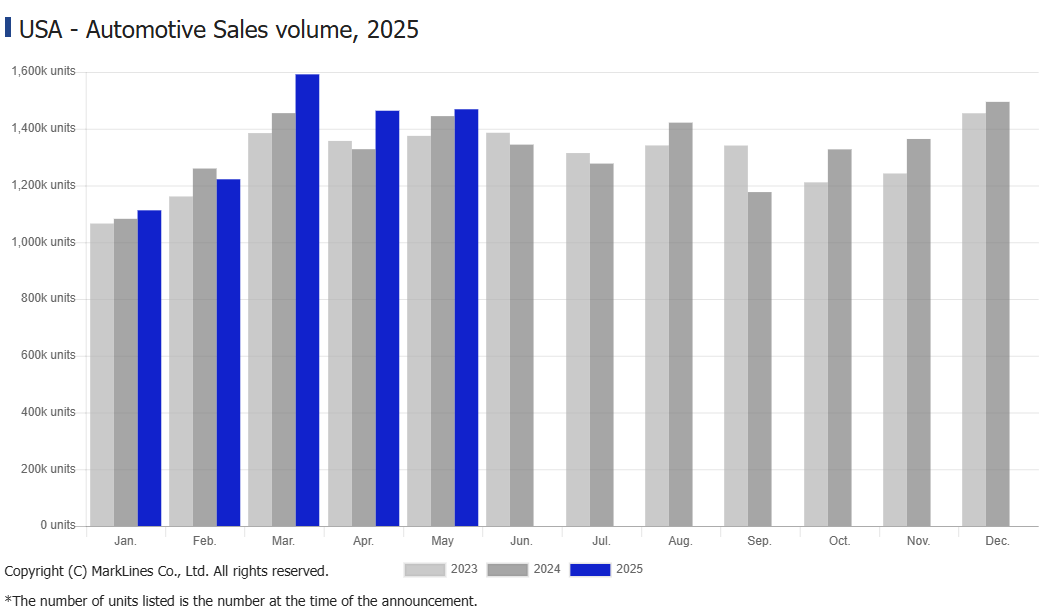

- Ford reports 16% sales increase in May amid employee pricing, tariffs (cnbc)

- U.S. auto sales up 1.4% in May, rush buying before tariff hikes slows (marklines)

- Proposed new auto loan tax deduction could help buyers get break on interest (usatoday)

- Alibaba, JD.com sales surge during 618 shopping festival on the back of subsidy programme (scmp)

- China stocks benefit from shift away from US assets: Natixis (scmp)

- Hong Kong’s Hopes Hinge On Trump-Xi Call & Policy Meeting Stimulus (chinalastnight)

- Action in Hong Kong Equity Markets Stirs Most Excitement in Years (bloomberg)

- Chinese Firms Brush Off US Tariff Risks With Domestic Confidence (bloomberg)

- The U.S. and China Are at Loggerheads Over Tariffs. Why a Trump-Xi Call Is Likely. (barrons)

- The Bull Market Is Being Powered by Stocks Outside the US (bloomberg)

- US Woes Spark Pivot to Europe, Safer Sectors, BC Partners Says (bloomberg)

- AI Data Center Boom Requires A Lot Of Natural Gas (zerohedge)

- Data Centers Added $9.4 Billion in Costs on Biggest US Grid (bloomberg)

- It’s Treasury Vs The Fed: With Fed Sidelined, Bessent Unleashes Record $10 Billion Bond Buyback (zerohedge)

- US Job Openings Unexpectedly Rose in April and Hiring Picked Up (bloomberg)

- Interest rates are normal, the world is not (ft)

- How Low Will the Dollar Go? (nytimes)

- PayPal Unveils Another Credit Card for In-Person Shopping Push (bloomberg)

- Tom Lee: Risk is now of a substantial leg-up rally from here (youtube)