- Fixing Boeing’s Problems Could Boost Its Stock by 35%. What It Needs to Do. (Barron’s)

- Charlie Munger’s Daily Journal scored a $132 million gain on stocks in 9 months – and its portfolio has quadrupled in value (Business Insider)

- If Inflation Isn’t a Problem Yet, This $3.5 Trillion Budget Will Make It One (Barron’s)

- Moderna Stock Crumbled Wednesday. Investors Are Questioning This Year’s Spectacular Surge. (Barron’s)

- Stock Prices Are Poised to Keep Rising, Says Longtime Bull. Here’s Why. (Barron’s)

- Looking for Stocks That Really Add Up? Meet These 10 Potential Compounders. (Barron’s)

- Splunk Stock Is Ready to Climb, Says UBS (Barron’s)

- Why Activision Blizzard Stock’s Decline Might Be a Buying Opportunity (Barron’s)

- Delta Variant Drops Small-Business Confidence to Lowest Level Since March (Wall Street Journal)

- Xi’s Dictatorship Threatens the Chinese State (George Soros – WSJ)

- Airbnb benefits from ‘travel recovery’ as bookings and revenue grow (Financial Times)

- Spectre of inflation stalks debate on $3.5tn US spending bill (Financial Times)

- Wall Street predicts that equity bull run will continue but some investors worry that market already reflects high levels of optimism (Financial Times)

- Slow Slog in Stocks Is Now a Steamroller Crushing Every Naysayer (Bloomberg)

- Consumer Sentiment in U.S. Plunges to Lowest Since 2011 (Bloomberg)

- How the ‘Madonna’ of Billionaires Is Playing His Fourth Act (Bloomberg)

- The Lamborghini Countach Returns as a $2.64 Million Hybrid Beast (Bloomberg)

- Aston Martin reveals its topless Valkyrie hypercar (CNN Business)

- Wall Street Will Keep Getting Good Talent: Leon Cooperman (Bloomberg)

- Bargain Stocks From The Father Of Value Investing (Forbes)

Tag: StockMarket

Tom Hayes – CGTN America Appearance – 8/13/2021

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – August 13, 2021

Unusual Options Activity – Kimberly-Clark Corporation (KMB)

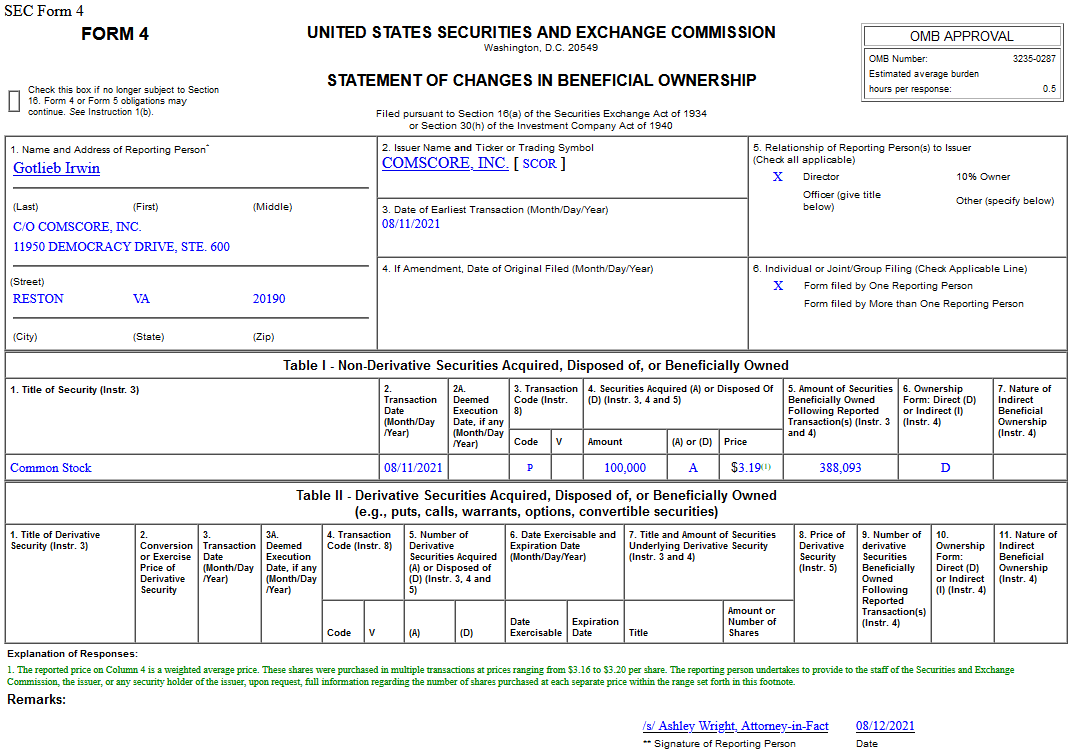

Insider Buying in comScore, Inc. (SCOR)

On Aug 11, 2021, Irwin Gotlieb – Director of comScore, Inc. (SCOR) – purchased 100,000 shares of SCOR at $3.19. His out of pocket cost was $319,000.

Where is money flowing today?

Data Source: Finviz

Be in the know. 10 key reads for Friday…

- Productivity Will Battle Inflation an Send Stocks Higher, Says Ed Yardeni (Barron’s)

- Rocket Earnings Fell Short, but the Company Expects Mortgage Demand to Remain Strong (Barron’s)

- Ways to Gear Up Your Portfolio for Inflation Concerns (Barron’s)

- Disney Posts a Rebound as Tourists Returned to Its Theme Parks (Wall Street Journal)

- Home Prices Jumped Across the U.S. in Second Quarter (Wall Street Journal)

- S. consumers suffered a ‘stunning loss of confidence’ in early August, University of Michigan survey finds (MarketWatch)

- ‘Memory – Winter is Coming’: Morgan Stanley Downgrades Micron (MU) to EW as Supply is Catching Up To Demand, Prefers Samsung (SSNLF) (Street Insider)

- Dan Loeb’s Third Point Gets a Taste of Its Own Activist Medicine (Wall Street Journal)

- Disney+ reaches 116 million subscribers, and its parks division returns to profitability. (New York Times)

- Yardeni Says ‘Roaring 2020s’ to Continue, and Stock Bulls Agree (Bloomberg)

Tom Hayes – Quoted in Reuters article – 8/12/2021

Thanks to Devik Jain and Ambar Warrick for including me in their article on Reuters today. You can find it here:

Thanks to Devik Jain and Ambar Warrick for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters

Unusual Options Activity – Activision Blizzard, Inc. (ATVI)

Data Source: barchart

Today some institution/fund purchased 9,810 contracts of Jan $90 strike calls (or the right to buy 981,000 shares of Activision Blizzard, Inc. (ATVI) at $90). The open interest was just 2,836 prior to this purchase. Continue reading “Unusual Options Activity – Activision Blizzard, Inc. (ATVI)”

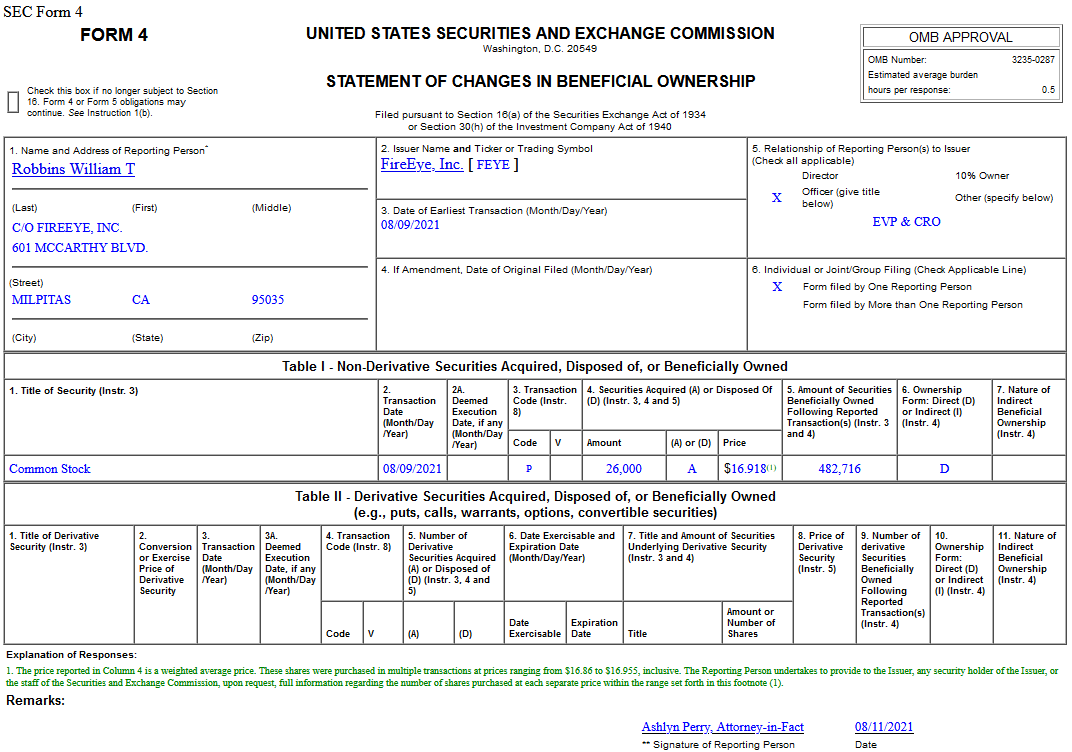

Insider Buying in FireEye, Inc. (FEYE)

On Aug. 9, 2021, William Robbins – EVP & CRO of FireEye, Inc. (FEYE) – purchased 26,000 shares of FEYE at $16.92. His out of pocket cost was $439,868.

Where is money flowing today?

Data Source: Finviz