- Taper Talk? Inflation Outlook? Here Are 4 Things to Watch in Fed’s Policy Update (Barron’s)

- Analysts Have Higher Hopes for These 4 Energy Stocks (Barron’s)

- Amazon Is Likely to Post Blowout Profits. The Question Is What Follows. (Barron’s)

- Inflation Is Coming. 5 Stocks to Buy Now. (Barron’s)

- Facebook Reports Earnings Wednesday. What to Expect. (Barron’s)

- What’s in $1.8 Trillion Biden Spending Plan Funded by Taxes (Bloomberg)

- Gundlach Says Fed Is Guessing That Inflation Will Be Transitory (Bloomberg)

- Shoemaker Allbirds reportedly in talks with banks for IPO (CNBC)

- Biden to unveil $1.8 trillion plan for families — here’s what’s in it (CNBC)

- General Electric (GE) Falls on Revenue Miss, But Still Plenty of Runway for the Turnaround Bull Case Says Analyst (Street Insider)

- The Best Managers Aren’t in It Just for the Money (Institutional Investor)

- GSK chief defends against accusations of flat performance (Financial Times)

- Apple To Slash AirPods Production Due To Competition From Cheaper Alternatives (Benzinga)

- India’s surging Covid-19 cases shouldn’t dissuade investors from buying emerging markets equities, UBS Wealth Management says (Business Insider)

- Investors are still keeping their cash levels high — but here’s what’s drawing them to stocks, UBS says (MarketWatch)

- Shoppers Return to Malls, With an Urge to Spend (Wall Street Journal)

- U.S. Warship Fires Warning Shots in Encounter With Iranian Vessels (Wall Street Journal)

Tag: StockMarket

Unusual Options Activity – American Electric Power Company, Inc. (AEP)

Data Source: barchart

Today some institution/fund purchased 3,085 contracts of June $95 strike calls (or the right to buy 308,500 shares of American Electric Power Company, Inc. (AEP) at $95). The open interest was just 716 prior to this purchase. Continue reading “Unusual Options Activity – American Electric Power Company, Inc. (AEP)”

Where is money flowing today?

Data Source: Finviz

Be in the know. 17 key reads for Tuesday…

- Why Wells Fargo Is a ‘Must-Own Stock’ (Barron’s)

- Prescription-Drug Price Cuts Set to Be Left Out of White House Proposal (Wall Street Journal)

- Still Getting Your Head Around Digital Currency? So Are Central Bankers. (New York Times)

- U.S. Population Over Last Decade Grew at Slowest Rate Since 1930s (New York Times)

- 5 visuals explain the shifting House seats and how the changes could affect the 2022 midterm elections (USA Today)

- Fed Will String Traders Along on Its Taper Timeline (Bloomberg)

- BP beats first-quarter estimates, says it plans to resume share buybacks (CNBC)

- OPEC+ to meet Tuesday amid concern about rising virus cases (CNBC)

- If Fed Chair Jerome Powell sounds ‘too optimistic’ this week, he’ll rattle Wall Street, Morgan Stanley warns (CNBC)

- 6 Mid-Cap Stocks That Are Cheap—and Have Potential (Barron’s)

- Saying Au Revoir to the Most Successful Policy in Federal Reserve History (Wall Street Journal)

- Supermarkets Say Goodbye to Pantry Loading, Hello to Inflation (Wall Street Journal)

- Biden’s first big speech to Congress is on Wednesday. Here’s what to expect. (MarketWatch)

- The No. 1 emerging property market in America is NOT in Texas or Florida — you may never even have heard of it (MarketWatch)

- Citi has updated its bear-market checklist. Here’s where we are now. (MarketWatch)

- U.S. Durable-Goods Orders Rebound Following Dip (Wall Street Journal)

- What Wall Street Is Telling Us About the U.S. Economic Outlook (Wall Street Journal)

Where is money flowing today?

Data Source: Finviz

Tom Hayes – Quoted in Reuters article – 4/26/2021

Thanks to Shivani Kumaresan and Shreyashi Sanyal for including me in their article on Reuters today. You can find it here:

Be in the know. 16 key reads for Monday…

- Tesla and 12 Other Stocks Poised for Earnings Fireworks This Week (Barron’s)

- Oil-Field Services—Lots to Like Beneath the Surface (Wall Street Journal)

- Top Strategist Says Get Defensive for the Next 6 Months: 4 Safe Stocks to Buy (24/7 Wall Street)

- Insurance Costs Threaten Florida Real-Estate Boom (Wall Street Journal)

- West Looks Past Covid-19 and Sees Economic Resurgence (Wall Street Journal)

- Fed to Taper Bond Buying in Fourth Quarter, Economists Say (Bloomberg)

- Sanofi Agrees to Help Make Doses of Moderna’s Covid Vaccine (Bloomberg)

- The Fed’s Next Test Is Breaking the Ice Over Policy Shift (Wall Street Journal)

- SPAC Insiders Can Make Millions Even When the Company They Take Public Struggles (Wall Street Journal)

- A capital-gains rate of 43.4% would reduce federal revenue. (Wall Street Journal)

- 10-year Treasury yields will break out of slump within weeks: Wells Fargo (CNBC)

- Legendary investor Bill Miller lost 90% of his fortune in the late 2000s. Bitcoin and Amazon stock have made him a billionaire. (Business Insider)

- Biden shocked markets this week with a proposal to nearly double the capital gains tax. Here’s what the move could mean for high-flying tech stocks, according to 5 experts. (Business Insider)

- Wall Street edges higher on Tesla boost ahead of big tech earnings (Reuters)

- No Surprises in President Biden’s Reported Capital Gains Proposal, a 28% Rate Looks Most Likely – Goldman Sachs (Street Insider)

- As Good As It Gets: Goldman Is Last Big Bank To Turn Bearish, Sees Market Dropping In Coming Months (ZeroHedge)

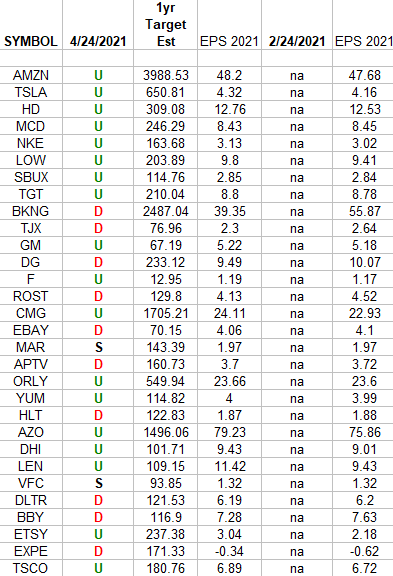

Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Discretionary Sector ETF (XLY) top 30 weighted stocks.

Continue reading “Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 12 key reads for Sunday…

- The Transcript 04.19.21: So. Much. Liquidity. (theweeklytranscript)

- How a Wave of Electric Trucks Could Create Millions of ‘Accidental Environmentalists’ (Wall Street Journal)

- 5 Sizzling Technology Stocks to Buy Now Trading Under $10 (247wallst)

- Next Bump in Post-Election Year Rally Could Be in May (Almanac Trader)

- 5 Innovative New Helicopters That Are Coming to the Skies (Robb Report)

- How to Stream All the Major Oscar Nominees This Year (townandcountrymag)

- First Look at the Insanely Speedy Ferrari 812 Superfast Limited Edition (Men’s Journal)

- Ari Emanuel Takes on the World (The New Yorker)

- Elon Musk Will Host ‘Saturday Night Live’ on May 8. Yes, You Read That Right (The Drive)

- How TikTok Chooses Which Songs Go Viral (Bloomberg)

- The Origin Of The Oscars (NPR)

- What We’re Watching In The NHL’s Playoff Races (fivethirtyeight)

Be in the know. 20 key reads for Saturday…

- Perrigo Stock Has Been Broken for a Long Time. It’s Time for a Turnaround. (Barron’s)

- 11 Undervalued Climate-Friendly Stocks (Morningstar)

- Amazon CEO Jeff Bezos championed invention, failure, and customer obsession in his 24 shareholder letters. Here are the 25 best quotes. (Business Insider)

- This Bull Market Is Far From Over, Pros Say. Where They’re Investing Now. (Barron’s)

- SPAC IPOs Fall Out of Favor After Hot Streak (Barron’s)

- Berkshire Hathaway 2021 Annual Meeting (valuewalk)

- Take Heart, Investors. A Higher Capital-Gains Tax Wouldn’t Be as Scary as It Sounds. (Barron’s)

- Wells Fargo’s Rehabilitation (netinterest)

- U.S. Ends Pause on Johnson & Johnson’s Covid Vaccine. What to Know. (Barron’s)

- Packaged Foods Boomed During the Pandemic. Why Their Stocks Still Have Room to Run. (Barron’s)

- Early Days in the Value Recovery (pzena)

- 10 Places Where Home Buyers Pay the Most Above Asking Price (Barron’s)

- Why Covid Surges in India Won’t Derail Global Recovery (Barron’s)

- Johnson & Johnson and 6 Other Companies Raised Their Dividends This Week. What to Know. (Barron’s)

- The Stock Market Got Spooked by What It Already Knew. Here’s Next Week’s Surprise. (Barron’s)

- Capital gains tax hike? Why the stock market bounced back so fast (MarketWatch)

- SPAC Surge Pumps Up Junk-Bond Market (Wall Street Journal)

- Will 2021 Be the Year for Value Stocks? (Kiplinger)

- Inflated Fears (investoramnesia)

- When a Rising Tide Lifts All Boats (compoundadvisors)