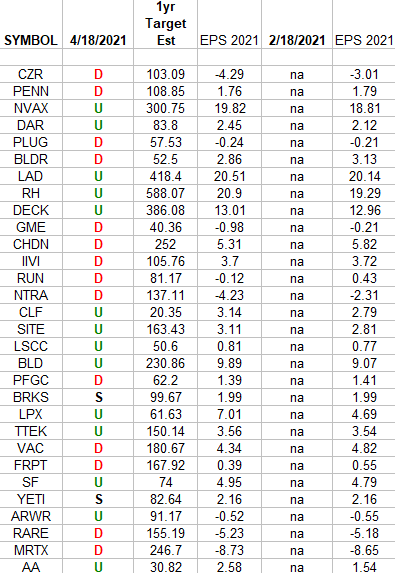

Data Source: barchart

Today some institution/fund purchased 2,153 contracts of December $20 strike calls (or the right to buy 215,300 shares of Li Auto Inc. (LI) at $20). The open interest was just 374 prior to this purchase. Continue reading “Unusual Options Activity – Li Auto Inc. (LI)”