- More Stocks Are Participating in Rally, an Encouraging Sign for Bull Market (Wall Street Journal)

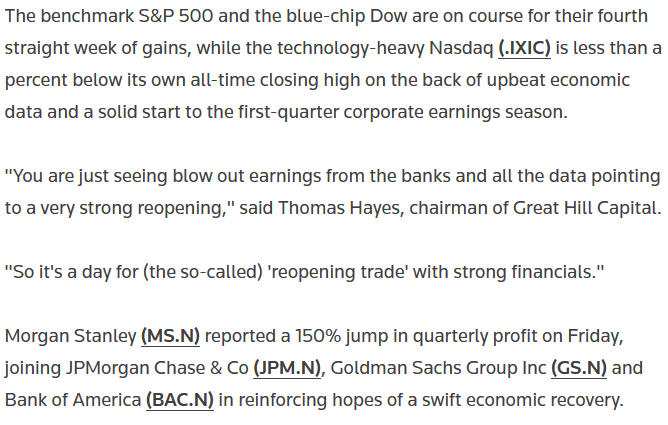

- S&P 500, Dow set to ease from record levels; Coca-Cola rises on results (Reuters)

- Nearly half of Americans are too nervous to invest in stocks right now, new survey shows (Business Insider)

- John Hempton on What It’s Like To Short Right Now (Podcast) (Bloomberg)

- Why did the Fed print so much money? Thomas Hayes on valuations, and best stock sectors (KITCO)

- Feel the Earth. The Energy Report 04/19/2021 (Phil Flynn)

- Here’s a technical analyst’s explanation of the short squeeze driving bonds (MarketWatch)

- Consumer Staples Stocks Had a Rough Year. We Found 3 Potential Winners. (Barron’s)

- Economic Growth Is Set to Surge. Hiring Might Not Keep Up. (Wall Street Journal)

- BP Wants to Stop Burning Off Gas in America’s Top Oil Field (Wall Street Journal)

- The New York Power Lunch Is Back, With New Rules (Wall Street Journal)

- Employers are chasing candidates amid worker shortages (USA Today)

- Tesla Runs on Faith, Exxon Runs on Discipline. Only One Is Right (Bloomberg)

- Fauci expects J&J COVID-19 vaccines to be back in use by Friday (MarketWatch)

- Coca-Cola beats on earnings, says demand in March hit pre-Covid levels (CNBC)

- Stocks are booming higher, but traders are having a harder time making money (CNBC)

- Investors should be ‘aggressively buying’ if stock market has pullback: Investment strategist (Fox Business)

- Citigroup to ramp up Chinese investment banking plan – source (streetinsider)

- Biogen (BIIB) Has Best Risk/Reward Over Next Couple of Years – Jefferies (streetinsider)

- CVS to offer three over-the-counter COVID-19 tests for use at home (Yahoo! Finance)

Tag: StockMarket

Tom Hayes – Kitco News Appearance – 4/16/2021

Kitco News – Thomas Hayes – Chairman of Great Hill Capital – April 16, 2021

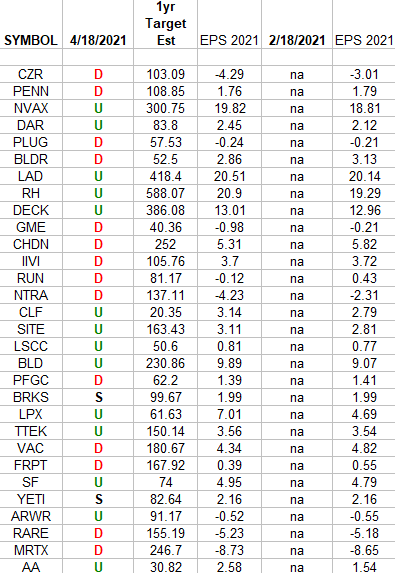

Russell 2000 (top weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2021 estimates were on 2/18/2021 and today. Continue reading “Russell 2000 (top weights) Earnings Estimates”

Be in the know. 10 key reads for Sunday…

- America Is Short of Home Builders as Well as Homes (Wall Street Journal)

- Robert Arnott on Global Asset Management (Podcast) (Bloomberg)

- Sell in May??? Post-Election-Year “Worst Months” Mixed (Almanac Trader)

- How Pfizer Became the Status Vax (Slate)

- Billionaire Reveals His ‘Secret’ To Beating China At Manufacturing (Forbes)

- How spooks are turning to superforecasting in the Cosmic Bazaar (The Economist)

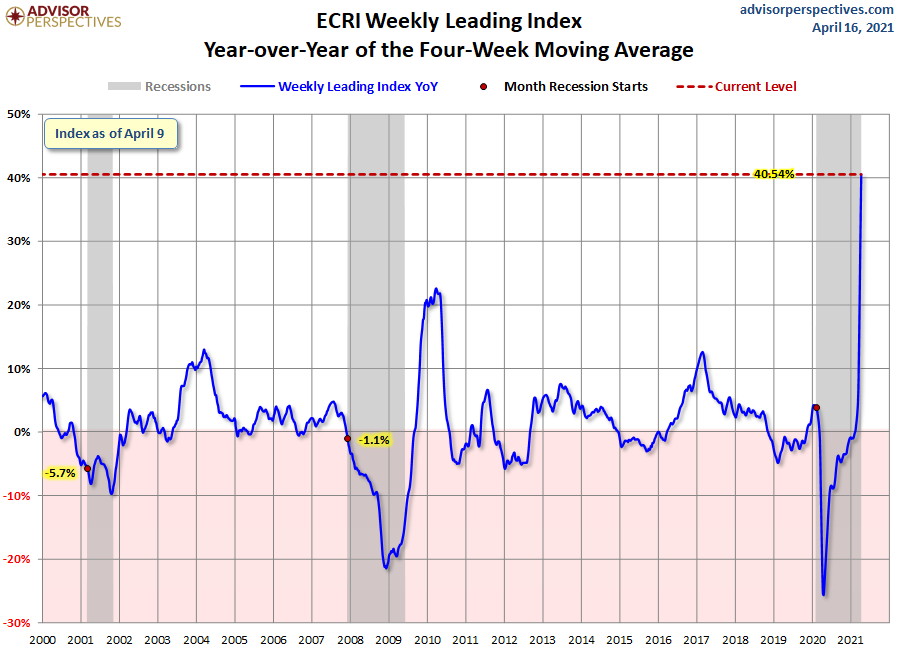

- ECRI Weekly Leading Index Update (advisorperspectives)

- The Transcript 04.12.21: Reopening euphoria (The Weekly Transcript)

- Formula 1 Is Heading to Miami (Road and Track)

- Historic Oil Glut Amassed During the Pandemic Has Almost Gone (Bloomberg)

Be in the know. 28 key reads for Saturday…

- 10 reasons why the value-stock resurgence has further to run, according to BofA (Business Insider)

- 10 Solid Dividend-Paying Stocks on Sale (Morningstar)

- Tech Stocks Are Mired in Unfamiliar Territory as Market Laggards (Bloomberg)

- Li Lu: Value Investing in China, Full Transcript (latticeworkinvesting)

- Activist Investors Are Rattling Cages Again (Barron’s)

- Last winter saw larger-than-average U.S. natural gas withdrawals from storage (EIA)

- Home Building Picked Up in March. What It Could Mean for Skyrocketing Prices. (Barron’s)

- 3 Big Banks Had Huge Bond Sales This Week. What It Means for Markets. (Barron’s)

- Mark Rothko’s ‘Untitled’ From 1970 Could Fetch US$40 Million at Christie’s (Barron’s)

- What It Would Take for the S&P 500 to Hit 4500 by Year End (Barron’s)

- How People Get Rich Now (paulgraham)

- 4 Electric-Vehicle Charging Stocks at Fire-Sale Prices (Barron’s)

- Mexican Stocks Look Ready to Rally. Here’s Why. (Barron’s)

- Jane Fraser’s Debut as Citi’s CEO Hits All the Right Notes (Barron’s)

- The Stock Market Climbed Because Tumbling Bond Yields Don’t Mean What They Used To (Barron’s)

- Here’s how the ‘pause’ on J&J’s COVID-19 shot may or may not affect the company’s earnings (MarketWatch)

- Bill Miller 1Q 2021 Market Letter (millervalue)

- No Causal Link Found So Far Between J&J’s Covid-19 Vaccine and Blood-Clot Cases, Company Researchers Say (Wall Street Journal)

- Oakmark’s Bill Nygren on his expectations for the economic recovery (CNBC)

- The Bull Case for a $100 Million New Jersey Deli (Wall Street Journal)

- The Most Important Number of the Week Is 9.8% (Bloomberg)

- Boom Times Are Coming, If Only You Can Wait (Bloomberg)

- Hedge Funds Are Ready to Get Out of New York and Move to Florida (Bloomberg)

- SpaceX wins $2.9bn Nasa contract to land Americans on the moon (Financial Times)

- The labor market is the strongest it’s been since the pandemic started — and setting up a huge boost to America’s most crucial economic engine (Business Insider)

- 3 reasons the stock market is poised for a near-term correction, according to LPL (Business Insider)

- Pipeline pressure and Elliott’s stake have GSK in a spin (Financial Times)

- Netscape 2.0: Coinbase stock debut rekindles memories of web breakthrough (Financial Times)

Tom Hayes – CGTN Global Business Appearance – 4/16/2021

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – April 16, 2021

Unusual Options Activity – Valero Energy Corporation (VLO)

Data Source: barchart

Today some institution/fund purchased 22,713 contracts of June $80 strike calls (or the right to buy 2,271,300 shares of Valero Energy Corporation (VLO) at $80). The open interest was just 4,657 prior to this purchase. Continue reading “Unusual Options Activity – Valero Energy Corporation (VLO)”

Where is money flowing today?

Data Source: Finviz

Tom Hayes – Quoted in Reuters article – 4/16/2021

Thanks to Shivani Kumaresan for including me in her article on Reuters today. You can find it here:

Be in the know. 18 key reads for Friday…

- U.S. housing starts increase more than expected in March (Reuters)

- 4 reasons why the bull market in stocks is alive and well with more upside ahead, according to LPL (Business Insider)

- Bitcoin falls as Turkey bans cryptocurrency payments (MarketWatch)

- Completing the Process. The Energy Report 04/16/2021 (Phil Flynn)

- This Is the Richest American of All Time (247wallst)

- Morgan Stanley tops earnings estimates on better-than-expected trading, investment banking results (CNBC)

- David Einhorn calls out Elon Musk and Chamath Palihapitiya, defends GameStop champion Roaring Kitty, and blasts market regulators in a new letter. Here are the 11 best quotes. (Business Insider)

- Jeff Bezos posts his final letter to shareholders as Amazon CEO. Read the key takeaways and full note. (Business Insider)

- Chinese Economy Grew More Than 18% in First Quarter (Wall Street Journal)

- Morgan Stanley tops earnings estimates on better-than-expected trading, investment banking results (CNBC)

- Family Offices Targeting 800% Returns With SPAC Economics (Bloomberg)

- Pfizer CEO Says a Covid Booster Shot Will Likely Be Needed (Barron’s)

- Citigroup Reports Higher Earnings, Plans to Trim Consumer Businesses in Asia (Wall Street Journal)

- Delta Reports Another Quarterly Loss, but Says Travel Demand Is Rising (Wall Street Journal)

- Shell to Let Shareholders Vote on Shift to Cleaner Energy (Wall Street Journal)

- This Recovery Is Special, Whatever Bond Yields Say (Bloomberg)

- China’s Economy Is Booming. Shoppers Are Skittish Anyway. (New York Times)

- Bank of America Profit Doubles After It Releases Reserves for Bad Loans (Wall Street Journal)