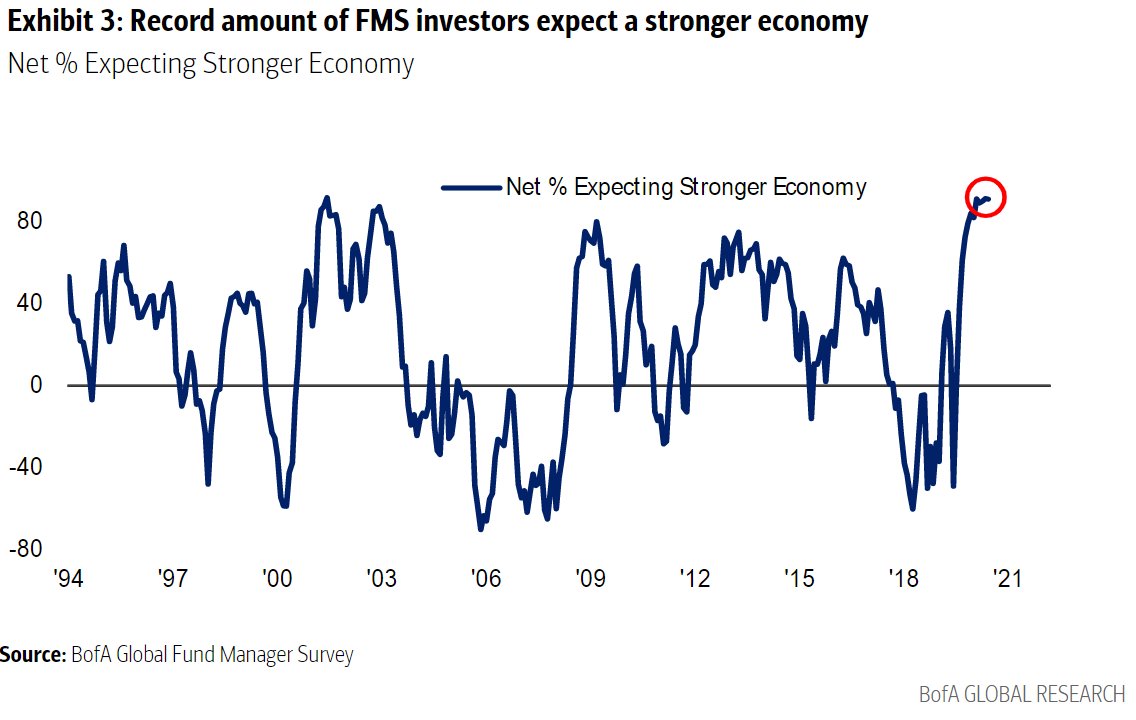

~200 Managers overseeing ~$600B AUM responded to this month’s BofA survey. Continue reading “March Bank of America Global Fund Manager Survey Results (Summary)”

Tag: StockMarket

Where is money flowing today?

Data Source: Finviz

Be in the know. 20 key reads for Monday…

- U.S. Banks to Turn Last Year’s Cash Buildup Into Profits (Wall Street Journal)

- Biden Eyes First Major Tax Hike Since 1993 in Next Economic Plan (Bloomberg)

- With New Covid Relief On Its Way, the Focus Turns to Infrastructure (Barron’s)

- China Industrial Output, Retail Sales Surge In Pandemic Rebound (Barron’s)

- Here’s What Wall Street Will Focus on as the Fed Rate Panel Meets (Barron’s)

- Americans Are Flying Again. Here’s Who Benefits. (Barron’s)

- White House Weighs How to Pay for Long-Term Economic Program (Wall Street Journal)

- Why the Next Big-Tech Fights Are in State Capitals (Wall Street Journal)

- Why $4-a-Gallon Gas May Be Coming Your Way This Summer (New York Times)

- New York Manufacturing Expands Most Since 2018 as Prices Climb (Bloomberg)

- The Housing Boom That Never Ends Already Wiped Out All the Short-Sellers (Bloomberg)

- India to propose cryptocurrency ban, penalising miners, traders –source (Business Insider)

- The $166 billion of SPAC deals in the 1st quarter exceeds all of 2020 (Business Insider)

- Big questions loom ahead of Biden’s next spending push, like ‘what is infrastructure?’ (Reuters)

- Investor questions for the Fed: rebound, inflation and yields (Reuters)

- Why Costco may actually still win long after the pandemic ends (Yahoo! Finance)

- China Becomes First Major Economy to Start Withdrawing Pandemic Stimulus Efforts (Wall Street Journal)

- Taylor Swift Wins Album of the Year at the Grammys (Wall Street Journal)

- Not-So Supertankers Deserve a Look as Pandemic Fades (Wall Street Journal)

- Overlooked corner of stock market offers protection from bond-market volatility (Fox Business)

Be in the know. 15 key reads for Sunday…

- Factbox: Energy firms seize on carbon tech, environmental goals to build new businesses (Reuters)

- Well-Known Companies Highlight Stocks to Buy Under $10 With Huge Potential (24/7 Wall Street)

- Fed to Hike Rates in 2023 but Dots Won’t Show It, Economists Say (Bloomberg)

- Air Force Receives First F-15EX Capable Of Carrying Hypersonic Weapons (ZeroHedge)

- Goldman’s Clients Are Asking If There Are Any Cheap Stocks Left (ZeroHedge)

- March Quarterly Options Expiration Week Historically Bullish: DJIA, S&P 500 & NASDAQ Up 10 of Last 13 (Almanac Trader)

- Banksy’s Painting for Health Care Workers Will Be Sold to Benefit England’s National Health Service (architecturaldigest)

- This Ferrari Monza SP1 Is World’s Most Beautiful Car, According to Science (Maxim)

- jaguar is restoring 12 e-type sports cars for its 60th anniversary (designboom)

- Top Gear Season 30: How the World’s Most Famous Motoring Show Out-Drove a Pandemic (thedrive)

- Most Dictators Self Destruct. Why? (getpocket)

- The European Central Bank fumbles its way towards yield curve control (moneyweek)

- Avoiding Bad Decisions (Farnam Street)

- Spirit: From laughingstock to legit airline (USA Today)

- Short Sellers Boost Bets Against SPACs (Wall Street Journal)

Be in the know. 50 key reads for Saturday…

- Big Pharma Battled the Pandemic. The Stocks Are Cheap. (Barron’s)

- These Aerospace Stocks Will Take Flight Soon. Flying Taxis? Not So Fast. (Barron’s)

- The pandemic made these cereals cool again (CNN Business)

- The value proposition for markets (Financial Times)

- Boeing Gets a Brand New 737 MAX Buyer, and the Stock Is Jumping (Barron’s)

- U.S. Surpasses 100 Million Covid-19 Vaccines Administered (Wall Street Journal)

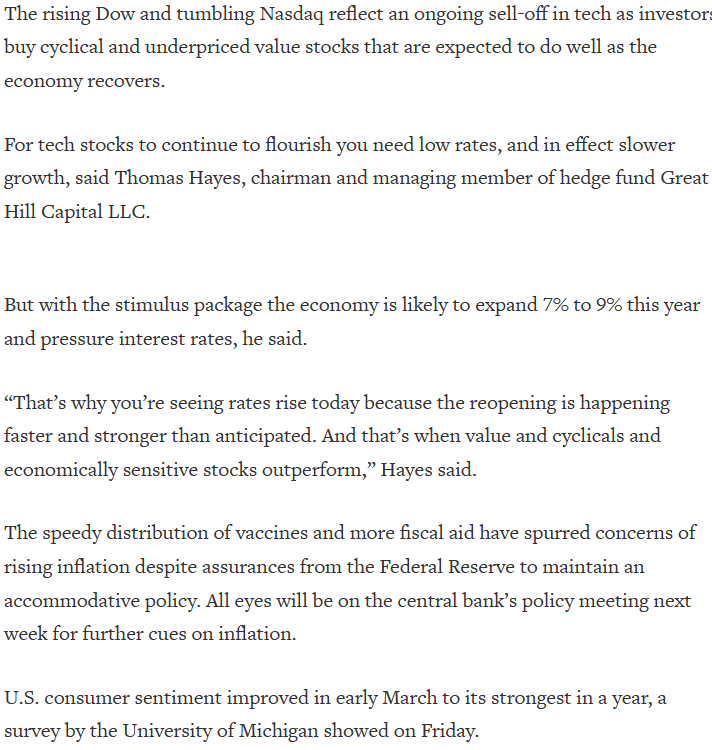

- The tech-heavy Nasdaq has underperformed the Dow for four straight weeks — a first since 2016 (CNBC)

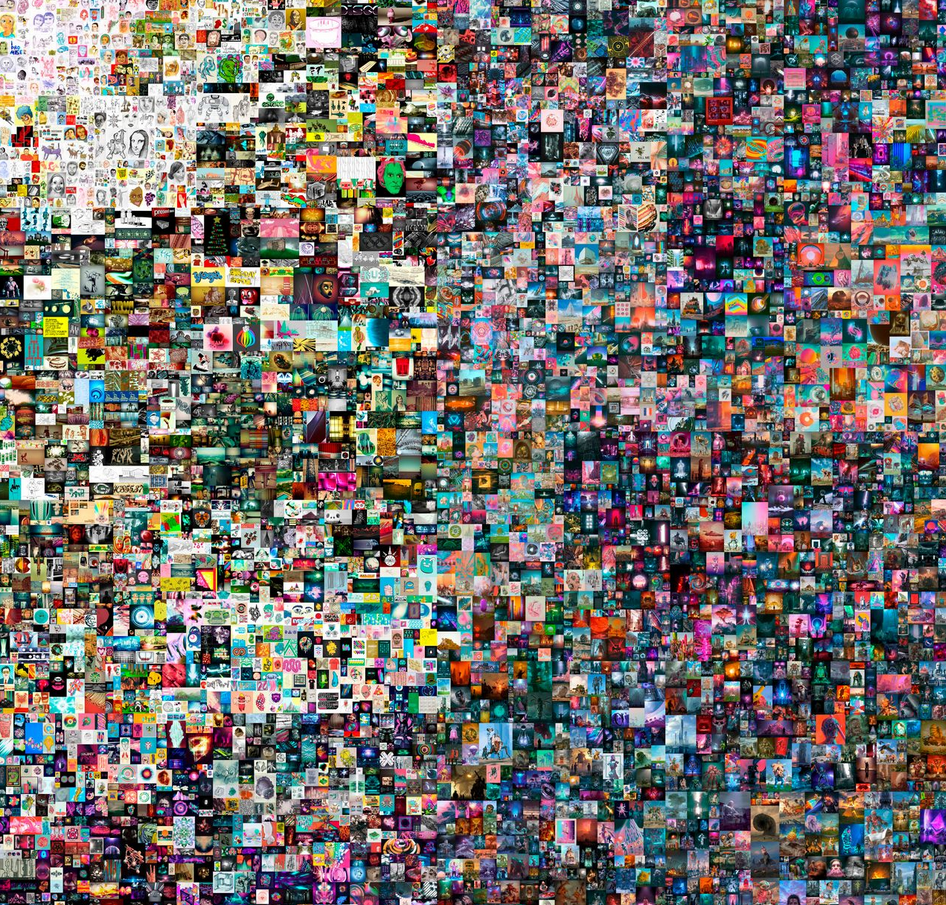

- Curious Speculations: Collectibles & NFTs (investoramnesia)

- As Covid Wanes, the U.S. Economy Could Soar. What That Means for Investors (Barron’s)

- Charlie Munger uses these mental tricks (cmqinvesting)

- Value Investors Finally Have Reason to Celebrate—for Now (Wall Street Journal)

- Fox’s Tubi Made Millions With Reruns. Now It Wants Original Programming (Bloomberg)

- Why You Should Be Wary of Claims That the Stock Market Is in a Bubble (Time)

- ‘Stimmy’ Is Setting Stage for Next Wave of Retail Stock Frenzy (Bloomberg)

- The Renaissance of Pipelines (contrarianedge)

- Novavax Stock Jumps on Final Data From U.K. Vaccine Trial (Barron’s)

- David Tepper says he’s getting bullish on stocks for a very specific reason (CNBC)

- Drive-Throughs That Predict Your Order? Restaurants Are Thinking Fast (New York Times)

- What Came Before the $10 Billion Bet on Flying Taxis (Wall Street Journal)

- Charlie Munger: How Berkshire got started and became a success (YouTube)

- 3D-printed housing developments suddenly take off – here’s what they look like (CNBC)

- Higher Rates Won’t Kill the Stock Market. What to Do Now. (Barron’s)

- The Tactics People Are Using to Get Their Money Out of China (Bloomberg)

- How Non-Fungible Tokens Are Transforming the Art World (Barron’s)

- The Booming IPO Market Shows No Signs of Slowing. What Investors Need to Know. (Barron’s)

- Eli Lilly Offers More Positive Data on Its Alzheimer’s Drug (Barron’s)

- 14 Undervalued Small-Cap Stocks (Morningstar)

- Here’s What Wall Street Will Focus on Next Week as Fed Rate Panel Meets (Barron’s)

- Bear Warning Seen With Nasdaq 100 Velocity Stalling at 2000 Peak (Bloomberg)

- How Israel Became the World Vaccine Leader (Wall Street Journal)

- It’s Not Just GameStop. Why These Retro Stocks Are Suddenly Hot. (Barron’s)

- How to Play the Valuation Gap Between Growth and Value Stocks (Barron’s)

- Covid-19 Rewrote the Rules of Shopping. What Is Next? (Wall Street Journal)

- Short Seller Takes Aim at Another EV Maker. Its Stock Is Tumbling. (Barron’s)

- China’s Corporate Earnings Set for Biggest Jump in a Decade (Bloomberg)

- Bridgewater’s Prince warns on risky assets after bond decline (Financial Times)

- China Aims to Vaccinate 70-80% of Population By Mid-2022 (Bloomberg)

- Americans with more education are optimistic about the economy. The rest aren’t. (Business Insider)

- Why the spiking bond yields driving sharp losses in tech stocks are not a long-term threat to the market, according to one Wall Street chief strategist (Business Insider)

- Tech’s Volatility Roller Coaster Is Back at Pandemic-Crash Level (Bloomberg)

- Factories Are Gearing Up for a Post-Covid Boom (Bloomberg)

- Billionaire and Celebrity Endorsements Lure Retail Investors to the SPAC Craze (Bloomberg)

- Everything Hot Is ‘Unwinding’ in $21 Billion of Clean-Power ETFs (Bloomberg)

- 50 Companies to Watch in 2021 (Bloomberg)

- Vitalik Buterin, Creator of Ethereum, on Understanding Ethereum, ETH vs. BTC, ETH2, Scaling Plans and Timelines, NFTs, Future Considerations, Life Extension, and More (Featuring Naval Ravikant) (#504) (Tim Ferriss)

- Investors Panic During Natural Disasters. Who Wins When They Do? (institutionalinvestor)

- Investors see ‘gold rush on steroids’ for green battery metals (Financial Times)

- For Wall Street, Everybody’s a Post-Covid Winner (Wall Street Journal)

- 17 Reasons to Let the Economic Optimism Begin (New York Times)

- $100 Billion Has Rotated Back To Value Investing, And More Could Be Coming (ZeroHedge)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 73

Article referenced in podcast above:

Hedge Fund Tips with Tom Hayes – Podcast – Episode 63

Article referenced in podcast above:

Tom Hayes – Quoted in Reuters article – 3/12/2021

Thanks to Herbert Lash for including me in his articles on Reuters today. You can find it here:

Where is money flowing today?

Data Source: Finviz

Be in the know. 23 key reads for Friday…

- Homebuyers Are Heading to Florida During Covid, but Nearly as Many Are Moving Out (Wall Street Journal)

- Want a greener world? Don’t dump oil stocks (Financial Times)

- JPMorgan says stocks in these sectors will lead markets higher as economy recovers (CNBC)

- Oil Giants Prepare to Put Carbon Back in the Ground (New York Times)

- Biden Sees Normalcy Returning by Summer as Vaccinations Surge (Bloomberg)

- Shell Doubled Oil-Trading Profit to $2.6 Billion Last Year (Bloomberg)

- Stockpickers Can Breathe Again as FANGs Stumble (Bloomberg)

- Apollo Bets a New Roaring ’20s Will Revive Vegas After Vaccines (Bloomberg)

- Apollo Bids $11 Billion For a Different Headache (Bloomberg)

- Novavax vaccine 96% effective against original coronavirus, 86% vs British variant in UK trial (CNBC)

- China’s GDP growth target of over 6% is easy to reach – and that’s not a bad thing, analysts say (CNBC)

- Hyatt Hotels CEO sees ‘clear path to recovery’ after Covid rocked industry (CNBC)

- Bill Gates is worried about Bitcoin, other cryptocurrencies for this reason (Fox Business)

- The Booming IPO Market Shows No Signs of Slowing (Barron’s)

- Things Are Good for Industrial Stocks. A Hidden Dividend Aristocrat Shows Why. (Barron’s)

- China’s Antitrust Regulators Fine Tencent, Baidu and 10 Others as Big Tech Crackdown Intensifies (Barron’s)

- Here’s how far the Nasdaq could fall if bond yields reach 2% (MarketWatch)

- 10 Ways to Play the Oil Rally (Barron’s)

- The rotation into cyclical stocks isn’t over, but investors should use volatility to ‘build positions’ in tech, UBS says (Business Insider)

- China Lays Plans to Tame Tech Giant Alibaba (Wall Street Journal)

- Israeli Strikes Target Iranian Oil Bound for Syria (Wall Street Journal)

- Beeple NFT Fetches Record-Breaking $69 Million in Christie’s Sale (Wall Street Journal)

- Cash-Out Refinancings Hit Highest Level Since Financial Crisis (Wall Street Journal)