The song we chose to embody this week’s stock market sentiment is Diana Ross’, “Upside Down”: Continue reading “The Diana Ross “Upside Down” Stock Market (and Sentiment Results)…”

Tag: StockMarket

Where is money flowing today?

Data Source: Finviz

Be in the know. 25 key reads for Wednesday…

- More Rate Scares Ahead for Stocks (Wall Street Journal)

- Exxon vs activists: can disenchanted investors force change? (Financial Times)

- US Treasury bond wobble heightens concerns over health of $21tn market (Financial Times)

- Financials may be a silver lining in bond market rout (Financial Times)

- Property and the pandemic: the great reckoning that never seems to arrive (Financial Times)

- Saudi Arabia says Khashoggi report won’t set back US relations (Financial Times)

- Bitcoin cannot replace the banks (Financial Times)

- Las Vegas Sands sells the Venetian, Sands Expo for $6.25B (FoxBusiness)

- SPACs are now a $700 billion market: Morning Brief (Yahoo! Finance)

- Analysis: Fed may need more than words in next battle with markets (Reuters)

- Oil up as OPEC+ considers rollover rather than raising output (Street Insider)

- Apollo to Acquire Retailer Michaels for $3.3 Billion in Cash (Bloomberg)

- Companies Are Feeling the Inflation Pinch. What to Watch Next. (Barron’s)

- Forget GameStop. If You Want Real Risk, Invest in Supercars (Bloomberg)

- Fox News Finds It’s Back in Familiar Spot: Prime-Time Lead (Bloomberg)

- ‘Big Short’ investor Michael Burry says governments may ‘handicap’ bitcoin – and doubts it can disrupt global finance (Business Insider)

- Oil industry is getting greener faster as U.S. policy shifts to climate change (CNBC)

- Cruise Stocks Get Upgraded by Macquarie, Because Covid’s Worst Is in the Past (Barron’s)

- There Probably Won’t Be a Post-Covid Wave of Foreclosures (Barron’s)

- U.S. Vaccine Shortage Could Soon End With Oversupply (Barron’s)

- Democrats Are Already Looking Ahead to More Economic Relief (Barron’s)

- Here’s the problem the Fed is fueling — and it’s not inflation, strategist says (MarketWatch)

- Big Oil ‘Friends’ the Carbon Tax (Wall Street Journal)

- CVS, Walgreens Look for Big Data Reward From Covid-19 Vaccinations (Wall Street Journal)

- Houston’s Big Oil Conference Goes Green as Energy Transition Accelerates (Wall Street Journal)

Unusual Options Activity – PG&E Corporation (PCG)

Data Source: barchart

Today some institution/fund purchased 19,817 contracts of Dec $15 strike calls (or the right to buy 1,981,700 shares of PG&E Corporation (PCG) at $15). The open interest was just 405 prior to this purchase. Continue reading “Unusual Options Activity – PG&E Corporation (PCG)”

Where is money flowing today?

Be in the know. 15 key reads for Tuesday…

- The Money Gusher Says There’s No Stocks Bubble Yet (Bloomberg)

- Space Will Be a Software Business Too (Barron’s)

- Goldman Sachs says it’s the beginning of a structural bull market in commodities (MarketWatch)

- Value Investing Is Finding Favor in Emerging Markets. Here’s What To Own Now. (Barron’s)

- Wall Street Bullishness Is Becoming a Contrarian Sell Signal (Bloomberg)

- The Energy Report 03/02/2021 (Phil Flynn)

- Big Oil Faces Off Against Clean-Energy Giants (Wall Street Journal)

- Rocket’s Mortgage Engine Is Still Running Hot (Wall Street Journal)

- Fed policy changes could be coming in response to bond market turmoil, economists say (CNBC)

- Saudi Arabia and Russia are at loggerheads again, but OPEC meeting ‘unlikely to ruin the oil party’ (CNBC)

- Investor Dan Loeb says he’s been exploring cryptocurrencies to bridge the gap between traditional finance and new ‘controversial ideas’ (Business Insider)

- Warren Buffett May Yet Have His Revenge on Dave Portnoy (Bloomberg)

- More Space Stocks Are Coming. Investors Are Pleased. (Barron’s)

- U.S. to Take Hard Line on Chinese Trade Practices, Administration Says (Wall Street Journal)

- United Airlines Buys 25 New Boeing 737 MAX Jets (Wall Street Journal)

Tom Hayes – The Claman Countdown – Fox Business Appearance – 3/1/2021

Fox Business Appearance – Thomas Hayes – Chairman of Great Hill Capital – March 1, 2021

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Monday…

- These Undervalued Stocks Are Set to Beat Pre-Covid Earnings (Barron’s)

- J&J’s Vaccine Is Authorized. Here’s What It Means for the Stock. (Barron’s)

- 12 Stocks and Funds to Play the Coming Green Boom for Utilities (Barron’s)

- U.K. Builders Are Surging. Morgan Stanley Says Government Program to Help Housing Market. (Barron’s)

- Iran Rejects Offer of Direct U.S. Nuclear Talks, Ratcheting Up Tension With West (Wall Street Journal)

- Biden offers support to Amazon workers attempting to unionize in Alabama (New York Post)

- Trump calls on states to address tech monopolies if congress fails to act (New York Post)

- 10-year Treasury yield holds below 1.50% as bond market selloff cools (MarketWatch)

- How Exxon Could Send Its Stock Even Higher (Barron’s)

- Oil prices resume rally ahead of this week’s OPEC+ decision on crude production (MarketWatch)

- South Korean exports rise for 4th straight month (MarketWatch)

- 5 Industrial Stocks Poised to Benefit From Rising Inflation (Barron’s)

- U.S. Enlists Allies to Counter China’s Technology Push (Wall Street Journal)

- How Europe Became the World’s Biggest Electric-Car Market—and Why It Might Not Last (Wall Street Journal)

- OPEC oil output falls in February on Saudi additional cut – survey (Reuters)

- Australian central bank boosts bond purchases after borrowing costs soar (Financial Times)

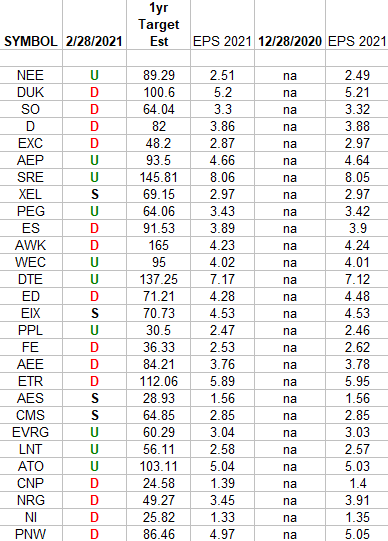

Utilities Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Utilities Sector ETF (XLU) top weighted stocks. Continue reading “Utilities Earnings Estimates/Revisions”