- Fed Needs Fiscal Support to Close Gap Between Markets, Real Economy (Wall Street Journal)

- Did Warren Buffett Do the Prudent Thing and Sell Some Apple (AAPL) as it Surpassed 50% of Berkshire’s Portfolio? (Street Insider)

- 5 Very Undervalued Large Cap Biotech Stocks That Could Explode in 2021 (24/7 Wall Street)

- Wall Street sees a bright side in ‘healthy’ tech selloff (Reuters)

- New York Islanders Fans Finally Have Something to Cheer About (Wall Street Journal)

- JPMorgan Says Big Options Bets Can Swing Stocks in Thin Markets (Bloomberg)

- The market and Congress are locked in a high-stakes game of chicken — and who blinks first will ultimately determine where stocks go next (Business Insider)

- More Americans Are Quitting Their Jobs. That’s a Good Sign (Bloomberg)

- Soybeans have been surging on Chinese demand, trade group CEO says buying could continue (CNBC)

- Maserati’s New Supercar: All the Photos and Specs (Bloomberg)

- Breaking Up With China Is Hard to Do. Here’s What Investors Need to Know. (Barron’s)

- AstraZeneca’s Vaccine-Trial Pause Won’t Slow Its Rivals (Barron’s)

- Goldman Sachs memo reveals plan to bring thousands of bankers back to the office (fn London)

- There are seven coronavirus vaccine candidates being tested in the U.S. — here’s where they stand (MarketWatch)

- New York City to Resume Indoor Dining at Restaurants (Wall Street Journal)

Tag: StockMarket

The Barry White, “Never Gonna Give You Up” Stock Market (and Sentiment Results)…

This shortened Holiday Week, the song we chose to embody Stock Market sentiment is Barry White’s, “Never Gonna Give you Up.” Continue reading “The Barry White, “Never Gonna Give You Up” Stock Market (and Sentiment Results)…”

Tom Hayes – CGTN Global Business Appearance – 9/9/2020

CGTN – Thomas Hayes – Chairman of Great Hill Capital – September 9, 2020

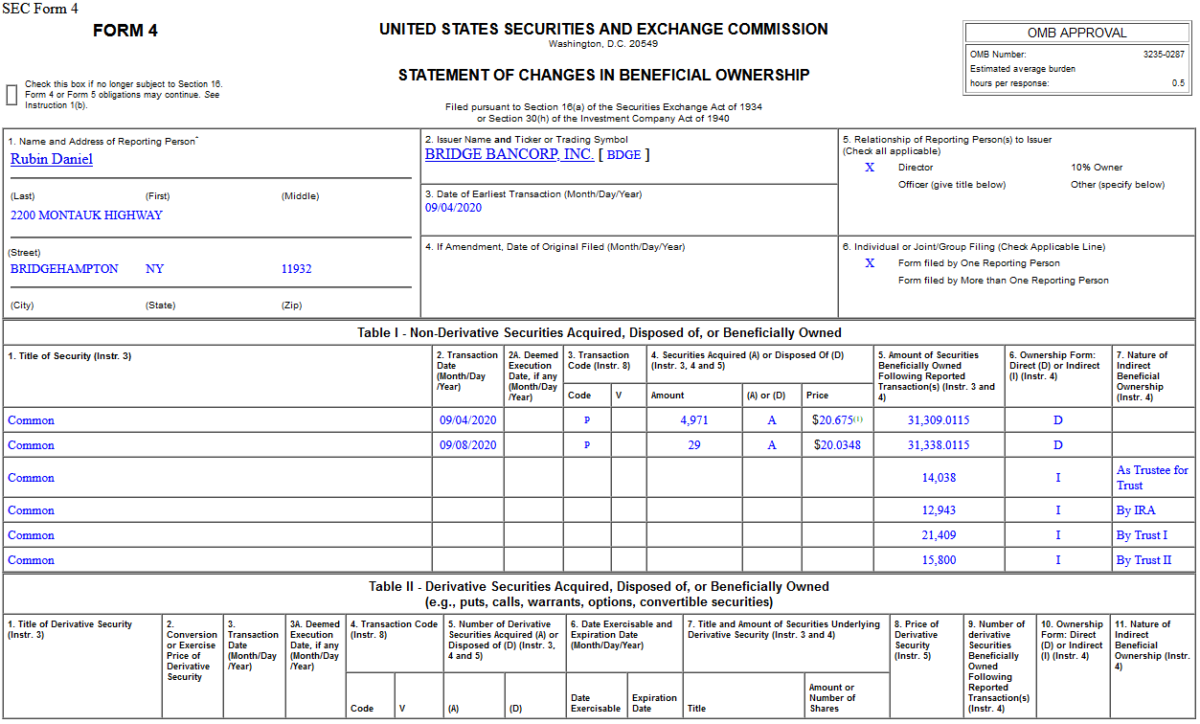

Insider Buying in Bridge Bancorp, Inc. (BDGE)

On Sept. 4, 2020, Daniel Rubin – Director of Bridge Bancorp, Inc. (BDGE) – purchased 5,000 shares of BDGE at $20.03-$20.68. His out of pocket cost was $103,356.

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Wednesday…

- AstraZeneca Pauses Coronavirus Vaccine Study (Barron’s)

- Buy NIO Stock Because Competition With Tesla Isn’t a Zero-Sum Game (Barron’s)

- Tesla Stock Drops as Wall Street Scrambles to Assign Blame (Barron’s)

- Southwest and 3 Other Airline Stocks Ready to Rebound, Says Morgan Stanley (Barron’s)

- Why Pfizer’s Drug Pipeline Will Outshine a Covid Vaccine (Barron’s)

- Citigroup Stock Is Earning Fans on Wall Street. Here’s Why. (Barron’s)

- Capri, a Getaway for the Rich and Famous, Misses Its Americans (New York Times)

- Paul Singer Wants a Piece of the Action in Chevron’s Deal for Noble Energy (24/7 Wall Street)

- Ex-Trump adviser Cohn raises more than planned in blank-check IPO (Reuters)

- Warren Buffett’s Berkshire Hathaway to buy $250 million worth of Snowflake’s shares in private placement (Yahoo! Finance)

- Zoom, Boston Beer, Nikola among Forbes 400’s newest members (Fox Business)

- Pfizer CEO says ‘we will have an answer by the end of October’ on coronavirus vaccine (Fox Business)

- Real Estate Mogul Sam Zell Is Launching A SPAC (Benzinga)

- Legendary investor Byron Wien says next ‘real opportunities’ in market are transportation and energy as tech falters (Business Insider)

- U.S.-China Chip-War Collateral Damage Will Range Far and Wide (Wall Street Journal)

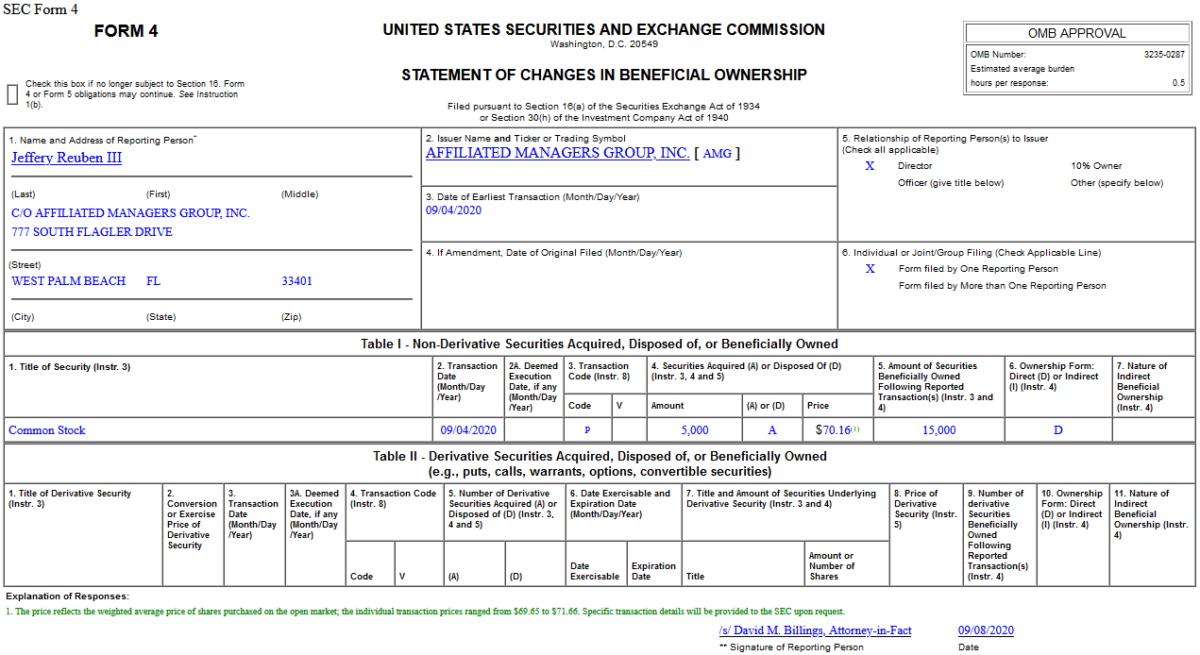

Insider Buying in Affiliated Managers Group, Inc. (AMG)

On Sept. 4, 2020, Jeffrey Reuben III – Director of Affiliated Managers Group, Inc. (AMG) – purchased 5,000 shares of AMG at $70.16. His out of pocket cost was $350,800.

Where is money flowing today?

Data Source: Finviz

Be in the know. 15 key reads for Tuesday…

- 13 Stocks That Both Growth and Value Investors Will Love (Barron’s)

- Are the Bulls or Bears Right? One Strategist Offers Context. (Barron’s)

- Summer Sayonara. The Energy Report 09/08/2020 (Price Group)

- Pfizer-BioNTech vaccine could be ready for approval by mid-October — but there are still ‘unknowns’ (CNN)

- Mortgage Market Booms, Even as Virus Hits Economy (Wall Street Journal)

- Goldman Sachs Has 10 Reasons the Bull Market Has Room to Run (24/7 Wall Street)

- Nikola soars 47% after striking $2 billion manufacturing partnership with General Motors (Business Insider)

- Netflix’s Reed Hastings Deems Remote Work ‘a Pure Negative’ (Wall Street Journal)

- Don’t bet against the U.S. market, it’s likely going higher, BlackRock’s Rieder says (Reuters)

- White House’s Meadows says he is optimistic for COVID-19 funds before election (Reuters)

- Activists Say Some Poison Pills Are Bad Medicine (Barron’s)

- SoftBank sheds $8.9bn as ‘whale’ options bets unnerve traders (Financial Times)

- Ivermectin Moves Towards Mainstream (TrialSiteNews)

- Apple Drops on Negative Goldman Outlook, Possible iPhone Delays (Yahoo! Finance)

- Trump Vows to Sharply Scale Back U.S.-China Economic Ties (Bloomberg)

Be in the know. 10 key reads for Labor Day…

- Trump floats using extra $300B in coronavirus relief aid for second stimulus check (Fox Business)

- Want to Invest in Emerging Markets? Here’s How to With European, Japanese Stocks. (Barron’s)

- China’s August exports stronger than expected (MarketWatch)

- Intel CEO on How the Chip Maker Plans to Get Back on Track (Barron’s)

- Another Reason to Be Bullish About Bank Stocks (Barron’s)

- U.S. Weighs Export Controls on China’s Top Chip Maker (Wall Street Journal)

- ‘Fomo feeling’ propels Indian investors into stock market (Financial Times)

- Fake reviews are all over Amazon and it’s getting harder to spot them (CNBC)

- The stock market’s latest sell-off amounts to ‘healthy’ recalibration before it heads even higher, says BlackRock’s bond chief who oversees $2.3 trillion (Business Insider)

- Here’s why the Dow plunged last week and what’s ahead for the stock market (MarketWatch)