- Berkshire Buys Passive Stakes in 5 Japanese Trading Houses (Barron’s)

- FDA willing to fast track coronavirus vaccine before phase three trials end (CNBC)

- Coronavirus Has Left Banks With Lots of Cash and Little to Do With It (Wall Street Journal)

- China’s Theme Parks Ride a Boom as Tourists Have Nowhere to Go (Wall Street Journal)

- Shinzo Abe’s Unfinished Revolution Hangs in the Balance (Wall Street Journal)

Tag: StockMarket

Be in the know. 10 key reads for Sunday…

- FDA Expands Emergency Use of Gilead’s Remdesivir in All Covid-19 Hospitalizations (Barron’s)

- Citigroup Economic Surprise Index (Yardeni)

- Inside A Billionaire’s Fight With A Small Town Over A Tiny Vacant Lot (Forbes)

- Wall Street Week Ahead: Value bulls bang drum for cheap stock resurgence on Fed, vaccine hopes (Reuters)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- How Tom Cruise Made This Impossible Movie Stunt Possible (digg)

- Is A Major Oil Price Breakout On The Horizon? (Oil Price)

- Tiffany Reports 90% Sales Jump in China: First real sign of Pandemic Luxury Recovery (Luxuo)

- 5 of the World’s Most Exclusive Private Island Resorts (Just Luxe)

- The Most Beautiful Golf Clubhouses in the U.S. (Just Luxe)

Be in the know. 20 key reads for Saturday…

- Warren Buffett and the $300,000 Haircut (Wall Street Journal)

- Fed’s Bullard says the recession is over but rates will ‘stay low for a long time’ (CNBC)

- Activists May Focus on Energy and Health Care Next Year (Barron’s)

- Losing the extra $600 unemployment benefit may not have stopped Americans from spending money, J.P. Morgan credit card data shows (MarketWatch)

- The U.S. Housing Market Is on Fire. Two Ways to Play It. (Barron’s)

- Get Ready for a Crazy Wave of IPOs (Barron’s)

- New York City’s Offices Are Empty. How to Gamble on a Recovery. (Barron’s)

- The Secrets of Elite College Admissions (Wall Street Journal)

- Elon Musk unveils working prototype of ‘brain-implant’ device (New York Post)

- This Market Rally Has Legs, Six Strategists Say. Here’s Proof (Bloomberg)

- A Simple Recipe for Oyster-Sauce Scallops to Make at Home (Bloomberg)

- Why One Analyst Has His Eyes Set on Singapore’s Virus-Hit Small Caps (Bloomberg)

- Warren Buffett’s 90th birthday is on Sunday. Here are 5 of the legendary investor’s best birthday stories. (Business Insider)

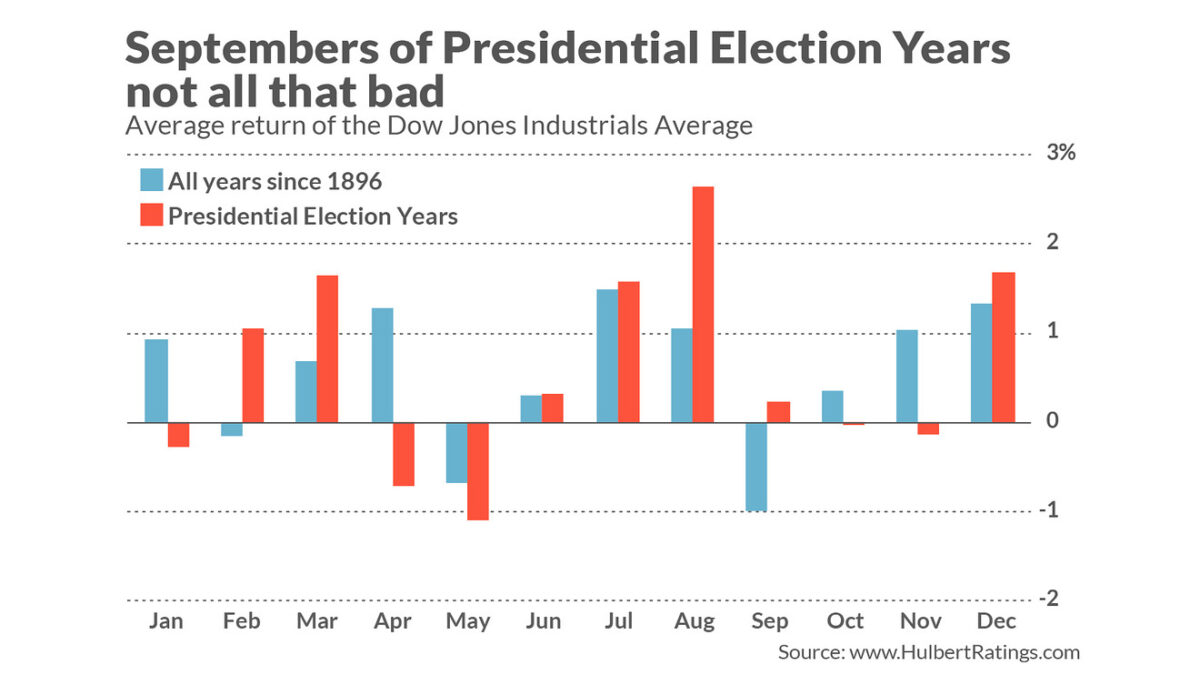

- Opinion: The stock market is on a tear, but now comes September, the worst month of the year. However, something curious happens in presidential-election years (MarketWatch)

- Cruise operators took a deep bruising from COVID-19, but history says they will recover (MarketWatch)

- Utz, maker of Zapp’s and Boulder Canyon chips, is going public (CNN Business)

- The United States set record for daily natural gas power burn in late July (EIA)

- Yield curve steepens after Fed policy shift (Financial Times)

- The Public and Private Markets (Investor Amnesia)

- Why Bank of New York Mellon Is Worth a Second Look (Barron’s)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 45

Article referenced in VideoCast above:

The Stevie Wonder, “Faith” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 35

Article referenced in podcast above:

The Stevie Wonder, “Faith” Stock Market (and Sentiment Results)…

Unusual Options Activity – JPMorgan Chase & Co. (JPM)

Data Source: barchart

Today some institution/fund purchased 6,127 contracts of Sept. 2021 $170 strike calls (or the right to buy 612,700 shares of JPMorgan Chase & Co. (JPM) at $170). The open interest was 6,127 prior to this purchase. Continue reading “Unusual Options Activity – JPMorgan Chase & Co. (JPM)”

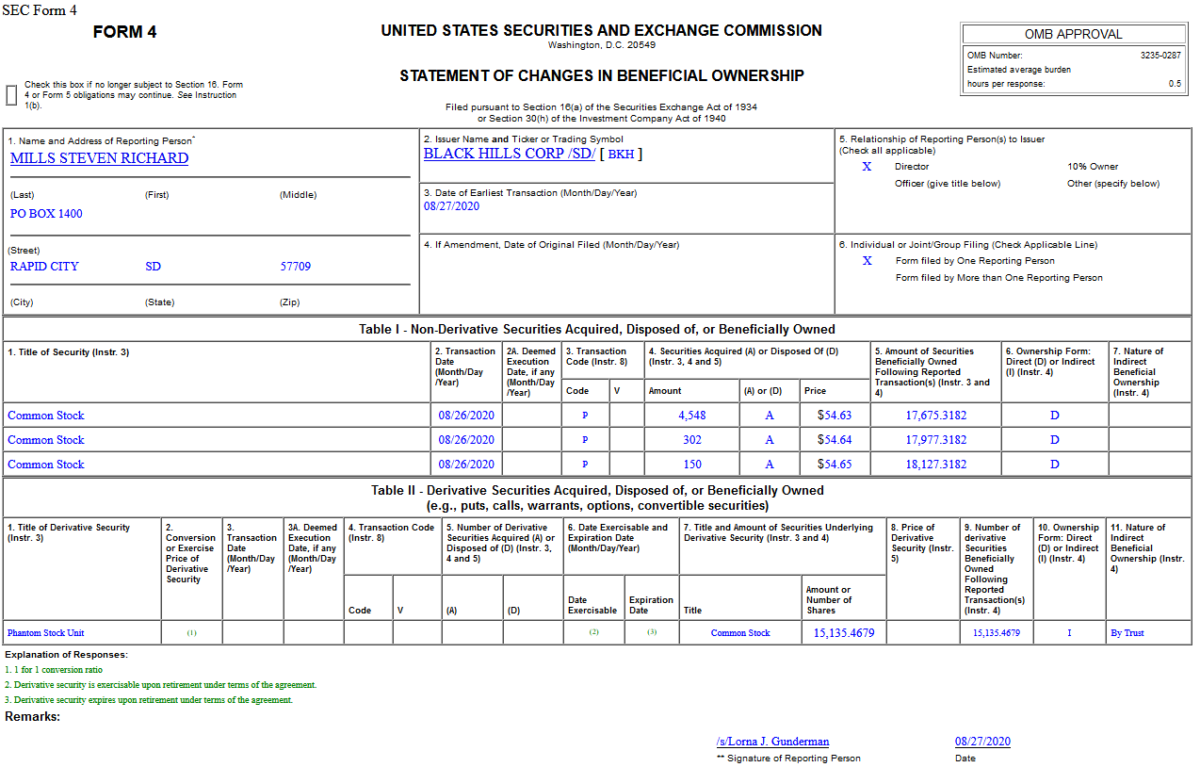

Insider Buying in Black Hills Corporation (BKH)

On Aug 26, 2020, Richard Mills – Director of Black Hills Corporation (BKH) – purchased 5,000 shares of BKH at $54.63. His out of pocket cost was $273,156.

Where is money flowing today?

Data Source: Finviz

Be in the know. 10 key reads for Friday…

- Yield curve steepens after Fed policy shift (Financial Times)

- This New Valuation Gauge Sees Earnings Upside, Says Stocks Have Room to Run (Barron’s)

- US hedge fund managers raise fees even as the rest of the world cuts them (fn London)

- Dell Profit Tops Estimates on Cost Controls and PC Demand (Barron’s)

- Why Bank of New York Mellon Is Worth a Second Look (Barron’s)

- Fed Chair Sets Stage for Longer Periods of Lower Rates (New York Times)

- Fed’s Elevation of Employment Goal Reflects a Changed World (Wall Street Journal)

- The US economy needs more stimulus to slash the risk of a ‘double dip’ recession, former Fed official says. (Business Insider)

- U.S. antitrust cases against Google (GOOGL) zeroes in on ‘tying’ products – Bloomberg (Street Insider)

- Fed’s Harker says it will take ‘a while’ for jobs market to heal, would be OK with inflation at 2.5% (CNBC)

Unusual Options Activity – JPMorgan Chase & Co. (JPM)

Data Source: barchart

Today some institution/fund purchased 5,119 contracts of Sept. 2021 $200 strike calls (or the right to buy 511,900 shares of JPMorgan Chase & Co. (JPM) at $200). The open interest was just 646 prior to this purchase. Continue reading “Unusual Options Activity – JPMorgan Chase & Co. (JPM)”