Key Market Outlook(s) and Pick(s)

On Monday, I joined Brian Brenberg, Taylor Riggs, Jackie DeAngelis, and Dagen McDowell on Fox Business “The Big Money Show” for the full hour to discuss markets, the China deal, Saudi Arabia, Trump’s Middle East trip, $UAL, the FAA, Digital detox, and outlook. Thanks to Brian, Taylor, Jackie, Dagen, Madison Murtagh, and Cassie Loeloff for having me on:

Watch in HD directly on Fox Business

On Tuesday, I joined Stuart Varney on Fox Business’s “Varney & Co.” alongside Kevin O’Leary to discuss inflation, earnings, markets, outlook, and Stanley Black & Decker. Thanks to Stuart and Christian Dagger for having me on:

On Monday, I joined Diane King Hall on Schwab Network to discuss markets, the China deal, and stock picks. Thanks to Diane and Heidi Schultz for having me on:

Watch in HD directly on Schwab Network

On Monday, I joined Kristen Scholer on NYSE TV to discuss markets, the China deal, and stock picks. Thanks to Kristen and Mel Montanez for having me on:

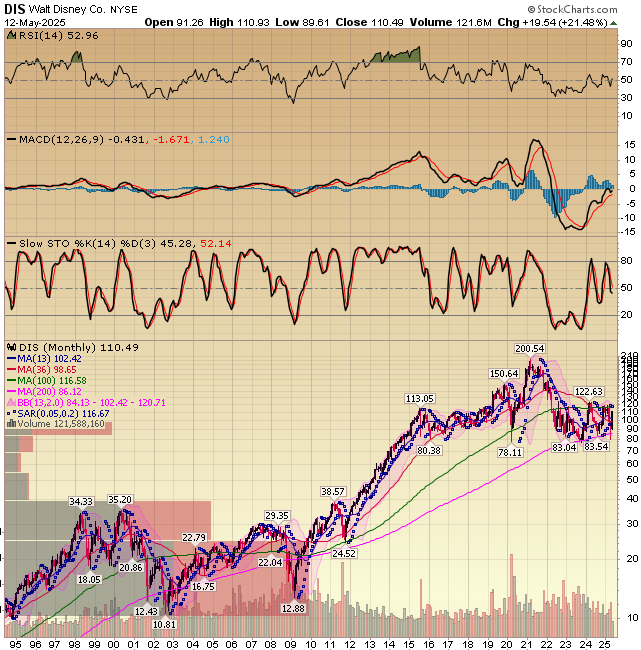

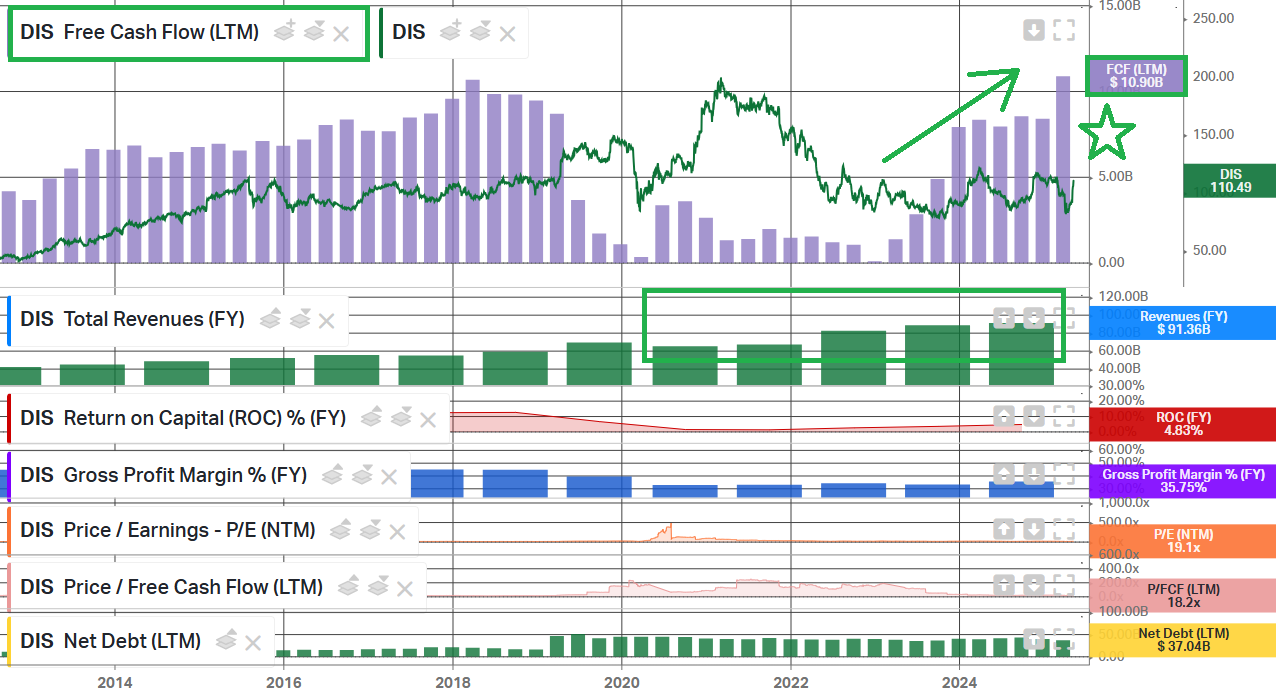

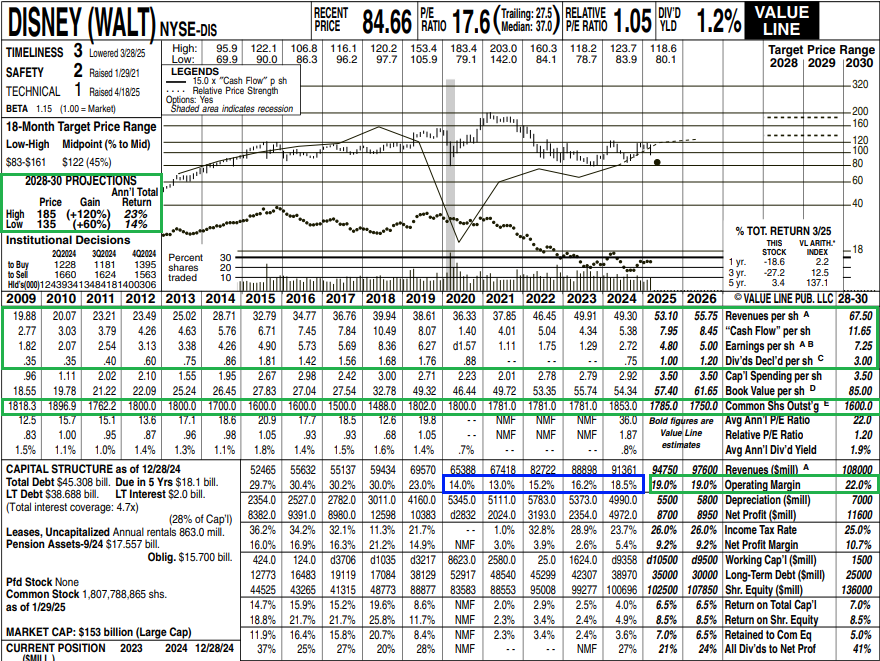

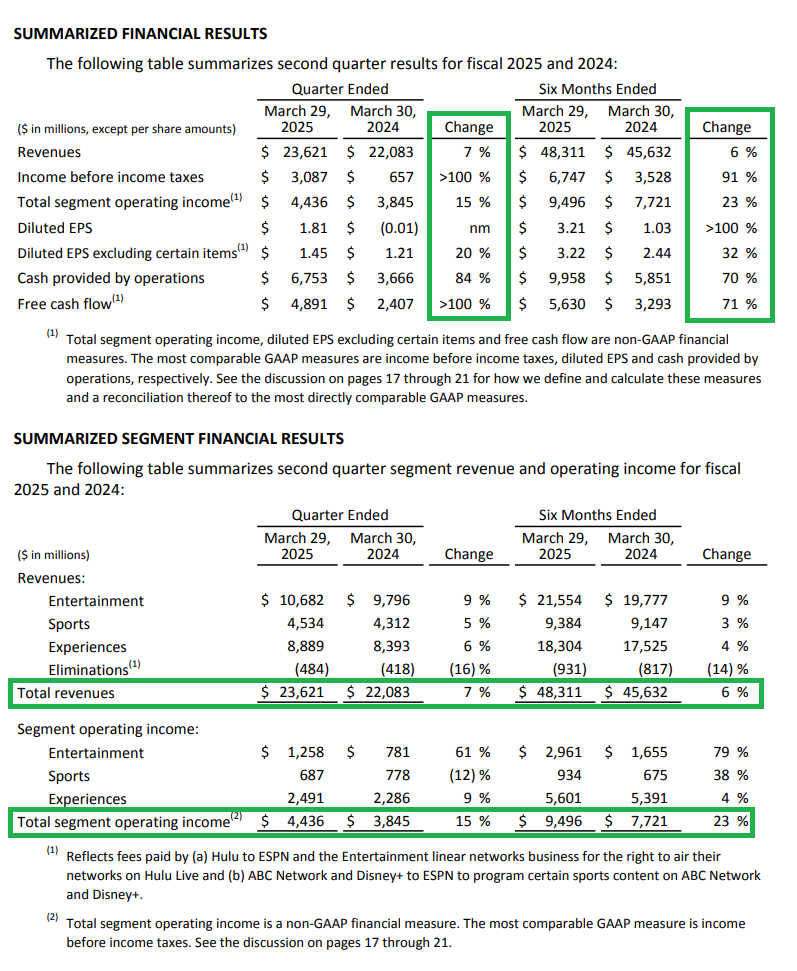

Disney Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

10 Key Points

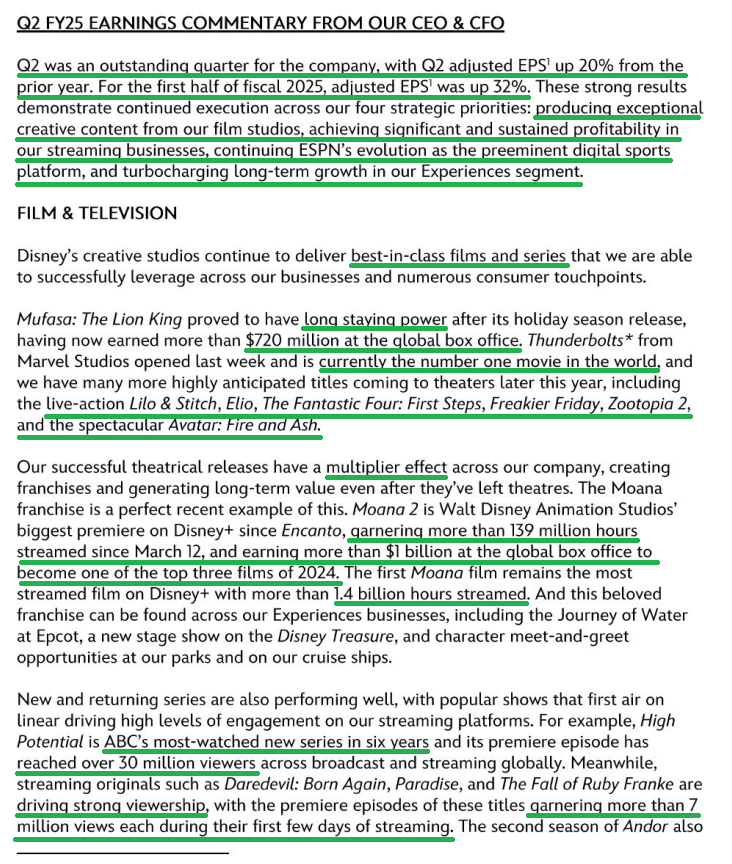

1) The turbocharged investment in Experiences and $30 billion in domestic parks has led to more expansion projects underway globally than at any point in Disney’s history. Return on invested capital for the segment is at record highs as land development continues to boost capacity.

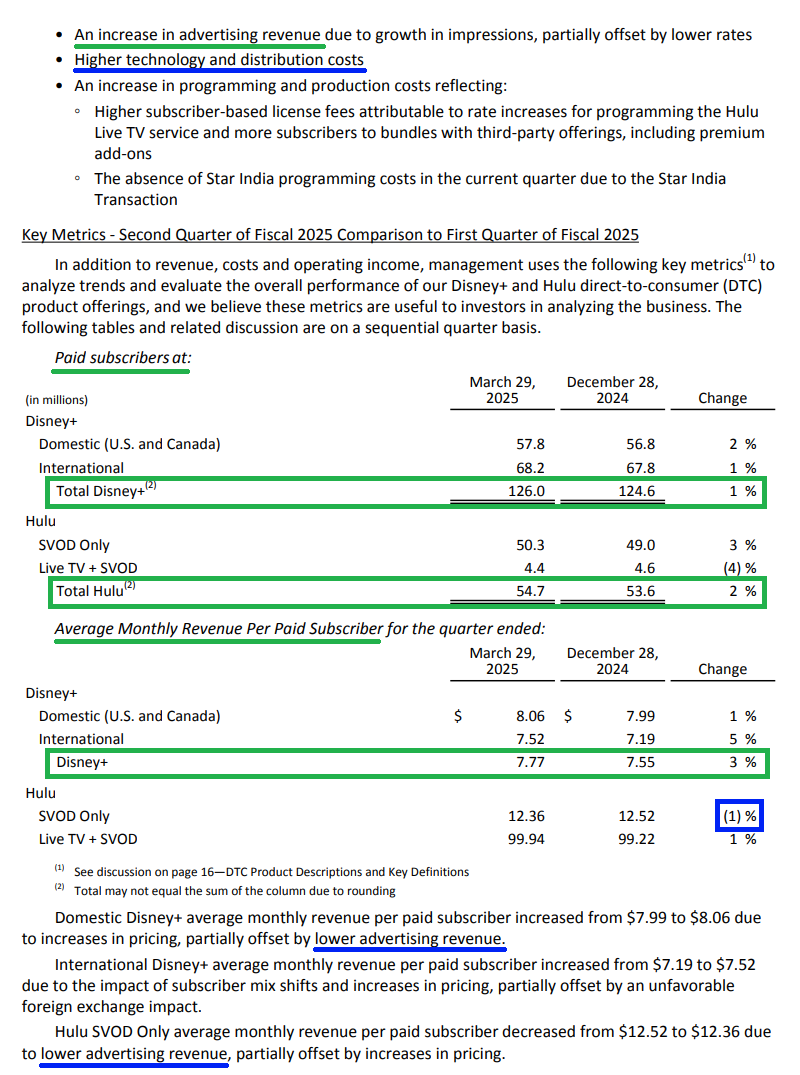

2) Management sees the upcoming 18-month film slate as the strongest since 2019, which was Disney’s best year on record. Major releases include Lilo & Stitch, The Fantastic Four, Zootopia 2, Avatar: Fire and Ash, with 2026 featuring Avengers, The Mandalorian, Toy Story, and a Moana live-action. Looking back at 2019, Disney had six films top $1 billion globally and set a record $11.12 billion at the global box office. If the next year and a half delivers anything close, DIS will be back to all-time highs.

3) Disney continues to lean into its high-margin, accretive cruise business, which is expected to be a major growth driver in the years ahead. The newly launched Disney Treasure is in its second quarter of operations and seeing strong demand. Two more ships will join the fleet later this year, with the Singapore-based ship selling out its first quarter of bookings in just days.

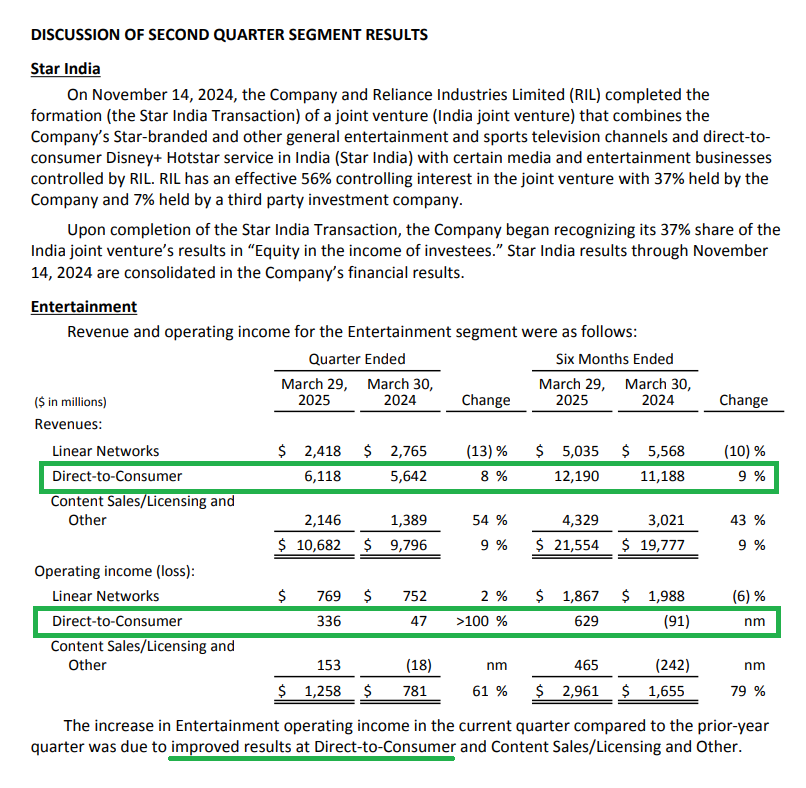

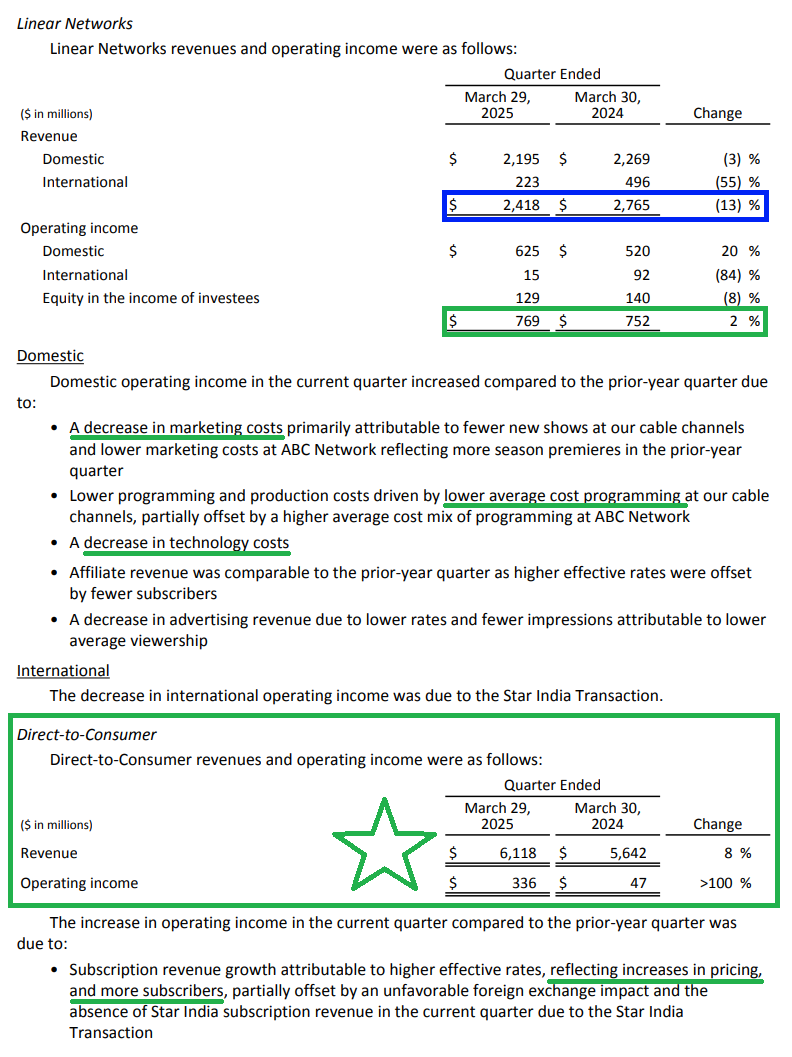

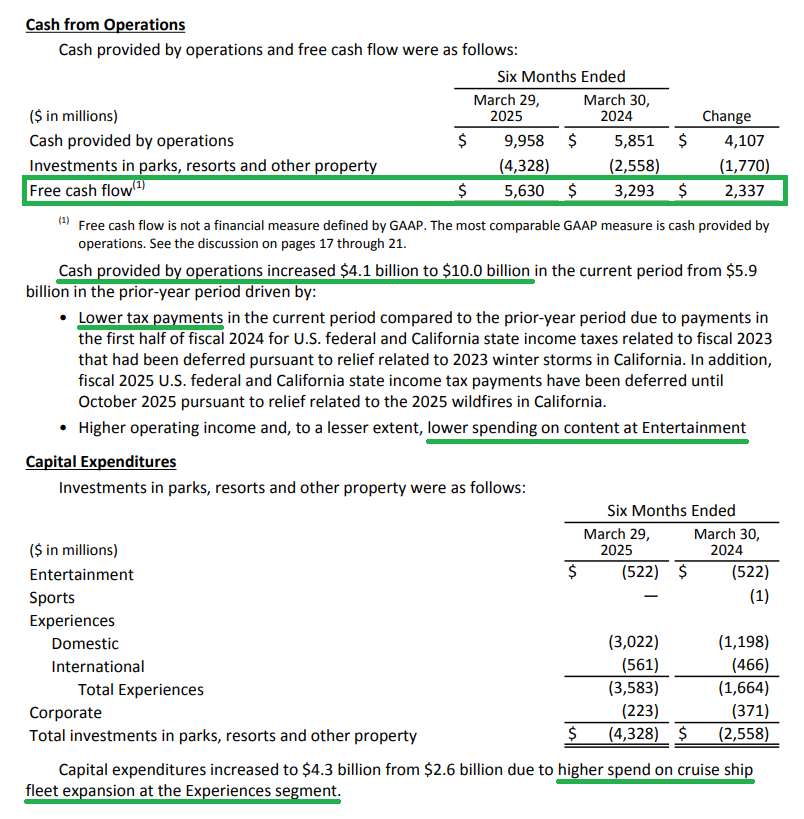

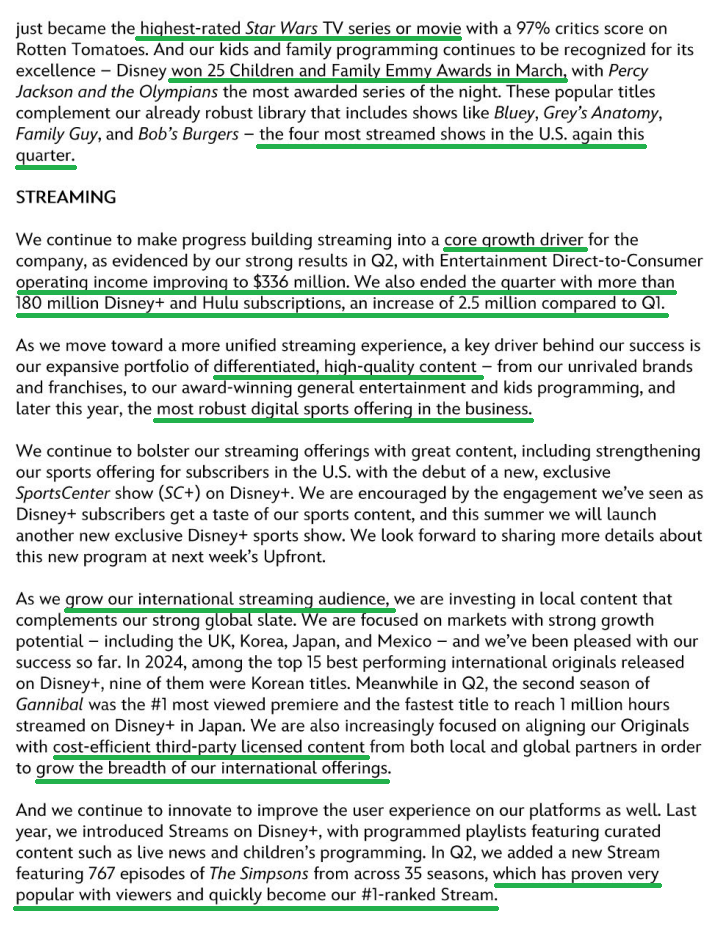

4) Streaming remains a core growth driver for the company, delivering 8% year-over-year top-line growth to $6.12 billion, while profitability continues to improve. Entertainment DTC operating income reached $336 million (5.5% margins), up from just $47 million in the prior year. The long-term goal is to achieve strong double-digit DTC margins. The quarter ended with over 180 million Disney+ and Hulu subscribers, marking a sequential increase of 2.5 million, with a modest subscriber growth expected in Q3.

5) Domestic Parks, Disney’s bread and butter and the main driver of EBIT, continue to see strong attendance, with $6.5B in revenues (+9% YoY) and $1.82B in EBIT (+13% YoY) for the quarter. Demand remains strong, with bookings for Walt Disney World up 4% for Q3 (80% complete) and 7% for Q4 (50-60% complete). Management expects EBIT growth to come in closer to the high end of the 6-8% range for the full year.

6) Management announced plans for Disneyland Abu Dhabi, the seventh Disney theme park resort. Disney will oversee the design and license its IP, while Miral Group will provide all the capital, making the deal essentially a licensing arrangement.

7) Management raised guidance, bumping the EPS target from $5.30 to $5.75, a 16% YoY increase. The three-year guidance for double-digit earnings growth through ‘27 remains intact.

8) Full-year operating cash flow is now expected to reach $17 billion, $2 billion above the previous guidance.

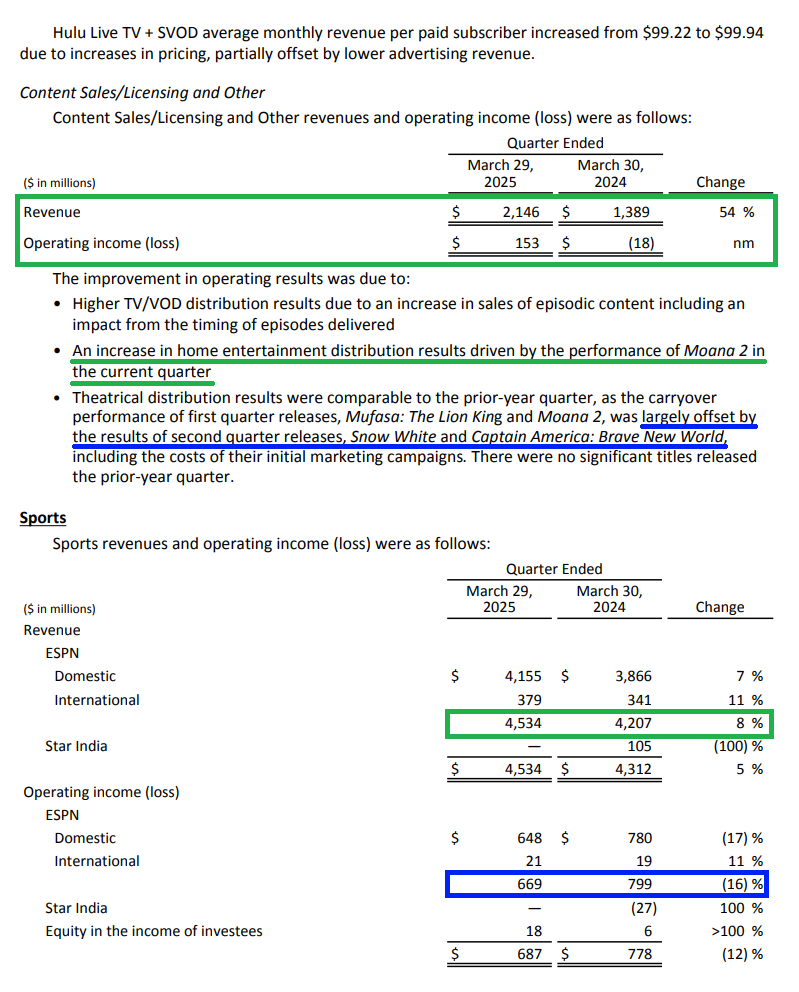

9) Advertising market demand remains healthy, with ESPN posting over 20% ad growth in the quarter. Management’s prior full-year guidance of +3% is now expected to come in even higher.

10) ESPN had record-breaking viewership in the quarter, delivering its most-watched Q2 in primetime ever, with viewership up 32% YoY. ESPN+ had its most-streamed quarter ever based on reach, and the new ESPN Flagship DTC is on track, just a few months away from launch.

Earnings Call Highlights

Morningstar Analyst Note

GXO Update

10 Key Points

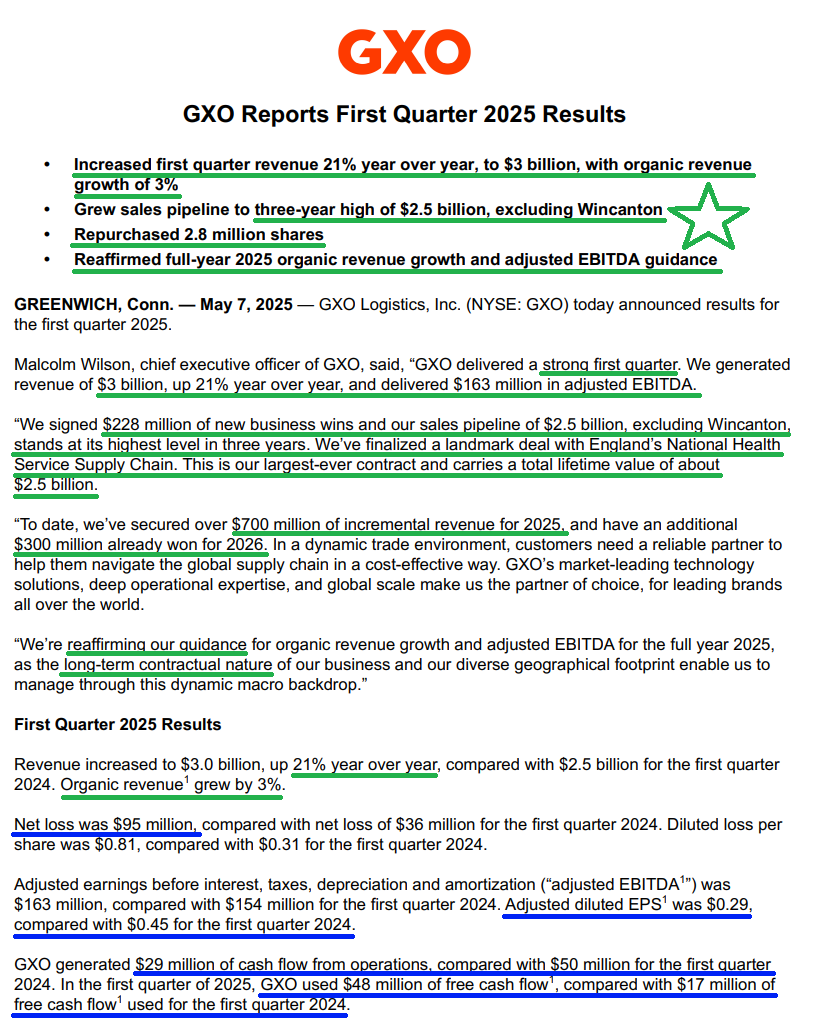

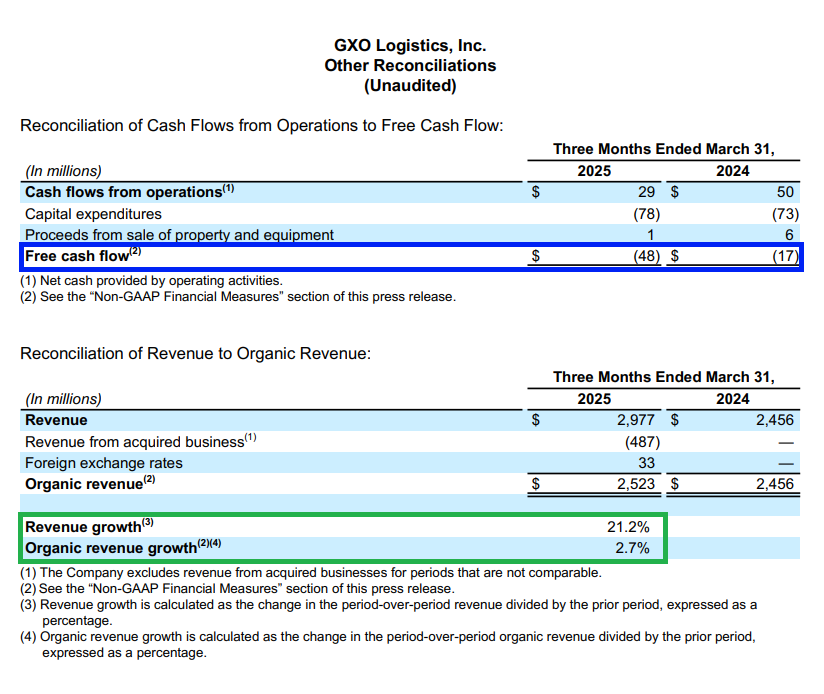

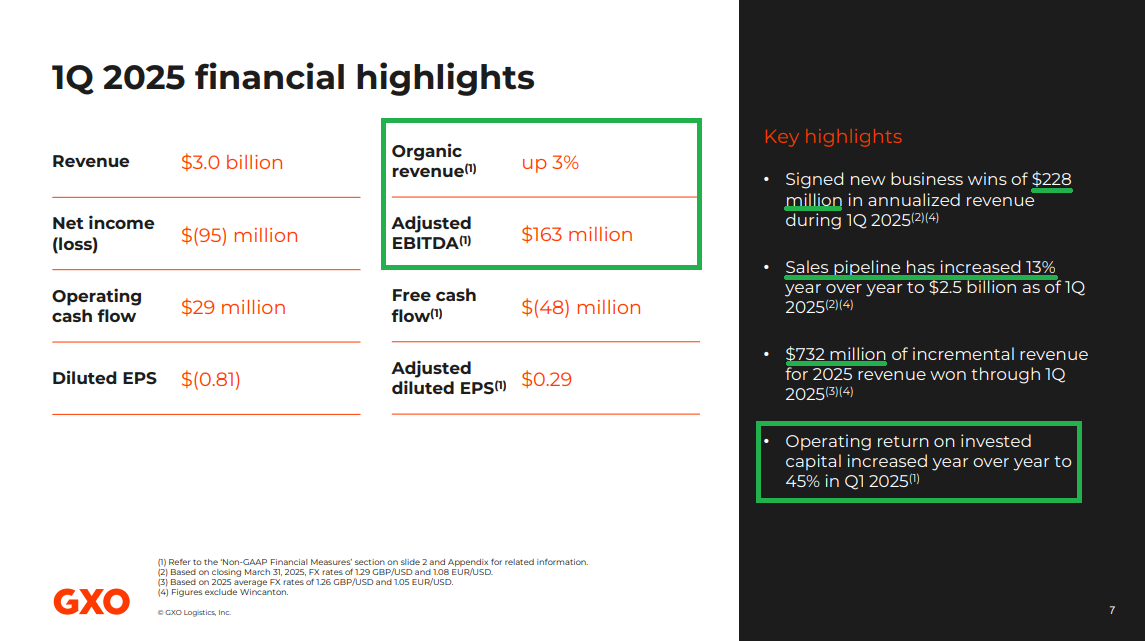

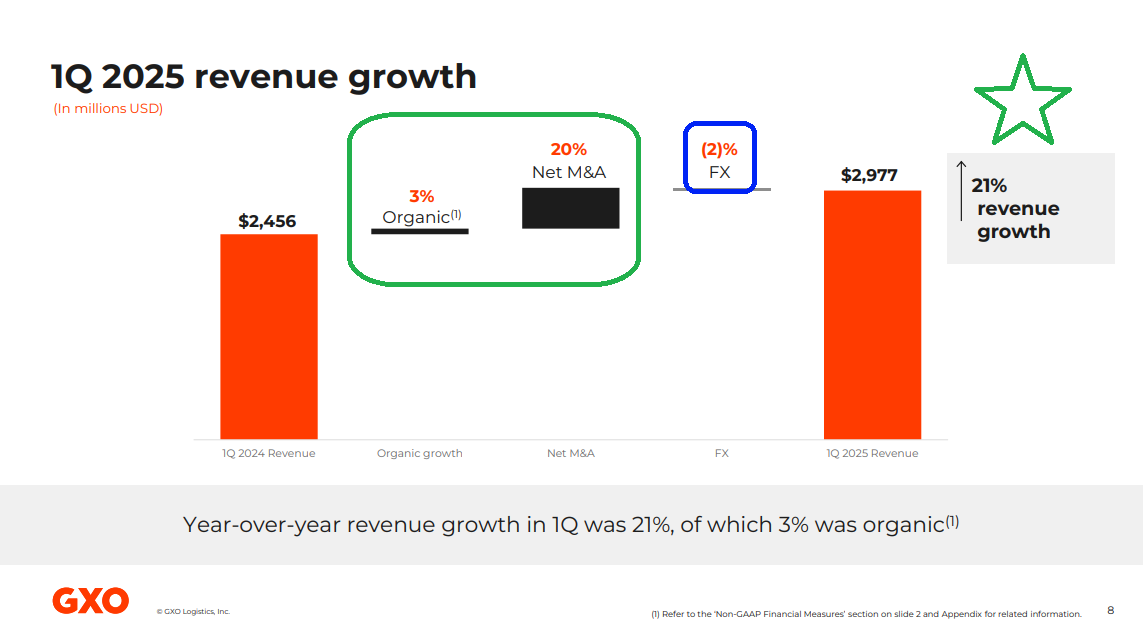

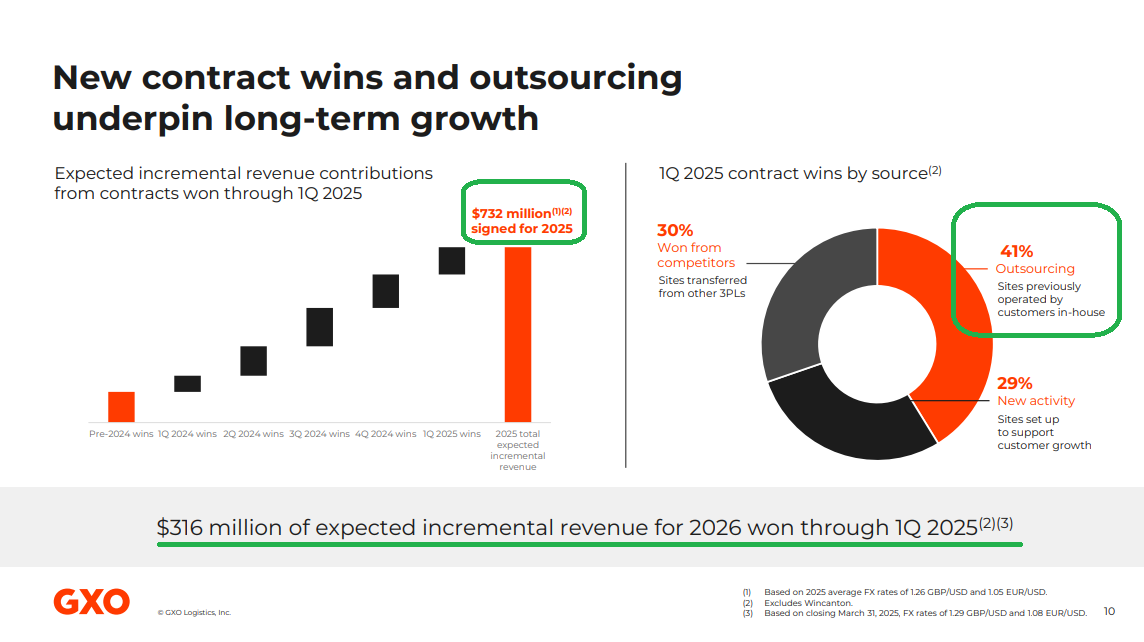

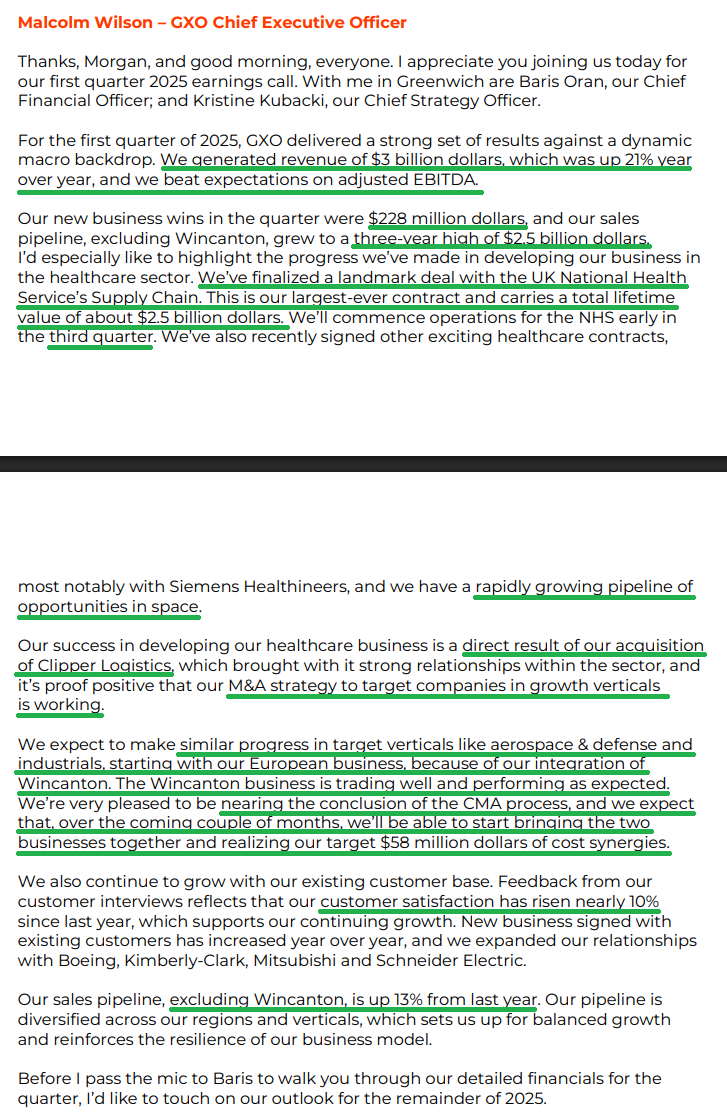

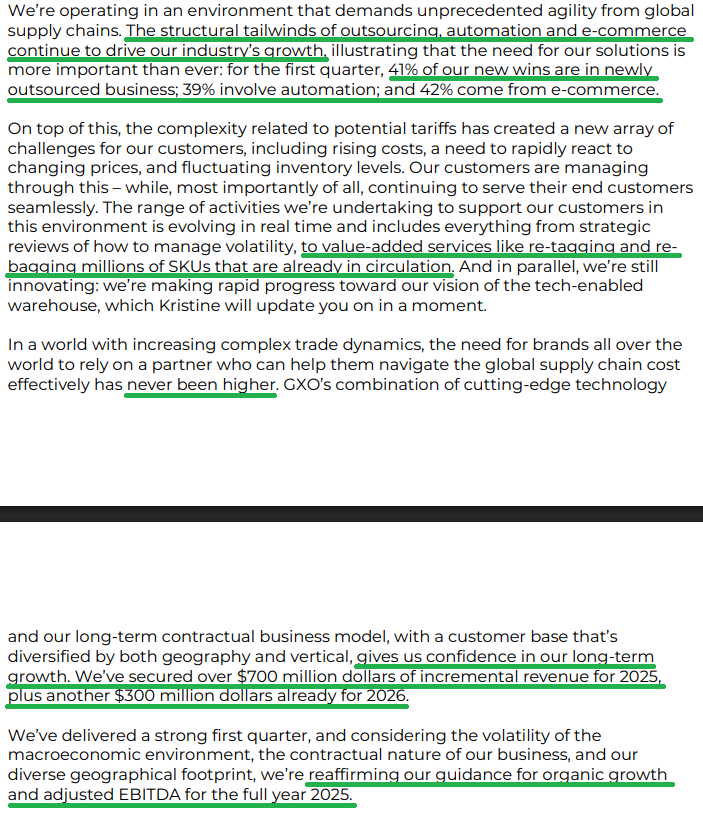

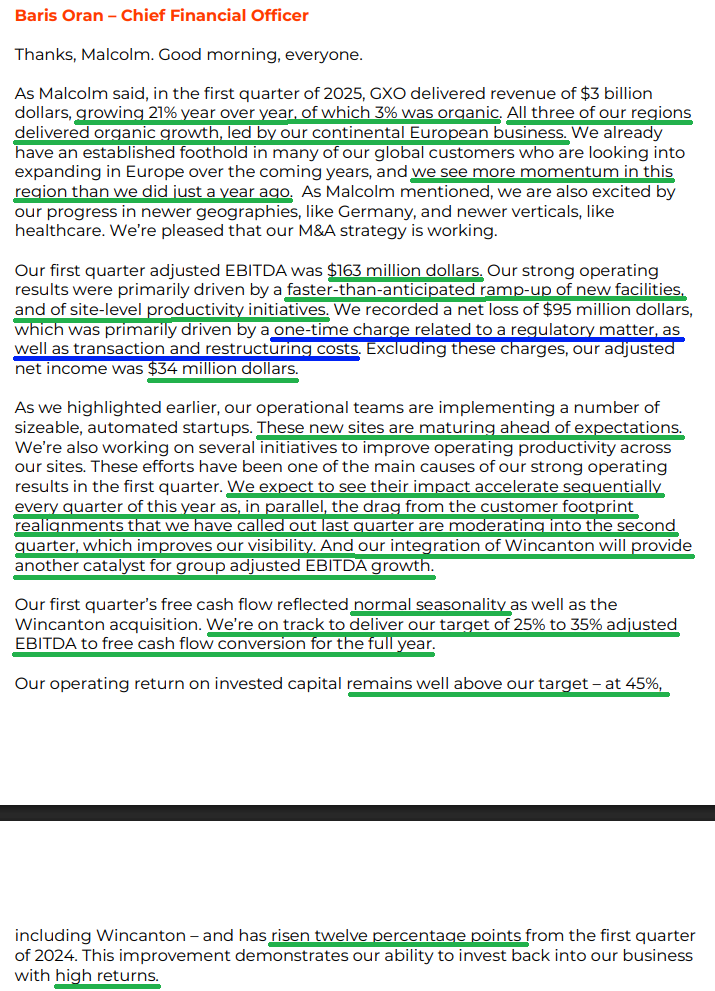

1) The sales pipeline, excluding Wincanton, grew to a three-year high of $2.5 billion, up 13% YoY. Management signed $228 million in new business wins during Q1, bringing incremental revenues for 2025 to $732 million and $316 million for 2026, 30% above where they were 12 months ago.

2) The Wincanton and CMA review process is now in its final stages, with an outcome expected in a few weeks and integration set to begin before the Q2 earnings call. Management expects either full clearance of the deal or a request to divest the Grocery business, which makes up only about 6% of the original Wincanton business and has much lower margins than the overall business. Management continues to expect $58 million in cost synergies once integrated, providing a margin tailwind as 2025 progresses.

3) After announcing a $500 billion share repurchase program earlier in the year, management purchased 2.8 million shares for around $110 million. This reduced the share count by approximately 2.4% during the quarter alone, and if sustained, GXO is on track to repurchase about 10% of the overall float this year.

4) GXO signed a landmark 10-year deal with England’s National Health Service Supply Chain, the largest contract on record, with a lifetime value of around $2.5 billion. Operations are expected to begin early in Q3. Management does not anticipate significant start-up costs and expects the deal to be a major catalyst for expansion into healthcare, with a strong new pipeline of healthcare-related customers expected to be announced in Q2.

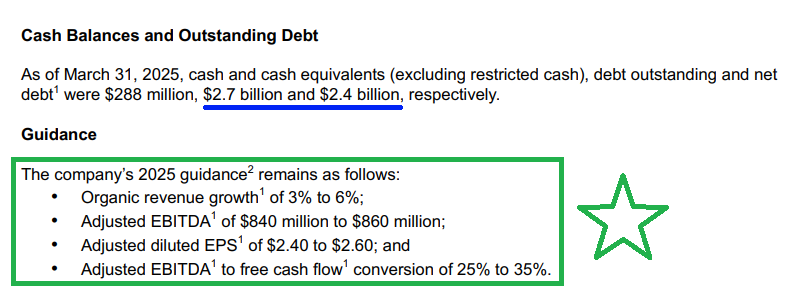

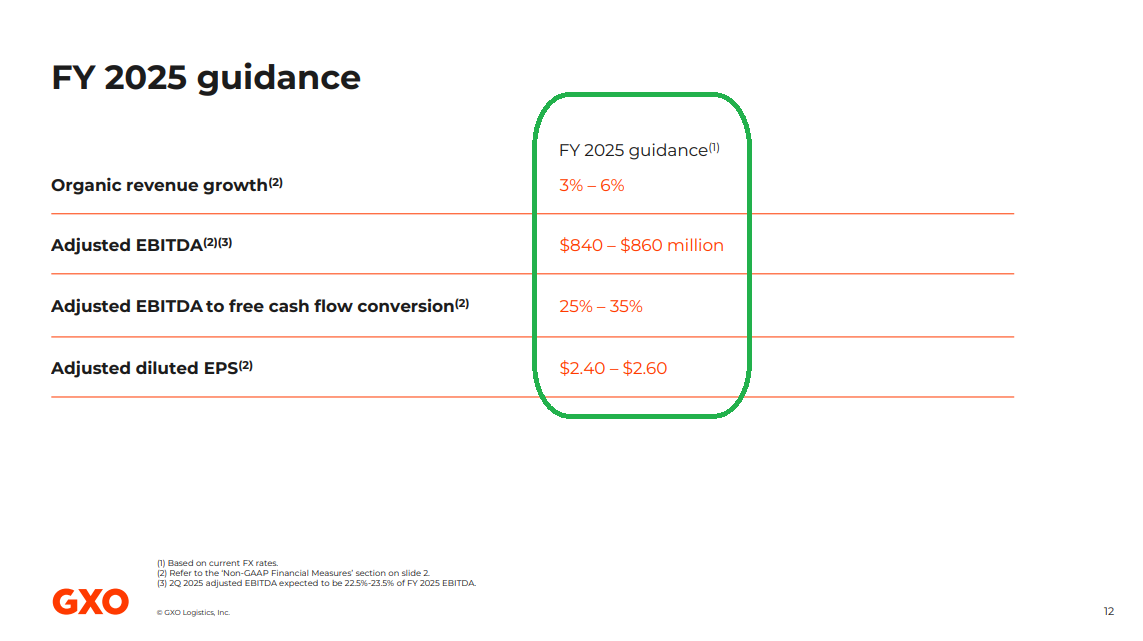

5) Management reaffirmed the 2025 outlook, expecting organic revenue growth of 3 to 6% and adjusted EBITDA of $840 to $860 million. In a normal operating environment, these results would have led to an increase in the full-year outlook. To put this into context, management is projecting 8% gross organic wins for the year, and in Q1 alone, they booked $228 million, delivering about 7% gross organic growth. This essentially implies no incremental wins contributing to revenue for the rest of the year, despite an all-time high sales pipeline of $2.5 billion and the landmark NHS deal. Welcome to Sandbagger City!

6) Management has seen no material impact on the sales pipeline or customer demand due to tariffs and has no exposure to China. In fact, the added complexity of tariffs has provided a tailwind for outsourcing wins, highlighted by a 41% increase in wins during Q1.

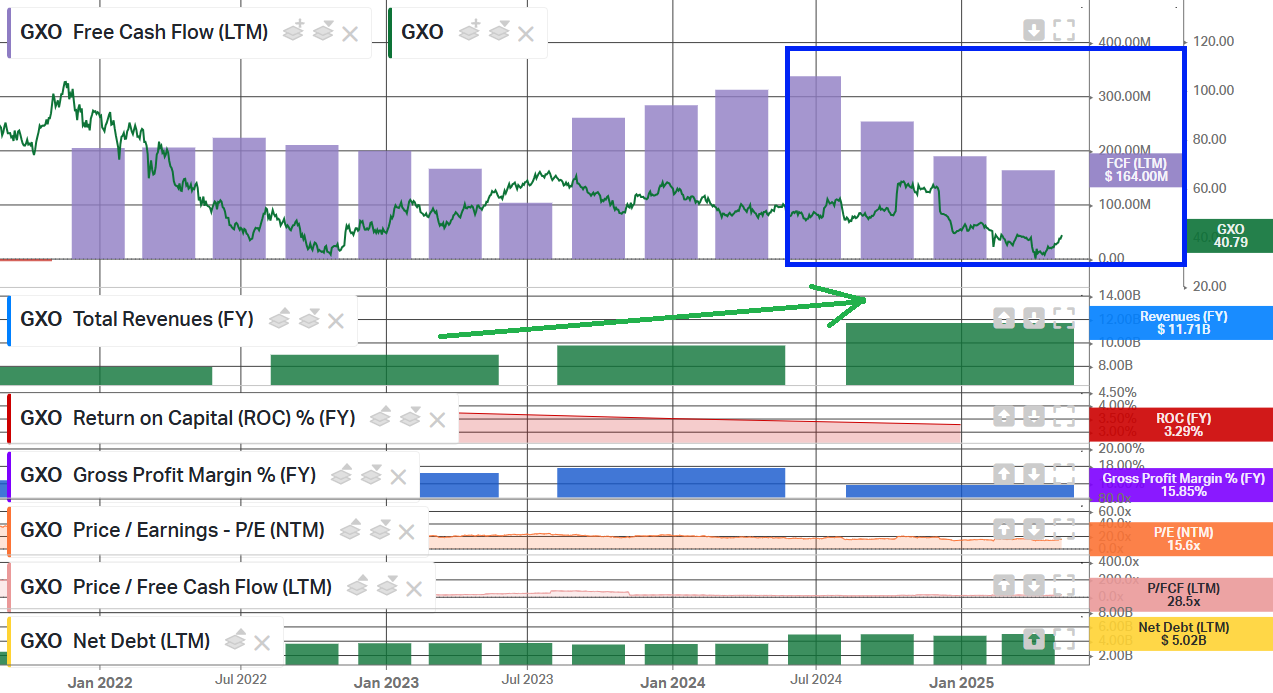

7) Operating return on invested capital was 45%, well ahead of the long-term target of >30%. Free cash flow was an outflow of ($48 million), in line with normal seasonality and impacted by the delayed Wincanton synergies. Management continues to expect 25% to 35% adjusted EBITDA to FCF conversion for the full year.

8) AI and automation are now live at 20 different operations, delivering record-setting productivity improvements in stock replenishment, order allocation, and item inspection. Management is beginning to see the first cost savings as a result and expects these savings to continue ramping up throughout 2025.

9) North America was the strongest region in Q1, driven by strength in aerospace and industrial customers. Continental Europe continues to perform well, with slight weakness in volumes in the UK during Q1 expected to rebound throughout Q2. The overall business is seeing similar trends heading into Q2.

10) A weaker dollar and a strengthening euro and pound are expected to be a strong tailwind for GXO in 2026, with an improvement over prior FX guidance if current rates hold through 2025.

Earnings Call Highlights

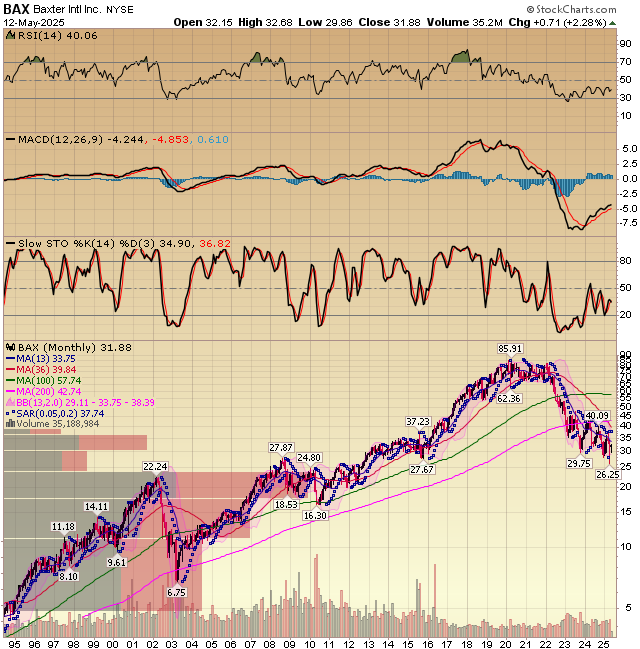

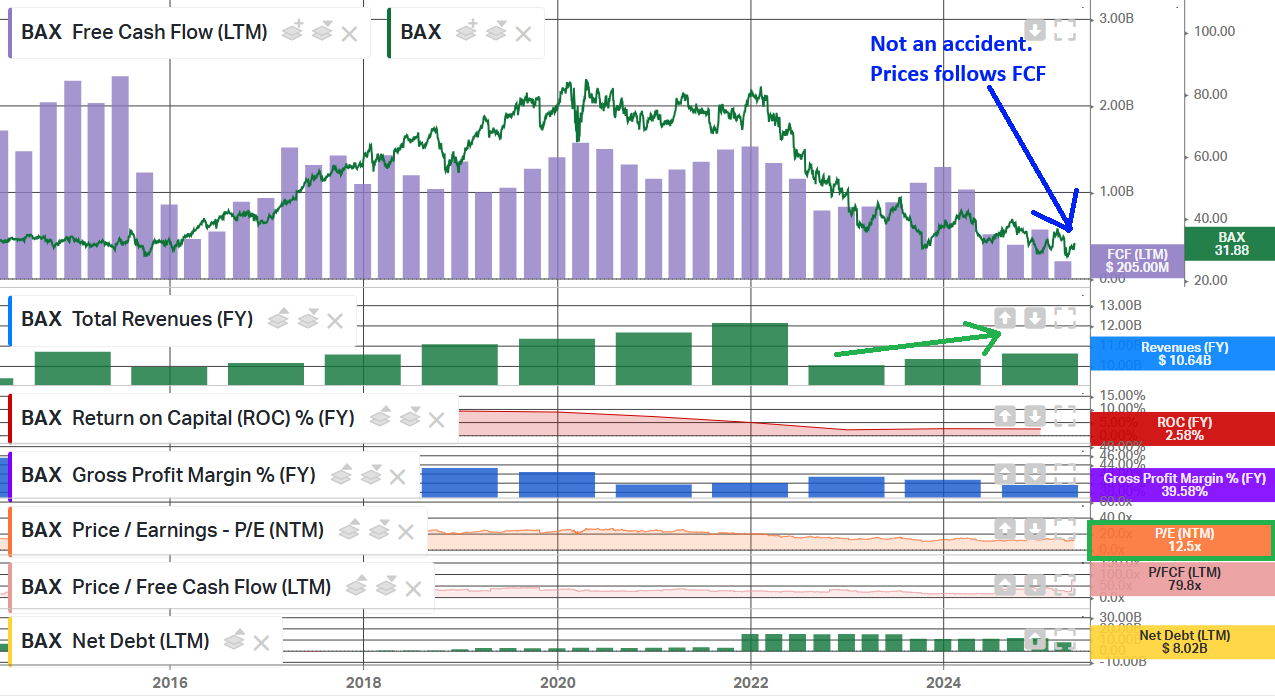

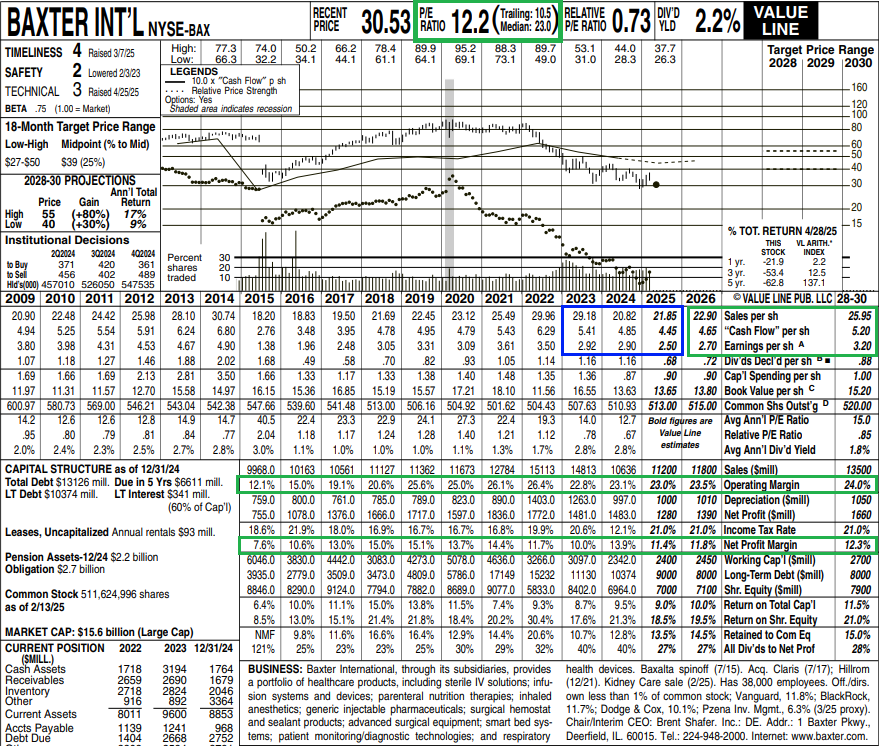

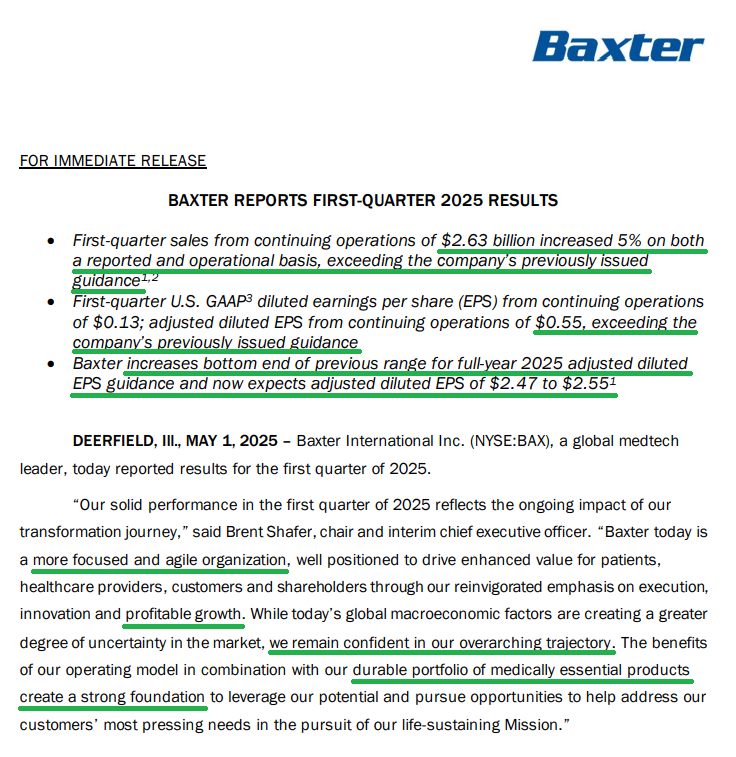

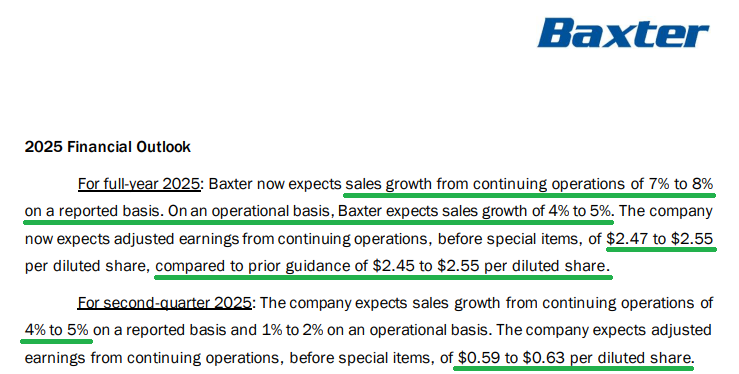

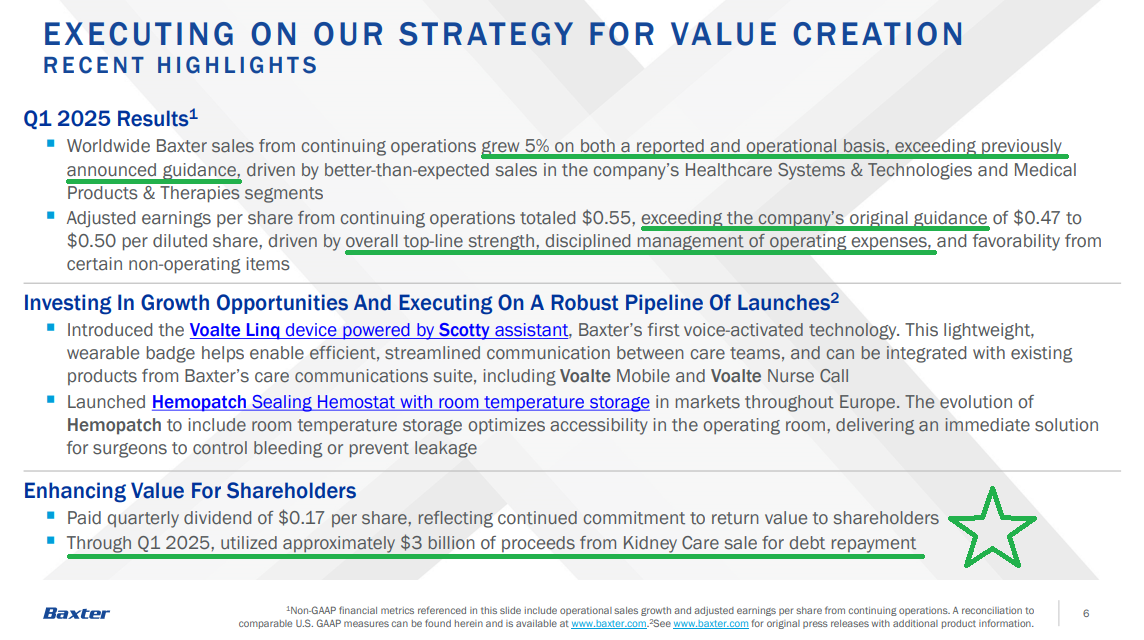

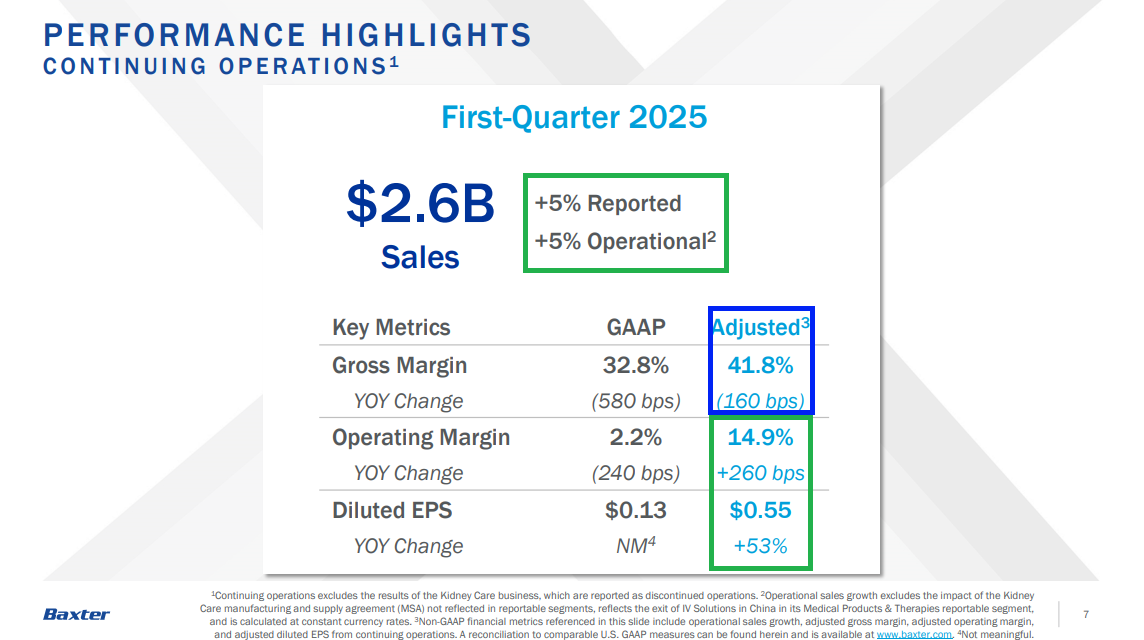

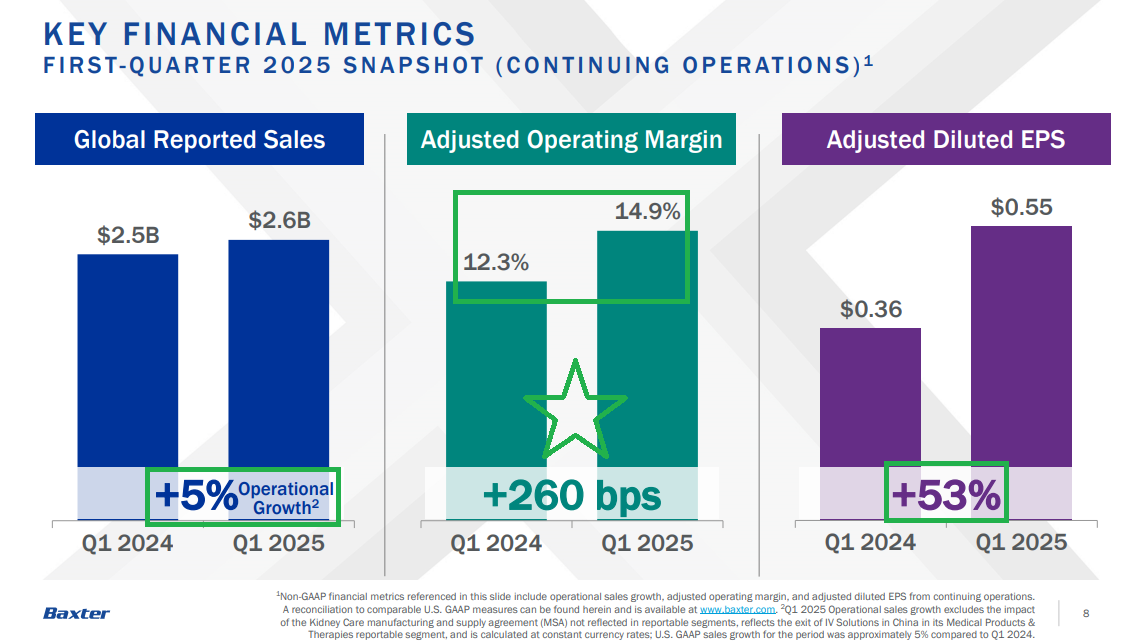

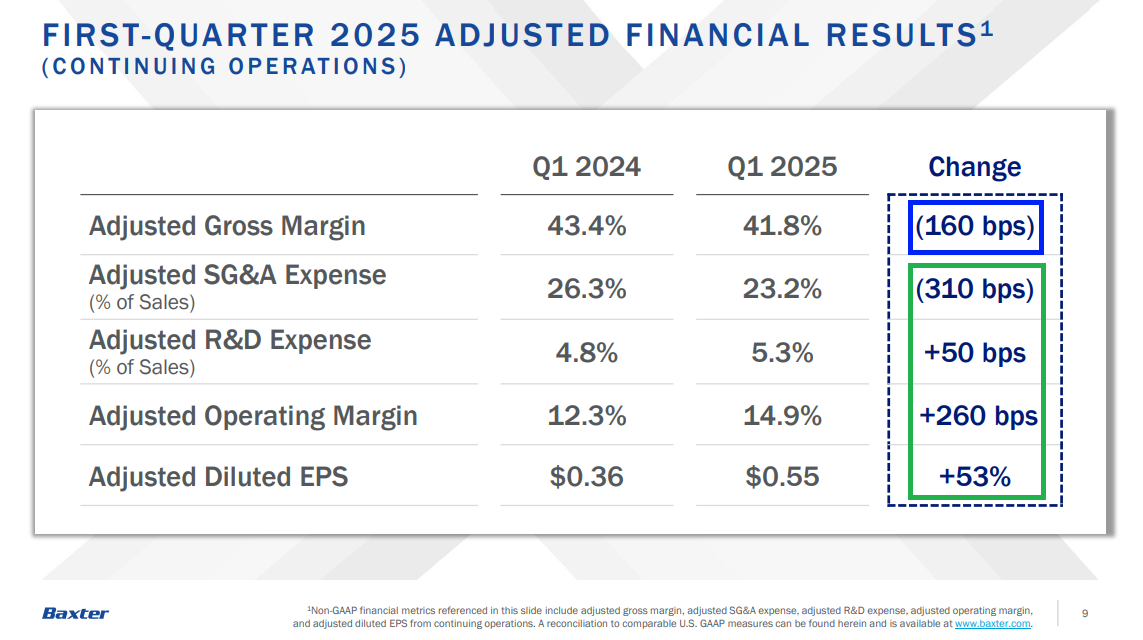

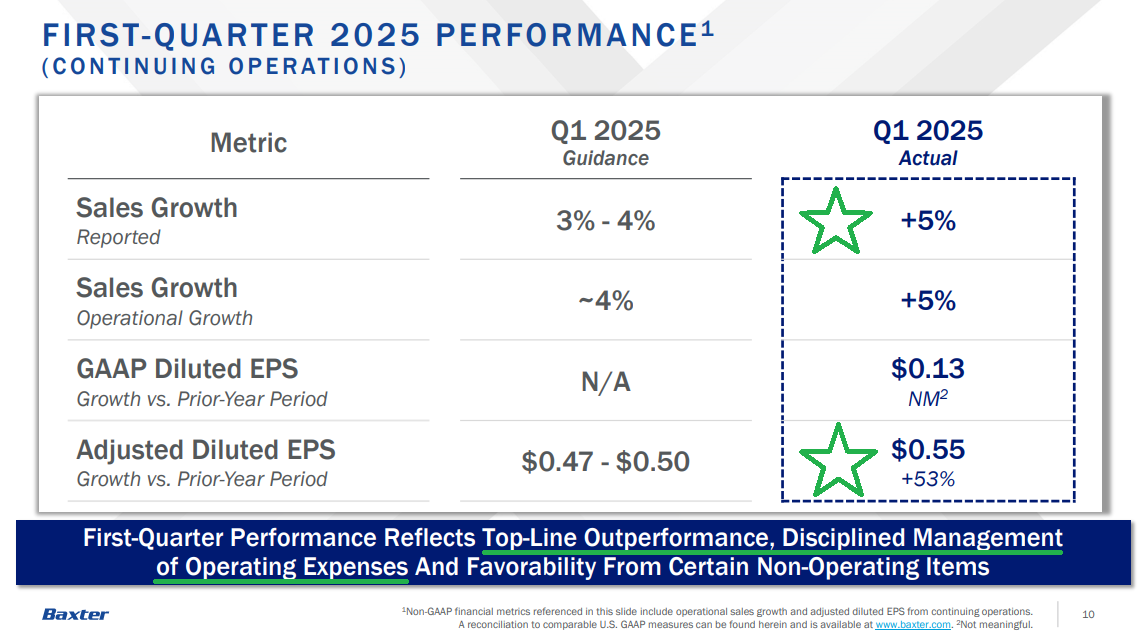

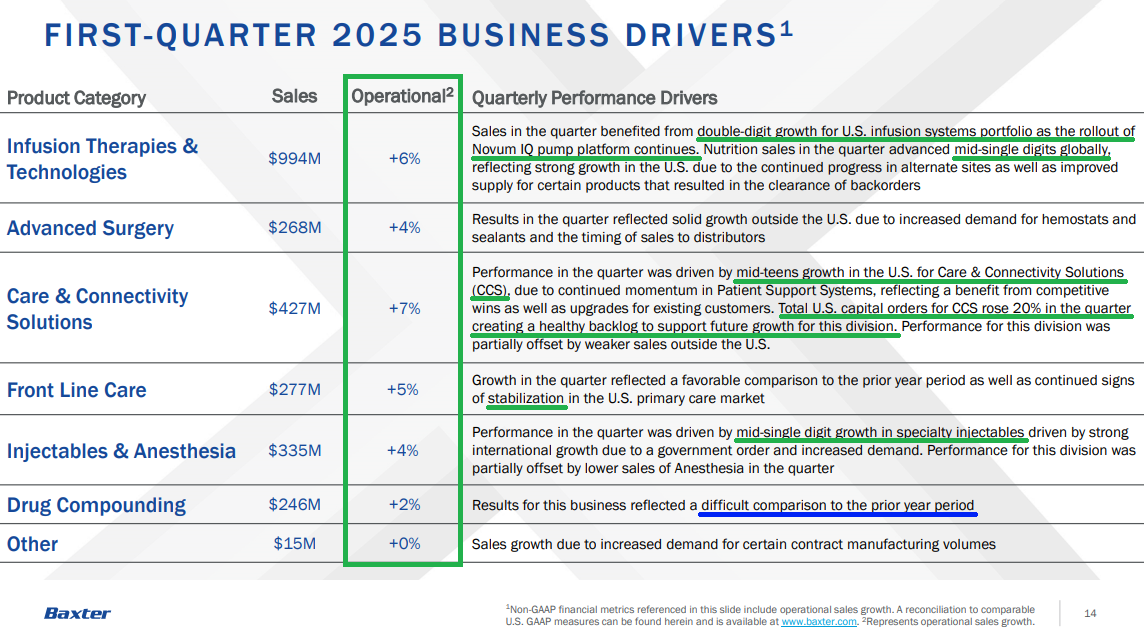

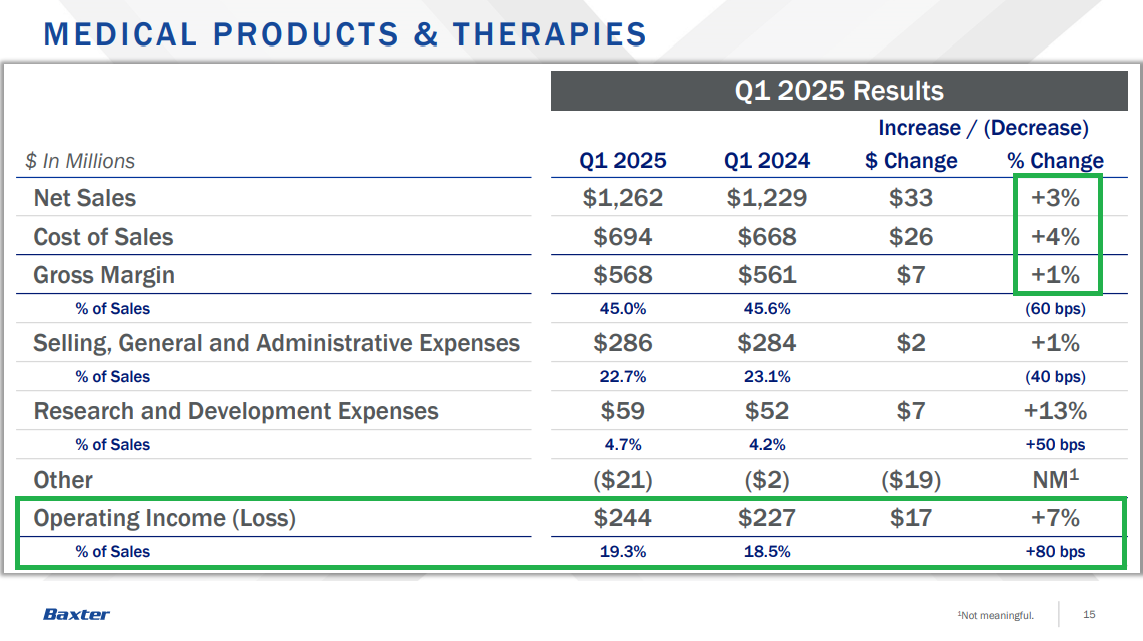

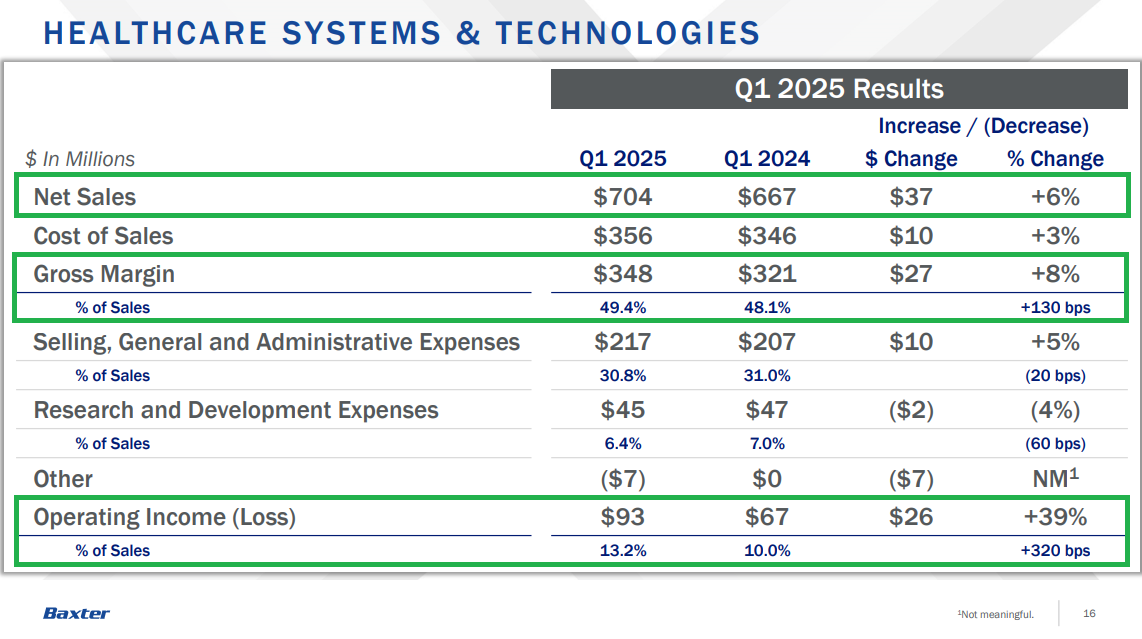

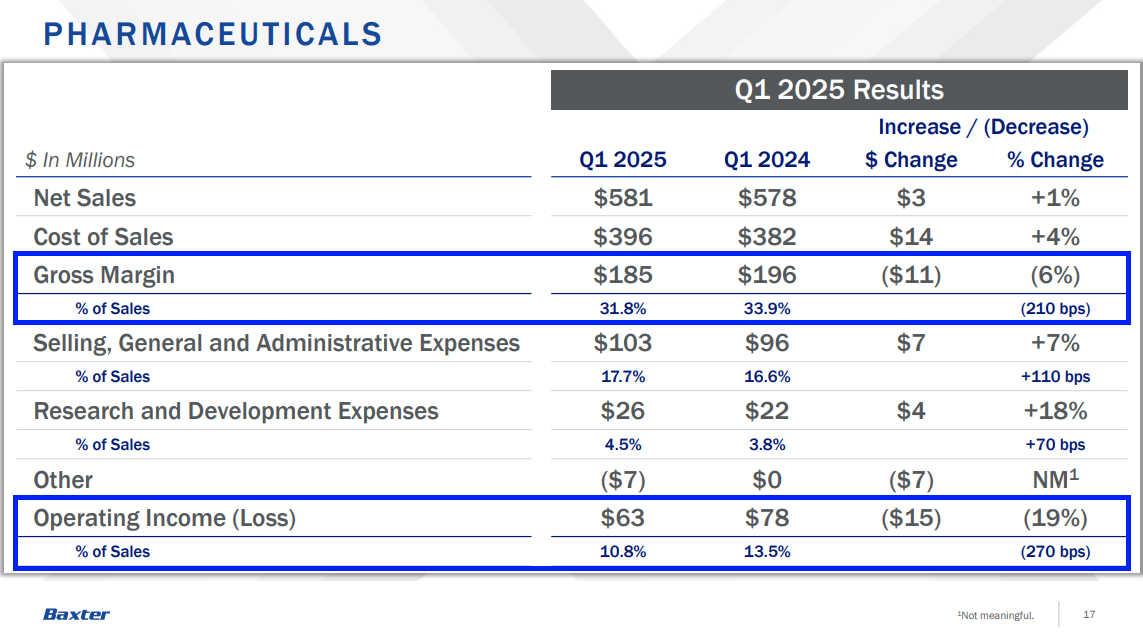

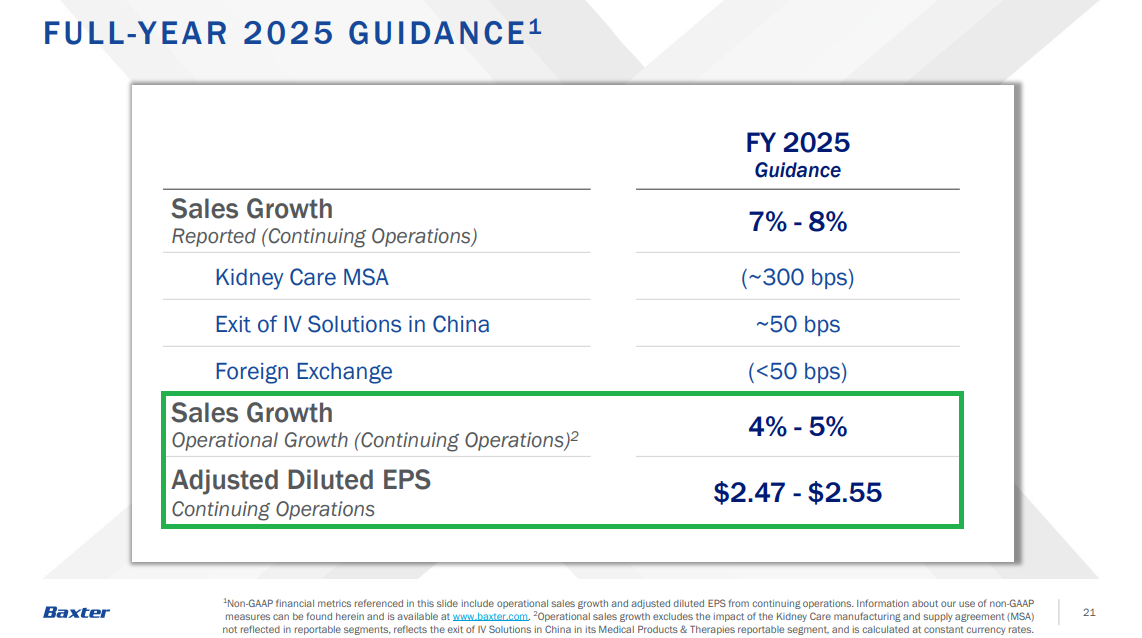

Baxter Update

Earnings Call Highlights

Morningstar Analyst Note

General Market

The CNN “Fear and Greed Index” ticked up from 57 last week to 66 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

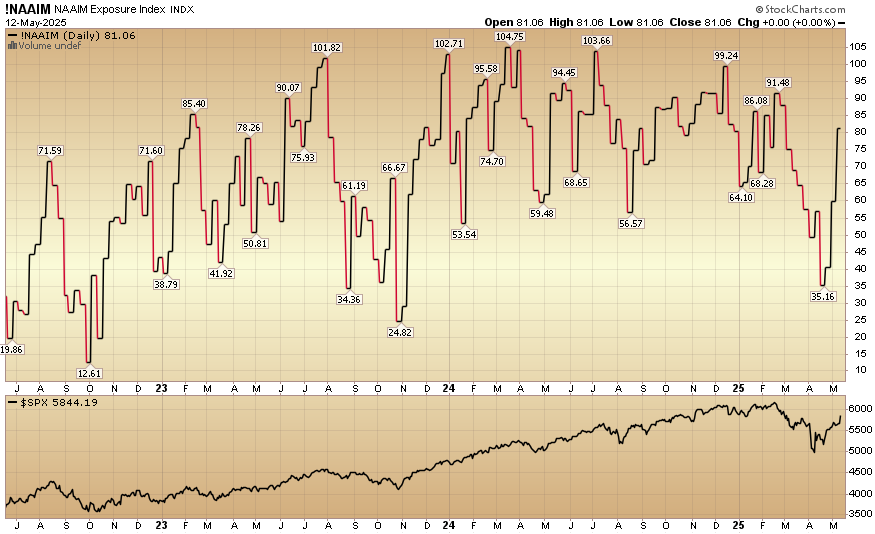

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 81.06% this week from 59.92% equity exposure last week.

Our podcast|videocast will be out sometime today. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms

Not a solicitation.