Key Market Outlook(s) and Pick(s)

On Monday, I joined Sean Callebs on CGTN America to discuss Elon Musk, DOGE, Starlink, Neuralink, SpaceX, Tesla, and more. Thanks for Sean and Nancy Said Ali for having me on:

Hormel Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

Both companies we are covering this week are classic examples of what we like to call “buying straw hats in the winter.” In other words, these are high quality, durable businesses that we buy when they are temporarily impaired on the operating table. And time and time again, they “miraculously” leave the hospital walking on their feet, not lying on their backs! In the meantime, we sit on our hands, collect our dividends, and wait.

Hormel fits that description to a T.

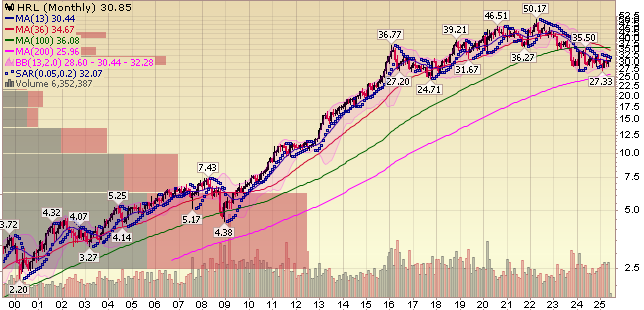

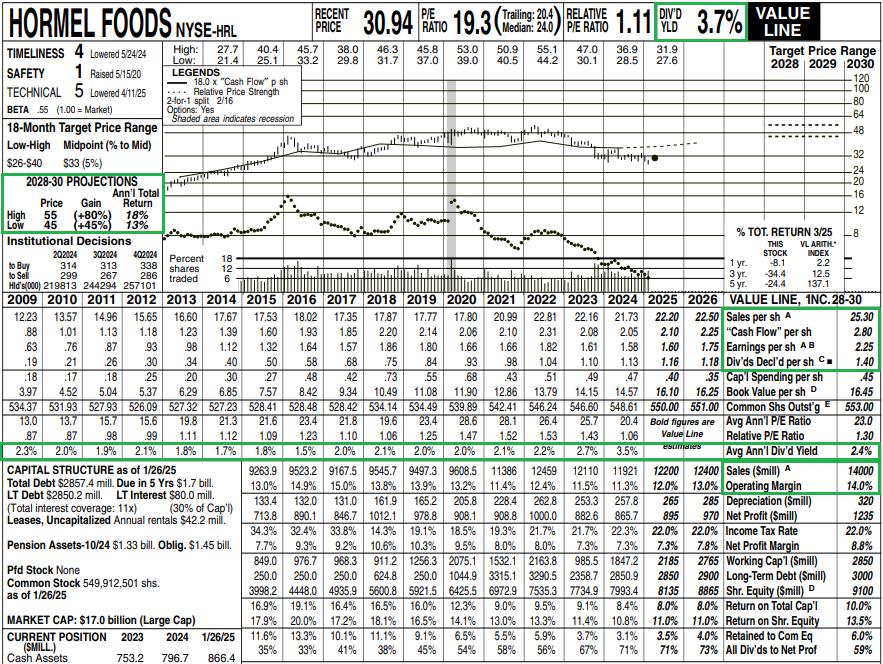

This is a company that has been a compounding machine since 1891. If you think this is the first cyclical drawdown Hormel has seen in its 130+ year history, think again.

The story this time is that consumers no longer want packaged or processed food. Legacy products are being left behind as demand, perhaps with a shot of GLP-1 in the arm, shifts toward lean, high protein diets.

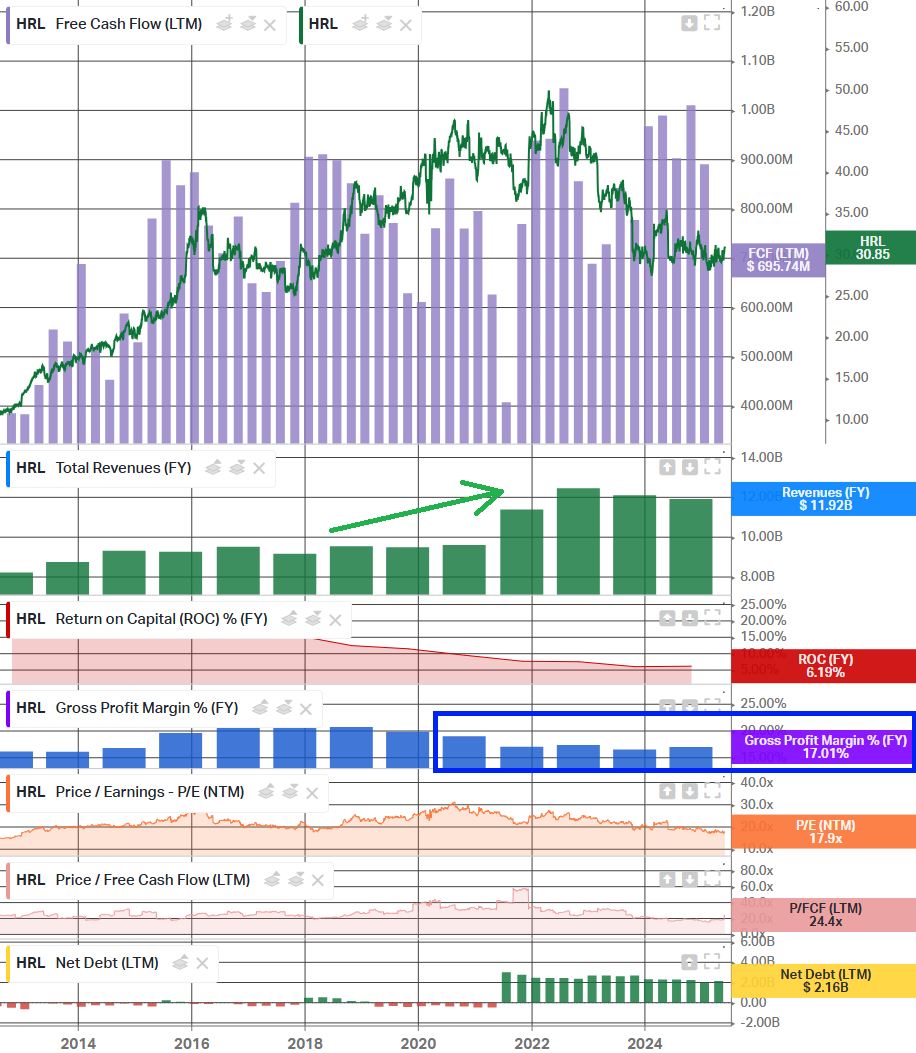

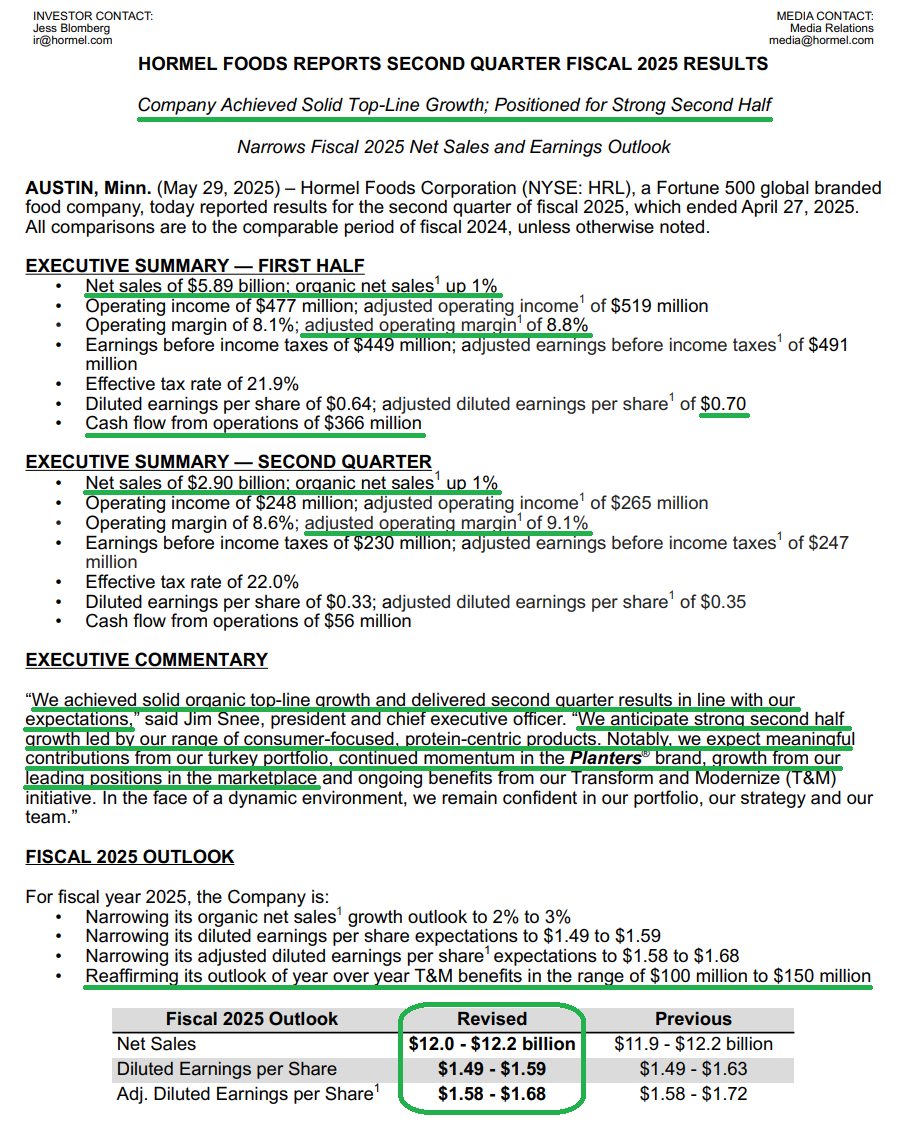

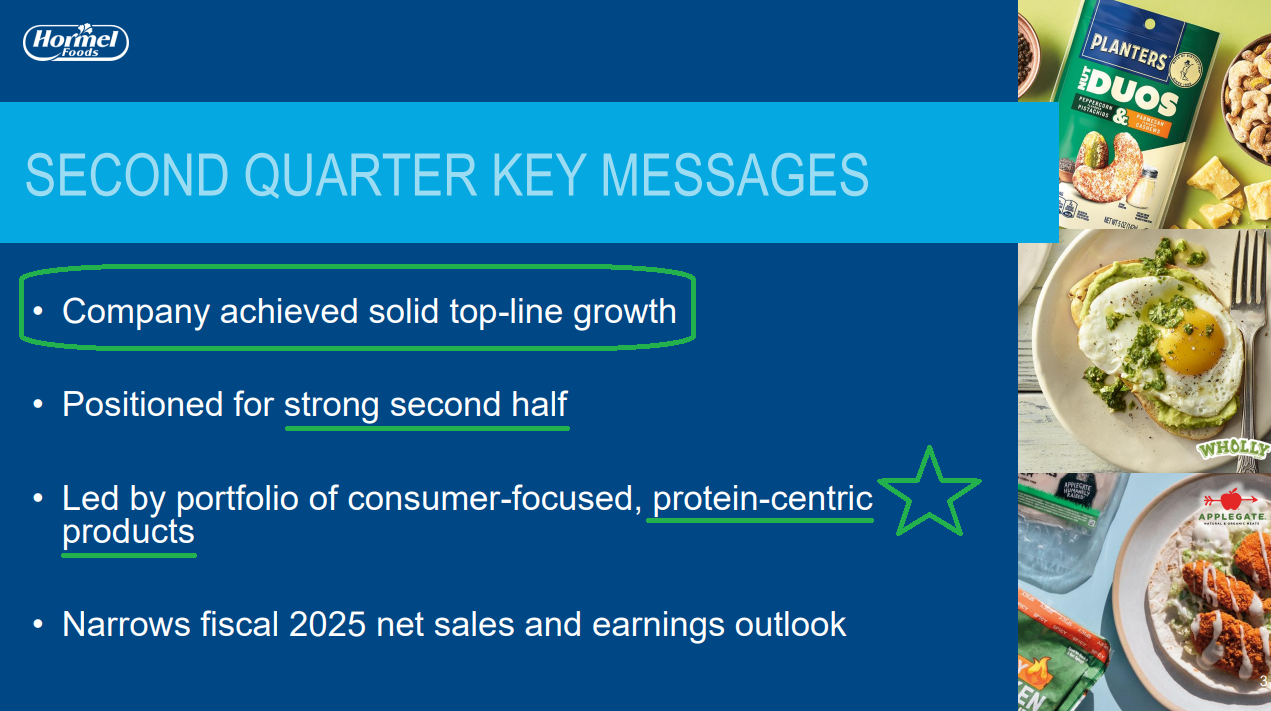

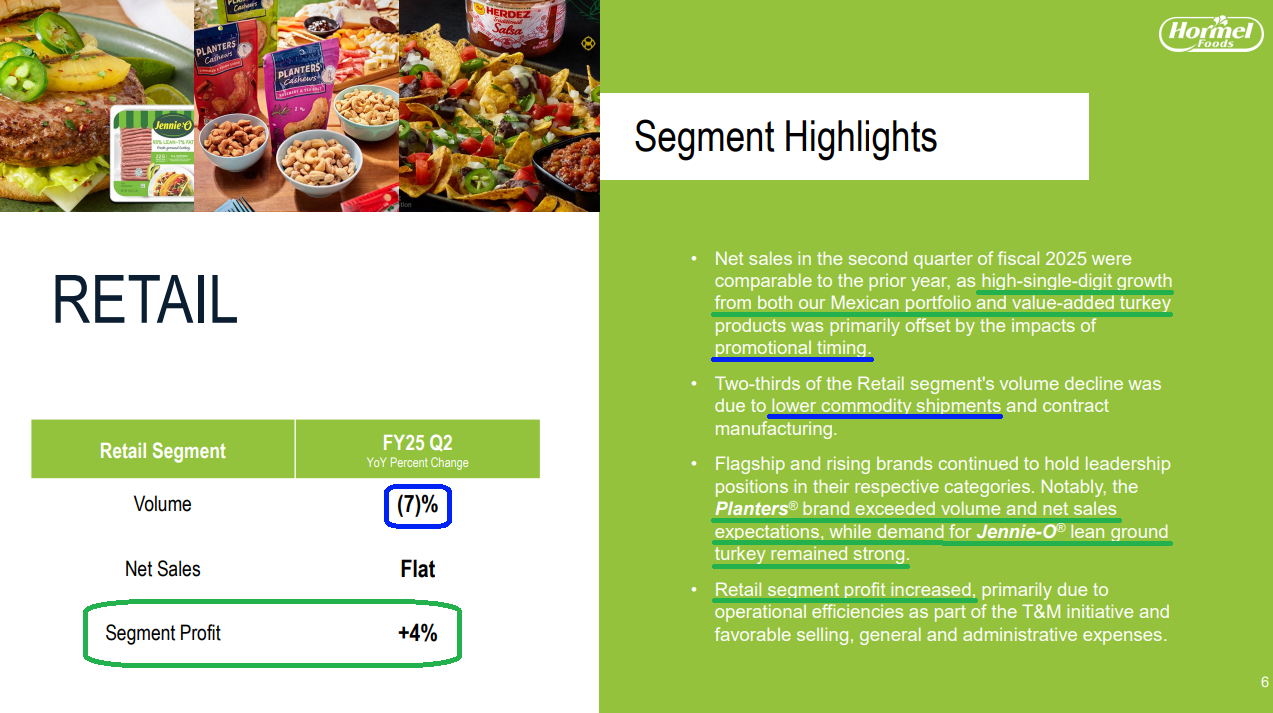

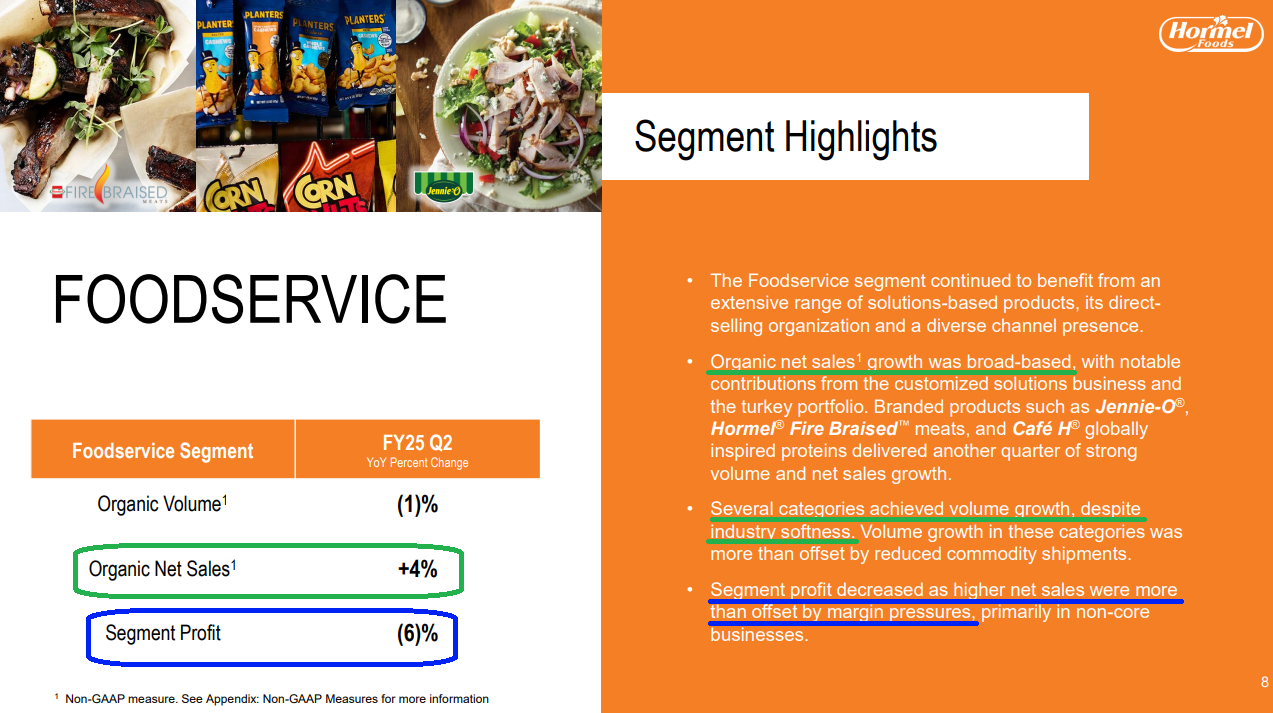

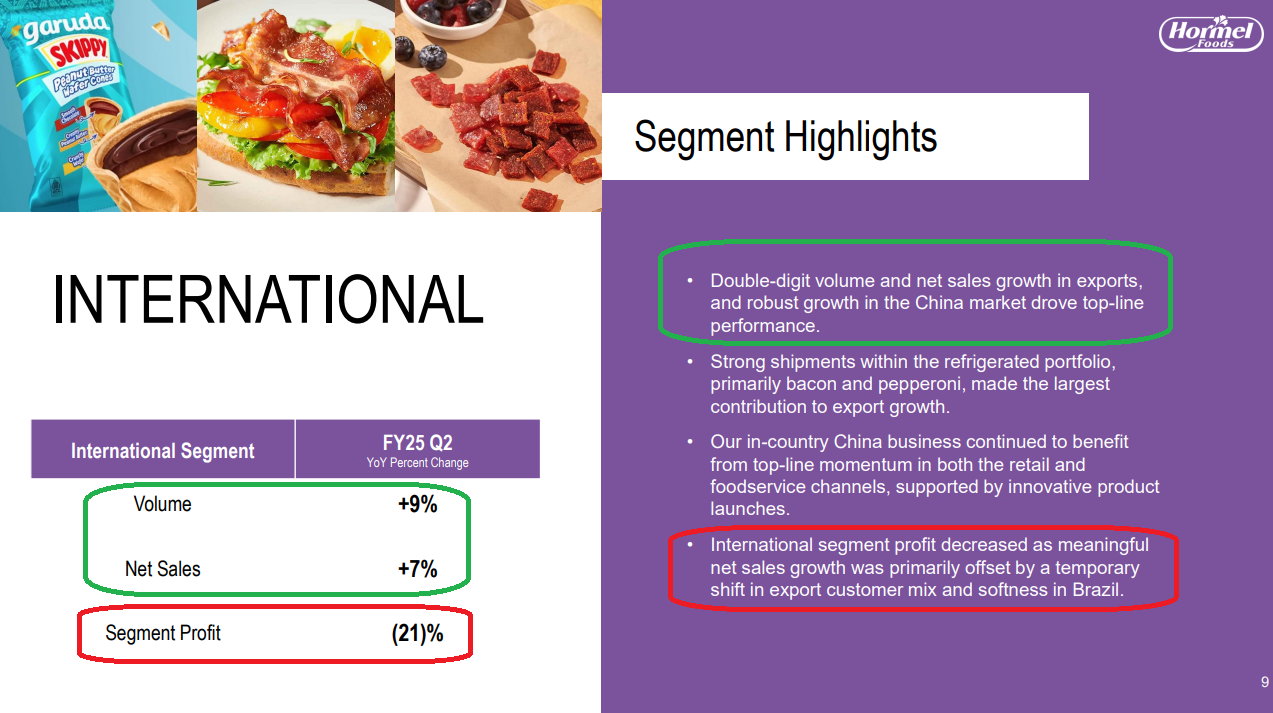

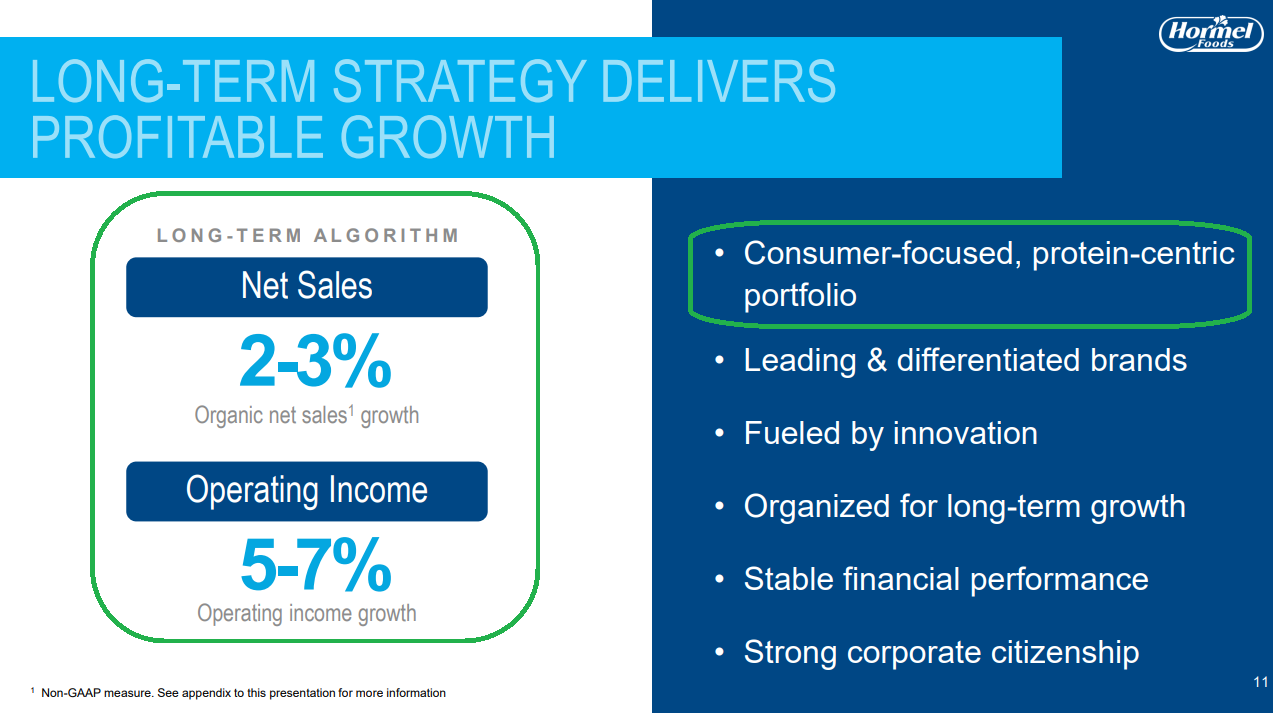

That trend is music to Hormel’s ears. Over the past couple of years, they have effectively pivoted to becoming a branded, protein centric powerhouse. More than 60% of sales now come from meat and protein rich foods. Jennie-O is the #1 ground turkey brand. Applegate is a leader in premium organic meats. Planters continues to grow as a protein rich snack brand. All three are shooting the lights out and gaining share.

Just listen to Hormel’s recent earnings calls. This quarter, management said the word protein 15 times. Last year it was 12. Two years ago, just 4. They are leaning into the trend and are arguably one of the best ways to play it.

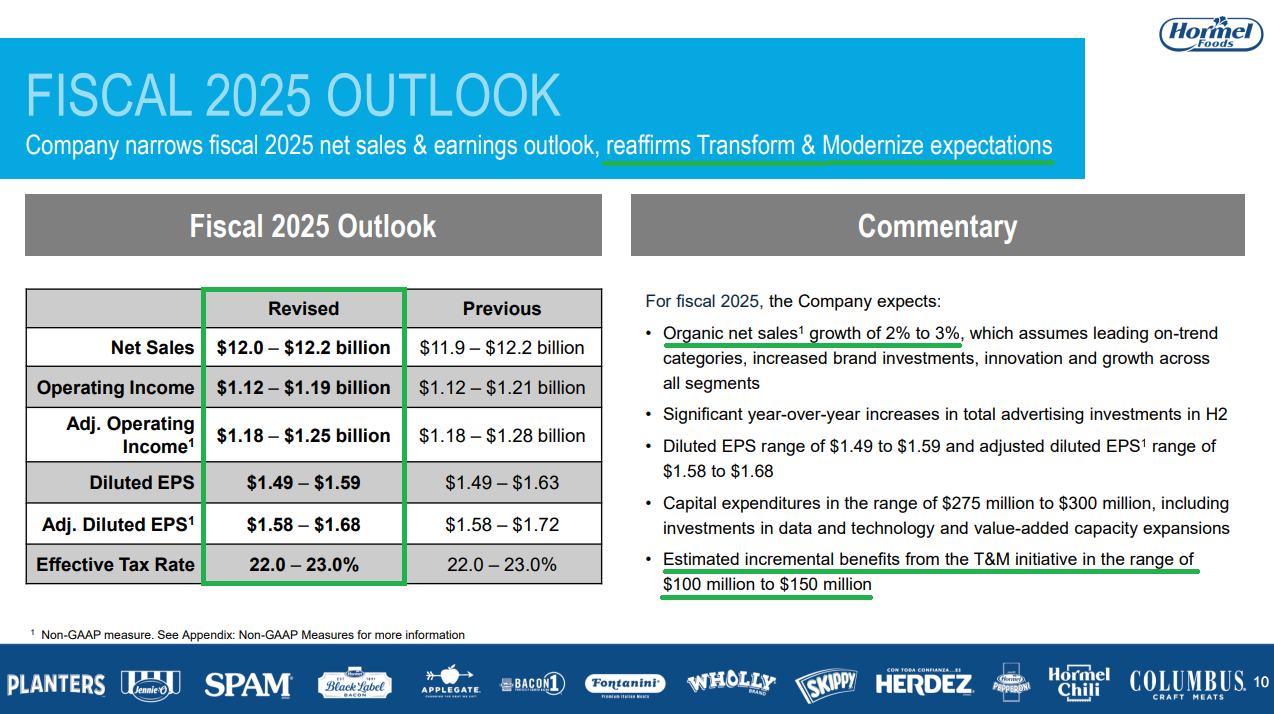

Management is expecting a strong second half driven by, you guessed it, the core protein brands. Meanwhile, they are on track to deliver over $250 million in operating income growth by 2026 as they work to restore margins to historical levels.

The way we see it, you have strong top line growth fueled by protein obsession, a margin inflection on deck, and a stock trading at a historical trough multiple. Give it a few more quarters like Q2, maybe say protein a few more times, and the stock should eventually earn a re-rating and be back to fresh highs within the next two to three years. Until then, we are happy to sit tight and collect a near 4% dividend yield while we wait.

Earnings Call Highlights

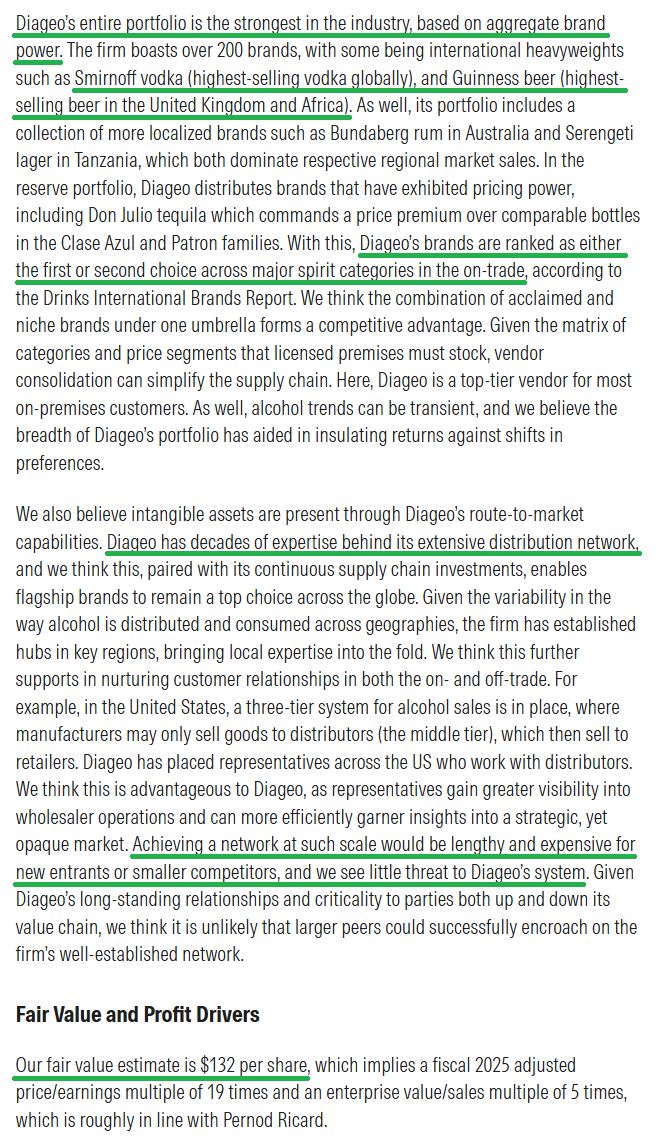

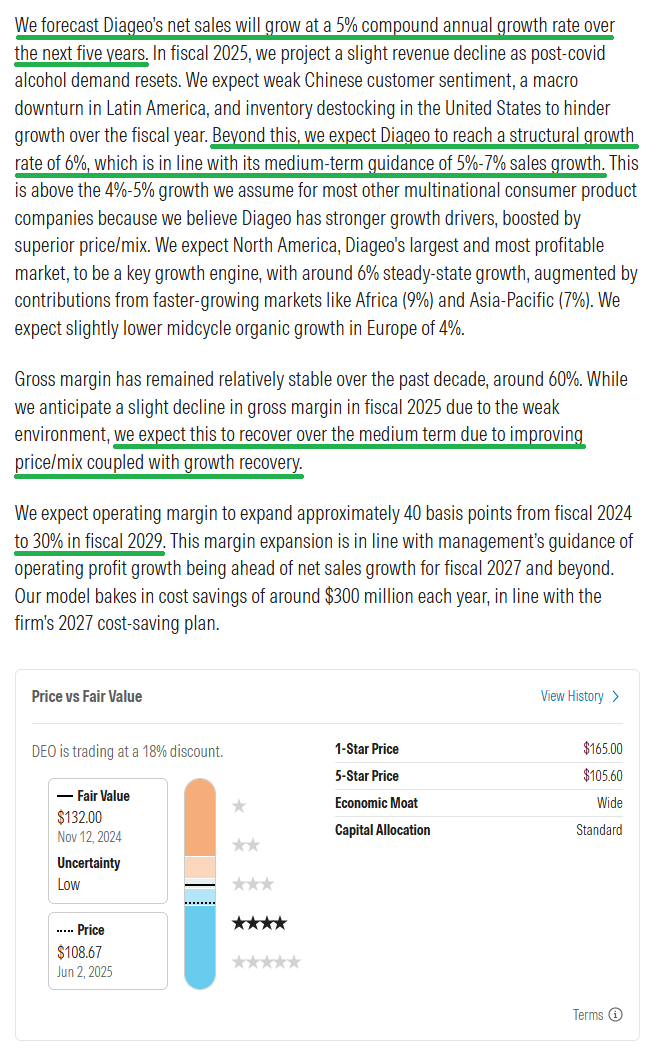

Diageo Update

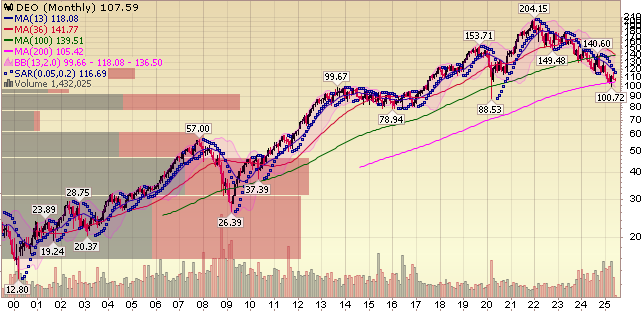

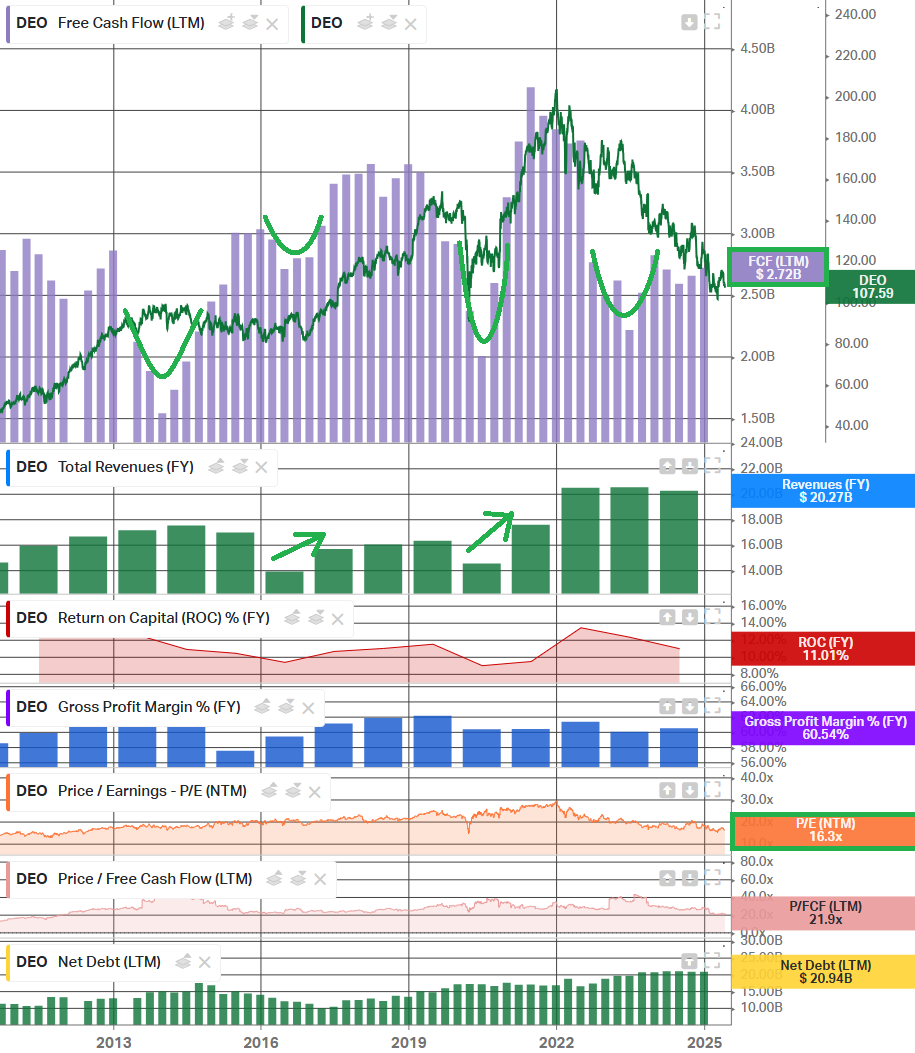

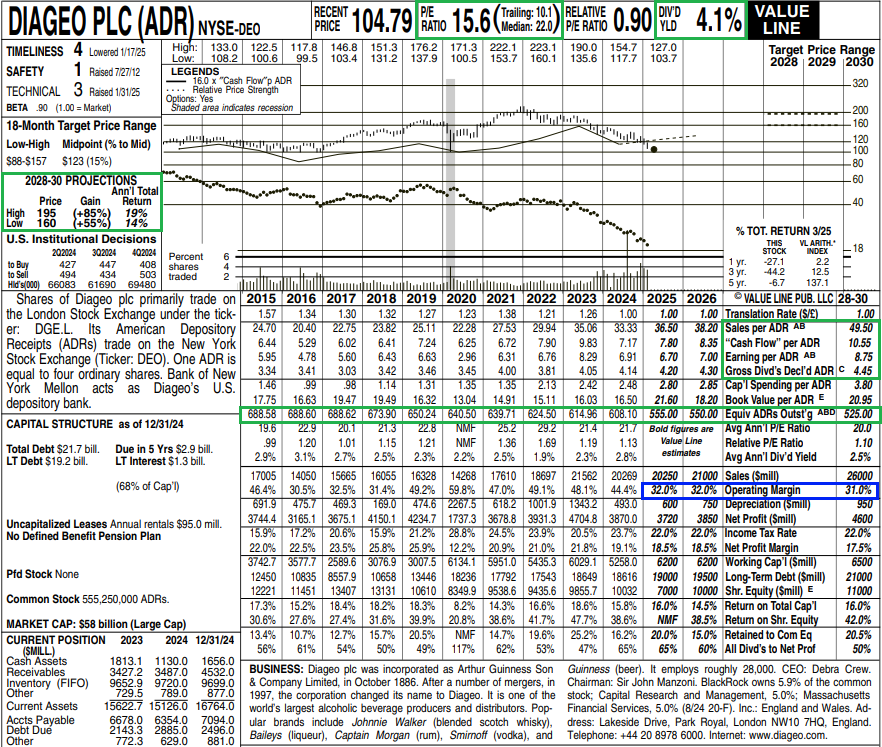

Just as Hormel has been priced like packaged foods are a thing of the past, Diageo stock has been cut in half and is trading as if consumers will never sip alcohol again. We’re more than happy to take the other side of that trade.

Yes, consumers may be drinking a bit less, but the trend is clear: drinking less, but drinking better. And no one is better positioned to benefit from the long term global premiumization trend than Diageo, with an industry-leading portfolio of 200+ brands spanning every category and price point.

Once again, the market has fallen victim to recency bias, extrapolating post-COVID softness into a permanent impairment across the entire industry. But zooming out, Diageo’s history tells a much different story. Every 5 to 10 years, you see a cyclical downturn that plays out within the context of a long term secular uptrend. The stock gets a bit ahead of its skis, digests for a couple of years, and eventually recovers to new highs. Same story, different day. We expect this time to be no different…

Fast forward a couple of years, and what you’ll see is a stronger Diageo with a cleaned up balance sheet, growing at a mid single digit clip, benefiting from margin tailwinds tied to premiumization, and a stock trading back above $200. In the meantime, we’re happy to collect a nearly 4% dividend while the nervous nellies keep asking if people will ever drink again!

10 Key Points

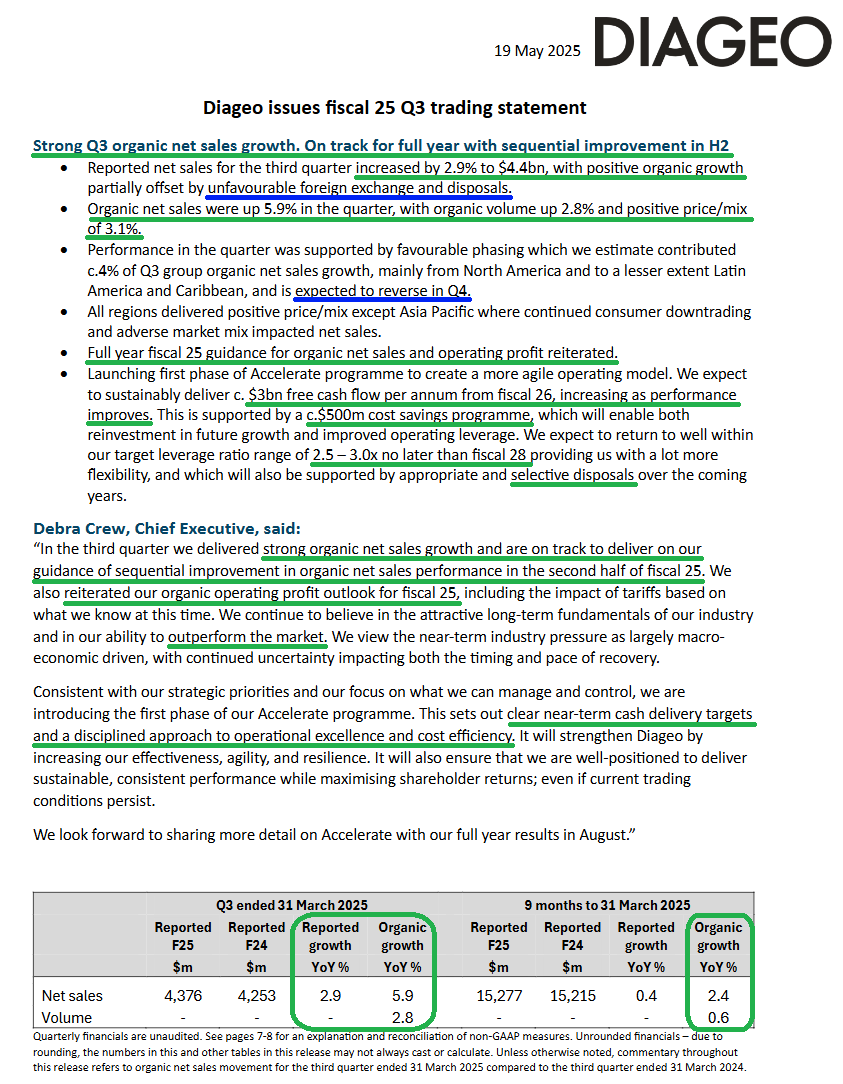

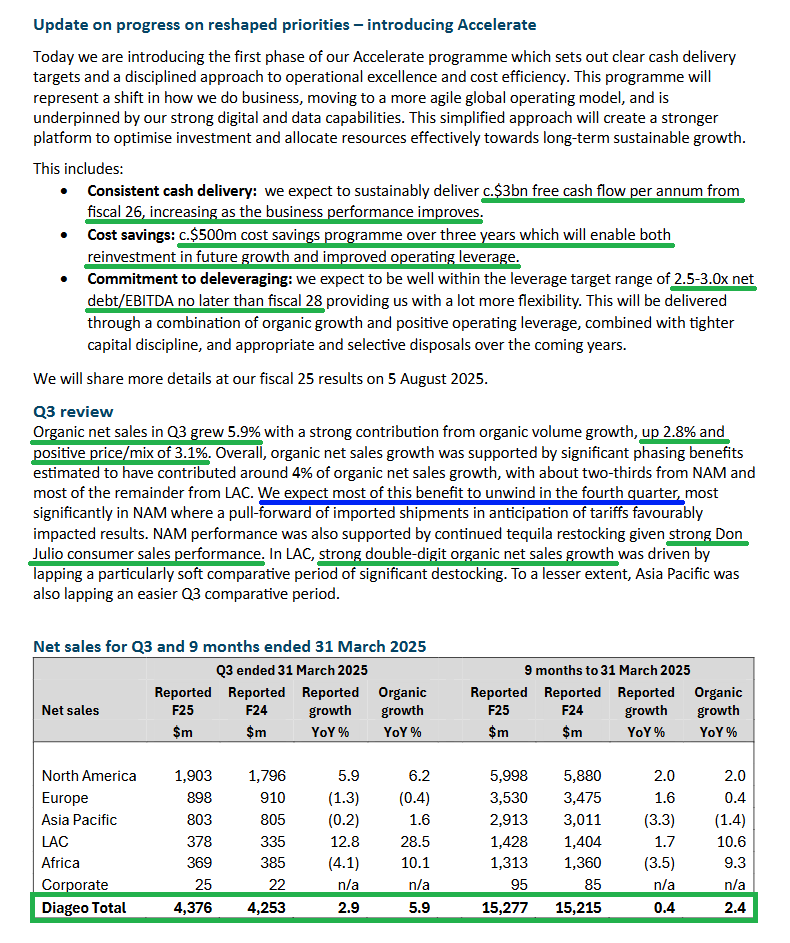

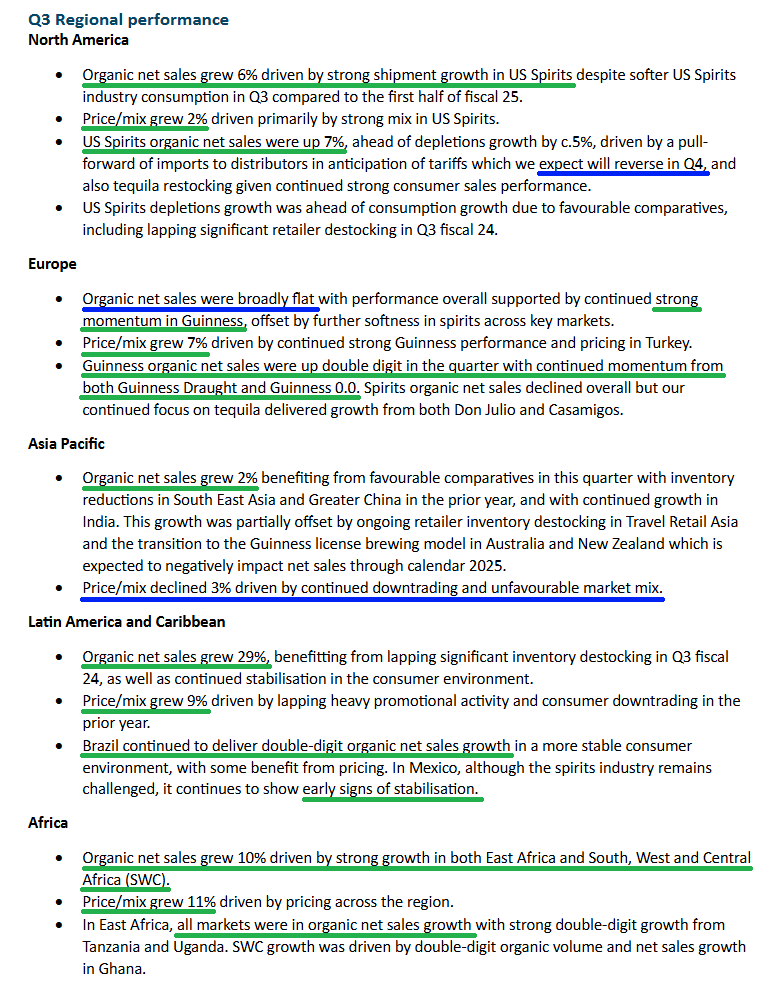

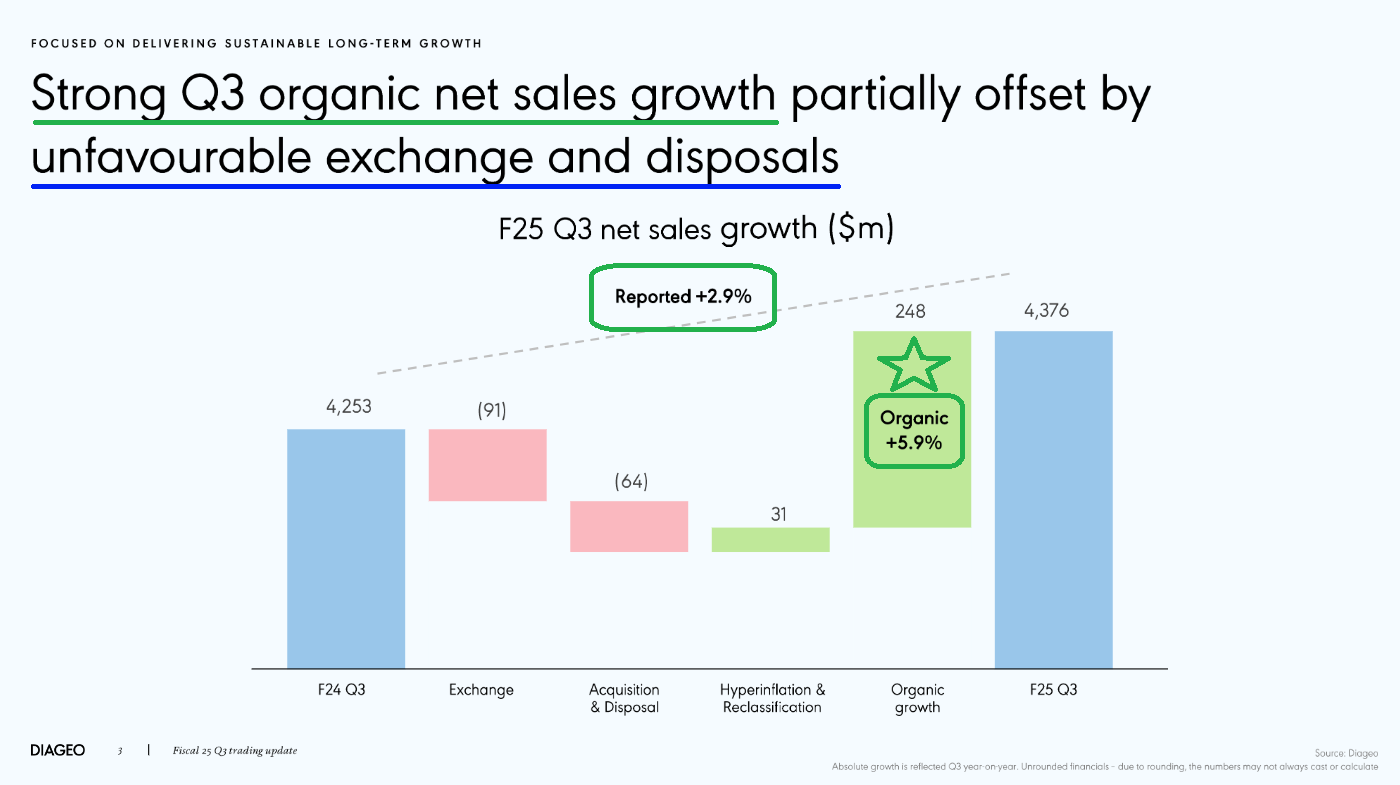

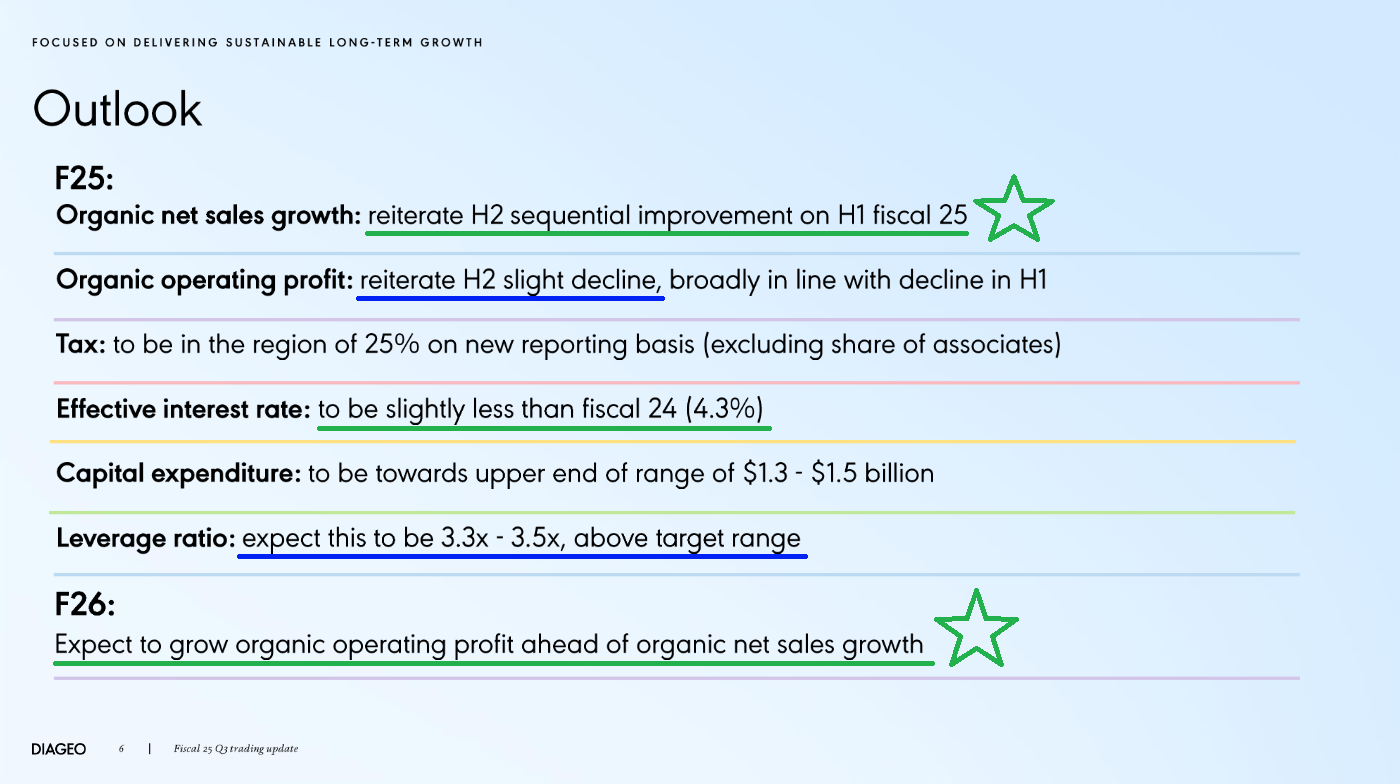

1) Organic net sales rose 5.9% YoY, though management estimates ~4% was driven by favorable phasing and tariff pull-forward, which should reverse in Q4. Still, they expect sequential improvement in the back half.

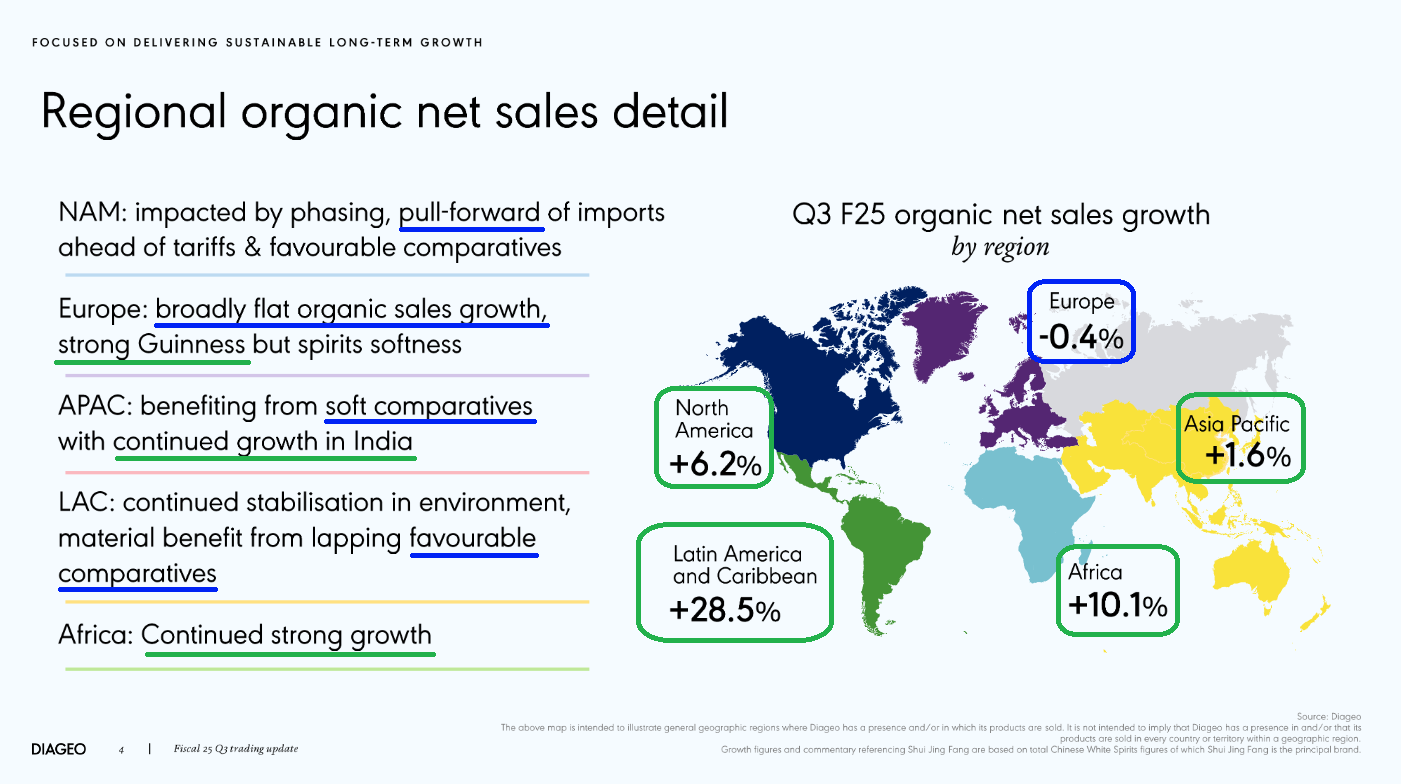

2) North American organic net sales grew 6% year-over-year. Europe remained soft, with organic net sales broadly flat despite strength from Guinness. Asia Pacific organic net sales grew 2%. Latin America and the Caribbean saw 29% organic net sales growth year-over-year, driven by continued stabilization in Brazil and Mexico. Africa saw 10% organic sales growth year-over-year.

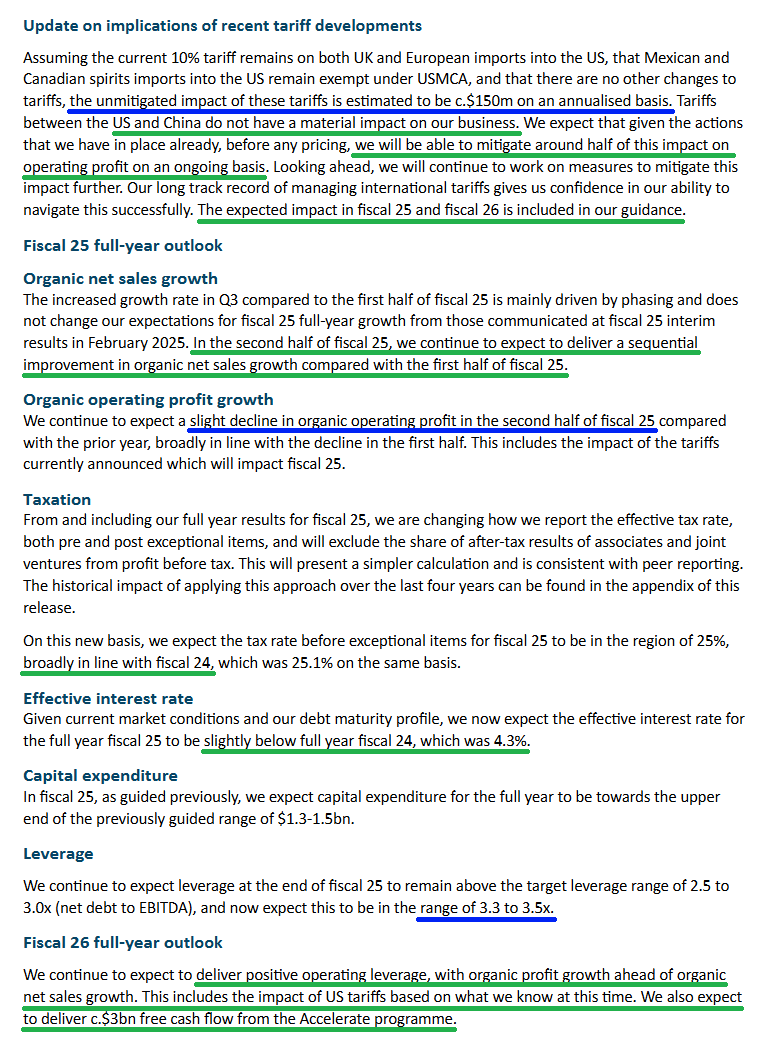

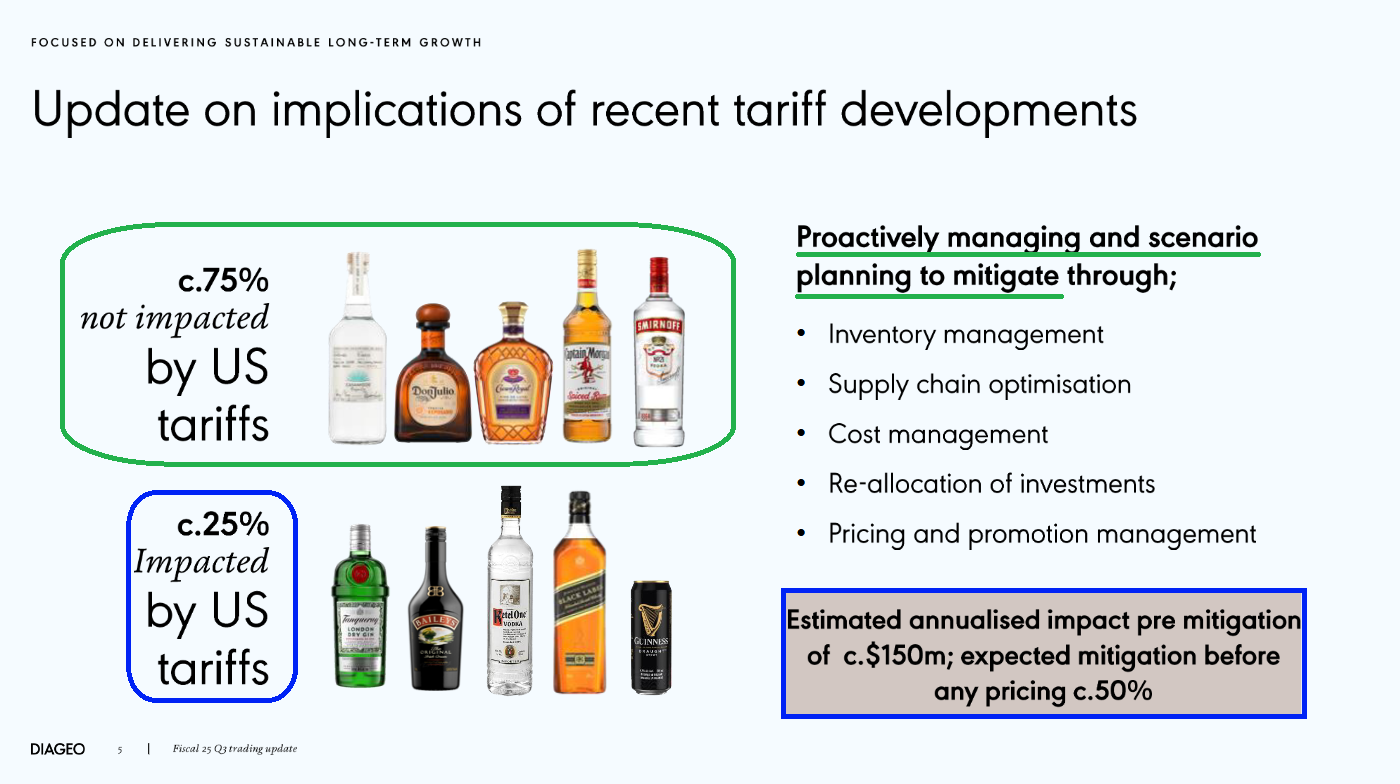

3) ~75% of Diageo’s business is not impacted by US tariffs, with most products exempt under the USMCA. The estimated unmitigated annual impact of current tariffs is estimated to be ~$150 million, which management expects to mitigate by ~50% through supply chain optimization and inventory management already in place. More importantly, this does not include any pricing actions. Tariffs between the US and China do not have a material impact on Diageo. Longer term, management is confident in their ability to fully offset tariffs.

4) Management expects to generate at least $3 billion in free cash flow annually starting in fiscal 2026, with further upside as overall performance improves.

5) Net leverage is expected to end the year between 3.3x and 3.5x, but is still expected to fall within the 2.5x to 3.0x target no later than fiscal 2028. Management not only sees a path to hitting the target early, but expects to land at the midpoint or below.

6) Guinness remains a standout as the highest-selling beer in the UK and Africa, with overall organic sales up double digits year-over-year and continued momentum driven by both Guinness Draught and Guinness 0.0.

7) Operating leverage is expected to kick in during fiscal 2026, with organic operating profit growth projected to outpace organic net sales growth even absent an overall market recovery.

8) Management launched the first phase of the Accelerate cost savings program, targeting approximately $500 million in savings over the next three years.

9) As management continues to focus on deleveraging, opportunities for significant brand disposals over the next few years have been discussed and are likely to happen, far more substantial than recent portfolio trimmings.

10) Both FX and the recent softness in agave prices, down ~30% year-to-date, are expected to be tailwinds in fiscal 2026 as growth in tequila continues.

Earnings Call Highlights

Morningstar Analyst Note

General Market

The CNN “Fear and Greed Index” ticked down from 65 last week to 56 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

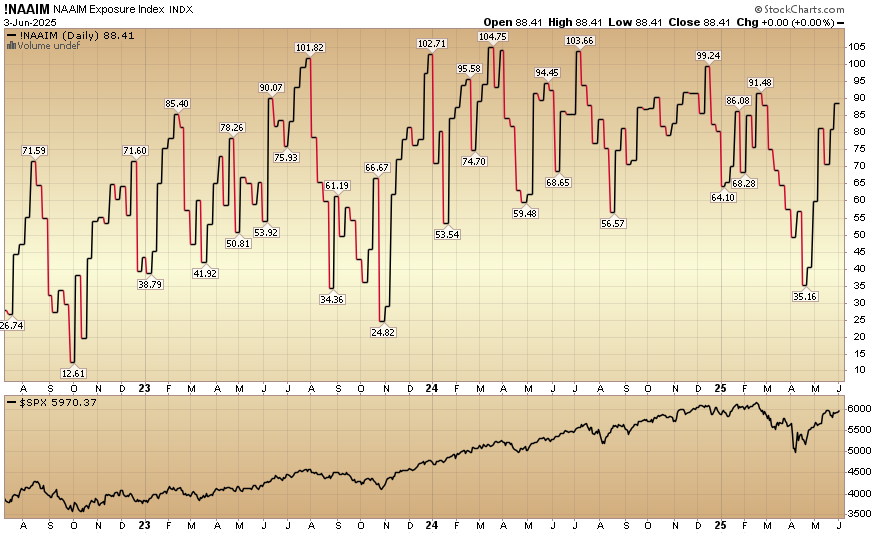

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 88.41% this week from 80.87% equity exposure last week.

Our podcast|videocast will be out sometime today. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms

Not a solicitation.