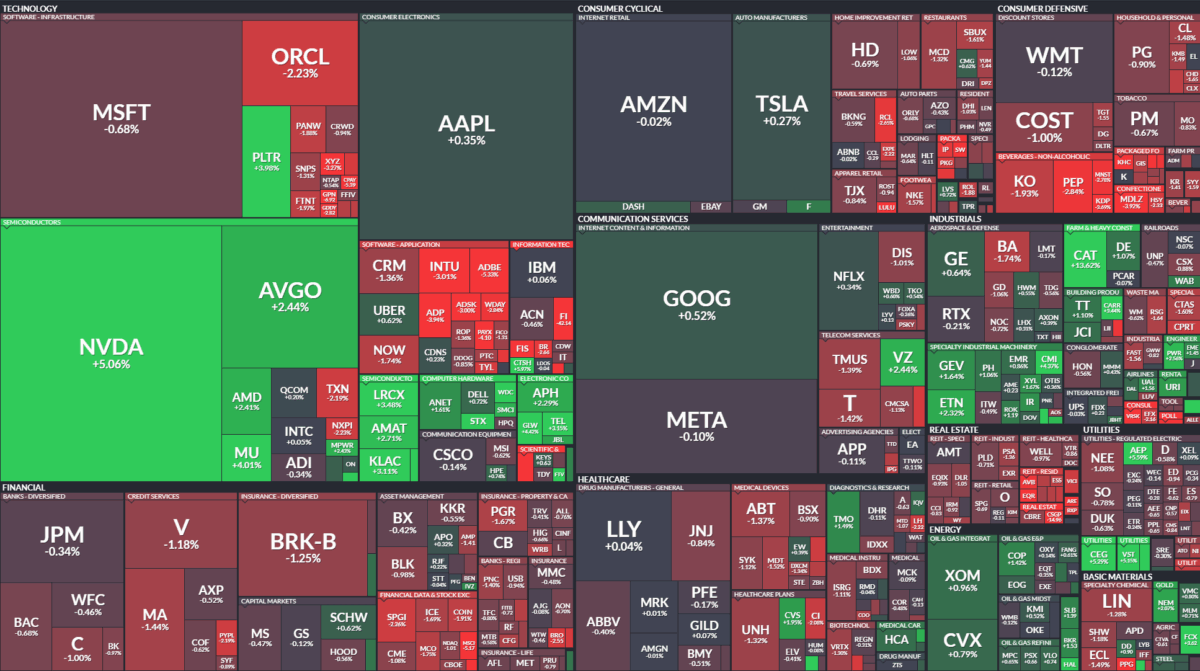

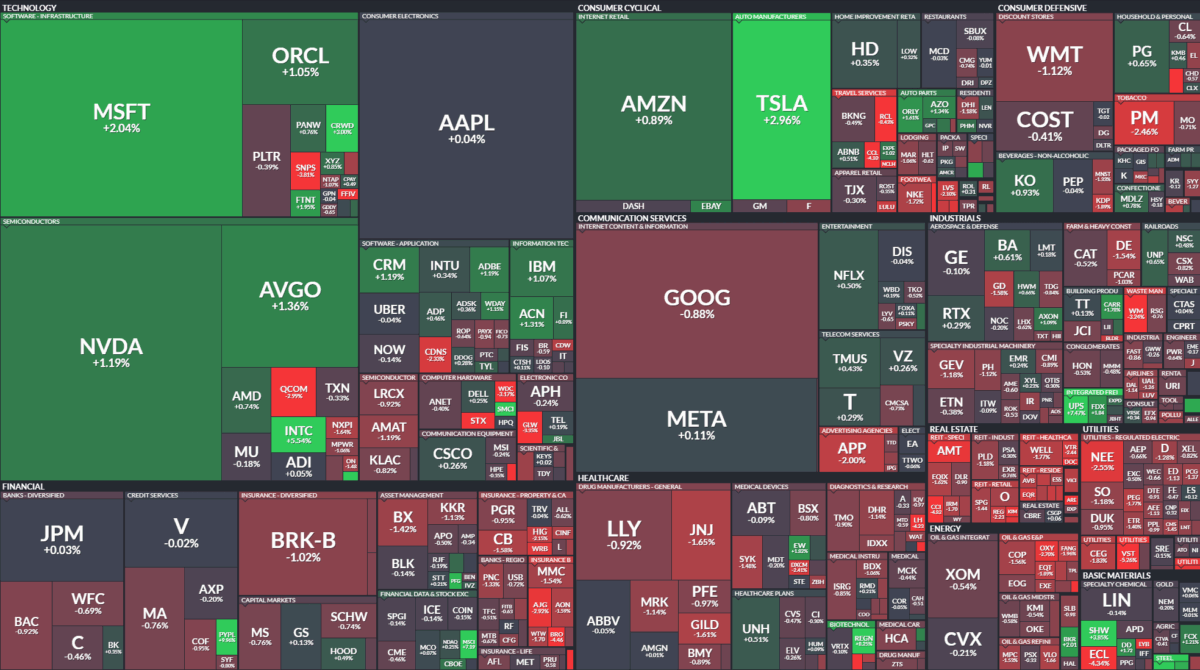

Data Source: Finviz

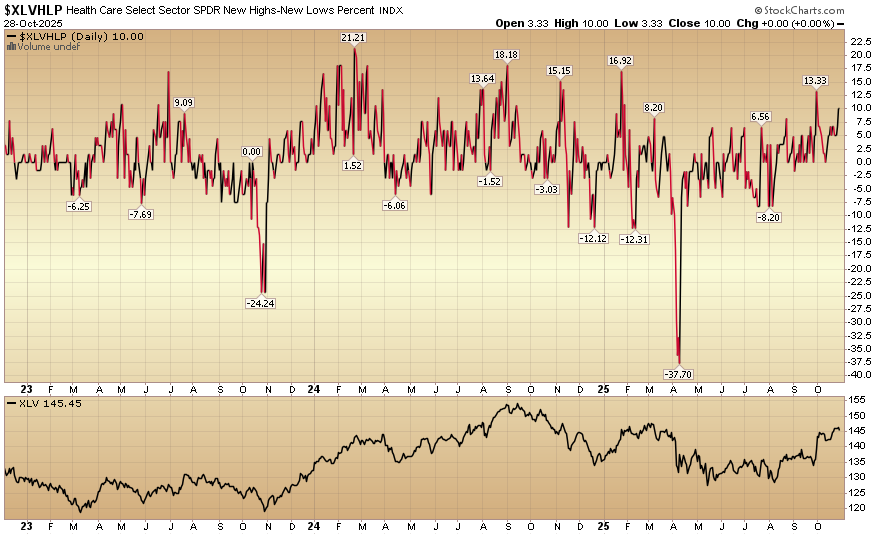

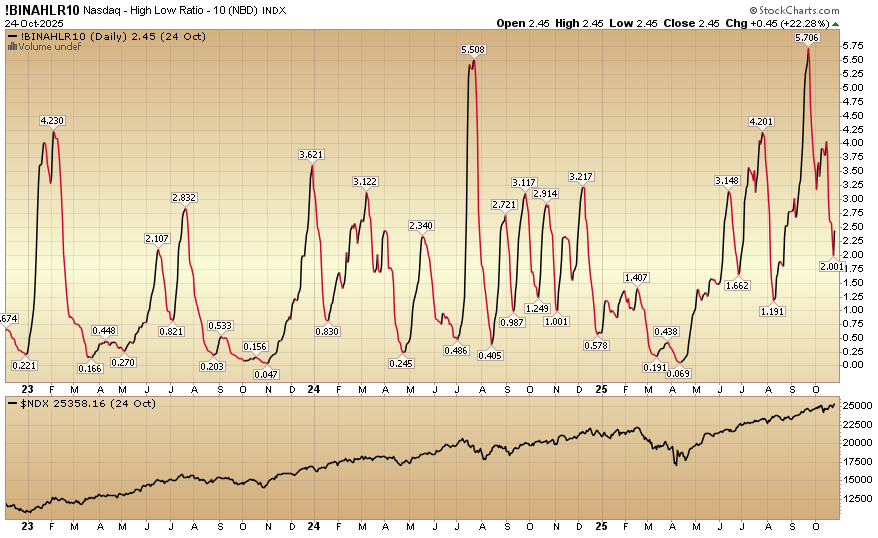

Indicator of the Day (video): Health Care New High New Low %

Quote of the Day…

MONEYSHOW Appearance – Thomas Hayes – Chairman of Great Hill Capital – December 1-2, 2025

Save The Date!

My WorkShop Schedule for MoneyShow Masters Symposium Sarasota

-Monday, December 1, 2025 • 11:15 AM – 11:30 AM

Keynote Presentation • Healthcare, Small Caps, Selective Energy and More Unloved “Once in 25-Year” Opportunities

-Monday, December 1, 2025 • 6:20 PM – 6:45 PM

Keynote Panel • 10 Stock Picks for the Next 12 Months

-Tuesday, December 2, 2025 • 1:00 PM – 1:45 PM

Educational Presentation • Mid-Term Election Year Jitters? How to Find Opportunities to Thrive!

I will be speaking at the MoneyShow in Sarasota, FL on Dec 1-2. You can pre-register here:

Click here for MoneyShow Registration

Be in the know. 24 key reads for Wednesday…

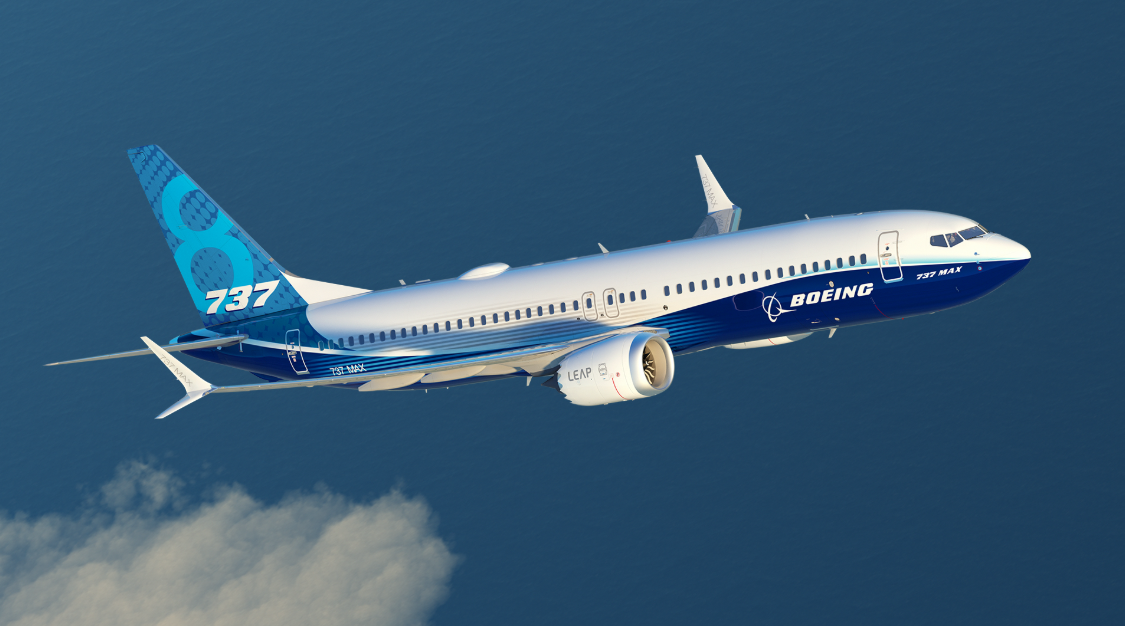

- Boeing posts Q3 revenue beat, improving cash flow burn rate as CEO Ortberg’s turnaround plan takes off (yahoo)

- Boeing stems cash burn for first time since 2023 but takes $4.9 billion charge on 777X delays (cnbc)

- Etsy Taps Chief Growth Officer as CEO to Navigate the AI Era (bloomberg)

- E-commerce consumption could bump 20% because of agentic AI, says Mizuho’s Dan Dolev (youtube)

- Estée Lauder partners with Shopify for digital commerce overhaul (investing)

- Hormel Foods to spin off Justin’s brand in private-equity agreement (yahoo)

- Hormel Foods Lowers Adjusted Earnings Guidance Citing Fire, Inflationary Pressures (wsj)

- Generac cuts full-year sales forecast on weak residential demand for generators (reuters)

- Mortgage rates drop to the lowest level in over a year, pushing refinancing 111% higher annually (cnbc)

- US Home Prices Post Weakest Gain in More Than Two Years (bloomberg)

- Venmo users will soon be able to pay rent, mortgages as PayPal announces Bilt partnership (nypost)

- JPMorgan Sees Fed Reviving 2019 Playbook to Ease Market Strains (bloomberg)

- Fed Preview: Rate Cut And End Of QT Will Be “Broadly Supportive Of Risk” (zerohedge)

- The Fed Is Looking for Signals From Job Market. Amazon May Have Sent a Message. (barrons)

- Wells Fargo calls for an ‘everything rally’ into year-end (streetinsider)

- Profit Margins Aren’t Just Higher in Tech. Call It a ‘Moneyball’ Rally. (barrons)

- The US Dollar’s Value Is Down—and These 3 Investments Are Way, Way Up (morningstar)

- Trump Expects to Sign China Trade Deal at Xi Summit (wsj)

- Foreign investors show renewed interest in China equities, HSBC report says (scmp)

- China Blows Past Record for Europe Car Sales on Hybrids, EVs (bloomberg)

- Lithium Prices Boosted by China’s Policy Drive on Energy Storage (bloomberg)

- Toyota pledges $10B toward new auto plants in US: ‘Go out and buy a Toyota,’ Trump says (nypost)

- US and South Korea seal trade deal (ft)

- 15th 5-Year Plan – AI & Tech Self-Reliance, AI & Tech Self-Reliance, AI & Tech Self-Reliance (Don’t Bury The Headline) (chinalastnight)

“Old Dogs, New Tricks” Stock Market (and Sentiment Results)…

Key Market Outlook(s) and Pick(s)

On Monday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss markets, outlook, earnings, the Mag 7, Alibaba, and more. Thanks to Stuart, Peyton Jennings, and Christian Dagger for having me on: