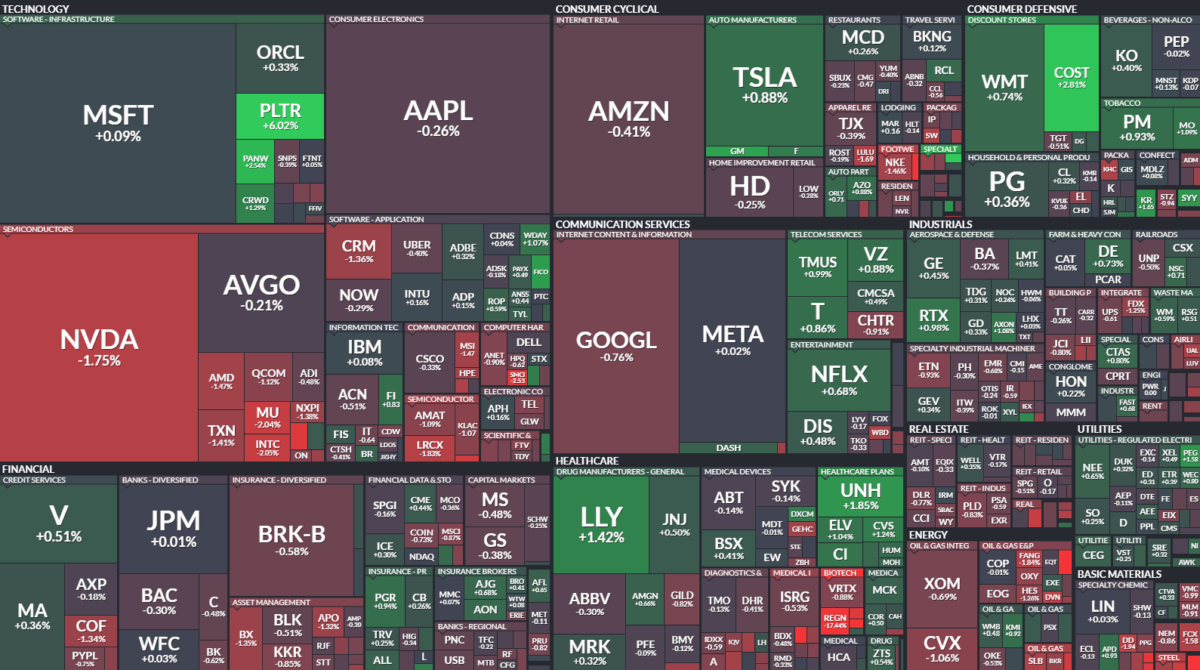

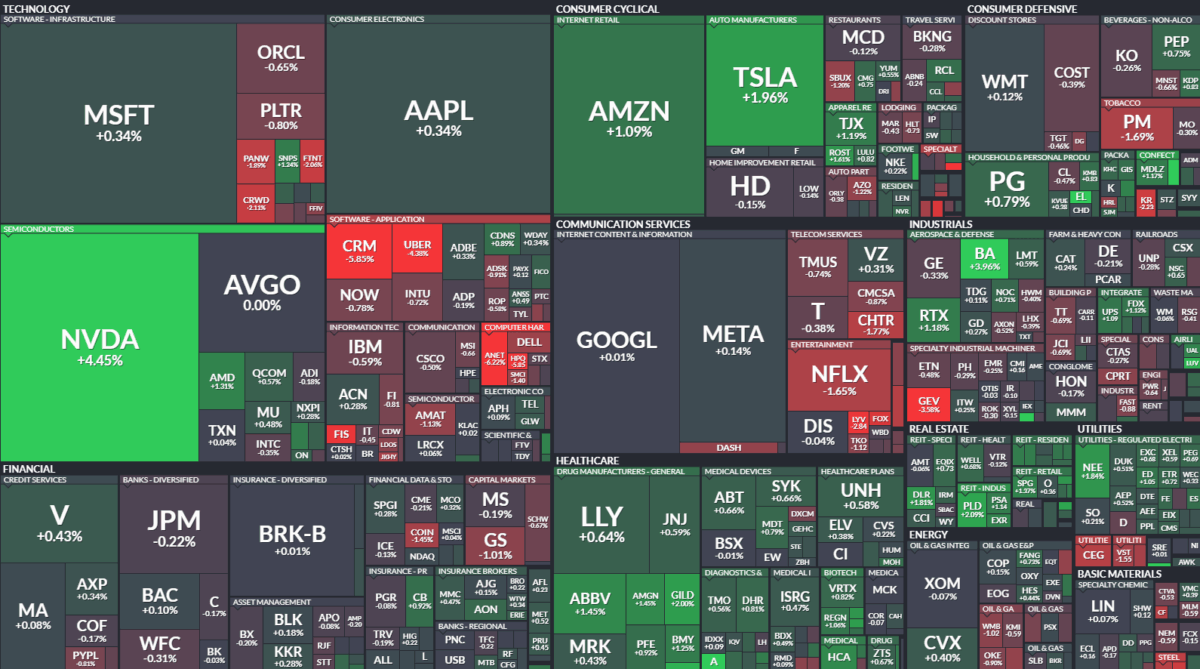

Data Source: Finviz

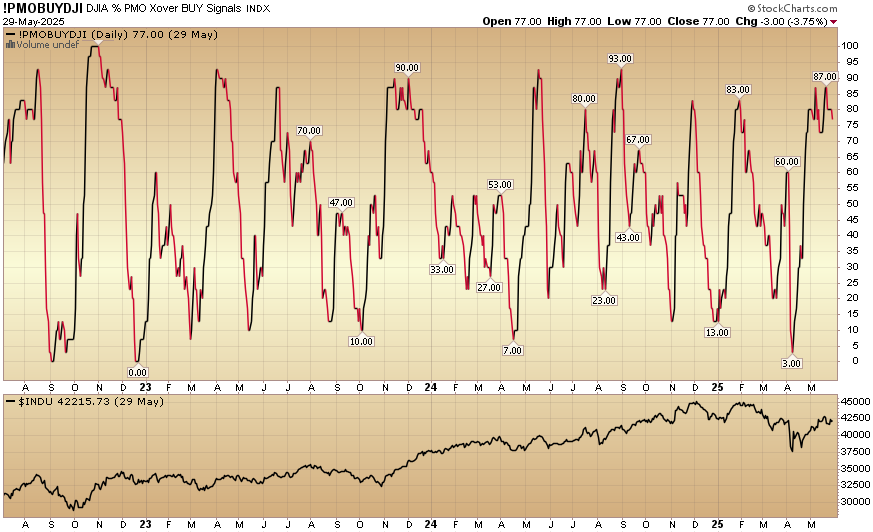

Indicator of the Day (video): Dow Percent on PMO Crossover BUY Signals

Quote of the Day…

Be in the know. 24 key reads for Friday…

- Drinks groups mount fightback as alcohol faces ‘tobacco moment’ (ft)

- Non-alcoholic beer projected to overtake ale as the second-largest beer category worldwide this year (cnbc)

- Boeing to resume airplane deliveries to China next month, ramp up Max production, CEO says (cnbc)

- US FAA extends program allowing Boeing to conduct agency tasks like inspections (reuters)

- Boeing to Weigh Big 737 Max Output Jump Later This Year (bloomberg)

- Turkey, nuts and Spam are appealing to ‘strained’ consumers, Hormel says (marketwatch)

- Disney+ Expands Subscriber Perks, Including Movie Premieres (bloomberg)

- ‘Trickle’ of global inflows to Chinese stocks could become a ‘flood’: Cambridge Associates (scmp)

- Chinese tech groups prepare for AI future without Nvidia (ft)

- Exclusive | China’s world-beaters in tech, energy sectors are focus of investors, JPMorgan says (scmp)

- Bessent Says US-China Talks ‘Stalled,’ Pushes for Trump-Xi Call (bloomberg)

- European Stocks Set for Biggest Monthly Advance Since January (bloomberg)

- The End of the Easy US Stock Bet Has Been Good to Contrarians (bloomberg)

- Citi: U.S. stocks now least preferred among global asset managers (streetinsider)

- Investors see US stocks rally broadening, even as ‘Magnificent Seven’ rebound (reuters)

- Interest-Rate Cuts Could Resume With Trade Deals, Says Chicago Fed President Austan Goolsbee (barrons)

- Bank of America CEO Brian Moynihan on What Makes the U.S. ‘Fundamentally Strong’ (barrons)

- GDP Shrank Less Than First Reported Last Quarter. This Is Why. (barrons)

- Inflation rate slipped to 2.1% in April, lower than expected, Fed’s preferred gauge shows (cnbc)

- Dollar set for fifth monthly drop on trade, fiscal uncertainty (streetinsider)

- For First Time Since 2019, Trump Invites Powell To White House To Discuss Economy (zerohedge)

- The Stock Market Is Crushing an Old Wall Street Cliché (barrons)

- Retailers, Ducking Trade-War Curveballs, Stick to Their Plans (wsj)

- Ulta Raises Full-Year Outlook as Consumers Keep Spending on Beauty (wsj)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 293

Hedge Fund Tips with Tom Hayes – Podcast – Episode 293

Where is money flowing today?

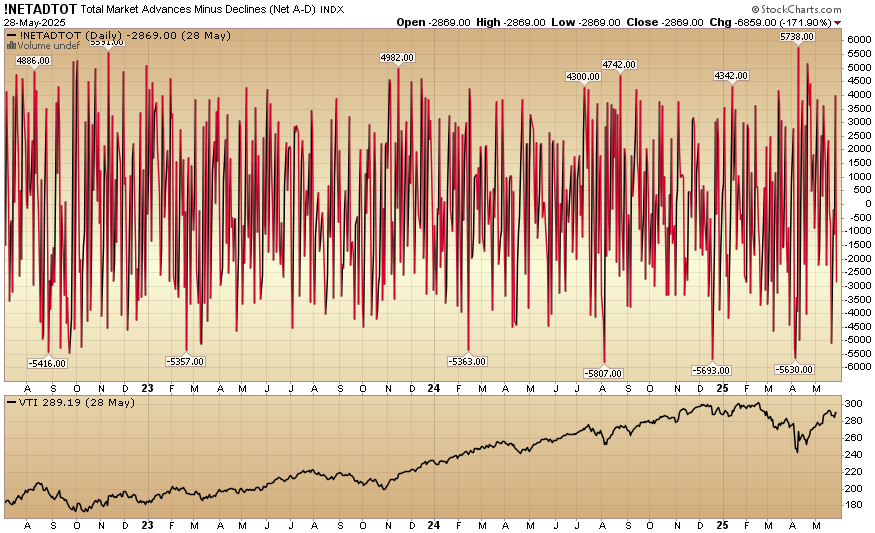

Indicator of the Day (video): Total Market Advances Minus Declines

Quote of the Day…

Be in the know. 18 key reads for Thursday…

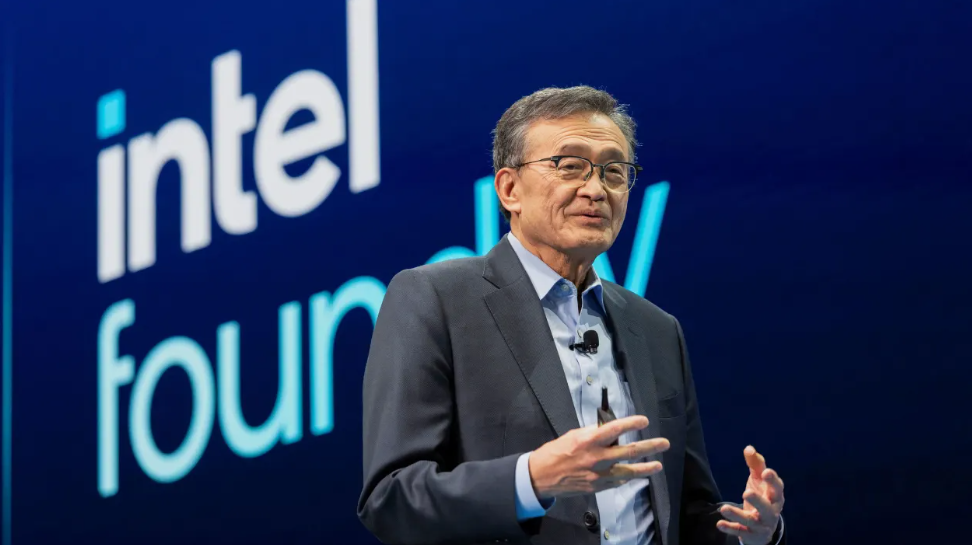

- Intel CEO Lip-Bu Tan has a long track record in the chip industry. Now he needs a big customer (cnbc)

- Nvidia CEO Warns That Chinese AI Rivals Are Now ‘Formidable’ (bloomberg)

- Toyota Sales Hit Second Monthly High on US Tariff Rush (bloomberg)

- General Motors CEO Defends Trump Auto Tariffs (wsj)

- Federal trade court strikes down Trump’s reciprocal tariffs (cnbc)

- Buying the stock market dip hasn’t paid off this much in 30 years (yahoo)

- The Best Energy Stocks to Buy Now (morningstar)

- How a Shortage of Transformers Threatens Electricity Supply (bloomberg)

- Boeing aims to certify 737 MAX variants by year-end, CEO tells Aviation Week (reuters)

- US suspends engine sales to Chinese planemaker COMAC, New York Times reports (reuters)

- “Race To The Bottom”: BYD Price Slashing To Prompt Chinese EV Consolidation (zerohedge)

- Record Foreign Demand For Blowout 5Y Treasury Auction (zerohedge)

- Will Tariffs Bring Manufacturing Back? BofA Says It’s Too Late. (barrons)

- Americans’ Finances Remain Solid. It’s the Job Market. (barrons)

- European stocks to scale new heights in 2026, trade tensions temper loftier hopes (reuters)

- This market wants to go higher, Carson Group’s Ryan Detrick (youtube)

- Hormel Foods tightens annual profit forecast amid weak retail demand (reuters)

- Citi’s Fraser Says Clarity From Trump Would Unleash IPO Markets (bloomberg)