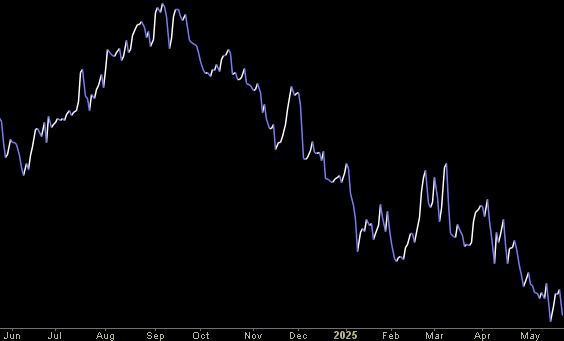

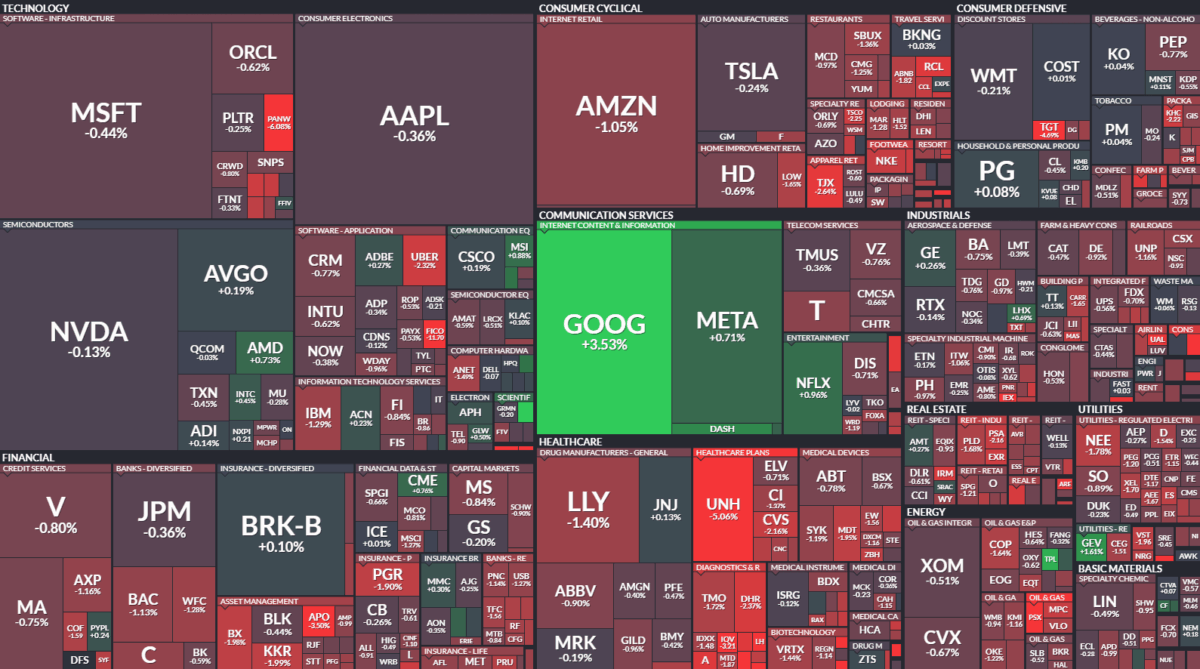

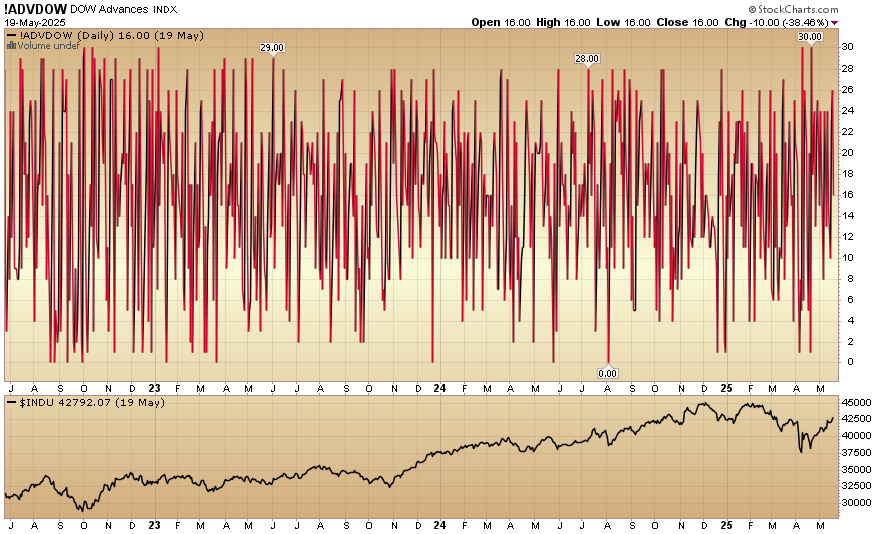

Where is money flowing today?

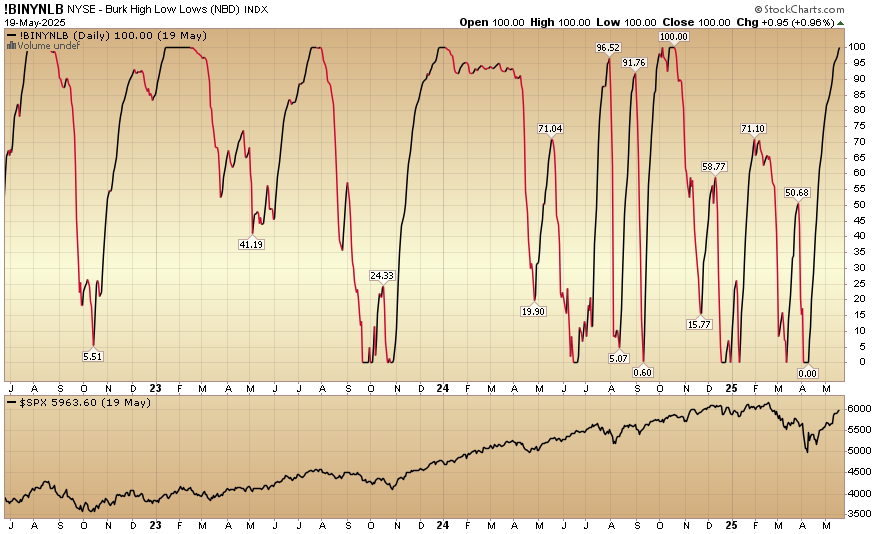

Indicator of the Day (video): Burk High Low Lows

Quote of the Day…

Be in the know. 26 key reads for Wednesday…

- Toyota Goes All-Hybrid With Its Best-Selling US Vehicle (bloomberg)

- Toyota Mulls Making Tiny Trucks for US Market as Demand Booms (bloomberg)

- Toll Maintains Home Sales Forecast as Luxury Demand Holds Up (bloomberg)

- Lowe’s sticks by full-year forecast as sales from home professionals boost business (cnbc)

- Dimon slams mortgage regulations for pushing rates higher, hurting lower-income homebuyers (foxbusiness)

- Great News DIYers: Home Depot CFO Reveals No Tariff Price Hikes (zerohedge)

- Home Sellers Are Dropping Prices But Buyers Aren’t Budging. What Could Change That. (barrons)

- QXO targets $50 billion in annual revenue, plans to double Beacon EBITDA (investing)

- Why Disney’s ‘Lilo & Stitch’ Is Set to Beat ‘Mission: Impossible’ at the Box Office (wsj)

- Streamers Are Finally Making Money. For Consumers, It’s Getting Messier. (wsj)

- Boeing Nears Key 737 Factory Milestone as CEO Steadies Factories (bloomberg)

- Boeing Stock Price Targets Are Rising. Where Shares Can Go Now. (barrons)

- Goldman Says Hedge Funds Cut Magnificent Seven, Bought China Stocks (bloomberg)

- Alibaba lands US$250 million convertible bonds deal, AI pact with selfie app giant Meitu (scmp)

- Alibaba and DeepSeek’s home province launches AI spending spree to become innovation hub (scmp)

- Nvidia’s Chief Says U.S. Chip Controls on China Have Backfired (nytimes)

- The AI Diffusion Rule is Over. What That Means for Trump and China. (barrons)

- Morgan Stanley turns bullish on most US assets, except dollar (streetinsider)

- For Goldman’s Trading Desk, Only Three Things Matter: CTAs, Buyback And Retail Buying (zerohedge)

- Options Traders Are Boosting Bearish Dollar Views to Record (bloomberg)

- Travel to U.S. Rebounds After Slump. It’s a Boost for These Stocks. (barrons)

- Never Bet Against Corporate America (zerohedge)

- VF Falls After Vans Owner Rushes Products to US to Beat Tariffs (bloomberg)

- VF earnings beat by $0.01, revenue topped estimates (investing)

- Canada Goose shares surge over 6% as Q4 results top estimates (investing)

- Canada Goose Profit Up But Withholds Guidance, Cites Tariff Uncertainty (wsj)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 292

Article referenced in VideoCast above:

“BABA Back in Business” Stock Market (and Sentiment Results)…