General Market Outlook

Last night I joined Sarah Al-Khaldi on CNA (Channel News Asia) to discuss Stock Market, Economy, Inflation and Biotech. Thanks to Sarah, Eugenia Lim, Olivia Marzuki and Marianne Inacay for having me on:

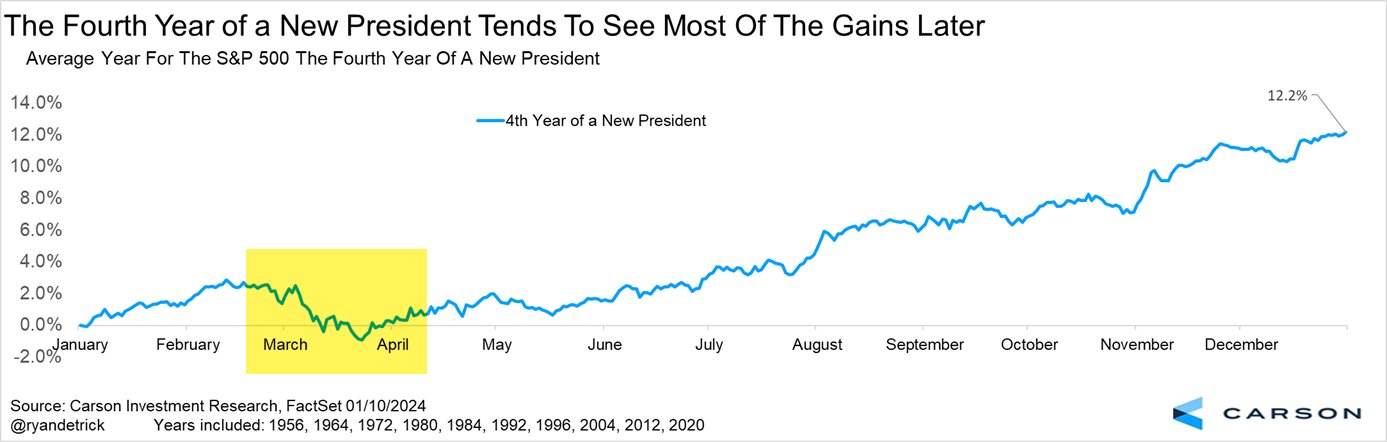

I reference this pattern (captured by Ryan Detrick of Carson quantitatively) in the interview above:

Right afterward, I joined Asieh Namdar on CGTN America, where we covered different aspects of inflation, the US consumer and Auto Sales. Thanks to Asiah and Kamelia Kilawan for having me on:

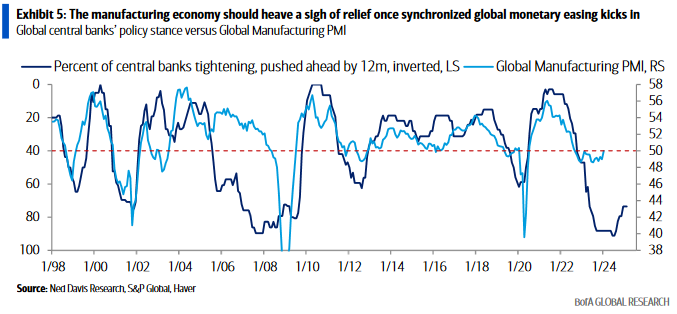

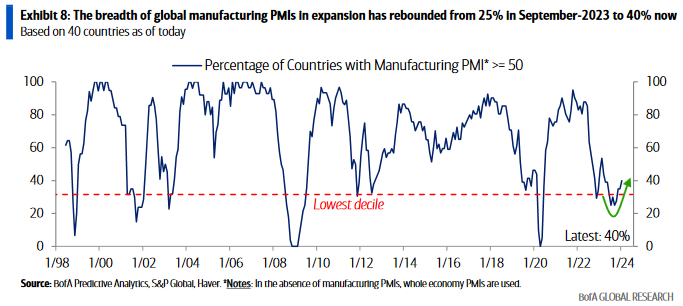

Synchronized global easing is headed to a theater near you:

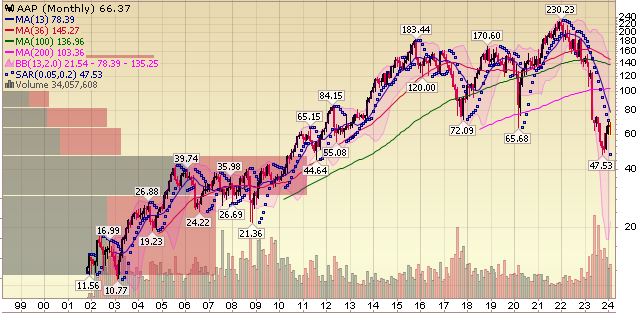

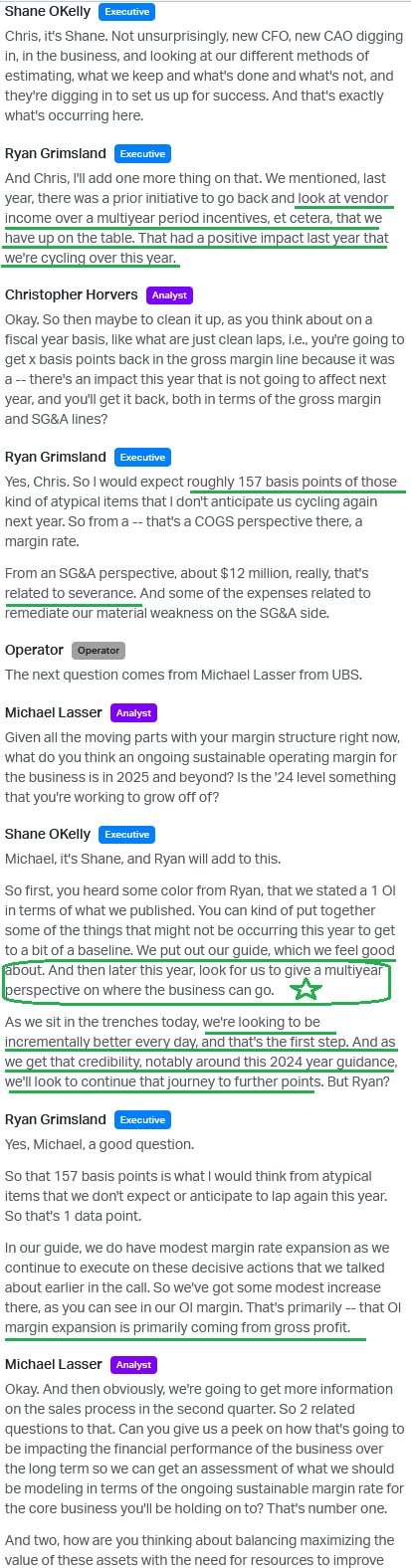

Advance Advancing

Advance Advancing

On Nov 15, 2023 I was on Fox Business with Charles Payne discussing the “turnaround story” of 90 year old Advance Auto Parts (AAP) when it was trading in the high 50’s:

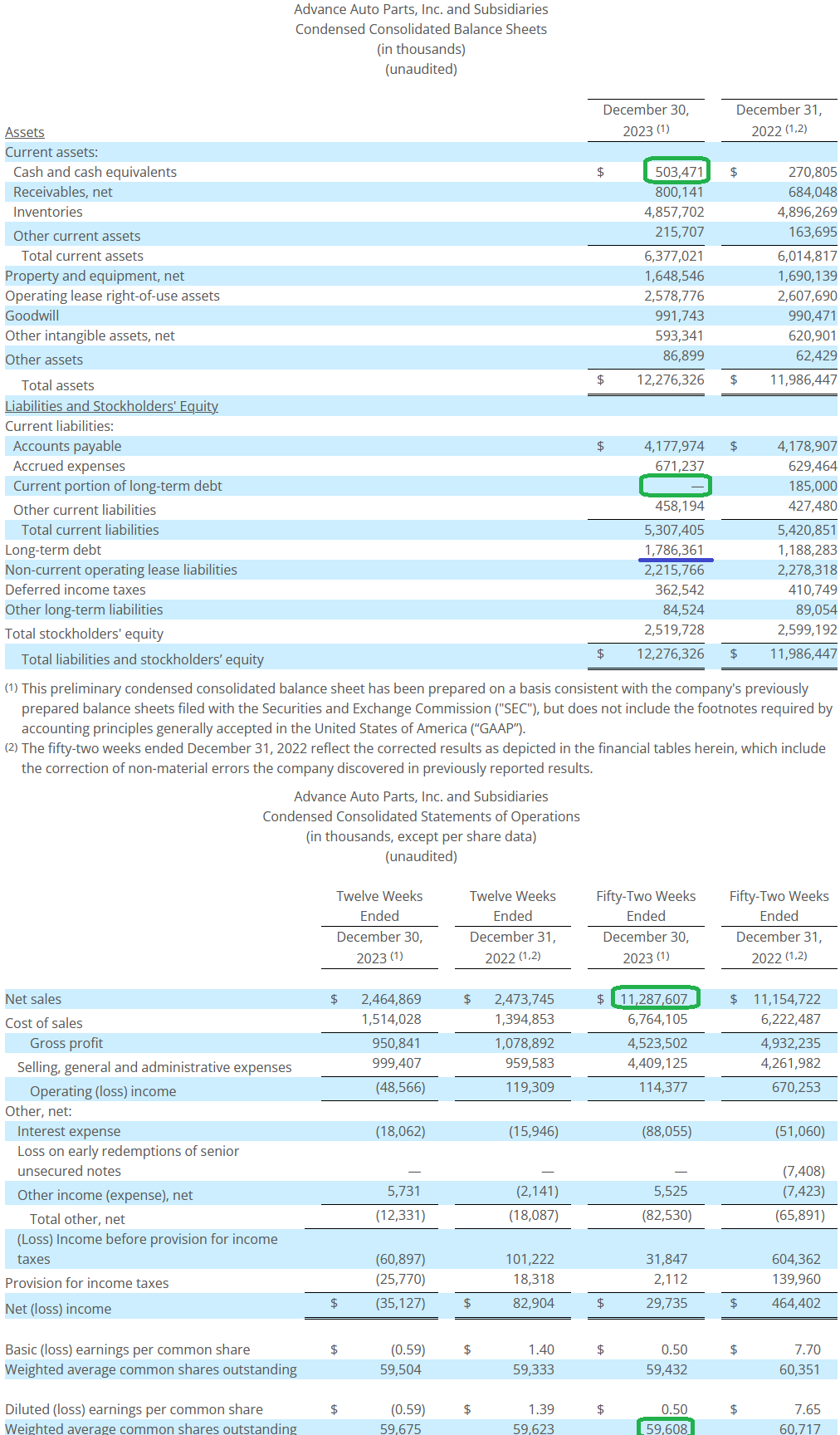

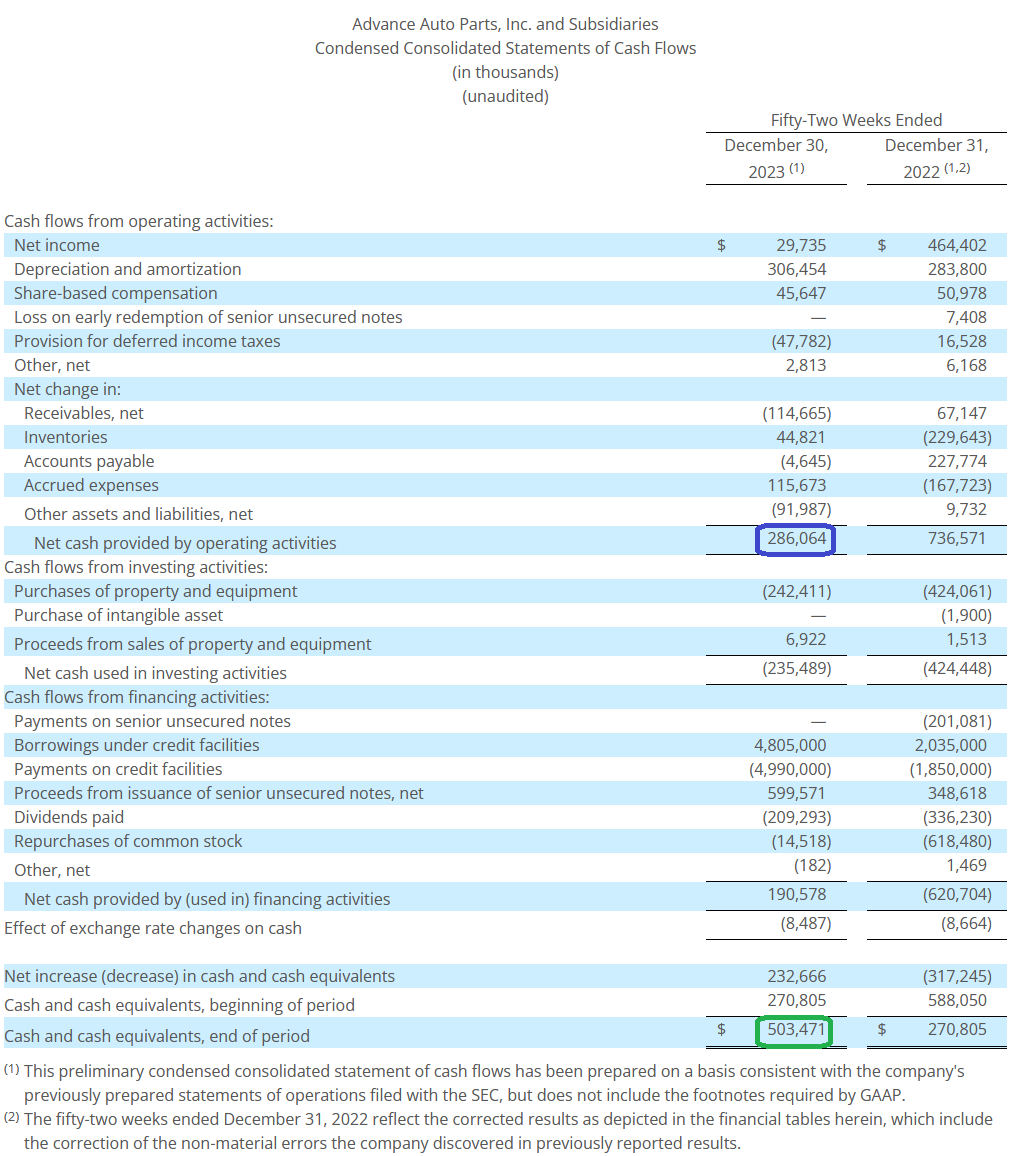

It’s making meaningful progress as evidenced in yesterday’s earnings results:

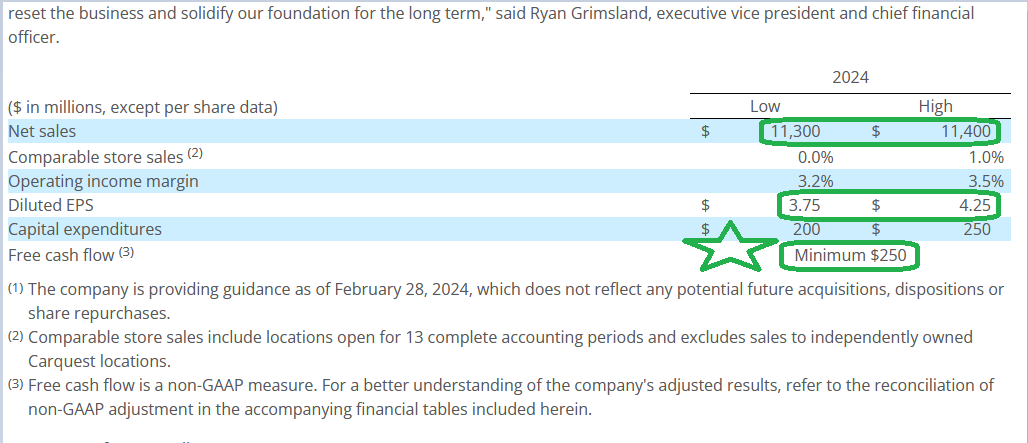

So if backward looking earnings results were a beat on top line, but a miss on bottom line, what caused the stock to like the report? GUIDANCE!

Prior to yesterday’s report, The FactSet consensus for 2024 was EPS of $3.65 and sales of $11.5 billion. The company is now expecting full-year sales to range from $11.3 billion to $11.4 billion, and for EPS to range from $3.75 to $4.25. So the new mid-range is ~10% greater than analysts had anticipated. A top end beat would imply a 17% jump above consensus.

Add to that the assertion of generating “a minimum” of $250M of free cash flow. The name of the game with any turnaround is FREE CASH FLOW to give them the runway to implement the changes of new management.

Shane O’Kelly (the new CEO) came from HD Supply – which was a $7B business within Home Depot that he ran. His new CFO was recruited from Lowe’s. They know retail, distribution and supply chain management for DIY’s and professionals. The skills translate perfectly.

Key points from the Earnings Call:

Biotech Bouncing

Biotech Bouncing

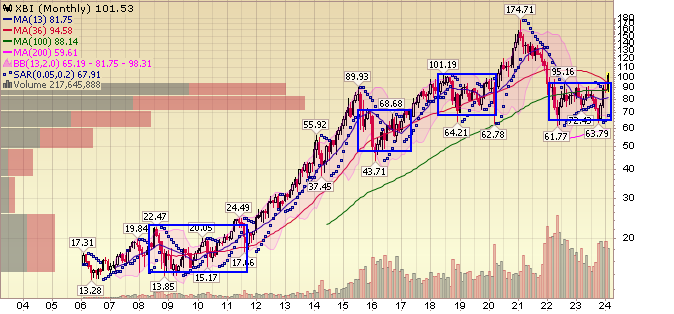

We thought we were a genius in 2022 when we got bullish on a basket of Biotech after the washout.

After a quick rebound off the lows, it grinded sideways for a year before testing our meddle by going “back to the future” and revisiting the 2022 lows again! Nothing in the original thesis (covered on our podcast|videocast) changed “Deals and Drugs” so neither did our positioning (other than adding a bit on weakness). Now it’s off to the races as the Fed nears stepping out of the way, more breakthrough drugs are being approved and utilized, and M&A is heating up (pharma using record cash to buy growth and innovation).

For the Babaholics…

They never want them in the bases eh (BABA)?

After doubts about Alibaba’s future, co-founder Joe Tsai says: ‘We’re back’

Now onto the shorter term view for the General Market:

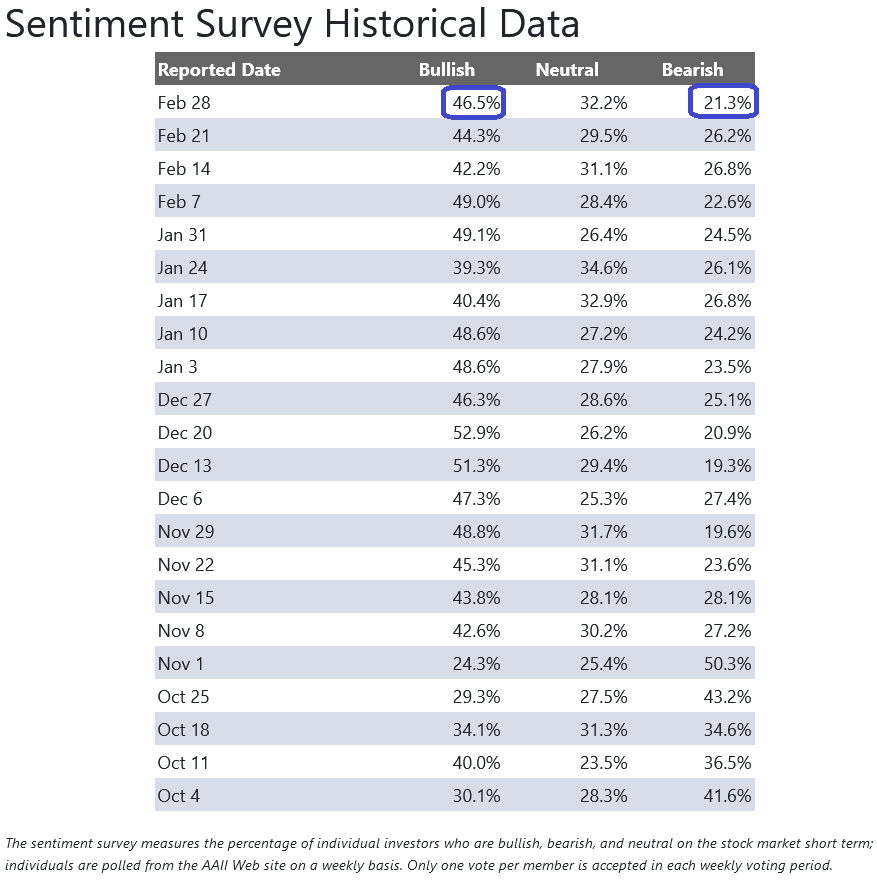

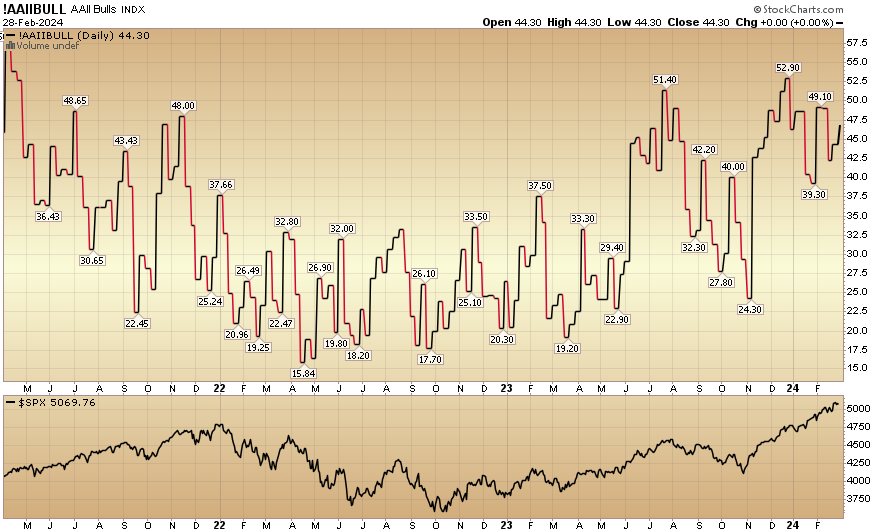

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up 46.5% from 44.3% the previous week. Bearish Percent dropped to 26.2% from 21.3%. The retail investor is a bit giddy.

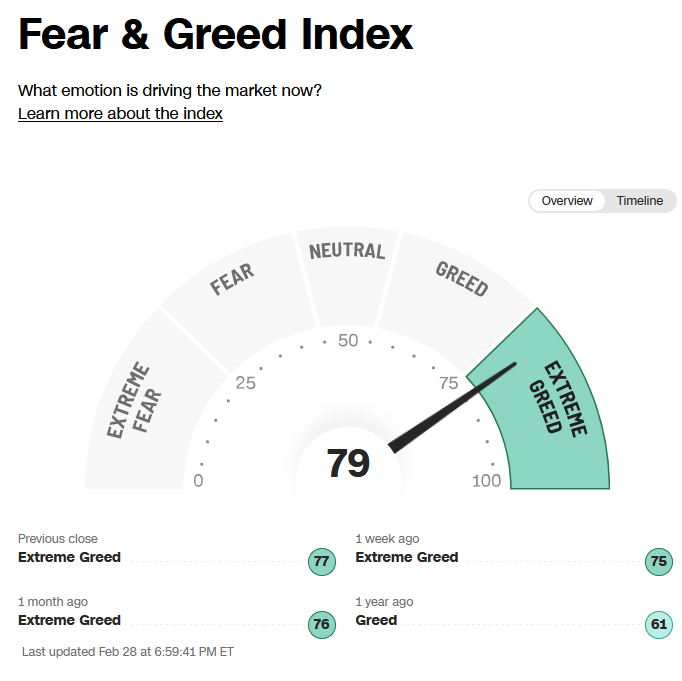

The CNN “Fear and Greed” moved up from 70 last week to 79 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

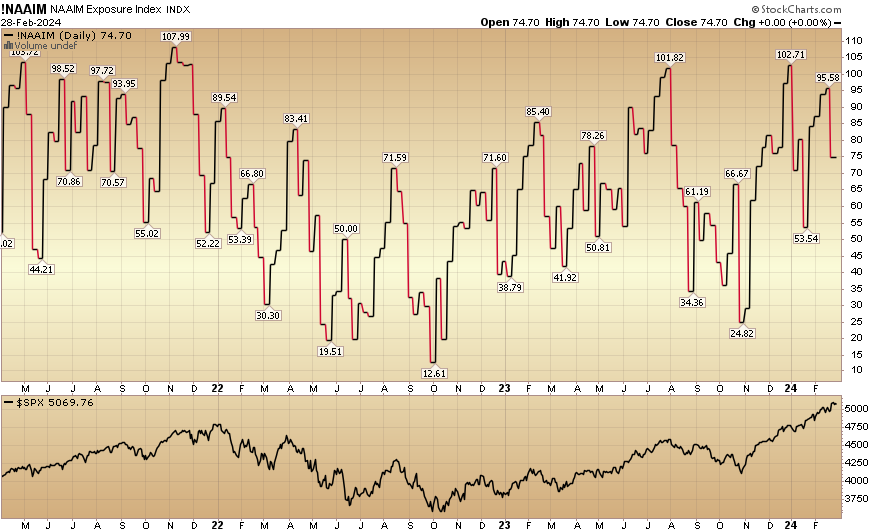

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 74.7% this week from 95.58% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 74.7% this week from 95.58% equity exposure last week.

Our podcast|videocast will be out late today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in during our Q1 raise. We will re-open to smaller accounts $1M+ again sometime in Q2. Larger accounts $5-10M+ can access bespoke service beforehand at their preference here.

*Opinion, Not Advice. See Terms