On Tuesday, I joined the amazing Liz Claman on Fox Business. I always enjoy going on with Liz because she was the first one to ever give me a shot on TV (almost 5 years ago now!) and I am forever grateful for that. Thanks to Liz, Jake Mack, Finley Walker and Kathryn Meyers for having me on. This was a very important segment, because we not only discussed our newest long-term position, but we covered a lot on Bonds, the Fed, cuts – and the most important development regarding rates that no one is paying attention to. You can view it here:

Watch in HD directly on Fox Business

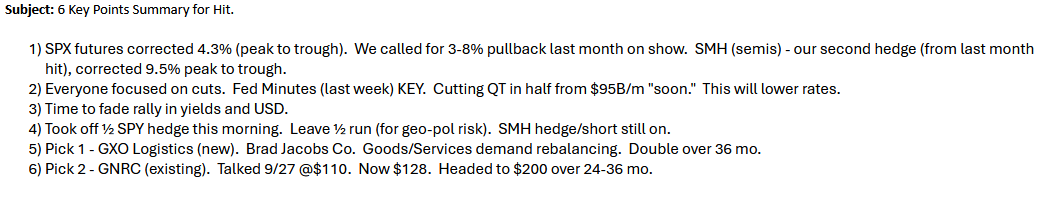

Here were my “show notes” ahead of the segment:

We didn’t have time to discuss Generac on the segment, but wanted to reference the interview CEO – Aaron Jagdfeld did with Liz on 4/12/24. We caught it while we were watching her show on Friday:

We didn’t have time to discuss Generac on the segment, but wanted to reference the interview CEO – Aaron Jagdfeld did with Liz on 4/12/24. We caught it while we were watching her show on Friday:

If you listen closely to what he said, you will understand part of why we’ve been talking a lot about our position in Comstock Resources.

Continued Mixed Messages

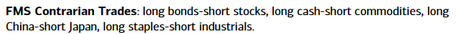

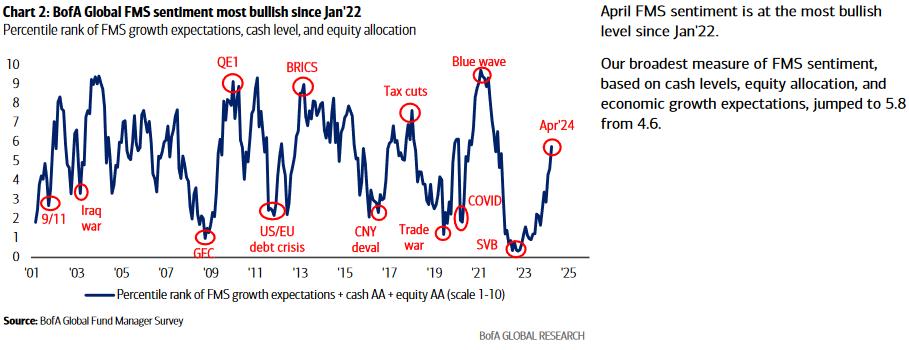

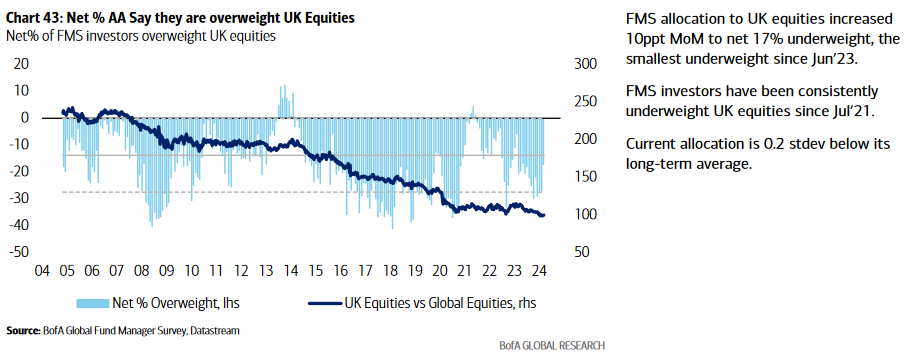

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed 224 managers with $638B AUM:

April 2024 Bank of America Global Fund Manager Survey Results (Summary)

Here were the key points:

- We agree with Hartnett’s contrarian trades – but only the first half of each pair: Long Bonds, Long China and Long Staples. His “short Japan, short Industrials, short Commodities, long Cash” we are agnostic.

The “Long China” is further supported by not only everyone to one side of the boat “short China” (2nd most crowded trade), but economic outlook finally starting to look up again:

The “Long China” is further supported by not only everyone to one side of the boat “short China” (2nd most crowded trade), but economic outlook finally starting to look up again:

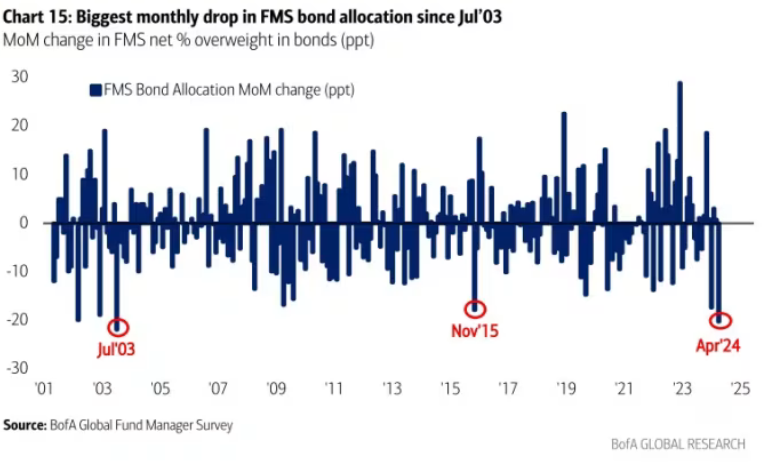

- Managers are dumping bonds like its going out of style – at the exact wrong time:

Large Traders/Hedge Funds (red line at bottom of chart below) haven’t been this short 10yr Treasuries since October 2018. The ACTUAL “smart money” – Commercial Hedgers – are the longest 10yr Treasuries they have been since October 2018. This bottom in bonds (top in yields) was followed by a year and a half rally in Treasuries (drop in yields). Who’s positioned for that right now? No one – which is why it becomes the “maximum pain” trade moving forward (along with all equity groups that will benefit from a compression of yields – EM, China, Small Caps, REITS, Banks, Utilities, Staples, etc). Or, you can follow the crowd and hope for the best…

Large Traders/Hedge Funds (red line at bottom of chart below) haven’t been this short 10yr Treasuries since October 2018. The ACTUAL “smart money” – Commercial Hedgers – are the longest 10yr Treasuries they have been since October 2018. This bottom in bonds (top in yields) was followed by a year and a half rally in Treasuries (drop in yields). Who’s positioned for that right now? No one – which is why it becomes the “maximum pain” trade moving forward (along with all equity groups that will benefit from a compression of yields – EM, China, Small Caps, REITS, Banks, Utilities, Staples, etc). Or, you can follow the crowd and hope for the best…

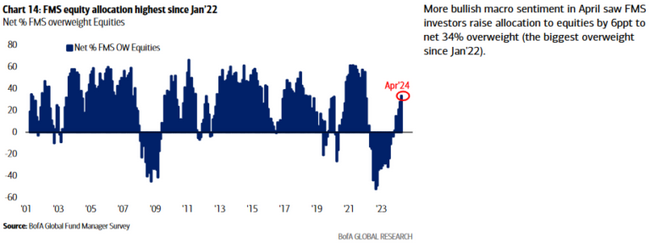

- Headlines are pointing to the idea that because sentiment and equity allocation is the highest it has been since Jan 2022 we must crash. They are paralyzed by recency bias. If you look further back, the level of sentiment and allocation also resembles early 2013 and 2009 – both of which periods had 1.5-2yrs of gas left in the tank.

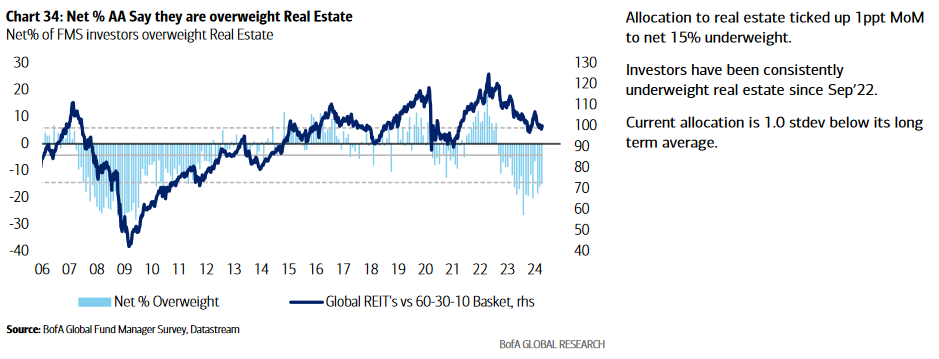

4. All the sellers out of UK Equities and Real Estate yet?

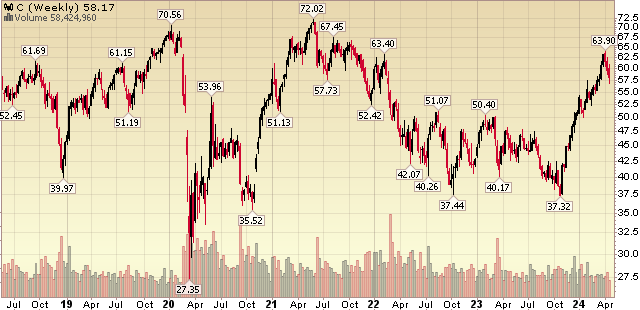

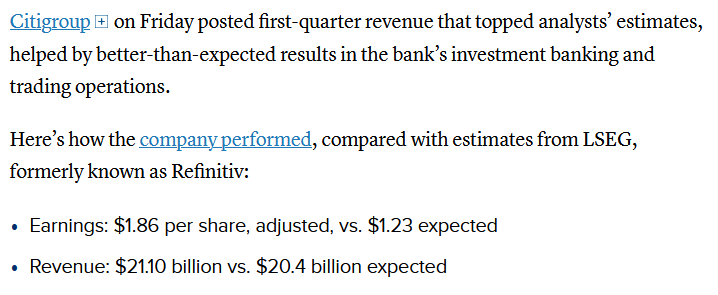

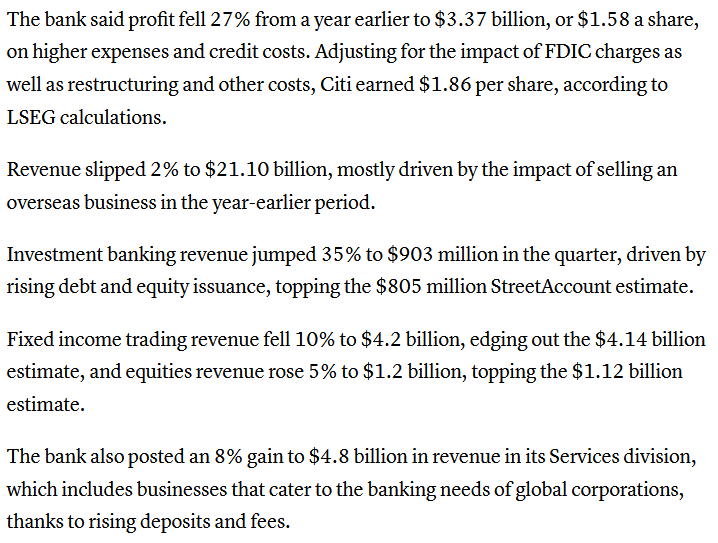

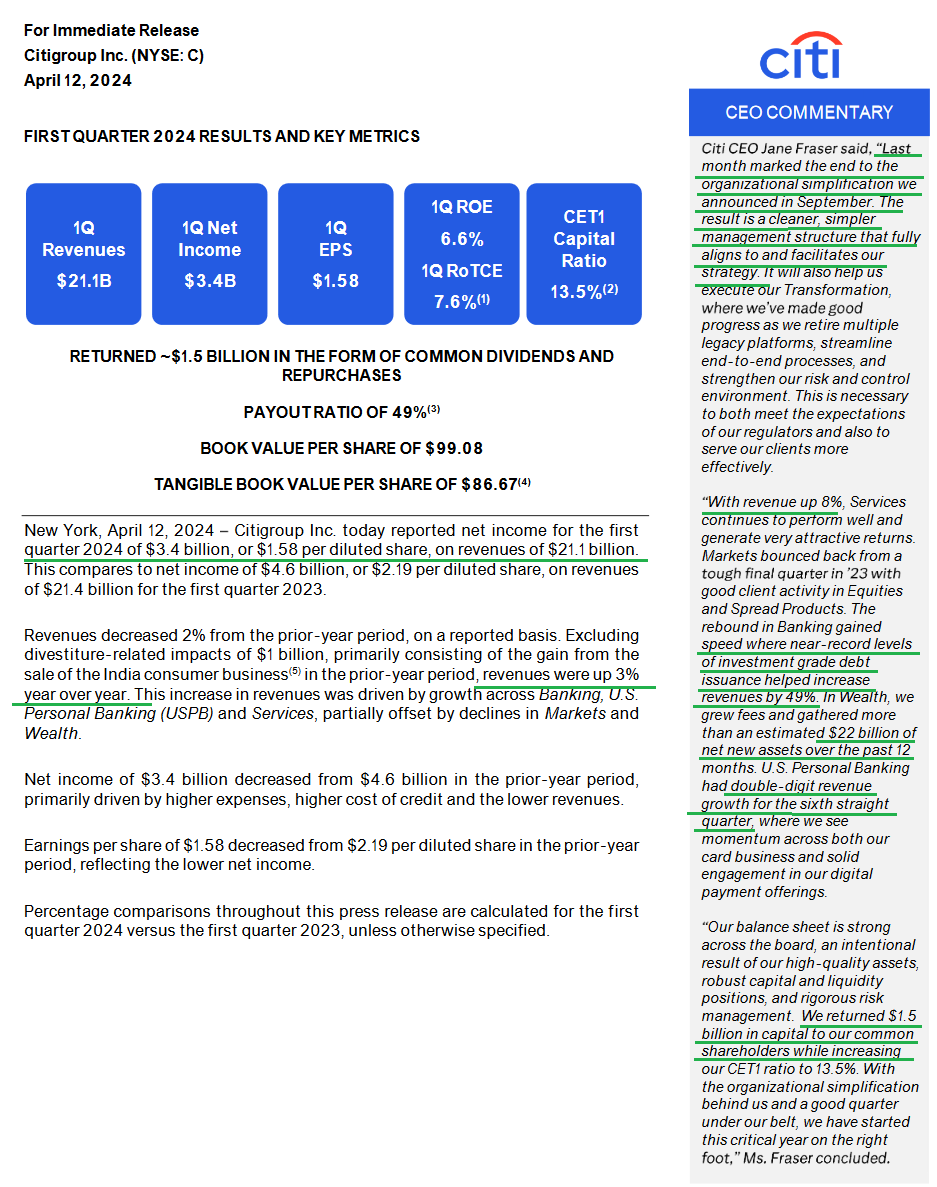

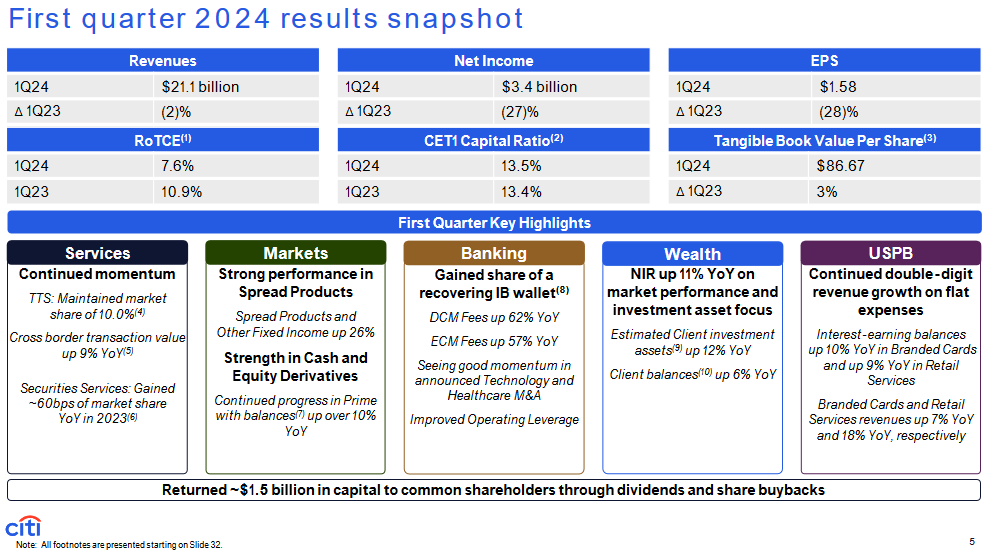

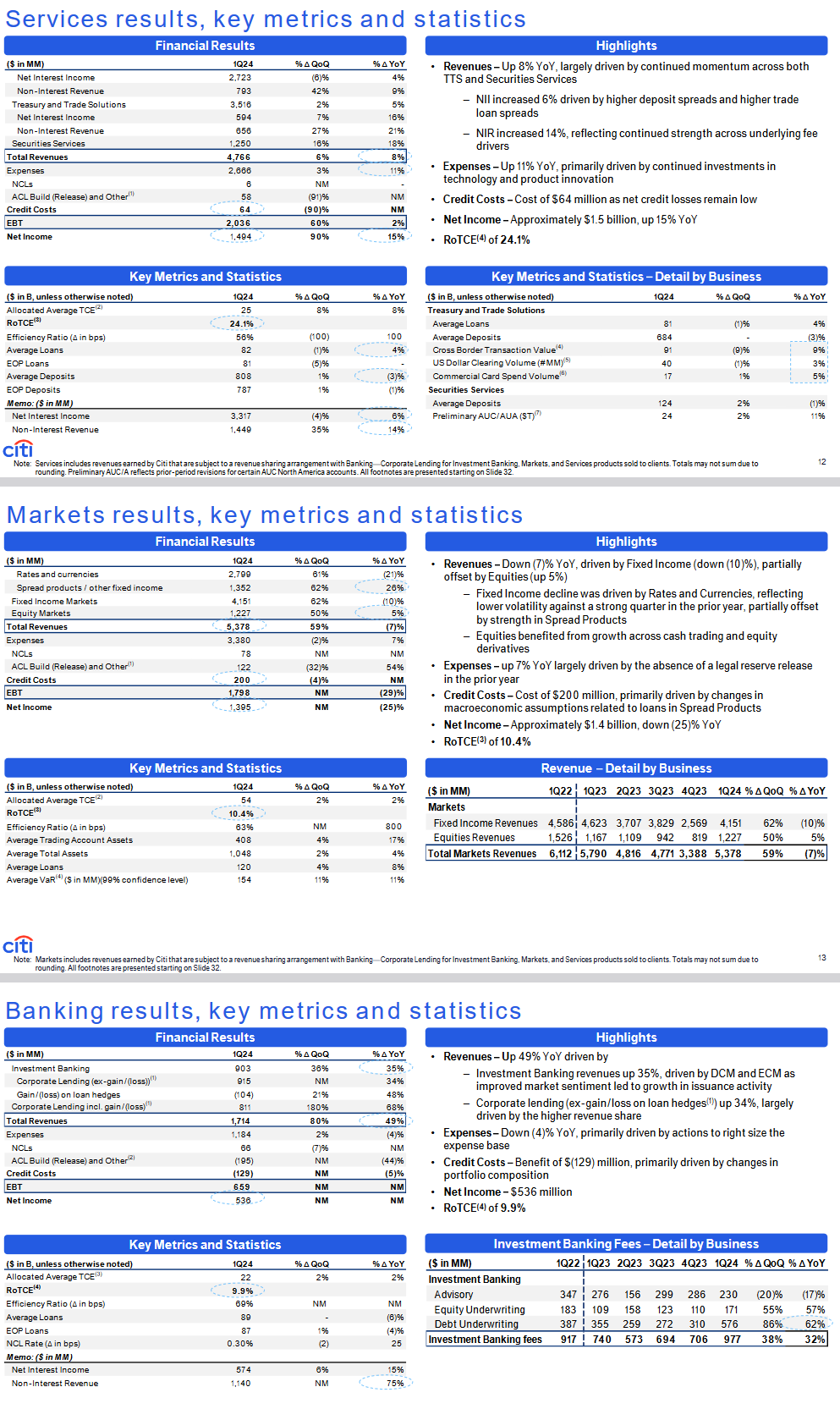

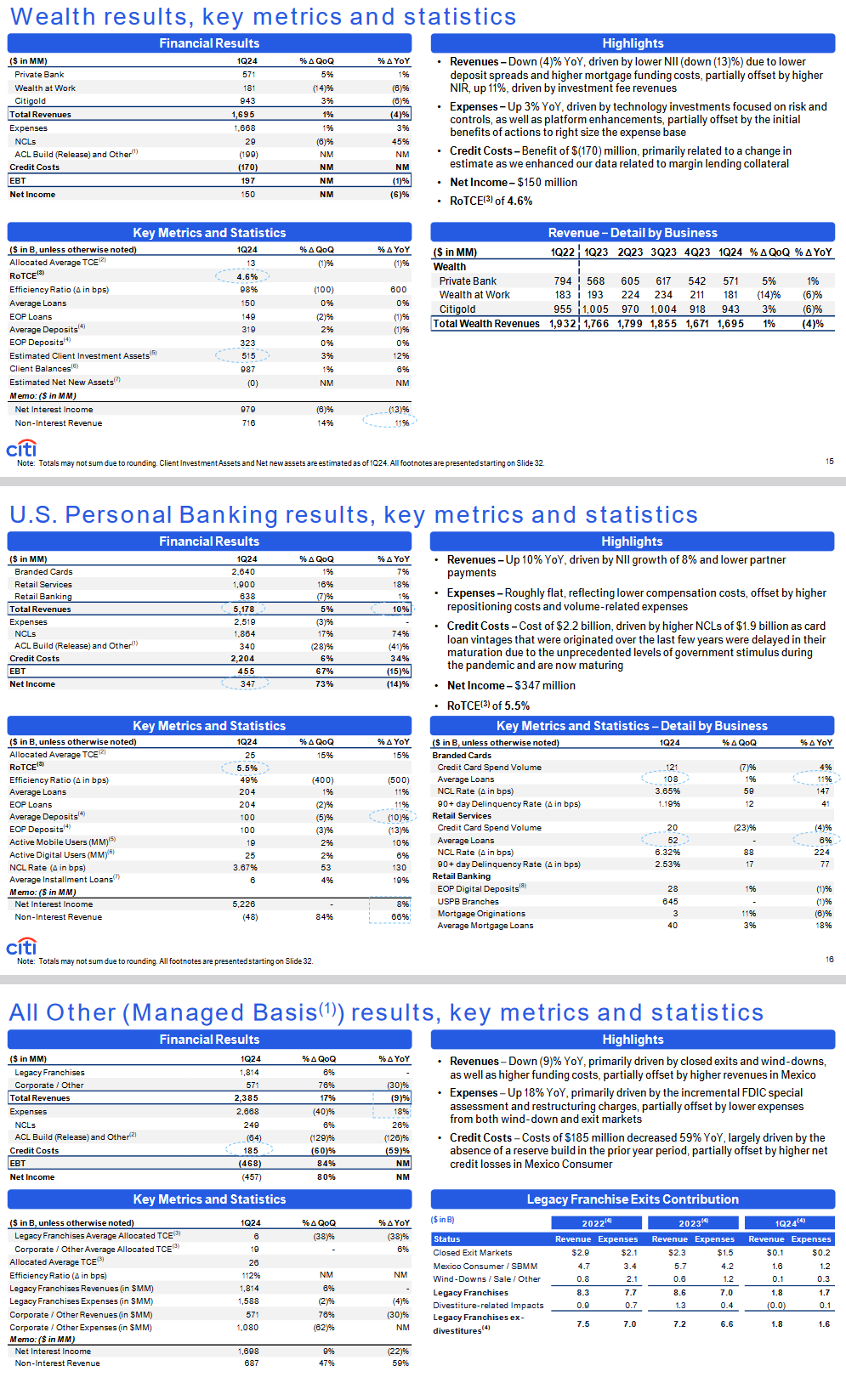

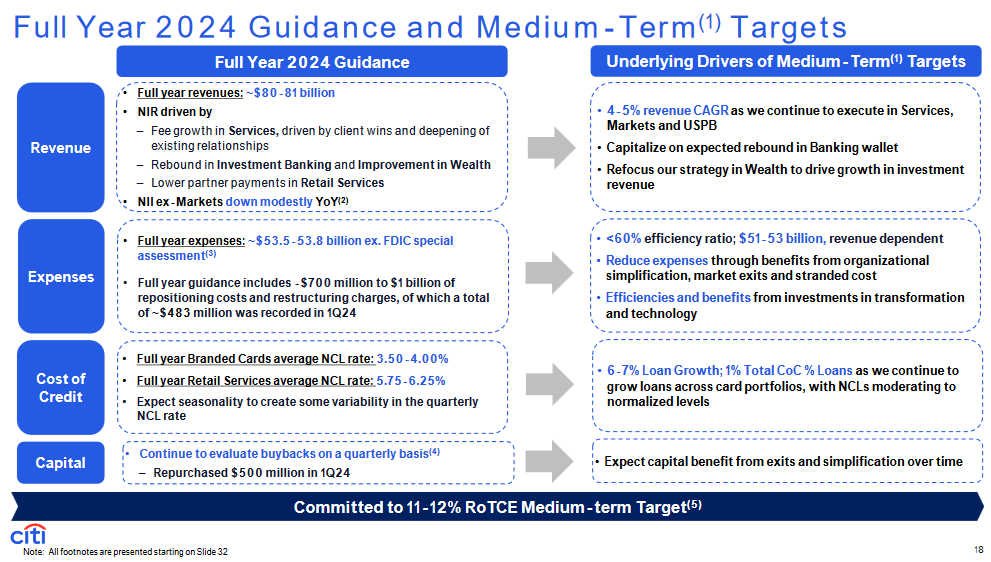

Citi Never Sleeps?

While CITI has had a nice move for us, we think it has further to go in coming years.

Here’s what Bill Nygrun of Oakmark had to say about it yesterday:

Now onto the shorter term view for the General Market:

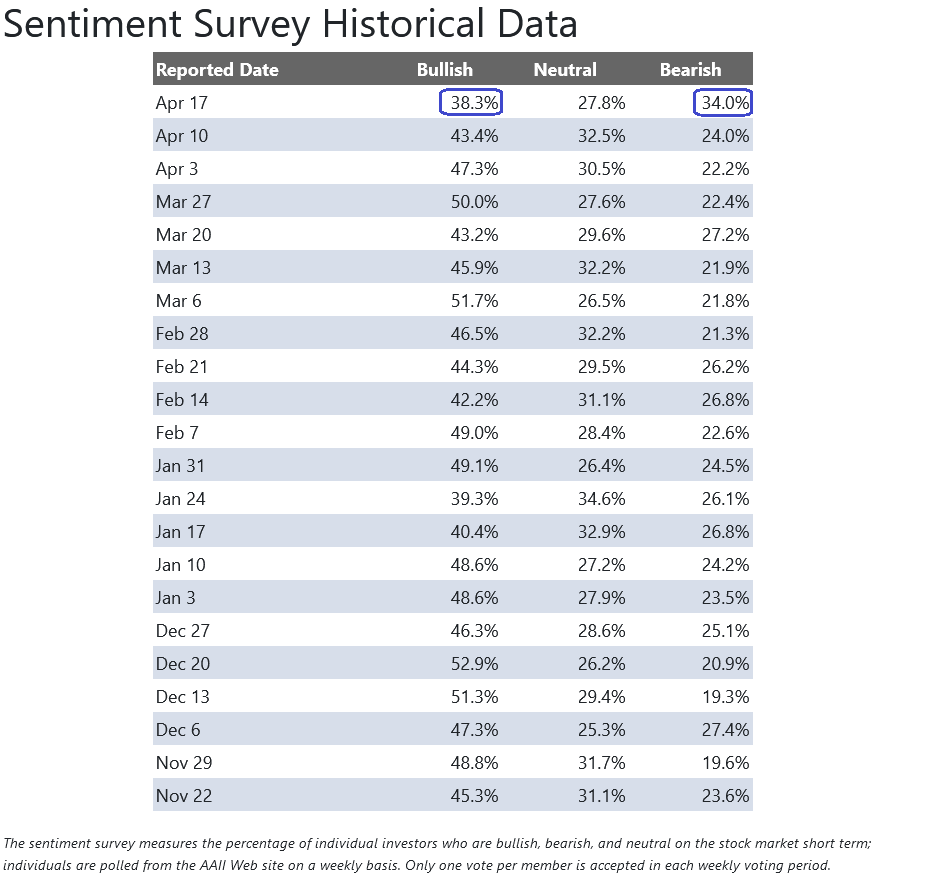

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 38.3% from 43.5% the previous week. Bearish Percent jumped to 34% from 24%. The retail investor is getting worried. “Opinion Follows Trend…”

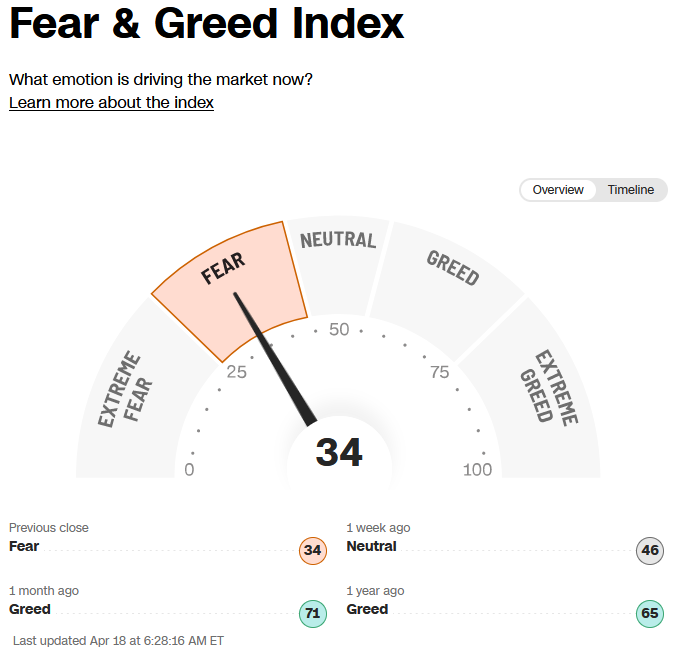

The CNN “Fear and Greed” collapsed from 54 last week to 34 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

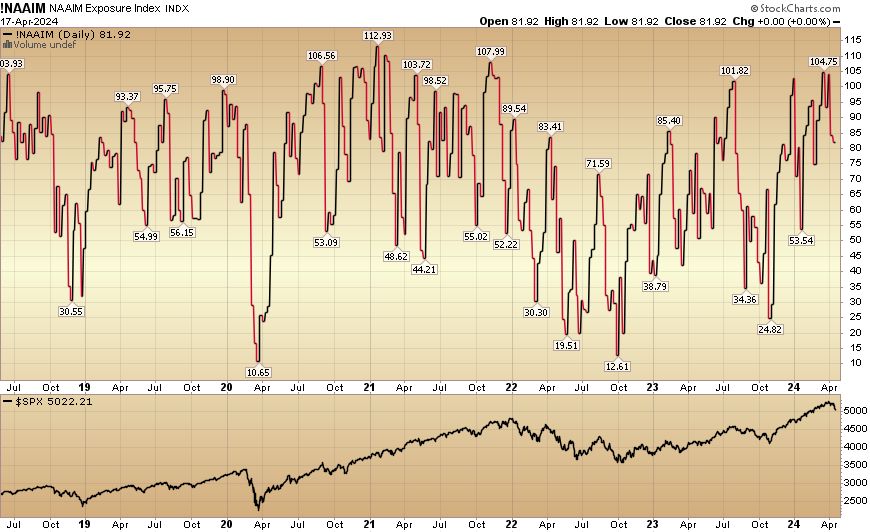

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 81.92 this week from 84.24% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 81.92 this week from 84.24% equity exposure last week.

Our podcast|videocast will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients that came in so far this year. We are now re-opened to smaller accounts $1M+ again as of last Thursday and will remain open until the end of next week (for Q2). To see if you qualify and to take advantage of this opening click here. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.