Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with ~$550B AUM. Here are the key takeaways from the survey published on April 14, 2020:

SENTIMENT:

- Bank of America’s flagship sentiment index remained pinned at 0.0, in contrarian “buy” territory. This indicator implies extreme bearishness at zero and extreme bullishness at ten.

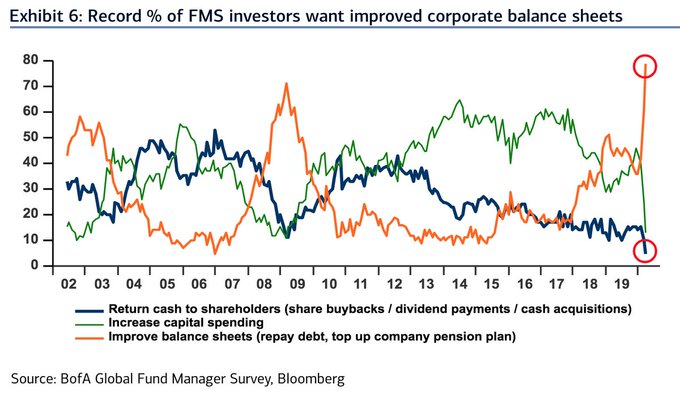

- 79% seek balance sheet improvement, highest in 20 years.

- 5% desire more buy-backs, lowest in 20 years.

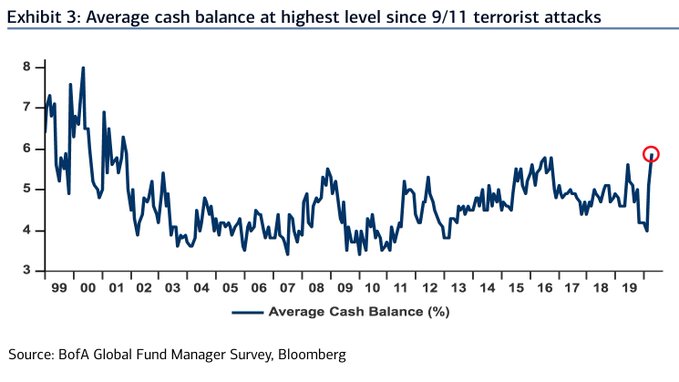

- Michael Hartnett, chief investment strategist at BofA, said he interprets the biggest move to cash since the bottom in March 2009 as “peak pessimism.”

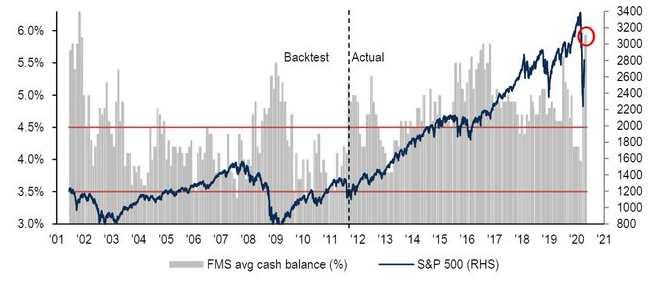

- Bank of America’s cash rule as follows: When the average cash balance rises above 4.5%, a contrarian “buy” signal is generated for equities and when it falls below 3.5%, a contrarian “sell” signal is generated.

OUTLOOK:

- 93% of survey respondents are expecting a global recession this year (two consecutive quarters of GDP decline).

- Previous peak was in March 2009, when 86% of surveyed fund managers expected a recession.

- 52% see a “U” shaped recovery

- 22% see a “W” shaped recovery

- 15% see a “V” shaped recovery

- Investors think global GDP cuts are largely over but global earnings-per-share cuts are just beginning.

POSITIONING:

- Highest cash positions since 9/11 attacks. Average cash balances of 5.9%, up from 5.1% in March and 4.0% in February.

- Allocation to stocks is at its lowest level since March 2009.

- #1 position is U.S. Treasury Bonds.

- #2 position is Cash.

- #3 position is U.S. Dollar.

- #4 position is Tech and Growth Stocks.

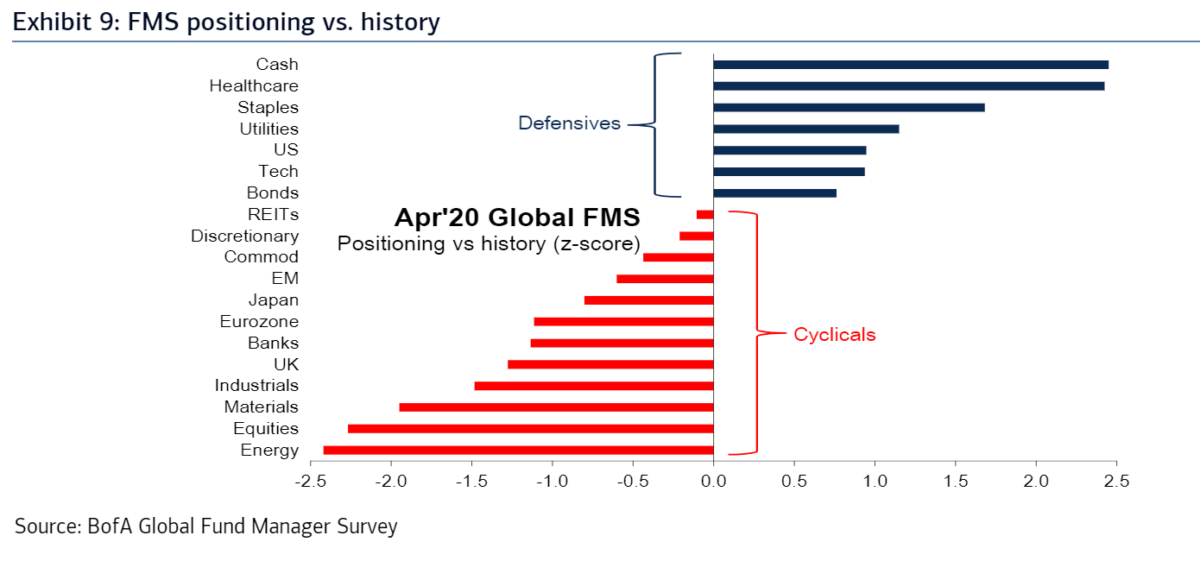

- Defensive Positioning: Staples in, Cyclicals out. Fund mangers are long cash, healthcare stocks, staples, utilities, US tech and fixed income and are underweight energy, materials, industrials and banks.

MOST CROWDED TRADE:

- U.S. Treasury Bonds

BIGGEST TAIL RISKS:

- 57% see second wave of coronavirus infections as the top danger.

- 2nd biggest fear is a systemic credit event – 30% of respondents.

- Spike in the U.S. dollar in advance of a credit event (Emerging Markets/Euro Zone/Energy credit) would be a downside catalyst to growth stocks.

- Further collapse in the energy sector.

- Fund managers believe that credit default risk poses the biggest threat to financial markets.

UPSIDE CATALYSTS:

- A COVID-19 vaccine is the biggest bull catalyst for distressed cyclicals (key for V shaped recovery).

- China Credit Growth.