~200 Managers overseeing $500B AUM responded to this month’s BofA survey.

OUTLOOK:

- 79% expect stronger economy. Highest since 2009.

- Net 57% of polled respondants want companies to improve balance sheets instead of expanding capex.

- Just 17% forecast a quick, V-shaped economic recovery

- 37% expect a W-shaped recovery that will come in stages.

- 31% expect U-shaped recovery that will take time.

- Respondents expect a vaccine announcement in Q1 2021.

- 57% expect higher profits in the next year. Up 21 percentage point and highest level since March 2017.

- A net 43% of investors said climate change is the ESG theme that will “outperform most” over the next year.

- Inflation expectations rose 15 percentage points (net 52%) of respondents expecting a higher global CPI.

- Global stocks have rebounded just over 50%, adding ~$24 trillion in value in five months.

- “Peak Policy” theme expected to cause September volatility – but needs disorderly rise in rates to manifest.

- Managers expect 10-year Treasury yield lower than 0.5% by year-end.

SENTIMENT:

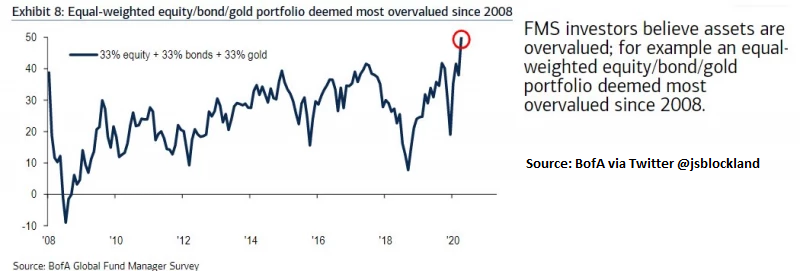

- Respondents see an equal-weighted portfolio of equities, bonds and gold as the most overvalued since 2008.

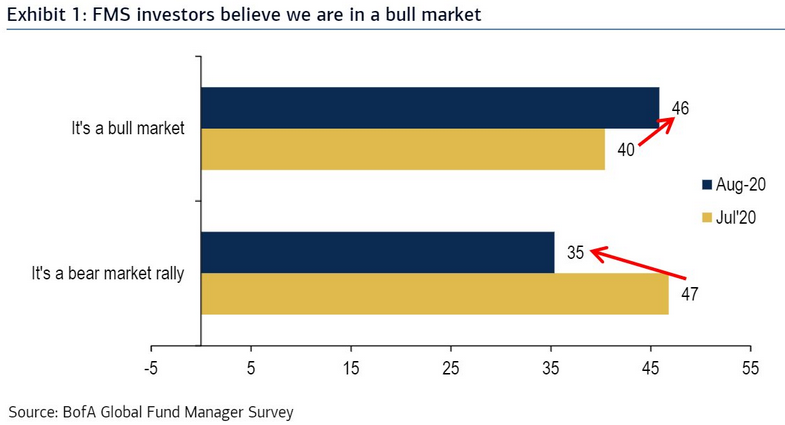

- 46% now see equities as in a bull market compared to 40% in July.

- 35% say it’s a “bear market rally” versus 47% in July.

- BofA Bull & Bear Indicator up to 3.7 (far from excessively bullish).

- 31% say gold is overvalued – highest percentage since 2011.

- More than a third of investors believe the time to be bearish over.

POSITIONING:

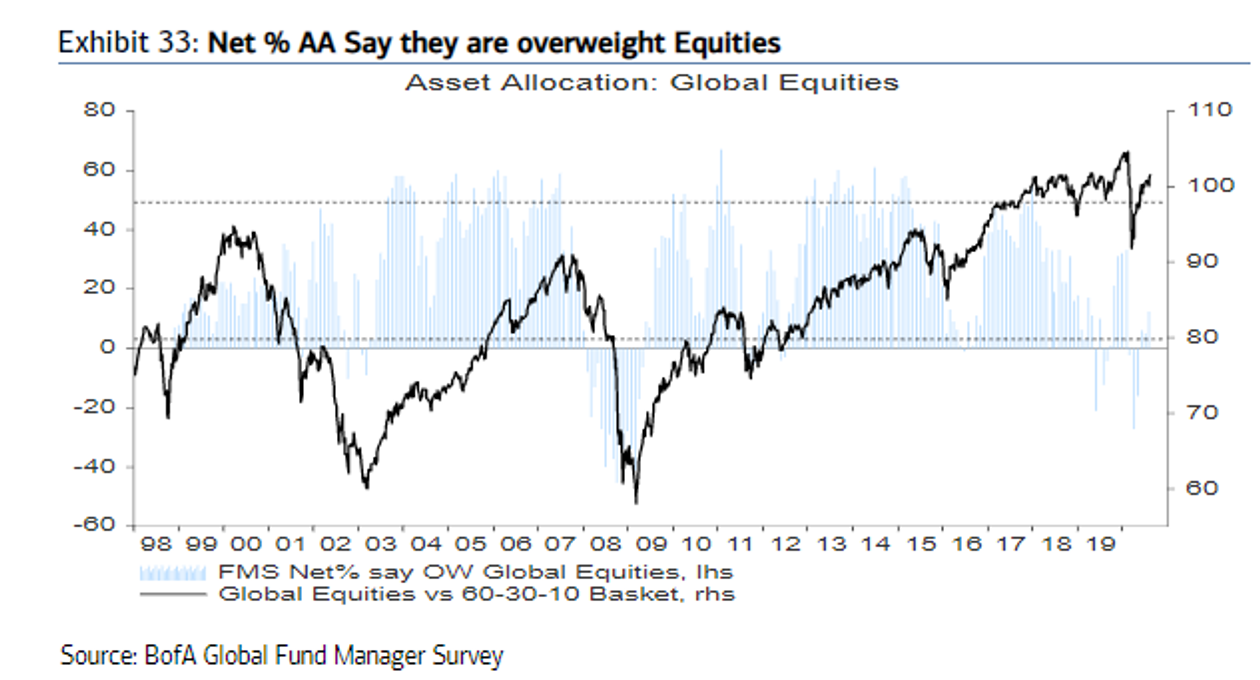

Net 12% were overweight Global equities. Up seven percentage points since July.

Net 12% were overweight Global equities. Up seven percentage points since July.- Not “dangerously bullish” according to BofA.

- U.K. stocks remain the top regional underweight.

- Cash allocation fell 6% to net 26% overweight versus last month.

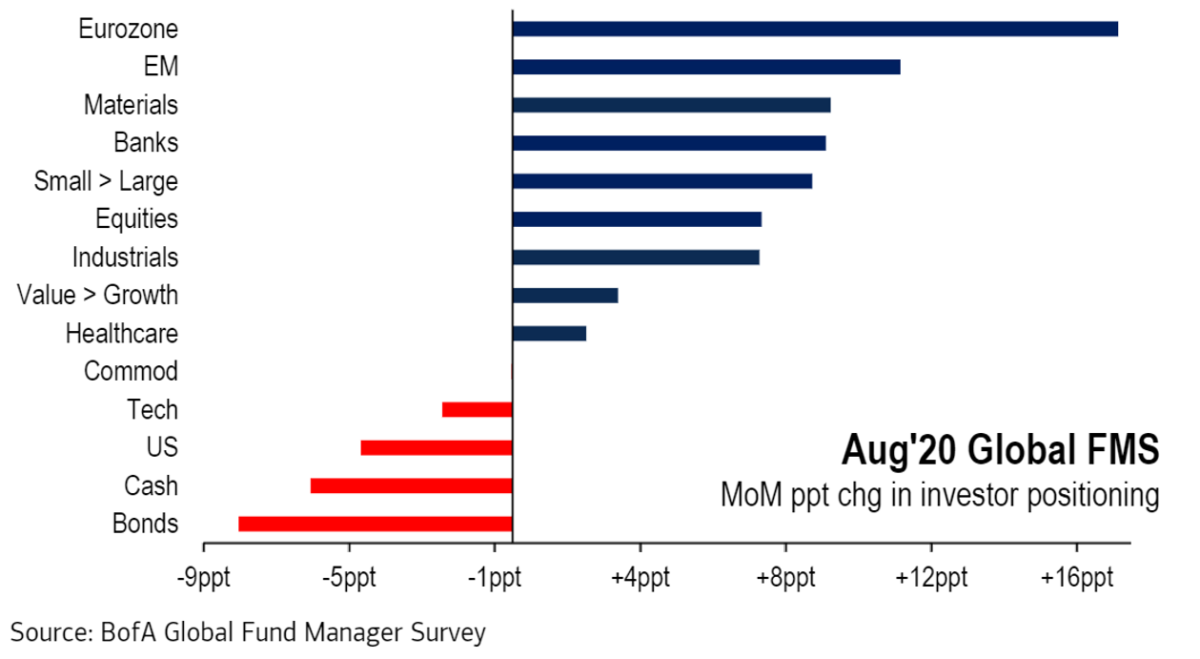

- Rotation toward euro-area and emerging-market equities.

- Eurozone is now the most popular equity region among the poll’s investors: Allocation increased 17 percentage points to a 33% overweight. This is the highest since Spring 2018.

- Emerging Market equities rose 11 percentage points to (net 26% overweight).

- Exposure to U.S. stocks declined 5 percentage points (net 16% overweight).

- Allocation to US, UK and Japanese equities all fell by 5 percentage points or more.

- Cash levels down to 4.6% but in neutral range (<4% = greed, >5% = fear)

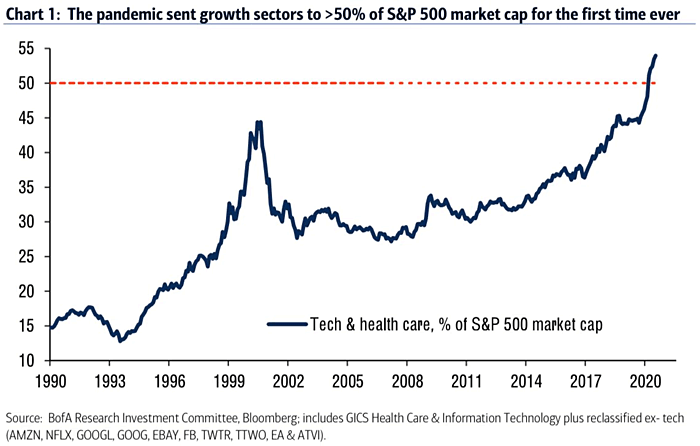

- Asset allocation remains “stubbornly” skewed towards Healthcare, US, Tech, Cash and Short Energy.

- Investors adding Eurozone and emerging-markets stocks as the dollar weakens.

- Banks, Materials and Small Caps were more in demand as bonds, cash, U.S. and Tech showed less demand than previous surveys.

- Commodities allocation remained at its highest level since July 2011 (net 12% overweight).

- Real Estate reversed its net underweight positioning, increasing to (net 1% overweight) for the first time in four months.

- Passive investing is down a bit. 22% of investor AUM was allocated to ETFs, dropding one percentage point from last month.

- Fewer investors intend to increase Passive exposure, down seven percentage points to 10%. This is the lowest level since July 2019.

- Managers expect to rotate their investments into Europe, Emerging Market Equities, Banks, Small-Cap and Value Stocks.

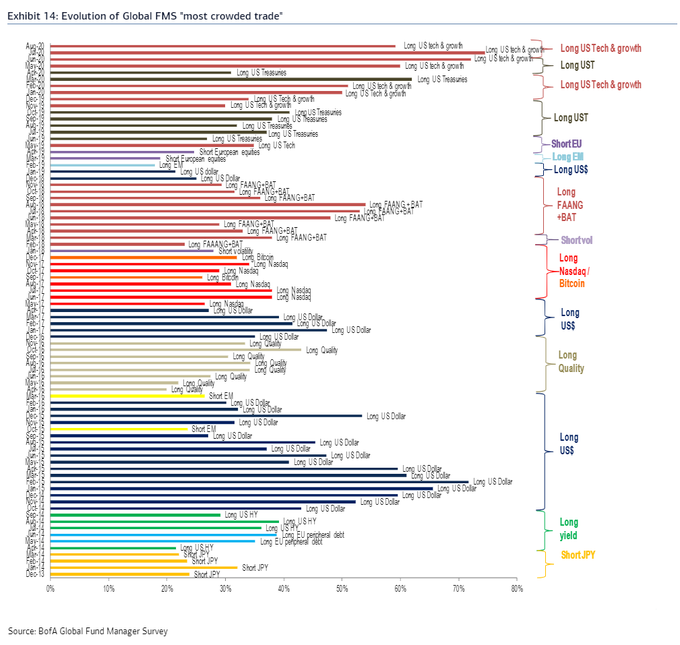

MOST CROWDED TRADE:

Source: BofA via Twitter @jsblokland

- Long US tech (59%)

- Long gold (23%)

- Long corporate bonds (8%)

BIGGEST TAIL RISKS:

1. Second wave of Covid-19. (35%)

2. U.S.-China trade war. (19%)

3. U.S. election/Blue Wave. (14%)

4. “Credit Event.” (13%)

CONTRARIAN TRADES:

- Contrarian risk on/vaccine and higher rates trade (BofA): Long Small-Caps and Short tech.

- Net 70% of respondents thought the Senate flipping to Democratic control was a “risk off” signal that would best be played by shorting health care stocks.