Key Market Outlook(s) and Pick(s)

On Wednesday, I joined Cheryl Casone on Fox Business “Claman Countdown” to discuss markets, outlook, and more. Thanks to Cheryl and Brooke Haliscak for having me on:

On Wednesday, I joined Julie Hyman on Yahoo! Finance for the full hour to discuss markets, picks, and outlook. Thanks to Julie and Justin Oliver for having me on:

MoneyShow

Over the weekend I had the privilege to speak at the legendary 4 decade+ MoneyShow in Miami, FL. Thanks to Kim Githler, Debbie Osborne, Mike Larson and Aaron West for inviting me to speak.

Part 1: “Value vs Growth, US vs International” Panel

This was an excellent panel to kick off the weekend. We covered a lot of great topics, from the long-term outperformance of value and ZIRP’s impact over the past ~15 years, to how value and growth are often joined at the hip. We also touched on how U.S. vs. international outperformance tends to play out in cycles, among much more. Give it a listen here:

Part 2: “2H Stock Market Outlook and 3 Ways to Play Housing Recovery”

This was my keynote presentation, and we covered a lot of important topics. We went over our #1 theme entering 2025, “Last Shall Be First,” how it’s played out so far, and more importantly, our #1 theme heading into the second half of the year: Housing. We touched on the near-term catalysts we see on the horizon—whether it’s opening federal lands for starter homes, peak millennial demographics, or a lower 10-year yield—and pitched our top three pick-and-shovel plays to express the theme. Check it out below:

Click HERE to follow along with Slide Deck

Part 3: “How the Uninvestable Became Investable”

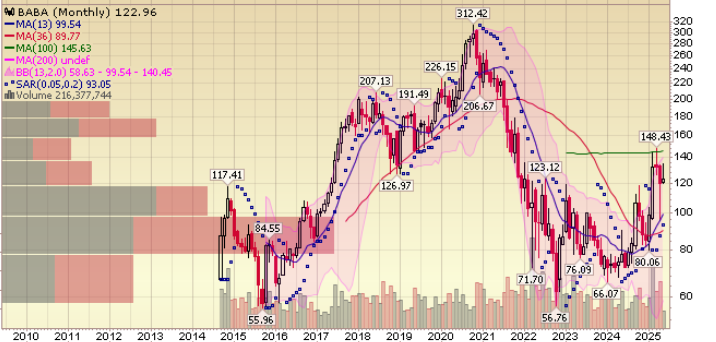

This was my third and final presentation of the weekend, and we got to cover one of our favorite topics: China and Alibaba. We looked back at previous times when sectors or asset classes were labeled “Uninvestable,” whether it was energy during the pandemic (XOM), big tech in 2022 (AMZN and GOOG), or financials after the mini banking crisis in 2023 (VNO, BAC, and C) — all incredible buying opportunities. Then we turned to today’s biggest “Uninvestable” opportunity: China, why we believe that’s about to change, and our #1 Chinese pick, Alibaba. Give it a listen below:

Click HERE to follow along with Slide Deck

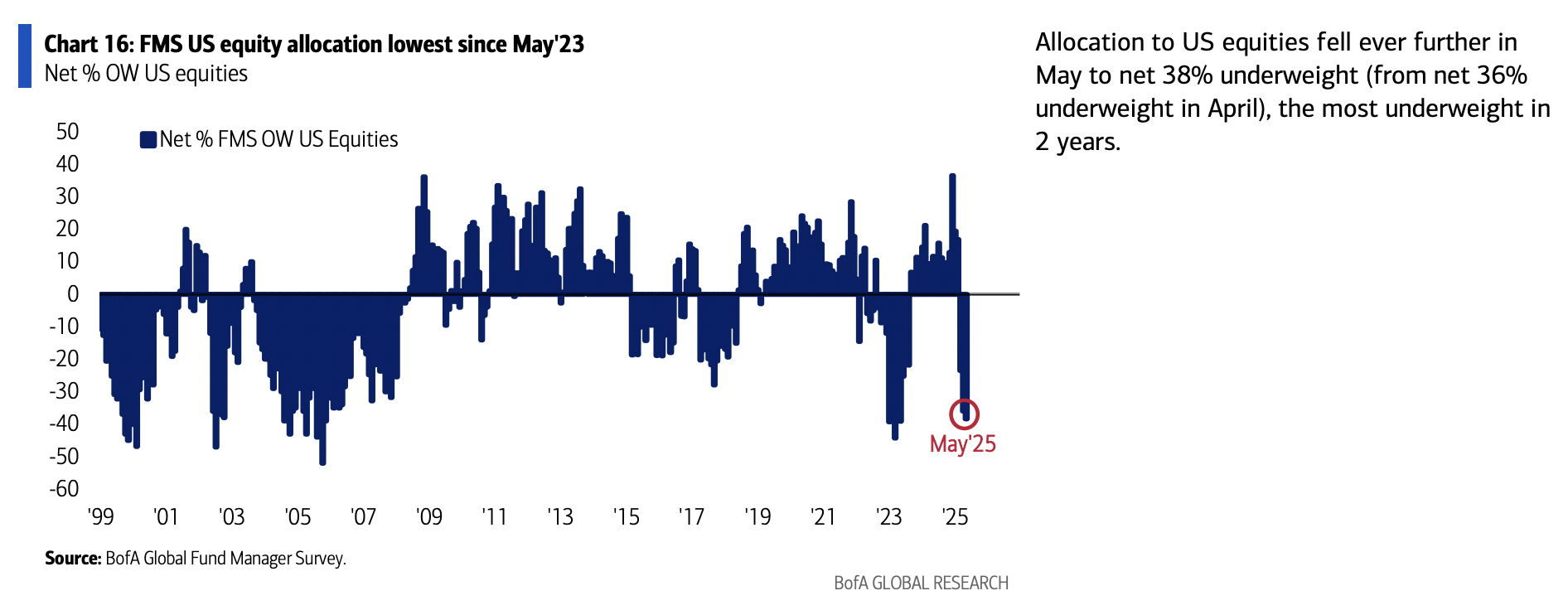

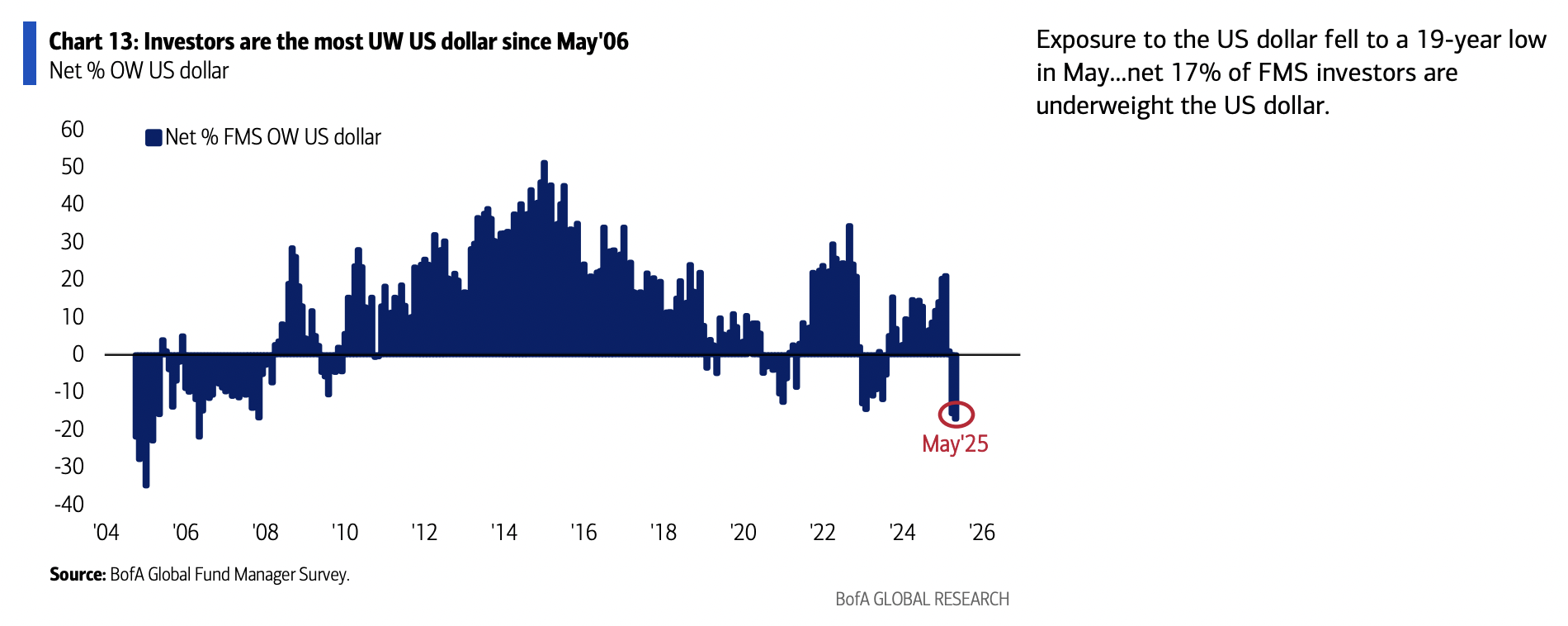

Bank of America Fund Manager Survey Update

On Friday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed 208 institutional managers with ~$522B AUM:

May 2025 Bank of America Global Fund Manager Survey Results (Summary)

Here were the 5 key points:

1) US equity allocation is now at its lowest since May 2023, with a net 38% underweight.

2) Managers are the most underweight the US dollar since May 2006, with 17% of investors holding a net underweight position.

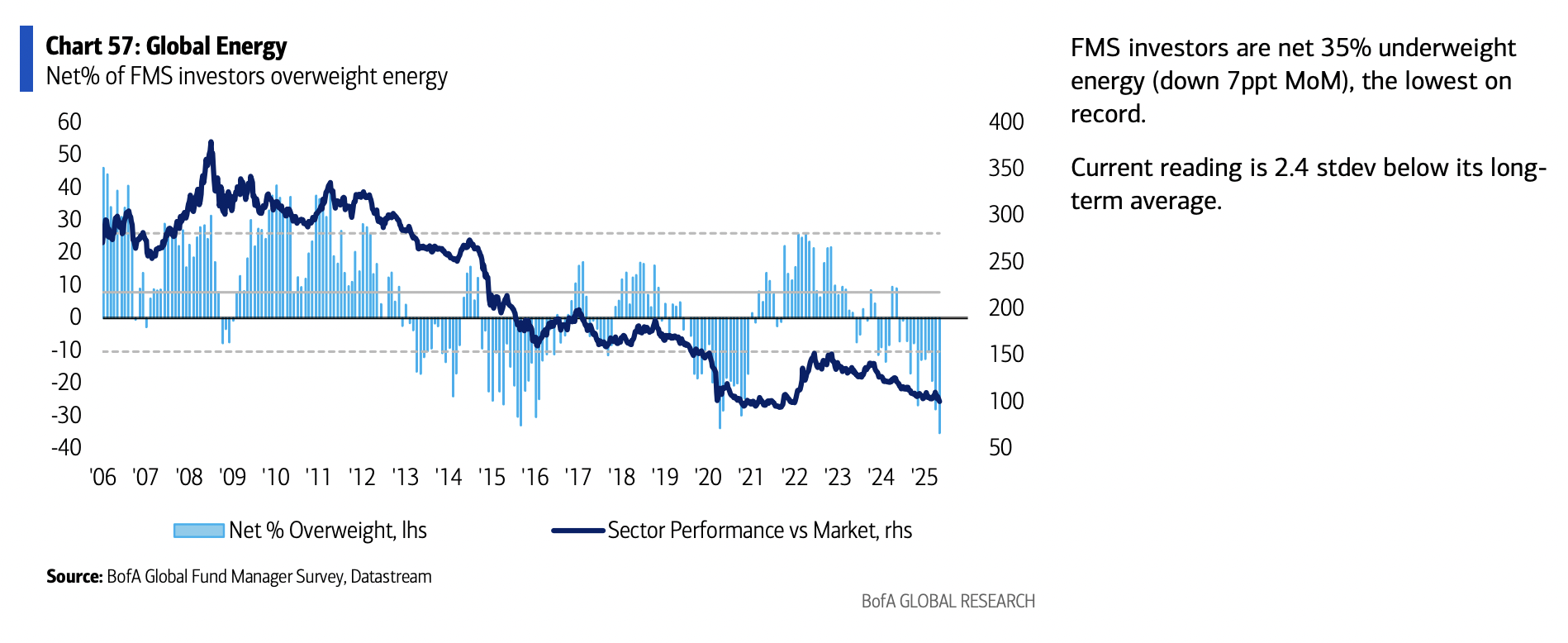

3) Nobody wants to touch Energy, with managers at a record low net 35% underweight the sector.

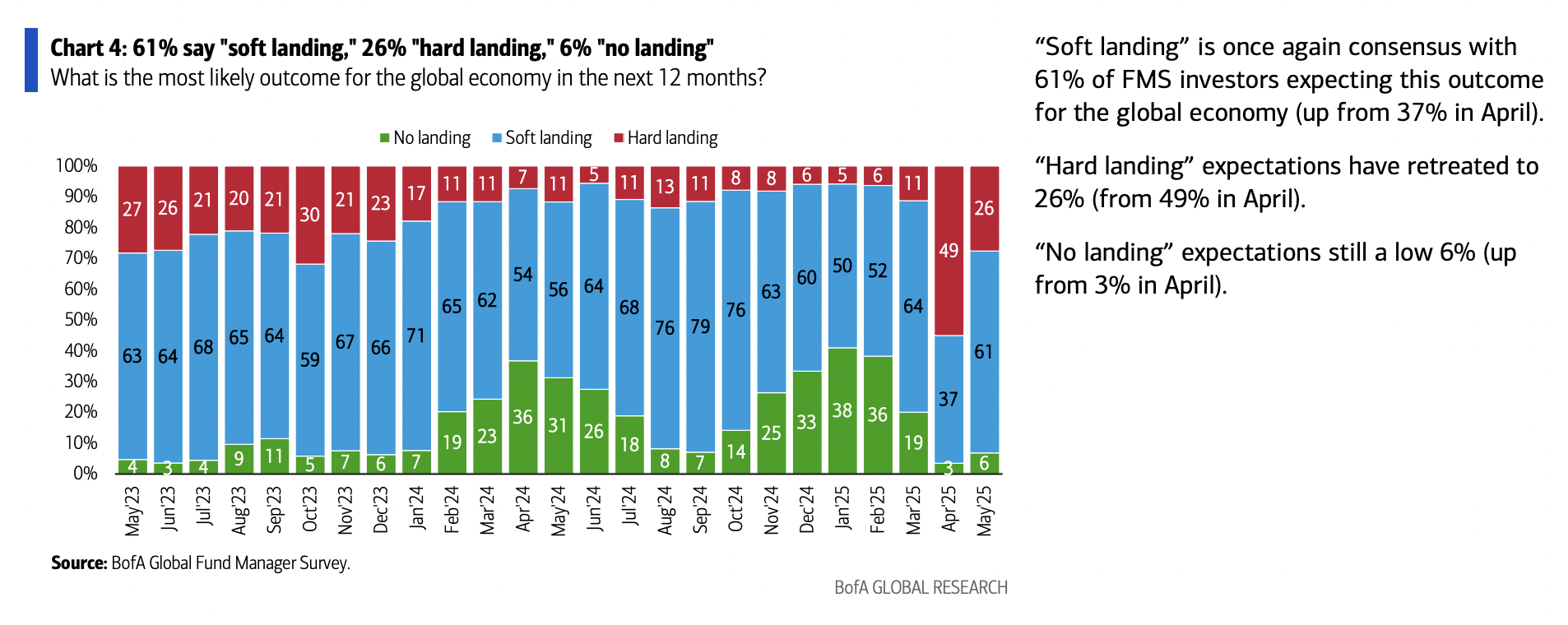

4) Expectations for a “soft landing” rebounded to 61%, up from just 37% in last month’s survey.

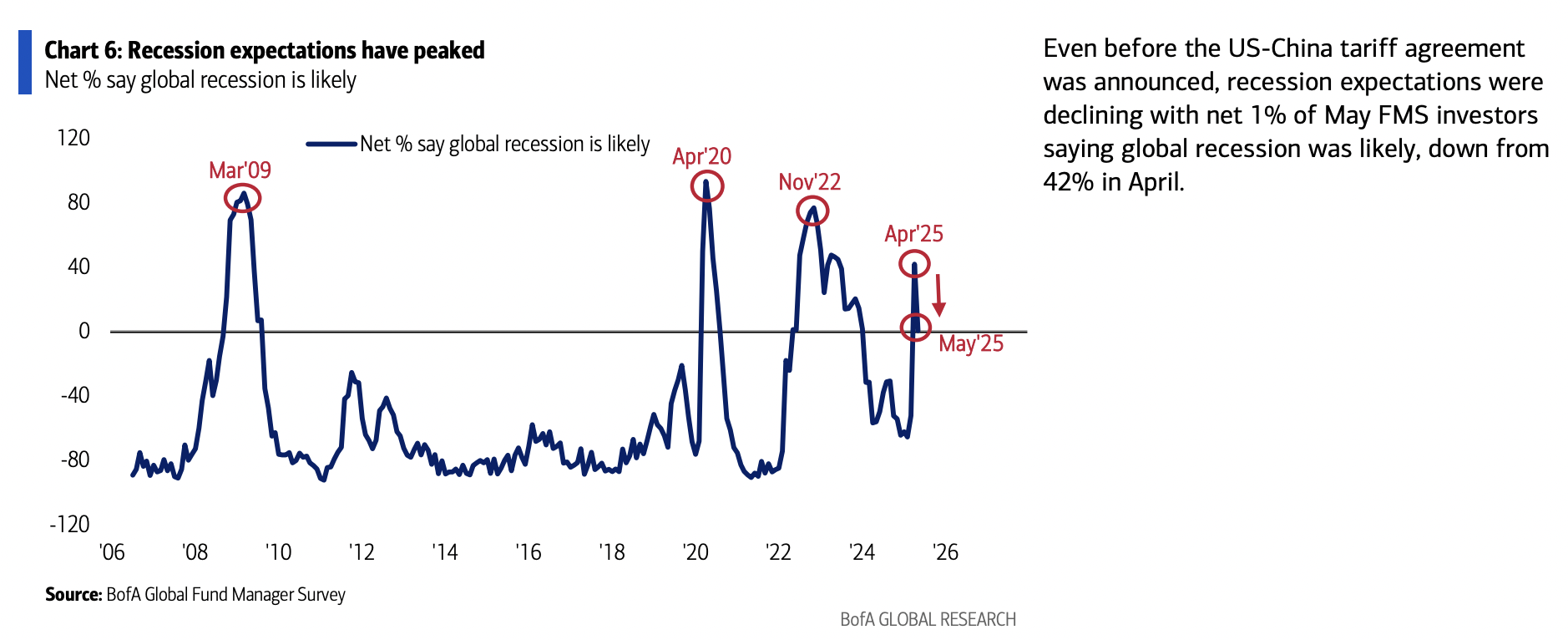

5) Recession expectations appear to have already peaked, even before the US-China tariff agreement was announced. Only 1% of May FMS investors now say a global recession is likely, down from 42% in April.

Alibaba Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

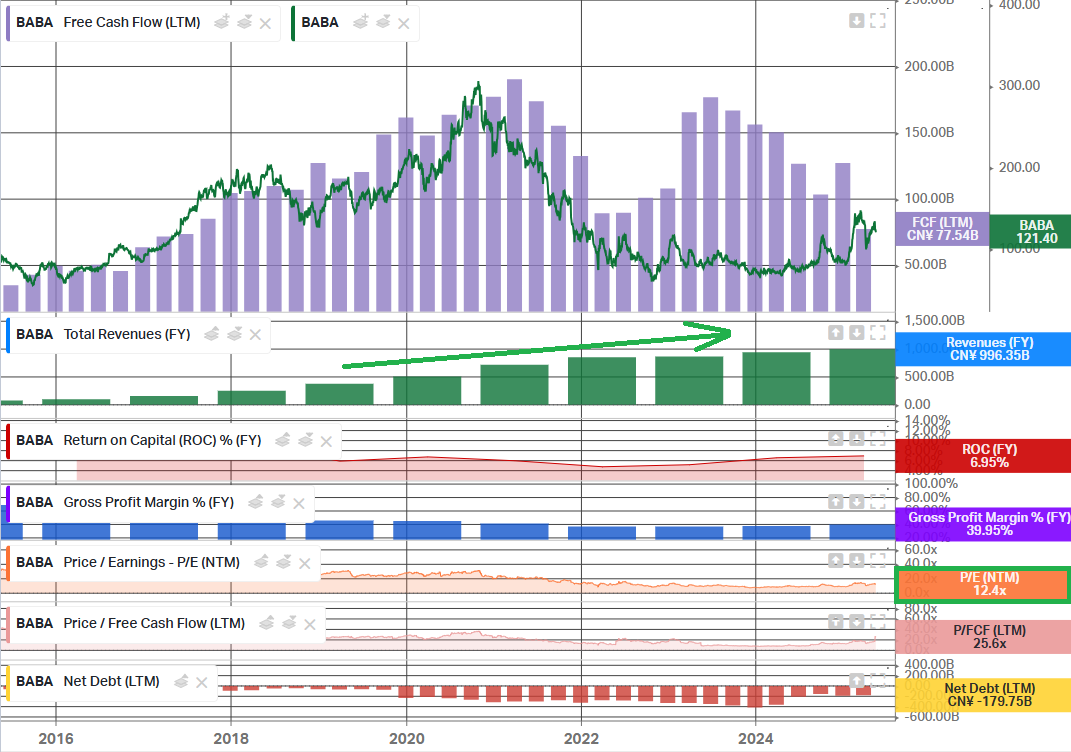

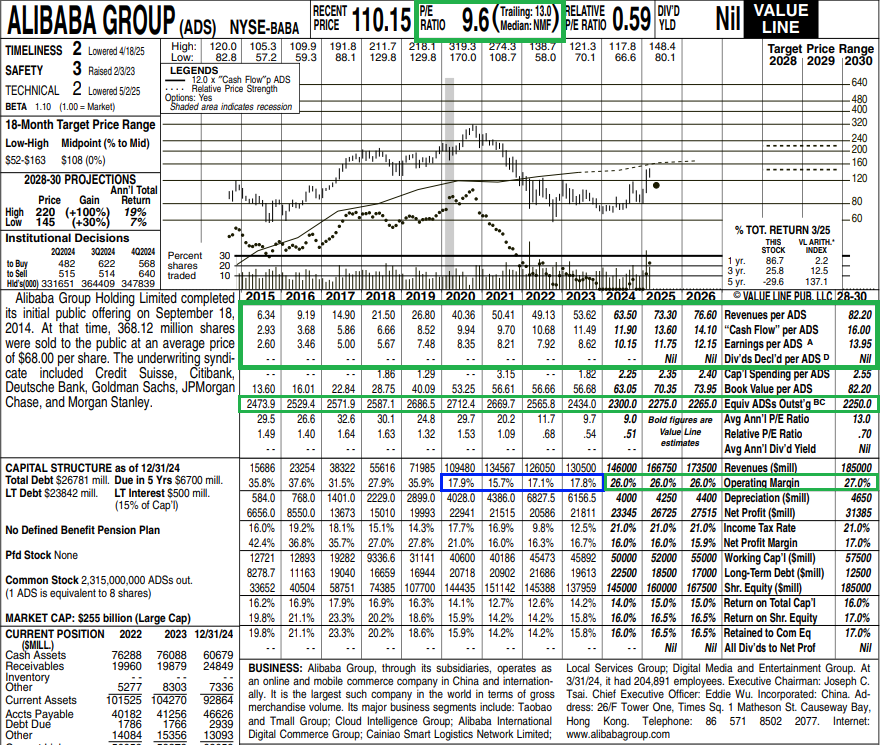

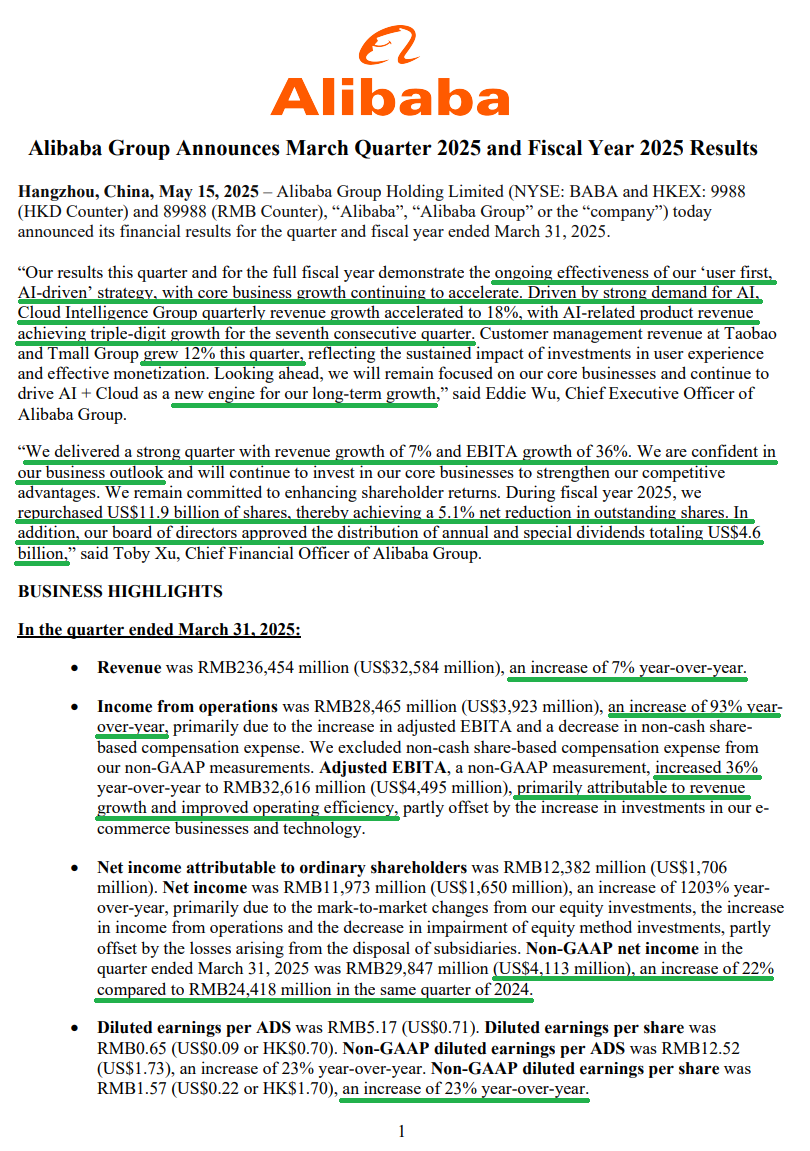

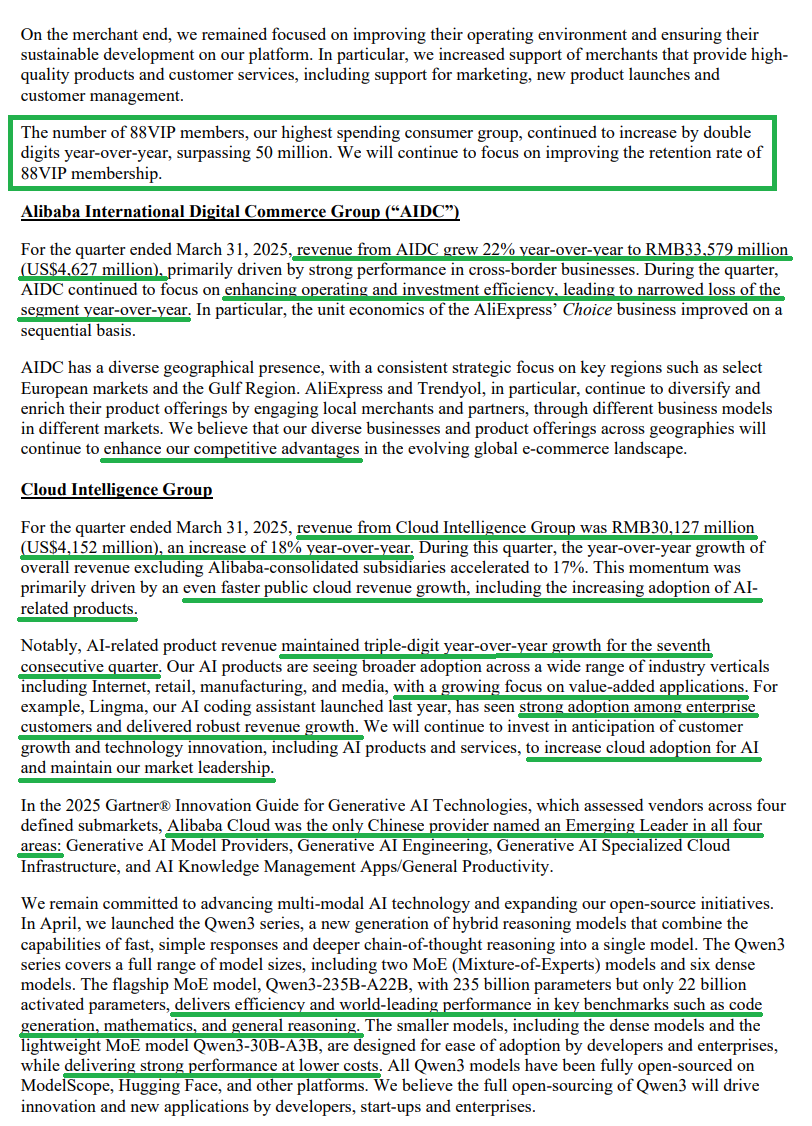

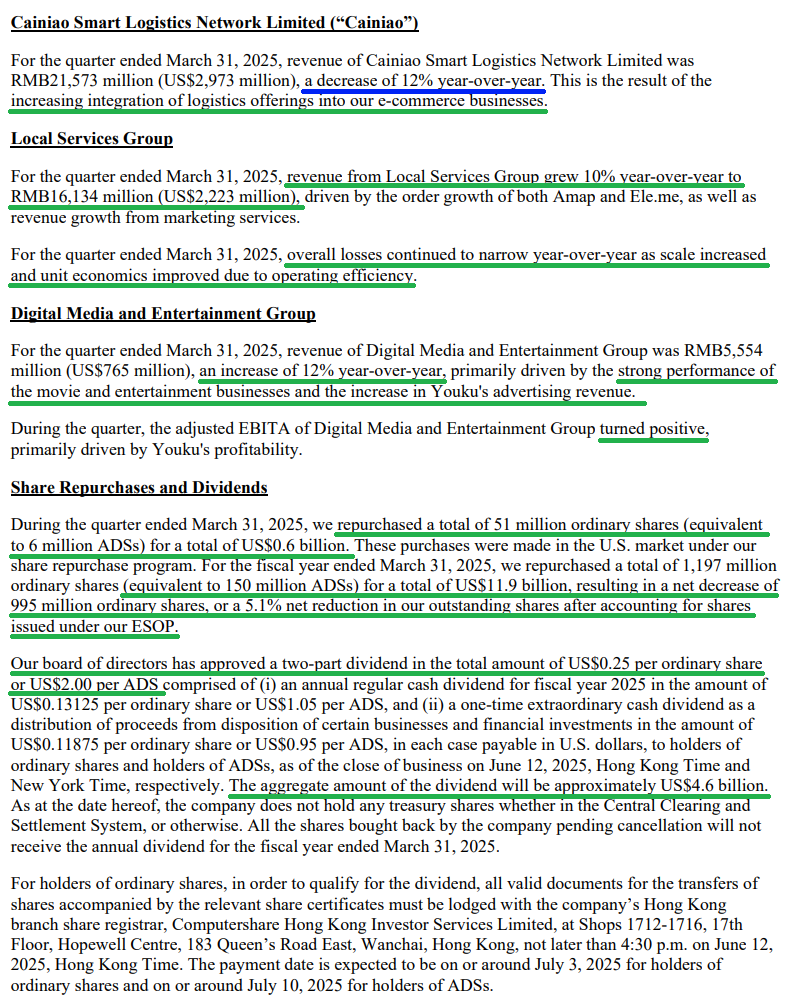

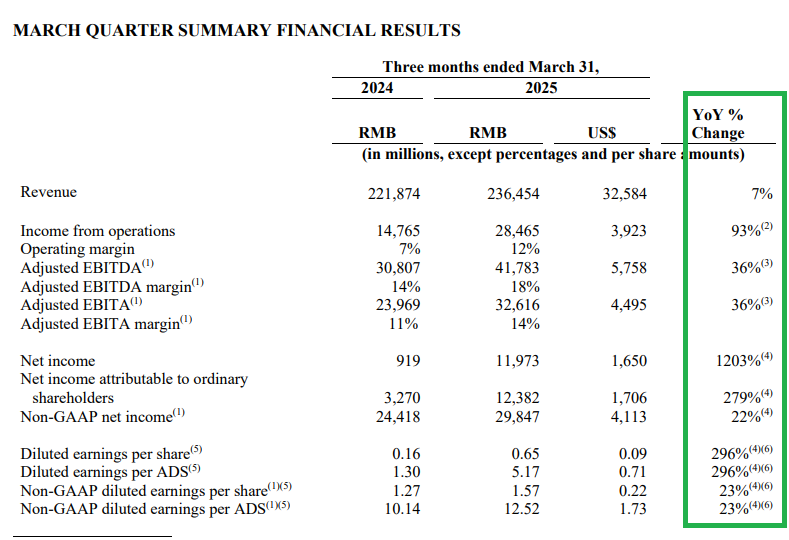

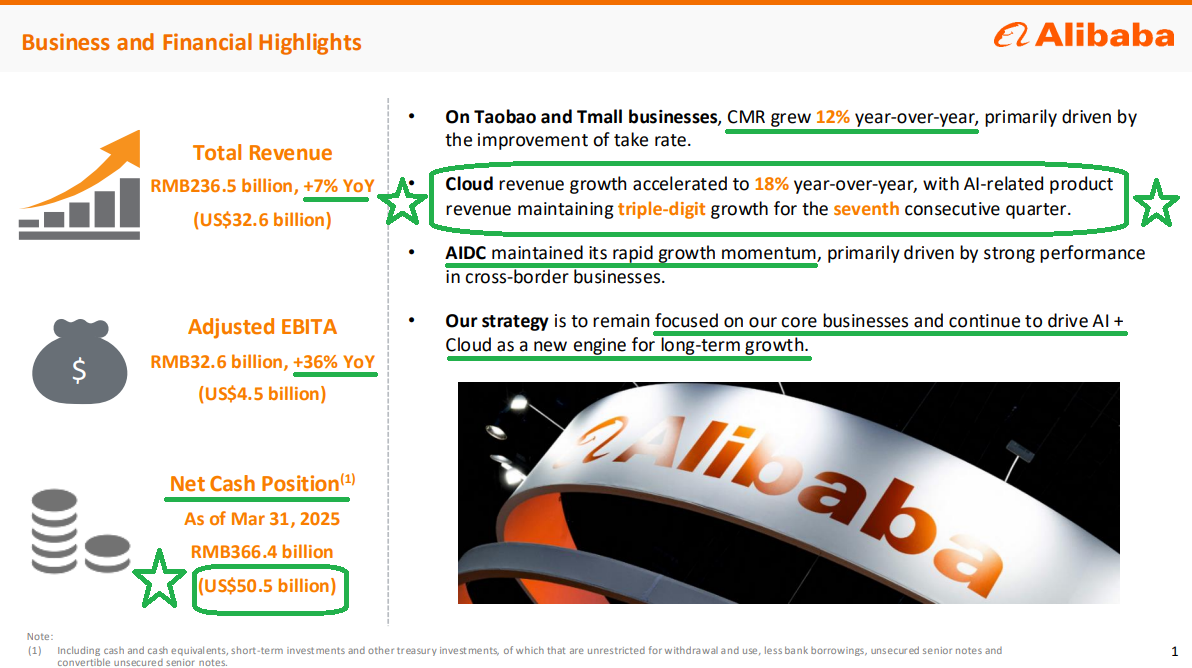

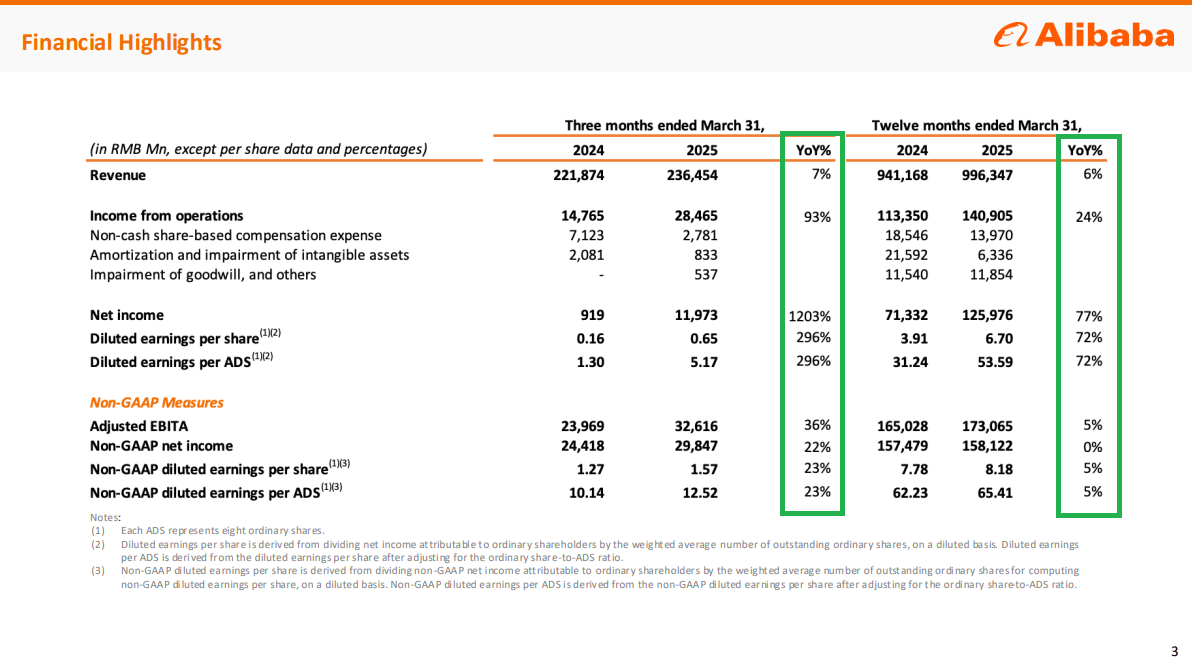

Alibaba reported Q4 earnings last week, with revenues of $32.58 billion roughly in line with estimates of $33.01 billion, while EPS of $1.73 came in just below the $1.76 consensus. The market reacted with the typical knee-jerk selloff to the “disappointing” quarter.

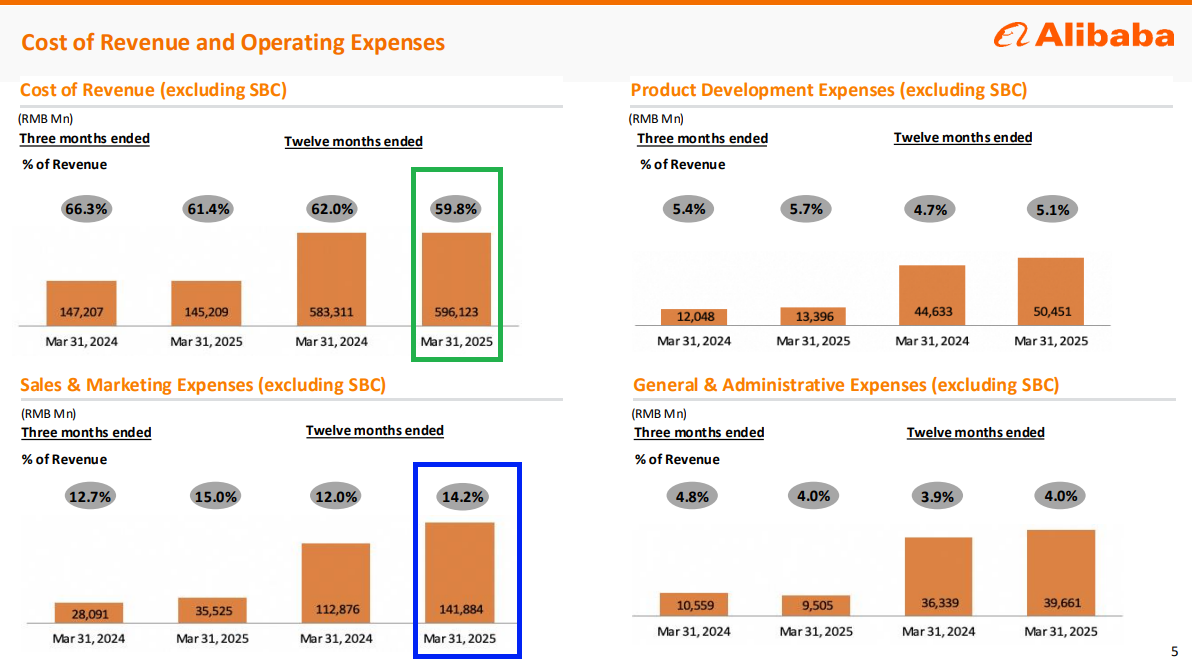

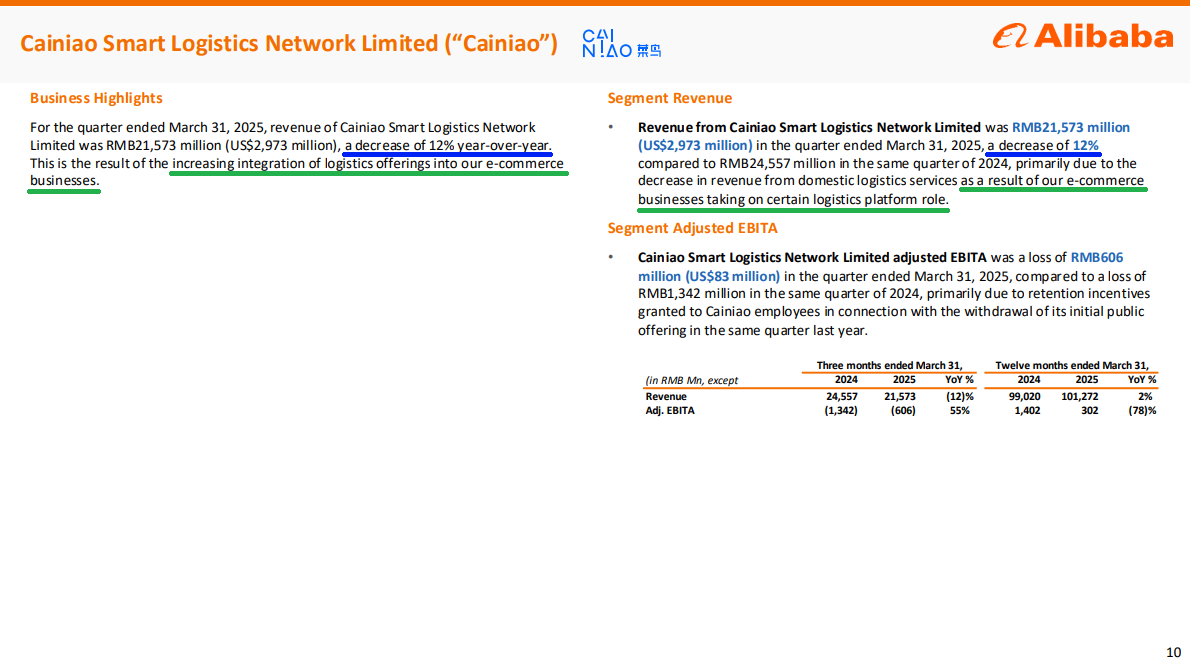

This was a textbook example of “short term voting machine, long term weighing machine.” To be clear, the quarter wasn’t perfect — ramped-up investments in cloud infrastructure and instant commerce weighed on profitability, and segments like AIDC and Cainiao came in softer than expected — but that’s all mostly short-term noise.

The core thesis of our Alibaba investment has always been that they are 1) a proxy for Chinese AI, and 2) the toll taker of the middle-class recovery and pivot toward consumption. Both of these growth engines were on full display this quarter.

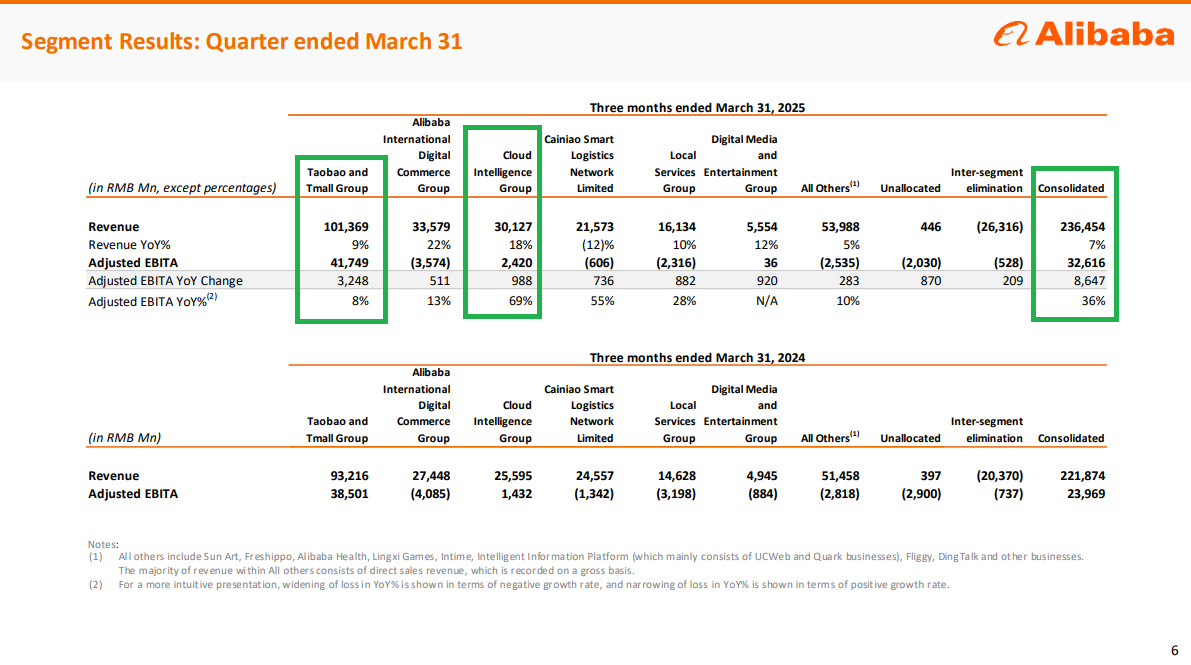

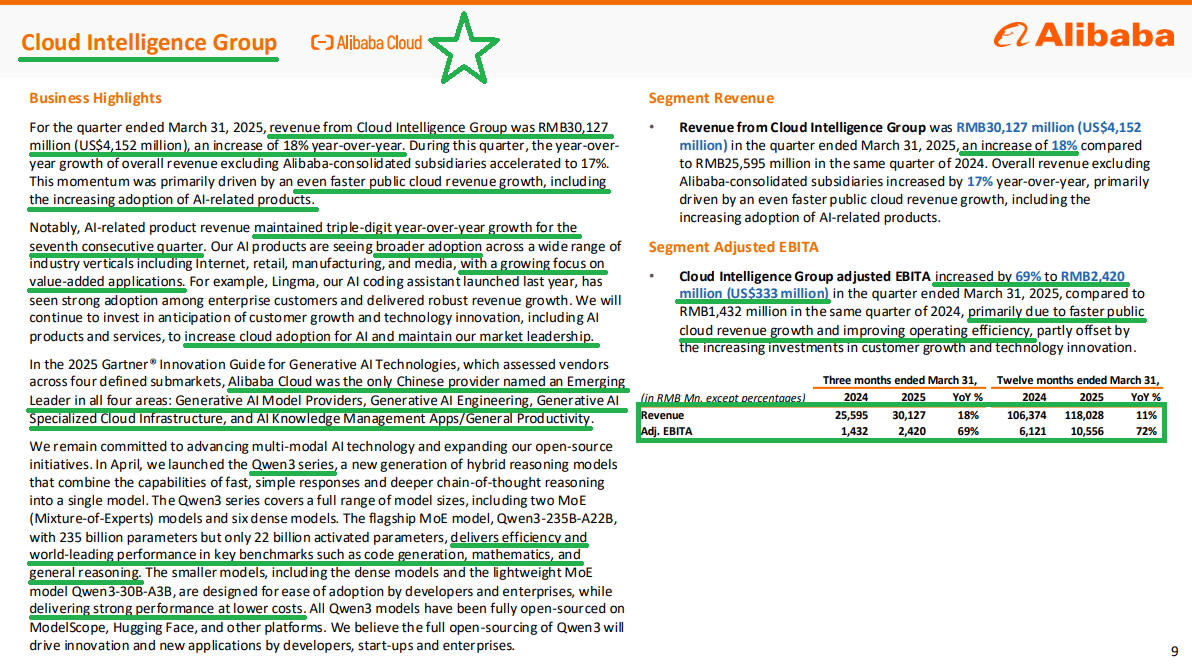

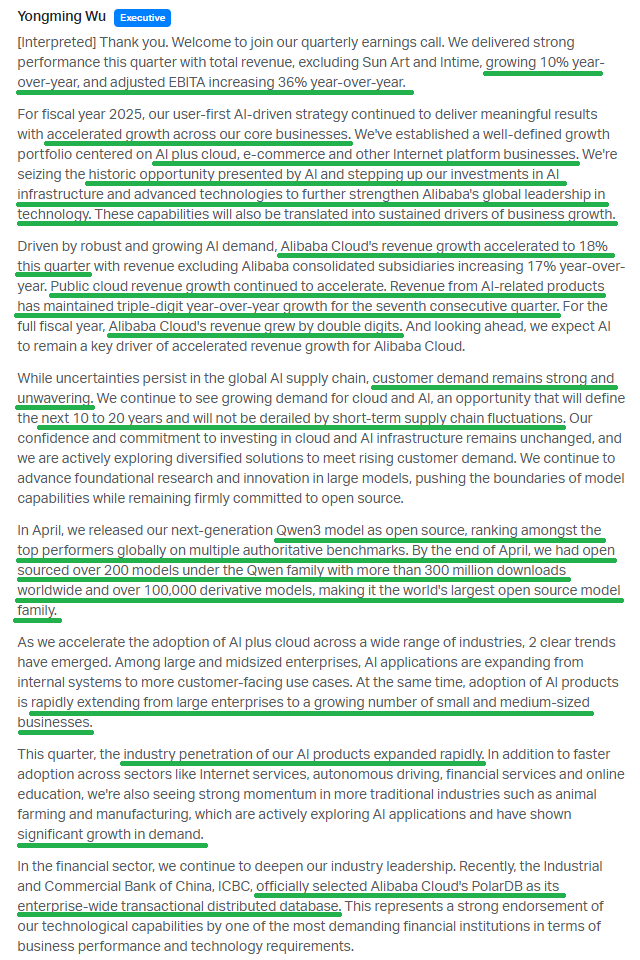

The cloud segment saw its fastest growth since 2022, up 18% year-over-year to $4.15 billion, with AI-related product revenue maintaining its seventh consecutive quarter of triple-digit year-over-year growth.

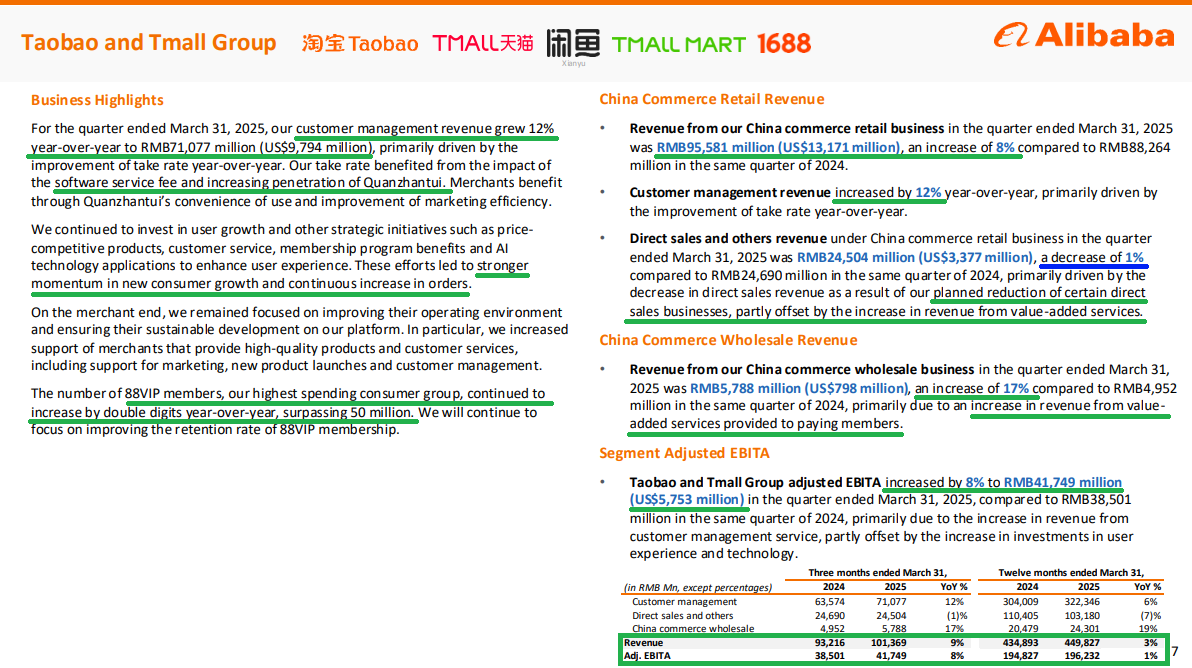

Taobao and Tmall crushed it during the quarter, posting 9% year-over-year revenue growth to $13.97 billion, driven by customer management revenues up 12% year-over-year.

Most importantly, both segments are expected to continue accelerating in fiscal year 2026, and as long-term shareholders, this is exactly what we want to see.

Part of what makes Alibaba so unique is that it is essentially the only company in the world, let alone China, to have both 1) a market-leading cloud position and 2) a market-leading in-house large language model (LLM).

Amazon has done incredibly well with AWS but lacks an in-house LLM.

Meta has a strong LLM position with Llama but doesn’t offer cloud services.

Microsoft holds strong cloud market share with Azure but outsources or partners with OpenAI for its LLM.

The only other company that somewhat has both is Google, but it is not a true market leader in cloud, holding a smaller #3 position.

Then there’s Alibaba, the #1 market leader in China with 36% cloud share and the Qwen3 model, which is the world’s largest open-source model family and a top performer globally, all developed at a fraction of competitors’ costs. This business model is incredibly powerful. Anyone using AI needs more cloud compute resources, and anyone using cloud compute wants AI capabilities. As it turns out, this combination is also highly profitable.

And this flywheel is just getting started. Cloud and AI are being incorporated into e-commerce (TTG), whether it’s improving search, personalized recommendations, or advertising efficiency. So when management talks about this opportunity shaping the next 10 to 20 years, this is exactly what they mean…

Meanwhile, the market is focused on some short-term margin volatility… The bottom line is that BABA is firing on all cylinders, and the beach ball hasn’t even broken the surface yet.

Here’s everything you need to know following Q4 earnings:

10 Key Points

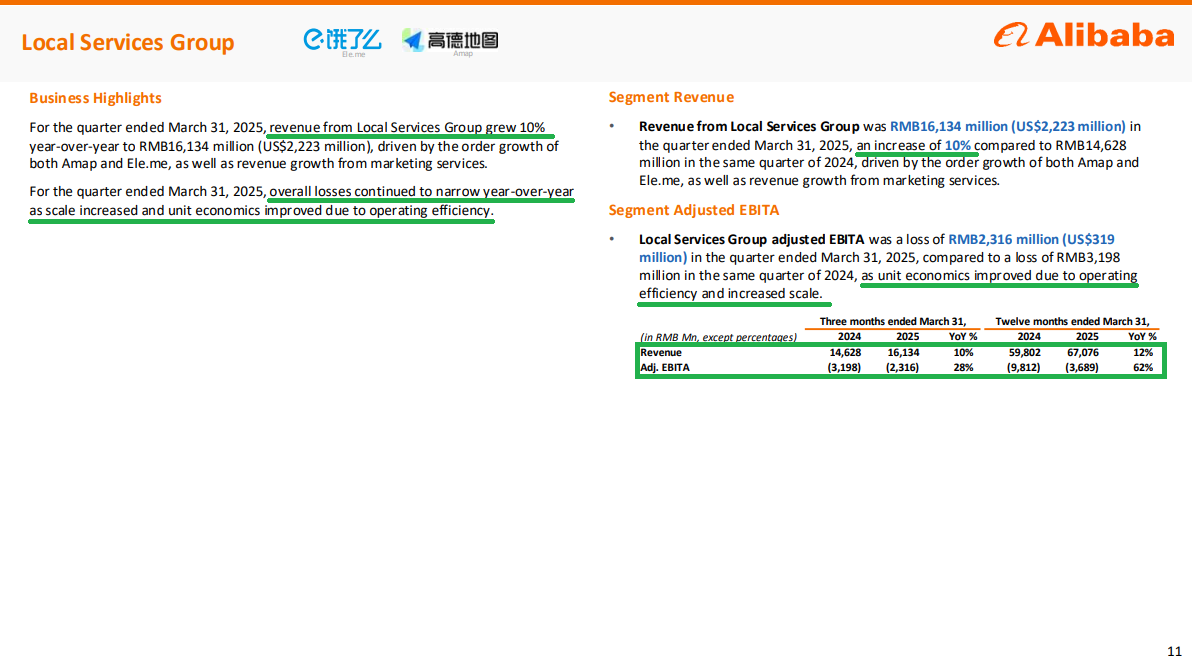

1) The Cloud segment saw 18% YoY top-line growth, but even more impressive, grew EBITA by 69% YoY to $333 million. Management saw a surge in enterprise customer demand across different industries, and more importantly, they are now seeing a growing number of small and medium-sized businesses demanding cloud and AI compute. Management continues to expect the Cloud segment to accelerate throughout FY2026, as they move forward with $52B of cloud and AI investments over the next three years.

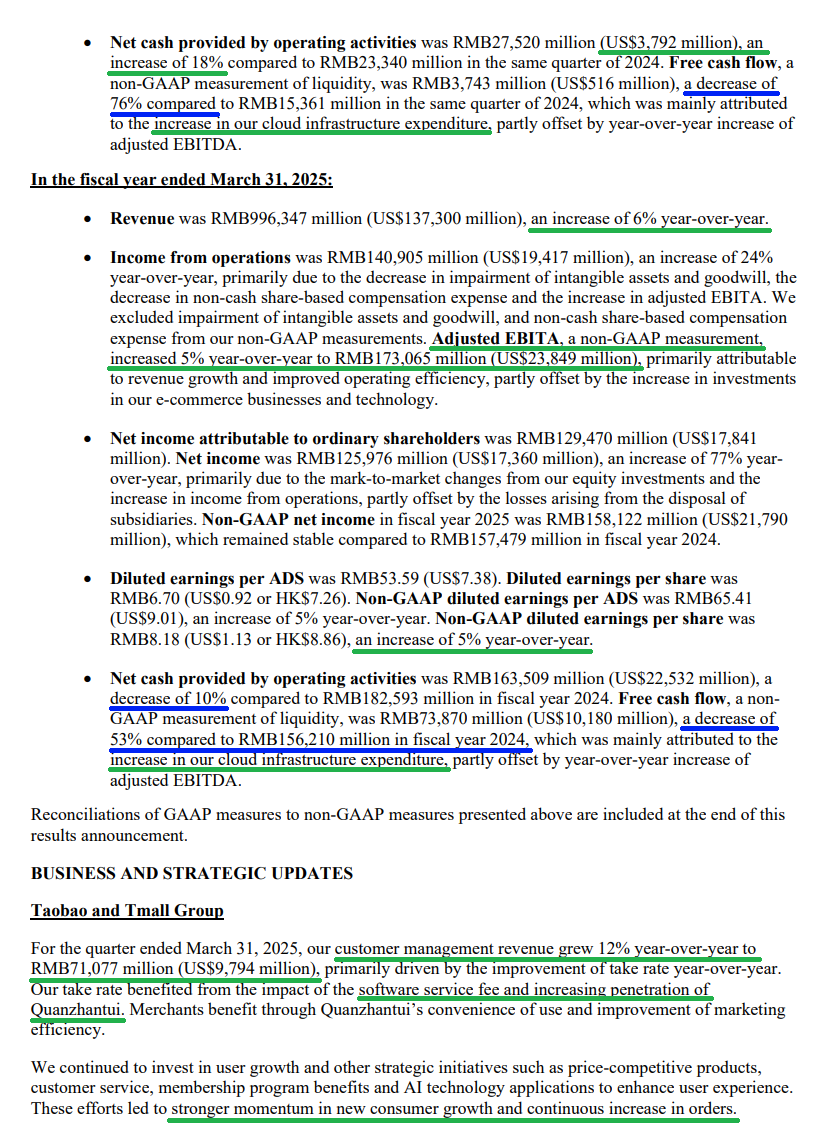

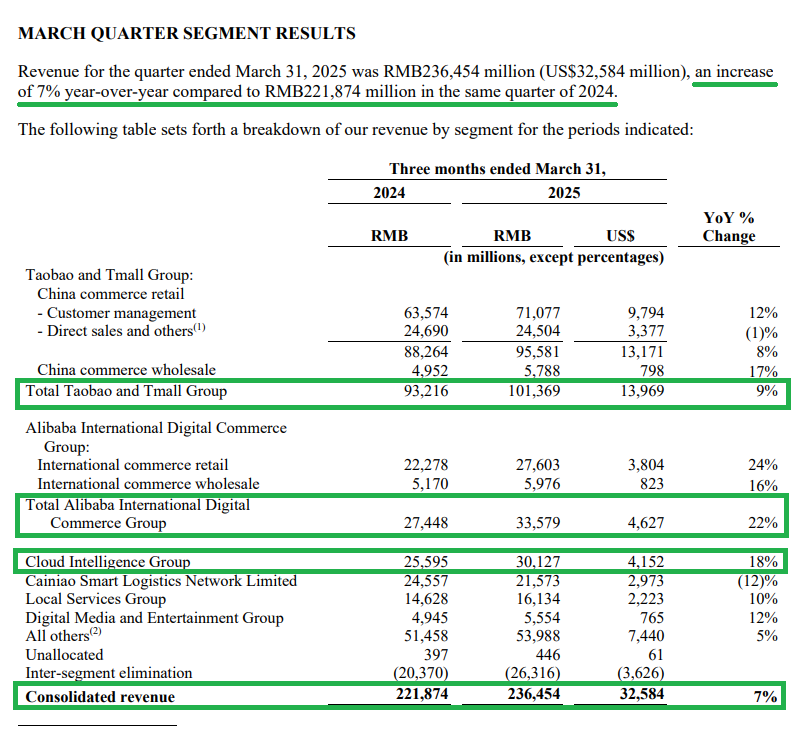

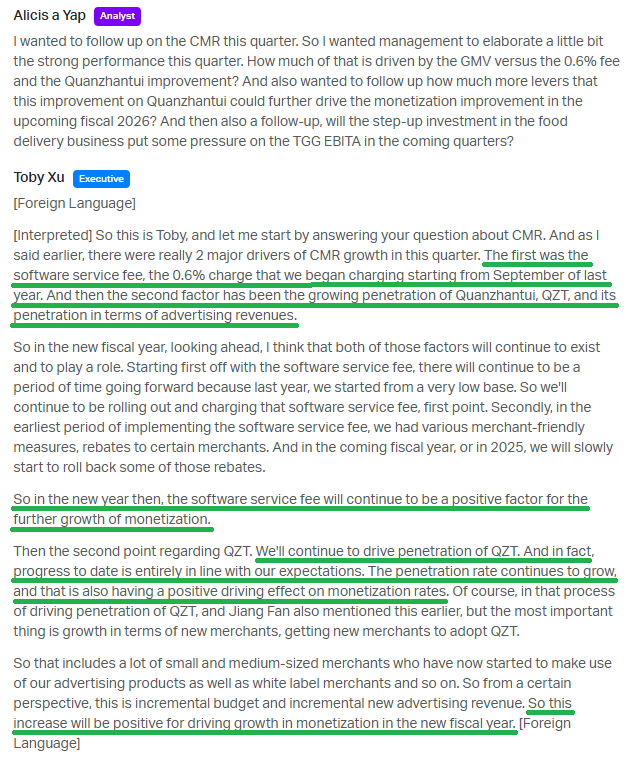

2) Taobao and Tmall posted another strong quarter, with total revenues up 9% to $13.97 billion and EBITA rising 8% year over year. 88VIP members, essentially the equivalent of Amazon Prime, remain the highest-spending consumer group and continued to grow by double digits year over year, now exceeding 50 million users. Customer management revenues (CMR) increased 12% in Q4 and are expected to maintain strong growth in 2026, driven by the 0.60% software service fee and expanding use of Quanzhantui, a merchant advertising tool. The medium-term goal remains stabilizing market share for TTG, which currently sits around 40%.

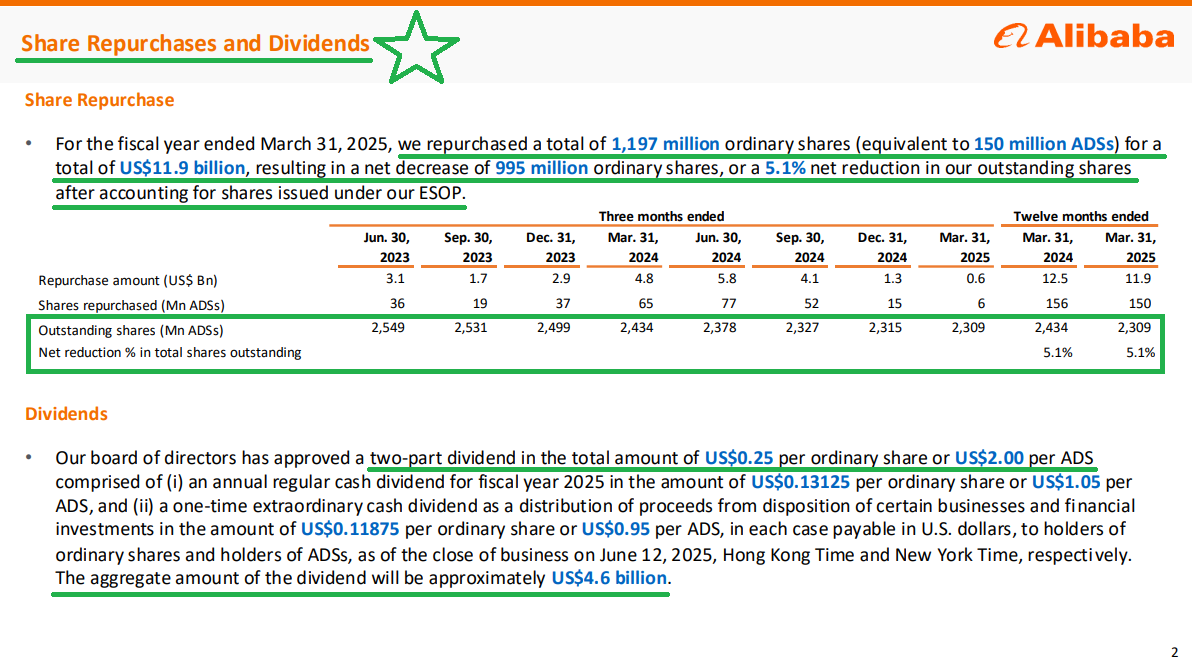

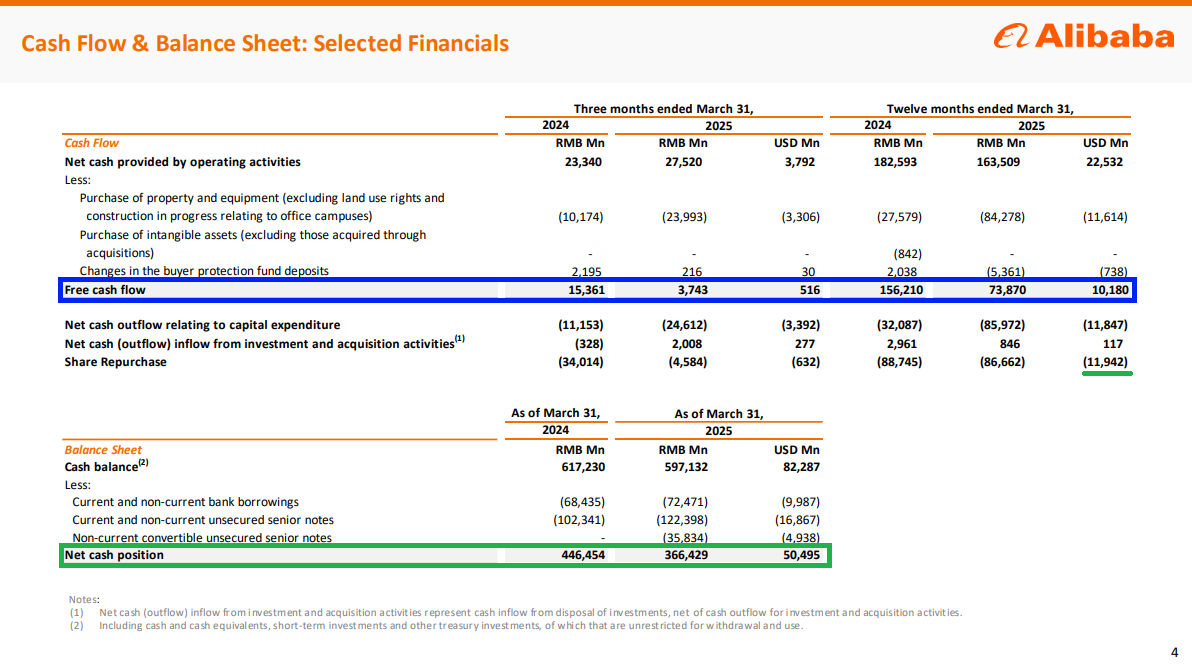

3) Management returned $16.5 billion to shareholders in FY25, including $4.6 billion in dividends at $2 per ADS and $11.9 billion in share buybacks, which reduced the share count by 5.1%. At today’s price, that gives you a 1.62% dividend yield and a 5.1% buyback yield — a total shareholder yield of 6.72% before taking into account any share price appreciation.

4) Management views instant commerce as a huge opportunity and is starting to lean into it. The market is expected to grow from 500 to 600 million consumers all the way to 1 billion over time in China. Early results have far exceeded original expectations as management integrates instant commerce through TTG, driving new users as well as increased stickiness, frequency, and overall consumption. These investments will weigh on EBITA margins in the near term but will be a long-term growth driver for BABA’s largest segment.

5) AI-related product revenue reached its seventh consecutive quarter of triple-digit year-over-year growth. The Qwen3 series is now the largest open-source model family and continues to deliver world-leading performance on key benchmarks, all at significantly lower costs.

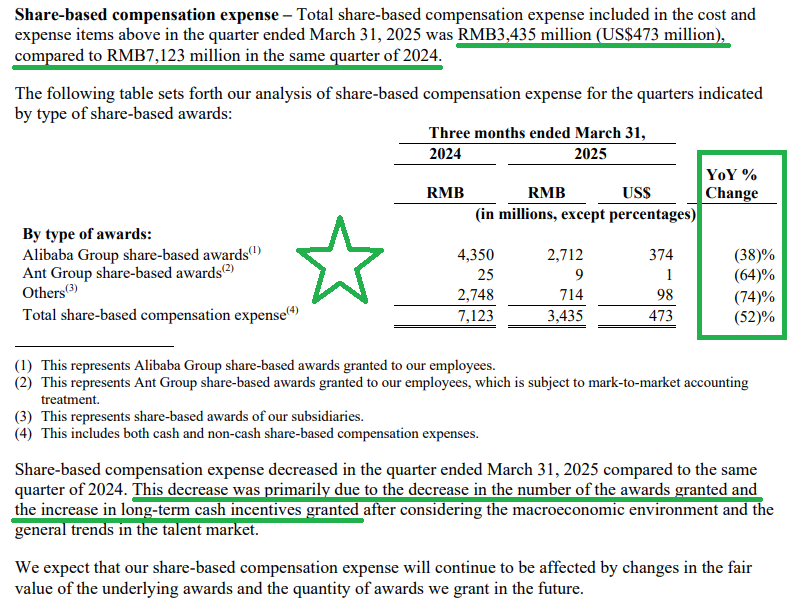

6) Stock-based compensation, which Alibaba used to hand out like candy, was just $473 million this quarter — down 52% year over year. Management has finally shifted toward long-term cash incentives, backed by a $50.5 billion net cash position. It’s a move we’ve long preferred.

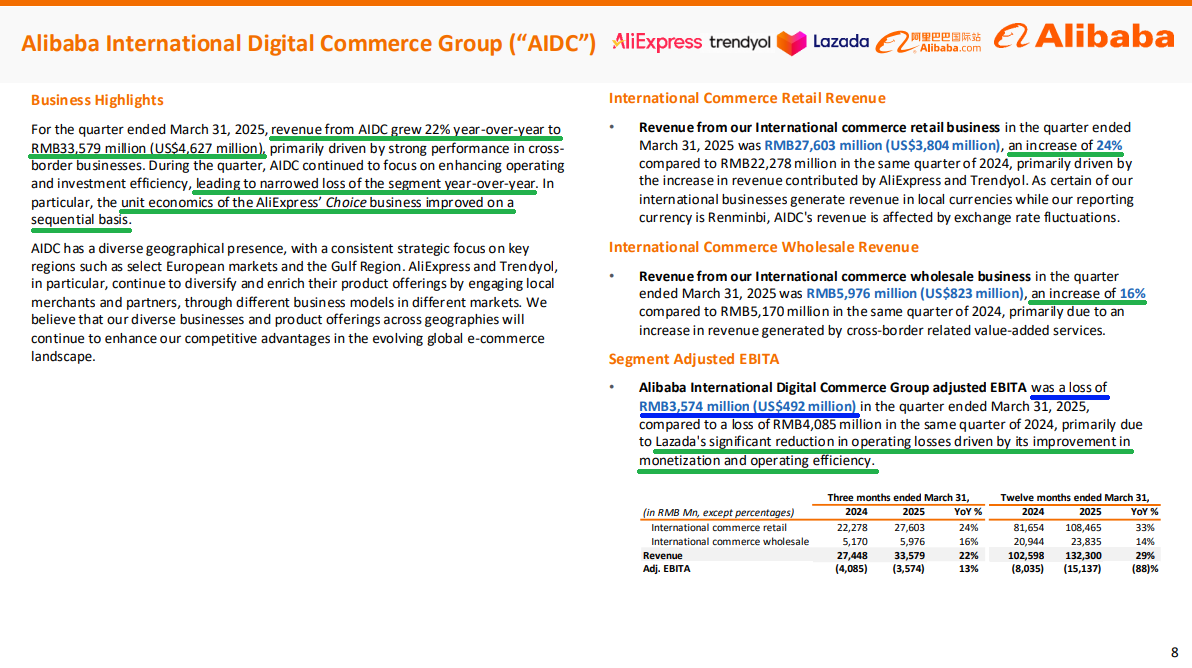

7) Alibaba International (AIDC) came in slightly below consensus expectations, with revenue growth of 22% year over year to $4.63 billion. Most importantly, management remains on track to achieve quarterly profitability for the segment in FY2026, as they work toward profitability at scale for one of the company’s largest overall segments.

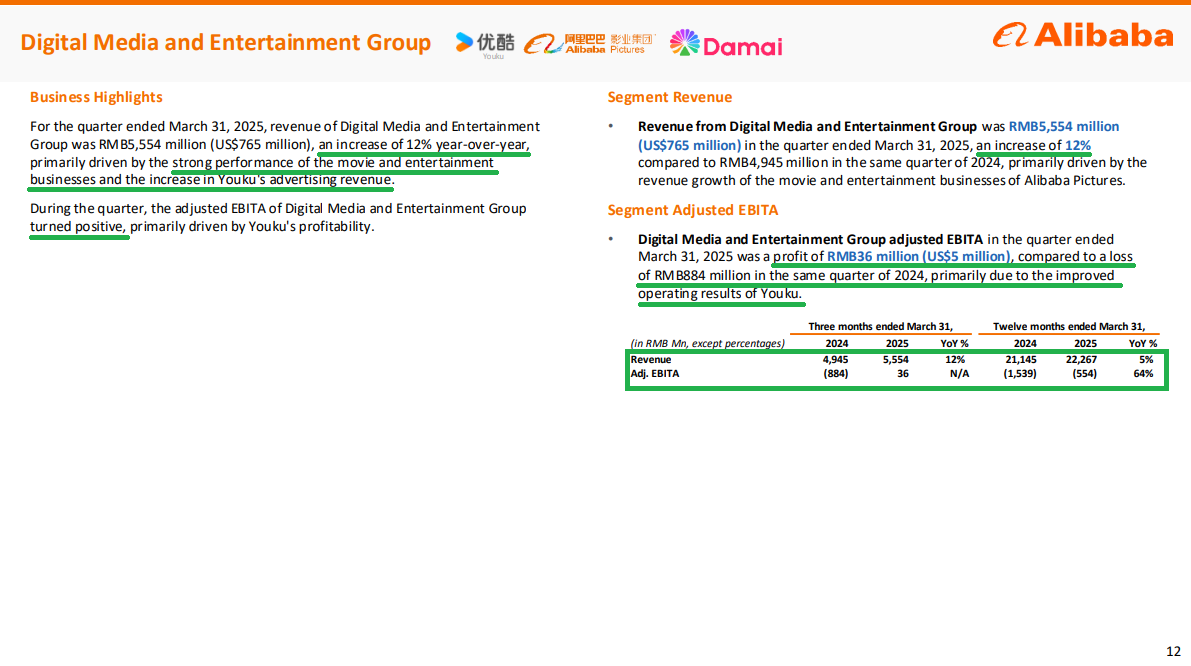

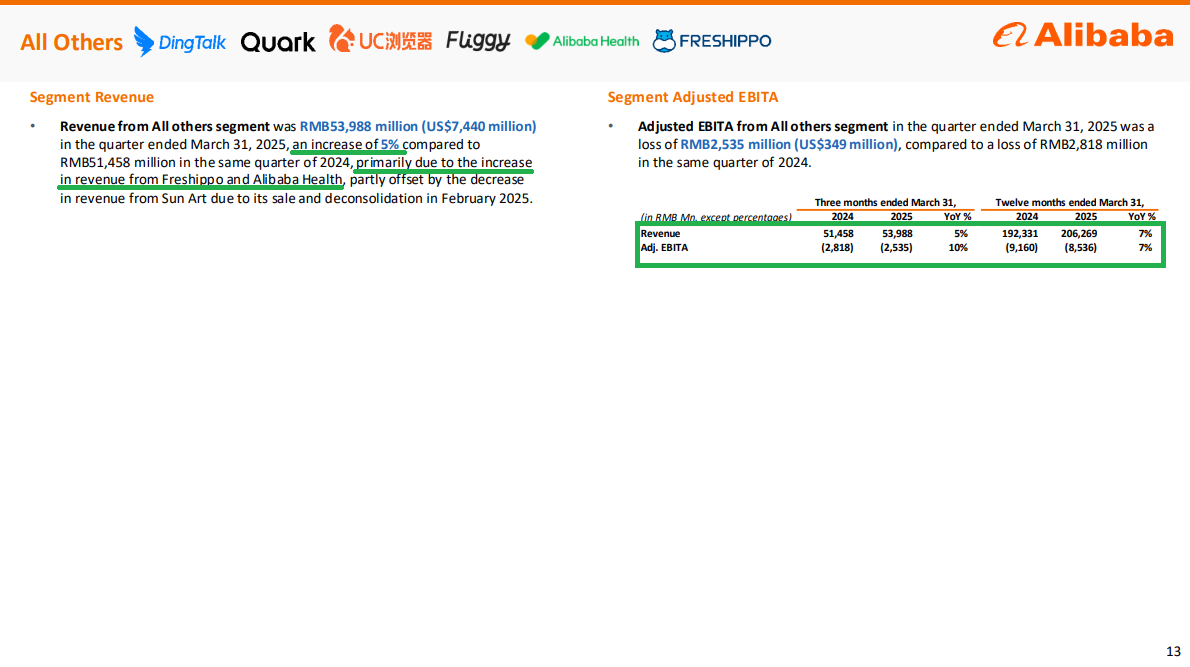

8) All other loss-generating segments continue to improve, with losses narrowing year over year. Management reiterated the expectation that all segments will reach at least breakeven within the next 1-2 years, with Digital Media and Entertainment already turning positive this past quarter.

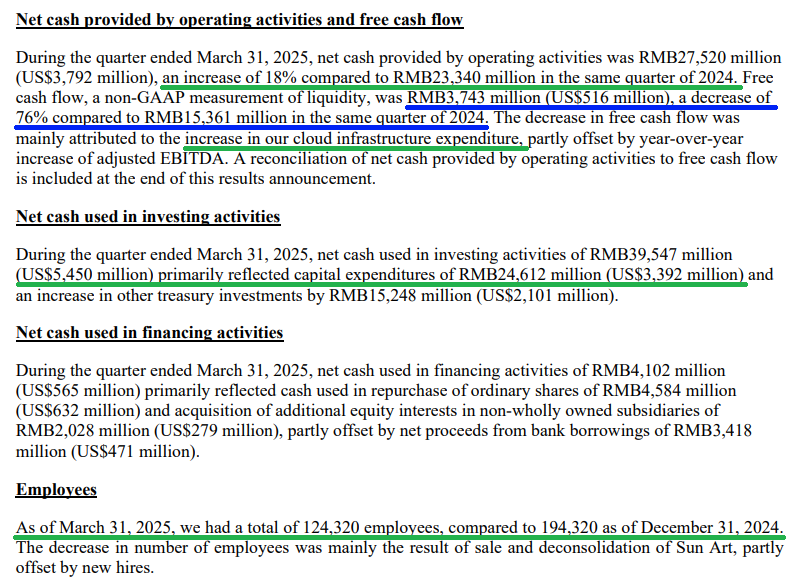

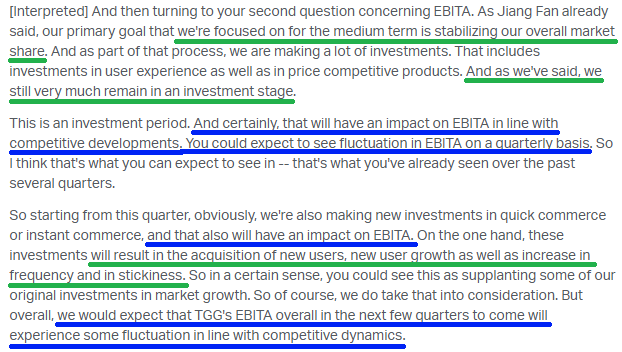

9) Free cash flow for the quarter was just $516 million, down 76%, but this was largely intentional and mainly due to increased cloud infrastructure spending. Cash provided by operating activities was $3.79 billion during the quarter, up 18% year over year, which supports this explanation.

10) During the quarter, management continued to monetize non-core assets, with the sale of Sun Art and Intime expected to generate $2.6 billion in cash proceeds.

Earnings Call Highlights

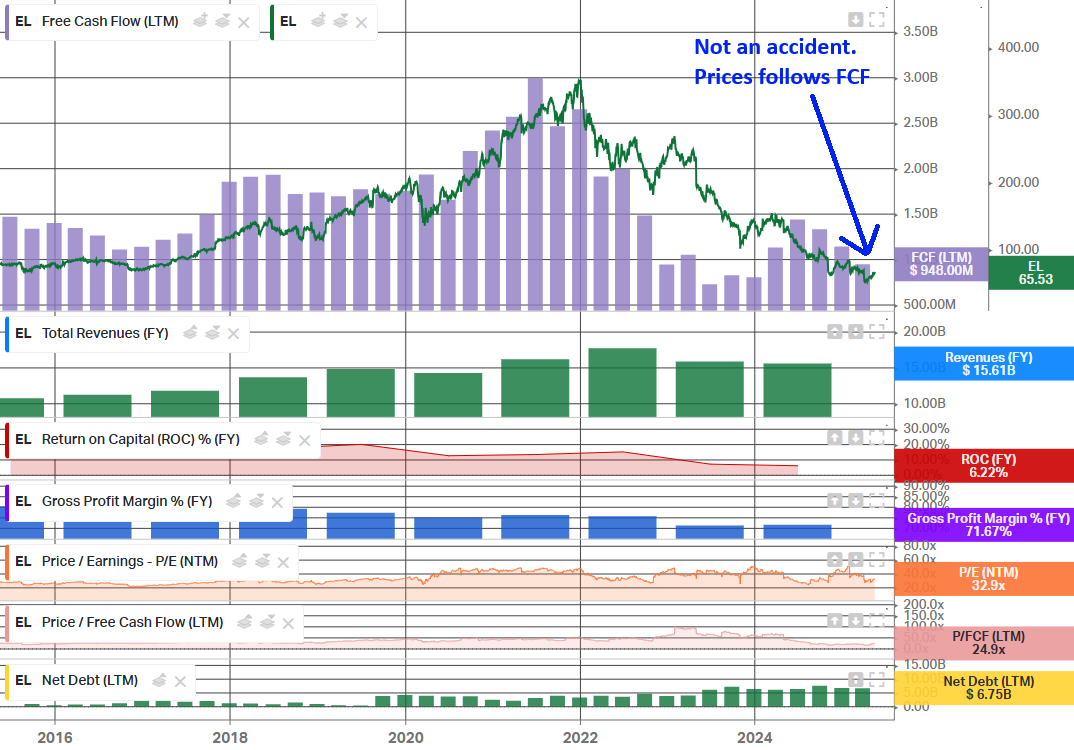

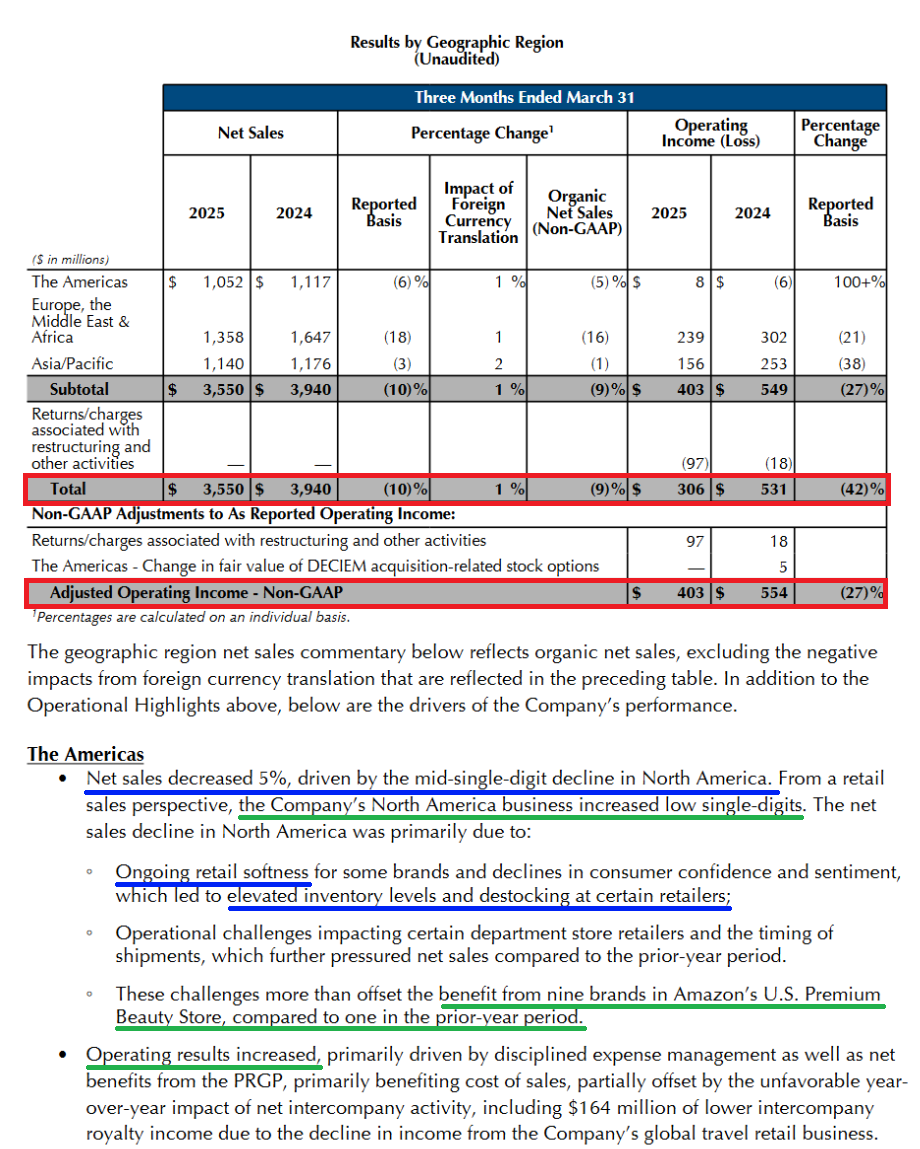

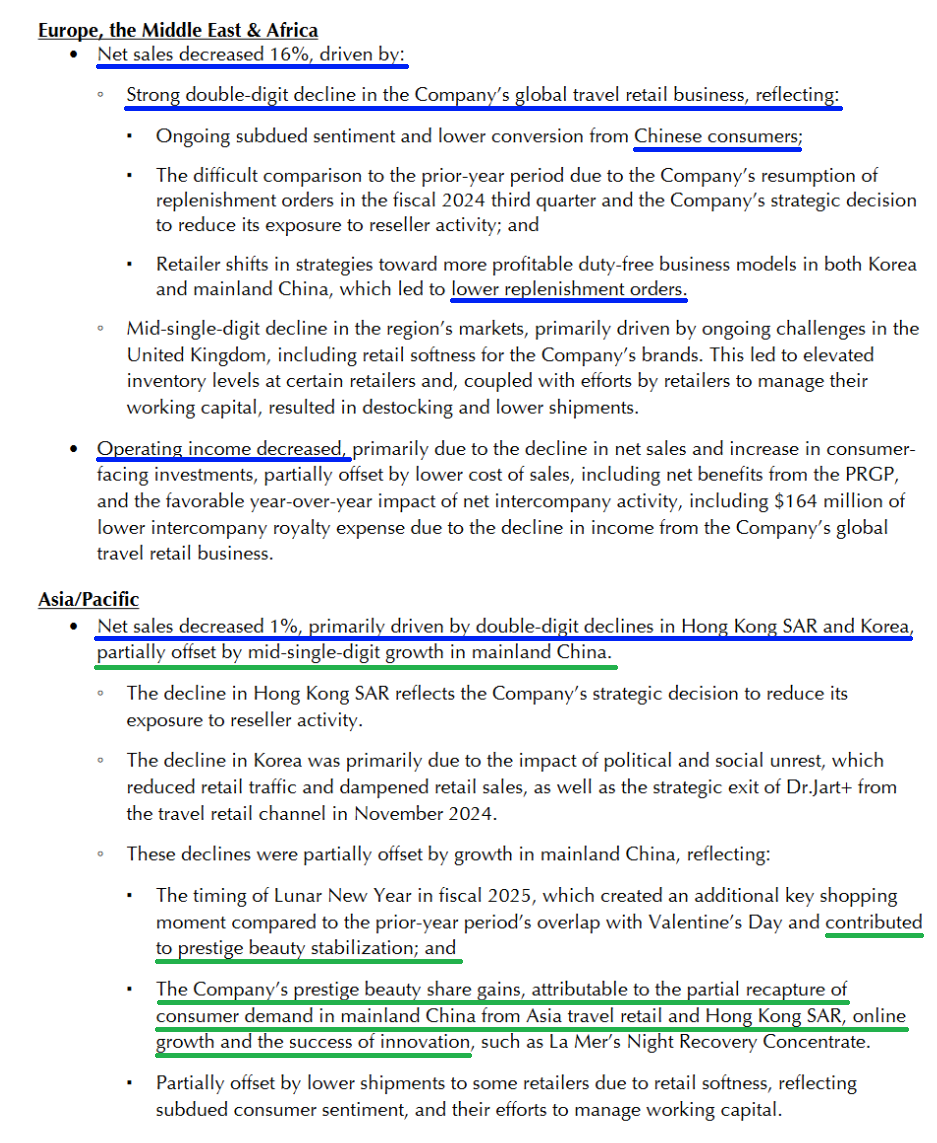

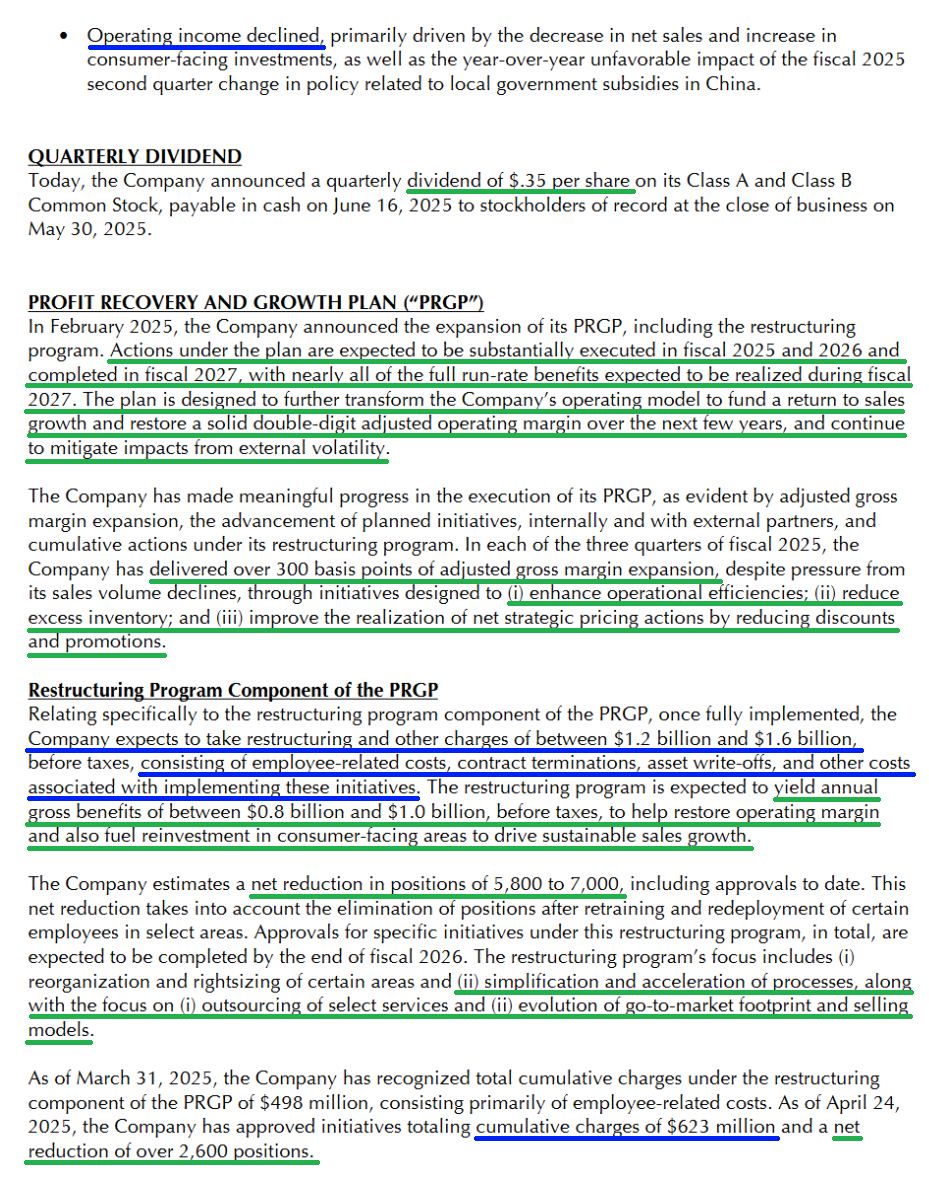

Estee Lauder Quick Update

Morningstar Analyst Note

General Market

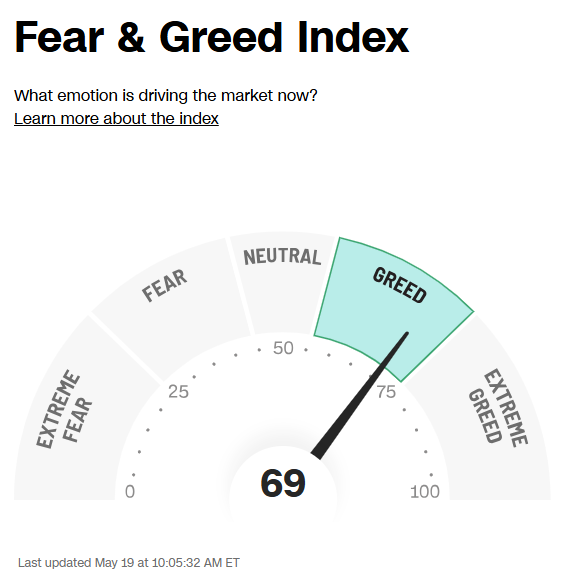

The CNN “Fear and Greed Index” ticked up from 66 last week to 69 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 70.56% this week from 81.06% equity exposure last week.

Our podcast|videocast will be out sometime today. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, Not Advice. See Terms

Not a solicitation.