Is Alibaba…?

-

The best A.I. play in China right now.

-

The “equivalent to owning a ‘China A.I. ETF.'”

-

The cheapest way to play A.I. globally.

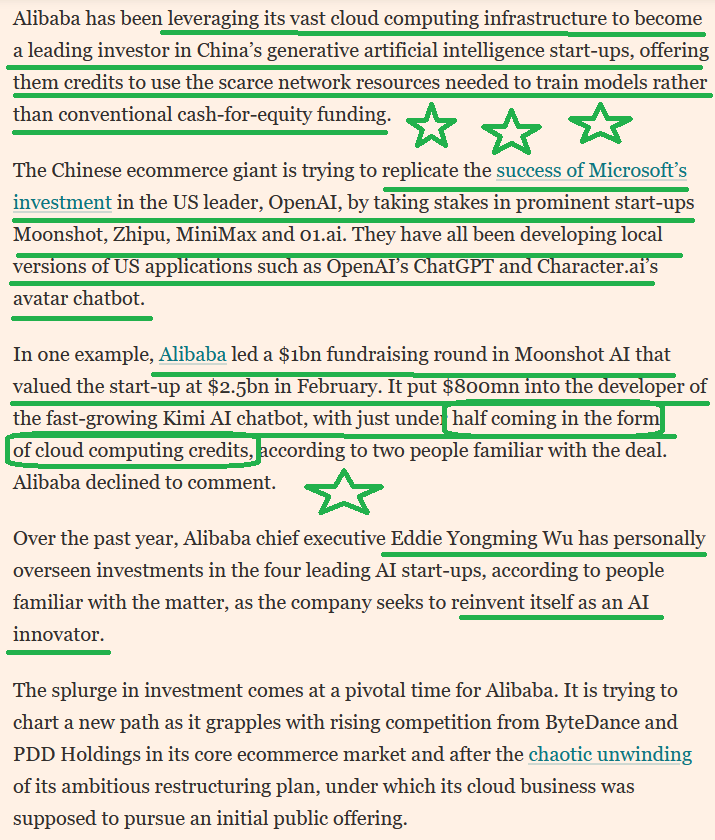

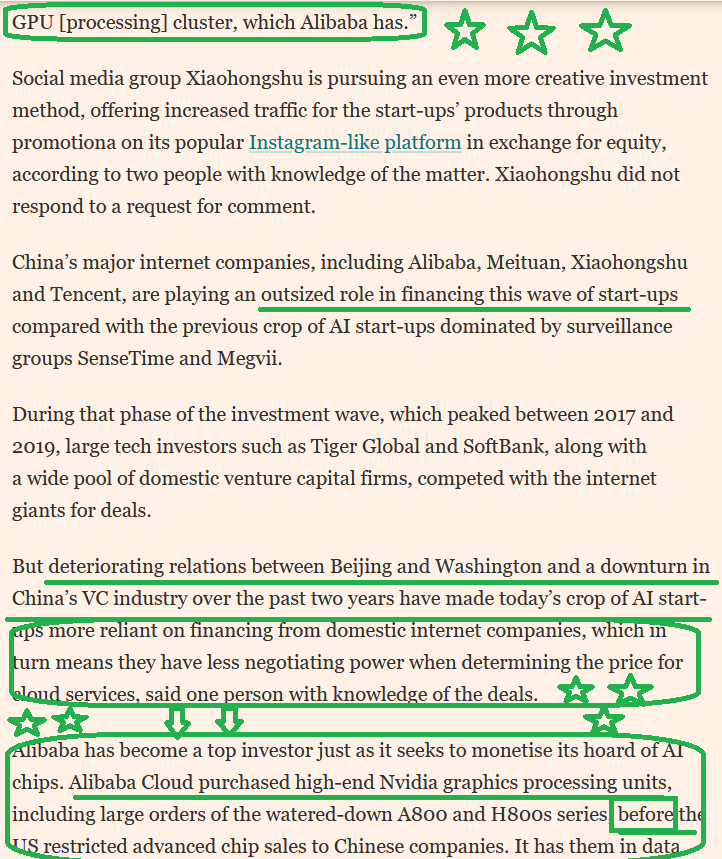

This recent article in the Financial Times lays out the nuance required to address these three points:

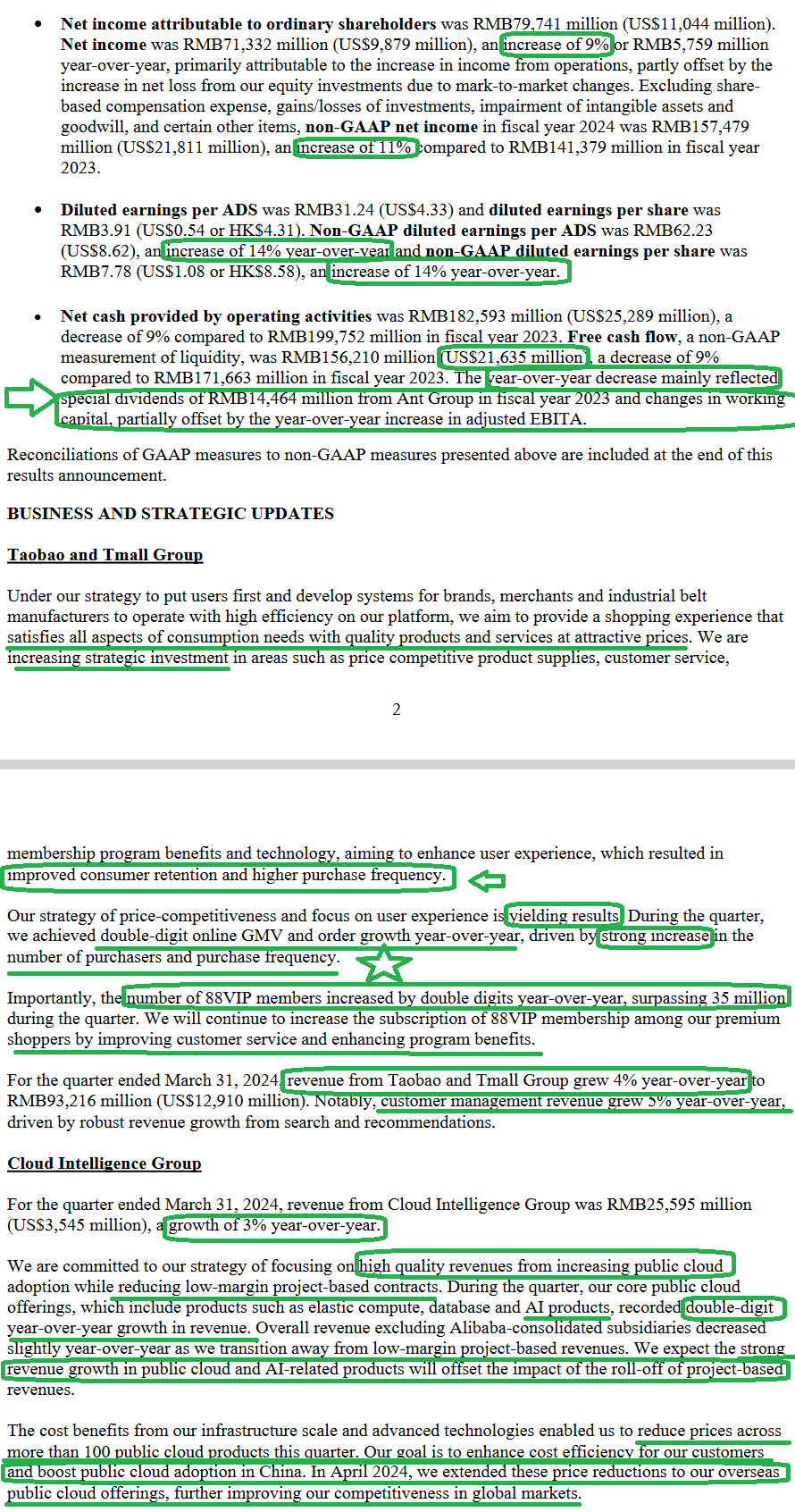

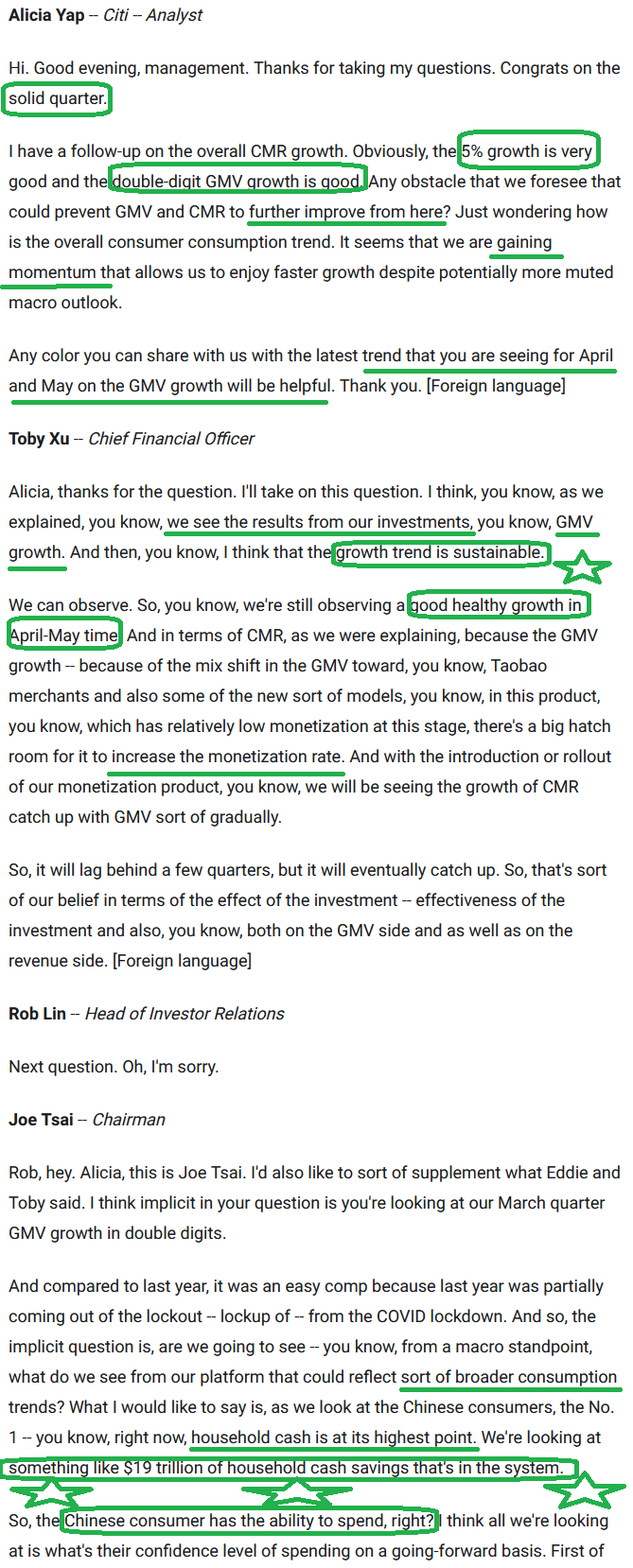

Alibaba Earnings – More Than Meets The Eye

While everyone was misdirected and focused on this misleading headline:

Here’s what they missed:

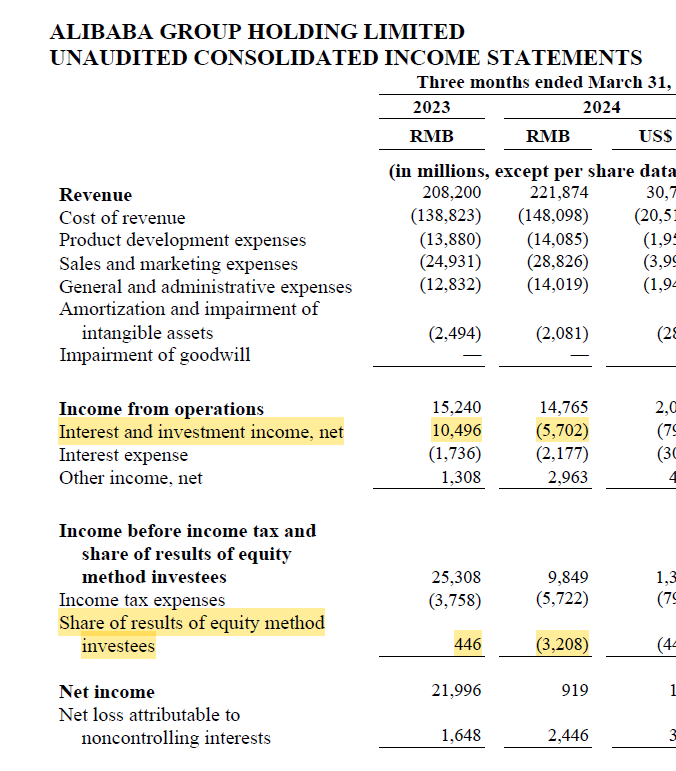

1) The “miss” in bottom line earnings was primarily attributable to “mark-to-market” losses on the long-term equity holdings in their securities portfolio – NOT THE UNDERLYING OPERATING BUSINESSES. Source: Brendan Ahern

Source: Brendan Ahern

2)

- Double-Digit yoy GMV growth

- Triple-Digit yoy AI Revenue Growth

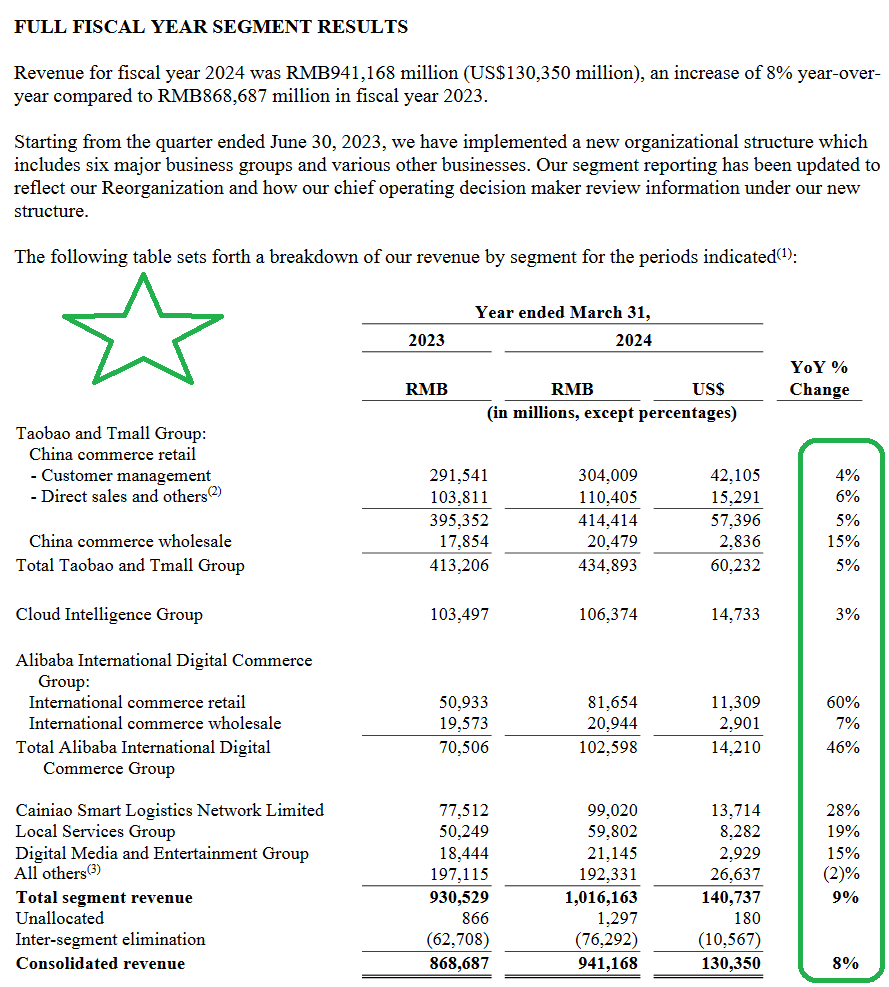

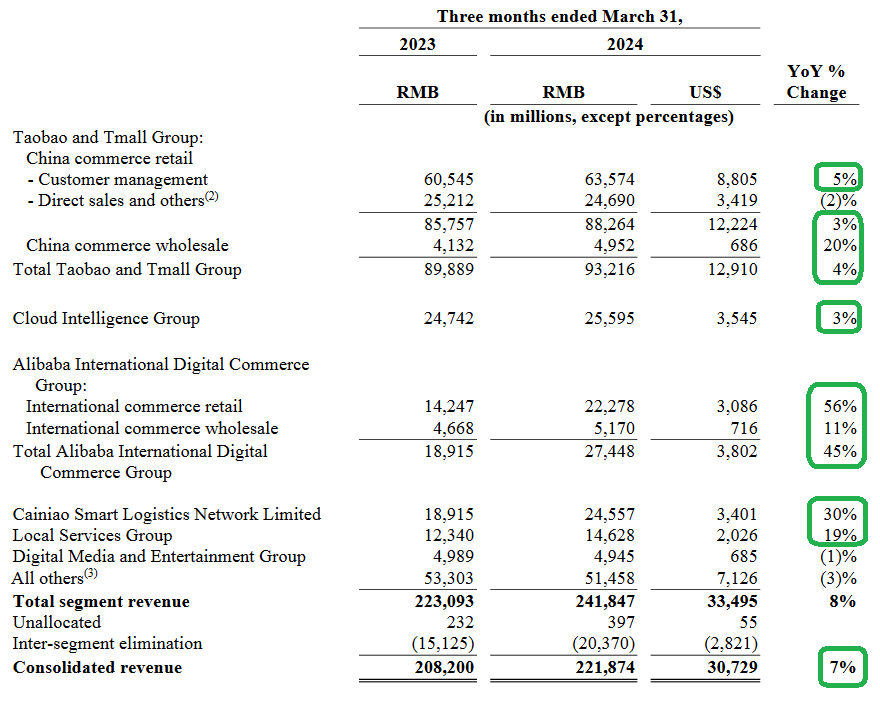

- 7% yoy revenue growth for the quarter

- $12.5B share buyback for fiscal year 2024

- $4B dividend fiscal year 2024

- Net Income (adjusted for mark-to-market pubic security loss) was -11% versus the misleading headline.

- Free cash flow was $2.1B for the quarter (decline attributable to massive capex for cloud business growth and dividend to shareholders)

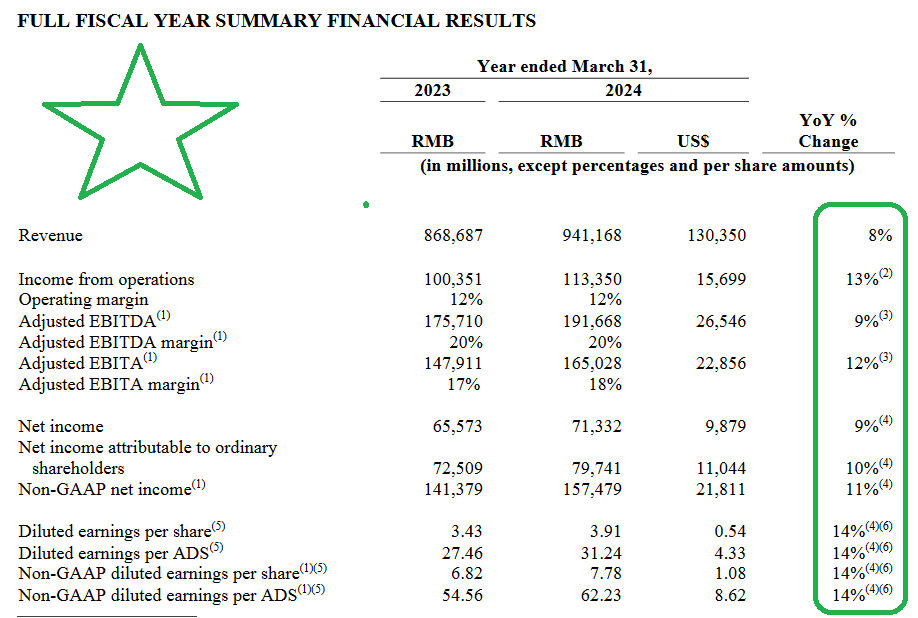

- 8% revenue growth for fiscal year 2024

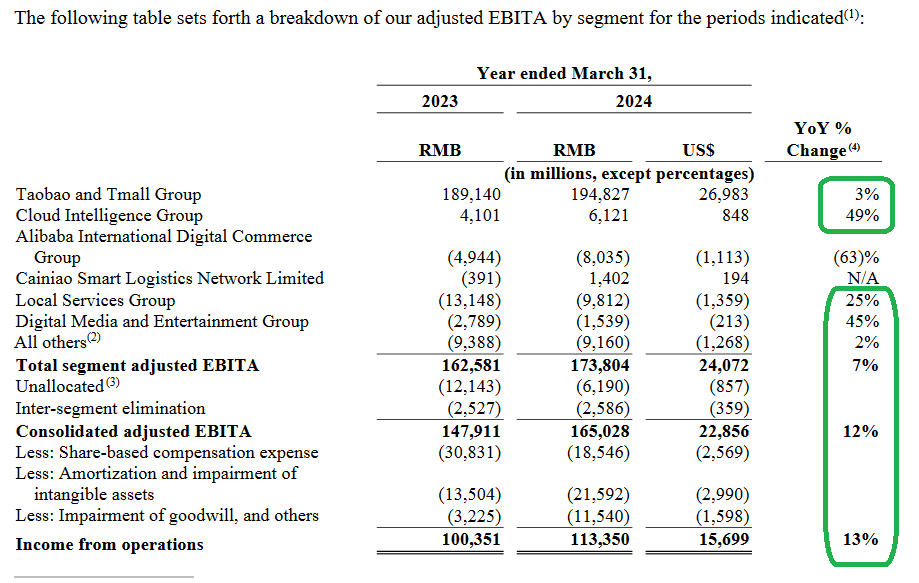

- 13% income from operations growth for fiscal year 2024

- Adjusted EBITDA growth of 12% for fiscal year 2024

3)

- Net Income was up 9% for fiscal year 2024

- non-GAAP Net Income was up 11% for fiscal year 2024

- Earnings per ADS up 14% for fiscal year 2024

- Free Cashflow was $21.6B after dividends paid out to shareholders and the absence of a special dividend from Ant Financial that was received in the prior year

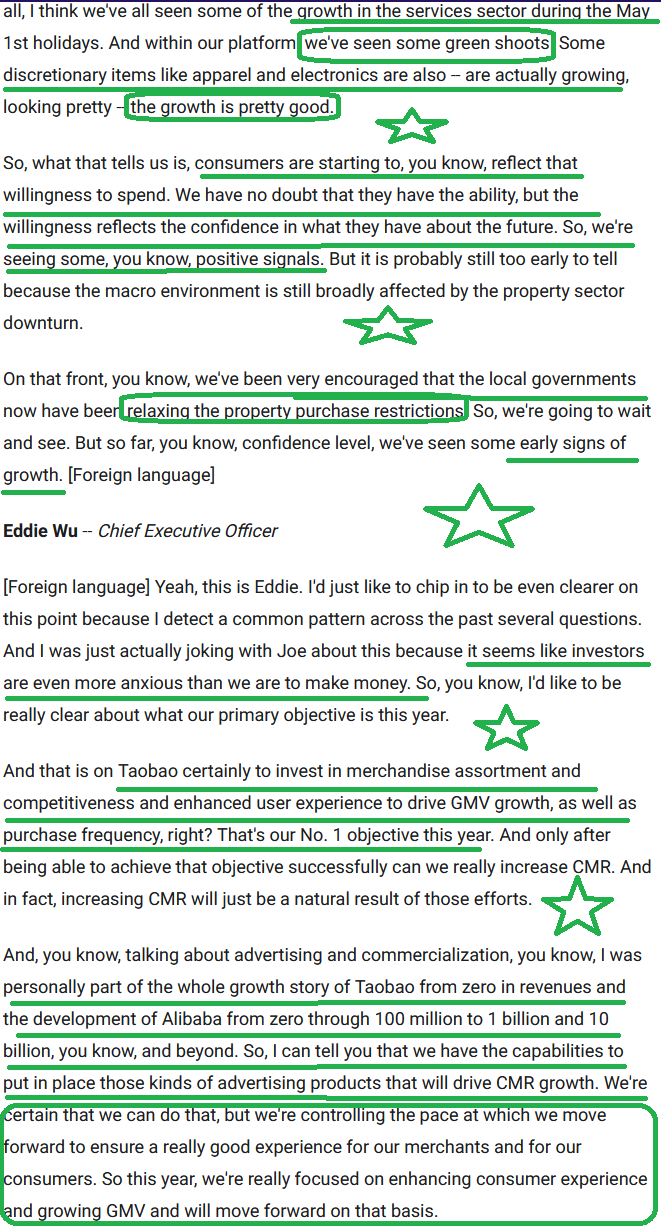

- Turnaround story working with improved customer retention and purchase frequency, double-digit online GMV and order growth and Taobao and Tmall Group revenue growth of 4%

- Cloud grew revenue 3% yoy despite cutting prices to gain share domestically and internationally.

4)

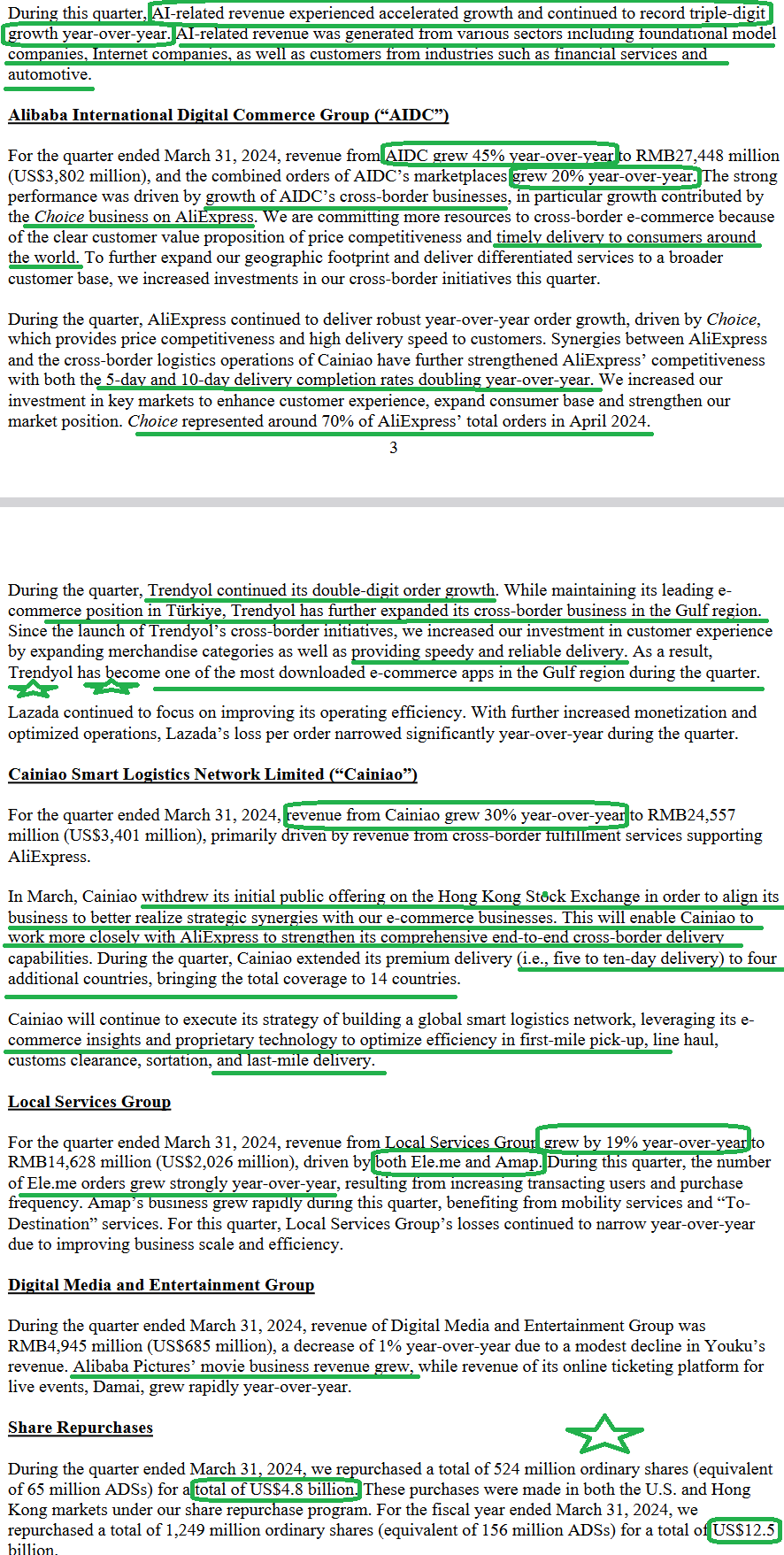

- AI-related revenue grew TRIPLE DIGITS year-over-year!

- AIDC (international commerce/AliExpress/Choice) grew 45% yoy

- Trendyol expanding aggressively in the Gulf region (one of most downloaded apps)

- Cainiao logistics grew 30% yoy

- Ele.me/Local Services grew 19% yoy

- Bought back $4.8B of stock for the quarter, $12.8B for the year.

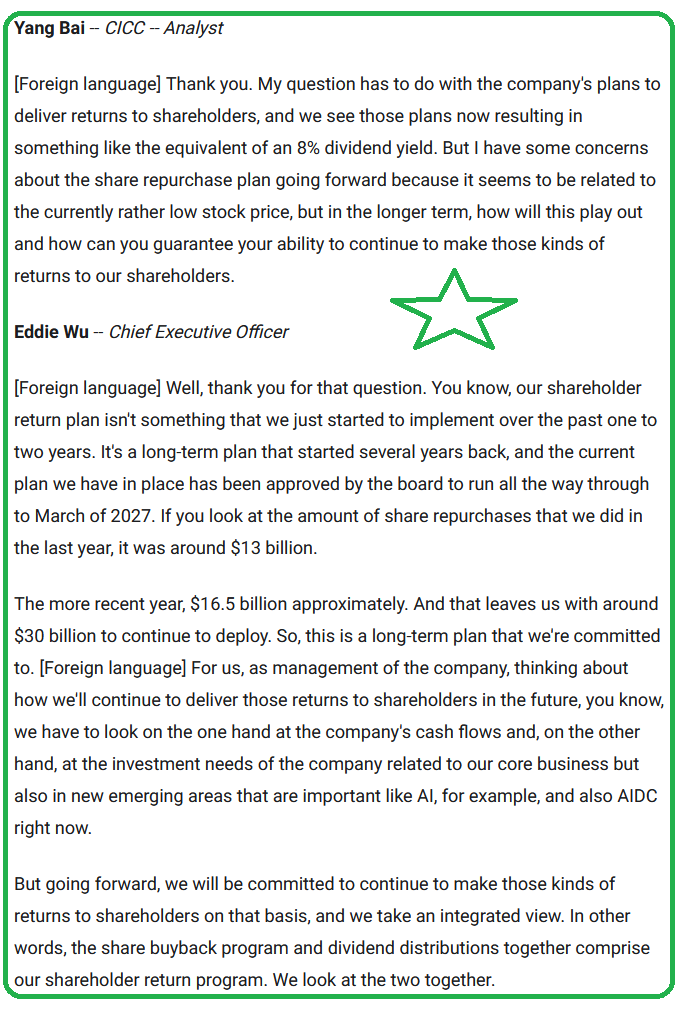

5)

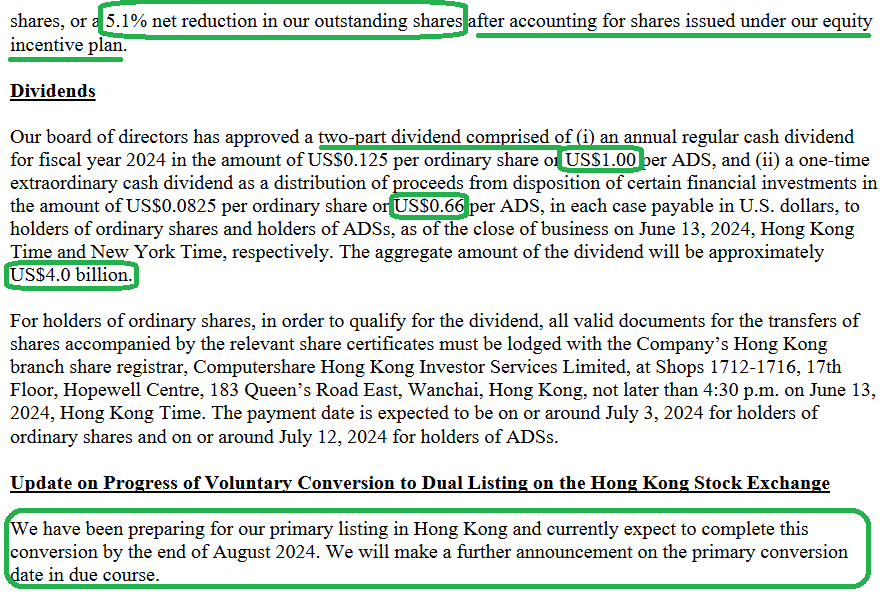

- The completed buyback means that your ownership in Alibaba increased by 5.1% WITHOUT LAYING OUT AN ADDITIONAL DOLLAR FOR SHARES. How did that happen? You got bigger slices in the same pie as they retired stock.

- They increased the dividend by 66% this year – from $1/ads to $1.66/ads

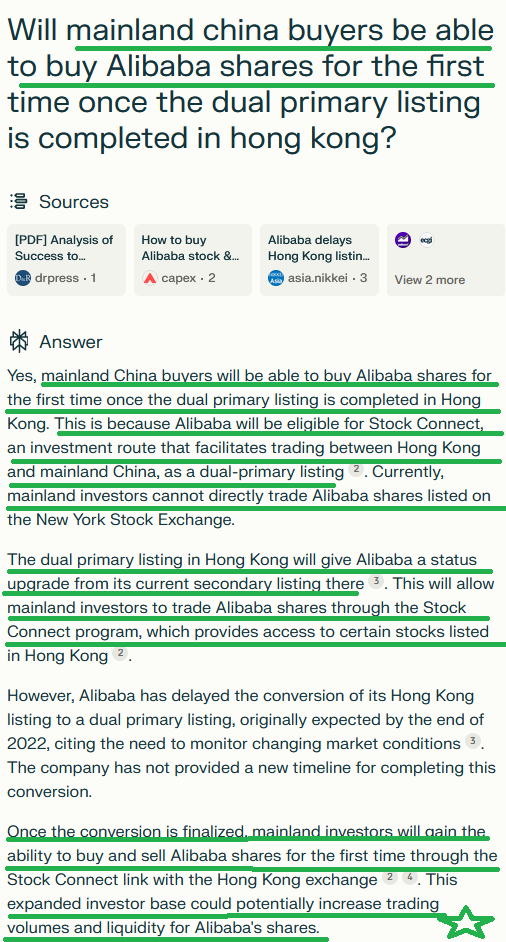

- The primary listing in Hong Kong is expected to complete by August.

- I anticipate a rally in Alibaba shares as we get closer – over the summer – and institutions begin to get ahead of the new buying demand. What is the magnitude of the new buying demand? Try up to 180,000,000 new buyers (see explanation from Perplexity.ai below).

Here is the explanation from Perplexity.ai:

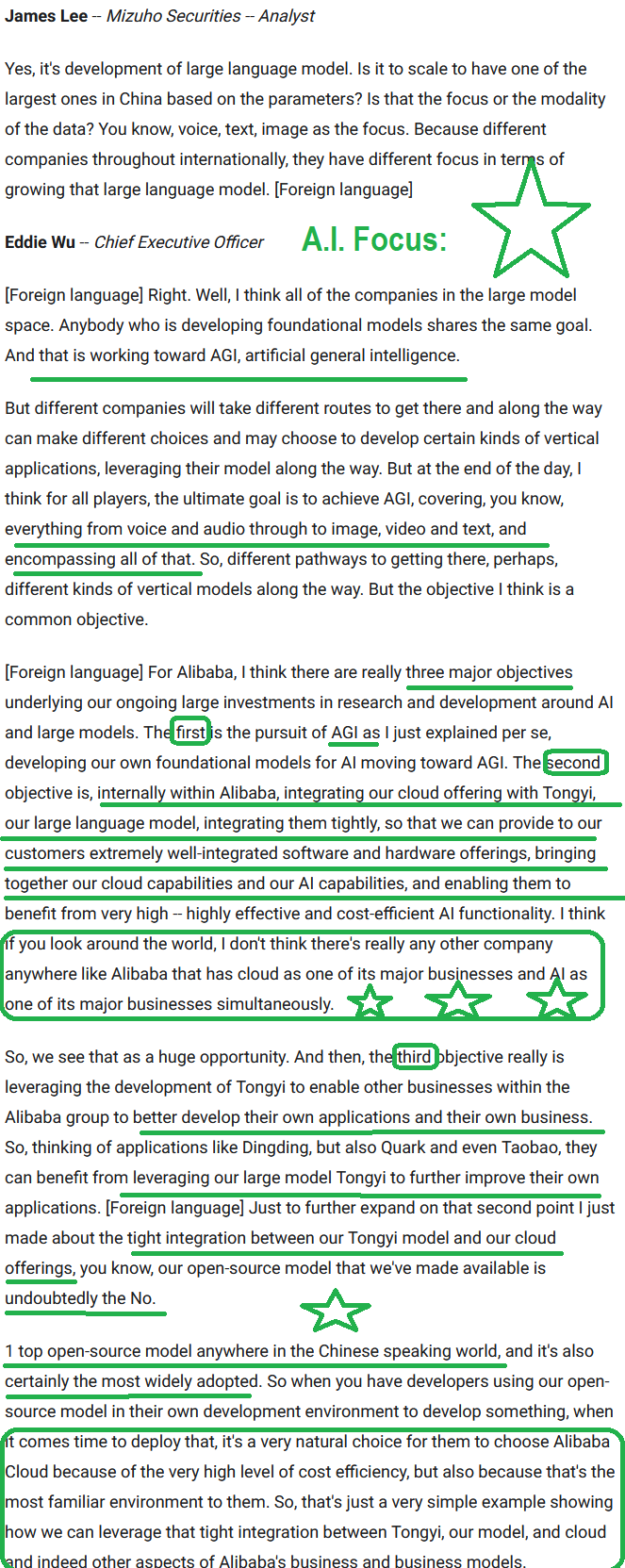

6) The company is BACK TO FULL ON GROWTH MODE:

7) Key segment highlights:

8) Highlights from Earnings Conference Call:

Bank of America Fund Manager Survey Update

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed 209 managers with $562B AUM:

May 2024 Bank of America Global Fund Manager Survey Results (Summary)

Here were the key points:

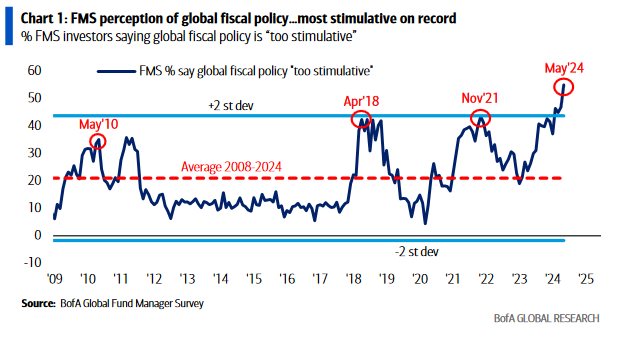

1) Managers are finding global fiscal policy to be too stimulative. They consistently have this view before continuation rallies in equities:

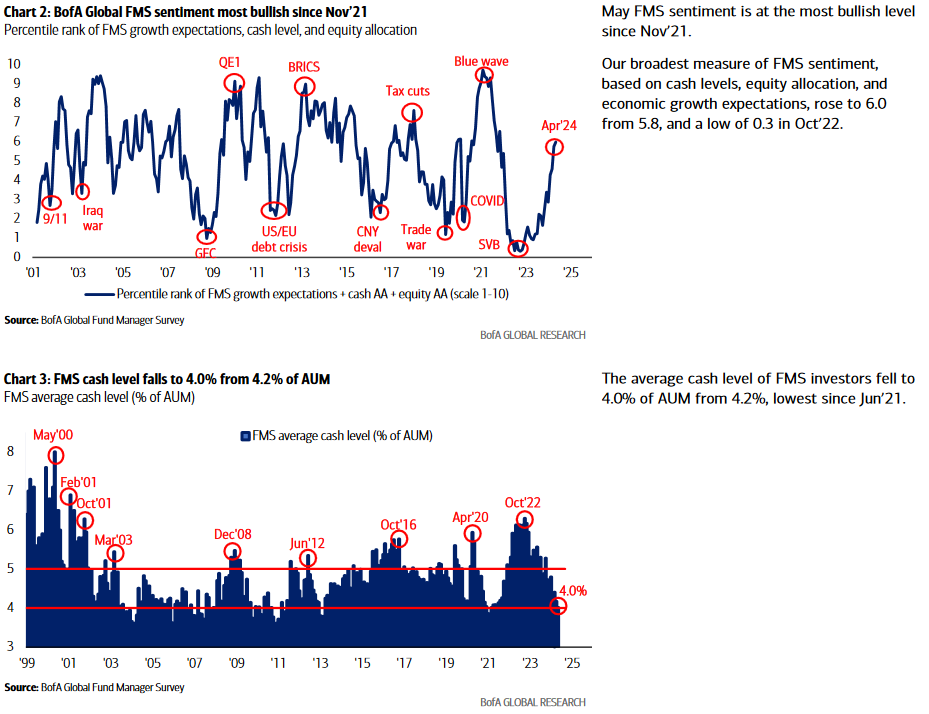

2) Sentiment is elevated, but not extreme:

2) Sentiment is elevated, but not extreme:

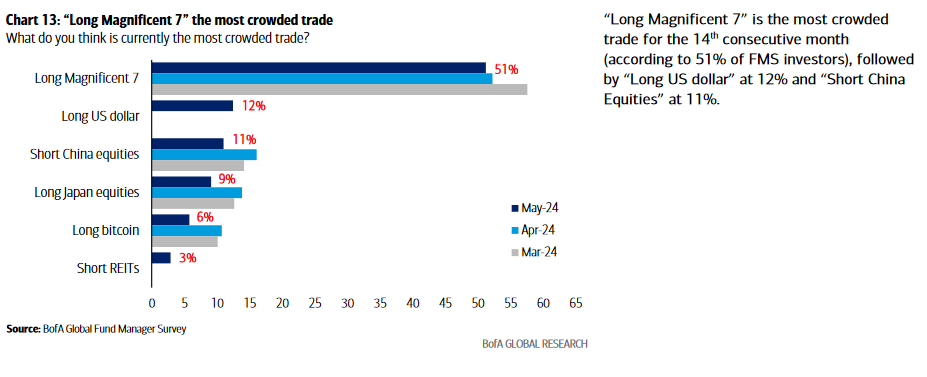

3) Managers will lose on their long USD and Short China Equities “Crowded Trades” over time:

PayPal Update

On Friday I joined Julie Hyman on Yahoo’s Finance to do a segment called “GOOD BYE or GOODBYE!” In this segment I updated our thesis on PayPal. Thanks to Julie and Hayley Marks for having me on:

Watch in HD directly on Yahoo! Finance

Stanley Black and Decker Update

The CEO did a good job of updating our thesis on Stanley Black and Decker this week on CNBC’s “Mad Money” with Jim Cramer. As Charlie Munger used to say, “I have nothing to add…”

Now onto the shorter term view for the General Market:

The CNN “Fear and Greed” moved up from 39 last week to 60 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

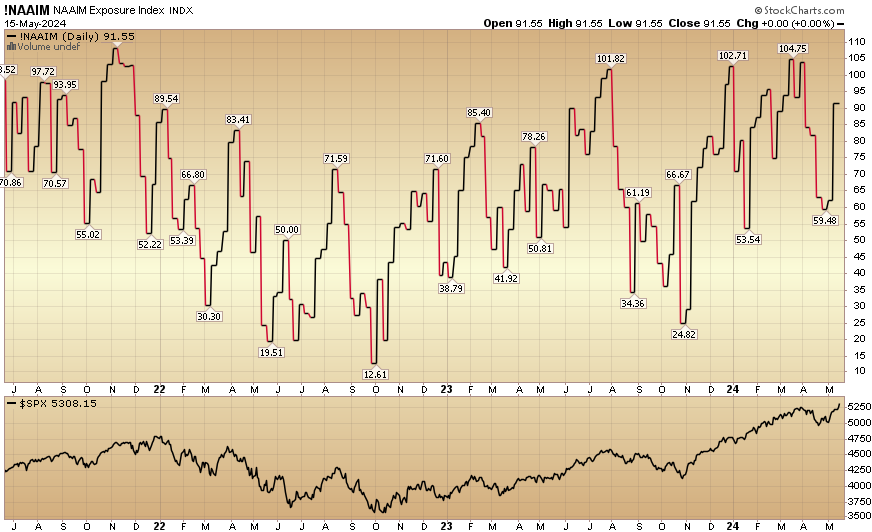

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) jumped to 91.55% this week from 61.97% equity exposure last week.

Our podcast|videocast will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients who came in so far this year during our Q1 and Q2 openings. We are now closed to smaller accounts ($1M+) again as of two weeks ago and will remain closed to smaller accounts until sometime in Q3. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.