This week I watched the classic film “Barbarians at the Gate” for the first time. It stars James Garner (of The Great Escape fame) and Peter Riegert (of Animal House fame). It chronicles the booming 80’s junk bond era when Michael Milken – at Drexel Burnham – was able to raise unlimited amounts of capital for leveraged management buyouts and corporate takeovers. No company was safe if Milken was involved.

Due to the excess capital available, the leaked MBO (management buyout) for RJR Nabisco (cigarettes and oreos) by CEO F. Ross Johnson created an unnatural bidding war. The company had never traded above $71 per share and at the time management constructed its MBO the stock was stuck in the $40’s. Management thought it would be a cinch to take it out at a premium to its highest ever price by offering $75.

When all was said and done, the bidding war was won by KKR (Henry Kravis) at $109 (or ~150% premium to where it had been trading months earlier). Keep in mind these deals were debt financed (by Milken’s high yield junk bonds). The result: be careful what you wish for because you might wind up getting it. It turned out to be an abysmal failure for Kravis and the worst performing investment in his fund by the time he sold the assets at a loss years later.

Why did it fail?

The investment didn’t work because they borrowed too much at peak rates and overpaid – which impaired the business. A great asset with a bad capital structure (too many turns of debt) yielded mediocre results and a big loss to the fund when it was ultimately sold at a loss.

Chairman Powell is doing the same thing to our country and it will not work. He will choke off growth, destroy jobs and increase our debt load if he doesn’t pause soon.

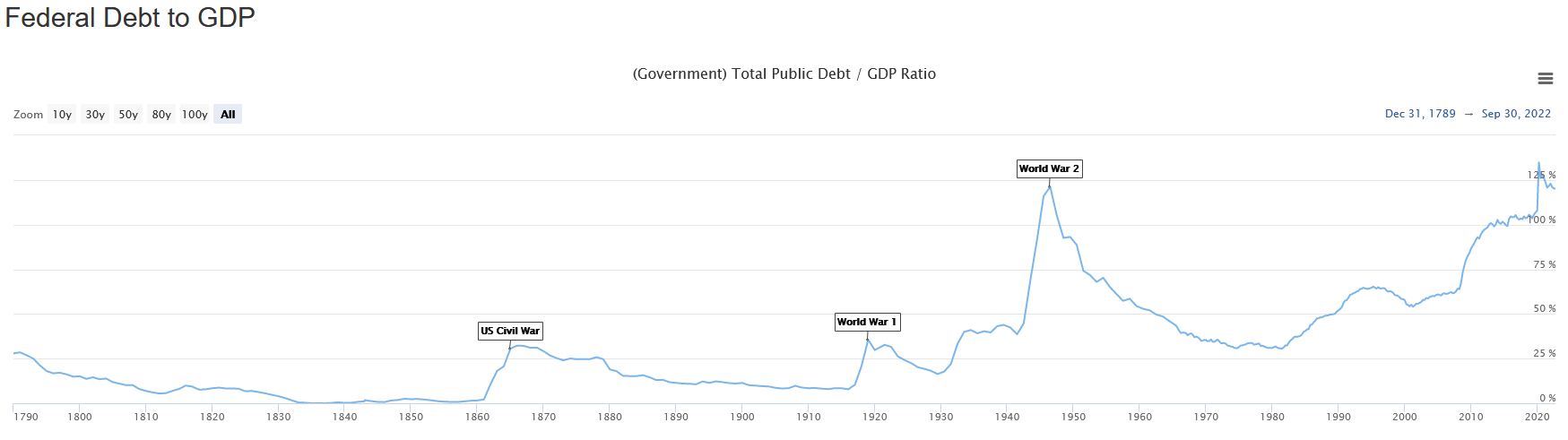

So how does this apply to today’s stock market? On Tuesday, Chairman Powell sent the markets into a tailspin when he uttered the words “Higher” and “Faster” when speaking to the Senate about interest rates. What Powell neglects to acknowledge is you cannot continue to raise interest rates at the pace he has done when the debt:gdp ratio is ~120%. When Volker did it, debt:gpd was ~33% so he had the runway.

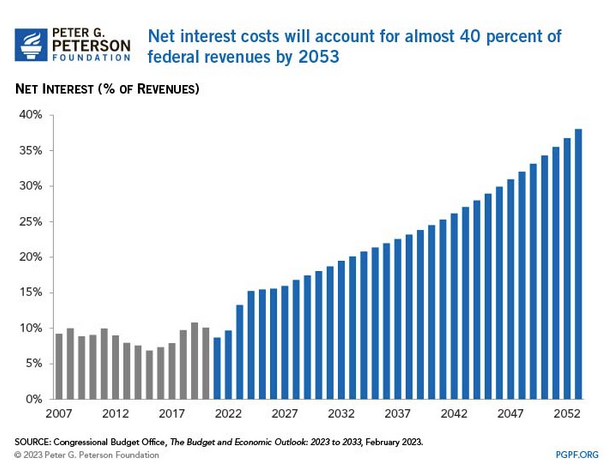

According to the Peterson Institute:

Peterson Institute:

The Congressional Budget Office (CBO) just released updated budget and economic projections, which highlighted the nation’s unsustainable fiscal outlook. One of the most significant findings from that report is that the federal government’s borrowing costs have increased rapidly over the past year and will grow through the next decade. Most notably:

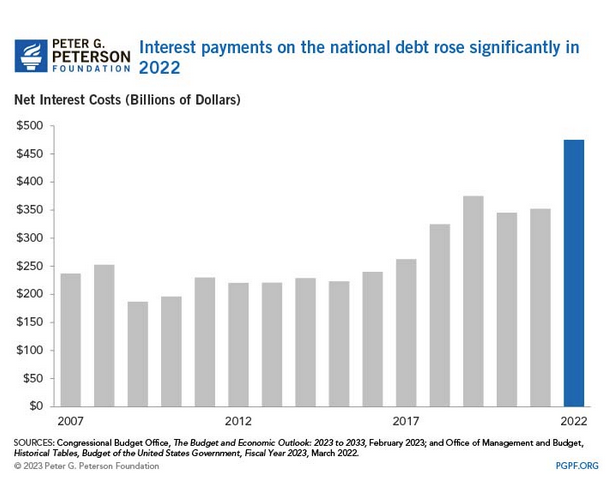

- Interest payments on the national debt were $475 billion in fiscal year 2022 — the highest dollar amount ever.

- Interest costs grew 35 percent last year and are projected to grow by another 35 percent in 2023.

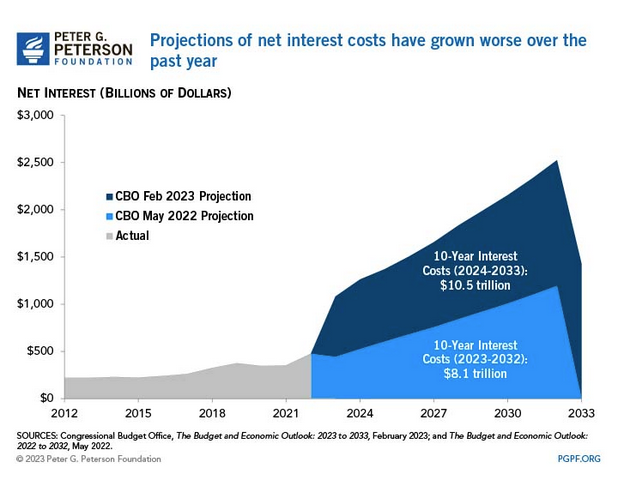

- Relative to the size of the economy, interest costs in 2030 will reach 3.3 percent of gross domestic product (GDP), exceeding the previous post-World War II high of 3.2 percent of GDP, which was recorded in 1991.

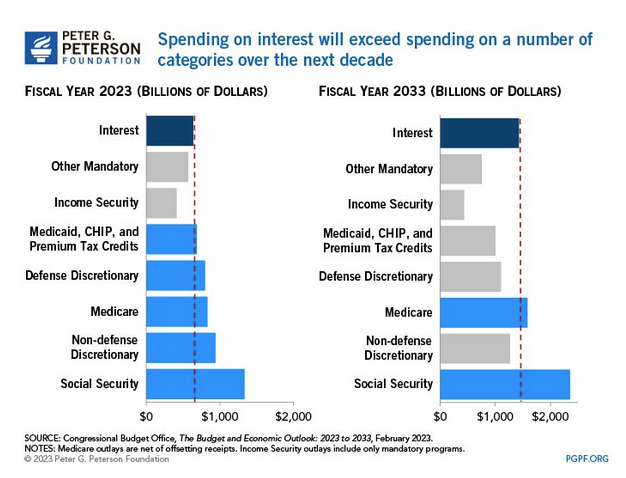

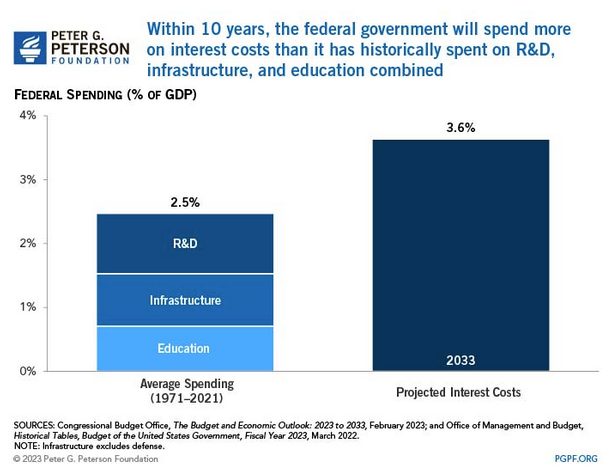

- Within 10 years, net interest costs will exceed federal spending on crucial programs like Medicaid and defense.

- Spending for net interest will become the largest “program” in the federal budget within the next 30 years, outpacing spending on Medicare and Social Security.

The last time debt:gdp was at this level (~120%) was post WWII 1948. The Fed was smart enough to let inflation run “above-trend” for the next few years to “inflate it away.” Within a hand full of years debt:gdp had collapsed from ~120% to ~55%:

Even CANADA understands this as they “paused” hikes yesterday:

Canada (BoC) just announced their “pause” on interest rate hikes today. Apparently their economic text books chronicle the “lagged effect” of policy and they have decided to let it work through the system before unnecessarily losing millions of jobs 🤔 pic.twitter.com/wZ5maWcsCR

— Thomas J. Hayes (@HedgeFundTips) March 8, 2023

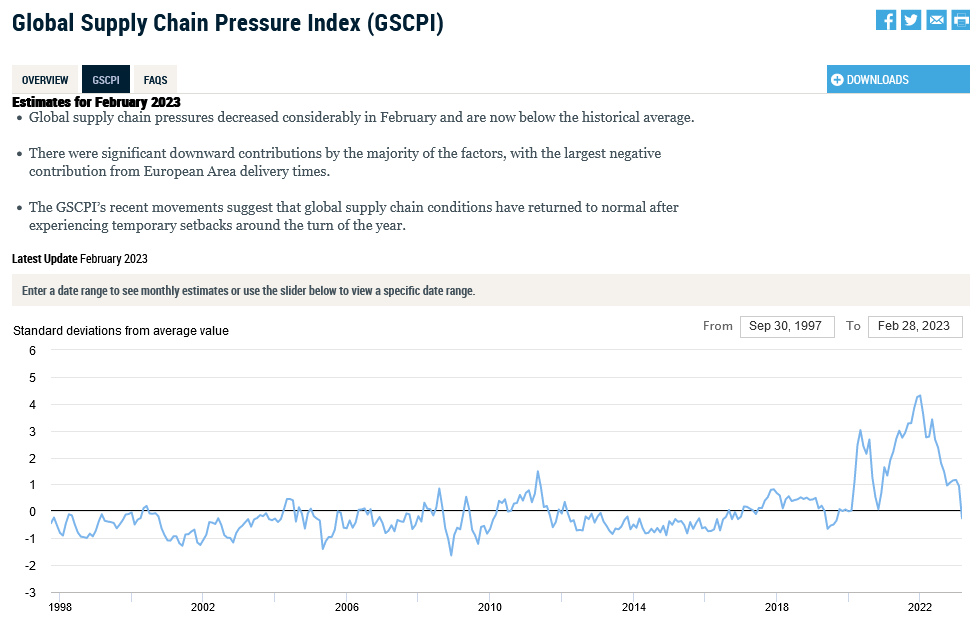

Chair Powell needs to take a pause after 1 or 2 more 25bps hikes (max). The culprit (supply shortages) has been put to bed. Remaining components will follow. Patience is required:

As we stated in our podcast|videocast last month, the political heat would turn up on Powell to pause once people in their districts started getting priced out of housing and losing their jobs.

Here is Congresswoman Ayanna Pressley explaining how Chair Powell is targeting the most vulnerable in society with his policies:

Here is Senator Warren on Tuesday:

Despite Powell’s risk of overdoing it and having to reverse course (not our base case), we remain constrictive on high quality businesses that have been temporarily marked down.

I joined Charles Payne on Fox Business this Friday to discuss two such businesses. Thanks to Charles and Kayla Arestivo for having me on:

We did some aggressive “Myth Busting” and positioning analysis with Rachelle Akuffo on Yahoo! Finance this Monday. Thanks to Rachelle and Pamela Granda for having me on:

Watch in HD directly on Yahoo! Finance

And finally, I joined Cheryl Casone on Fox Business – The Claman Countdown – yesterday. Thanks to Cheryl, Kathryn Meyers and Liz Claman for having me on:

Watch in HD directly on Fox Business

Here were my notes ahead of the segment:

Key Points from Powell Testimonial

Bad –

–“Higher” and “faster” were likely the keywords that triggered the algorithmic traders (i.e. if “______”, then “sell”). POWELL: RECENT DATA, DOES SUGGEST THE POSSIBILITY THAT WE’LL HAVE TO RAISE RATES HIGHER THAN EXPECTED.

-Services Inflation Sticky: POWELL: WE DO EXPECT IT WILL TAKE TIME FOR US TO HAVE AN IMPACT ON THE SERVICE SECTOR, THE SERVICE SECTOR IS LESS INTEREST-RATE SENSITIVE.

-Pedal on the metal: POWELL: WE MUST CONTINUE TO TIGHTEN.

-Dot Plot moving above 5.4%: POWELL: THE PEAK RATE IN THE NEXT DOT PLOT MAY BE HIGHER THAN DECEMBER. SO FAR, DATA SUGGESTS THAT OUR NEXT SEPS WILL HAVE A HIGHER TERMINAL RATE.

-50bps on the table for March: FED FUNDS FUTURES ARE NOW PRICING IN A HALF-POINT RATE HIKE FOR MARCH.

Good –

-Data Dependent: EPOWELL: WE HAVE IMPORTANT DATA RELEASES TO ANALYSE BEFORE NEXT MEETING, THEY’LL BE VERY IMPORTANT.

-January Fluke? POWELL: SOME OF THE STRENGTH IN THE OVERALL JANUARY DATA IS MOST LIKELY DUE TO UNSEASONABLY WARM WEATHER.

-Heaviest weight in CPI starting to collapse: POWELL: MEASURES OF NEW HOUSING LEASES BEING SIGNED SHOW SIGNIFICANT DECLINES IN INFLATION.

-Wages are moderating: POWELL: WAGES HAVE BEEN MODERATING WITHOUT A LABOUR MARKET SOFTENING.

-Goods inflation dropping: POWELL: GOODS INFLATION HAS BEEN DECLINING FOR SOME TIME.

-Soft Landing on table: POWELL: I BELIEVES THAT A SIGNIFICANT DOWNTURN IS NOT REQUIRED. POWELL: THERE IS A PATH TO RESTORING 2% INFLATION WHILE HAVING

-LESS OF AN IMPACT ON THE LABOUR MARKET THAN HAS HISTORICALLY BEEN THE CASE.

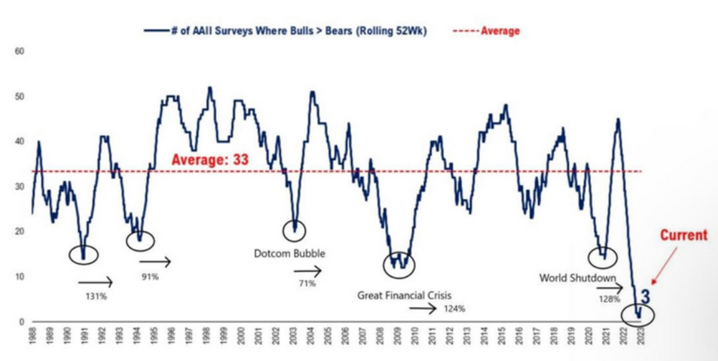

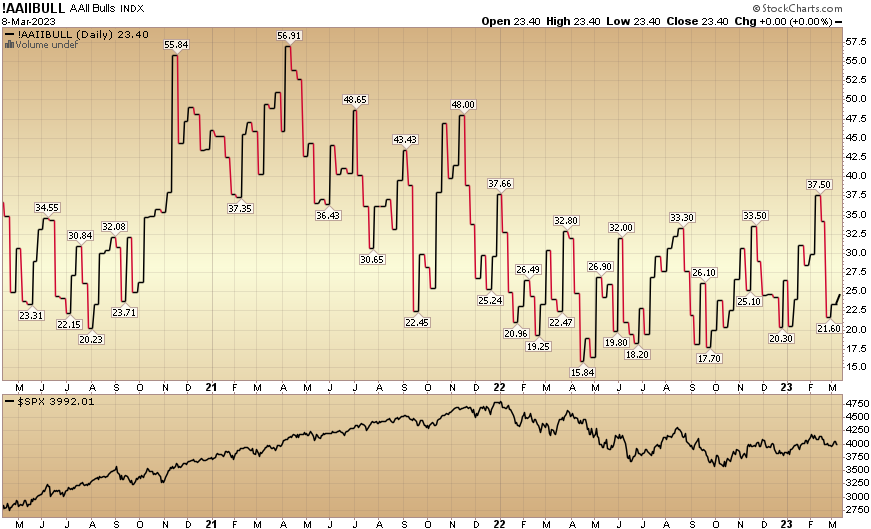

AAII Sentiment Indicator:

52 week rolling Average where BULLS are > BEARS. Only 3x last year. Avg return when indicator bottoms below 20 and turns up (which it has begun in 2023) is 109%. 1990, 1994, 2002, 2009, 2020, 2022/2023

Source: Listener Alan W.

Source: Listener Alan W.

100% Indicator?

Since 1960 every time the S&P 500 closed above its 10 month moving average for 2 months in a row AFTER the market had corrected at least 20%, it marked a new bull market.

This has occurred 14 times in 63 years. The indicator was confirmed in Jan/Feb 2023.

Monthly Seasonality Tailwind (March & April)

Pick:

AMZN is back at 2018 levels despite:

-AWS rev 2022 3x – +$80B (up from $25.7B in 2018)

-Ad rev 2022 3x -+$35B (up from $10B in 2018)

-E-commerce revenue doubled from 2018

-Operating Cash Flow Up 50%

-Prime members 163.5M (up from 100M in 2018)

Uninvestable to Unavoidable!

Sentiment is returning to Chinese equities as the re-openinng numbers continue to exceed expectations. So WHEN will the equities take their next leg higher? As we’ve covered in the past – when the dollar stops going up (counter-trend rally stops) and the weakness resumes:

The recent consolidation in Chinese equities after the 100%+ rally off the lows has nothing to do with Balloons, Xi, TikTok, Taiwan or any other noisy headlines. It has everything to do with when Powell is done. The political pressure is building ahead of next year’s election. You saw the first taste above from Warren and Pressley. Next they’ll be calling for HIS job as one of the 2 Million lost if he doesn’t get religion from Canada (of all places!)…

Now onto the shorter term view for the General Market:

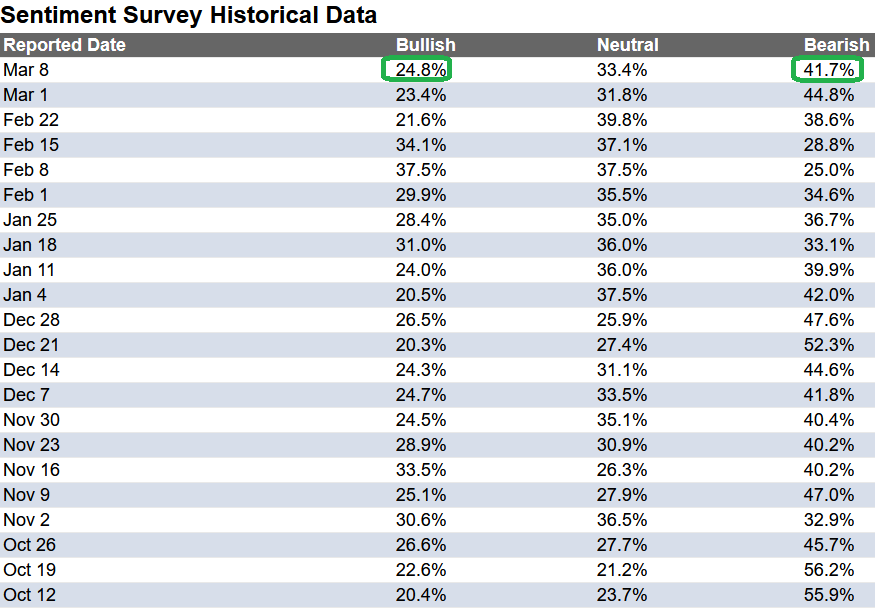

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) ticked up to 24.8% from 23.4% the previous week. Bearish Percent ticked down to 41.7% from 44.8%. Retail traders/investors are shaking in their boots…

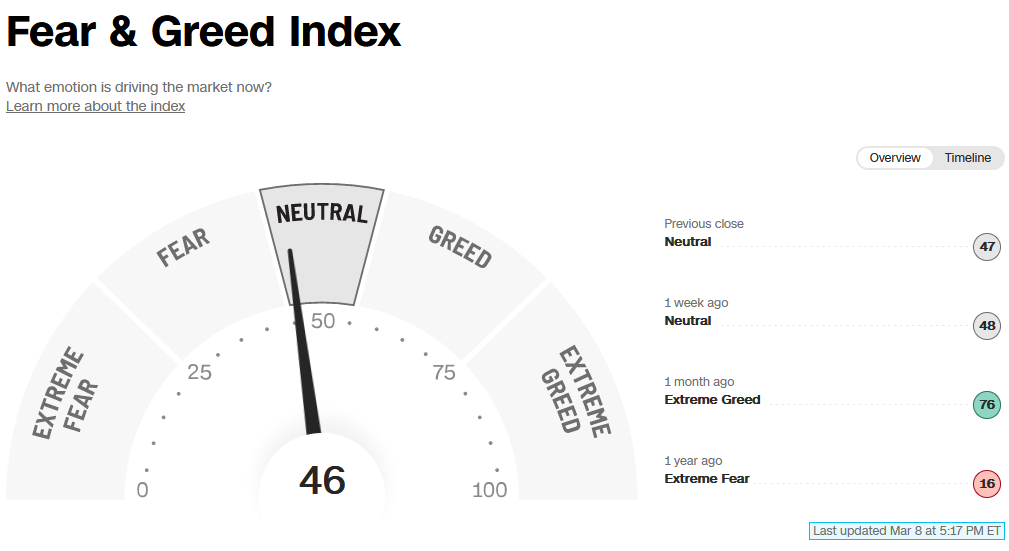

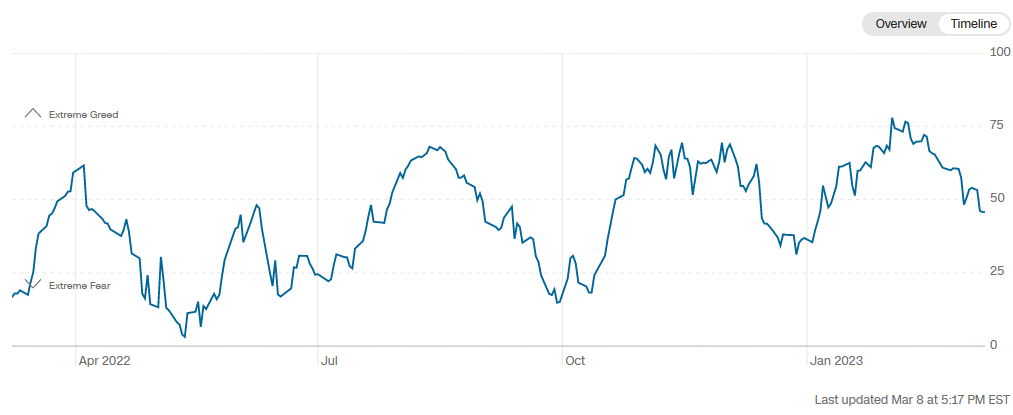

The CNN “Fear and Greed” fell from 56 last week to 46 this week. Sentiment is neutral. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The CNN “Fear and Greed” fell from 56 last week to 46 this week. Sentiment is neutral. You can learn how this indicator is calculated and how it works here: (Video Explanation)

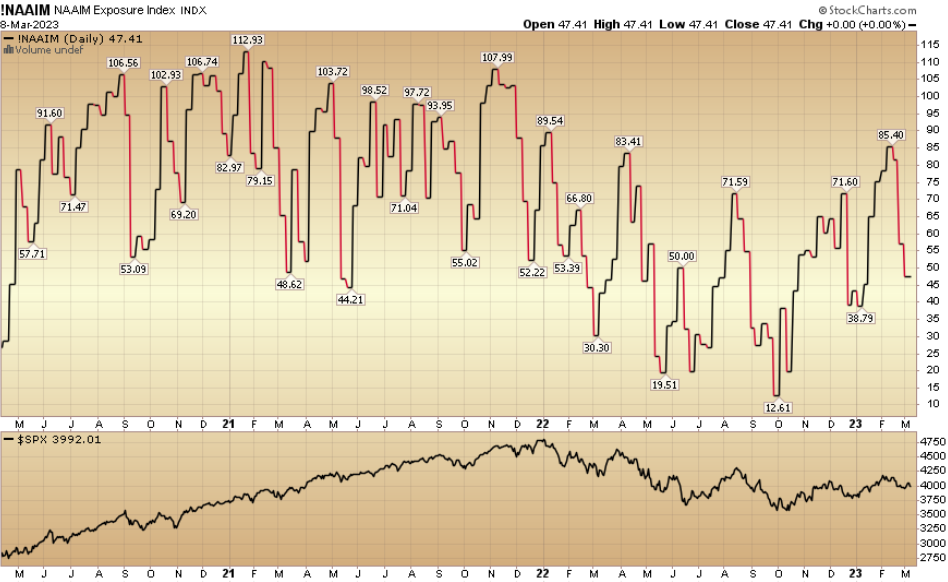

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 47.41% this week from 57.09% equity exposure last week.

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 47.41% this week from 57.09% equity exposure last week.

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Our podcast|videocast will be out today or tomorrow. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

*Opinion, not advice. See “terms” above.