- Dealmaking Is Looking Up as Companies Stop Waiting Out the Fed (wsj)

- ASML Orders Plunge as Chipmakers Pause High-End Gear Purchases (bloomberg)

- Serious investors need China exposure, should ‘forget about the short-term pain’, asset managers say (scmp)

- Fed’s Beige Book Holds Clues to Predicting Downturn, Study Shows (bloomberg)

- The stock market just flashed bullish a signal suggesting 19% upside by August 2025, BofA says (business)

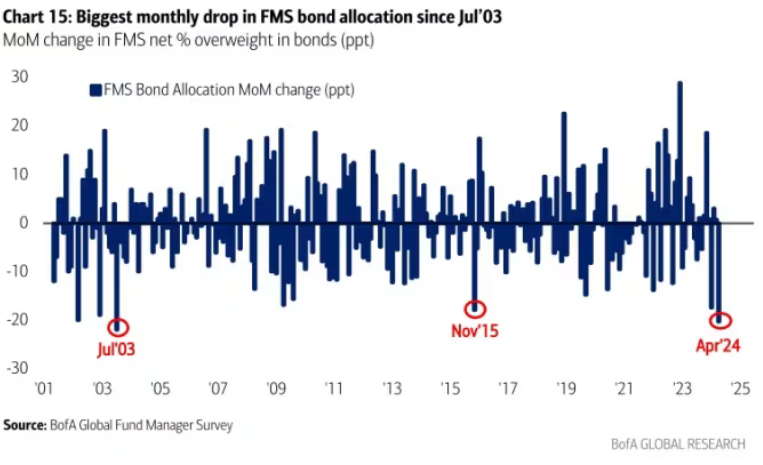

- Fund managers are giving up on bonds in a way they haven’t in 20 years (marketwatch)

- Do cash-gushing stocks outperform the S&P 500? Here’s what history has to say. (marketwatch)

- Consumer spending has slowed but is hanging in there, says BofA CEO Brian Moynihan (cnbc)

- Oakmark’s Bill Nygren shares his thoughts on CITI (cnbc)

- Bonds are a good diversifier for risk assets over most cycles: Steve Laipply (foxbusiness)

- China warns west of ‘survival of the fittest’ as manufacturing boosts economy (ft)

- Powell Dials Back Expectations on Rate Cuts (wsj)

- Rents have finally stopped skyrocketing. (marketwatch)

- Boeing Defends Safety of 787 Dreamliner After Whistle-Blower’s Claims (nytimes)

Be in the know. 14 key reads for Wednesday…