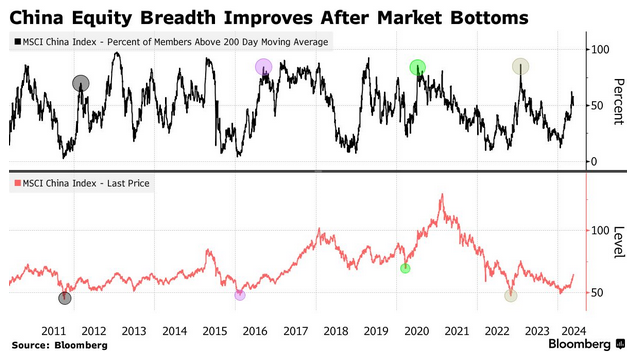

- China’s Improving Market Breadth Is Good News for Stock Bulls (bloomberg)

- China’s online retail sales up 11.5 pct in January-April period (cn)

- China’s 618 shopping festival: Alibaba touts early sales after withholding data last year, a sign of brighter outlook (scmp)

- China’s property stimulus bazooka fuels instant rebound in sentiment as inquiries, home sales in Shanghai, Beijing jump (scmp)

- China stock rally far from over as Beijing doles out stimulus: Alpine Macro (streetinsider)

- Hedge Funds Trim Big Tech Exposure in Hunt for Other AI Winners (bloomberg)

- The SEC’s T+1 settlement rule will transform stock trading: Here’s what you need to know. (marketwatch)

- Risky Bonds Join Everything Rally (wsj)

- The Highest Paid CEOs of 2023 (wsj)

- Biogen to Pay Up to $1.8 Billion for Immune Drug Developer (bloomberg)

- The last bear on Wall Street: Why JPMorgan’s Marko Kolanovic is sticking by his forecast for a 20% market sell-off (businessinsider)

- ‘Not a good sign:’ Lululemon (LULU) stock down after CPO departs (streetinsider)

- A tidal wave of cash is headed for markets post-Nvidia results, this strategist argues. (marketwatch)

- Several Chinese cities slash down payments, mortgage rates to boost property demand (yahoo)

- Meta AI chief says large language models will not reach human intelligence (ft)

- Japan’s 10-year yield tops 1% for first time in 11 years (ft)

- Time to Pounce: 2 Ultra-High-Yield S&P 500 Dividend Stocks That Are Screaming Buys Right Now (fool)

- BABA-SW Pumps US$230M into Lazada (aastocks)

- Chinese premier stresses financial support for real economy (cn)

- It’s not your imagination. Pickleball courts are everywhere (cnbc)

Be in the know. 20 key reads for Wednesday…