Skip to content

- China cuts benchmark lending rates for the first time in 7 months in Beijing’s growth push (cnbc)

- Alibaba, JD, and Other China Stocks Rise. What’s Giving Them a Boost. (barrons)

- China Banks Cut Deposit Rates to Aid Margins, Drive Spending (bloomberg)

- Understanding the US Housing Market in 2025: Mortgage Rates, Affordability, and Growth Trends (morningstar)

- Home Depot Maintains Guidance as US Spending Holds Up (bloomberg)

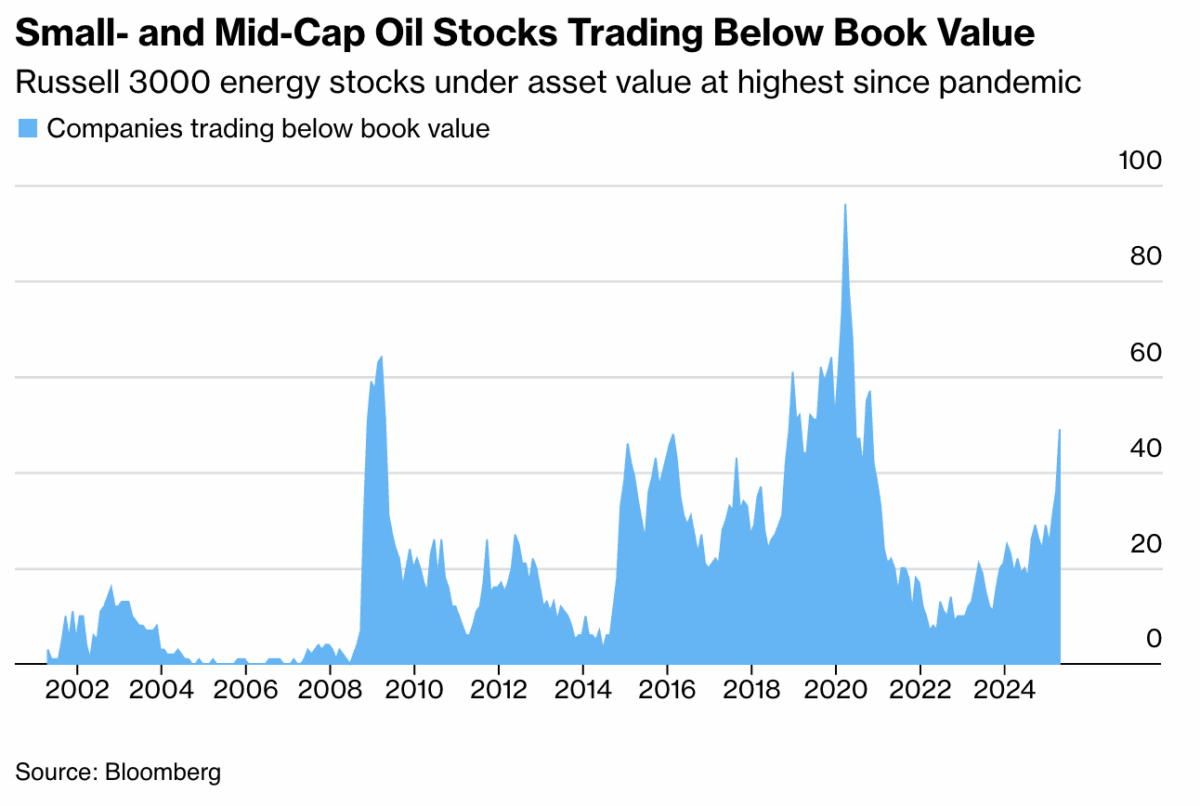

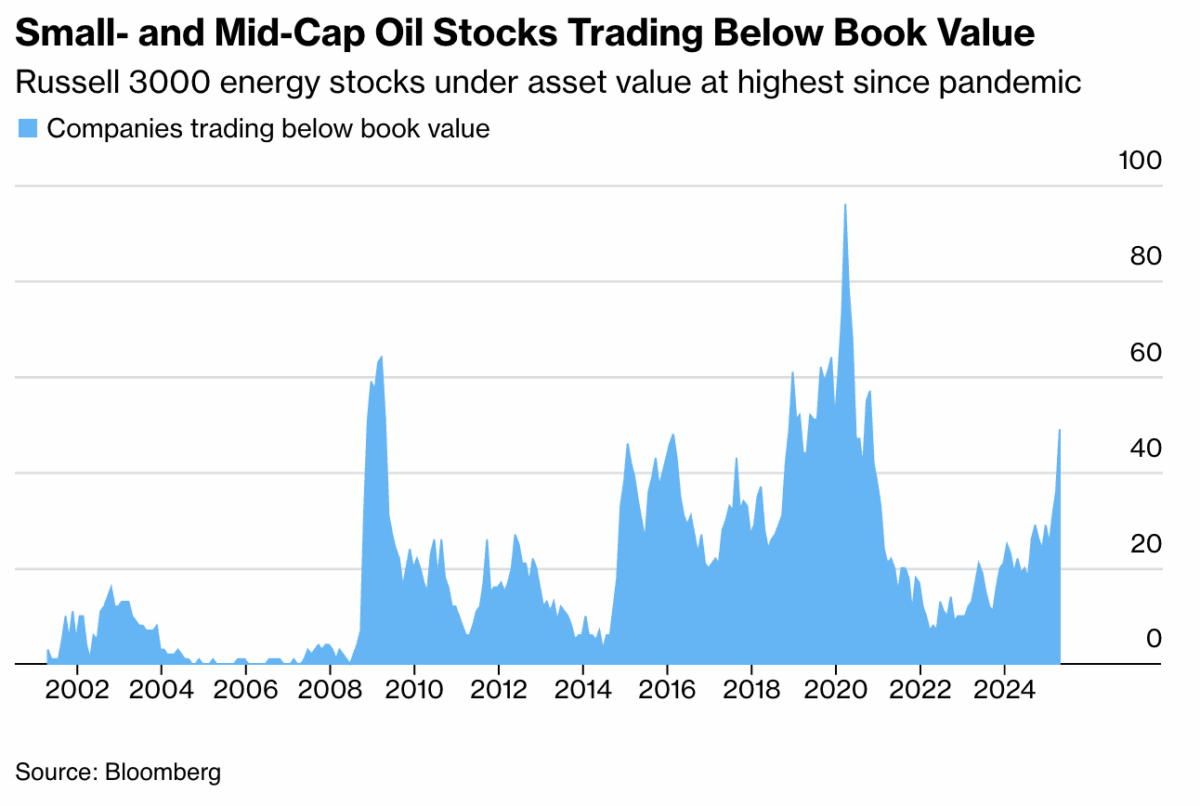

- A Third Of Russell 3000 Energy Companies Trade Below Book Value (zerohedge)

- Natural Gas Power Plants are Energy’s Biggest Buyout Targets (barrons)

- JPMorgan and Citi See European Stocks Blowing Past the US (bloomberg)

- Citi Sees Weaker Dollar After G-7 Meeting as US Softens Tariffs (bloomberg)

- Dollar set for more weakness as ‘Brand USA’ falls further out of favor (reuters)

- Tax Cuts Are Coming. Moody’s Warning on Debt Won’t Make a Difference. (barrons)

- Fundstrat’s Tom Lee: There’s not much signal in Moody’s U.S. downgrade (youtube)

- 5 Stocks to Buy to Profit From Trump’s Trade Deals (morningstar)

- Exclusive: Intel explores sale of networking and edge unit, sources say (reuters)

- Goldman: Biopharma Valuation Discount Hits Extreme Lows; Key Near-Term Catalysts In Focus (zerohedge)

- Bernstein raises Boeing stock price target to $249, maintains Outperform (investing)

- Retail Traders Go on Record Dip Buying Spree, Calming a Jumpy Stock Market (bloomberg)

- UnitedHealth Built a Giant. Now Its Model Is Faltering. (wsj)

- Nike Will Be the Winner If Dick’s Can Revive Foot Locker (bloomberg)

- Wall Street Banks Bet on Emerging Markets After Wasted Years (bloomberg)

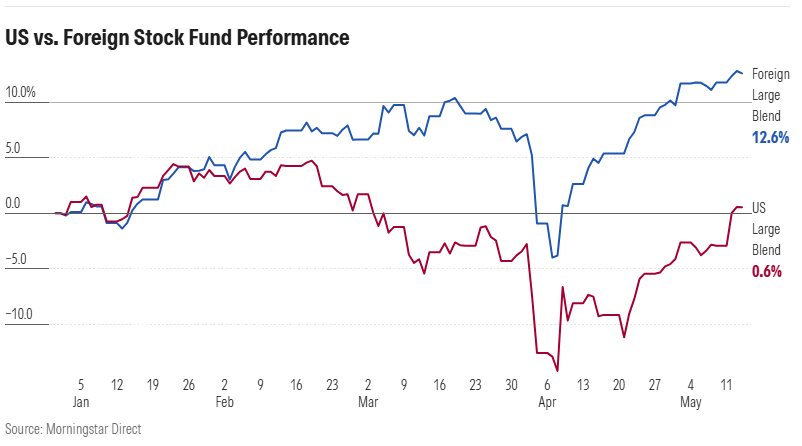

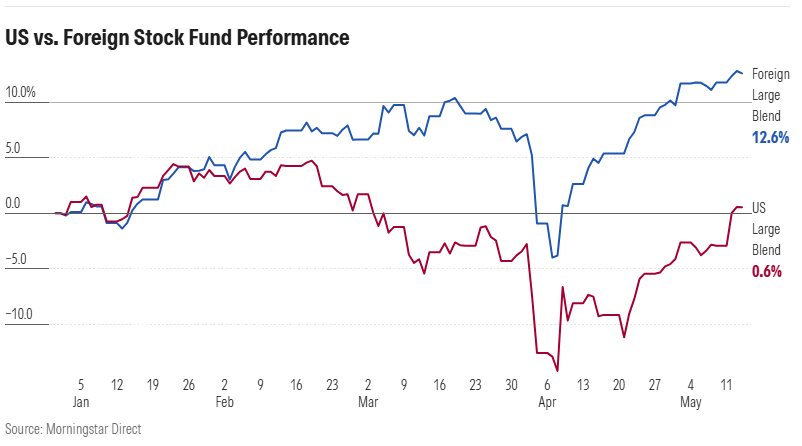

- Despite US Rebound, International Stock Funds Continue to Lead (morningstar)

- Alibaba cements AI leadership as cloud unit reports fastest growth since 2022 (scmp)

- Exclusive | ‘Still a good time to buy’: Goldman urges value investors to make ‘precise’ stock picks (scmp)

- Ant Group Global Unit Brings in $3 Billion Ahead of Spinoff (bloomberg)

- Breaking down the US and Chinese markets’ recoveries (ft)

- Morgan Stanley’s Wilson Says Buy US Stock Dips After Moody’s Cut (bloomberg)

- Goldman Prime: OWICs Galore, Hedge Funds Stopped-In During Biggest Squeeze Since Dec 2021 (zerohedge)

- M&A Target Stocks Surge in Bet on Wall Street Dealmaking Rebound (bloomberg)

- Big Tech Goes From Stock Market’s Safest Bet to Biggest Question (bloomberg)

- What are the key similarities and differences between 2025 and 2000 (streetinsider)

- Bessent Dismisses Moody’s Downgrade as ‘Lagging’ Indicator (barrons)

- Why the U.S. consumer may be more resilient than many think (marketwatch)

- Intel debuts AI GPUs for workstation system as it works to gain ground on Nvidia, AMD (yahoo)

- Johnnie Walker Maker Diageo Expects Tariff Hit, But Sticks With Guidance (wsj)

- Diageo plans $500 million in cost savings by 2028, lowers tariff impact view (reuters)

- House Republicans Advance Trump’s “Big, Beautiful Bill” After Weekend Of Negotiations (zerohedge)

- Will Anyone Take the Factory Jobs Trump Wants to Bring Back to America? (wsj)

- Spain Boosts Costlier Gas Power to Secure Grid After Blackout (bloomberg)

- Clean Energy Is Under Attack Even Where It’s Booming (wsj)

- First LNG ship bunkering hub in US Gulf Coast secures permits to start work (reuters)

- Hartnett: How To Trade The “Next Big Bull Market” (zerohedge)

- The U.S. Doesn’t Have a Perfect Credit Rating Anymore. Investors Shouldn’t Worry Yet. (barrons)

- Does Moody’s US downgrade matter? (ft)

- M2 charts look good (scottgrannis)

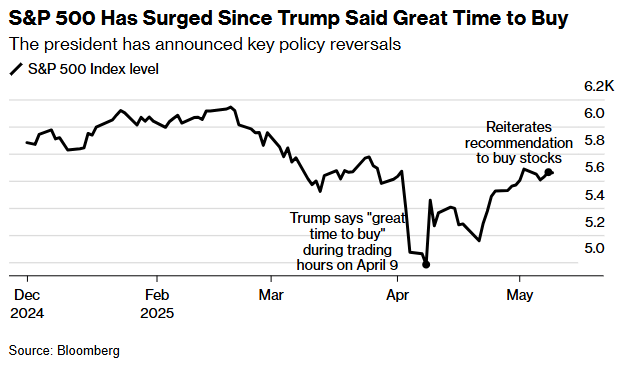

- The Trump Administration’s New ‘Big Star’ Could Make All the Difference for Markets (barrons)

- Housing market shift explained—and where it’s happening the fastest (fastcompany)

- Housing market standoff: Gen Z wants in, but boomers are staying put (fastcompany)

- Why aren’t Americans filling the manufacturing jobs we already have? (npr)

- Is the market up or down? Republicans and Democrats disagree (economist)

- America has given China a strangely good tariff deal (economist)

- AliViews: Eddie Wu on Alibaba’s Q4 Earnings (alizila)

- The invisible tech revolution poised to make in-chat AI shopping real (yahoo)

- Disney parks boss Josh D’Amaro touts Mouse House bona fides as succession chatter rages (yahoo)

- Consumers Face Challenges as New-Vehicle Inventory Drops 7.4% in April Amid Tariff Uncertainty (coxauto)

- Scottie Scheffler took control of PGA Championship with 4 superhuman swings (golf)

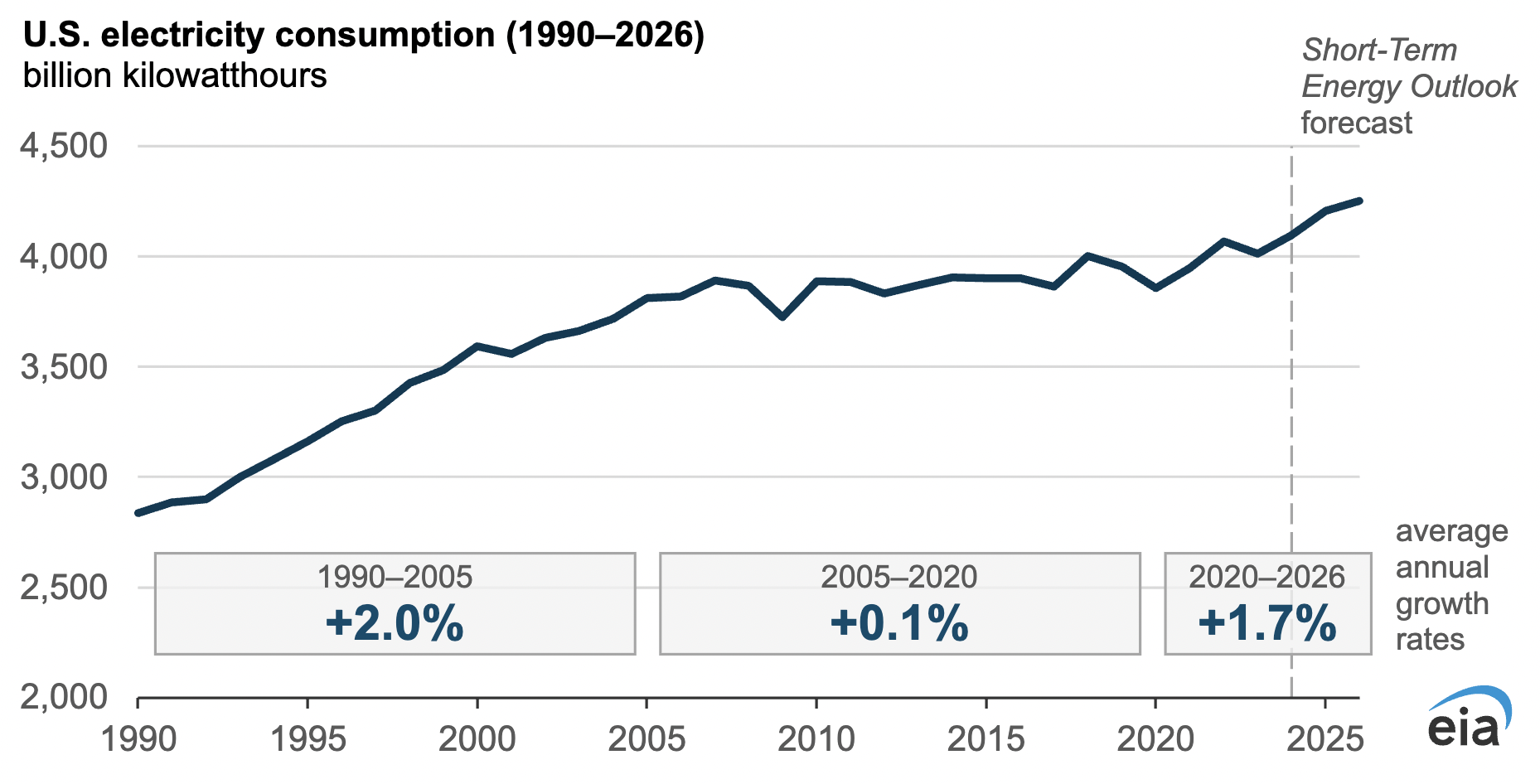

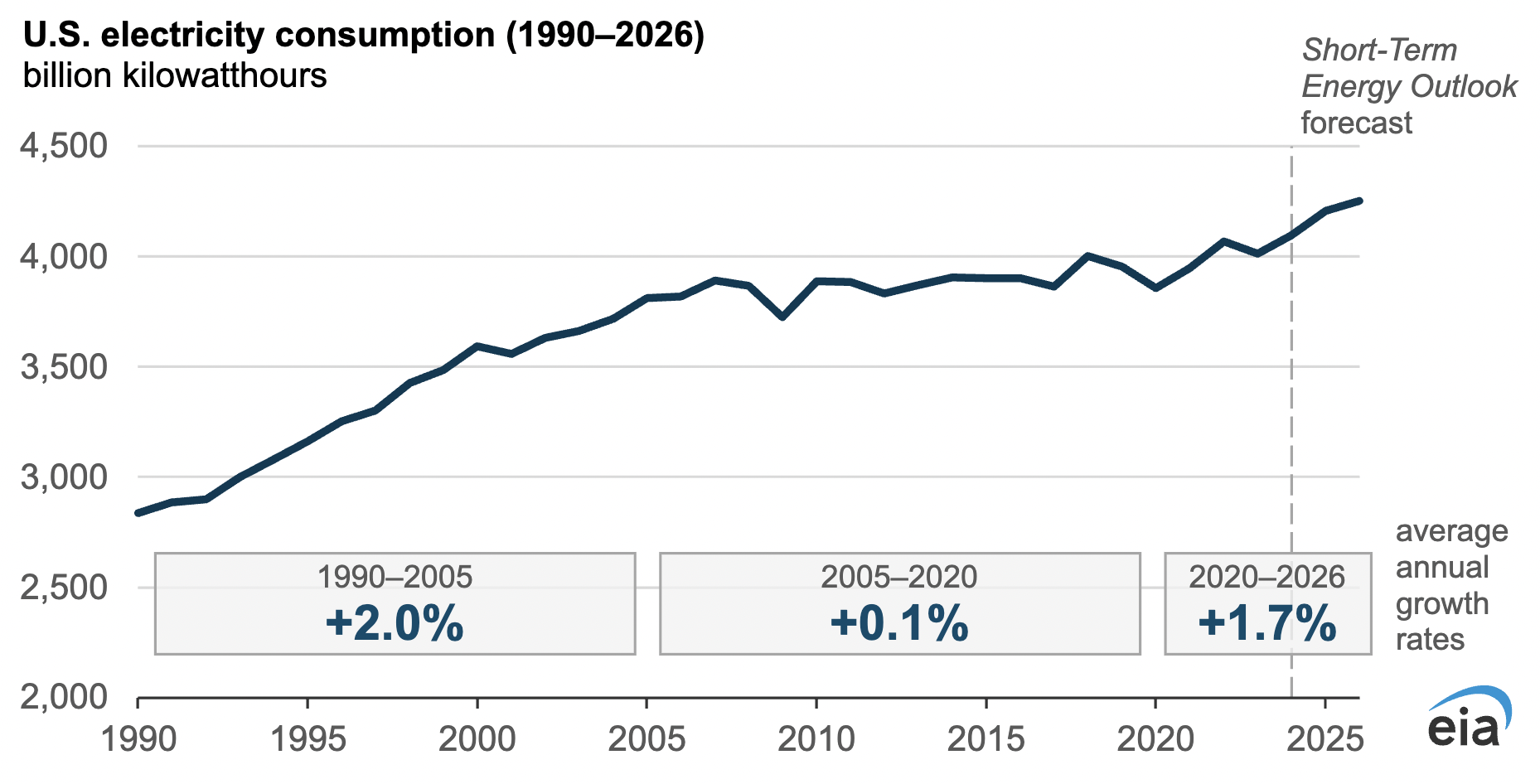

- After more than a decade of little change, U.S. electricity consumption is rising again (eia)

- Data Centers’ Hunger for Energy Could Raise All Electric Bills (nytimes)

- 13 Energy Stocks to Buy Even as Oil Prices Fall, According to Roundtable Pros (barrons)

- Builder Stocks Shrug Off Bad Construction Data. Mortgage Rates Matter More. (barrons)

- U.S. Housing Starts Ticked Up in April (wsj)

- Hedge Fund Insider Sees Dollar Rout as Biggest Players Eye Exit (bloomberg)

- What a Weaker US Dollar Means for the Economy (bloomberg)

- Businesses Made a Big Tax-Cut Request. Republicans Said Yes—and Then Some. (wsj)

- Value investing is poised to rise from the dead (reuters)

- There’s a big disconnect between US economic vibes and what the data actually says (marketsinsider)

- Elite CEOs Don’t Need Earnings Guidance (wsj)

- Why Small Cap Stocks Are Ready For A Rebound (forbes)

- Push To Exempt Treasuries From Liquidity Ratio Is Boon For Bond Rally (zerohedge)

- Here’s What Hedge Funds Bought And Sold In Q1: 13F Summary (zerohedge)

- Trump Says He’s Willing to Travel to China for Xi Meeting (bloomberg)

- Alibaba Earnings: Results In Line, With Cloud Business to Drive Growth (morningstar)

- Vietnam steps up talks with US to reduce hefty tariff (reuters)

- U.S. Credit Gets Downgraded by Moody’s, the Last Triple-A Rating (barrons)

- U.S. Won’t Prosecute Boeing Over 737 MAX Crashes, WSJ Reports (barrons)

- BofA’s Hartnett Says EM Stocks Will Outperform Everything Else (bloomberg)

- Earnings Sank Alibaba. The Stock Can Make a Comeback. (barrons)

- Big Chinese companies like Alibaba show that AI-powered ads are giving shopping a boost (cnbc)

- China calls U.S. trade talks ‘good’ but quiet on next steps, as Trump hints at Xi call (cnbc)

- Capital flows back to US-listed China ETFs post big selloff (reuters)

- Alibaba, NetEase, & KE Holdings Report Q1 (chinalastnight)

- A Trade Made for Buffett: Energy Stocks Priced Below Book Value (bloomberg)

- US set to cut capital requirements for banks, FT reports (reuters)

- Boeing Stock Rises Again. Wall Street Is More Positive on Sales. (barrons)

- Trump announces $14.5 billion Etihad order for 28 Boeing planes with GE engines (reuters)

- Boeing stock target raised to $230 by TD Cowen (investing)

- Goldman Unveils New ‘Trump Trade’ (zerohedge)

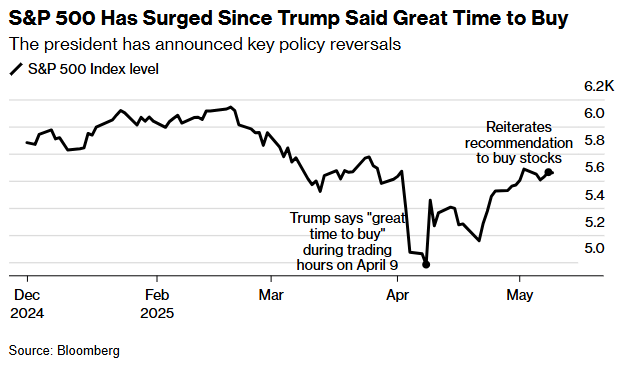

- From Panic to FOMO: Wall Street’s Sentiment Whiplash (zerohedge)

- Smart Money Loses to Retail Crowd That Bet on Stock Rebound (bloomberg)

- How to Invest Like Warren Buffett (morningstar)

- EU Exports to U.S. Surge Ahead of Trump Tariffs (wsj)

- Weight-Loss Drugs Providing a Boost to US Meat Demand, JBS Says (bloomberg)

- Alibaba Revenue Grows Despite Competition, Boosting Profit (wsj)

- Alibaba’s quarterly revenue grows 7% as AI-driven cloud business remains buoyant (scmp)

- Alibaba’s financial health in 12 charts (techinasia)

- Alibaba Sustains AI Frenzy With Second Video Upgrade in Weeks (bloomberg)

- Boeing inks record-breaking deal for Qatar Airways to buy up to 210 planes (cnbc)

- Boeing stock target raised at Wolfe after ’a big beautiful order’ from Qatar (investing)

- Boeing Booms From Trump’s Trade Deals. This Can Lift Aerospace, Defense Stocks Higher. (barrons)

- AI Boom Has Generac Looking to Data Centers for Growth (bloomberg)

- Millions of Americans at Risk of Summer Power Shortfall, Regulator Says (bloomberg)

- Generac Rethinking Supply Chain Amid Tariffs, CEO Jagdfeld Says (youtube)

- A Less-Generous Warren Buffett Would Be $67 Billion Richer Than Elon Musk (bloomberg)

- There Are Still Stock Bears Left To Throw In The Towel (zerohedge)

- Wall Street’s sudden rebound catches investors ‘offside’ (ft)

- US poised to dial back bank rules imposed in wake of 2008 crisis (ft)

- Why Trade Deals and Tax Cuts May Be a Recipe for US Success (bloomberg)

- Trump’s Tax Bill Could Give Babies $1,000 ‘MAGA’ Accounts. How It Works. (barrons)

- A Trade War Winner? The Booming Business of Returned Products. (nytimes)

- Ford and Tesla Are Best-Positioned for Trump’s Car Tariffs. These Companies Are the Worst. (barrons)

- Ford CEO Jim Farley says company will be ‘advantaged’ around tariffs: ‘Fairest fight in decades’ (nypost)

- EU Trade Officials See Signs of Optimism for US Tariff Deal (bloomberg)

- Trump Says India Offered to Remove All Tariffs on US Goods (bloomberg)

- UK Economy Has Best Quarter in a Year With 0.7% Expansion (bloomberg)

- Perplexity, PayPal partner to provide easy payment checkouts to users (reuters)

- BofA lifts Albemarle stock price target to $93 on cost cuts (investing)

- Perplexity partners with PayPal for in-chat shopping as AI race heats up (cnbc)

- ESPN’s New Streaming Service Will Cost $29.99 a Month (wsj)

- Will ESPN’s new streaming service spell the end for cable television? (marketwatch)

- Disney Entertainment Co-Chair Dana Walden goes one-on-one with Jim Cramer (youtube)

- JD.com Stock Is Rising. How China’s Economic Rebound Boosted Earnings. (barrons)

- Chinese Stocks Advance on Growing Optimism Over Tech Earnings (bloomberg)

- Tencent Grows Fastest Since 2021 in Solid Start to Rocky Year (bloomberg)

- Alibaba pushes global adoption of Qwen3 AI models via more developer platforms online (scmp)

- U.S. Scraps ‘AI Diffusion’ Rule in Revamp of Biden-Era Chip Curbs (wsj)

- Top Asia Advisers at Morgan Stanley, UBS See China Revival (bloomberg)

- Funds Kept Shifting Out of U.S. Stocks as Rally Picked Up (barrons)

- Global EV sales rise in April despite trade disruptions, research finds (reuters)

- Banking sector says easing of US leverage rules could support Treasury market (reuters)

- Boeing delivered 45 jets in April, nearly double last year (investing)

- Saudi Wealth Fund to Order 30 Boeing 737s During Trump Visit (bloomberg)

- Trump and MBS Tout $1 Trillion Pledge as Details Remain Elusive (bloomberg)

- Intel’s New CEO to Focus on Executing Its Existing Strategy (bloomberg)

- Hedge Funds Capitulate With Second Biggest Short Covering Panic On Record During Monday Meltup (zerohedge)

- Investors Chasing Stock Rally Will Find It Gets Harder From Here (bloomberg)

- US inflation slows unexpectedly to 2.3% in April — Trump presses Fed to slash rates: ‘Just let it all happen’ (nypost)

- The 10 Best Dividend Stocks (morningstar)

- Yardeni cuts U.S. recession odds to 25%, lifts S&P 500 target to 6,500 (streetinsider)

- There won’t be another Buffett because no one will have his advantages (ft)

- Citi lifts Cooper-Standard price target to $25 from $12, keeps neutral (investing)

- UnitedHealth Places New Bet on Old CEO Who Made It a Giant (wsj)

- S&P 500 Has Jumped 14% Since Trump Said ‘Great Time to Buy’ (bloomberg)

- Bearish Stock Investors Left to Chase Rally, BofA Poll Shows (bloomberg)

- CTAs Now Buyers In Every Scenario As Buybacks Accelerate And Bearish Funds Capitulate (zerohedge)

- Short Squeeze Could Be Giving Stocks a Boost (barrons)

- JD.com’s Sales Rise 16% After China Stimulus Draws Shoppers Out (bloomberg)

- Alibaba pushes global adoption of Qwen3 AI models via more developer platforms online (scmp)

- China Removes Ban on Boeing Deliveries After US Trade Truce (bloomberg)

- Shipping demand set to explode as firms rush to exploit US-China tariff pause (scmp)

- Trump signals he could speak with China’s Xi by end of the week (reuters)

- How far is China from becoming self-sufficient in AI? (investing)

- Nomura Turns Bullish on China’s Stocks After Trade Truce With US (bloomberg)

- What the U.S.-China Trade Agreement Means for Markets (wsj)

- Nike and 3 More Top Stocks for the U.S.-China Tariffs Pause (barrons)

- Small Caps Soar on the U.S.-China Trade Deal. They Can Rally a Whole Lot More. (barrons)

- Goodbye, EV Tax Credit. Hello, Aid for Buyers of U.S.-Made Cars. (barrons)

- Traders See Fed Cutting Rates Just Twice in 2025 on Cooling Trade War (bloomberg)

- Trump’s Drug-Price Crackdown, Like His Trade War, Could Be More Bark Than Bite (wsj)

- Trump Executive Order Could Reshape How Americans Pay for Drugs. Why It Isn’t Bad for Pharma Stocks. (barrons)

- Boeing Stock Is Rising. Why It’s Getting a Boost From Tariff Talks Breakthrough. (barrons)

- NRG Buys 18 Natural-Gas Power Plants in Bet on Soaring Energy Demand (wsj)

- Are We Entering the Golden Age of Secondhand Shopping? (wsj)

- U.S. and China agree to slash tariffs for 90 days in major trade breakthrough (cnbc)

- Alibaba Stock Soars. It’s Not Just the China Trade Deal. (barrons)

- Surprise U.S.-China Trade Deal Gives Global Economy a Big Reprieve (wsj)

- ‘Decisive Moment’ in Trade Talks Puts China Rally Back on Track (bloomberg)

- US-China Trade Talks to Boost Sentiment in Asia, Strategists Say (bloomberg)

- New Alibaba method slashes costs of training AI for search by 88% (scmp)

- HEDGE FLOW Hedge funds re-enter Chinese equities on trade talk optimism, Morgan Stanley says (reuters)

- Nvidia, Intel, Marvell Stocks Jump. Why China Trade Progress Is Good for Chip Makers. (barrons)

- ‘Buy America’ Sweeps Across Global Markets After China-US Talk (bloomberg)

- Bullish Sign for S&P Flashes With More Stocks Shouldering Rally (bloomberg)

- The rally is real. The exposure? Still missing (zerohedge)

- The Ominous “Other”: Record Bearish Liquidation Is Misery For The Bears (zerohedge)

- Why JPMorgan says the U.S. lag vs. European stocks is just beginning (marketwatch)

- Investors Are Still Betting the Euro’s Rally Is in its Infancy (bloomberg)

- Americans Embrace Road Trips as Economic Fears Discourage Flying (bloomberg)

- Disney, Abu Dhabi and a growing theme park capital at ‘crossroads’ of world (cnbc)

- How to Think About the Stock Market When Earnings Guidance Becomes Meaningless (wsj)

- Spain’s unprecedented power outage sparks a blackout blame game over green energy (cnbc)

- Trump Touts “Great Progress” In China Tariff Talks, Suggests “Total Reset” On The Table (zerohedge)

- Stakes Rise as U.S. and China Open Second Day of Trade Talks (wsj)

- AI will be the mainstay of Alibaba’s business in next 3-5 years, chairman Joe Tsai says (scmp)

- Why the World Keeps Getting Shocked by China’s Technological Progress (bloomberg)

- China’s May Day holiday travel rebounds with surge in domestic, inbound, and outbound activity (technode)

- Donald Trump is right to ditch Joe Biden’s chip-export rules (economist)

- Huawei and other Chinese chip firms are catching up fast (economist)

- Why Warren Buffett matters beyond Wall Street (npr)

- Warren Buffett has created a $348bn question for his successor (economist)

- America’s Largest Grid Operator Warns Of Summer Power Shortages (zerohedge)

- Two online retailers think they have the key to beating tariffs (yahoo)

- Buy the dip: the trend that keeps stocks from crashing (economist)

- Why The Classic Ferrari 275 Is More Coveted Than Ever (maxim)

- 5 collector cars to put into your garage this week (classicdriver)