Skip to content

- Stockpickers: How investors can take a leaf out of Warren Buffett’s book (ft)

- Warren Buffett’s Unparalleled Investing Record—in Charts (wsj)

- Why the Fed Should Be Easing—Even In the Face of Tariffs (barrons)

- Ex Fed’s Warsh highlights a path to lower rates, takes a fresh dig at the Fed (reuters)

- Pain trades are inevitable (ft)

- China and US kick off high-stakes trade talks in Geneva (ft)

- Fear Of Economic Collapse Forced China To Negotiate With Trump, Quietly Reach Out First: Reuters Report (zerohedge)

- What to Watch During the U.S.-China Talks This Weekend (wsj)

- Jack Ma’s Alibaba visit and replica flat spark nostalgia over company’s humble start (scmp)

- Alibaba’s Quark, China’s most popular AI app, launches ‘deep search’ (scmp)

- Trump Says 10% Tariff Baseline Unless ‘Exceptional’ Offer Made (bloomberg)

- Extreme Heat Risks Summer Power Shortages, Warns Largest US Grid (bloomberg)

- Big Wall Street Comeback Is Upending a Slew of Bear Market Bets (bloomberg)

- ‘The Only Material Buyer Of This Dip Was Mr & Mrs Retail’; Goldman Macro Trader Sees ‘Path To Real Market Tailwinds’ (zerohedge)

- Boeing Stock Rises. Trump Was Right. (barrons)

- ESPN will call its forthcoming flagship streaming app simply ‘ESPN,’ sources say (cnbc)

- Trump suggests cutting China tariff to still-high 80% ahead of U.S.-Beijing trade talks (cnbc)

- How a China Trade Deal Would Put Stocks on Course for New Records (barrons)

- Trump Team Seeks Tariff Cuts, Rare Earths Relief in China Talks (bloomberg)

- Mr. Ahern Goes to Washington (chinalastnight)

- Alibaba breaks down barriers as CEO Eddie Wu calls for a return to entrepreneurial roots (scmp)

- China’s e-commerce giants to kick off midyear shopping festival next week (scmp)

- Exclusive: Nvidia modifies H20 chip for China to overcome US export controls, sources say (reuters)

- Trump Makes a Deal With the U.K. Now Comes the Hard Part. (barrons)

- IAG Orders 71 Large Jets from Boeing, Airbus to Grow Network (bloomberg)

- Boeing Stock Jumps on Trade News. It Isn’t About Plane Sales to the U.K. (barrons)

- With U.K. Deal, U.S. Signals That 10% Tariff on World Is New Baseline (wsj)

- Boeing is the first winner in new era of piecemeal trade deals (yahoo)

- UBS lifts Boeing stock target, doesn’t sees tariffs impacting FCF recovery (investing)

- Exclusive: India offers to slash tariff gap by two-thirds in dash to seal trade pact with Trump (reuters)

- Commerce Secretary Howard Lutnick: We’re going to roll out dozens of trade deals over the next month (youtube)

- Markets Soar As Trump Says “Better Go Buy Stocks Now” (zerohedge)

- How Global Carmakers Are Responding To Tariffs: Full Summary (zerohedge)

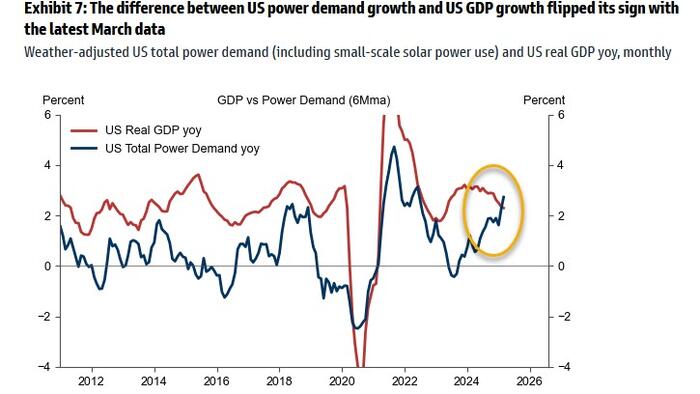

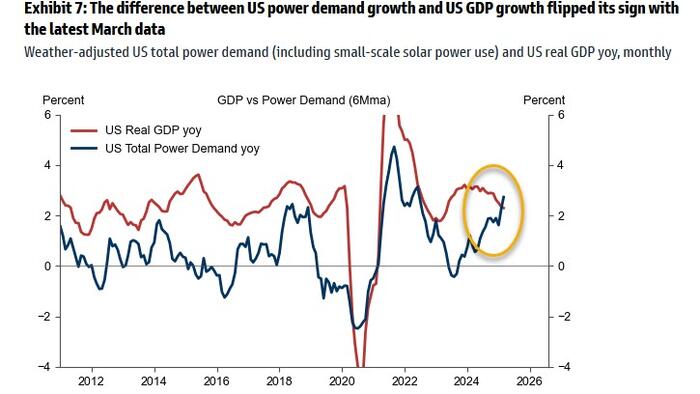

- Shock: Surging US Power Demand Suggests GDP Growth Over 3% (zerohedge)

- Corporate share buybacks were a shock absorber in April’s sell-off (ft)

- The Best Consumer Cyclical Stocks to Buy (morningstar)

- The Secret Thread Between Warren Buffett and Other Game Changers (barrons)

- Disney CEO Bob Iger delivers new magic for investors (foxbusiness)

- Stifel maintains Buy rating and $66 target on GXO Logistics stock (investing)

- The GOP Tax Bill Could Solve the Tariff Problem (wsj)

- Disney Makes It Official: The Middle East Is the New Theme-Park Hot Spot (wsj)

- Disney Earnings: Stellar Results with No Inkling of Recession Fears (morningstar)

- Disney CEO Bob Iger on new Abu Dhabi theme park: A momentous occasion for the company (youtube)

- Disney CFO: We have confidence from what we’re seeing in data (youtube)

- Lights, camera, inaction: why film tariffs would be a flop (ft)

- Trump to Announce Trade Agreement With Britain (wsj)

- Trump says trade deal with U.K. will be ‘full and comprehensive’ and that more deals will follow (marketwatch)

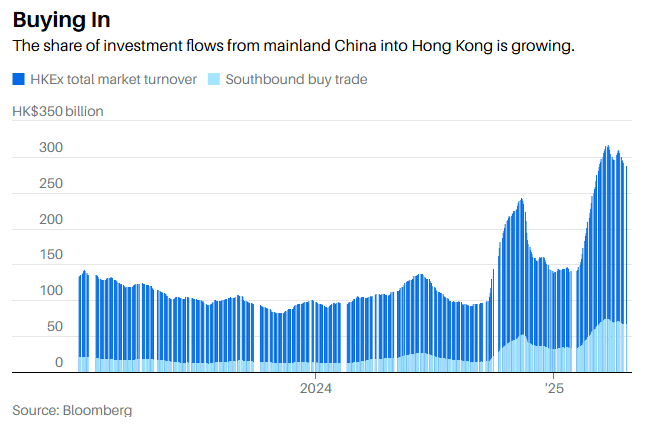

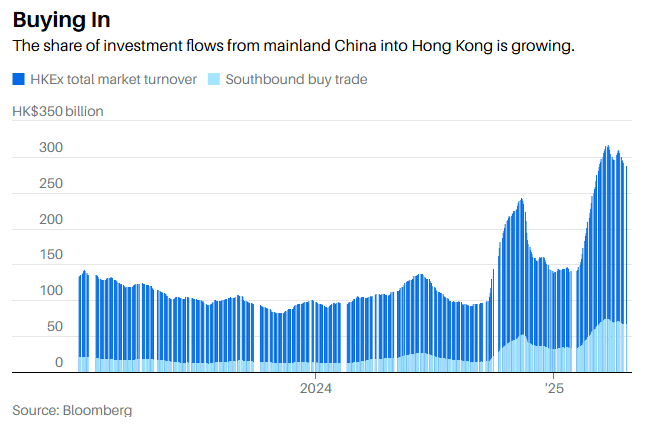

- Hong Kong stocks rise after Beijing unveils support plan; US-China trade talks loom (scmp)

- Bessent Working on Clear Rules for US Investment in China (bloomberg)

- Beijing pours tens of millions of dollars into fostering Nvidia-free AI ecosystem in China (scmp)

- U.S. to Overhaul Curbs on AI Chip Exports After Industry Backlash (wsj)

- America’s Self-Defeating AI Export Controls (wsj)

- Chinese Automakers Crank Up Sales of Cars With Combustion Engines in Europe (bloomberg)

- Vietnam Says It Wants to Buy More From US as Trade Talks Begin (bloomberg)

- JLR, Diageo Among Winners as UK-India Sign Model Trade Deal (bloomberg)

- U.S. exports of natural gas liquids touch record high in April (reuters)

- LNG Is A Key Bargaining Chip In Tariff Talks With Asian Nations (zerohedge)

- A Russian Gas Ban Will Boost These Companies (barrons)

- Interior Secretary Warns U.S. At Risk Of Spain-Style Blackouts (zerohedge)

- US Consumer Borrowing Rises Most in Three Months in Broad Pickup (bloomberg)

- US Mortgage Applications Climbed Last Week as Rates Eased (bloomberg)

- Taiwan’s China Airlines orders 14 Boeing 777X planes (reuters)

- Boeing taps Wisk Aero CEO to head commercial airplane product development (reuters)

- GXO Logistics earnings beat by $0.04, revenue topped estimates (investing)

- Recession Warnings Are Everywhere, Except in the Data (nytimes)

- Why the Fed Isn’t Ready to Join Other Central Banks in Cutting Rates (wsj)

- Ford hikes prices on these Mexico-produced models, citing Trump’s tariffs (nypost)

- Disney Raises Profit Forecast on Strong Parks, Streaming (bloomberg)

- Disney reports surprise uptick in streaming subscribers, beats on top and bottom lines (cnbc)

- Alibaba’s Qwen3 topples DeepSeek’s R1 as world’s highest-ranked open-source AI model (scmp)

- Trump officials Bessent and Greer to meet with Chinese counterparts on trade, economic issues (cnbc)

- China injects ‘tactical’ monetary stimulus ahead of US trade meeting (reuters)

- China Cuts Key Rate, Reserve Ratio to Aid Economy Hit by Tariffs (bloomberg)

- Alibaba collaborates with social media platform RedNote in fresh domestic e-commerce push (scmp)

- US-China Tariff Pause Reasonable to Expect, Council Head Says (bloomberg)

- Post-Holiday Rebound Driven By Consumer Stocks (chinalastnight)

- Bessent Says Good Trade Offers Made, Sees Deal Soon as This Week (bloomberg)

- So Much For “Not A Safe Asset”: Yields Tumble After Stellar 10Y Treasury Auction Stops Through On Soaring Direct Demand (zerohedge)

- UK and US in Intensive Talks on Economic Deal to Reduce Tariffs (bloomberg)

- Rush to beat tariffs boosts US trade deficit to record high in March (reuters)

- The economy is resilient enough to handle this uncertainty, says Ed Yardeni (youtube)

- Europe Is a Safe Haven. 5 Stocks—and 3 ETFs—to Buy for Turbulent Markets. (barrons)

- EU Lays Out Plan to Cut Russian Energy Imports by 2027 (wsj)

- BMW chief predicts lower tariffs from July (ft)

- US companies plot $500bn share buyback spree (ft)

- What’s in Buffett’s Berkshire Empire? Cowboy Boots, Candy and Railroads (wsj)

- Baby boomers are buying more homes than millennials. Is that backwards? (usatoday)

- Traders Most Bullish Loonie Since 2009 as Carney, Trump Meet (bloomberg)

- Intel shareholders approve equity incentive plan, new CEO pay (reuters)

- PayPal to introduce contactless mobile wallet in Germany (yahoo)

- Temu, Shein See US Sales Drop in Week After Tariff Price Hikes (bloomberg)

- ‘Made in China’ airliner faces trade turbulence (ft)

- Trump’s Middle East Trip Has Qatar Lining Up Major Boeing Order (bloomberg)

- Alipay and WeChat Pay see booming inbound spending in China during Labour Day holiday (scmp)

- China Plans Wednesday Briefing on Market Stabilization Measures (bloomberg)

- Beijing’s ‘Made in China’ Plan Is Narrowing Tech Gap, Study Finds (wsj)

- China’s New AI Niche Could Upend Global Tech Investing. How to Get in on the Data Gold Rush. (barrons)

- Pres. Trump will reduce China tariffs to 60% in coming weeks, says Piper Sandler (youtube)

- Optimism Is Back for Biotech Stocks. This Time, It Could Last. (barrons)

- What Recession: Goldman Now Expects Q2 GDP To Surge To 2.4% (zerohedge)

- Hollywood Wanted Trump to Bring Movie-Making Back to the U.S.—but Not Like This (wsj)

- Bessent Pitches Skittish Investors to Bet on Trump’s Economic Plan (nytimes)

- India Offers Zero-for-Zero Tariffs on Auto Parts, Steel From US (bloomberg)

- We should not believe consumers who say they’ve got the blues (ft)

- Avoid Unforced Errors and Stay Humble: Warren Buffett’s Leadership Lessons (wsj)

- BofA’s Trading Chief Says Shift Out of US Is Still Marginal (bloomberg)

- 5 Stocks to Buy in May and Hold for the Long Term (morningstar)

- GXO secures $2.5 billion NHS logistics contract (investing)

- Generac Urges Homeowners to Prepare as 2025 Hurricane Season Forecasts Above-Average Storm Activity (investing)

- Nike Switches Up Leadership Team Amid Ongoing Turnaround (wsj)

- Hims & Hers Stock Stumbles After Earnings. The Long-Term Sales Outlook Looks Low. (barrons)

- You’re More Like Warren Buffett Than You Think (wsj)

- How Warren Buffett Changed the Way Investors Think of Investing (nytimes)

- What Warren Buffett Learned From His Biggest Hits—and Misses (wsj)

- CEOs Celebrate Buffett as He Calls a Close on 5,500,000% Run (bloomberg)

- Warren Buffett to Remain Berkshire Hathaway Chairman (wsj)

- Disney’s Marvel Takes Top Spot at Weekend Box Office (barrons)

- Trump Calls for 100% Tariff on Movies Made Overseas (wsj)

- Trump Suggests Some Trade Deals May Come as Soon as This Week (bloomberg)

- Trump Won’t Fire Powell, But He Wants a Rate Cut (barrons)

- Hartnett: Market Now Expecting Trump Pivot To “Lower Tariffs, Lower Rates, Lower Taxes” (zerohedge)

- Trump Says He’s Willing to Lower China Tariffs at Some Point (bloomberg)

- Malaysia Seeks to Bring US-Imposed Tariffs Down to Zero in Talks (bloomberg)

- Strategists optimistic on China even as US-China trade war climbdown looks far off (reuters)

- Goldman: Upside massively under-priced (zerohedge)

- “Better Than Cash”: PayPal Announces Plans to Revolutionize In-Store Payments in Germany (paypal)

- Warren Buffett Plans to Step Down as Berkshire CEO at Year-End (wsj)

- Why There Will Never Be Another Warren Buffett (wsj)

- Read the WSJ’s Early Coverage of Warren Buffett (wsj)

- Warren Buffett, on Stage at Berkshire Meeting, Defends Global Trade (wsj)

- Who Is Greg Abel, the Man Preparing to Take Over for Warren Buffett? (wsj)

- Warren Buffett has created a $348bn question for his successor (economist)

- U.S. auto sales up 10.0% in April on rush demand, inventory decline and price hikes concerns going forward (marklines)

- Ford CEO does the math on Trump’s auto tariffs (npr)

- GM to increase production in existing U.S. plants, hold pricing steady (marklines)

- April Auto Sales: How Tariffs Shaped the Market (coxauto)

- eBay and Etsy are relatively confident despite tariff pressures (techcrunch)

- China’s Ant Group plans to list overseas unit in Hong Kong, report says (reuters)

- Can Starbucks be turned around? (economist)

- Big tech has a big Trump problem (economist)

- The trouble with MAGA’s manufacturing dream (economist)

- 69 housing markets where higher inventory is tipping scales to buyers (fastcompany)

- The 4 bucket-list trips that any cultured golfer needs to take (golfdigest)

- The Ferrari 296 just got a lot more Speciale (classicdriver)

- Nike, Adidas, Puma, Steve Madden, Caleres + Dozens More Companies Urge Trump to Exempt Shoes From Tariffs in FDRA Letter (footwearnews)

- Vans Owner VF Corp. Confirms 400 More Layoffs Across the Company (footwearnews)

- Berkshire Stock Could Drop 99% and Still Top S&P 500 Over Buffett’s 60-Year Reign (barrons)

- Berkshire shareholders head to Buffett’s 60th annual meeting, economy top of mind (reuters)

- Trump’s Auto Tariff Relief Shields USMCA Auto Parts From 25% Tax (bloomberg)

- Commercial aircraft demand boosts US factory orders in March (reuters)

- U.S. natural gas inventories in underground storage ended winter at a three-year low (eia.gov)

- US adds surprisingly strong 177K jobs in April as labor market holds up in face of tariffs (nypost)

- Speculators Turn Most Bearish on the Dollar Since September (bloomberg)

- Even Marvel Knows Its Movies and Shows Need to Be Better (wsj)

- Beijing Weighs Fentanyl Offer to U.S. to Start Trade Talks (wsj)

- Europe’s first grid crisis may not be its last (ft)

- Visa, Mastercard, PayPal Fuel Agentic AI Commerce Boom (pymnts)

- Temu and Shein Will Feel ‘De Minimis’ Pain. So Will These U.S. Companies. (barrons)

- These 3 Oil Refiners Can Buck the Energy Downturn (barrons)

- Warren Buffett proves, once again, why he’s the best (marketwatch)

- Warren Buffett, Mum So Far on the Trade War, Steps Up to the Mic (wsj)

- 10 Burning Questions for Warren Buffett at the Annual Berkshire Meeting (barrons)

- Cooper Standard Reports Robust Operating Performance and Significant Margin Improvement in the First Quarter of 2025 (investing)

- Ford’s April sales, led by pickups, surged 16% ahead of tariffs (usatoday)

- Inside Ford’s Kentucky Truck Plant, It’s About as American as Can Be (barrons)

- General Motors to deploy ‘Covid playbook’ to offset $5bn tariff hit (ft)

- Chinese EV makers sell more plugin-hybrids in the EU to avoid tariffs, research firm says (reuters)

- China Signals Readiness to Respond to U.S. Trade Overtures (wsj)

- China Says Its ‘Door Is Wide Open’ for Trade Talks. What It Means for the Market. (barrons)

- China Quietly Exempts About a Quarter of US Imports from Tariffs (bloomberg)

- Hong Kong’s Growth Unexpectedly Picks Up on Tourism, Export Boom (bloomberg)

- Alibaba launches Taobao fast-delivery service ahead of time to challenge JD.com, Meituan (scmp)

- Emerging-Market Stocks Roar Back a Month After Tariff Shock (bloomberg)

- EU Could Offer to Buy $56 Billion of U.S. Products to End Trade War, Top Negotiator Says (wsj)

- Venmo gaining ground in payments as Cash App struggles (cnbc)

- Etsy is leveraging AI to boost personalization (yahoo)

- Baxter tops quarterly estimates on strong demand for medical devices (reuters)

- Trump Plans Record $1.01 Trillion National Security Budget (bloomberg)

- Amazon Shares Drop on Tariff Concerns Despite Strong Quarter (wsj)

- Why the dollar doom is overdone (ft)

- Investing Pros Haven’t Been This Worried About the Stock Market in at Least 28 Years, Our Exclusive Poll Finds (barrons)

- Chinese Stocks Look Like an Opportunity Amid Trump’s Tariff Chaos (barrons)

- China signals opening for trade talks with US (ft)

- US Has Reached Out to China to Initiate Tariff Talks, CCTV Says (bloomberg)

- Alibaba’s Qwen3 AI model family helps narrow tech gap between China and US: analysts (scmp)

- Goldman’s First-Take On Alibaba’s Hybrid Qwen3 Model (zerohedge)

- Chinese Automakers Report Robust Sales Growth in April (wsj)

- How the New Trump Tariffs on Car Parts Will Work (wsj)

- A Small, Affordable Pickup Truck? It’s Finally Here (wsj)

- Ford to Delay Price Increases to See How Rivals React to Tariffs (bloomberg)

- Home Builders Are Piling on Discounts as They Struggle to Entice Buyers (wsj)

- America’s housing crisis: Realtor.com CEO says there is way to solve it (foxbusiness)

- US Pending Sales of Existing Homes Increase by Most Since 2023 (bloomberg)

- US Treasury chief urges Fed to cut rates (reuters)

- U.S. Treasury Won’t Boost Bond Sizes for Refunding, Signals Changes to Buybacks (barrons)

- Small-Cap Stocks Have Suffered. It’s Time to Be Cautiously Optimistic. (barrons)

- EU to Present Trade Proposals to US Negotiators Next Week (bloomberg)

- Millions of people in Europe lost power for hours on Monday, and no one knows why (marketwatch)

- Biggest Dollar Slump Since 2022 Hints at More Losses Ahead (bloomberg)

- U.S. Economy Shrank in First Quarter as Imports Surged Ahead of Tariffs (wsj)

- E-Commerce Sellers Brace for End of De Minimis (wsj)

- The 10 Best Companies to Invest in Now (morningstar)

- Estée Lauder Forecasts Return to Sales Growth in 2026 (bloomberg)

- Albemarle maintains 2025 outlook due to lithium tariff exemptions (reuters)

- Baxter shares rise as Q1 earnings top estimates, guidance raised (investing)

- Crown Castle Reports First Quarter 2025 Results and Maintains Outlook for Full Year 2025 (investing)

- Comstock Resources beats Q1 estimates, stock rises 3.5% (investing)