Skip to content

Real Santa Claus Rally (Almanac Trader )

What’s Wrong with Wind and Solar? (Manhattan Institute )

The Year in Deals Can Be Summed Up in 4 Letters (New York Times )

California Reports Record COVID Cases And Deaths… Despite Strictest Lockdown (ZeroHedge )

Boom conditions for US homebuilders defy the pandemic (Financial Times )

Congress poised to vote on COVID aid package after Fed compromise (Reuters )

ECRI Weekly Leading Index Update (advisorperspectives )

Billion-Dollar Dynasties: These Are The Richest Families In America (Forbes )

Senate Leaders Clear Last Hurdle on Covid-19 Package (Wall Street Journal )

‘Coming 2 America’: First Look At Eddie Murphy’s Sequel to Comedy Classic (Maxim )

Guy Fieri’s Epic ‘Trash Can Nachos’ Are Now Available For Delivery Across U.S. (Maxim )

This Classic Aston Martin Drophead Coupe Could Be Yours (Maxim )

Epidemologist explains why COVID-19 mutations shouldn’t scare you (thenextweb )

Tiger Woods Proudly Looks on as Son Charlie, 11, Drains Impressive Shot at PNC Championship: ‘Atta Boy’ (People )

Without Frank’s RedHot There’d Be No Buffalo Wings (howstuffworks )

41 Festive Facts About Christmas Vacation (Mental Floss )

The 10 Best Movies to Watch on Netflix This Holiday Season (Mental Floss )

Everything You Need to Know About Indian Creek Island, Miami’s Most Exclusive Enclave (townandcountry )

Federal Reserve loosens restrictions on big bank stock buybacks (MarketWatch )

U.S. liquefied natural gas exports set a record in November (EIA )

The S&P 500 Could Gain Another 10% Next Year, Experts Say (Barron’s )

Washington avoids government shutdown, but no stimulus vote until Sunday at earliest (MarketWatch )

Why the Future Now Looks Brighter for Value Investing (troweprice )

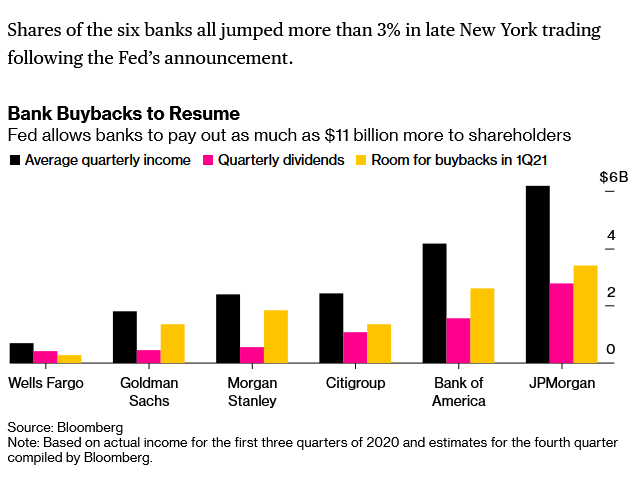

The Fed Just Said Banks Could Buy Back Stock Again. (Barron’s )

Banks Have Begun to Merge Again. Next Year Could See Even More Deals. (Barron’s )

FDA approves second Covid vaccine for emergency use as it clears Moderna’s for U.S. distribution (CNBC )

Fed allows banks to resume share buybacks, JPMorgan stock jumps 5% (CNBC )

While you’re buying value stocks for your portfolio, add some diversity too (MarketWatch )

JPMorgan, Goldman to Restart Buybacks as Fed Gives Green Light (Bloomberg )

Why Natural-Gas Prices Could Continue to Rise (Barron’s )

The Last 10 Years and the Next 10 (compoundadvisors )

Fed Stress Tests Show U.S. Banks Can Withstand Covid-19 Pandemic (Wall Street Journal )

Wells Fargo to Sell Student Loan Book to Apollo, Blackstone (Bloomberg )

The Transcript 12.14.20 (theweeklytranscript )

Roblox and the Dispersal of Creativity (profgalloway )

What Do We Mean By Reinvestment? (akrecapital )

Siren Songs: IPOs & SPACs (investoramnesia )

Charlie Munger Interview (CalTech )

Moderna’s Covid-19 Vaccine Is Backed by FDA Advisory Panel (Barron’s )

Stock-market timing expert DeMark ‘confident’ S&P 500 surges 5% in next 2 weeks—then watch out! (MarketWatch )

‘Lovin’ On You’ Stock Market (SeekingAlpha )

Google’s Legal Peril Grows in Face of Third Antitrust Suit (New York Times )

Gores Holdings started at outperform with $13.50 stock price target at Wedbush (MarketWatch )

‘The biggest stimulus plan ever known to man’ is coming, strategist says — here are two ways to play it (MarketWatch )

Foreign investors dash into emerging markets at swiftest pace since 2013 (Financial Times )

The Latest Housing Data Show the Market Is Still Hot (Barron’s )

FedEx Revenue Jumps on Holiday Surge (Wall Street Journal )

General Mills Anticipates Higher Demand Beyond Pandemic (Wall Street Journal )

Fed Stays the Course (Barron’s )

What’s Inside the $908 Billion Stimulus Bill (Barron’s )

Lennar Says This Was Its Best Year Ever. What It Expects in 2021. (Barron’s )

Oil trades at more-than-9-month highs (MarketWatch )

Wall Street Is Warming Up to Exxon Mobil Stock (Barron’s )

Latest Google antitrust lawsuit accuses it of ‘unlawful’ union with Facebook (New York Post )

10 States Accuse Google of Abusing Monopoly in Online Ads (New York Times )

U.S. Housing Starts Rose For a Third-Straight Month in November (Bloomberg )

Powell Sees Light at End of Tunnel and Policy Staying Very Easy (Bloomberg )

5 things to know before FDA panel votes on Moderna’s Covid vaccine Thursday (CNBC )

Weekly jobless claims unexpectedly rise, hit highest level since early September (CNBC )

Antibody drugs could cut Covid-19 hospitalizations by half, but they’re not getting to Americans (CNBC )

Facebook declares war on Apple (MarketWatch )

DoorDash, Grubhub, Others Could Face Pared-Down Menu (Wall Street Journal )

Fed sees US GDP fully rebounding by end 2021. (Business Insider )

Goldman Sachs Has 4 Sizzling Energy Stocks to Buy That All Pay 5% or More Dividends (24/7 Wall Street )

EU sounds optimistic note as hopes for Brexit trade deal mount (Financial Times )

Pfizer COVID-19 Vaccine US Supply Could Rise 40% As FDA Clears Use Of Extra Doses In Vials (Benzinga )

These Are the U.S. Antitrust Cases Facing Google, Facebook and Others (Wall Street Journal )

Texas’ Tax Advantage Is All About Individuals, Not Business Taxes (Wall Street Journal )

16 Bank Stocks That Could Outpace the Sector in 2021 (Barron’s )

Speakeasy of secrets: Forgotten tales of debauchery from NYC’s ‘21’ Club (New York Post )

Banks’ Billions in Payouts Hinge on Fed’s View of the Pandemic (Bloomberg )

What Spending Slowdown: BofA Credit, Debt Cards Show Soaring Retail Sales (ZeroHedge )

December Bank of America Global Fund Manager Survey Results (Summary) (Hedge Fund Tips )

Goldman Sachs Upgrades ExxonMobil (XOM) to Buy; Challenges Reflected in Valuation with Upside Potential (Street Insider )

10 Ways to Play a 2021 Energy-Stock Rebound (Barron’s )

The 2021 Dogs of The Dow (Barron’s )

The Fed’s Monetary Stimulus Has Boosted Household Wealth (Barron’s )

The Fed Is Walking a Tightrope With Its Policy Messaging (Barron’s )

It Has Definitely Been a Big Year for IPOs. It Just Might Be Tech Bubble 2.0. (Barron’s )

Tech Giants Face New Rules in Europe, Backed by Huge Fines (Wall Street Journal )

FDA Finds Moderna Covid-19 Vaccine Highly Effective (Wall Street Journal )

Congressional Leaders Say They Are Closer to Deal on Covid-19, Year-End Spending Bill (Wall Street Journal )

Real Estate’s Biggest Losers Enjoy a One-Month Stock Bounce (Wall Street Journal )

Moderna Vaccine Is Highly Protective Against Covid-19, the F.D.A. Finds (New York Times )

Critical to Vaccines, Cold Storage Is Wall Street’s Shiny New Thing (New York Times )

Leaders Close In on Aid Deal Below $900 Billion (Bloomberg )

Lyft Wants People to Be Hailing Fully Driverless Cars on Its App by 2023 (Bloomberg )

Fed Mulls Shift in Bond Buying Program: FOMC Decision-Day Guide (Bloomberg )

The FTC’s Antitrust Case Against Facebook Stakes Out New Ground (Bloomberg )

Rich States Uncover Tax Windfall, Undercutting Push for More Aid (Bloomberg )

Refinance demand jumps 105% annually, as mortgage rates set another record low (CNBC )

U.S. retail sales decrease more than expected in November (Reuters )

Fed faces tricky act balancing impact of vaccines against economic pain (Reuters )

Former poker champion says this common mistake is a ‘huge problem’ in business (Yahoo! Finance )

Southwest to take delivery of 35 737 MAX jets through end-2021 (Yahoo! Finance )

‘It’s Going to Rain Dividends and Buybacks Next Year.’ What to Expect for Markets and Consumer Stocks in 2021. (Yahoo! Finance )

Spectre of higher inflation threatens historic bond rally (Financial Times )

There is no stock market bubble (Financial Times

Wells Fargo upgraded to Outperform from Market Perform at Keefe Bruyette (TheFly )

This Is How Vaccines Are Distributed and Which Stocks Benefit (Barron’s )

‘It’s an economic war’— Warren Buffett urges Congress to extend relief for small businesses (CNBC )

Lockheed Martin awarded $900M F-16 service contract (Fox Business )

Why These Tech Stocks Face a Regulatory Reckoning in Europe On Tuesday (Barron’s )

Why Consumer Stocks Will Remain in Focus in 2021 (Barron’s )

This is not just a value recovery – it could be the biggest market opportunity of our lifetimes (fnLondon )

China’s economic recovery picked up in November (MarketWatch )

Here’s what the stock market predicts for 2021 (USA Today )

Demand for 2021 Ford F-150 pickups exceeds supply (USA Today )

The ‘Savings Glut’ Is Really a Dearth of Investment (Bloomberg )

FDA staff endorses emergency use of Moderna’s Covid vaccine in a critical step toward approval (CNBC )

Goldman Sachs CEO said that 90% of small businesses have exhausted PPP funds (CNBC )

Casinos should have a huge year in 2021, Jim Cramer says (CNBC )

The S&P 500 could soar 18% in 2021 as social and economic disruptions from the pandemic reverse, says a Wall Street chief strategist (Business Insider )

Goldman Sachs CEO expresses concern about market euphoria driven by small investors buying IPOs (CNBC )

Warren Buffett’s right-hand man discussed the ‘frenzy’ in stocks, technological shifts, and what makes a great investor in a recent interview. Here are Charlie Munger’s 22 best quotes. (Business Insider )

GE’s stock bounces toward snapping 3-day losing streak after Deutsche Bank boosts price target (MarketWatch )

These 3 regions hold the best bets for 2021, say top fund managers (MarketWatch )

Ameriprise, CI Eyeing Wells Fargo Asset Management Arm (Yahoo! Finance )

Fleeing New Yorkers resulted in an estimated $34 billion in lost income –study (Reuters )

EU warns that it may break up Big Tech companies (Financial Times )

FTC Demands Social-Media, Operations Data From Big Tech Companies (Wall Street Journal )

‘The Best Year Ever’: 2020 Was Surprisingly Good to Small Banks (Wall Street Journal )

Steel Orders Jump After Covid-19 Slowdown (Wall Street Journal )

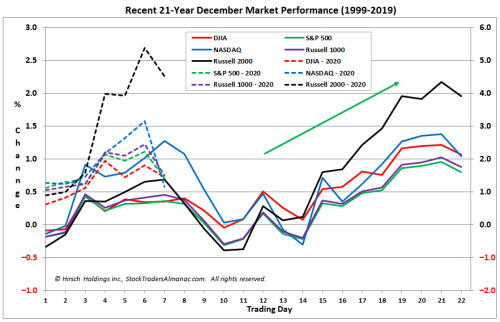

December Opex Week Historically Bullish (quantifiableedges )

US STOCKS-Wall St headed higher as travel stocks rally on vaccine roll-out (Reuters )

Oil lifted on vaccine optimism, tanker explosion (MarketWatch )

The Mass Distribution of Covid-19 Vaccines Is Under Way. ‘Everything Has to Come Together.’ (Wall Street Journal )

Vaccine Boosts Fed Confidence That Worst-Case Outcomes Can Be Avoided (Wall Street Journal )

Elliott Management Has Significant Stake in Public Storage (Wall Street Journal )

Huntington Bancshares Agrees to Merge With TCF Financial (Wall Street Journal )

AstraZeneca’s Alexion Splurge Could Attract a Crowd (Wall Street Journal )

Big Tech Turns Its Lobbyists Loose on Europe, Alarming Regulators (New York Times )

CDC panel recommends Pfizer Covid vaccine for people 16 years and older (CNBC )

Michael Jordan’s New Golf Course Uses Drone To Deliver Beer To Golfers (ZeroHedge )

Goldman Strategists Say SPACs May Spur $300 Billion M&A Activity (Yahoo! Fiinance )

EU diplomat says ‘narrow path’ to a Brexit trade deal is ‘visible’ (Fox News )

‘Can’t Take My Eyes Off You’ Stock Market (SeekingAplha )

Barron’s Picks And Pans Of The Week: Time Is Ripe To Sell NIO, XPeng, Li; And Lessons From The IPO Frenzy (Benzinga )

Rally To Resume Mid-Month – Typical December Seasonal Pattern (Almanac Trader )

Are Energy Stocks About To Breakout In 2021? (kimblechartingsolutions )

Will the Fed adjust its asset purchase programme? (Financial Times )

Dividends Will Have Their Day Again (Wall Street Journal )

10 Best Value Stocks To Buy Now According To Seth Klarman (Insider Monkey )

ECRI Weekly Leading Index Update (Advisor Perspectives )

Strategists in a Major Struggle to Reach a 2021 Stock Consensus (Bloomberg )

McLaren Sells Up to 33% Stake in Racing Unit to U.S. Investors (Bloomberg )

Walgreens CEO: We Are Ready for Immediate Vaccinations (Barron’s )

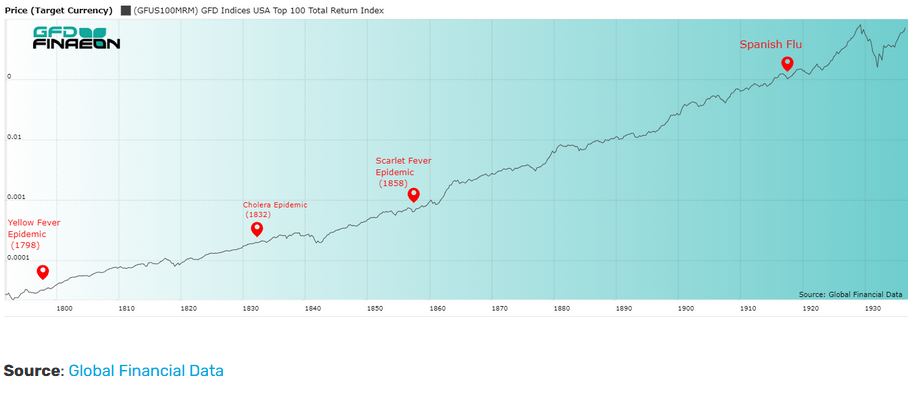

Common Investing Mistakes of the Early 1900s and How to Fix Them (novelinvestor )

Hedge funds look beyond Brexit risks in bet on beaten-down UK stocks (Financial Times )

Lockdowns, Innovation, and Businesses (investoramnesia )

Apollo circling AMC as theater chain scrambles to stay afloat: sources (New York Post )

Pfizer Vaccine Cleared in U.S., a Landmark in Covid-19 Fight (Bloomberg )

Oracle Moves Headquarters to Texas, Joining Valley Exodus (Bloomberg )

New Yorkers Turn Palm Beach Into Hamptons South Fleeing Virus (Bloomberg )

‘Big Short’ investor Michael Burry studied Warren Buffett but realized he would never be as popular, and needed his own style (Business Insider )

A legendary venture-capital firm bought Airbnb shares for $0.01 each in 2009 (Business Insider )

You’re Only As Good As Your Worst Day (Farnam Street )

One stunning Airbnb chart perfectly encapsulates the ongoing IPO-market frenzy (Business Insider )

Walgreens may begin Covid vaccinations at nursing homes before Christmas (CNBC )

Airlines Gear Up to Transport Vaccines That Could Revive Travel (New York Post )

Nordstrom shares soar with one analyst group upbeat about the luxury retailer’s post-COVID prospects (MarketWatch )

Jerry Seinfeld — A Comedy Legend’s Systems, Routines, and Methods for Success (#485) (Tim Ferriss )

Bob Iger – Executive Chairman of The Walt Disney Company (Coffee With the Greats )

Why Value Investing Is Like Buying a House (Yahoo! Finance )

This Massive New Vertical Farm Can Produce 1,000 Tons of Produce a Year (Futurism )

The Transcript 12.07.20 (theweeklytranscript )

Distinguishing Value from Valuation (First Eagle )

Mario Gabelli at CNBC FA Summit (10.20.2020) (Gabelli TV )

Warren Buffett: Rare speech from Omaha Press Club 1992 (YouTube )

NIO, Xpeng, and Li Auto Are Not the Next Tesla. Why It’s Time to Unplug From Chinese EV Stocks (Barron’s )

It Was a Crazy Week for IPOs. Here Are 9 Things Investors Need to Know. (Barron’s )

Stock-market uncertainty runs high headed into Fed’s final meeting of 2020 (MarketWatch )

Cheers for International Stocks Are Getting Louder (Barron’s )

Kraft Heinz Director Elio Leoni Sceti Bought Up Shares (Barron’s )

8 Ways the U.S. Can Compete with China and Build Up Middle America (Barron’s )

How Pfizer Delivered a Covid Vaccine in Record Time: Crazy Deadlines, a Pushy CEO (Wall Street Journal )

The one big reason growth stocks have outperformed over the last decade is about to change, strategist says (MarketWatch )

JPMorgan sees $1 trillion flowing into the stock market in 2021 amid ‘one of the best environments’ in years (Business Insider )

Mortgage Originations Are on Pace for Best Year Ever (Wall Street Journal )

Stocks Due for a Quick Pop and Stocks Due to Drop (Barron’s )

Lyft Stock Could Rally Another 30%, One Analyst Says. Here’s Why He Thinks So. (Barron’s )

Congress stuck after McConnell resists state aid in COVID-19 deal (New York Post )

Disney May Finally Make Netflix Sweat (Wall Street Journal )

5 Dividend-Paying Pharmaceutical Stocks to Buy for Solid 2021 Total Return (24/7 Wall Street )

From Bob Dylan to Blondie — why investors are buying up hit songs (Financial Times )

Was Buffett Right About Energy In 2020? (Yahoo! Finance )

Citigroup and Wells Fargo Are Morgan Stanley’s Top Bank Stock Picks (Barron’s )

Natural Gas Prices Outpaced Oil in 2020. Here’s Why They Could Keep Rising. (Barron’s )

Porsche Isn’t Giving Up On The Combustion Engine (ZeroHedge )

Big Tech has an antitrust target on its back — and here’s why that should concern investors (MarketWatch )

Goodbye Covid, Hello Inflation? (Wall Street Journal )