Skip to content

- Pfizer stock jumps after it reports positive data in early-stage coronavirus vaccine trial (CNBC)

- June private payrolls rose 2.37 million and there was a big positive revision for May, ADP says (CNBC)

- FedEx Crushes Earnings Views As Residential, Pacific Deliveries Jump (Investor’s Business Daily)

- Companies Hit by Covid-19 Want Insurance Payouts. Insurers Say No. (Wall Street Journal)

- Fed Keeps Options Open on Yield Caps but Looks to Other Tools First (Wall Street Journal)

- US buys nearly all global stock of coronavirus drug remdesivir (New York Post)

- $130 Billion Left at Paycheck Program Deadline, but Senate Acts to Extend It (New York Times)

- An Economist on What the Next Fiscal Stimulus Package Could Include (Barron’s)

- Here’s what history tells us happens after the S&P 500’s best quarters of all time, as strategist says it’s set to repeat (MarketWatch)

- China’s Caixin manufacturing PMI hits 6-month high (MarketWatch)

- Dow Has Best Quarter Since 1987. Is It a New Bull Market? (Barron’s)

- Conf. Board Consumer Confidence (Jun) 98.1 vs 91.5 Expected (Street Insider)

- EXCLUSIVE: US negotiates rival to OPEC as historic Trump trade deal takes effect (Fox Business)

- US private sector added 2.37M jobs in June, May revised to gain of 3M (Fox Business)

- Commerce Sec. Ross: Why Hong Kong may start to see companies relocate (Fox Business)

- Europe outperforms Wall Street as investors look across the Atlantic (Financial Times)

- How The Popeyes Chicken Sandwich Is Helping Drive Sales Increases Despite The Pandemic (Benzinga)

- OPEC Plus Success. The Energy Report (Phil Flynn)

- BOE’s Haskel Sees Activity Returning Faster Than Expected (Bloomberg)

- United plans to add 25,000 flights in August as customers ‘are slowly returning’ (CNBC)

- The hedge fund manager behind a long-shot coronavirus pill (Financial Times)

- Goldman Sachs says a national mask mandate could slash infections and save economy from a 5% hit (CNBC)

- A Few Thoughts on the Wells Fargo Dividend Cut/Cap (Hedge Fund Tips)

- Dow futures bounce around as investors await Powell, Mnuchin testimony on the coronavirus response (MarketWatch)

- How Dell Stock Can Take Off. A VMware Spinoff Is Just Part of the Answer. (Barron’s)

- Gilead Is Wise to Leave Remdesivir Money on the Table (Wall Street Journal)

- Who Says Emerging Economies Shouldn’t Print Money? (Wall Street Journal)

- Saudi Prince Calls OPEC Laggard Nigeria Amid Push for Oil Cuts (Bloomberg)

- Low and slow – how to barbecue beef ribs (Financial Times)

- Tesla On Track To Beat Q2 Deliveries Forecast, Analyst Says (Benzinga)

- CanSino’s coronavirus vaccine candidate approved for military use in China (CNBC)

- Fed Reveals Bond Purchases Including AT&T, UnitedHealth, Walmart (Bloomberg)

- Covid Takes a Back Seat. The Energy Report 06/29/2020 (Phil Flynn)

- Gilead Discloses Pricing Plans for Covid-19 Treatment Remdesivir (Barron’s)

- Boeing 737 MAX Test Flights Are Set to Begin (Barron’s)

- FedEx, Micron, June Jobs Data, Fed Minutes, and More to Watch This Week (Barron’s)

- Burger King sales rebound as states reopen after COVID-19 lockdown (Yahoo! Finance)

- We need to get capital into communities of color: Michael Milken (Fox Business)

- Hedge funds eye new corporate structure in Singapore (Financial Times)

- Coty to buy 20% stake in Kim Kardashian West’s beauty line (Financial Times)

- Hedge Funds Are Rushing to Get Out of Bearish U.S. Stock Bets (Bloomberg)

- Telehealth’s Long-Term Staying Power (Bloomberg)

- Ten Years After IPO, a Look Back at Tesla’s Extraordinary Decade (Bloomberg)

- Reopenings Power a 9-Week Climb in Canadian Consumer Confidence (Bloomberg)

- Southwest will soar 47% as domestic focus and strong balance sheet outshine rivals, Goldman says (Business Insider)

- Baltic index rises on firmer capesize, supramax demand (Reuters)

- Fed Looks Down Under for Rate Strategy (Wall Street Journal)

- Will Anyone Bid $60 Million Online for a Painting? (Wall Street Journal)

- Even the Bible Is Full of Flawed Characters (Wall Street Journal)

- Big-Tech Investors Need to Start Watching Brussels More Closely (Wall Street Journal)

- Americans Hold Huge Pile of Cash That’s Key to Economic Recovery (Bloomberg)

- Boeing 737 MAX certification flight tests to begin Monday: sources (Fox Business)

- What The Black Death And Spanish Flu Tell Us (Podcast) (Bloomberg)

- The Word of the Day Is Cautious (Futures Mag)

- Well-Known Energy Companies Highlight Goldman Sachs Stocks to Buy Under $10 (24/7 Wall Street)

- Masks Could Help Stop Coronavirus. So Why Are They Still Controversial? (Wall Street Journal)

- Gilead is about to start trials of an inhaled version of Remdesivir (Gilead)

- Jim Cramer: Memo to Texas – No Mask, No Success, Period (TheStreet)

- Christmas in July: NASDAQ’s Mid-Year Rally (Almanac Trader)

- Pandemic Real Estate Boom? Medieval History Says Yes (Wall Street Journal)

- What Type Of Yacht Does Rande Gerber Escape To In The Summer? (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Bentley Rolls the Final Mulsanne Off the Production Line (Robb Report)

- John F. Kennedy’s Former Winter White House in Palm Beach Sells (Architectural Digest)

- This Reinforced 1971 Plymouth Road Runner Packs A V10 From A Viper (The Drive)

- The Donkervoort D8 GTO-JD70 Is an Absurdly Fast Dutch Roadster (Maxim)

- Old Drugs Could Reveal a New Way to Attack the Coronavirus (Wired)

- Will Ferrell’s Best Comedy in Years Is Here (The Atlantic)

- The people who get the best coaches aren’t the ones who need them most (Michael Lewis)

- The best rubs you can buy for grilled steak, chicken, pork and fish (CNET)

- Tesla Model Y – Jay Leno’s Garage (YouTube)

- ‘The Profit’ Host Marcus Lemonis on Bringing Small Businesses Back After Lockdown (Guest Column) (Variety)

- AstraZeneca makes another vaccine supply agreement (BioPharma)

- Credit managers race to hire distress experts (Pensions and Investments)

- Many Will Pay Later If the Government Doesn’t Borrow Freely Now (Barron’s)

- 7 Beaten-Up Housing Stocks Poised For Growth (Barron’s)

- Continental Resources Founder Harold Hamm Bought Up the Oil Stock (Barron’s)

- ETF Fund Flows (ETF.com)

- Sterling has not become an emerging market currency (Financial Times)

- Berkshire Hathaway Is Now a Deep Value Stock (Guru Focus)

- Jeremy Siegel on the Stock Market Under Covid-19 (Bloomberg)

- Why You Feel At Home In A Crisis (Farnam Street)

- Boyar’s Presentation from The 2020 Contrarian Investment Conference (Boyar Value)

- Blank Check Company Backed by Former State Street Exec Eyeing Asset Management Deals (Institutional Investor)

- The US Marine Corps’ New Weapon Can Electrocute Targets from 100 Feet Away (Futurism)

- Jeremy Strong’s Succession Inspiration (Vanity Fair)

- Covid-19 Is a Puzzle That Wall Street Can’t Solve (Wall Street Journal)

- Gap will sell Kanye West’s Yeezy line (CNN Business)

- Nike’s COVID-related sales decline is a bump on the path to long-term growth, analysts say (MarketWatch)

- Opinion: These 5 giant stocks are driving the U.S. market now, but watch out down the road (MarketWatch)

- Amateur Traders Pile Into Asian Stocks, Making the Pros Nervous (Bloomberg)

- Markets Bombed, Investors Carried On (Wall Street Journal)

- Here are the key questions for the stock market heading into the second half of the year (CNBC)

- Meet Barron’s 25 Top CEOs (Barron’s)

- Magellan Midstream Has a Vital Pipeline Network and an Attractive Yield (Barron’s)

- Fed Stress Test Finds U.S. Banks Healthy Enough to Withstand the Coronavirus Crisis (Wall Street Journal)

- FDIC to Lift Postcrisis Curb on Banks (Wall Street Journal)

- Banks Get Easier Volcker Rule and $40 Billion Break on Swaps (Bloomberg)

- Fed puts restrictions on bank dividends after test finds some banks could be stressed in pandemic (CNBC)

- ECB’s Lagarde says we’ve probably passed the worst of the coronavirus crisis (CNBC)

- Ford unveils new F-150 as tech-savvy pickup with hands-free driving, integrated power generator (CNBC)

- Two European Airport Stocks Are Ready to Take Off (Barron’s)

- Why one strategist is actually encouraged by a spike in new U.S. coronavirus cases (MarketWatch)

- Race for a COVID-19 vaccine has drug makers scaling up manufacturing — before one is developed (MarketWatch)

- Don’t Fault Florida Yet for Its Handling of Covid-19 (Bloomberg)

- Once the Center of the Coronavirus Crisis, Europe Now Looks Ahead With Hope (Wall Street Journal)

- Connecticut Plans to Reopen Schools in the Fall (Wall Street Journal)

- Kanye West Signs Multiyear Deal to Sell New Yeezy Line at Gap (Bloomberg)

- The 2021 Ford F-150 Aims to Double as a Rolling Office (Wall Street Journal)

- Top Energy Analyst Upgrades 3 Stocks With Big Potential Upside (24/7 Wall Street)

- Hospitals Sued to Keep Prices Secret. They Lost. (New York Times)

- LeBron James Gets $100 Million Investment to Build Media Empire (Bloomberg)

- One Biohacker’s Improbable Bid to Make a DIY Covid-19 Vaccine (Bloomberg)

- No Apps, Just Old-School Contact Tracing in Japan (Bloomberg)

- A $60 million painting will test the art market’s resilience during the pandemic (CNBC)

- Toughened Bank Stress Tests Are Today. Don’t Expect Clarity on Dividends. (Barron’s)

- The Urgency of Returning to Full Employment (Wall Street Journal)

- How to Lose a Billion Dollars Without Really Trying (Institutional Investor)

- Opinion: Bank stocks may ‘rally powerfully’ once investors realize their concerns are overblown (MarketWatch)

- Is July 15th still tax day? Treasury may consider delaying deadline to Sept. 15, Mnuchin says (USA Today)

- U.S. durable-goods orders rebound 15.8% in May (MarketWatch)

- Bank Shares Jump in Rocky Session (Wall Street Journal)

- Baltic index up for 20th session on stronger vessel demand (Reuters)

- Southwest Airlines May Have Just Started a Fare War (Yahoo! Finance)

- Race for a COVID-19 vaccine has drug makers scaling up manufacturing — before one is developed (MarketWatch)

- A Tiff A Tariff. The Energy Report (Phil Flynn)

- The Tiny Bank That Got Pandemic Aid to 100,000 Small Businesses New York Times)

- ‘Welcome to the age of copper’: Why the coronavirus pandemic could spark a red metal rally (CNBC)

- Low Expectations for Tomorrow: Bank Dividends in Peril With Crisis Veterans Warning of Trouble (Bloomberg)

- Mnuchin Says U.S. May Emerge From Recession by End of Year (Bloomberg)

- Sweden’s Covid Expert Says ‘World Went Mad’ With Lockdowns (Bloomberg)

- The US could slam tariffs on $3.1 billion of European goods, with products like olives, beer, gin, and planes on the list. (Business Insider)

- Hospitals must disclose actual prices for tests and procedures, court rules (MarketWatch)

- Dell Explores Spinoff of $50 Billion Stake in VMware (Wall Street Journal)

- Global Economy Shows Signs of Pulling Out of Its Slump (Wall Street Journal)

- Treasury Dept. May Consider Extending Tax Filing Deadline a Second Time (Wall Street Journal)

- The Coronavirus Savings Glut (Wall Street Journal)

- Housing Market’s Green Shoots (Wall Street Journal)

- Property Owner Simon Sees Buying Tenants as a Way to Boost Malls (Wall Street Journal)

- Walt Disney (DIS) PT Raised to $135 at Morgan Stanley as the Firm Envisions ESPN DTC Product (Street Insider)

- China has picked up its ‘game’ on trade with U.S., Trump adviser says (Reuters)

- The housing market rebound continues (Yahoo! Finance)

- Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor by Seth Klarman, (Capital Allocators)

- Record number of US companies seek relief on loan terms (Financial Times)

- Barron’s on MarketWatch: Japan discovers the problem with yield-curve control — that it works too well (MarketWatch)

- 5 Oil & Gas Stocks That Have Shown They Can Grow Safely (Barron’s)

- The U.S. Economy Is About Halfway Back to Normal, a Weekly Virus-Recovery Indicator Says (Barron’s)

- Trump supports second ‘very generous’ coronavirus stimulus package (New York Post)

- Trump says ‘China trade deal is fully intact’ (Street Insider)

- Gilead Sciences (GILD) will acquire 49.9% equity interest in Pionyr Immunotherapeutic for $275 million (Street Insider)

- Gilead to Begin Human Testing of Inhaled Version of Covid-19 Drug Remdesivir (Wall Street Journal)

- A Weaker Dollar Is Just What the World Needs (Bloomberg)

- Hotel stocks: Bull and bear cases for buying into the travel rebound (CNBC)

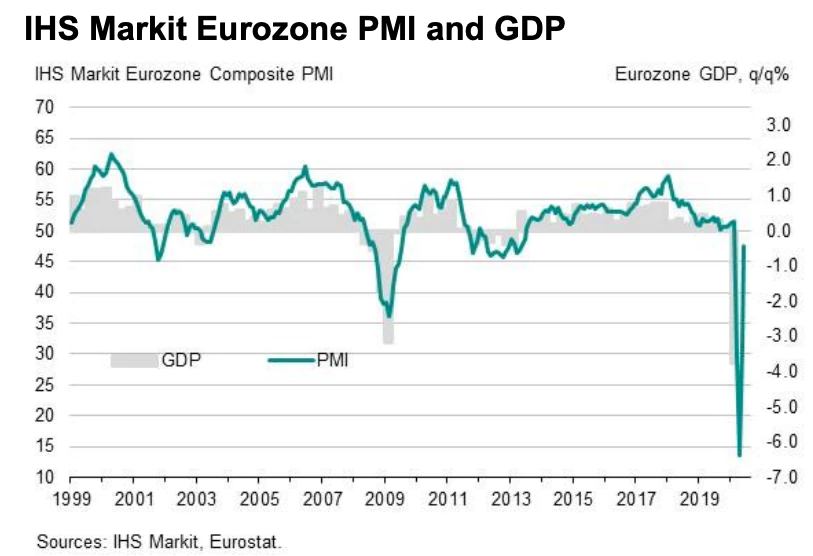

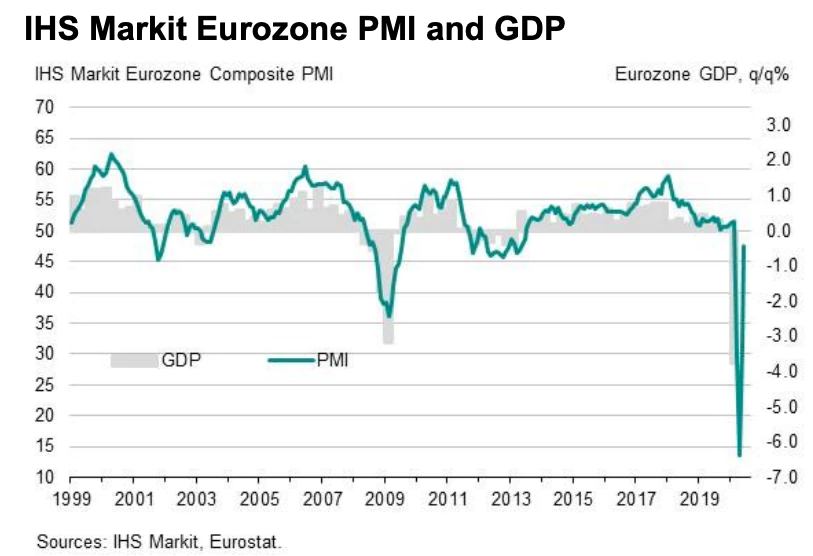

- European Economic Data Is V-Shaped, but the Economy Isn’t Wall Street Journal)

- European stocks lifted by PMI numbers (Financial Times)

- Tesla Analyst Estimates ‘Staggering’ 650K Cybertruck Preorders (Benzinga)

- Photo from Pixabay.

- BofA Bullish On Allegiant, Southwest, Says Leisure Travel Recovering (Benzinga)

- BofA Upgrades Concho Resources, Cimarex Energy On Improving Oil Outlook (Benzinga)

- Schwarzman Sees ‘Big V’ Economic Rebound in Next Few Months (Yahoo! Finance)

- Kansas City Southern volumes are ‘improving’ off of early-May bottom; stock gains (MarketWatch)

- Europe’s economy bounced back sharply in June (Business Insider)

- As States Reopen, Workers, Executives Want Government to Make Masks Mandatory (Wall Street Journal)

- Rally in Raw Materials Signals Economic Rebound (Wall Street Journal)

- Coronavirus Cash Needs Prompt Companies to Rethink Investments (Wall Street Journal)

- U.S. banks are ‘swimming in money’ as deposits increase by $2 trillion amid the coronavirus (CNBC)

- China Investor Buys Record-Cheap Bank Stocks Nobody Else Wants (Bloomberg)

- ‘Fed story’ will win out over second virus wave and election fears, says UBS, so it’s time for investors to get off the sidelines (MarketWatch)

- BlackRock says it’s warming up to Europe, which it says may outgrow the U.S. in second half of the year (MarketWatch)

- Your blood type may determine your odds of contracting the coronavirus, study finds (MarketWatch)

- Wearing masks is ‘all we have’ to try to reduce the spread of coronavirus, former FDA commissioner says (MarketWatch)

- Fed to Assess How Banks React to Possible Covid-19 Scenarios (Wall Street Journal)

- Restaurant Reservations, Driving Directions and Other Indicators Wall Street Is Watching (Wall Street Journal)

- Pandemic Travel Patterns Hint at Our Urban Future (Bloomberg)

- Here are five charts that track how the U.S. economy is recovering from coronavirus (CNBC)

- Can the Fed’s Main Street loan program save midsize companies during COVID-19 crisis? (USA Today)

- Flavortown, Ohio? Thousands want Columbus renamed for native celebrity chef Guy Fieri (USA Today)

- Hedge Funds Exploit CLO Weakness Laid Bare by Corporate Distress (Bloomberg)

- The New Weapon in the Covid-19 War (Bloomberg)

- Google billionaire Sergey Brin has a secret charity that sends ex-military staff into disaster zones on a superyacht (Business Insider)

- UBS Upgrades Wal-Mart (WMT) to Buy; Entering Era of Amplified Earnings Growth (Street Insider)

- Foreign investors to be biggest buyers of US stocks: Goldman Sachs (FoxBusiness)

- How zero-fee trading helped Citadel cash in on retail trading boom (Financial Times)

- Live Nation announces drive-in concert series in 3 cities (Fox Business)

- Baltic index edges up on higher panamax, supramax rates (Reuters)