- 5 Oil & Gas Stocks That Have Shown They Can Grow Safely (Barron’s)

- The U.S. Economy Is About Halfway Back to Normal, a Weekly Virus-Recovery Indicator Says (Barron’s)

- Trump supports second ‘very generous’ coronavirus stimulus package (New York Post)

- Trump says ‘China trade deal is fully intact’ (Street Insider)

- Gilead Sciences (GILD) will acquire 49.9% equity interest in Pionyr Immunotherapeutic for $275 million (Street Insider)

- Gilead to Begin Human Testing of Inhaled Version of Covid-19 Drug Remdesivir (Wall Street Journal)

- A Weaker Dollar Is Just What the World Needs (Bloomberg)

- Hotel stocks: Bull and bear cases for buying into the travel rebound (CNBC)

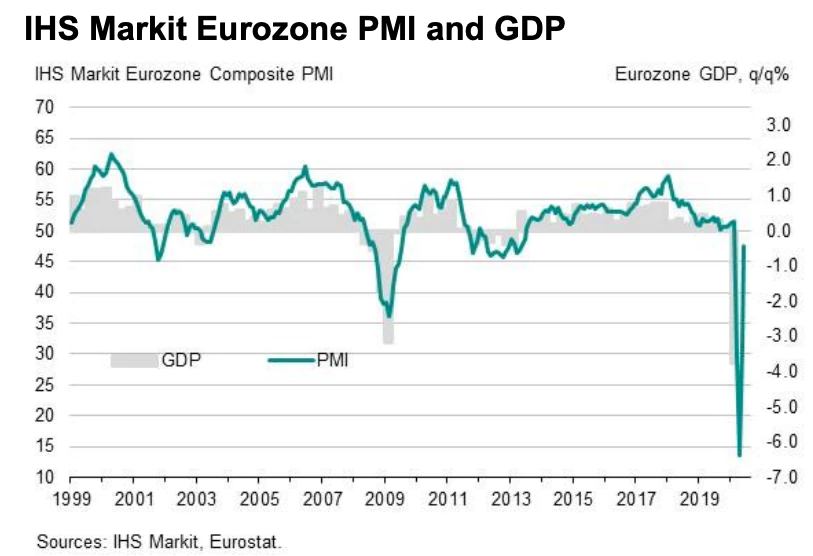

- European Economic Data Is V-Shaped, but the Economy Isn’t Wall Street Journal)

- European stocks lifted by PMI numbers (Financial Times)

- Tesla Analyst Estimates ‘Staggering’ 650K Cybertruck Preorders (Benzinga)

- Photo from Pixabay.

- BofA Bullish On Allegiant, Southwest, Says Leisure Travel Recovering (Benzinga)

- BofA Upgrades Concho Resources, Cimarex Energy On Improving Oil Outlook (Benzinga)

- Schwarzman Sees ‘Big V’ Economic Rebound in Next Few Months (Yahoo! Finance)

- Kansas City Southern volumes are ‘improving’ off of early-May bottom; stock gains (MarketWatch)

- Europe’s economy bounced back sharply in June (Business Insider)

- As States Reopen, Workers, Executives Want Government to Make Masks Mandatory (Wall Street Journal)

- Rally in Raw Materials Signals Economic Rebound (Wall Street Journal)

- Coronavirus Cash Needs Prompt Companies to Rethink Investments (Wall Street Journal)

Be in the know. 20 key reads for Tuesday…