Skip to content

All 50 States Have Now Taken Steps to Reopen (Wall Street Journal )

Shopping Malls Are Reopening, but Visits Are Still Way Down (Barron’s )

“Leave My Mom Out Of It”: Virtual Debate Between Caruso-Cabrera And AOC Turns Ugly (ZeroHedge )

Coronavirus live updates: Italian PM says ‘worst is behind us;’ Elvis Presley’s Graceland to reopen (CNBC )

Boeing Stock Will Rebound. Look Beyond Covid-19. (Barron’s )

The Grace Potter “Falling or Flying” Stock Market (and Sentiment Results)… (ZeroHedge )

Lowe’s Did What Home Depot Couldn’t (Barron’s )

Oil prices extend climb toward highest level since March as demand and supply seen taking steps toward recovery (MarketWatch )

This could be the next signal for the S&P 500 to climb past 3,000, says Standard Chartered (MarketWatch )

Airline Stocks Rally as Carriers Plan June Restart and State Bailouts Ease Fears (Barron’s )

Fed Minutes Outline Potential Next Steps to Fight Crisis (Barron’s )

5 Restaurant Stocks That Are Still Worth Buying (Barron’s )

More Analysts See Oil Demand Exceeding Supply Later This Year. That’s a Bullish Sign for Oil. (Barron’s )

Contact Tracing Takes a High-Tech Step Forward (Barron’s )

The Dow Is Up — and the Number of Stocks In Up Trends Is Too (Barron’s )

Can You Get Covid-19 Twice? (Wall Street Journal )

TikTok parent company valued at over $110B (New York Post )

Coronavirus Shut Down the ‘Experience Economy.’ Can It Come Back? (New York Times )

China’s Xi Seeks to Portray Unity and Pivot to Economy Under Coronavirus Shadow (Wall Street Journal )

When Will Big Concerts Finally Return After Covid? (Think 2021) (Wall Street Journal )

Andrea Bocelli Wants to Get Back to Work (Wall Street Journal )

U.S. Raises Ante in Vaccine Race With $1.2 Billion for Astra (Bloomberg )

Trump Points Finger at China’s Xi, Escalating Fight Over Virus (Bloomberg )

Disney and Universal to Begin Submitting Florida Reopening Plans (Bloomberg )

Young Join the Rich Fleeing America’s Big Cities for Suburbs (Bloomberg )

Starbucks U.S. same-store sales have recovered more than 60% from last year, summer menu announced (MarketWatch )

2.4 million more file for unemployment, but weekly number steadily decreasing (Fox Business )

Why Texas Roadhouse Could Be A Big Post-Shutdown Winner (Yahoo! Finance )

Trump admin. gives energy companies temporary breaks on royalty rates, rent (Fox Business )

Why Magic Johnson, Mark Cuban Are Connecting Minority-Owned Businesses With Millions In PPP Loans (Benzinga )

Target Stock Is Up After Earnings. Walmart Wasn’t a Tough Act to Follow After All. (Barron’s )

Why states can’t go bankrupt (CNBC )

Homebuilding stocks rise despite April slowdown — how to play the move (CNBC )

Weekly mortgage applications point to a remarkable recovery in homebuying (CNBC )

The Metropolitan Museum of Art plans to reopen in mid-August (New York Post )

Thousands of sports fans who can’t gamble on their favorite teams are reportedly flocking to the stock market instead. (Business Insider )

Chinese smartphone maker Xiaomi reports 13.6% rise in first-quarter revenue. (Business Insider )

Lowe’s stock surges after profit, sales rise well above expectations (MarketWatch )

‘Main Street’ lending program will start at end of May, Fed officials say (MarketWatch )

Here come the TALF funds (MarketWatch )

For Home Builders, a Better Kind of Recession (Wall Street Journal )

‘The Joe Rogan Experience’ Launches Exclusive Partnership with Spotify (SPOT) (Street Insider )

JetBlue, United Airlines take more steps to counter coronavirus spread (Street Insider )

Northrop Grumman (NOC) Raises Quarterly Dividend 9.8% to $1.45; 1.8% Yield (Street Insider )

5 Dividend Aristocrat Stocks to Buy That Could Weather Another Brutal Sell-Off (24/7 Wall Street )

Delta CEO to Bartiromo: No US airlines will go out of business thanks to Trump (Feox Business )

Venetian Las Vegas reveals coronavirus safety measures, charity (Fox Business )

U.S. bank regulator finalizes new community lending rule (Reuters )

Is the U.S. on the Path to Recovery? 14 Charts to Watch. (Bloomberg )

Return of Car Traffic Fuels Surge in Oil (Wall Street Journal )

Did Angela Merkel Just Make a U-Turn in Her European Policy? (Bloomberg )

Live Sports Will Return to TV in June, ViacomCBS Says (Barron’s )

Value Stocks Look Cheaper Than Ever (Barron’s )

President Trump Can Choose Which States Get Coronavirus Payback From FEMA (Wall Street Journal )

At Least 30 Public Companies Say They Will Keep PPP Loans (Wall Street Journal )

Value Managers Fight Back (Institutional Investor )

Southwest says bookings outpace cancellations in May (Reuters )

4 Energy Stocks to Buy Now as Massive Oil Rally Continues (24/7 Wall Street )

TikTok nabs Disney’s streaming boss to be its new CEO (CNBC )

Some signs children may not transmit COVID-19, two UK epidemiologists say (Reuters )

The U.S. Space Force Is Starting to Launch Rockets. These Stocks Should Benefit. (Barron’s )

Regions Financial funds 37,000 PPP loans totaling $4.7B (TheFly )

Walmart earnings soar as e-commerce sales jump, shoppers flock to stores (CNBC )

Home Depot (HD) Misses Q1 EPS by 18c, Revenues Beat; Suspending FY20 Guidance, ‘Sales Were Strong at End of 1Q’ (StreetInsider )

JPMorgan hands out $30 billion in loans to small businesses: memo (StreetInsider )

U.S. housing starts drop more than expected (Reuters )

Kohl’s online sales surge amid lockdown, reopens about half of its stores (StreetInsider )

47% of people will visit restaurants ‘as soon as they reopen:’ Piper Sandler (Yahoo! Finance )

Covid Patients Testing Positive After Recovery Aren’t Infectious, Study Shows (Bloomberg )

Loaded With Cash, Real Estate Buyers Wait for Sellers to Crack (Bloomberg )

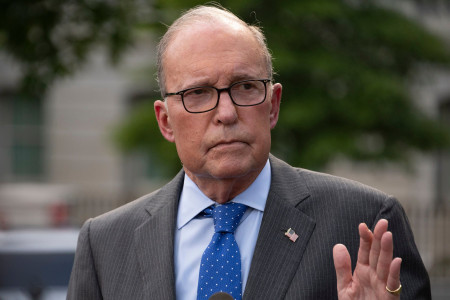

Kudlow to Bartiromo: Why Beijing won’t sell US debt despite coronavirus feud (FoxBusiness )

3 factors why this economic bounceback won’t mirror 2008: Commerce Secretary Wilbur Ross (FoxBusiness )

Olive Garden parent plans to reopen more than 65% of dining rooms by end of May (CNBC )

Liability protections are top GOP priority in next coronavirus bill, McCarthy says (CNBC )

The Auto Market Is Improving Faster Than Expected (Barron’s )

President Trump says he is taking hydroxychloroquine (Reuters )

Fed Chair Powell’s Comments Spark Rally in Bank Stocks Barron’s )

21 Cheap Stocks With Above-Average Growth Prospects (Barron’s )

Global Stocks Advance on Signs of Slowing Virus as Powell Interview Adds Cheer (Barron’s )

Moderna Reports Positive Vaccine News (Barron’s )

Fed’s Powell tells ‘60 Minutes’ he’s not out of ammunition to fight the recession (MarketWatch )

Work-from-home productivity pickup has tech CEOs predicting many employees will never come back to the office (MarketWatch )

Barron’s Picks And Pans: Cisco, Gilead, Netflix, Wayfair And More (Yahoo! Finance )

Hertz appoints new CEO to lead car rental giant (Fox Business )

Dwayne ‘The Rock’ Johnson ‘very proud’ of his daughter joining WWE New York Post )

Dan Bilzerian Pushes Party Brand From a Social Distance (Bloomberg )

Brent at one-month high, U.S. oil tops $31 as restrictions ease (Street Insider )

5 COVID-19 Casualty Stocks to Buy With Big-Time Upside Potential (24/7 Wall Street )

Retest Possible, But Bottom Likely In as Jobless Claims Trend Lower (Almanac Trader )

Oil Futures Pricing in Tighter Supplies (Futures Mag )

Hedge Fund and Insider Trading News: Barry Rosenstein, Jim Simons, Marshall Wace LLP, Selwood Asset Management, Pantera Capital, Vivint Smart Home Inc (VVNT), Penn National Gaming, Inc (PENN), and More (InsiderMonkey )

Space Force unveils flag; Trump touts ‘super-duper missile’ (AP )

President Trump unveils new vaccine effort ‘Operation Warp Speed’ (OANN )

This Art Installation Of A Giant Wave In South Korea Is Honestly Pretty Chill (digg )

Saudi wealth fund boosts U.S. holdings with stakes in Citi, Boeing, Facebook (OANN )

Brabham Automotive Unleashes BT62 Race Car (Maxim )

Seth Klarman: Top 10 Holdings (Q1 2020) (The Acquirers Multiple )

Rethinking Fear (Farnam Street )

2020 Ferrari F8 Tributo review: Somehow, it got better (cnet )

A Strategy for Reopening New York City’s Economy (Manhattan Institute )

Reopening Sports: Does MMA Point The Way? (NPR Planet Money )

Young Bulls and Old Bears (The Irrelevant Investor )

Major tax benefits for Tesla if Elon Musk moves production from California (Fox Business )

Maximilian Schneider Designs a 21st Century Batmobile Dubbed The Koenigsegg Konigsei Concept (Luxuo )

Your Ultimate Grill Buying Guide—Tested and Approved (Popular Mechanics )

“Poison Pills” Make Comeback at Hollywood Firms Bracing for Hostile Takeovers (Hollywood Reporter )

Stock Market Keeping Score in the Three-Front War Against the Virus (Yardeni )

Newly Flush PNC Could Kick Off the Next Round of Bank M&A (Barron’s )

Oil Market Dazzled With a Swift Delivery of Supply Cuts (Bloomberg )

Slash tax rate in half for corporations returning to US, White House adviser suggests (New York Post )

McConnell says next stimulus must have coronavirus liability protections (New York Post )

Appaloosa buys Twitter, Netflix stakes, exits Caesars, cuts Facebook position (TheFly )

TSA Preparing to Check Passenger Temperatures at Airports Amid Coronavirus Concerns (Wall Street Journal )

Wells Fargo Has Lost $220 Billion in Market Value Under Fed Cap (Bloomberg )

Inside the Science and Companies Racing to Develop a Covid-19 Vaccine (Barron’s )

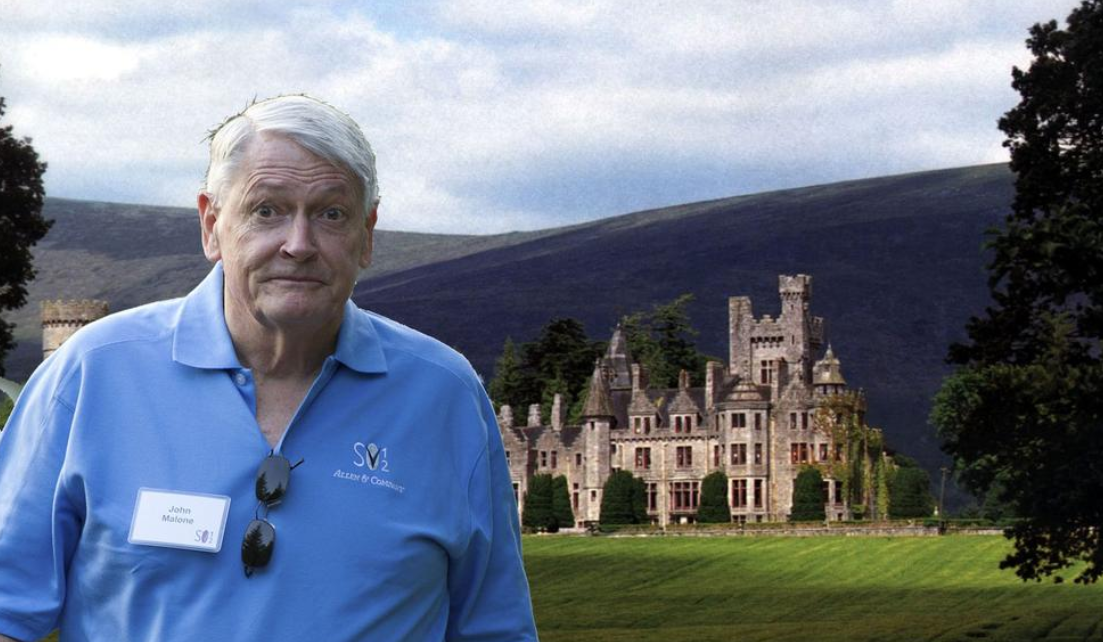

John Malone Has a Great Investing Record. Here’s How to Play Along. (Barron’s )

How Investors Should Evaluate Energy Bonds — And the Funds That Own Them (Barron’s )

This Economist Sees a ‘Regime Change’ Favoring Stockpickers (Barron’s )

Assessing the stock market after one of the fastest declines and subsequent comebacks in history (CNBC )

On Furlough From the Kingdom, Disney Workers Try to Keep the Magic Alive (Wall Street Journal )

Michael Jordan Didn’t Manage People, He Lit Them on Fire (Wall Street Journal )

Car Makers See Chinese Market Picking Up (Wall Street Journal )

Bill Murray drinks, jokes with Guy Fieri on Nacho Showdown: ‘Truth is, he’s a redhead’ (USA Today )

Google Antitrust Lawsuit Being Drafted by U.S Justice Department (Bloomberg )

Next coronavirus aid package expected to become reality ‘in June at the earliest,’ as House passes its bill (MarketWatch )

Is this the pullback you’ve been waiting for? (QuantifiableEdges )

JPMorgan Bets on a Dash for the Suburbs (Institutional Investor )

What Happens to Stocks After a Big Up Month? (A Wealth of Common Sense )

Bill Miller doesn’t see market as ‘dramatically overvalued,’ says Amazon could double in 3 years (CNBC )

Loeb’s Third Point Builds Stake in Disney, Exits Campbell Soup (Bloomberg )

Saudi wealth fund snaps up $7.7bn of blue-chip stocks (Financial Times )

How bank hedging jolted investors into talk of negative rates (Financial Times )

Value Stocks Look Cheaper Than Ever. How to Play a Rebound. (Barron’s )

‘Stealth Bailout’ Shovels Millions of Dollars to Oil Companies (Bloomberg )

TikTok Raises Profile As Digital Ad Rival To Snap, Facebook, Google (Investor’s Business Daily )

The Oil Market Is Changing Its Tune (Barron’s )

GE Stock Dropped Again. Here’s What’s Going Right. (Barron’s )

Factory Output in China Surged in April (Barron’s )

NYSE Will Partially Reopen Its Trading Floor (Barron’s )

Meet the trikini, beach fashion’s answer to coronavirus (New York Post )

McDonald’s Details What Dining In Will Look Like (New York Times )

Elon Musk’s Boring Company completes second tunnel in Las Vegas (USA Today )

Wealthy Travelers Are Starting to Book Year-End Vacations (Bloomberg )

Are We Asking Too Much of Testing? (Bloomberg )

Drive-in theaters have become a safe haven for moviegoers. Here’s what it’s like to visit one (CNBC )

Who’s on The Hook for Skipped Mortgage Payments? (Wall Street Journal )

Economic Shock of Virus Hit Lower-Income Households Harder, Fed Finds (Wall Street Journal )

Time for GE to Bring Good Things Back to Life (Wall Street Journal )

Oil back at early April highs as demand shows signs of picking up (Street Insider )

PPP Loans Under $2 Million Get A Significant Waiver From SBA (Yahoo! Finance )

Ross to Bartiromo: Taiwan manufacturer hopes to bring supply chain to this state (Fox Business )

Investors warn Covid-19 crisis is paving the way for inflation (Financial Times )

13 Stock Ideas From Top Value Managers (Barron’s )

Gilead’s Remdesivir Is a Rare Example of Foresight in This Pandemic (Bloomberg )

What’s Good for Banks Isn’t Necessarily Good for Bankers (Wall Street Journal )

Deals Aren’t Dead. Here Are 12 Stocks That Could Become Buyout Targets (Barron’s )

Green Shoots for the Economy and 5 More Things to Know (Barron’s )

As Stock Buybacks Disappear, Dividends Stand to Gain (Barron’s )

As States Reopen, Home Purchase Applications Rise for the Fourth Week in a Row (Barron’s )

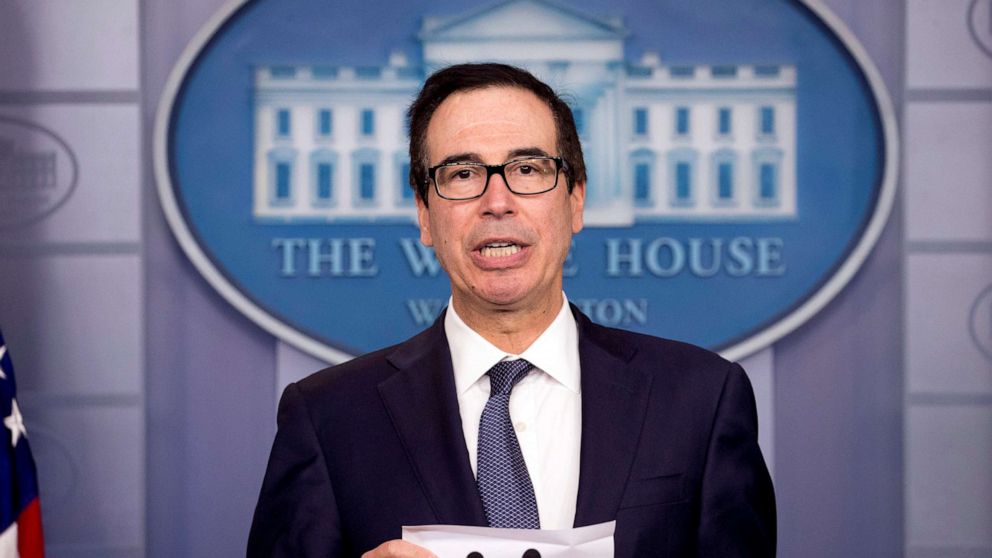

Mnuchin Seeks to Assuage Investors After Powell’s Gloomy Outlook (Bloomberg )

Trump Says He Disagrees With Fauci’s Concerns Over Reopening (Bloomberg )

Wisconsin Supreme Court strikes down state’s ‘stay-at-home’ order (CNBC )

A London-based trading house bought 250,000 barrels of oil during the historic plunge below $0, and likely made a fortune. (Business Insider )

U.S. weekly jobless benefits to stay elevated as coronavirus layoffs widen (Reuters )

AbbVie’s Potential Is ‘Underappreciated,’ Says Morgan Stanley Analyst (Benzinga )

The Swedish Model Trades More Disease for Less Economic Damage (Bloomberg )

Oil Price Crash Could Hurt Trump in Texas, Help in Pennsylvania (Bloomberg )

New York and New Jersey Start to Reopen Their Economies (Wall Street Journal )

Fed TALF Revision Could Help Clear CLO Logjam (Wall Street Journal )

Tesla Wins as County Blinks First in Standoff Over Plant (Barron’s )

Fed spells out terms of TALF rescue facility, potentially paving way to unleash funds in weeks (MarketWatch )

Hedge Funds, Go Home — Japan Is Closing the Door (Bloomberg )

Steve Cohen, Jeff Bezos Achieve Scroll Fame at Robin Hood Telethon (Bloomberg )

Hedge Fund That Never Loses Bets Big on South Africa Debt (Bloomberg )

House Democrats unveil new $3 trillion coronavirus relief bill (CNBC )

Gilead strikes deal to make remdesivir coronavirus treatment in 127 countries (CNBC )

What Doesn’t Kill Fast Food Makes It Stronger (Wall Street Journal )

The Emerging-Market Debt Trap (Wall Street Journal )

Live Nation to issue $800 million of bonds that mature in 2027 (MarketWatch )

Boyd Gaming is offering $500 million of senior notes that mature in 2025 (MarketWatch )

Royal Caribbean pledges 28 ships as collateral for $3.3 bln bond offering (Reuters )

CNBC’s Jim Cramer: Elon Musk may be a ‘zealot’ but he’s ‘dead right’ about his decision to break the rules (MarketWatch )

China will step up macro-economic adjustments to offset pandemic impact – state TV (Reuters )

Powell Says Washington Will Need to Spend More to Battle Downturn (Wall Street Journal )

Saudis to make further oil supply cut to ‘encourage’ peers (Financial Times )

Shanghai Disneyland Reopens With Strict Safety Procedures (New York Times )

Investors Are Terrified of Chinese Stocks. How to Profit From Their Fear. Barron’s )

Chinese investment in US drops to lowest level since 2009 (USA Today )

Trump orders federal retirement money invested in Chinese equities to be pulled (Fox Business )

China announces new tariff waivers for some U.S. imports (Reuters )

The Fed Is Buying E.T.F.s Today (New York Times )

Simon to reopen half of its malls within a week as states begin to reopen (New York Post )

Palm Beach is new escape for New Yorkers looking to dodge coronavirus (New York Post )

Boeing Plans to Resume Building the 737 MAX This Month (Barron’s )

A Movie Studio Could Buy AMC, Even if Amazon Isn’t Interested (Barron’s )

Why Investors Should Consider Companies That Are Repaying Their Credit-Line Debt (Barron’s )

‘Feels like we’re at the bottom’: Some executives see signs of recovery in April (CNBC )

Secret recipes for United Airlines’ stroopwafel, Disney’s beignets, more to make in quarantine (USA Today )

AbbVie Stock Is ‘Unsustainably Cheap’ After Allergan Acquisition (Yahoo! Finance )