- 13 Stock Ideas From Top Value Managers (Barron’s)

- Gilead’s Remdesivir Is a Rare Example of Foresight in This Pandemic (Bloomberg)

- What’s Good for Banks Isn’t Necessarily Good for Bankers (Wall Street Journal)

- Deals Aren’t Dead. Here Are 12 Stocks That Could Become Buyout Targets (Barron’s)

- Green Shoots for the Economy and 5 More Things to Know (Barron’s)

- As Stock Buybacks Disappear, Dividends Stand to Gain (Barron’s)

- As States Reopen, Home Purchase Applications Rise for the Fourth Week in a Row (Barron’s)

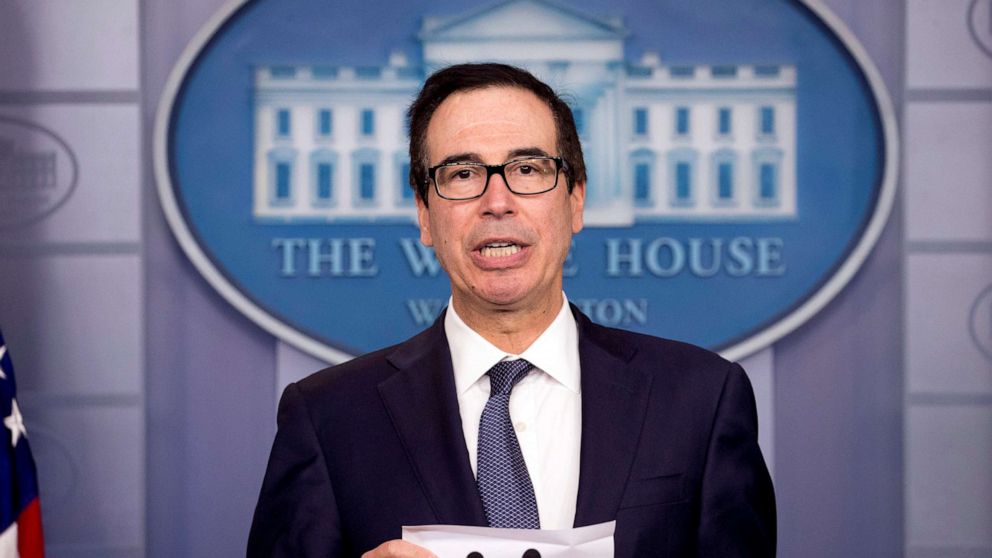

- Mnuchin Seeks to Assuage Investors After Powell’s Gloomy Outlook (Bloomberg)

- Trump Says He Disagrees With Fauci’s Concerns Over Reopening (Bloomberg)

- Wisconsin Supreme Court strikes down state’s ‘stay-at-home’ order (CNBC)

- A London-based trading house bought 250,000 barrels of oil during the historic plunge below $0, and likely made a fortune. (Business Insider)

- U.S. weekly jobless benefits to stay elevated as coronavirus layoffs widen (Reuters)

- AbbVie’s Potential Is ‘Underappreciated,’ Says Morgan Stanley Analyst (Benzinga)

- The Swedish Model Trades More Disease for Less Economic Damage (Bloomberg)

- Oil Price Crash Could Hurt Trump in Texas, Help in Pennsylvania (Bloomberg)

- New York and New Jersey Start to Reopen Their Economies (Wall Street Journal)

- Fed TALF Revision Could Help Clear CLO Logjam (Wall Street Journal)

Be in the know. 17 key reads for Thursday…