This week we chose Thomas Rhett’s “Beer Can’t Fix” song to capture the current theme of the Stock Market. After a near 35% rally off the March 23rd (spike) lows, we have been digesting the gains sideways for ~4 weeks now.

But have no fear, as Thomas Rhett’s got it covered in his timely lyrics:

You could be stressed about your work situation

Ain’t no pain it can’t wash away

The Four Horsemen of the Apocalypse

In the last couple of days, we had four major market-moving figures come out with generally pessimistic or cautious outlooks. While one could ordinarily dismiss them as alarmists, the heft and credibility or all four “horseman” warrants some consideration.

According to wikipedia, “The Four Horsemen of the Apocalypse” are figures in Christian faith, appearing in the New Testament’s final book of Revalations as well as in the Old Testament’s prophetic Book of Zechariah, and in the Book of Ezekiel, where they are named as punishments from God.

Some Christians interpret the Horsemen as a prophecy of a future Tribulation, during which many on Earth will die as a result of multiple catastrophes. The Four Horsemen are the first in a series of judgements. This is when God will judge the Earth, and is giving the World a chance to repent before they die.

This is how the market generally interpreted the outlooks of: Dr. Fauci, Stan Druckenmiller, Chairman Powell, and David Tepper.

The First Horseman: Dr. Anthony Fauci

(Source: CNN)

In his appearance on Tuesday, Dr. Fauci warned senators that states and cities face serious consequences if they open up too quickly, urging states not to reopen until they know they have the capabilities to handle an inevitable uptick in cases once they relax stay-at-home orders.

Fauci also told the Senate committee on Tuesday it was a “bridge too far” for schools to expect a vaccine or widely available treatment for Covid-19 by the time students return to campuses in the fall, though he expressed optimism a vaccine would be developed in the next year or two.

“There is a real risk that you will trigger an outbreak that you may not be able to control, which in fact, paradoxically, will set you back, not only leading to some suffering and death that could be avoided but could even set you back on the road to try to get economic recovery,” Fauci later added.

Sen. Rand Paul, a Kentucky Republican who tested positive for coronavirus in March, challenged Fauci and other public health experts Tuesday, arguing that the virus has been on a “relatively benign course” outside of high infection rates in New England. He warned that there would be an even greater damage to the country if schools did not re-open in the fall.

“As much as I respect you, Dr. Fauci, I don’t think you’re the end-all,” Paul said. “I don’t think you’re the one person that gets to make a decision. We can listen to your advice, but there are people on the other side saying there’s not going to be a surge and that we can safely open the economy. And the facts will bear this out.”

The Second Horseman: Stan Druckenmiller

(Source: Bloomberg)

Former Hedge Fund Manager, Billionaire Stan Druckenmiller said the risk-reward calculation for equities is the worst he’s seen in his career, and that the government stimulus programs won’t be enough to overcome real world economic problems.

“The consensus out there seems to be: ‘Don’t worry, the Fed has your back,’” said Druckenmiller on Tuesday during a webcast held by The Economic Club of New York. “There’s only one problem with that: our analysis says it’s not true.”

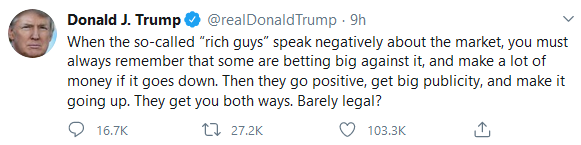

President Trump responded with the following tweet:

The Third Horseman: Fed Chairman Powell

In a speech Wednesday morning, Mr. Powell revealed concern about the path ahead, describing the outlook as “highly uncertain and subject to significant downside risks.”

“There is a growing sense that the recovery may come more slowly than we would like…and that may mean that it’s necessary for us to do more,” he said, urging the White House and Congress to spend more money to ensure the economy’s rebound.

Powell also underscored some of the painful consequences of the recession. Among people who had been working in February, nearly 40% of households earning less than $40,000 a year lost a job in March, Powell said.

Powell ended on a constructive note saying the economy could eventually return to where it was before the pandemic, with unemployment at a 50-year low of 3.5%. “It’ll take some time to get back to where we were.” he said. “I have every reason to think we should get back there.”

The Fourth Horseman: David Tepper

(Source: CNBC)

Billionaire hedge fund investor David Tepper told CNBC on Wednesday that the stock market is one of the most overpriced he’s ever seen, only behind 1999. He also said some Big Tech stocks like Amazon, Facebook and Alphabet may be “fully valued.”

Ending on a constructive note, he said, “There might have been a bottom put in … but that doesn’t mean you can’t fall significantly from these levels,” Tepper said.

Are you sure this is something that a “Beer Can Fix?”

Of the “Four Horseman of the Apocalypse” that led the markets lower in recent sessions, I would say David Tepper was the most balanced in his outlook. He acknowledged the power of the Fed/Treasury backstops and said that the bottom was probably in. He also pointed to the top 5 or so stocks that make up > 22% of the S&P 500 weight as potentially “fully valued.” We discussed this issue in our note on April 23:

The Kanye West, “Drive Slow” Stock Market (and Sentiment Results)…

If Tepper is right and the bottom is in, but the top weighted stocks are the most overvalued that they have ever been (2nd to 1999/2000), then the only logical way forward is through a rotation and broadening in market participation from leaders to laggards. We have made the case in recent weeks that we anticipate this type of rotation in the coming months – and started to see it prior to the last few sessions: Banks, Small Caps, Home Builders and Energy. We will see if they persist when the market finishes its consolidation/digestion of the big gains off the March lows.

The Cost of “Caution”

Let me start with the obligatory money manager disclaimer of the era, that “I am not a Doctor, but…”

Senator Rand Paul’s comments yesterday triggered a thought in my mind that I decided I would share. The objective is not to be controversial, but to lay out the true “Cost of Caution” because few people are getting to the heart of the matter.

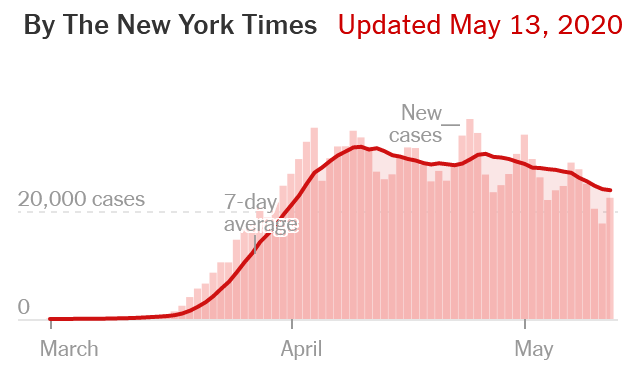

I was and am 100% FOR the two month shared sacrifice that the country made to “Flatten the Curve.” We have succeeded. The purpose of “Flattening the Curve” was not to cure the illness, but rather ease the stress on the healthcare system so that treatment would be available for all who needed it, and that after the peak was behind us we could handle any short term flare ups or spikes in cases. We are now there…

Coming out of the 2008-2009 Great Financial Crisis, there were a group of well meaning traders that were consistently short the market – waiting for the next shoe to drop. Many everyday people took their advice and either stayed out of the market and made nothing, or tried to short and lost money.

What was the true cost? On a small $1M account, it cost you $4M of profits on the ride from 666 to 3,393 on the S&P 500. While the “cautious” traders were trying to be helpful and sincerely believed they were correct, that is what you paid to listen to them on a modest retirement account.

Maybe the market “shouldn’t have gone up” and the “fed shouldn’t have interfered” but it did and they did, and the cost of fighting a 200 year trend was $4M over the last 11 years (409% gain).

So here we are again, but with a different problem. The “cautious” people always sound the most sophisticated and thoughtful in the short term (which is why it’s easy to act on what they say). The problem is there is no downside to saying “be cautious” because if they are right they look brilliant, and if they are wrong people are happy that the worst did not happen (even if it cost them in real terms).

When Dr. Fauci suggested keeping schools closed in the Fall after we have flattened the curve I thought, “well, he’s being cautious.” Then I decided to put some math to it. Here is the ACTUAL cost of caution:

For the 60 day shutdown (which probably 90% of the population – including me – believes was the right move and worth the shared sacrifice to protect our most vulnerable):

COST:

-30,000,000 Jobs

-$9,000,000,000,000+ (Trillion) of Stimulus, Aid, and Liquidity (provided by the taxpayer in the form of borrowing and increased money supply)

So in rough terms, every day of “Shelter in Place” costs ~$150B and 500,000 jobs (people/families impacted/effected).

So for every day we stay “Sheltered in Place” we can assume we can keep the COVID-19 deaths to ~1000 per day (or less) by making the shared sacrifice. The cost of keeping the deaths low is 500,000 jobs/families impacted per day and $150B in costs. It does not account for suicides and overdoses associated with depression/unemployment/business loss.

So the real question is not whether we should be “cautious.” The real question is, now that the curve is flattened, is each additional day of “shelter in place/business shut down” worth destroying 500,000 jobs/lives per day and costing the economy $150B per day?

What is the actual cost of “caution” and is it worth it? The option is NOT FREE and when Doctors say that we have to be cautious they need to say it in the context of being RIGHT, not protecting their downside because EACH DAY that they are wrong or TOO CAUTIOUS has a serious cost. So far that cost has been:

-500,000 jobs per day

-$150B in Stimulus/Aid/Liquidity per day

So yes, we can leave the schools closed and the businesses closed to be “cautious” but let’s not ignore the real cost to real people EVERY SINGLE DAY.

What’s beautiful about the markets is that there is a buyer for every seller and vica versa. In many cases both participants are smart/sophisticated players – but one of them is wrong the moment the transaction executes. Time may heal that error one way or the other, but there is a cost. To Rand Paul’s point, I think we need more voices (credentialed and qualified), but varied (bulls vs. bears on “caution”), because the REAL “Cost of Caution” (now that we’ve accomplished the mission of flattening the curve) is extremely high and few people are talking directly about the trade-offs.

“Caution” is a luxury – that we have to make a collective decision if we want to continue to pay for – at a very steep daily price that will be borne for decades to come. This is especially important when you consider that the epicenter of COVID-19 in the US was NYC, and 66% of people who contracted the virus were people who “sheltered in place” at home (NY1).

I’m among the lucky few that can work from home and have no material impact to my earning power by doing so. Many of the people making these policies and guiding public thought are similarly fortunate. A strong consideration must be given to the majority that will pay the greatest cost and make the greatest sacrifice by continued “caution.”

We have to accept the fact that by the time the vaccine is ready and “approved” we will have likely achieved herd immunity and there will be no/limited use for the vaccine. I’m more bullish on treatments, but even the best options have opponents, hurdles to overcome, and embedded risks. At some point we have accept the risks and move forward with opening (as safely as we can), but definitively.

Moving forward, I welcome those who prescribe further “caution” but ask that they be held to account for the cost of their opinion (i.e. Is your caution worth 500,000 jobs per day and $150B in daily costs? Please weigh that against the costs of not following your advice – mini spikes, etc).

Maybe the future decisions will look something like this:

If we stay closed for another 30 days in XYZ state, we will lose 50,000 jobs per day or 1.5 million for the month we stay closed. We will add $200B to our state deficit that we will have to pay through higher property tax and sales tax for the next two decades (~$25,000+ extra cost for each resident), BUT we will save 3000 lives that would have died from COVID-19 if we had opened.

It’s impossible to quantify exactly, but this is the nature of the real question at hand moving forward that each state, city, region will have to deal with – and that is how it must be honestly framed. If we enter a Depression, it will have been at our own choosing, not by necessity. We will have chosen to save 50,000-100,000 lives at the cost of 1-2 decades of subdued growth. It may be the right choice or it may not, but this is the true “Cost of Caution.”

I hope and believe we will chose as wisely post-flattening of the curve as we did pre-flattening of the curve. We have the opportunity to return to growth much sooner than is anticipated – if we choose wisely – and employ best practices for safety throughout the opening/recovery process.

Now onto the shorter term view for the General Market:

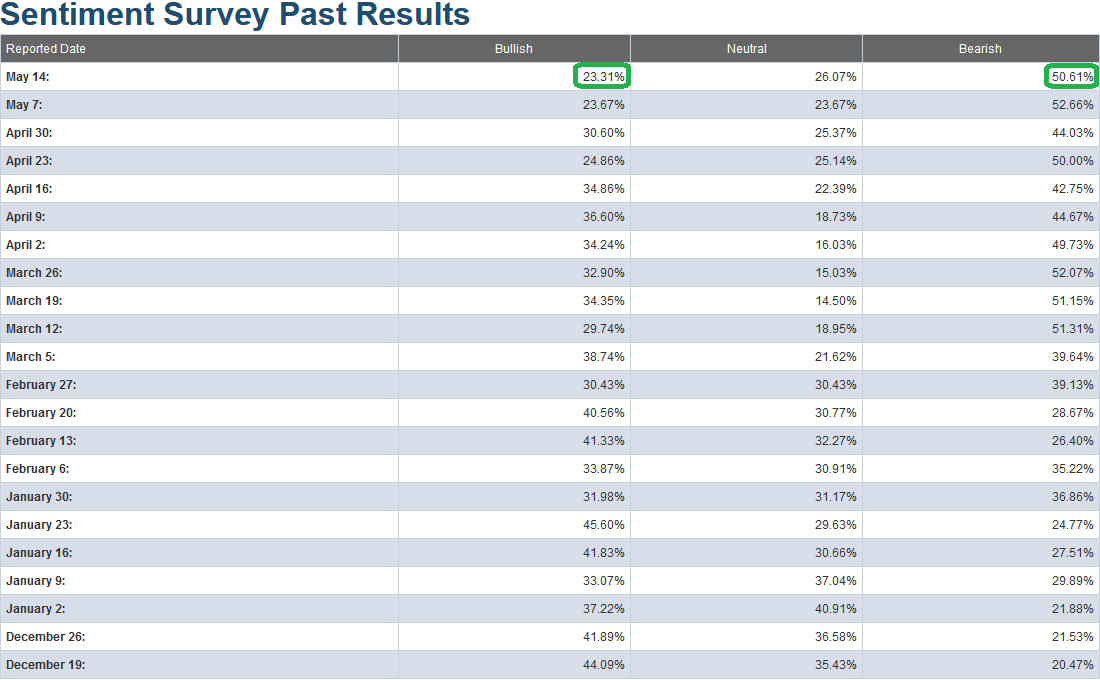

This week’s AAII Sentiment Survey result Bullish Percent (Video Explanation) flat-lined to 23.31% from 23.67% last week. Bearish Percent edged down a hair to 50.61% from 52.66% last week. Fear is still at/near an extreme level for individual investors. The market continues to consolidate its big gains off of the March 23 low. As you will see on the chart below, reads like this are generally found near short term bottoms versus tops.

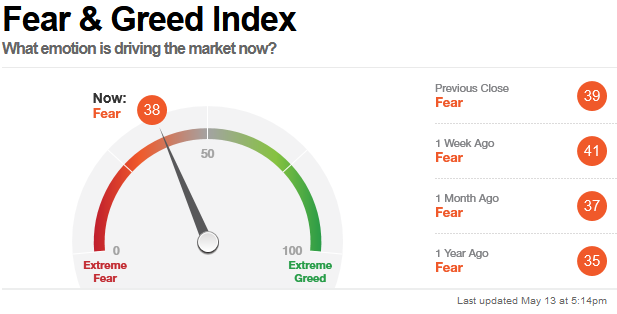

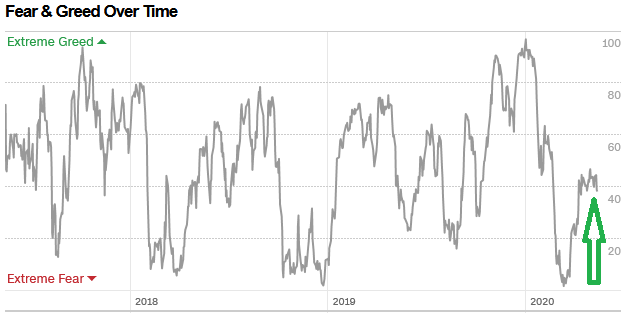

The CNN “Fear and Greed” Index fell from 40 last week to 38 this week. The fear continues to slowly thaw and will move in fits and starts in coming weeks. You can learn how this indicator is calculated and how it works here: (Video Explanation)

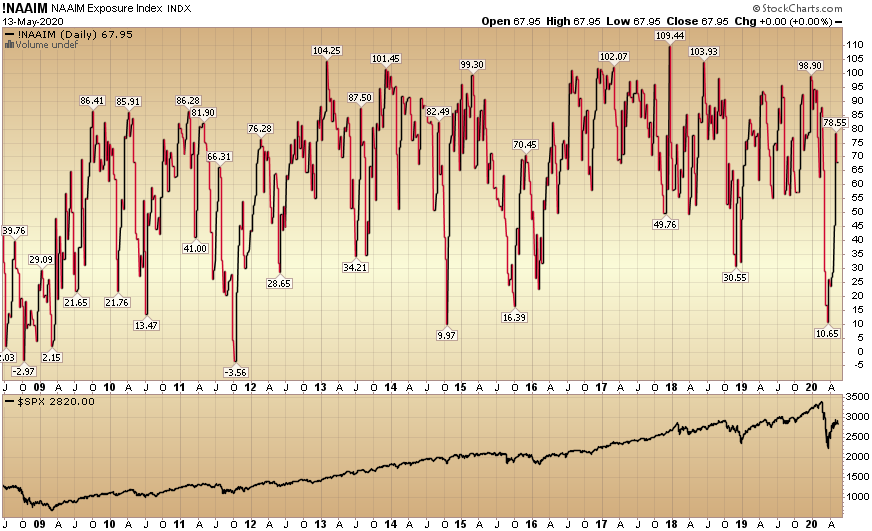

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) fell from 78.55% equity exposure last week, to 67.95% this week.

Our message for this week:

Because we have taken advantage of most of the best discounts that were available in equities (during mid-March to early April – see previous weekly notes under “sentiment” category of the site), we shifted focus in the past 5-6 weeks to building up a selective portfolio of distressed high yield credit – that has fallen materially since the advent of COVID-19 (i.e. some bonds have fallen as much as 40-60% in the past 8-10 weeks – from par).

There are selective pockets that have not recovered to the same extent as the equity markets have. We believe that many of these securities will recover to par over time as credit markets repair and government provided liquidity (see last week’s note that explained liquidity programs) finds its way to this distressed corner of the market.

We also have dry powder available to add to equities in the event we do get a re-test (or lower in coming weeks and months), but that appears to be a low probability at this point. If the facts change, we will adjust, and be ready to take advantage. But for the time being, the bulk of the opportunity is in a selective basket of researched individual distressed credit securities (and holding the equities we already own).

As was our repeated plan in the previous weeks (prior to early April) of buying the highest quality equities on every red/down day (and sitting on our hands on green days), we have followed and will follow the same template in the high yield credit markets.

Additionally, we took advantage of the weakness in banks this week to add to selected long-term equity positions.

There’s a Pony in the Pile

So as Thomas Rhett would suggest, go crack open a beer and relax – because as this story goes, there’s a pony in the pile and there “ain’t no problem that a beer can’t fix!”:

Once there were five-year-old twin boys,

one a pessimist and the other an optimist.

Wondering how two boys who seemed so alike could

be so different, their parents took them to a psychiatrist.

The psychiatrist took the pessimist to a room piled high

with new toys, expecting the boy to be thrilled, but instead he burst into tears.

Puzzled, the psychiatrist asked, “Don’t you want to play with these toys?”

“Yes,” the little boy bawled,

“but if I did I’d only break them.”

Next the psychiatrist took the optimist to a room piled high with horse manure.

The boy yelped with delight, clambered to the top of the pile,

and joyfully dug out scoop after scoop,

tossing the manure into the air with glee.

“What on earth are you doing?” the psychiatrist asked.

“Well,” said the boy, beaming,

“There’s got to be a pony in here somewhere!”