During earnings season we try to cover 1-2 companies we have discussed in previous podcast|videocast(s). This week, Cooper Standard (CPS) reported results. We originally initiated this position in May of 2022 ~$5.50. You can see our original and time-stamped historic commentary in our note last quarter here.

Go HERE to see historic thesis and updates for Cooper Standard (CPS)

I was initially not happy with Cooper Standard’s earnings results. I was specifically disappointed with the -$31M of free cashflow.

Then I took the time to burden myself with the facts. It turns out that Q1 is consistently a negative free cash flow quarter and has been the case even during the halcyon days when the stock traded to ~$146.

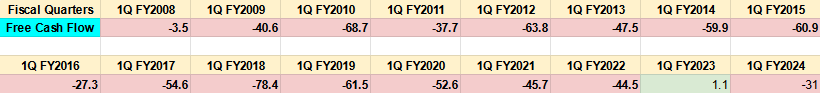

I have circled every 1Q FCF result in the chart below and added a table to illustrate the consistent trend:

So of the last 17 First Quarter results, 16 of them had NEGATIVE FREE CASH FLOW. And in ALL cases where the stock was trading ABOVE $100/share, the negative free cash flow was GREATER THAN the negative free cash flow in Q1 2024.

I am NOT saying that to get back to a multi-bagger from here the key is to generate negative free cash flow every Q1 moving forward! However, I am saying it appears to be a cyclical phenomenon (since inception) for this part of the year – with a tendency to improve in the following three quarters.

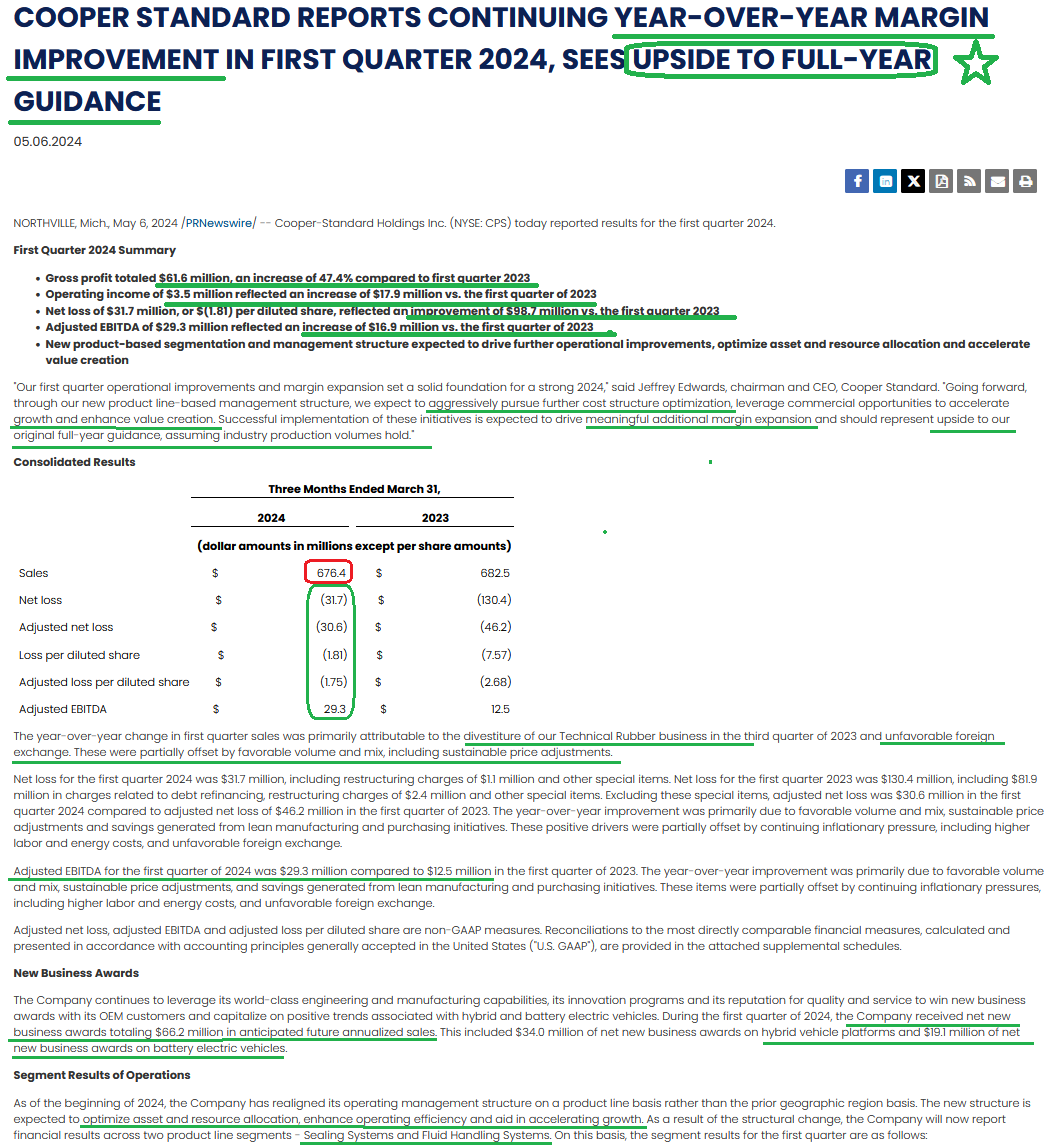

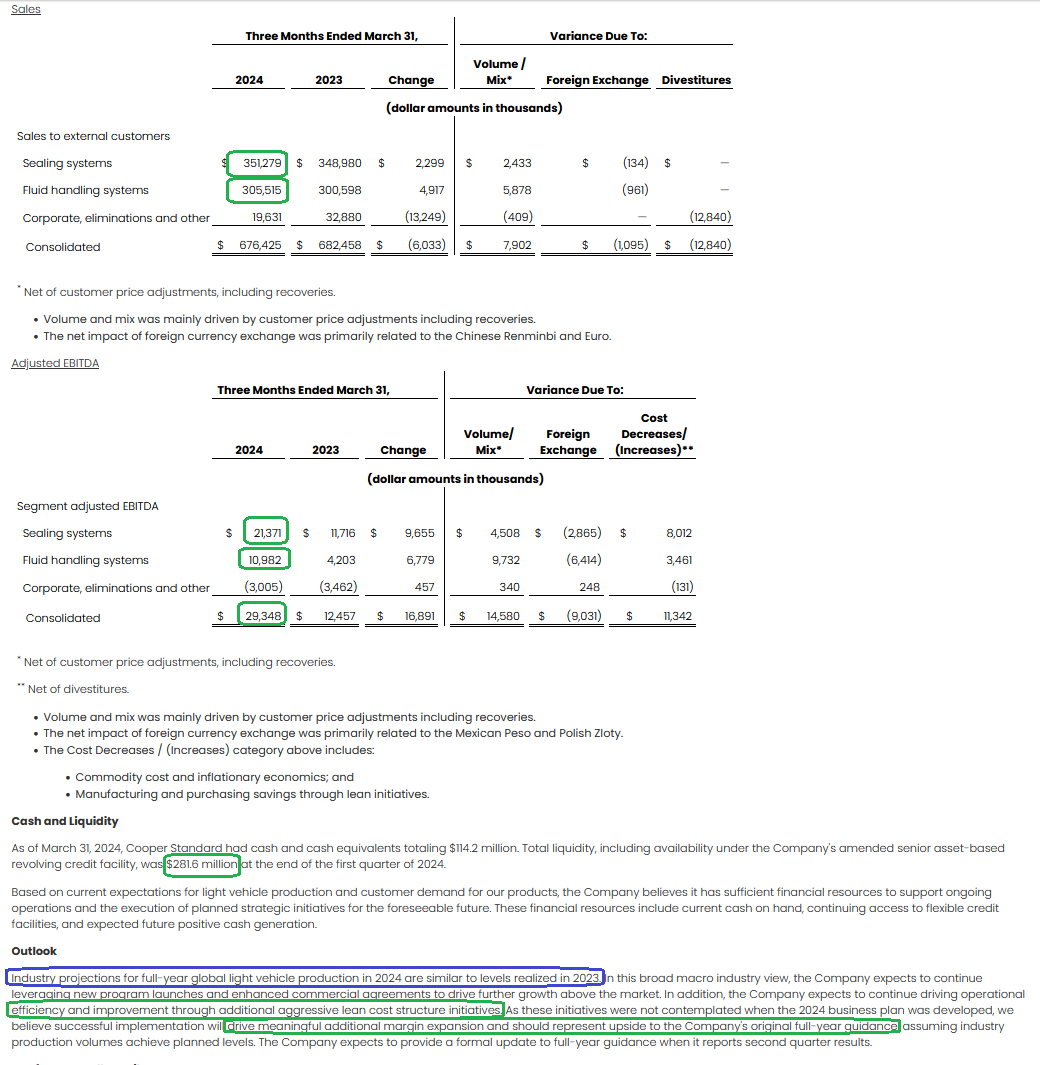

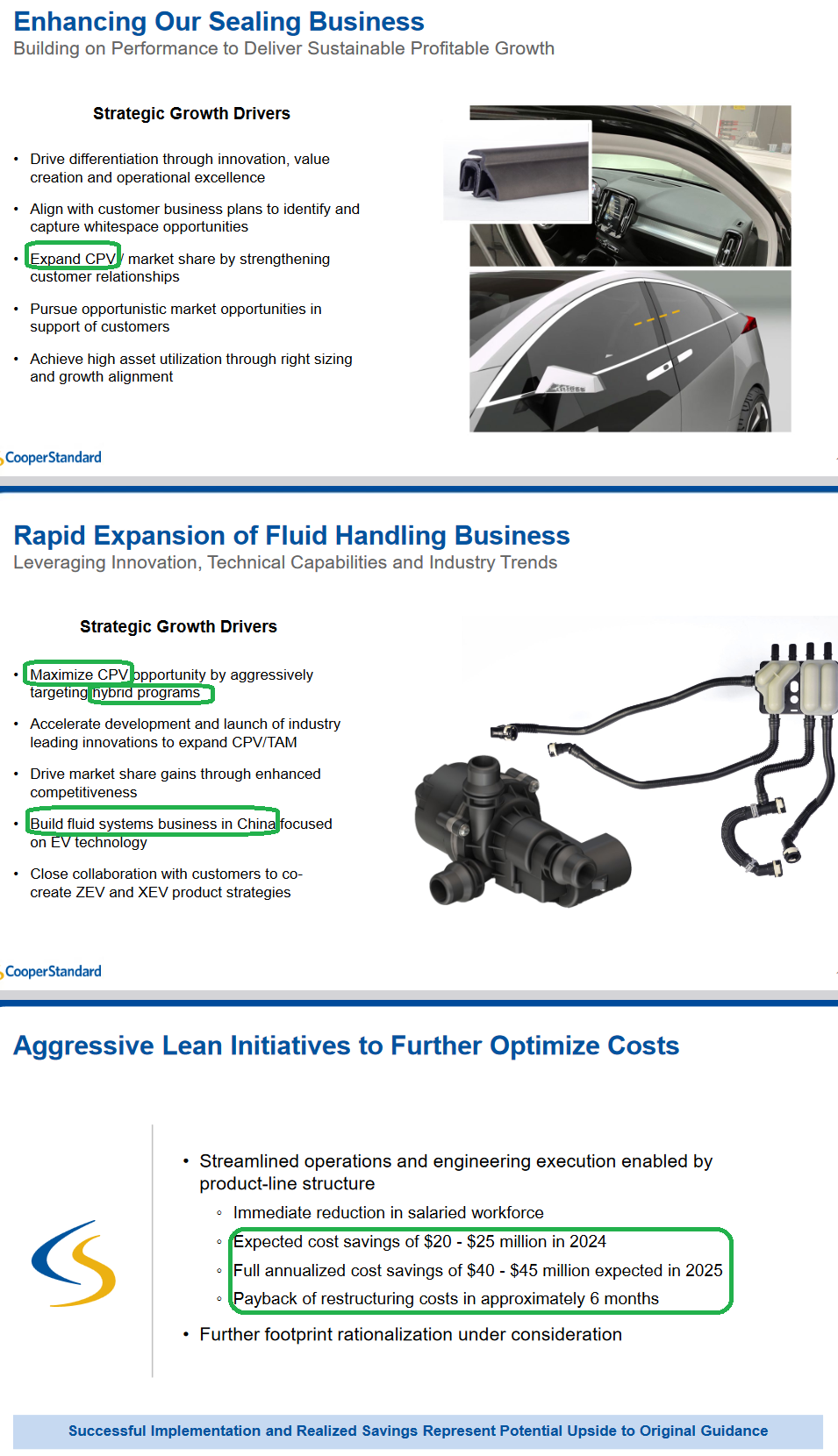

Now that we see what went wrong, let’s take a look at what went right:

Now onto the shorter term view for the General Market:

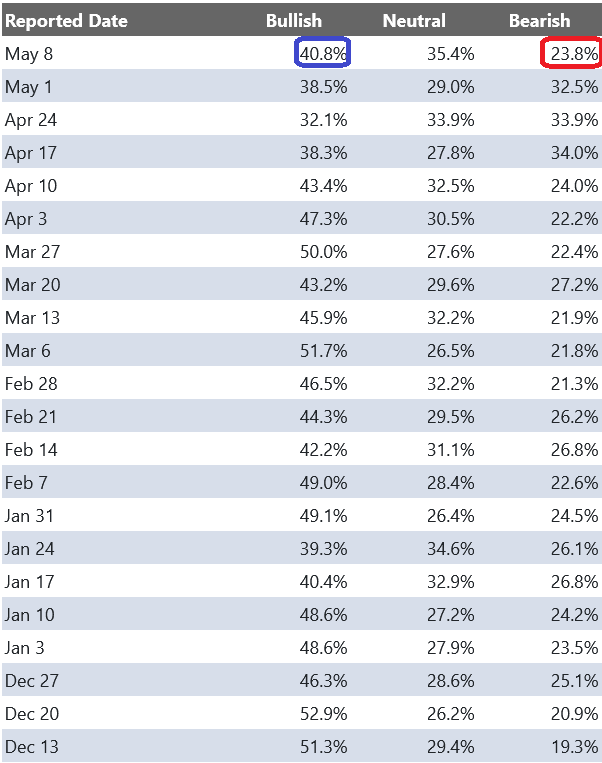

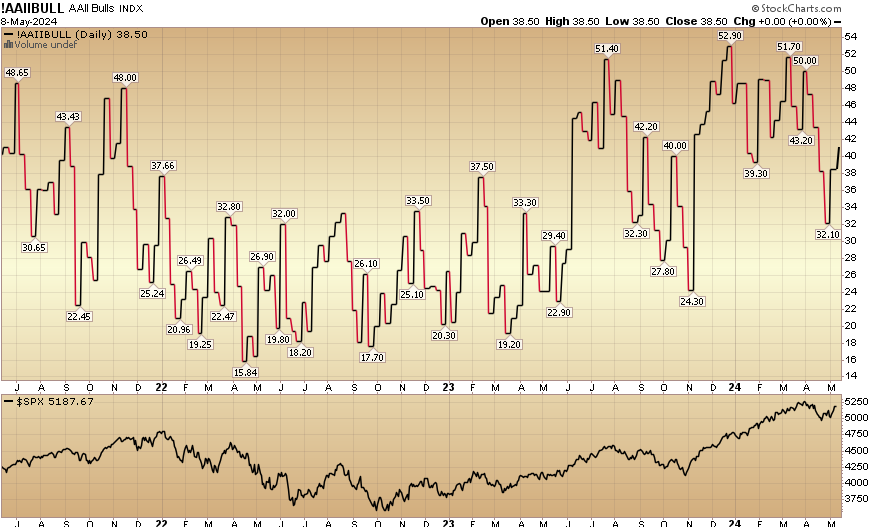

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) rose to 40.8% from 38.5% the previous week. Bearish Percent collapsed to 23.8% from 32.5%. The retail investor is regaining confidence.

The CNN “Fear and Greed” flat-lined from 40 last week to 39 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

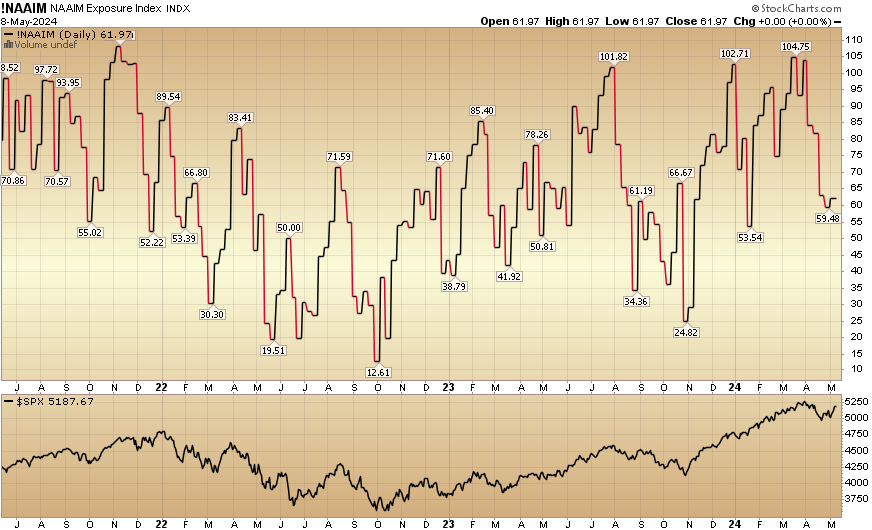

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 61.97% this week from 59.48% equity exposure last week.

Our podcast|videocast will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

Congratulations to all of the new clients who came in so far this year during our Q1 and Q2 openings. We are now closed to smaller accounts ($1M+) again as of last Saturday and will remain closed to smaller accounts until sometime in Q3. Larger accounts $5-10M+ can access bespoke service at their preference here.

*Opinion, Not Advice. See Terms

Not a solicitation.