Skip to content

- Congress close to reaching deal on $2 trillion coronavirus aid package (New York Post)

- I’m Scared. That’s a Reason to Buy. (Wall Street Journal)

- U.S. Stimulus Talks and Lower Italy Toll Boost Global Stocks (Barron’s)

- Trump Considers Easing Social-Distancing Guidelines to Boost Economy (Wall Street Journal)

- Whatever It Takes: How the Fed Aims to Rescue the Economy (New York Times)

- Northrop Grumman Stock Should Strengthen With Rising Global Tensions (24/7 Wall Street)

- Global investor Barry Sternlicht: Trump ‘kind of right’ on wanting to get US back to work soon (CNBC)

- Stocks, oil, and bitcoin surge after Fed boosts coronavirus stimulus ()

- These bank stocks could enjoy a ‘major rally’ as Fed gives unprecedented support, says longtime analyst (MarketWatch)

- What David Tepper Needs to See Before Going ‘Balls to the Wall’ in the Market (Institutional Investor)

- Fed has thrown everything at coronavirus slowdown: El-Erian (Fox Business)

- Fed is now effectively the ‘lender of last resort’ to Main Street not just Wall Street (MarketWatch)

- These Drugs Are Helping Our Coronavirus Patients (Wall Street Journal)

- Federal Reserve issues FOMC statement (Federal Reserve)

- Fed calls emergency meeting, announces unprecedented moves to calm corporate debt (Yahoo! Finance)

- Barron’s Picks And Pans: Big Tech Picks, Bank Stocks Large and Small And More (Yahoo! Finance)

- Danaher (DHR) Unit Cepheid Granted FDA Emergency Use Authorization for 45 Minute COVID-19 Test (Street Insider)

- One Anecdote (NY Testing Starts Tomorrow): Florida man with coronavirus says drug touted by Trump saved his life (New York Post)

- Stock futures cut losses as Fed announces limitless asset purchases to keep markets functioning (CNBC)

- Bond girl Olga Kurylenko says she has ‘completely recovered’ from coronavirus (New York Post)

- Gilead Stops Accepting Emergency Applications for Covid-19 Drug Remdesivir (Barron’s)

- Tom Hanks, Rita Wilson ‘feel better’ two weeks after first coronavirus symptoms (New York Post)

- Virus Rescue Plan Stalls When Democrats Block McConnell’s Offer (Bloomberg)

- Honeywell boosting mask production, creating hundreds of jobs (Fox Business)

- Kashkari to Congress: Err on the side of being too generous (MarketWatch)

- Dollar General to hire 50,000 employees by the end of April (MarketWatch)

- Fed will make up to $4 trillion in loans to businesses to rescue the U.S. economy, Mnuchin says (MarketWatch)

- Why It’s So Difficult to Stop the Spread of the Coronavirus (Wall Street Journal)

- NY will immediately start conducting trials of an experimental COVID-19 treatment with hydroxychloroquine and Zithromax. (New York Times)

- Danaher’s Cepheid Receives FDA Emergency Use Authorization For 45-Minute Coronavirus Test (Benzinga)

- France makes ‘massive’ discovery that old medicines work against coronavirus (Fox Business)

- Will the weather help us fight the virus? (The Reformed Broker)

- Bullard said the “core aim” can be kept simple: “keep everyone, households and businesses whole through the second quarter.” (Yahoo! Finance)

- Humanity Rallies to Battle Coronavirus (Almanac Trader)

- What The 2020 Coronavirus Stimulus Checks Might Look Like (Forbes)

- Meet The Italian Engineers 3D-Printing Respirator Parts For Free To Help Keep Coronavirus Patients Alive (Forbes)

- Most second quarter GDP forecasts now range from horrible (-8%) to catastrophic (-15%) (Fortune)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Google Now Offering Virtual Tours of Over 1,200 Iconic Museums (Maxim)

- Episode 982: How To Save The Economy Now (NPR)

- The Doctor Who Helped Defeat Smallpox Explains What’s Coming (Wired)

- Gen X Was Born for This (Medium)

- What If You Buy Stocks Too Early During a Market Crash? (A Wealth of Common Sense)

- Why I’m Building My Own Airplane (Popular Mechanics)

- Coronavirus Cases Top 316,000 As U.S. Covid-19 Cases Surge Near 27,000; Stimulus May Hit $2 Trillion Amid Coronavirus Market Crash (Investors)

- Dell Stock Is Slumping, but CEO Michael Dell Scooped Up Shares (Barron’s)

- The Worst of the Global Selloff Isn’t Here Yet, Banks and Investors Warn (Wall Street Journal)

- Coronavirus crisis: Feds should use banks to help small biz, homeowners (New York Post)

- Evidence over hysteria — COVID-19 (Medium)

- OPEC, U.S. Shale Producers Open Talks Amid Oil Rout (Wall Street Journal)

- Washington Needs to Act (Barron’s)

- Fed Going All In to Save Economy. Here’s What Could Come Next (Bloomberg)

- Coronavirus-Triggered Downturn Could Cost 5 Million U.S. Jobs (Wall Street Journal)

- Coronavirus Recession Looms, Its Course ‘Unrecognizable’ (New York Times)

- Doug Ramsey’s Best Case for Stocks and Other Views of the Future (Bloomberg)

- Google Coronavirus Website Launches (Bloomberg)

- Bond-Market Strains Keep Traders on Edge (Wall Street Journal)

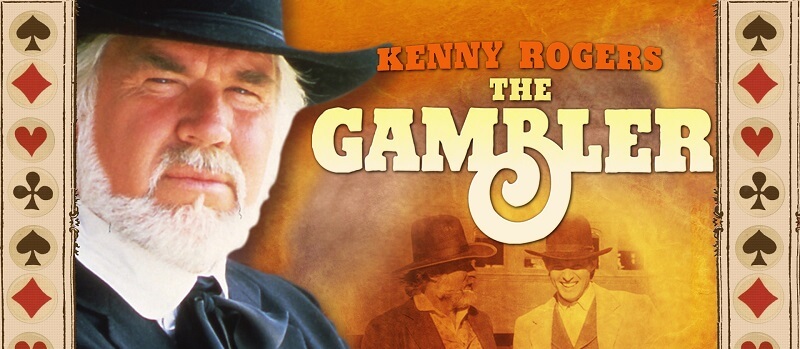

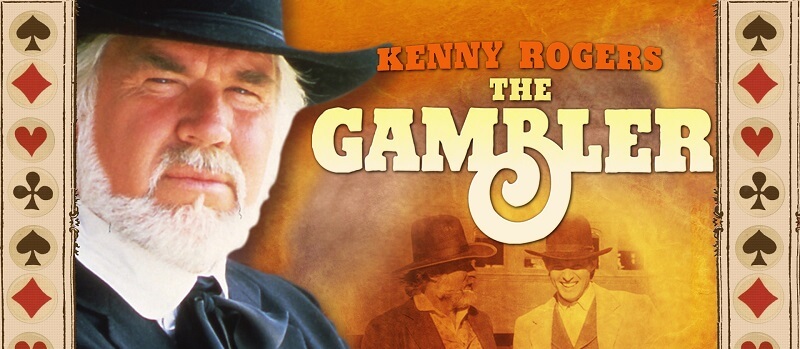

- Country Music Legend Kenny Rogers Dies at 81 (Bloomberg)

- Big Banks Are Getting a Real-Life Stress Test (Barron’s)

- Read Our Free Coronavirus Coverage Here (Bloomberg)

- Bank stocks are ‘very cheap,’ traders say — here’s where they see signs of stabilization (CNBC)

- The Coronavirus’s $4 Trillion Hit to US Corporations (Bridgewater – Greg Jensen)

- What the Fed Could Do Next to Try to Prevent an Economic Unraveling (New York Times)

- Germany to raise €356bn in new borrowing to fight coronavirus (Financial Times)

- Wall Street takes late tumble as US shutdown widens (Financial Times)

- Warren Buffett discussed coronavirus, Coca-Cola, and past market crashes in a recent interview. Here are his 12 best quotes. (Business Insider)

- Rethinking the Coronavirus Shutdown (Wall Street Journal)

- Wells Fargo asks Fed to lift cap on growth to support customers: FT (Reuters)

- Global Stocks Rise as Governments and Central Banks Pour on Stimulus (Barron’s)

- In the Hunt for Cash, Here Are 5 Companies With Plenty of It (Barron’s)

- Gilead upgraded to Overweight from Neutral at Piper Sandler (TheFly)

- Search for Coronavirus Vaccine Becomes a Global Competition (New York Times)

- Will ‘Helicopter Money’ and the ‘Big Bazooka’ Help Rescue Europe? (New York Times)

- Experts recommend these stocks to buy during coronavirus outbreak (New York Post)

- Divided G20 faces pressure to lead global response to coronavirus (Reuters)

- Republicans work to cut withdrawal penalty from savings accounts (Fox Business)

- This big bank to offer mortgage relief (Fox Business)

- Ventilator manufacturer works to ease shortage (USA Today)

- Ray Dalio: Damage From Coronavirus Will Be ‘Much Greater’ Than Reported (Institutional Investor)

- J.P. Morgan strategist says markets are about to get calmer, if not better (MarketWatch)

- Market action a century ago suggests worst could be over for stocks (MarketWatch)

- Carl Icahn Shows New 14.86% Stake in Delek US Holdings (DK), Pushes for CVI (CVI) Merger (Street Insider)

- Fed buying more this week than biggest week during the financial crisis – CNBC’s Liesman (Street Insider)

- The Spanish Flu – Coo coo ca choo – Stock Market (and sentiment results)… (ZeroHedge)

- Another Exxon Mobil Executive Makes a $1 Million Stock Buy (Barron’s)

- Health Crisis Could Give Cigarette Makers a Break (Wall Street Journal)

- 5 Bottom-Fishing Blue-Chip Dividend Stocks (24/7 Wall Street)

- Mnuchin and Pelosi Are Most Pivotal Duo in Virus-Hit Capital (Bloomberg)

- ‘Dividend Cuts Are Inevitable.’ They Won’t Be Across the Board (Barron’s)

- In U.S. Markets, Capitulation Was the Word of the Day (Barron’s)

- The Coronavirus Crisis Is Showing Us How to Live Online (New York Times)

- Is Saudi Arabia To Blame For The Looming Economic Recession? (Yahoo! Finance)

- Trump Signs Coronavirus Relief Bill, ECB Injects $821B In Liquidity, Japan Considers Cash Payouts (Benzinga)

- Gilead Sciences’ (GILD) First COVID-19 Antiviral Data Validates Remdesivir – Wells Fargo (StreetInsider)

- The European Central Bank has launched a ‘bazooka’ $820 billion pandemic fund to aid markets. ‘There are no limits.’ (Business Insider)

- Buffett’s Cash Stash Makes Berkshire a Safe Port in the Storm (Barron’s)

- When to buy during an ugly stock market rout? These charts have the answers. (MarketWatch)

- Strong Restaurant Chains May Feast After Coronavirus Famine (Wall Street Journal)

- Regeneron’s CEO Says We Could Have a Covid-19 Treatment ‘Quickly’ (Barron’s)

- Market Plumbing Is Hit, But the Fed Can Probably Handle It (Wall Street Journal)

- Fed Unveils Emergency Lending Programs as Companies Struggle to Raise Cash (New York Times)

- Trump wants to start sending millions of Americans a check. Here’s how to use it wisely (CNBC)

- The Federal Reserve is adding another program to keep money flowing for big financial institutions (CNBC)

- Here’s one analyst’s take on the coronavirus drugs for today and the future (MarketWatch)

- As China’s coronavirus outbreak eases, a wary return to shops for consumers (Reuters)

- Hydroxychloroquine and Remdesivir Info (Nature.com)

- Article on Chloroquine Treatment for Coronavirus (COVID-19) (Presented by: James M. Todaro, MD)

- French researcher posts successful Covid-19 drug trial (connexionfrance)

- The NYSE, a symbol of America, is fighting to keep its trading floor open amid coronavirus pandemic (MarketWatch)

- FedEx stock spikes as sales grow amid coronavirus outbreak, but earnings guidance is pulled (MarketWatch)

- Warren Buffett on negative rates and ‘the most important question in the world’ (Yahoo! Finance)

- Markets Want Congress to Help Private Sector, Morgan Stanley Head Says (Institutional Investor)

- Japanese flu drug ‘clearly effective’ in treating coronavirus, says China (The Guardian)

- Fed QE Starts With A Bang — $80 Billion In Two Days (Investor’s Business Daily)

- ‘We came back to the office in shifts.’ Hong Kong takes first, cautious steps to return to a New Normal, this expat says (MarketWatch)

- GE Stock Has Gotten Hammered by Coronavirus and Debt Worries. Here’s What Could Turn the Tide. (Barron’s)

- Wells Fargo CEO Charles Scharf Bought ~$5M of Stock (Barron’s)

- Opinion: Who’s buying stocks? Executives at TripAdvisor, Newell Brands and other companies are buying at low prices (MarketWatch)

- A rare win for Gen X? Boomers gave us latchkey childhoods that prepped us for coronavirus quarantine (MarketWatch)

- How much stimulus would rescue economy from outbreak? (USA Today)

- Coronavirus Could Very Well Slow by the Summer (Bloomberg)

- Wall Street Pros Panic Over Coronavirus While Mom and Pop Buy (Bloomberg)

- Fed’s Kashkari says ‘we are using our tools aggressively,’ but he doesn’t see negative rates coming (CNBC)

- 18 Stocks to Buy Amid the Coronavirus Carnage, According to Barron’s Roundtable Experts (Barron’s)

- 8 Big Banks Are Halting Buybacks to Brace for More Virus Fallout (Barron’s)

- Fed Cuts Rates to Zero as Financial-Crisis Tools Return (Barron’s)

- Buffett’s Massive Cash Stash Makes Berkshire a Safe Port in the Storm (Barron’s)

- How Coronavirus Remade American Life in One Weekend (Wall Street Journal)

- The Fed and Friends: What Central Banks Did in Past 24 Hours (Bloomberg)

- Regeneron, Sanofi to evaluate Kevzara in patients hospitalized with severe COVID-19 (MarketWatch)

- Coronavirus vaccine clinical trial begins (Fox Business)

- Peter Navarro: Faced with coronavirus pandemic, Congress should pass Trump’s $800 billion payroll tax cut (Fox Business)

- Barron’s Picks And Pans: Roundtable Picks, Airline And Oil Stocks, And More (Benzinga)

- Carl Icahn Says Some Stocks Are Being ‘Given Away’ (Benzinga)

- Can Risk Parity Funds Hang in There? (Institutional Investor)

- Thinking About Airline Stocks? This Is How Air Travel Is Recovering in China. (Barron’s)

- Secretary of the Treasury – Steven T Mnuchin – discusses federal coronavirus response (ValueWalk)

- Italians are singing songs from their windows to boost morale during coronavirus lockdown (CNBC)

- National Emergency Declaration for COVID-19 Helps Oil & Gas, To Fill Strategic Petroleum Reserve (24/7 Wall Street)

- MiB: Cristiano Amon, President of Qualcomm on 5G (Bloomberg)

- Friday 13th, DJIA Attempting to Recover & End Losing Friday Streak (Almanac Trader)

- Coronavirus Drug Update: The Latest Info On Pharmaceutical Treatments And Vaccines ()

- The Big Bet of 10-year Breakevens at 0.94% (E-piphany)

- Why Soap Is Such An Effective Killer Of The Coronavirus (digg)

- McLaren Elva ‘M1A Theme’ Honors Retro Grand Prix Winner (Maxim)

- 7 Energy Stocks to Buy on the Dip (U.S. News & World Report)

- ECRI Weekly Leading Index Update (AdvisorPerspectives)

- Warren Buffett: ‘I won’t be selling airline stocks’ (Yahoo! Finance)

- Why Did the Wright Brothers Succeed When Others Failed? (Scientific American)

- House passes aid bill after Trump declares virus emergency (Fox Business)

- Trump emerges as oil’s white knight after worst week since 2008 (Fox Business)

- These Common Household Products Can Destroy the Novel Coronavirus (Consumer Reports)

- Shopping for Stocks? Think Like a Lender. (Barron’s)

- Crown Prince’s Oil War Looms Over First Aramco Results Since IPO (Yahoo! Finance)

- Will The Fed’s $1.5 Trillion Emergency Stimulus Actually Help? (Benzinga)

- Where does the stock market go from here after the worst drop since 1987? Here’s what the analyst who called the 2018 rout says (MarketWatch)